7 Affordable Insurance Solutions for Families in 2025

- dustinjohnson5

- Jun 20, 2025

- 13 min read

Securing Your Family's Future Without Breaking the Bank

For conservative, budget-minded families, finding financial products that align with your values and your wallet can be a significant challenge. The landscape of insurance is vast and often confusing, filled with complex policies and steep premiums that can strain any household budget. However, protecting your loved ones and securing your hard-earned assets doesn't have to mean compromising your principles or your financial plan. It is more important than ever to explore practical, affordable insurance solutions that provide robust protection.

This guide cuts through the noise to present a curated list of seven carefully selected options. These strategies are tailored for families who prioritize financial stability, personal responsibility, and traditional values. We will cover a range of powerful choices, from innovative healthcare alternatives like Health Sharing Ministries and Direct Primary Care to foundational plans such as High-Deductible Health Plans paired with a Health Savings Account (HSA).

This article provides the actionable insights you need. We will delve into how each solution works, identify who it's best for, and offer practical tips for implementation. Our goal is to equip you with the knowledge to make informed decisions and build a comprehensive safety net that truly safeguards your family's future.

1. Health Sharing Plans (Health Care Ministries)

For budget-minded families seeking a values-aligned alternative to traditional health insurance, Health Sharing Plans, also known as Health Care Sharing Ministries (HCSMs), present a compelling option. These organizations are not insurance; rather, they are nonprofit, faith-based or ethically-driven groups where members contribute monthly "shares" into a collective pool. When a member incurs a qualifying medical expense, they submit a request, and funds from this pool are used to cover the bill, reflecting a community-based approach to healthcare costs.

This model often results in significantly lower monthly payments compared to standard insurance premiums, making it a powerful tool for managing household expenses. For example, Christian Healthcare Ministries has processed over $500 million in medical bills annually, while Samaritan Ministries serves a large community with average monthly family shares around $405. These ministries operate under religious exemptions and are not bound by the Affordable Care Act (ACA), which contributes to their unique structure and lower costs. They represent one of the most direct and community-focused affordable insurance solutions available.

How to Implement Health Sharing

Successfully transitioning to a health sharing plan requires careful diligence and proactive financial planning.

Scrutinize the Guidelines: Before joining, meticulously read the ministry’s sharing guidelines. These documents detail what medical needs are eligible for sharing and which are excluded. Pay close attention to limitations on pre-existing conditions, wellness visits, and prescription drugs.

Establish an Emergency Fund: Since sharing plans are not insurance and do not guarantee payment, members are often required to pay for services upfront. Maintain a robust emergency fund to cover initial costs while your sharing request is processed.

Verify Provider Compatibility: While many providers work with HCSMs, it's wise to confirm. Contact your preferred doctors and hospitals to ask if they accept direct payment from the ministry or are willing to work with self-pay patients.

Consider Supplemental Coverage: To fill potential gaps, you might pair your health sharing plan with a high-deductible or catastrophic health plan, or a direct primary care (DPC) membership for routine needs.

2. Short-Term Health Insurance

For individuals and families navigating transitional periods, such as a job change, recent graduation, or waiting for new employer benefits to begin, Short-Term Health Insurance offers a critical safety net. These temporary medical plans provide catastrophic coverage for a defined period, typically from 30 days up to a year, with some states allowing renewals for up to 36 months. They are designed to bridge gaps in permanent coverage, protecting against the financial shock of an unexpected accident or illness.

The primary appeal of these plans is their affordability and accessibility. Premiums are substantially lower than those for ACA-compliant plans because they are medically underwritten and do not have to cover essential health benefits like maternity care, mental health services, or pre-existing conditions. For example, a healthy young adult might find a plan from National General for as little as $50 per month. Major providers like UnitedHealthcare and Pivot Health offer a range of options across the country, making them one of the most practical and immediate affordable insurance solutions for those in a coverage gap.

How to Implement Short-Term Health Insurance

Effectively using a short-term plan requires understanding its purpose and limitations. It's a temporary tool, not a permanent healthcare strategy.

Review Exclusions Carefully: Before committing, obtain and read the full policy documents. Pay close attention to the list of exclusions, limitations on prescription drug coverage, and waiting periods for certain conditions. Unlike ACA plans, these policies are not standardized.

Plan for Out-of-Pocket Costs: Short-term plans often have high deductibles and coinsurance. You should have a plan to cover these significant out-of-pocket expenses should a major medical event occur. Budget accordingly and consider pairing the plan with a robust emergency fund.

Time Your Purchase: To prevent any lapse in coverage, purchase your short-term policy before your current insurance expires. The application process is typically fast, often providing next-day coverage, but it's wise not to wait until the last minute.

Understand Its Role: Remember that this is not a long-term solution. Use it strictly for its intended purpose: to provide protection during a temporary, well-defined period. It is not a substitute for comprehensive major medical insurance.

3. Catastrophic Health Insurance

For healthy young adults and individuals facing financial hardship, catastrophic health insurance offers a vital safety net against worst-case scenarios without the high monthly cost of traditional plans. These are low-premium, high-deductible health plans designed to protect you from the financial ruin of a serious accident or major illness. While you pay for most routine medical services out of pocket, the plan kicks in to cover essential health benefits once you meet a substantial annual deductible, providing peace of mind.

These plans are typically available to people under 30 or those who qualify for a hardship exemption from the government. Despite their low premiums, often ranging from $200-$400 per month from carriers like Blue Cross Blue Shield or Anthem, they are compliant with the Affordable Care Act (ACA). This means they cover the same essential health benefits as other marketplace plans after the deductible is met, including emergency services and hospitalization. This makes them one of the most practical affordable insurance solutions for those who qualify.

How to Implement Catastrophic Health Insurance

Maximizing the value of a catastrophic plan requires a strategic and disciplined approach to your healthcare and finances.

Build a Substantial Emergency Fund: The high deductible is the core trade-off for low premiums. Before a medical need arises, you must have a dedicated savings account, like a Health Savings Account (HSA) if eligible, to cover out-of-pocket costs up to your deductible amount.

Utilize Free Preventive Care: A key benefit of ACA-compliant plans is the coverage of certain preventive services at no cost, even before you meet your deductible. Be sure to schedule your annual check-up, vaccinations, and screenings to proactively manage your health.

Evaluate Your Risk Tolerance: Carefully consider if the significant premium savings justify the high potential out-of-pocket exposure. If you have chronic conditions or anticipate needing regular medical care, a plan with a lower deductible may be more cost-effective in the long run.

Manage Prescription Costs: Since most prescription drugs will be an out-of-pocket expense until the deductible is met, use discount programs like GoodRx or manufacturer coupons to significantly lower your costs at the pharmacy.

4. Direct Primary Care (DPC)

Direct Primary Care (DPC) offers a refreshingly straightforward approach to healthcare, making it an excellent strategy for families looking to control routine medical expenses. In this model, patients pay a flat, recurring monthly or annual membership fee directly to their primary care physician. This fee covers most, if not all, primary care services, including consultations, lab work, and minor procedures, completely bypassing the traditional insurance system for day-to-day health needs.

This direct financial relationship eliminates insurance overhead, allowing doctors to maintain smaller patient panels and offer highly personalized, accessible care. For instance, Atlas MD in Kansas serves thousands of patients with memberships starting around $50 per month, while One Medical offers its services in major cities for a transparent annual fee. By removing the insurer as a middleman for primary care, DPC provides predictable costs and fosters a stronger doctor-patient relationship, making it one of the most innovative and affordable insurance solutions when paired with a major medical plan.

How to Implement Direct Primary Care

Integrating a DPC membership into your family's healthcare strategy requires a few key steps to ensure comprehensive coverage and value.

Pair with Major Medical Coverage: DPC is not insurance and does not cover hospitalizations, surgeries, or specialist visits. It is essential to pair your DPC membership with a high-deductible health plan, a catastrophic insurance policy, or a health sharing plan to protect your finances from major medical events.

Verify Provider Services: Before enrolling, confirm exactly what is included in the membership fee. Ask about the scope of in-office procedures, which lab tests are covered, and how after-hours care is handled. Ensure the provider can manage your family’s specific health conditions.

Calculate the Total Cost: Analyze the complete financial picture. Add the DPC membership fee to the monthly premium for your catastrophic or health sharing plan. Compare this total to the cost of a comprehensive, low-deductible insurance plan to see which option provides the best value for your needs.

Check Provider Credentials: Research the qualifications and experience of the DPC physician. A strong, trusting relationship with your primary care doctor is the cornerstone of the DPC model, so it is vital to choose a provider you are comfortable with.

5. High-Deductible Health Plans (HDHP) with Health Savings Accounts (HSA)

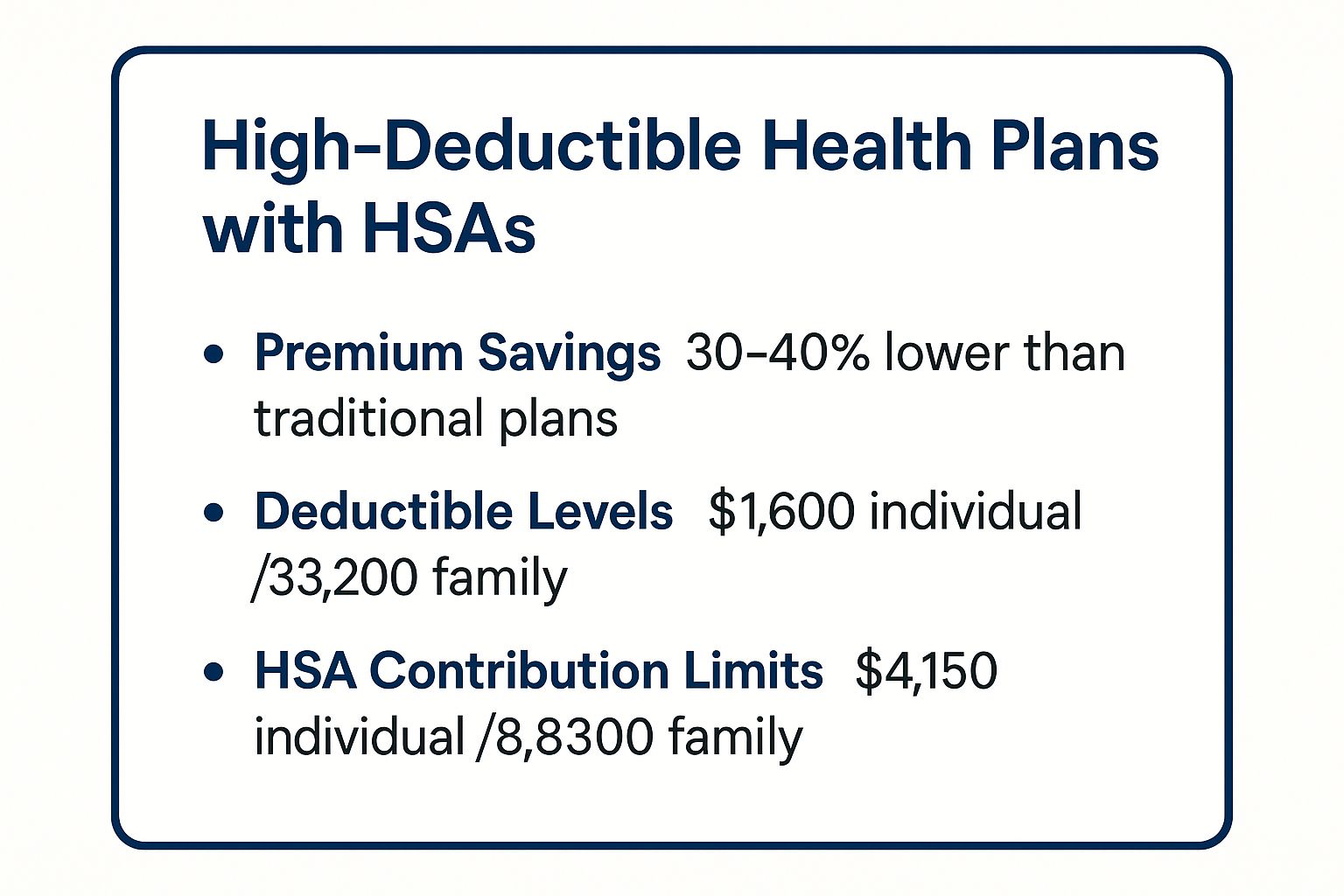

For individuals and families who are proactive about their health and finances, High-Deductible Health Plans (HDHPs) paired with a Health Savings Account (HSA) offer a strategic and cost-effective approach. These ACA-compliant plans combine lower monthly premiums with a higher annual deductible. The premium savings can then be channeled into a powerful, tax-advantaged HSA, creating a personal fund for medical expenses that you own and control, making it one of the most empowering affordable insurance solutions.

This dual-component system encourages smart healthcare consumerism while providing a safety net for major medical events. Major carriers like Anthem, Aetna, and Kaiser Permanente offer HDHP options with premiums often 30-40% lower than traditional PPO or HMO plans. The funds in an HSA benefit from a triple tax advantage: contributions are tax-deductible, the money grows tax-free, and withdrawals for qualified medical expenses are also tax-free. Unused funds roll over year after year and can even be invested, turning your healthcare fund into a supplementary retirement account.

To give you a clear picture of the financial landscape of these plans, here is a summary box highlighting key figures for 2024.

These figures demonstrate the direct trade-off: accepting a higher initial out-of-pocket threshold unlocks significant premium savings and a substantial, tax-advantaged savings opportunity.

How to Implement an HDHP with an HSA

Maximizing the value of an HDHP and HSA requires a disciplined and forward-thinking strategy to manage both costs and savings effectively.

Maximize HSA Contributions: If possible, contribute the maximum allowed amount to your HSA each year. Front-loading contributions early in the year gives your money more time to grow through investment options offered by providers like Fidelity HSA.

Build Your Balance Before Procedures: Before scheduling a planned surgery or significant medical procedure, try to build a sufficient balance in your HSA to cover your deductible and out-of-pocket costs.

Keep Meticulous Records: Retain all receipts for qualified medical expenses. You can reimburse yourself tax-free from the HSA at any time, even years later, allowing your funds to continue growing.

Research HSA Providers: Don't automatically use the bank partnered with your insurance company. Compare HSA administrators like HSA Bank or Fidelity for lower fees, better investment options, and more user-friendly platforms.

6. Medicaid and CHIP (Children's Health Insurance Program)

For families navigating tight budgets, Medicaid and the Children's Health Insurance Program (CHIP) offer a foundational safety net, providing free or very low-cost health coverage. These government-funded programs are designed to ensure that low-income individuals, children, pregnant women, and people with disabilities have access to essential medical care. Unlike private insurance, eligibility is determined by household income relative to the Federal Poverty Level, making it a critical resource for those who do not have access to affordable employer-sponsored plans.

These programs provide comprehensive benefits that often include doctor visits, hospital care, prescription drugs, and vital preventive services. The impact is significant; for example, California’s Medi-Cal program covers over 15 million residents, while Texas CHIP provides essential health services to hundreds of thousands of children. By covering fundamental healthcare needs, Medicaid and CHIP serve as one of the most direct and impactful affordable insurance solutions, protecting a family’s financial stability from the strain of unexpected medical costs.

How to Implement Medicaid and CHIP

Navigating the application and enrollment process for these government programs requires attention to detail and proactive management.

Determine Your State's Rules: Medicaid is a joint federal and state program, so eligibility rules and expansion status vary. Visit Healthcare.gov or your state’s specific Medicaid agency website to understand the income thresholds and requirements that apply to your family.

Gather Necessary Documentation: Be prepared to provide proof of income (pay stubs, tax returns), household size, citizenship or lawful residency, and other relevant information. Keeping these documents organized will streamline your application.

Report Changes Promptly: Once enrolled, you must report any changes in your income or household size to your state agency. Failing to do so can jeopardize your eligibility during annual renewals.

Utilize All Program Benefits: Explore the full range of covered services. Many families are unaware that these programs often cover dental, vision, and mental health care, as well as transportation to medical appointments.

7. Healthcare Discount Plans and Membership Programs

For families and individuals looking to reduce out-of-pocket healthcare costs without the commitment of a full insurance plan, Healthcare Discount Plans and Membership Programs offer a straightforward solution. These are not insurance products; they are membership-based programs that have negotiated lower rates with a network of healthcare providers, dentists, vision centers, and pharmacies. Members pay a small monthly or annual fee to gain access to these pre-negotiated discounts, receiving immediate savings at the point of service.

This model bypasses deductibles, claims, and waiting periods, making it an excellent tool for managing predictable expenses. For instance, a dental discount plan from Careington can provide 20-50% savings on procedures for a low monthly fee, while prescription programs like SingleCare can reduce medication costs by up to 80% at over 35,000 pharmacies nationwide. These programs provide a simple, transparent way to access care at a lower cost, making them one of the most accessible affordable insurance solutions for supplementing existing coverage or managing routine expenses.

How to Implement a Healthcare Discount Plan

Maximizing the value of a discount plan involves strategic selection and verification to ensure it meets your specific needs.

Verify Provider Participation: Before enrolling, confirm that your preferred doctors, dentists, or pharmacies are part of the plan’s network. Most discount plan websites feature a provider search tool. Call the provider’s office directly to double-check their participation.

Compare Discounted Prices: If you have high-deductible insurance, compare the plan’s discounted price to what you would pay using your insurance. For routine dental cleanings or prescription refills, the discount plan may offer a better price than your insurance copay.

Use for Specific Gaps: These plans are ideal for services often excluded from traditional insurance, like dental, vision, or chiropractic care. They can also be paired with a catastrophic health plan to cover routine care affordably while protecting against major medical events.

Read the Fine Print: Carefully review the plan documents to understand the exact discounts offered. Unlike insurance, these plans do not guarantee payment, only access to a discounted rate. Be clear on what savings are guaranteed and what services are covered.

Affordable Insurance Solutions Comparison Matrix

Plan Type | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

Health Sharing Plans (Health Care Ministries) | Moderate: Requires lifestyle adherence and understanding sharing rules | Low to moderate monthly costs ($150-$500) | Major medical expense sharing with community support | Healthy individuals/families with religious convictions seeking major coverage | Lower costs, no network restrictions, strong community support |

Short-Term Health Insurance | Low: Quick approval, temporary duration | Low premiums ($50-$300), limited benefits | Basic emergency and accident coverage | Temporary coverage between jobs or transitions | Immediate coverage, lower premiums, no enrollment period |

Catastrophic Health Insurance | Moderate: ACA-compliant but age-limited | Moderate premiums ($200-$400), high deductibles | Financial protection against major medical events | Young, healthy individuals wanting low-premium catastrophic coverage | Lowest ACA-compliant premiums, includes preventive care |

Direct Primary Care (DPC) | Moderate: Monthly membership, direct payment | Low monthly fees ($50-$150), no insurance overhead | Unlimited primary care access, no copays/deductibles | Individuals/families seeking enhanced primary care access | Predictable costs, enhanced doctor relationship, 24/7 access |

High-Deductible Health Plans (HDHP) + HSA | High: Manage insurance and tax-advantaged savings | Moderate premiums ($200-$600), requires budgeting | Tax savings, investment growth, lower premiums | Health-conscious individuals/families minimizing premiums, saving for future | Triple tax advantage, rollover funds, preventive care covered |

Medicaid and CHIP | Low to moderate: Eligibility and application process | Minimal to no cost ($0-$50), government-funded | Comprehensive coverage with minimal out-of-pocket | Low-income, children, elderly, disabled needing affordable coverage | Free/low-cost care, comprehensive benefits, guaranteed renewal |

Healthcare Discount Plans and Membership | Low: Simple membership subscriptions | Very low monthly fees ($10-$50) | Savings on routine medical, dental, vision, prescriptions | Individuals seeking cost reduction on routine care without insurance | Very low cost, immediate discounts, no pre-existing condition restrictions |

Your Next Step: Building a Values-Based Financial Shield

Navigating the landscape of modern insurance can feel overwhelming, especially when you are trying to balance robust protection with a responsible family budget. As we have explored throughout this guide, the path to security is not about finding a single, perfect product. Instead, it is about strategically assembling a financial shield using a variety of effective and affordable insurance solutions. You have the power to protect your family's future without compromising your principles or your financial stability.

The key takeaway is this: proactive, informed choices are your greatest asset. By understanding the distinct advantages of options like Health Sharing Plans, Short-Term Health Insurance, and Direct Primary Care, you move from being a passive consumer to an active architect of your family’s well-being. These are not just abstract concepts; they are practical tools for real-world challenges.

Recapping Your Affordable Insurance Solutions

Let's quickly revisit the core strategies we've discussed:

Health and Wellness Coverage: From community-based Health Sharing Plans to the high-deductible plans paired with a powerful Health Savings Account (HSA), you can tailor your health coverage to your family’s specific needs, saving significant money while maintaining control.

Targeted, Short-Term Protection: Solutions like Short-Term Health Insurance and Catastrophic Plans offer a vital safety net during transitional periods or for worst-case scenarios, ensuring a single event doesn't derail your financial goals.

Government-Supported Programs: For families who qualify, programs like Medicaid and CHIP provide a foundational layer of care, demonstrating that support is available to protect our nation's most vulnerable.

Each of these affordable insurance solutions serves a unique purpose. The true strength lies in understanding how they can work together, creating a customized defense that aligns with your conservative values and financial priorities.

Putting Your Knowledge into Action

Mastering these concepts is more than a financial exercise; it is an act of stewardship for your family. By taking decisive action, you are building a legacy of responsibility and preparedness. The next steps are clear and achievable:

Assess Your Family's Unique Risk Profile: What are your immediate health concerns? What does your long-term financial picture look like? An honest assessment is the foundation of a smart strategy.

Review Your Monthly Budget: Determine exactly what you can comfortably allocate to premiums and out-of-pocket costs. This will help you select the right plans without straining your finances.

Seek Out Providers Aligned with Your Values: Look for organizations that respect your principles and are dedicated to serving families like yours, free from the political noise of mainstream institutions.

Taking control of your insurance strategy is one of the most significant steps you can take to secure your family's future. It provides peace of mind, knowing that you have a plan in place to handle life’s uncertainties, all while being a wise steward of the resources you have been blessed with.

For families seeking a partner that understands the importance of faith, family, and freedom, exploring your options with a values-driven provider is a crucial next step. Companies like America First Financial specialize in crafting affordable insurance solutions that protect what matters most, from term life to health coverage, all grounded in traditional American values. To see how their tailored plans can fit your family’s needs and budget, connect with the team at America First Financial today.

_edited.png)

Comments