7 Essential Budgeting Tips for Families in 2025

- dustinjohnson5

- Jul 30, 2025

- 16 min read

In today's complex economic landscape, creating a solid financial foundation for your family is more important than ever. Effective budgeting isn't about restriction; it's about empowerment. It's the roadmap that guides you toward your most important goals, whether that's a debt-free life, a down payment on a home, or a secure retirement.

However, for busy families, the idea of managing a budget can feel overwhelming. Juggling school activities, work, and household duties leaves little time for complex financial spreadsheets. This guide demystifies the process by breaking down seven of the most effective, real-world budgeting tips for families. Each strategy is designed to be actionable and adaptable, providing you with the tools to take control of your money, reduce financial stress, and build a prosperous future together.

We'll move beyond generic advice and provide specific steps, practical examples, and fresh perspectives to help you implement these methods successfully. This article focuses on detailed implementation of core systems like the 50/30/20 rule, Zero-Based Budgeting, and the envelope method. For a broader overview of strategies, you can explore more top family budget tips to save money.

From organizing family budget meetings to setting up sinking funds and automating your savings, you will gain concrete skills. Let's explore how you can transform your family's financial well-being, one strategic step at a time.

1. The 50/30/20 Rule

When looking for effective budgeting tips for families, the 50/30/20 rule stands out as a foundational strategy that simplifies financial planning without requiring tedious, line-by-line micromanagement. Popularized by Senator Elizabeth Warren and her daughter, Amelia Warren Tyagi, in their book All Your Worth: The Ultimate Lifetime Money Plan, this framework offers a balanced and intuitive approach to managing your after-tax income. It provides a clear blueprint for allocating money, ensuring you cover essentials while still enjoying life and building a secure future.

The rule divides your take-home pay into three distinct categories:

50% for Needs: This largest portion covers your essential living expenses. These are the non-negotiable costs you must pay each month, such as your mortgage or rent, utility bills, transportation to work, groceries, and minimum payments on existing debts.

30% for Wants: This category is for all the non-essential lifestyle choices that add enjoyment and quality to your life. This includes dining out, family vacations, entertainment subscriptions like Netflix, hobbies, and new clothes that aren't strict necessities.

20% for Savings and Debt Repayment: The final portion is dedicated to your financial goals. This includes building an emergency fund, saving for retirement, investing, making extra payments on debt (like student loans or a mortgage), and saving for a down payment on a home.

How to Implement the 50/30/20 Rule

To start, track your spending for one to two months to understand where your money currently goes. Compare your spending habits to the 50/30/20 allocation. For a family with a monthly after-tax income of $5,000, this would mean allocating $2,500 to needs, $1,500 to wants, and $1,000 to savings.

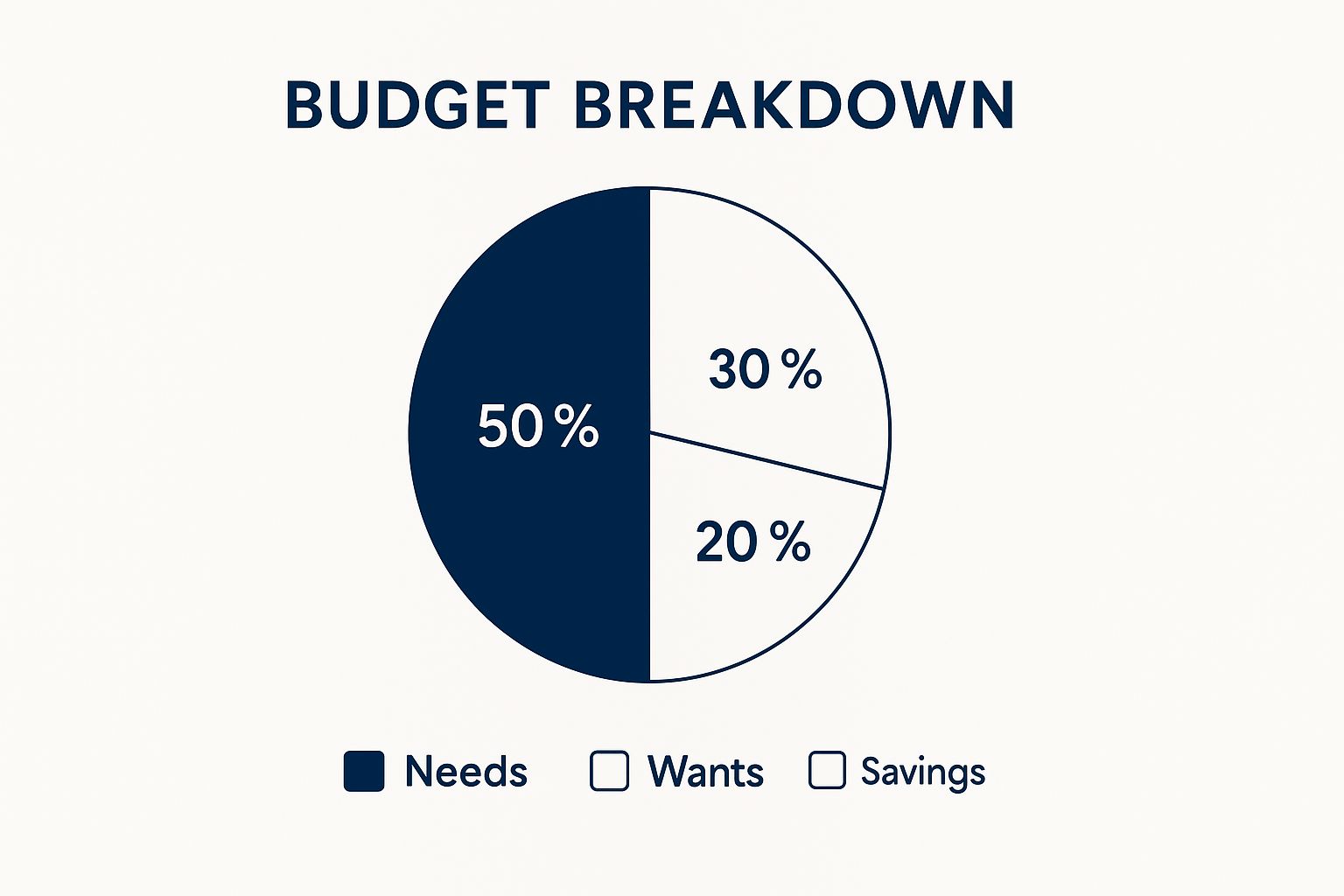

This pie chart visualizes the simple yet powerful allocation of the 50/30/20 budgeting rule.

As the chart illustrates, half of your income is reserved for necessities, while the other half is thoughtfully split between personal wants and future financial security.

If your "Needs" category exceeds 50%, which can happen in high-cost-of-living areas, you may need to adjust to a 60/20/20 split temporarily and look for ways to reduce fixed expenses. Many families find success by setting up separate bank accounts for each category, which automates the process and removes the temptation to overspend. Review your budget monthly or quarterly to ensure it still aligns with your family's needs and financial goals. This structured yet flexible approach is why financial institutions like Bank of America often recommend it, and it has helped families successfully tackle significant goals, such as paying off over $30,000 in debt in just a few years.

2. Zero-Based Budgeting

For families seeking ultimate control over their finances, Zero-Based Budgeting (ZBB) offers a highly detailed and intentional approach. This method, popular in both corporate finance and personal money management circles, works on a simple principle: your income minus your expenses must equal zero. This doesn't mean you spend every penny; it means every single dollar of your income is assigned a specific job, whether that's paying a bill, buying groceries, adding to savings, or paying down debt. It’s a powerful strategy among budgeting tips for families because it forces you to be proactive and accountable for your money.

The core idea is to create a fresh budget from "zero" each month, ensuring no dollar is left unaccounted for. You give every dollar a name and a purpose before the month even starts.

Income: Tally up all expected income for the month (paychecks, side hustles, etc.).

Expenses: List every single anticipated expense, from fixed costs like your mortgage to variable spending like entertainment.

Savings & Debt: Treat your savings goals and extra debt payments as expenses that must be "paid" to yourself first.

The Goal: Adjust your spending categories until your total income minus your total expenses equals zero.

How to Implement Zero-Based Budgeting

To begin, look at last month's bank and credit card statements to get a realistic baseline for your spending categories. From there, build your first zero-based budget. For a family with a monthly income of $6,000, this means assigning all $6,000 to various categories. For instance, $2,000 might go to the mortgage, $800 to groceries, $400 to car payments, $500 to savings, $300 to utilities, and so on, until the entire $6,000 is allocated.

Many families have found incredible success with this method. Followers of Dave Ramsey's Financial Peace University often use ZBB to aggressively attack debt, while military families have used it to maximize savings during deployments. Budgeting apps like YNAB (You Need A Budget) and EveryDollar are built specifically for this method, making the tracking process much simpler.

A crucial element is to create "sinking funds" for irregular but predictable expenses like holiday gifts, car maintenance, or annual insurance premiums. By setting aside a small amount each month for these future costs, you avoid being caught off guard. During your first few months, it’s wise to review the budget weekly to make adjustments, as it takes time to perfect your spending estimates. This meticulous approach ensures that your spending aligns perfectly with your family's priorities and financial goals.

3. The Envelope Method

For families seeking a hands-on, tangible way to control spending, the envelope method is one of the most effective budgeting tips for families available. This cash-based system, championed by financial experts like Dave Ramsey and used in households for generations, forces you to become acutely aware of your spending habits in real time. The principle is simple: you allocate a specific amount of cash into physical envelopes for various spending categories, and once the cash in an envelope is gone, you stop spending in that category until the next budget period. This physical limit makes it impossible to accidentally overspend.

The method works best for variable spending categories where you have the most control, such as:

Groceries: Setting a firm cash limit can curb impulse buys and encourage smarter shopping. Many families report reducing their grocery bills by 20-30% within the first month.

Dining Out: Having a dedicated "restaurant" envelope makes you think twice before ordering takeout, helping you stick to your financial goals.

Entertainment: This includes movie tickets, family outings, and other fun activities. When the money's gone, it's time for free activities at home or in the community.

Personal Spending: Allocating "fun money" for each family member in their own envelope teaches valuable financial lessons about scarcity and choice.

How to Implement the Envelope Method

To get started, first create your monthly budget and determine how much you can allocate to your chosen variable spending categories. At the beginning of the month (or each pay period), withdraw the total amount in cash and divide it among your labeled envelopes. For example, you might put $600 in the "Groceries" envelope and $150 in the "Entertainment" envelope.

As you can see, the physical act of handing over cash creates a psychological friction that swiping a card lacks, reinforcing disciplined spending.

If you are not comfortable carrying large amounts of cash, a modern alternative is to use digital envelope systems. Banks like Ally Bank and some credit unions offer "buckets" or "vaults" that function as digital envelopes within your savings account. Apps like Goodbudget or Mvelopes are also designed specifically for this purpose. Start with just two or three challenging categories, like groceries and dining out, to get a feel for the system before applying it more broadly. By providing clear, non-negotiable spending boundaries, the envelope method empowers families to take decisive control of their finances.

4. Family Budget Meetings

Transforming budgeting from a solitary task into a collaborative family effort is one of the most powerful budgeting tips for families you can implement. Family budget meetings create a scheduled time for all members, including children in an age-appropriate way, to discuss financial goals, review spending, and make decisions together. This approach, championed by financial experts like Dave Ramsey and Suze Orman, fosters transparency, teaches invaluable money skills, and ensures the entire family is aligned and working toward common financial objectives.

These regular check-ins turn abstract financial concepts into tangible, shared experiences. They create a culture of financial literacy and shared responsibility within the household.

Shared Goals: When everyone contributes to setting a goal, like a family vacation or paying off a car, there's a collective sense of ownership and motivation to stick to the budget.

Financial Education: Children learn firsthand about the value of money, the difference between needs and wants, and the importance of saving. This hands-on experience is far more impactful than a simple lecture.

Increased Accountability: Openly discussing spending habits in a supportive environment helps everyone become more mindful of their choices, naturally leading to reduced waste and more intentional spending.

How to Implement Family Budget Meetings

Start by scheduling your first meeting and setting a positive, forward-looking tone. The goal is not to assign blame for past spending but to plan for a better financial future together. Frame it as a team huddle where you strategize how to win with money.

For a family aiming to save for a trip to Disney World, a meeting might involve tracking progress on a visual chart, brainstorming ways to cut back on "want" spending (like fewer take-out meals), and giving kids responsibility for saving a portion of their allowance toward a special souvenir.

Many families report that these meetings lead to significant financial turnarounds, such as cutting household spending by 15% simply through increased awareness and teamwork. To make your meetings a success:

Schedule Consistently: Hold meetings monthly at the same time so they become a regular family routine.

Stay Positive: Focus on solutions and celebrate wins, no matter how small. Create a no-shame, no-blame environment.

Use Visuals: Employ a whiteboard, a budgeting app on a tablet, or a simple chart to show income, expenses, and progress toward goals.

Involve Everyone: Give children age-appropriate roles, such as tracking grocery receipts or coloring in a savings goal thermometer.

Start Small: Keep initial meetings short (15-20 minutes) to maintain engagement, especially with younger children.

By making budgeting a family affair, you not only improve your financial health but also equip your children with the essential money management skills they will need for a lifetime of financial well-being.

5. Meal Planning and Grocery Budgeting

For many households, the grocery bill represents one of the largest and most unpredictable variable expenses. This makes mastering your food budget one of the most impactful budgeting tips for families looking to gain control over their finances. A strategic approach that combines meal planning with savvy shopping can drastically reduce food waste, eliminate costly impulse buys, and free up hundreds of dollars each month for other financial goals.

This method involves planning your family's meals in advance, creating a detailed grocery list based on those plans, and then executing your shopping trip with discipline. Instead of wandering the aisles and buying what looks good, you enter the store with a clear mission. This simple shift in mindset is the key to transforming your grocery spending from a budget-buster into a predictable, manageable expense. Families who embrace this strategy often report significant savings, with some reducing their monthly grocery bills from over $800 down to $500.

How to Implement Meal Planning and Grocery Budgeting

Getting started doesn't have to be overwhelming. You can begin by planning just four or five dinners for the upcoming week, allowing for leftovers or a spontaneous meal out. Before you even start a list, take inventory of what you already have in your pantry, fridge, and freezer.

Here is a step-by-step approach to put this into practice:

Plan Around Sales: Check your local grocery store's weekly flyer or app and build your meal plan around sale items and seasonal produce.

Create a Detailed List: Write down every single ingredient you need for your planned meals. Stick to this list and avoid aisles that don't contain items you need.

Use Technology: Leverage apps like Ibotta or Checkout 51 to earn cash back on your purchases. Many shoppers earn over $200 annually just from these rebates.

Consider Generic Brands: Opting for store or generic brands over name brands can save you 20-40% on many items without a noticeable difference in quality.

Shop with a Calculator: Keep a running total of the items in your cart to ensure you stay within your predetermined budget.

Many families find success by dedicating a few hours on the weekend to "batch cooking" or meal prepping, which saves both time and money during busy weekdays. Beyond traditional meal planning and smart grocery shopping, consider long-term strategies for reducing food expenditures, such as by learning about cultivating a survival garden to feed your family year-round. By taking a proactive, organized approach championed by resources like the blog Budget Bytes and meal planning apps, you can conquer your food budget and make significant progress toward financial freedom.

6. Sinking Funds for Family Expenses

When it comes to effective budgeting tips for families, creating sinking funds is a proactive strategy that transforms large, irregular expenses from budget-breaking emergencies into manageable, planned events. Popularized by personal finance experts like Dave Ramsey and integral to budgeting systems like YNAB (You Need A Budget), this method involves setting aside a small, fixed amount of money each month for a specific, known future expense. This simple habit prevents the financial shock of costs like holiday gifts, car repairs, or annual insurance premiums, ensuring you can cover them with cash instead of relying on credit.

The principle behind sinking funds is straightforward: instead of scrambling to find hundreds or even thousands of dollars at once, you break down the large cost into smaller, monthly savings goals. This approach smooths out your cash flow and provides immense peace of mind.

Predictable, Irregular Expenses: This method is perfect for costs you know are coming but don't occur every month. Examples include annual subscriptions, back-to-school shopping, property taxes, family vacations, or even a planned home renovation.

Not an Emergency Fund: A sinking fund is for a known expense, whereas an emergency fund is for unknown surprises like a job loss or unexpected medical bill. The two work together to create a strong financial safety net.

Reduces Debt: By planning ahead, you eliminate the need to put these large purchases on a credit card, which saves you from high-interest debt and financial stress.

How to Implement Sinking Funds

Getting started is simple and can be tailored to your family’s specific needs. First, identify the large, non-monthly expenses you anticipate over the next year. For instance, if you know you'll spend around $1,200 on Christmas gifts and celebrations, you would create a "Holiday" sinking fund and set aside $100 each month. A family anticipating $600 in car maintenance would save $50 monthly.

This chart illustrates how a family might break down their annual expenses into manageable monthly savings goals for various sinking funds.

As the chart demonstrates, small, consistent contributions add up to fully fund major expenses without disrupting your regular monthly budget.

To make this strategy work, automate the process. Set up automatic transfers from your checking account to separate, high-yield savings accounts labeled for each goal (e.g., "Car Repairs," "Vacation Fund"). This "out of sight, out of mind" approach ensures the money is saved consistently. Many families have successfully used sinking funds to pay cash for everything from a $5,000 roof repair to a dream family vacation, turning what could have been a major financial burden into a stress-free, planned achievement.

7. Automated Savings and Bill Pay

For busy families searching for practical budgeting tips for families, the "set it and forget it" method of automating finances is a game-changer. This strategy significantly reduces the daily mental effort required for money management by using technology to enforce financial discipline. Popularized by personal finance experts like David Bach, author of The Automatic Millionaire, this approach ensures that savings goals are consistently met and bills are paid on time, building a foundation for long-term financial stability without constant manual intervention.

The core principle is to "pay yourself first" automatically. It works by setting up recurring, automated transfers and payments:

Automated Savings: You schedule regular transfers from your primary checking account to your savings, retirement, or investment accounts. This happens automatically, often right after payday, so the money is set aside before you have a chance to spend it.

Automated Bill Pay: You set up automatic payments for recurring bills like your mortgage, utilities, car payment, and insurance premiums. This prevents late fees and protects your credit score by ensuring every due date is met.

How to Implement Automated Finances

First, decide on a realistic savings amount to automate. Even a small, consistent transfer builds significant momentum. For a family struggling to save, an automatic transfer of just $100 per week can result in over $5,200 in a year. The key is to start immediately, then gradually increase the amount as your budget allows.

Next, log into your online banking portal and set up automatic payments for all your fixed monthly bills. A powerful tactic is to open a separate, dedicated checking account solely for these automated bills. You can calculate the total of your monthly automated payments and set up a single, recurring transfer from your main income account to this "bill pay" account each month. This quarantines your bill money, preventing accidental spending and making it easy to see if you have sufficient funds. Many families have used this exact method to build emergency funds of over $10,000 in two to three years and improve their credit scores by 50-100 points simply by eliminating late payments.

Review your automated system quarterly or biannually. As your income or expenses change, you can adjust the transfer amounts. This approach transforms budgeting from a stressful daily chore into a simple, background process. It ensures you are consistently working toward your financial goals, like building wealth and securing your family's future, with minimal ongoing effort.

Family Budgeting Strategies Comparison

Budgeting Method | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

The 50/30/20 Rule | Low – simple percentage splits | Low – basic tracking tools | Balanced budgeting, prioritized savings, quality of life | Families seeking easy, adaptable budgeting structure | Easy to understand; flexible; promotes savings and guilt-free spending |

Zero-Based Budgeting | High – detailed monthly planning | Moderate – time and detailed tracking | Maximized spending efficiency, elimination of wasteful expenses | Families wanting full control and intentional money allocation | Eliminates waste; increases control; maximizes savings potential |

The Envelope Method | Moderate – requires cash management | Moderate – physical/digital envelopes | Prevents overspending, tangible spending limits | Families needing strict spending limits and visual budgeting | Prevents overspending; tangible tracking; good for teaching kids |

Family Budget Meetings | Moderate – regular scheduling | Low – time investment and communication | Increased transparency, accountability, financial education | Families emphasizing collaboration and financial education | Builds awareness; reduces stress; teaches financial skills |

Meal Planning & Grocery Budgeting | Moderate – planning and list creation | Moderate – time and effort upfront | Lower food costs, reduced waste, improved nutrition | Families aiming to cut food expenses and improve meal efficiency | Reduces costs and waste; saves time; improves nutrition |

Sinking Funds for Expenses | Low to moderate – setup and discipline | Low – automated savings accounts | Predictable irregular expenses managed, reduces debt risk | Families facing irregular but predictable expenses | Prevents emergencies; reduces debt; improves financial security |

Automated Savings & Bill Pay | Low to moderate – initial setup | Low – requires automation tools | Consistent savings, on-time payments, reduced mental load | Busy families wanting hassle-free savings and bill management | Eliminates late fees; consistent saving; reduces decision fatigue |

Building Lasting Financial Security for Your Family

Navigating the financial landscape of family life can feel complex, but it is one of the most rewarding journeys you can undertake. The budgeting tips for families we have explored are not just abstract financial theories; they are practical, actionable blueprints for building a life of stability and opportunity. By embracing these strategies, you are taking decisive steps to protect your loved ones and secure their future.

The key to success is not in finding a single "perfect" method, but in discovering the right combination of tools that aligns with your family’s unique values and goals. Think of this process as constructing a strong foundation. Each strategy adds another layer of support, creating a structure that can withstand unexpected challenges and support your aspirations for generations to come.

From Theory to Tangible Results

The power of these budgeting tips for families lies in their consistent application. Let's recap how these individual strategies come together to create a powerful, unified financial plan:

Frameworks for Control: Methods like the 50/30/20 Rule provide a high-level overview, ensuring your spending is balanced. For those who crave more granular control, Zero-Based Budgeting assigns a job to every single dollar, eliminating wasteful spending and maximizing your income's potential.

Tactical Execution: The tangible nature of the Envelope Method helps curb overspending in real-time, making it an excellent tool for teaching financial discipline. Meanwhile, Automated Savings and Bill Pay acts as your silent financial partner, ensuring your obligations are met and your savings goals are consistently funded without requiring constant manual effort.

Collaborative Success: A budget is a family affair. Holding regular Family Budget Meetings transforms financial management from a solitary chore into a collaborative team effort. This open communication fosters shared responsibility, teaches valuable life lessons to your children, and ensures everyone is working towards the same objectives.

Proactive Planning: Instead of reacting to large, predictable expenses like holiday gifts, annual insurance premiums, or car repairs, Sinking Funds allow you to prepare for them proactively. This approach turns potential financial emergencies into manageable, planned events, preserving your peace of mind and protecting your emergency fund.

Ultimately, the goal of a well-crafted budget extends far beyond simply paying bills on time. It is about creating the financial margin necessary to live a life aligned with your deepest values. A budget gives you the power to say yes to what matters most, whether that’s a family vacation, a debt-free education for your children, or a comfortable retirement. A key outcome of successful budgeting is working towards financial freedom. You can explore more strategies for unlocking financial freedom and building a life with more choices and fewer constraints.

Your Next Steps to Financial Empowerment

The journey to financial mastery begins with a single, decisive step. Do not feel overwhelmed by the need to implement everything at once. Instead, choose one strategy from this guide that resonates most with you and your family’s current situation.

Your Action Plan: 1. Choose One Strategy: Pick the approach that seems most achievable right now. Is it the structure of Zero-Based Budgeting or the simplicity of automating your savings? 2. Schedule a Family Meeting: Set aside 30 minutes this week to discuss your financial goals with your partner and older children. Explain the chosen strategy and get their buy-in. 3. Take the First Step: Open that high-yield savings account for your sinking fund. Download the budgeting app. Write out the categories for your cash envelopes. Action, no matter how small, builds momentum.

Remember, consistency will always be more impactful than intensity. A simple budget that you follow consistently is infinitely more powerful than a complex one that you abandon after a few weeks. The effort you invest today in implementing these budgeting tips for families will compound over time, yielding a legacy of financial strength, security, and independence for the people you care about most.

A strong budget builds the foundation, and a solid protection plan builds the walls that keep your family safe. As you organize your finances, ensure your budget includes comprehensive insurance coverage tailored to your family’s needs. America First Financial offers straightforward, dependable life, health, and disability insurance solutions designed to protect your legacy without the political noise. Secure your family’s future today.

_edited.png)

Comments