Life Insurance vs 401k A Guide for Your Financial Future

- dustinjohnson5

- Jul 1, 2025

- 13 min read

When you're weighing life insurance vs. a 401(k), it helps to think of them as two completely different tools in your financial toolbox. A 401(k) is your wealth-building engine, designed to grow over time for retirement. Life insurance, on the other hand, is a shield—its main job is to provide a death benefit to protect your family.

The lines get blurry when certain types of life insurance enter the conversation, specifically those that build cash value. This feature makes some people wonder if a policy can double as an investment, which is where a lot of the confusion starts.

Defining Your Financial Foundation

The question isn't really "Should I get a 401(k) or life insurance?" It’s about figuring out which financial goal you're tackling right now. For most families, especially those with a conservative mindset, the answer is often both. They just don't do the same job.

Your 401(k) is your primary vehicle for saving for your own future, hopefully supercharged by market growth and an employer match. Life insurance is fundamentally different; it's a safety net designed to secure your family's future if you’re no longer there to provide for them.

It's true that some permanent life insurance policies have a cash value component that grows. This has led some to market them as a supplemental retirement strategy. But that growth is a secondary benefit, not the policy's core purpose. Understanding this distinction is the first and most critical step to building a financial plan that works.

Comparing Their Core Roles

The easiest way to see where each one fits is to put them head-to-head. One is built for long-term growth and accumulation, while the other is all about security and protecting your legacy.

The core conflict in the "life insurance vs 401k" debate stems from a misunderstanding of purpose. A 401(k) is designed to fund your future, whereas life insurance is designed to protect your family's future without you.

Here’s how they stack up based on their primary jobs:

Feature | 401(k) Plan | Permanent Life Insurance |

|---|---|---|

Primary Goal | Accumulate wealth for retirement | Provide a death benefit to beneficiaries |

Main Advantage | Investment growth & employer match | Guaranteed death benefit & family protection |

Contribution Source | Employee salary deferrals (pre-tax or Roth) | After-tax premium payments |

Best For | Building a primary retirement nest egg | Securing dependents' financial future |

Key Distinctions for Family Planners

Once you see the different roles they play, your path forward becomes much clearer. For the vast majority of families, the strategy involves two non-negotiable first steps that you should tackle at the same time:

Secure a 401(k) Match: If your job offers a 401(k) with a company match, your first priority is to contribute enough to get the full amount. Not doing so is like turning down a raise. It's free money dedicated to your retirement, and it’s one of the best deals in personal finance.

Establish Protection: At the same time, you need to make sure your family is protected. An affordable term life insurance policy is the most straightforward way to do this. It covers your family's immediate needs without the higher costs and complexities of permanent insurance.

With that foundation in place, we can move past a simple comparison and get into the details of how to use each of these tools to their full potential. This guide will help you make smart choices that align with your family's values and build true long-term security.

Understanding Core Purpose and Function

When you pit life insurance against a 401(k), the first thing to grasp is that they're designed for completely different jobs. A 401(k) is a pure-and-simple retirement savings machine. Permanent life insurance, on the other hand, is a protection tool first, with a savings element built in as a secondary feature. They aren't interchangeable, and digging into how each one works makes that perfectly clear.

A 401(k) plan is an investment account you get through your job. You contribute money, usually before taxes are taken out, which handily lowers your taxable income for the year. But the real magic of a 401(k) is the employer match. Many companies will match your contributions up to a certain percentage of your salary. That's free money—a guaranteed, instant return you just won't find anywhere else.

Once inside the account, your money gets invested in things like mutual funds that you choose, giving you a direct line to potential market growth.

How Permanent Life Insurance Works

Now, let's look at permanent life insurance. It's doing two things at once. Part of your premium payment goes toward the "cost of insurance," which is what secures that tax-free death benefit for your loved ones. The rest of your premium is funneled into a cash value account.

This cash value grows, but it does so in a very different way than a 401(k). Depending on the policy, it might earn a steady, fixed interest rate or its growth could be linked to a market index, but with safety nets like caps and floors to limit volatility. To really get a handle on it, you need to understand the key provisions of a life insurance policy that spell out how it performs and what it costs.

The core functional difference is this: A 401(k) is an investment-first tool designed for personal wealth accumulation. Permanent life insurance is a protection-first tool with a supplemental, and more conservative, savings component.

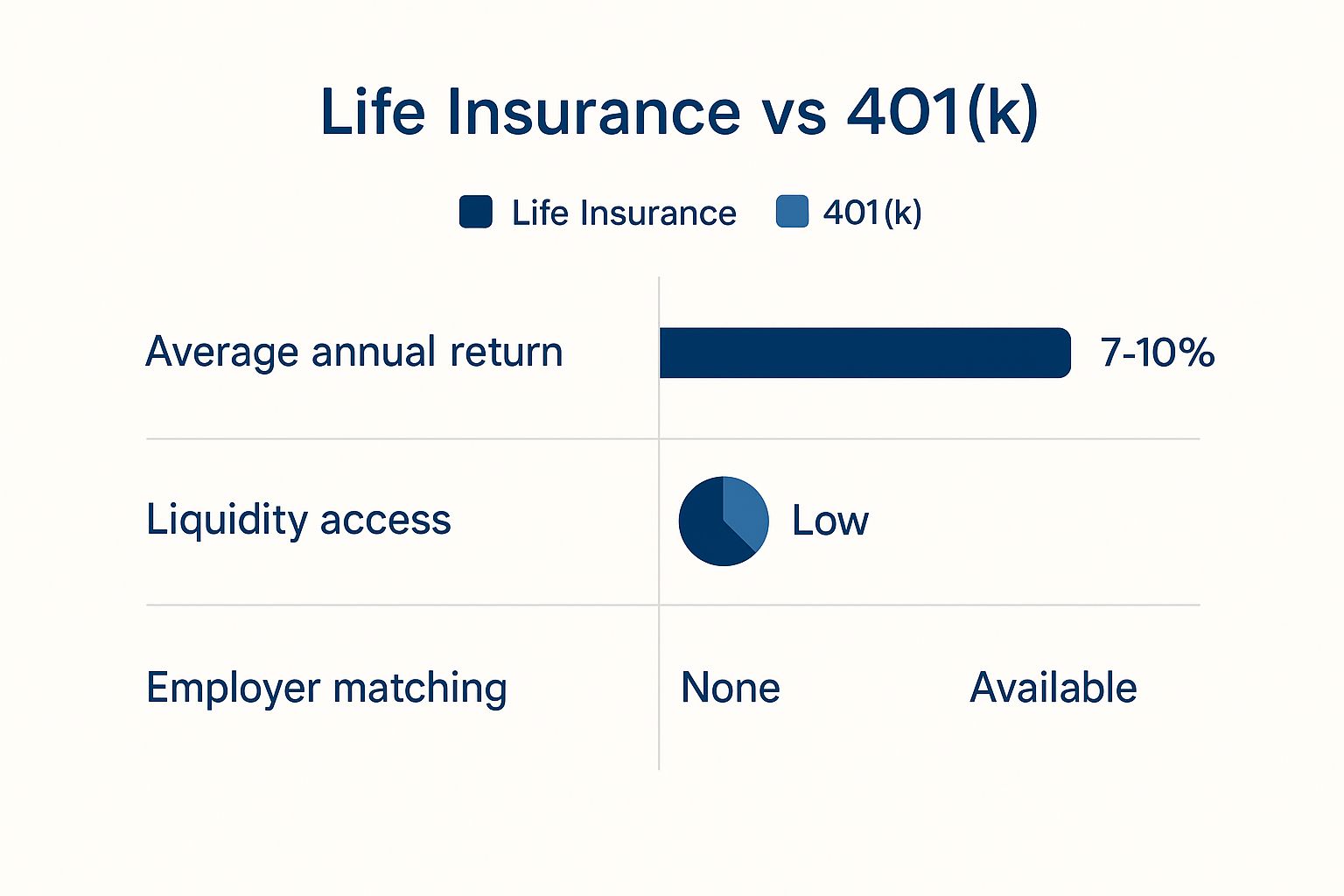

The image below gives a great visual summary of some key data points in this comparison.

As you can see, the 401(k) is built for higher potential returns and easier access to your money. Life insurance offers incredible stability, but that comes at the cost of lower growth potential and less liquidity.

A Clear Comparison Of Functions

Let's break down their jobs side-by-side. This table really clarifies their distinct roles in a family's financial strategy.

Key Functional Differences Life Insurance vs 401k

Feature | Permanent Life Insurance | 401(k) Plan |

|---|---|---|

Primary Purpose | To provide a tax-free death benefit for financial protection. | To accumulate wealth through investments for retirement. |

Contribution Method | After-tax premium payments split between insurance cost and cash value. | Pre-tax or Roth salary deferrals, often with an employer match. |

Growth Engine | Fixed interest rates or indexed returns with caps, offering stable but limited growth. | Direct market exposure through mutual funds, offering higher growth potential. |

Main Benefit | A guaranteed death benefit for beneficiaries and tax-deferred cash value growth. | Tax-deferred growth, employer matching contributions, and high contribution limits. |

Understanding this functional divide is the starting point for deciding where your money should go. For most conservative families, the conversation isn't about choosing one or the other. It's about figuring out how to use both to their full potential.

Analyzing the Impact of Premiums and Fees

The long-term value you get from any financial product boils down to how much it costs you along the way. When we look at life insurance and a 401(k), their cost structures are night and day, which directly affects how much of your money is actually put to work for your future.

Think of it this way: a 401(k) contribution is a direct investment. The money you put in goes straight into the funds you’ve chosen. The costs are generally straightforward fees. A life insurance premium, on the other hand, is a payment for a whole bundle of services.

With a permanent life insurance policy, your premium payment is sliced and diced before it ever sees a chance to grow. A portion immediately covers the cost of the death benefit itself. From what's left, the insurance company deducts a series of internal charges, and only the remainder finally lands in your cash value account.

Breaking Down the Internal Costs

These internal fees are the real silent killers of growth. Because they're taken out behind the scenes, they directly chip away at your cash value's potential. They aren't always easy to spot on a statement and can seriously drag down your returns over time, making it a much less efficient way to build wealth compared to an account designed purely for retirement.

Permanent Life Insurance Fees often include:

Mortality and Expense Charges: This is the big one. It covers the insurance company's risk for insuring your life.

Administrative Fees: These are the ongoing costs to keep your policy active and managed.

Surrender Charges: If you decide to cancel your policy early—often within the first 10 to 15 years—the company will hit you with a hefty penalty that can erase a huge chunk of your accumulated cash value.

Here’s the bottom line on costs: transparency. In the life insurance vs. 401(k) debate, 401(k) fees are usually pretty clear—you'll see expense ratios and administrative costs. Life insurance fees are layered and often opaque, making it tough to understand their true, long-term impact on your money.

Comparing Fee Structures Side by Side

The fee structures for these two products are worlds apart, and this difference directly impacts how much of your savings you actually get to keep. The average annual fee for a 401(k) plan hovers around 0.57%. In stark contrast, some permanent life insurance policies can have internal costs that effectively start at 3% or higher in the early years.

Let's put that in real numbers. For someone with $50,000 saved, that's a difference between paying roughly $285 a year in 401(k) fees versus $1,500 or more with an insurance policy. That's a massive hurdle for your money to overcome before it can even begin to grow. You can learn more about these retirement costs on Policygenius.

Over decades, the compounding effect of these fees is staggering. What looks like a small 1-2% difference in annual costs can easily add up to tens or even hundreds of thousands of dollars less in your account by the time you retire. For a family whose primary goal is to build the biggest possible nest egg, the simple, low-cost structure of a 401(k) offers a clear mathematical advantage.

Growth Potential vs. Risk Exposure

When you're deciding where to put your money, you're really asking two questions: "How much can this grow?" and "How much could I lose?" This is where the life insurance vs. 401(k) comparison really gets interesting. They are built on completely different ideas about how to handle growth and risk.

A 401(k) is, by its very nature, a growth machine. It’s hitched directly to the stock market. Your contributions buy into mutual funds and other equities, giving you direct access to the market's potential for impressive returns. This is precisely how small, regular contributions can compound over a career into a sizable retirement fund.

Of course, that potential for high growth doesn't come for free. The price you pay is risk. Because your 401(k) is tied to the market, its value will go up and down—sometimes dramatically. There's no safety net protecting your principal from losses, particularly in the short run. It’s a tool designed for the long game, giving your money decades to ride out the downturns and capture the market's overall upward trend.

The Steady Path of Life Insurance Cash Value

Permanent life insurance, on the other hand, lives at the opposite end of the risk spectrum. The cash value component is built for one thing above all else: stability. Its growth engine is far more conservative, and it typically works in one of two ways:

Fixed Interest Rates: Many policies offer a guaranteed minimum interest rate. The growth is slow and steady, but it's predictable.

Indexed Returns: Some policies tie your growth to a market index, like the S&P 500. But here’s the key—they come with built-in protections. There’s a floor (often 0%) that prevents you from losing money when the market drops, and a cap that limits your upside when the market soars.

This setup is designed to give you a much smoother ride. You'll miss out on the exhilarating highs of a bull market, but you’re also completely shielded from the gut-wrenching lows.

Think of it this way: A 401(k) puts you in the front row of a roller coaster, where you experience every thrilling peak and terrifying dip. A permanent life insurance policy is more like a carousel—the ride is gentle, predictable, and you always end up right where you started, just a little bit ahead.

A Head-to-Head Look at Returns

The difference in potential returns isn't just a minor detail; it's massive. Over a recent nine-year span, the average annual return for a 401(k) was around 15.6%. During that same period, a permanent life insurance policy might have credited a fixed rate of 2-3%. If you want to see how this plays out over time, you can explore a deeper dive into these return differences.

This sharp contrast gets right to the heart of their intended purposes. A 401(k) is a tool for accumulating wealth, using market risk as its fuel. Permanent life insurance is designed for protection first, offering modest, safe growth as a secondary feature to its core promise: a death benefit for your loved ones. Ultimately, your choice depends on what you need most right now—aggressive growth or rock-solid stability.

Navigating the Tax Advantages and Disadvantages

When you’re trying to choose between a 401(k) and life insurance, you have to follow the money—specifically, how the IRS treats it. The tax rules for these two tools are worlds apart, and understanding them is crucial to figuring out which one actually fits your family’s financial picture.

A traditional 401(k) gives you an immediate, upfront tax advantage. Because you contribute with pre-tax dollars, every dollar you put in lowers your taxable income for that year. It's a nice perk that lets you feel a little less of a sting come tax time and allows more of your money to go to work for you right away.

Inside the account, everything grows tax-deferred. That means you don't owe Uncle Sam anything on the dividends, interest, or capital gains that build up year after year. But don’t mistake "deferred" for "forgiven." The tax bill is just waiting for you down the road.

The Tradeoff During Retirement

That day of reckoning for a 401(k) comes when you retire. Every single dollar you withdraw is taxed as ordinary income, based on whatever your tax bracket is at that time. This is a point people often miss—the retirement income you’ve worked so hard for will be fully taxable.

Permanent life insurance is built on the complete opposite tax principle. You pay your premiums with after-tax dollars, so there’s no deduction or tax break today.

The core tax difference is simple: A 401(k) gives you a tax break now but requires you to pay taxes later. Permanent life insurance offers no upfront break but provides significant tax-free benefits on the back end.

After you've paid those premiums, the policy's cash value grows tax-deferred, much like a 401(k). The real magic, though, happens when you need to get your hands on that money.

Accessing Your Money Tax-Free

Life insurance brings some powerful tax advantages to the table that a 401(k) simply can't offer, creating some interesting possibilities for a conservative financial plan.

Tax-Free Death Benefit: This is the big one. The payout your beneficiaries receive when you pass away is 100% income-tax-free. Your family gets the full amount you planned for them, with no surprise tax bill attached.

Tax-Free Policy Loans: You have the ability to borrow against the cash value you've built up, and these loans are not considered taxable income. As long as you keep the policy in force, you won't owe taxes on the amount you borrow.

Tax-Free Withdrawals (to a point): You can also withdraw money directly. You're allowed to take out an amount equal to what you've paid in premiums—what's known as your "cost basis"—completely tax-free.

This unique structure positions permanent life insurance as a potential source of tax-free supplemental retirement income. It's not a simple strategy, however, and requires careful planning with a professional to make sure you don't accidentally trigger a taxable event.

Picking the Right Tool for Your Life Stage

The nuts and bolts of life insurance and 401(k) plans are one thing, but figuring out how they fit into your actual life is what really counts. The "life insurance vs. 401(k)" conversation isn't about crowning a winner. It's about knowing which tool to pull out of the toolbox for the job at hand. Your strategy should always come back to where you are in life and what you're trying to accomplish.

Let's walk through a few common situations that conservative American families often find themselves in. Each scenario really shows how these products solve completely different financial puzzles.

For the Young Professional Focused on Growth

If you're in your 20s or 30s with decades of your career still ahead of you, your main financial mission is building wealth. In this case, the 401(k) is the undisputed champion. The name of the game is to contribute as much as you can, especially enough to get your full employer match—that’s a guaranteed return you just can't beat anywhere else.

You have time on your side, which means you can afford to ride out the market’s inevitable ups and downs and let compound growth do its heavy lifting. It’s smart to have a simple, affordable term life policy to protect anyone who depends on you, but sinking a lot of cash into a permanent policy at this stage would likely just slow down your wealth-building engine when you need it most.

For the High-Income Earner Maxing Out Accounts

Now, picture a family in their 40s or 50s. They're great savers and have been consistently maxing out their 401(k) and IRA contributions for years. But they want to put away even more for retirement in a tax-friendly way. For this family, a permanent life insurance policy starts to look like a very attractive supplemental tool.

Since permanent life insurance doesn't have government-set contribution limits, it can serve as an extra, conservative savings bucket. The policy's cash value grows tax-deferred, and later on, they can take out tax-free loans against it. This can be a fantastic way to supplement their taxable 401(k) withdrawals in retirement, giving them a more balanced income stream and helping them manage their overall tax bill.

Both investment and protection are critical parts of a sound financial future. The need for both is underscored by a projected $240 trillion global retirement savings shortfall and a $160 trillion protection gap by 2030, showing how underfunded both areas are. You can read the full analysis on this global challenge from EY.

For the Family Seeking a Balanced Approach

Finally, think about a family with young kids who need both protection and steady, secure growth. For them, a hybrid strategy is often the perfect fit.

Their first move should always be contributing to the 401(k) up to the full employer match. At the same time, they can put a permanent life insurance policy in place. This ensures their family is protected no matter what, while also building a modest but stable cash value on the side. This blended approach doesn’t force them into an either/or decision; it lets them build a solid foundation of both wealth and security.

Answering Your Key Financial Planning Questions

When you start digging into the details of life insurance versus a 401(k), the real-world questions pop up. What happens when life throws you a curveball? How do these accounts actually work when you need them? The answers really get to the heart of what makes them so different.

Can I Borrow From Both?

You can, but the experience is night and day.

Taking a 401(k) loan means you're formally borrowing from your own retirement funds, and your employer sets the terms. You have to pay it back, with interest, on a strict schedule. The biggest catch? If you leave your job—whether you quit or are let go—that loan can become due almost immediately. It’s a huge risk that can turn a job change into a financial crisis.

A life insurance policy loan, on the other hand, is a completely different animal. It’s more like a private advance against your policy's cash value. You don't have a rigid repayment schedule, which gives you incredible flexibility. While interest will accrue and an unpaid loan will reduce the death benefit for your heirs, you’re in the driver's seat.

What Happens if I Change Jobs?

This is where the difference between an employer-sponsored plan and a personal asset really shines.

Your 401(k) is directly tied to your job. When you leave, you have to decide what to do with it—usually, you'll roll it over into an IRA or your new company's 401(k). You can't just leave it behind and forget about it.

A personal life insurance policy, however, is 100% portable. It’s yours, not your employer's. As long as you keep paying the premiums, your coverage and your cash value go with you, no matter how many times you change jobs. It provides a level of stability that a 401(k) simply can’t offer.

When planning your financial future, many questions arise, including concerns about the security of your retirement savings. For example, understanding the IRS's authority over 401k accounts and how to protect them is a key part of informed decision-making.

_edited.png)

Comments