What Is an Insurance Deductible and How Does It Work

- dustinjohnson5

- Nov 2, 2025

- 11 min read

An insurance deductible is simply the amount of money you have to pay out of your own pocket for a covered loss before your insurance company steps in to pay the rest. Think of it as your share of the repair bill or medical expense when you need to file a claim. You get to choose this amount when you first buy your policy, and it plays a huge role in how much you pay for your coverage.

Your Financial Stake in an Insurance Claim

Here's a good way to think about it: imagine your insurance policy is a treasure chest full of financial protection. The deductible is the key you need to unlock it. Until you’ve paid your share of the cost, the insurer’s contribution stays locked away. This cost-sharing approach is central to how insurance works, making sure that both you and the insurance company have a financial stake in every claim.

This isn't just some fine print detail; it’s a core piece of the puzzle that shapes the affordability and design of almost every insurance product out there.

Take health insurance, for example. Deductibles are a major factor. Under the Affordable Care Act (ACA), the average deductible for a silver-tier plan in 2025 is expected to be over $5,000, with bronze plans often climbing near $7,500. You can dig deeper into how these figures impact Marketplace health plans over at commonwealthfund.org.

Understanding the Key Players

To really get a handle on what an insurance deductible is, it helps to see how it fits in with a couple of other key terms: your premium and a claim. Each one has a distinct job to do in your agreement with the insurance provider.

Key Takeaway: Your deductible, premium, and claim are all interconnected. The deductible is what you pay upfront during a claim, the premium is the regular fee to keep your policy active, and a claim is the formal request you make for payment after something happens.

Getting these three pillars straight is the first step to making smart choices about your coverage. This table breaks them down side-by-side for a quick comparison.

Key Insurance Terms at a Glance

Term | What It Is | When You Pay It |

|---|---|---|

Deductible | Your out-of-pocket share of a covered loss. | Only when you file a claim that is approved. |

Premium | The regular fee you pay to keep your policy active. | Monthly, quarterly, semi-annually, or annually. |

Claim | A formal request to your insurer for payment. | After an incident occurs that is covered by your policy. |

As you can see, you only deal with a deductible when you actually need to use your insurance. Your premium, on the other hand, is a fixed, ongoing expense.

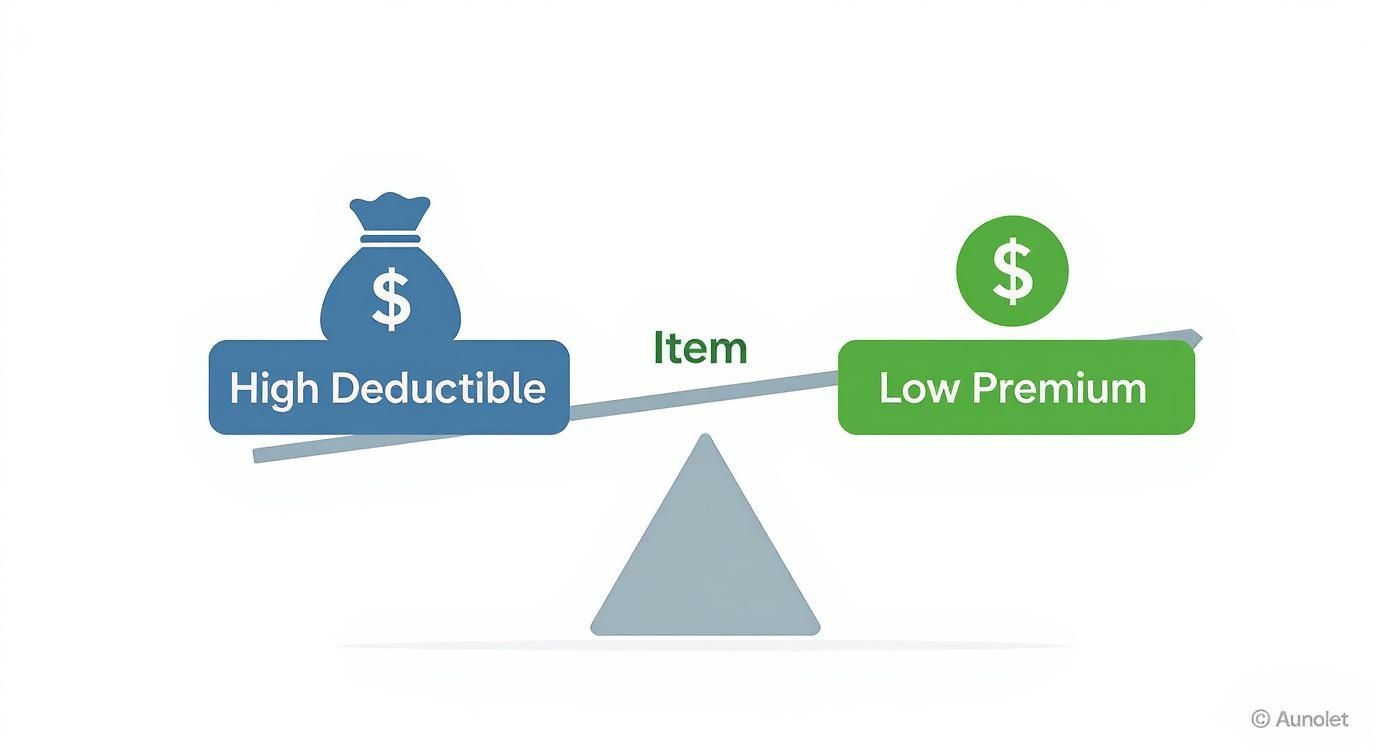

The Deductible vs. Premium Seesaw

Think of your insurance policy as a financial seesaw. On one end, you have your deductible—the cash you pay out of pocket when you make a claim. On the other end is your premium—the regular bill you pay to keep the policy active. It’s a simple balancing act: when one goes up, the other almost always comes down.

This inverse relationship is the bedrock of insurance pricing. When you agree to a higher deductible, you're essentially telling your insurer, "I'm willing to handle the smaller stuff myself." By taking on more of the initial financial risk, you instantly become less of a potential liability to them.

Because you’re shouldering the cost of minor claims, the insurance company expects to pay out less over the life of your policy. In return for you accepting more of the risk, they give you a break on your premiums. It's a classic trade-off: risk for cost.

How This Choice Hits Your Wallet

Let's put this into perspective with a real-world auto insurance example. Say you're getting quotes for the exact same coverage on your car, but you're playing with the collision deductible.

Quote A (Low Deductible): You choose a $250 deductible. Your monthly premium comes out to $150.

Quote B (High Deductible): You opt for a $1,000 deductible. Your monthly premium drops to just $110.

By choosing the higher deductible, you're saving $40 every single month. That’s a tidy $480 back in your pocket over the year. The catch? If you get into a fender bender, you have to be ready to pull that full $1,000 from your own funds before the insurance company pays a dime. The lower deductible is your safety net for a smaller out-of-pocket hit, but you pay more for that peace of mind every month.

The Core Trade-Off: A high deductible means lower insurance bills but a bigger financial hit when you file a claim. A low deductible means higher bills but a much smaller out-of-pocket expense after an accident.

Finding the Sweet Spot for Your Budget

Picking the right deductible isn't just a math problem—it's a personal finance decision. The real question you need to ask yourself is, "Could I comfortably write a check for this amount tomorrow without causing a financial crisis?"

If you have a solid emergency fund sitting in the bank, choosing a higher deductible to lock in those lower premium payments is often a smart move. You get the savings month after month, confident you can handle the deductible if needed.

On the other hand, if your budget is tight and an unexpected $1,000 expense would be a major blow, the predictability of a higher premium might be worth it. You pay more regularly for the security of a smaller, more manageable deductible. Understanding this balance is how you get a policy that truly protects you without wrecking your budget. It's the key to understanding what is an insurance deductible in the context of your own life.

How Deductibles Work Across Different Insurance Types

A deductible isn't a one-size-fits-all concept. It changes its stripes depending on the type of insurance policy you're looking at, whether it's for your car, your home, or your health. Think of it as a different set of rules for each game.

Understanding these nuances is crucial for managing your budget and making sure there are no nasty surprises when you actually need to file a claim. Let's break down how deductibles operate in the three most common areas.

Auto Insurance Deductibles

When it comes to car insurance, you'll usually find that deductibles are split by the type of damage. This lets you tailor your coverage to what you think your biggest risks are.

Collision Deductible: This is the one you'll use if your car is damaged in an accident with another vehicle or you hit a stationary object, like a fence post or a guardrail. You pay this amount out of pocket before your insurance kicks in for the repairs.

Comprehensive Deductible: This covers just about everything else—damage that isn't from a collision. We're talking about things like theft, vandalism, fire, or hitting a deer. The article What Is Comprehensive Auto Insurance? does a great job of explaining how deductibles apply in these specific scenarios.

The neat part is you can set different deductible amounts for each. For instance, you could choose a $500 collision deductible but go with a lower $250 comprehensive one if you live in an area where storm damage or car theft is more of a concern.

Home Insurance Deductibles

Home insurance deductibles can get a bit more complicated. You’ll often see a mix of simple flat-dollar amounts and more complex percentages.

Your standard deductible is a fixed amount, say $1,000 or $2,500, that applies to most common claims like a kitchen fire or a burst pipe. Simple enough.

But for major disasters, especially in high-risk regions, the rules change. Many policies have a separate percentage-based deductible for specific events like hurricanes, windstorms, or even earthquakes. Instead of a fixed number, it’s a percentage of your home's total insured value, typically from 1% to 10%.

So, if your home is insured for $300,000 and you have a 2% hurricane deductible, you’d be on the hook for the first $6,000 of damage from that storm.

Health Insurance Deductibles

Health insurance deductibles reset every year. The concept is straightforward: you have to pay a set amount for your covered medical care before your health plan starts to pitch in. Once you hit that magic number, you usually just owe a smaller copayment or coinsurance for future services.

Individual Deductible: This is the specific amount one person on the plan has to meet.

Family Deductible: This is the combined total that everyone on the family plan must meet. In many plans, once the family deductible is reached, the insurance starts paying for every family member, even if one person hasn't met their individual deductible yet.

This infographic does a great job of showing the core trade-off you make with any deductible.

The seesaw is the perfect analogy. When you agree to a higher deductible (more risk for you), your regular premium payments go down. This fundamental balancing act is true for pretty much every type of insurance out there.

Putting It All Together with Real-World Examples

Theory is one thing, but seeing how a deductible plays out in real life is where it all starts to make sense. Let’s walk through three everyday situations—a car crash, a leaky pipe at home, and a year's worth of doctor visits—to see the numbers in action. Each story shows exactly who pays what and when.

Scenario 1: The Auto Insurance Claim

You're driving home from work and get into a fender bender. Thankfully, no one's hurt, but your car isn't so lucky. The body shop gives you an estimate for $3,000 to get it looking new again. You pull up your auto insurance policy and see you have a $500 collision deductible.

So, what happens next?

You Pay First: Before your insurance kicks in, you’re on the hook for the first $500 of the repair bill. You'll pay this directly to the auto body shop.

Insurance Covers the Rest: Once you've paid your part, your insurer takes care of the remainder. They'll cut a check for $2,500 to the shop.

In the end, your car gets fully repaired for $3,000, but your out-of-pocket hit was just the $500 deductible. Your policy absorbed the much bigger financial blow.

Scenario 2: The Home Insurance Claim

Picture this: you get home from a long weekend away and find a disaster. A pipe burst in the kitchen, flooding the room and causing serious water damage. The contractor quotes you a painful $10,000 for all the repairs. You check your homeowners policy and find your deductible is $1,500.

Just like with the car accident, you have to cover your share first. You'll pay $1,500 towards the repairs, and your insurance provider will handle the remaining $8,500. It’s a tough situation, but that policy just saved you from a five-figure bill that could have wiped out your savings.

Key Insight: Think of the deductible as your contribution to the repair cost. Your insurer subtracts it from the total claim amount, and they pay the rest.

This system discourages people from filing claims for every minor scuff or issue while still providing a crucial safety net for major events that could be financially devastating.

Scenario 3: The Health Insurance Claim

Health insurance deductibles work a bit differently because they typically reset every year and apply to a cumulative total of expenses.

Let's follow a family with a plan that has a $4,000 annual family deductible.

January: Their son gets sick and needs a trip to urgent care. The bill is $250. The family pays the full amount out of pocket.

April: A parent sees a specialist for some tests, which comes to $1,250. Again, they pay this entirely.

July: Another family member has a minor outpatient procedure that costs $2,500.

At this point, they've paid a total of $4,000 ($250 + $1,250 + $2,500) in medical bills for the year. They've officially met their deductible.

For any other covered medical care for the rest of the year, their insurance company starts paying its share. The family will now only owe smaller amounts, like copayments or coinsurance, for future doctor visits or prescriptions.

How to Choose the Right Deductible for Your Needs

Picking an insurance deductible isn't just about circling a number on a form. It's a real financial strategy that requires balancing what you pay each month with what you can afford to pay out of the blue if something goes wrong. The "right" choice is different for everyone and comes down to your personal finances and how much risk you're comfortable with.

Before you make a call, take a good, honest look at your savings. The single most important question to ask yourself is: “Could I comfortably pay this deductible amount tomorrow without going into debt or wrecking my budget?”

This is where a solid emergency fund becomes your superpower. If you’ve got a healthy cash cushion set aside, you can probably handle a higher deductible, which in turn unlocks lower monthly premiums. That saves you money in the long run, and you still have the peace of mind knowing you can cover your end of the deal if you ever need to file a claim.

Assess Your Emergency Fund

When you file a claim, your emergency fund is your first line of defense for covering the deductible. Opting for a higher deductible is only a smart move if you actually have the cash ready to go. If a surprise $1,000 or $2,500 bill would throw your finances into a tailspin, you’re much better off choosing a lower deductible.

Sure, you'll pay a higher premium each month, but think of it as pre-paying for financial security. You're trading a little more each month for a much smaller, more manageable expense when things go sideways. It's a classic case of predictability versus potential long-term savings.

The Golden Rule: Never choose a deductible that is higher than the amount you have readily available in your emergency savings. Your insurance should reduce financial stress, not create it.

Compare High vs Low Deductibles

Getting to the heart of this decision means understanding the trade-offs. Each path has clear pros and cons that affect both your monthly budget and your financial stability if you ever have a claim.

Let’s lay it all out.

High Deductible vs Low Deductible Which Is Better for You

Deciding between a high and low deductible plan often feels like a tug-of-war between saving now and saving later. The table below breaks down the key differences to help you see which approach aligns best with your financial situation.

Feature | High Deductible Plan | Low Deductible Plan |

|---|---|---|

Monthly Premium | Lower, saving you money every month. | Higher, costing you more over time. |

Out-of-Pocket Cost | Higher when you file a claim. | Lower and more manageable during a claim. |

Best For | Individuals with a strong emergency fund. | Those with tighter budgets or lower risk tolerance. |

Financial Risk | You accept more of the initial financial risk. | The insurer takes on more of the initial risk. |

At the end of the day, there's no magic number. It all comes down to a personal calculation. Weigh your savings, your monthly cash flow, and how much financial uncertainty you can live with. When you line up your deductible with your financial reality, you create a policy that gives you genuine security.

Common Questions About Insurance Deductibles

Even after you've got the basics down, a few practical questions about deductibles always seem to come up. Let's tackle some of the most common ones to clear up any lingering confusion.

Do I Pay the Deductible to My Insurance Company?

This is a great question and a very common point of confusion. The short answer is no, you don't write a check to your insurance company for the deductible amount.

Think of it this way: the deductible is simply your share of the repair bill. If your car has $2,000 in damage from a covered accident and your deductible is $500, the insurance company will pay $1,500. You're then responsible for paying the remaining $500 directly to the auto body shop. The insurer just subtracts your portion from the total they pay out.

Can I Change My Deductible Amount Anytime?

You can definitely change your deductible, but timing is everything. These changes are typically made at your policy renewal, not in the middle of a policy term.

Most importantly, you can't change your deductible after you've had an accident or a loss to try and get a better payout for that specific claim. If you're thinking about adjusting your deductible, the best time to talk to your agent is a month or two before your policy is set to renew. This gives you plenty of time to explore your options for the upcoming year.

Key Takeaway: If the cost to fix something is less than your deductible, it usually doesn't make sense to file a claim. You'd be paying the entire bill yourself anyway, and you'd still end up with a claim on your record.

At America First Financial, we believe in providing clear, straightforward protection that aligns with your values. Secure your family’s future with insurance solutions designed to safeguard your assets and financial stability. Get a free, no-hassle quote in under three minutes by visiting our website.

_edited.png)

Comments