10 Essential Wealth Preservation Strategies for 2025

- dustinjohnson5

- Jul 16, 2025

- 18 min read

As you approach retirement, the financial focus shifts decisively from wealth accumulation to wealth preservation. After decades of diligent work, saving, and investing, the primary goal is no longer just about growing your net worth but about safeguarding it against the myriad forces that can erode its value. For conservative American families, this transition is particularly critical. Your nest egg represents more than just numbers on a statement; it is the foundation for your family’s security, the embodiment of your values, and the legacy you intend to pass on to future generations.

Protecting this legacy requires a proactive and strategic approach. Market volatility, inflation, complex tax laws, and unforeseen personal events can all pose significant threats to your financial stability. Relying on simple savings or basic investment plans is often insufficient to build a truly resilient financial fortress. Effective wealth preservation strategies involve a sophisticated, multi-layered plan that anticipates risks and employs specific tools designed for long-term defense.

This comprehensive guide moves beyond generic advice to deliver a detailed roundup of ten powerful strategies tailored for those who prioritize stability. We will delve into actionable insights on everything from advanced trust structures and tax-efficient retirement accounts to tangible assets like real estate and strategic insurance planning. You will learn how to implement these methods to create a durable framework that protects your assets, minimizes tax liabilities, and ensures your wealth endures for your lifetime and beyond. This is your blueprint for securing your financial future and ensuring your hard-earned legacy remains intact.

1. Asset Diversification and Portfolio Allocation

A cornerstone of any robust financial plan, asset diversification is one of the most fundamental wealth preservation strategies available. The core principle is simple yet powerful: "don't put all your eggs in one basket." By spreading investments across various asset classes, geographic regions, and economic sectors, you insulate your portfolio from the shocks of market volatility. If one asset class, like technology stocks, experiences a downturn, gains in another area, such as government bonds or real estate, can help offset those losses.

How It Works in Practice

Pioneers like David Swensen at the Yale Endowment revolutionized this concept by moving beyond a simple stock-and-bond mix to include alternative assets like real estate, private equity, and commodities. This multi-asset approach provides multiple sources of return and significantly reduces dependency on any single market condition. For conservative families nearing retirement, this strategy is not about chasing the highest possible returns; it's about building a resilient portfolio that can withstand economic turbulence and safeguard your nest egg.

To effectively manage risk and maximize returns, mastering smart asset allocation strategies is crucial for long-term wealth preservation. A disciplined approach ensures your portfolio remains aligned with your financial goals and risk tolerance, preventing emotional decisions during market swings.

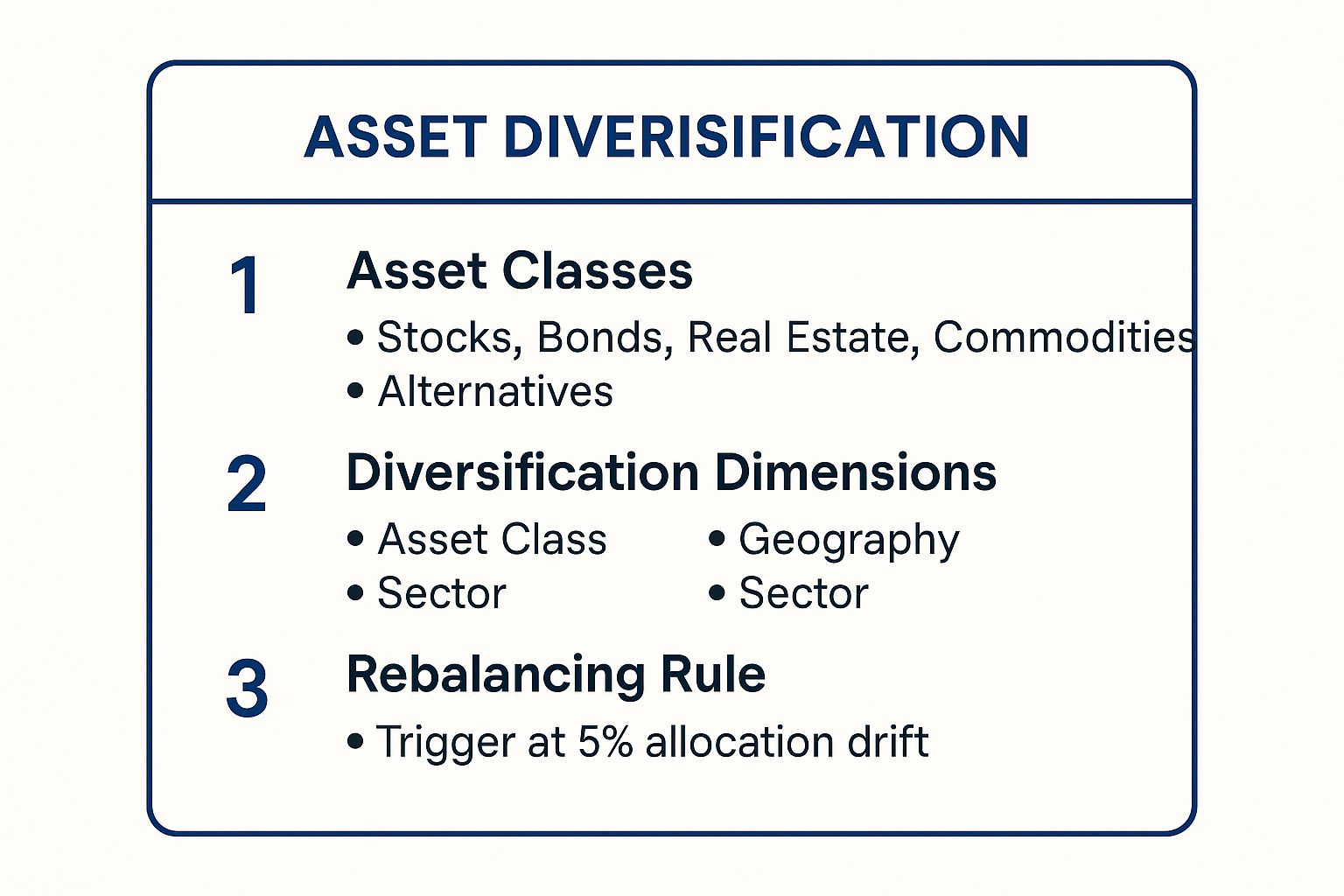

The infographic below summarizes the core components of a well-diversified portfolio.

This visual guide highlights the key dimensions of diversification, from the types of assets you should hold to the rules for maintaining balance, ensuring your strategy remains effective over time.

Implementing Your Diversification Strategy

Getting started doesn't have to be complex. A traditional 60/40 portfolio (60% stocks, 40% bonds) serves as a solid foundation. From there, you can add layers of diversification, such as international stock funds and real estate investment trusts (REITs). Regular rebalancing, perhaps quarterly or when an allocation drifts more than 5% from its target, is essential to lock in gains and buy underperforming assets at a lower price.

For a deeper dive into portfolio construction, this video offers valuable insights from financial experts.

2. Trust Structures and Estate Planning

Beyond simple portfolio management, establishing sophisticated legal structures is a critical component of long-term wealth preservation strategies. Trust structures and comprehensive estate planning allow you to control how your assets are managed, protected, and distributed, both during your lifetime and after. A trust is a legal entity that holds assets on behalf of beneficiaries, managed by a trustee, ensuring your wealth is transferred according to your specific wishes while minimizing tax burdens and avoiding the lengthy, public probate process.

How It Works in Practice

Proper estate planning is more than just writing a will; it's about creating a durable legal framework to safeguard your legacy. For instance, tech billionaires have famously used Grantor Retained Annuity Trusts (GRATs) to transfer significant wealth to their heirs with minimal gift or estate tax. Similarly, legacy families like the Rockefellers pioneered the use of Dynasty Trusts to preserve wealth across multiple generations, shielding assets from estate taxes and creditors for decades or even centuries.

These tools are not just for the ultra-wealthy. For conservative families approaching retirement, a thoughtfully constructed trust can protect assets from potential lawsuits, ensure funds are available for a spouse’s care, or manage a special needs beneficiary's inheritance without disqualifying them from government benefits.

Implementing Your Estate Plan

Getting started requires professional guidance to navigate the legal and tax complexities. The first step is to work with an experienced estate planning attorney who understands your family dynamics and financial goals.

Key considerations include:

Choosing the Right Trust: Determine if a revocable living trust (for flexibility and probate avoidance) or an irrevocable trust (for asset protection and tax reduction) is more suitable.

Selecting Trustees: Your trustee will manage the trust's assets. This could be a trusted family member, a professional fiduciary, or a corporate trust company like Northern Trust. A clear succession plan for the trustee role is vital.

Regular Reviews: Life circumstances, family relationships, and tax laws change. It is crucial to review and update your trust documents every few years or after significant life events like a marriage, birth, or divorce.

By proactively engaging in estate planning, you create a resilient shield that protects your family’s financial future and ensures your legacy endures exactly as you envision.

3. Offshore Banking and International Structures

While often misunderstood, offshore banking and the use of international structures can be powerful wealth preservation strategies when used legally and transparently. The core principle involves holding assets in reputable financial institutions located outside your home country. This approach is designed to provide a layer of protection against domestic economic instability, political risk, and potential legal challenges, while also offering access to different investment opportunities.

How It Works in Practice

High-net-worth families have long utilized jurisdictions like Switzerland and Singapore for their strong banking privacy laws, political stability, and sophisticated wealth management services. For example, a U.S. family might establish a trust in a jurisdiction like the Cayman Islands or set up a bank account with a Swiss private bank. This doesn't eliminate U.S. tax obligations, but it does diversify their assets geopolitically, shielding a portion of their wealth from localized U.S. market or legal system risks.

The primary goal for conservative families is not tax evasion, which is illegal, but asset protection and stability. Using international structures ensures that not all of your wealth is subject to the laws and economic conditions of a single country. This geographic diversification is a key component of a resilient financial fortress.

Implementing Your International Strategy

Engaging in offshore banking requires meticulous planning and professional guidance to ensure full compliance with U.S. laws, such as the Foreign Account Tax Compliance Act (FATCA). The first step is to consult with legal and tax professionals who specialize in international finance. They can help you vet reputable institutions in well-regulated jurisdictions and structure your holdings correctly.

Key steps include:

Thorough Due Diligence: Select stable jurisdictions with robust legal frameworks and a history of protecting depositor assets.

Professional Guidance: Work with experienced international wealth managers, tax advisors, and attorneys.

Full Disclosure: Ensure you meet all U.S. reporting requirements, including filing a Report of Foreign Bank and Financial Accounts (FBAR). Failure to comply carries severe penalties.

This strategy is not for everyone, but for those with significant assets, it provides an unparalleled level of diversification and protection, safeguarding wealth for future generations.

4. Real Estate Investment and Ownership Strategies

Tangible assets like real estate serve as a powerful hedge against inflation and currency fluctuations, making them a classic component of long-term wealth preservation strategies. Unlike stocks or bonds, which exist purely in digital or paper form, physical property offers the security of direct ownership. Real estate has historically appreciated over the long term and can provide a steady stream of rental income, creating a reliable cash flow stream for retirees.

How It Works in Practice

The strategy extends far beyond simply buying a family home. Real estate moguls and large investment firms like Blackstone leverage real estate portfolios for stable returns and capital appreciation. For individual investors, this can mean owning residential rental properties, commercial buildings, or even investing in land. A key advantage is the ability to use leverage, controlling a large asset with a smaller initial investment through a mortgage. This amplifies potential returns and wealth accumulation over time.

For those who want real estate exposure without the responsibilities of being a landlord, Real Estate Investment Trusts (REITs) are an excellent alternative. REITs like Realty Income Corporation allow you to invest in a diversified portfolio of income-producing properties and receive dividends, offering liquidity and simplicity. This approach is ideal for conservative investors seeking to safeguard capital while still benefiting from real estate's growth potential.

Implementing Your Real Estate Strategy

Success in real estate investing hinges on careful planning and due diligence. Begin by identifying your goals: are you seeking rental income, long-term appreciation, or both? Focus on high-quality locations with strong economic fundamentals like job growth and population increases.

Before purchasing, it is critical to analyze all associated costs, including property taxes, insurance, maintenance, and potential management fees. For those considering a more hands-off approach, exploring a professionally managed REIT or a real estate fund can provide diversification and reduce individual property risk. Finally, consider geographic diversification, including stable international markets, to protect your portfolio from localized economic downturns.

5. Precious Metals and Commodity Investments

For millennia, tangible assets like gold, silver, and other commodities have served as a universal store of value. As one of the oldest wealth preservation strategies, investing in precious metals acts as a powerful hedge against inflation, currency devaluation, and widespread economic uncertainty. Unlike stocks or bonds, these physical assets carry no counterparty risk and have historically maintained their purchasing power through financial crises, wars, and periods of instability.

How It Works in Practice

The value of precious metals often moves inversely to traditional financial assets. When confidence in governments or their currencies falters, investors flock to gold and silver as a safe haven. Billionaire investor Ray Dalio famously advocates for a strategic allocation to gold as portfolio insurance, a lesson reinforced during the 2008 financial crisis when gold prices soared while equity markets collapsed. Central banks worldwide, particularly in emerging economies like China and India, continue to bolster their gold reserves, signaling its importance as a stabilizing force in a volatile global economy.

Adding a tangible asset component can significantly enhance a portfolio's resilience. For those looking to expand their portfolio globally, consider the benefits of investing in property in Spain or Portugal as a means of asset diversification. This approach combines the security of real estate with the benefits of international exposure, further insulating wealth from domestic economic shocks.

Implementing Your Precious Metals Strategy

Incorporating precious metals into your portfolio requires a measured approach. Financial advisors often recommend a modest allocation, typically between 5% and 10% of your total assets, to avoid over-concentration. You can gain exposure through several methods:

Physical Bullion: Buying gold or silver coins and bars from reputable dealers like APMEX or JM Bullion. This provides direct ownership but requires secure storage solutions.

Exchange-Traded Funds (ETFs): Products like GLD (SPDR Gold Shares) track the price of gold and offer high liquidity, though you do not own the physical metal yourself.

Mining Stocks: Investing in companies that mine precious metals, which offers potential for appreciation but also introduces equity market risk.

A balanced strategy might involve a mix of physical holdings for ultimate security and ETFs for liquidity. It is crucial to understand the different tax implications, as gains on physical metals held for over a year are taxed as collectibles at a higher rate than long-term capital gains on stocks or ETFs.

6. Life Insurance as Wealth Transfer Tool

Often viewed solely as a safety net, life insurance can be one of the most sophisticated and powerful wealth preservation strategies for multi-generational planning. Beyond its primary role of replacing lost income, permanent life insurance serves as a highly efficient wealth transfer vehicle. It allows families to pass on a significant, income-tax-free death benefit to heirs, bypassing the often lengthy and public probate process.

How It Works in Practice

The strategic use of life insurance centers on its unique tax advantages and its ability to create instant liquidity for estate planning purposes. High-net-worth families frequently use an Irrevocable Life Insurance Trust (ILIT) to own the policy. By placing the policy inside a trust, the death benefit is removed from the deceased's taxable estate, preventing it from being subject to federal estate taxes. This ensures the full, intended amount reaches the beneficiaries.

This strategy is not just for avoiding taxes; it’s about providing the necessary cash to cover estate taxes on other, less liquid assets like real estate or a family business. This prevents heirs from being forced to sell valuable assets under pressure to pay an estate tax bill. For ultra-wealthy individuals, private placement life insurance (PPLI) offers a customized vehicle to hold alternative investments in a tax-advantaged wrapper.

Key Insight: The true power of life insurance in wealth preservation lies in its ability to create a tax-free pool of liquidity precisely when it's needed most, protecting family assets from forced liquidation and ensuring a smooth transition of wealth.

Implementing Your Life Insurance Strategy

Proper implementation is critical and requires professional guidance. Start by working with an experienced estate planning attorney and a qualified insurance professional who can model different scenarios. They can help you select a policy from a highly rated insurance company, ensuring its long-term financial stability.

For this strategy to be effective, you must:

Establish an ILIT: Work with an attorney to create the trust, name a trustee, and define the terms for your beneficiaries.

Fund the Policy Correctly: The trust, not you personally, should pay the premiums. This is often done through annual gifting to the trust within federal gift tax exclusion limits.

Conduct Regular Reviews: Policies should be reviewed every few years with your advisor to monitor performance, costs, and ensure the death benefit still aligns with your estate's needs.

7. Business Ownership and Entrepreneurship

While often viewed as a wealth creation engine, strategic business ownership is one of the most powerful and enduring wealth preservation strategies. Unlike passive investments, owning a business gives you direct control over income generation, asset management, and pricing power, which provides a natural hedge against inflation. This hands-on approach allows you to build an asset that not only generates cash flow but can also appreciate significantly over time, creating a lasting legacy.

How It Works in Practice

Visionary entrepreneurs like Warren Buffett transformed Berkshire Hathaway from a struggling textile mill into a diversified holding company, demonstrating how business ownership can preserve and compound capital across generations. On a smaller scale, family-owned enterprises, from local manufacturing plants to service businesses, have been the backbone of generational wealth for centuries. The key is to create a durable enterprise with a strong competitive advantage, capable of weathering economic downturns and adapting to market changes.

For business owners, ensuring the longevity and profitability of your venture is key to its role in your overall wealth preservation plan. Learning about effective financial management for small businesses can help you safeguard your business assets and enhance their long-term value. This proactive management ensures the business remains a source of stability rather than a liability.

Implementing Your Business Ownership Strategy

Success in business ownership hinges on more than just a great idea; it requires careful planning and execution. Establishing the correct legal structure, such as an LLC or S-Corp, is critical for protecting personal assets from business liabilities. Building a competent management team reduces your operational dependence and makes the business more resilient and valuable.

Most importantly, succession planning should begin early. Whether you intend to pass the business to family, sell to employees, or position it for an external sale, a clear exit strategy is fundamental to realizing its value and securing your financial future. This foresight transforms a job into a truly transferable asset.

8. Tax-Advantaged Retirement Accounts

A powerful component of any long-term financial plan, utilizing tax-advantaged retirement accounts is one of the most effective wealth preservation strategies available. These accounts, including 401(k)s and IRAs, allow your investments to grow either tax-deferred or tax-free, shielding your wealth from annual taxation. This compounding effect significantly enhances your savings potential over time, making it a cornerstone for a secure retirement.

How It Works in Practice

The U.S. tax code incentivizes retirement savings by offering substantial tax breaks. Traditional 401(k)s and IRAs allow you to contribute pre-tax dollars, lowering your current taxable income. Your investments then grow without being taxed each year. You only pay income tax on withdrawals in retirement, presumably when you are in a lower tax bracket. Roth versions of these accounts use post-tax contributions, but qualified withdrawals in retirement are completely tax-free.

For self-employed individuals or small business owners, options like a Solo 401(k) or a SEP IRA allow for much larger contribution limits, supercharging their retirement savings. High-income earners can leverage strategies like the Backdoor Roth IRA to participate in tax-free growth, even if their income exceeds standard contribution limits. This disciplined approach ensures that a significant portion of your nest egg is protected from tax erosion.

Implementing Your Retirement Account Strategy

Begin by maximizing any employer match offered in your 401(k) plan; it's an instant, guaranteed return on your investment. If you are over age 50, take full advantage of catch-up contributions to accelerate your savings.

Diversify Tax Treatment: Contribute to both traditional (pre-tax) and Roth (post-tax) accounts if possible. This gives you flexibility in managing your taxable income during retirement.

Optimize Investments: Choose low-cost index funds or ETFs within your retirement accounts to minimize fees and maximize growth potential.

Plan Your Withdrawals: Develop a tax-efficient withdrawal strategy before you retire. This may involve drawing from different account types in different years to stay in a lower tax bracket.

9. Alternative Investments and Private Markets

Venturing beyond traditional stocks and bonds, alternative investments represent a sophisticated tier of wealth preservation strategies. These non-traditional assets, including private equity, hedge funds, commodities, and even collectibles like fine art or vintage cars, offer diversification benefits by operating independently of public market fluctuations. Their unique risk and return profiles can provide a powerful hedge against volatility in a conventional portfolio.

How It Works in Practice

High-net-worth individuals and family offices have long used alternatives to achieve portfolio resilience. For example, private equity firms like Blackstone or KKR invest directly in private companies, unlocking value outside the public sphere. Similarly, hedge funds managed by pioneers like Ray Dalio of Bridgewater Associates employ complex strategies designed to generate returns in both rising and falling markets. This approach is not about replacing traditional assets but augmenting them to build a more robust financial fortress.

For conservative families nearing retirement, accessing these markets can insulate a portion of their wealth from stock market downturns, providing a potential source of stable, uncorrelated returns. The goal is to reduce overall portfolio risk while capturing growth opportunities that are unavailable to the average investor.

Implementing Your Alternative Investment Strategy

Gaining exposure to alternatives has become more accessible, but it requires diligence and a clear understanding of the risks involved.

Start with Liquid Alternatives: Begin with publicly traded alternative mutual funds or ETFs. These offer exposure to strategies like managed futures or real estate without the long lock-up periods typical of private investments.

Understand the Costs: Private market investments often come with higher fees, including management and performance fees. Scrutinize all associated costs to ensure they don't erode potential returns.

Maintain Liquidity: Alternatives are often illiquid, meaning your capital may be tied up for years. Ensure the rest of your portfolio has sufficient cash and liquid assets to cover unexpected expenses.

Work with Specialists: Navigating this complex space is best done with an experienced financial advisor who specializes in alternative assets. They can help vet opportunities and ensure they align with your risk tolerance and long-term goals.

10. Currency Hedging and International Diversification

Expanding your portfolio beyond domestic borders is a sophisticated yet powerful wealth preservation strategy, particularly for those concerned about the long-term stability of a single currency. Currency hedging and international diversification protect your wealth from the risks of domestic economic downturns and US dollar devaluation. By holding assets denominated in various foreign currencies, you create a natural buffer against exchange rate fluctuations that could otherwise erode your purchasing power.

How It Works in Practice

This strategy involves more than just buying international stocks; it's a deliberate allocation to different economic regions and currencies. For instance, if the US dollar weakens, assets held in euros, Swiss francs, or Japanese yen may increase in value when converted back to dollars, offsetting potential losses in your domestic portfolio. This approach was famously utilized by global macro hedge funds and international investment firms like Templeton, which built fortunes by capitalizing on global economic trends and currency movements.

For a conservative investor, this isn't about speculating on forex markets. It's about achieving true diversification. Holding a global bond fund or international real estate provides exposure to different interest rate cycles and property markets, ensuring your wealth is not tied solely to the fortunes of the US economy.

Implementing Your International Diversification Strategy

Getting started with international exposure is more accessible than ever. Consider these actionable steps to build a globally diversified portfolio:

Start with Broad Exposure: Begin by allocating a portion of your portfolio to broad international index funds or ETFs. These funds provide instant diversification across hundreds of companies in developed and emerging markets.

Decide on Hedging: Evaluate both hedged and unhedged international funds. Unhedged funds offer potential gains from favorable currency movements, while hedged funds use financial instruments to minimize the impact of exchange rate volatility, offering a more stable, albeit potentially lower, return.

Monitor Global Conditions: Stay informed about global economic and political developments. A shift in a foreign country's interest rate policy or political climate can significantly impact your investments.

Understand Tax Implications: Foreign investments can have different tax treatments. Consult with a financial advisor to understand the implications of foreign dividend taxes and reporting requirements to ensure compliance and tax efficiency.

Wealth Preservation Strategies Comparison Matrix

Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

Asset Diversification and Portfolio Allocation | Moderate 🔄 | Moderate ⚡ | Reduced volatility, steady long-term returns 📊 | Long-term investors seeking risk mitigation | Risk reduction, broad growth opportunities ⭐ |

Trust Structures and Estate Planning | High 🔄 | High ⚡ | Estate tax reduction, asset protection 📊 | High-net-worth individuals focused on wealth transfer | Tax optimization, probate avoidance ⭐ |

Offshore Banking and International Structures | High 🔄 | High ⚡ | Asset protection, tax efficiency 📊 | Wealth preservation amid political/economic instability | Privacy, currency diversification ⭐ |

Real Estate Investment and Ownership Strategies | Moderate 🔄 | Moderate to High ⚡ | Inflation hedge, rental income, appreciation 📊 | Investors seeking tangible assets and income generation | Tangible asset, tax benefits, leverage ⭐ |

Precious Metals and Commodity Investments | Low to Moderate 🔄 | Low to Moderate ⚡ | Inflation hedge, portfolio insurance 📊 | Portfolio diversification and economic uncertainty hedging | Store of value, liquidity, no counterparty risk ⭐ |

Life Insurance as Wealth Transfer Tool | High 🔄 | Moderate to High ⚡ | Tax-free death benefits, cash value growth 📊 | Estate planning and intergenerational wealth transfer | Tax advantages, creditor protection ⭐ |

Business Ownership and Entrepreneurship | High 🔄 | High ⚡ | Potential for high wealth growth 📊 | Entrepreneurs and business owners seeking control | Unlimited upside, tax benefits, control ⭐ |

Tax-Advantaged Retirement Accounts | Low to Moderate 🔄 | Low to Moderate ⚡ | Tax deferral, disciplined saving 📊 | Individuals aiming for long-term tax-efficient retirement | Tax benefits, employer match, creditor protection ⭐ |

Alternative Investments and Private Markets | High 🔄 | High ⚡ | Higher risk-adjusted returns, diversification 📊 | Sophisticated investors seeking non-traditional exposure | Diversification, professional management ⭐ |

Currency Hedging and International Diversification | Moderate to High 🔄 | Moderate to High ⚡ | Currency risk reduction, economic diversification 📊 | Investors exposed to currency risk and global markets | Currency protection, political risk reduction ⭐ |

Building Your Family's Financial Fortress: Next Steps

Navigating the landscape of wealth preservation can feel like assembling a complex, multi-layered fortress. Each strategy detailed in this guide, from sophisticated trust structures to tangible assets like real estate and precious metals, represents a critical component of that fortress. The goal is not just to accumulate wealth but to build a durable financial legacy capable of withstanding economic storms, tax burdens, and unforeseen life events for generations to come.

We have explored ten powerful wealth preservation strategies, each serving a unique purpose in your financial architecture. We moved from the foundational principles of asset diversification and tax-advantaged retirement accounts to more advanced tactics like international diversification, offshore structures, and leveraging alternative investments. The common thread weaving through all these approaches is proactive, disciplined planning. Wealth preservation is not a passive pursuit; it is an active, ongoing commitment to safeguarding the fruits of your labor.

From Knowledge to Action: Your Implementation Blueprint

Merely understanding these concepts is the first step. The true power lies in their implementation. The most effective wealth preservation plan is not a one-size-fits-all template but a bespoke blueprint meticulously designed for your family’s unique circumstances, values, and vision for the future.

Your immediate task is to transition from learning to doing. Here is a structured approach to get started:

Conduct a Comprehensive Financial Audit: Begin by taking a clear, honest inventory of your current financial standing. Where are your assets held? What is your current exposure to market volatility, inflation, and taxes? How does your current portfolio align with the diversification principles we discussed?

Prioritize Your Objectives: Not all ten strategies will be relevant or necessary for you today. Identify the ones that address your most pressing concerns. Are you approaching retirement and primarily focused on tax efficiency and income generation? Or is your main goal to create a seamless, tax-minimized wealth transfer to your heirs?

Stress-Test Your Current Plan: Imagine various scenarios. How would your current holdings perform during a significant market downturn, a period of high inflation, or a change in tax law? Identifying these vulnerabilities now is crucial for reinforcing your financial defenses before a crisis hits.

Assembling Your Team of Trusted Advisors

Building a financial fortress is not a solitary endeavor. The complexity of these wealth preservation strategies requires professional expertise. Attempting to navigate the intricate legal and financial frameworks of estate planning, international banking, or private market investments alone can lead to costly errors.

Your next critical step is to assemble a dedicated team of professionals who understand your conservative values and long-term goals. This team should ideally include:

A Certified Financial Planner (CFP): To help you create a holistic financial plan, manage your investment portfolio, and align your assets with your long-term objectives.

An Estate Planning Attorney: To draft essential documents like wills, trusts, and powers of attorney, ensuring your assets are transferred according to your wishes with minimal tax impact.

A Certified Public Accountant (CPA): To provide strategic tax planning advice, helping you navigate complex tax laws and optimize for tax efficiency across all your financial activities.

Key Insight: Your team of advisors should work in concert, communicating with each other to ensure every piece of your financial plan is integrated seamlessly. A disjointed approach can create gaps and inefficiencies, undermining your overall strategy.

By taking these deliberate, informed steps today, you transform abstract knowledge into a tangible, powerful force for your family's future. You are not just managing money; you are building a legacy of security, opportunity, and freedom that will endure for generations. This is the ultimate objective of true wealth preservation.

Protecting your family’s future is the cornerstone of any sound financial plan. For insurance solutions that align with conservative, patriotic values and provide a reliable layer of security, consider America First Financial. Their focus on family protection and asset security can be a vital component of your comprehensive wealth preservation strategies. Visit America First Financial to learn how their products can help fortify your family’s financial foundation.

_edited.png)

Comments