8 Advanced Wealth Transfer Strategies for 2025

- dustinjohnson5

- Jun 22, 2025

- 14 min read

Securing Your Legacy: An In-Depth Guide to Sophisticated Wealth Transfer Strategies

Planning for the future involves more than just accumulating assets; it requires a deliberate plan for transferring your wealth to the next generation efficiently and effectively. While a simple will is a start, it often falls short when dealing with significant assets, complex family dynamics, or the goal of minimizing tax burdens. A proactive and informed approach is essential for true financial stewardship.

This in-depth guide moves beyond basic estate planning to explore eight sophisticated wealth transfer strategies. We will break down powerful tools, from Grantor Retained Annuity Trusts (GRATs) to Dynasty Trusts, providing actionable insights into how they work and who can benefit most. Successfully implementing these methods often begins with a solid foundation, which includes understanding and properly utilizing essential estate planning forms to formalize your intentions.

Whether you are a business owner seeking a smooth succession, an investor protecting a diverse portfolio, or a family-focused individual aiming to build a lasting legacy, this article provides the practical details you need. Discover how these strategies can help you preserve your hard-earned wealth, support your family’s values, and ensure your financial legacy endures for generations to come.

1. Grantor Retained Annuity Trust (GRAT)

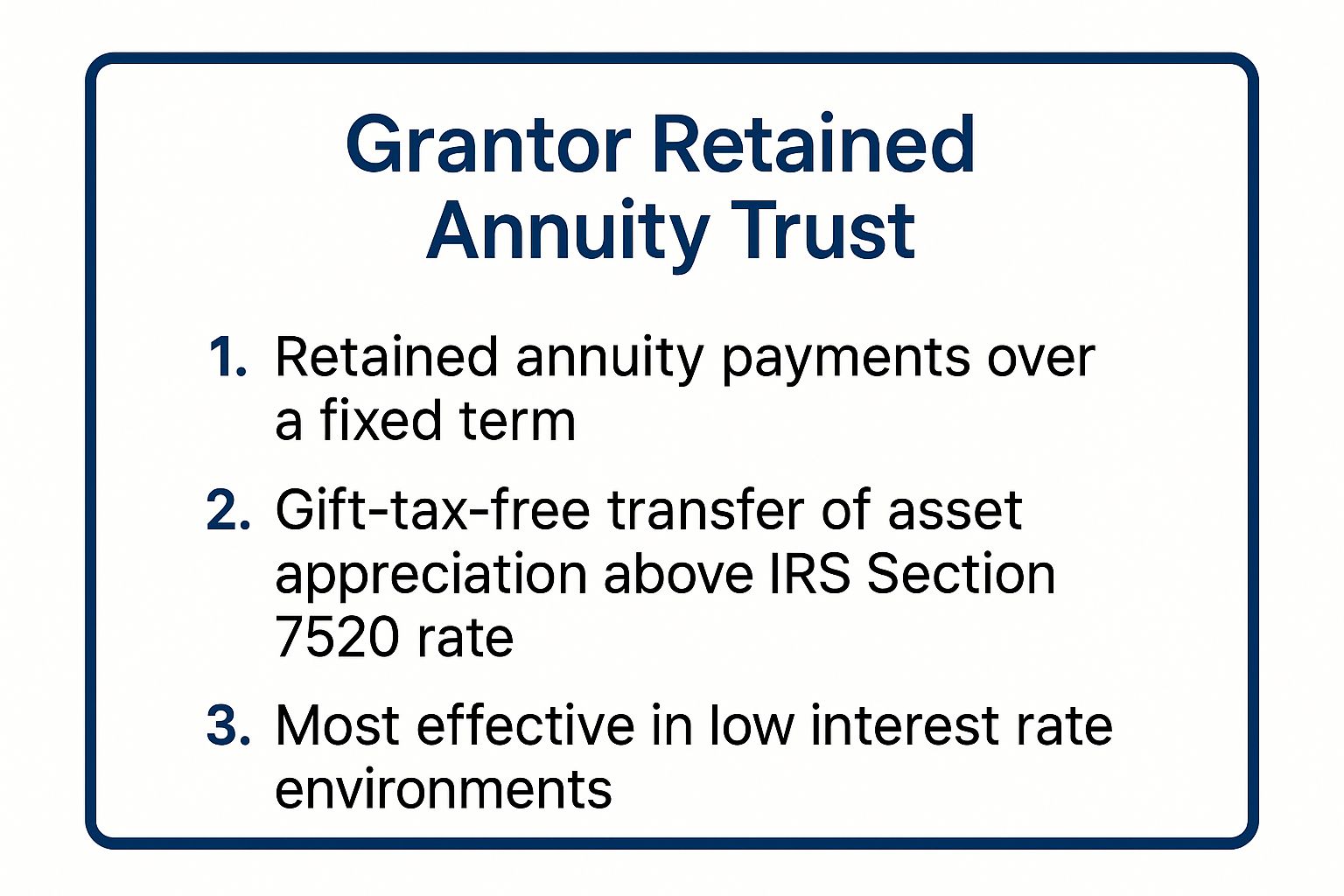

A Grantor Retained Annuity Trust (GRAT) is a sophisticated and powerful tool for transferring significant wealth to the next generation while minimizing gift and estate taxes. This irrevocable trust is particularly effective for assets you expect to appreciate significantly, making it a cornerstone of many advanced wealth transfer strategies.

How a GRAT Works

When you create a GRAT, you, the grantor, transfer assets into the trust. In return, the trust pays you a fixed annuity for a predetermined number of years. At the end of the term, any asset value remaining in the trust, specifically the growth that exceeds an IRS-specified interest rate (the Section 7520 rate), passes to your named beneficiaries completely free of gift tax. This technique essentially "freezes" the value of the assets for estate tax purposes, allowing all future appreciation to transfer tax-efficiently.

For a clearer understanding of its core mechanics, this infographic summarizes the key components of a GRAT.

As the infographic highlights, the strategy's success hinges on the trust's assets outperforming the IRS hurdle rate, a feat more achievable in a low-interest-rate environment.

Who Should Consider a GRAT?

GRATs are favored by high-net-worth individuals holding assets with high growth potential. Famous examples include tech executives like Mark Zuckerberg transferring pre-IPO stock and the Walton family (Walmart heirs) using GRATs to pass on their immense wealth. This strategy is also ideal for:

Real estate developers transferring appreciating properties.

Family business owners passing on shares of a growing company.

Private equity managers transferring carried interest.

To maximize a GRAT's effectiveness, consider funding it with volatile assets when their valuation is low and using a series of short-term, or "rolling," GRATs to mitigate risk.

2. Charitable Remainder Trust (CRT)

A Charitable Remainder Trust (CRT) is an irrevocable trust that offers a unique way to support a charity you care about while simultaneously generating an income stream for yourself or your beneficiaries. This powerful vehicle is one of the more altruistic wealth transfer strategies, allowing you to fulfill philanthropic goals, receive significant tax benefits, and provide for your heirs.

How a CRT Works

As the donor, you transfer highly appreciated assets like stocks or real estate into an irrevocable trust. The trust then sells the assets and, because it is tax-exempt, it pays no capital gains tax. The trust invests the proceeds and pays you (or other named beneficiaries) an income stream for life or a specified term. When the trust term ends, the remaining assets, the "remainder," are distributed to your chosen charity. You receive an immediate income tax deduction for the present value of the future charitable donation.

This strategy is highly effective for deferring capital gains on appreciated assets while creating a reliable income flow, making it a cornerstone of philanthropic estate planning.

Who Should Consider a CRT?

CRTs are especially beneficial for charitably inclined individuals with significant, highly appreciated assets they wish to sell without incurring a large tax bill. It’s a strategy used by philanthropists like Warren Buffett and donors to major university endowments. A CRT is ideal for:

Entrepreneurs planning to sell their business.

Investors with a large, concentrated position in a low-basis stock.

Real estate owners wanting to sell a property and diversify.

Retirees seeking a stable income stream and a way to leave a charitable legacy.

To get the most from a CRT, consider pairing it with a life insurance policy in an irrevocable life insurance trust (ILIT) to replace the asset's value for your heirs. It’s also crucial to choose between a Charitable Remainder Annuity Trust (CRAT) for fixed payments or a Charitable Remainder Unitrust (CRUT) for payments that vary with the trust's value.

3. Family Limited Partnership (FLP)

A Family Limited Partnership (FLP) is a business entity created by family members to consolidate and manage their collective assets, such as real estate, investments, or a family business. This structure is one of the most established wealth transfer strategies, allowing senior family members (as general partners) to maintain control while gradually transferring ownership to younger generations (as limited partners) in a tax-efficient manner.

How an FLP Works

Parents or senior family members typically act as general partners, funding the FLP with assets. They retain a small ownership stake but hold full management control. They then gift limited partnership interests to their children or other heirs over time. Because these limited partners have no control over the management or sale of the assets and their interests are not easily sold, the value of their gifted shares can be discounted for lack of control and lack of marketability. This allows the general partners to transfer more underlying asset value while using less of their lifetime gift and estate tax exemption.

Who Should Consider an FLP?

FLPs are particularly effective for families with significant, illiquid assets that they wish to manage centrally and pass down through generations. The structure has been famously used by high-net-worth families like the Waltons to protect and transfer their fortunes. It is also an ideal solution for:

Multi-generational farming operations to keep the family farm intact.

Families with extensive real estate holdings who want to centralize management.

Owners of a closely-held family business seeking an orderly succession plan.

Investors with large, diversified portfolios who want to involve younger family members in asset management.

To ensure an FLP is respected by the IRS, it is crucial to maintain strict business formalities. This includes getting independent appraisals, avoiding the personal use of partnership assets, and operating the entity with a legitimate business purpose beyond just tax savings.

4. Charitable Lead Trust (CLT)

A Charitable Lead Trust (CLT) is a sophisticated estate planning tool that allows you to support charitable causes while transferring significant wealth to your family with potentially substantial tax savings. This irrevocable trust is a powerful option for philanthropically inclined individuals and families looking to integrate their charitable goals into their overall wealth transfer strategies.

How a CLT Works

When you establish a CLT, you, the grantor, transfer assets into the trust. The trust then makes payments, either a fixed annuity (CLAT) or a percentage of the trust's value (CLUT), to one or more charities for a specified term. At the end of that term, the remaining assets in the trust pass to your non-charitable beneficiaries, typically your children or grandchildren, often at a reduced or zero gift or estate tax cost. This strategy effectively leverages your charitable giving to benefit your heirs.

The initial gift to your heirs is calculated by subtracting the present value of the charity's income stream from the total value of the assets you placed in the trust. A higher payout to charity or a longer trust term reduces the taxable value of the gift to your heirs.

Who Should Consider a CLT?

CLTs are exceptionally well-suited for high-net-worth individuals with strong philanthropic intent who also want to pass on assets to the next generation. A famous example is the CLT established by Jacqueline Kennedy Onassis, which provided for her grandchildren while supporting charitable causes. This strategy is also ideal for:

Family business owners planning to transfer company stock pre-IPO.

Real estate investors holding properties expected to appreciate significantly.

Individuals with concentrated stock positions who want to diversify and give back.

To optimize a CLT, you should fund it with assets poised for strong growth, as any appreciation beyond the IRS-set interest rate (the Section 7520 rate) passes to your heirs tax-free. Timing the trust's creation when asset valuations are low can significantly enhance its effectiveness.

5. Dynasty Trust

A Dynasty Trust is an enduring and powerful tool designed for multi-generational wealth preservation, allowing assets to grow and benefit descendants for many decades, or even in perpetuity, without being depleted by transfer taxes. This irrevocable trust is a cornerstone of long-term wealth transfer strategies for families aiming to create a lasting financial legacy.

How a Dynasty Trust Works

When you, the grantor, establish a Dynasty Trust, you transfer assets into it and allocate your generation-skipping transfer (GST) tax exemption. By doing so, the assets are shielded from estate, gift, and GST taxes not just for your children, but for your grandchildren and subsequent generations. The trust assets are managed by a trustee who makes distributions to beneficiaries according to the terms you set forth. This structure prevents the trust's assets from being included in the taxable estates of your descendants, allowing the wealth to compound across generations.

The key is leveraging the GST exemption and establishing the trust in a state that has abolished or significantly extended the rule against perpetuities, which traditionally limited a trust's lifespan.

Who Should Consider a Dynasty Trust?

Dynasty Trusts are particularly well-suited for ultra-high-net-worth families who want to ensure their wealth supports future generations and protects assets from creditors or marital disputes. The Rockefeller family famously used multi-generational trusts to preserve their fortune. This strategy is also ideal for:

Tech entrepreneurs establishing trusts in jurisdictions like Nevada or Delaware to protect their wealth.

Oil and gas families creating legacy trusts to manage mineral rights and royalties over the long term.

Private equity founders structuring their carried interest and other assets for perpetual family benefit.

To maximize a Dynasty Trust’s effectiveness, it is crucial to select a trust-friendly jurisdiction like South Dakota, Delaware, or Nevada. Also, build in flexibility by including provisions for a trust protector who can modify the trust to adapt to changing laws and family circumstances.

6. Intentionally Defective Grantor Trust (IDGT)

An Intentionally Defective Grantor Trust (IDGT) is an advanced estate planning tool that allows you to transfer wealth to beneficiaries while minimizing gift and estate taxes. This irrevocable trust is "defective" for income tax purposes, meaning you, the grantor, pay the trust's income taxes. However, it is effective for estate tax purposes, removing the assets and their future growth from your taxable estate.

How an IDGT Works

To create an IDGT, you sell appreciating assets, like business shares or real estate, to the trust in exchange for a promissory note. The interest rate on the note is typically set at the low Applicable Federal Rate (AFR). For the strategy to succeed, the assets inside the trust must generate returns that outperform this interest rate. The growth beyond the interest payments remains in the trust for your beneficiaries, completely free from gift and estate taxes. By personally paying the income taxes on the trust's earnings, you are essentially making an additional tax-free gift to the beneficiaries, further enhancing the power of this wealth transfer strategy.

Who Should Consider an IDGT?

IDGTs are highly effective for high-net-worth individuals, particularly those with assets expected to grow significantly. This technique was refined by estate planning attorneys and is now widely used by sophisticated investors and family offices. It is ideal for:

Business owners selling company shares to an IDGT before a sale or IPO.

Real estate investors transferring income-producing properties to shift appreciation.

Private equity and hedge fund managers moving carried interests out of their estates.

Families seeking a structured way to execute business succession plans.

To maximize an IDGT's benefits, ensure you use a third-party, independent appraisal to value the assets being sold to the trust. It's also crucial to plan for your own ability to cover the trust's income tax liability for the duration of the trust, as this is a key component of its success.

7. Qualified Personal Residence Trust (QPRT)

A Qualified Personal Residence Trust (QPRT) is a specialized irrevocable trust designed to transfer a primary or secondary residence to beneficiaries at a fraction of its market value for gift tax purposes. This powerful tool allows you to continue living in your home for a set period while effectively removing one of your most valuable assets from your taxable estate, making it a key component in many wealth transfer strategies.

How a QPRT Works

As the grantor, you transfer title of your personal residence into the QPRT, while retaining the right to use the property for a specified number of years, known as the "retained interest term." The value of the gift to your beneficiaries is calculated at the time the trust is created, but it's significantly discounted based on your retained interest and the IRS's applicable interest rates. If you outlive the trust's term, ownership of the home officially passes to your beneficiaries. The home is then excluded from your estate, avoiding potentially steep estate taxes.

Who Should Consider a QPRT?

A QPRT is an excellent strategy for high-net-worth individuals and families whose estates include valuable real estate that they wish to pass down. It is particularly effective for those who are confident they will outlive the trust term and want to lock in a lower valuation for a cherished family property. This strategy is frequently used by:

Wealthy retirees with valuable primary residences in high-cost-of-living areas.

Vacation home owners looking to transfer a beloved beachfront or mountain property to their children.

High-net-worth families in expensive real estate markets, like Manhattan or coastal California, seeking to minimize tax exposure.

Maximizing a QPRT's Effectiveness

To ensure a QPRT successfully achieves your goals, careful planning is essential. You must obtain a professional appraisal to establish the home's value when funding the trust. It's also crucial to consider your health and life expectancy when setting the term; if you do not survive the term, the property reverts to your estate. Plan ahead for post-term arrangements, as you will need to pay fair market rent to your beneficiaries if you wish to continue living in the home. Coordinating the QPRT with your overall estate plan is vital for a seamless wealth transfer.

8. Private Placement Life Insurance (PPLI)

Private Placement Life Insurance (PPLI) is a sophisticated, institutionally priced variable universal life insurance policy designed for ultra-high-net-worth individuals. It allows policyholders to invest in a broad array of assets, including hedge funds and private equity, within a tax-advantaged insurance wrapper. This makes PPLI a formidable tool among advanced wealth transfer strategies, offering tax-free growth, tax-free distributions, and a tax-free death benefit.

How a PPLI Works

A PPLI policy functions as a customized investment account housed within a life insurance contract. The policy owner pays premiums, which are then invested in a curated selection of funds, often managed by the policyholder’s own investment advisors. The cash value within the policy grows tax-deferred. Upon the insured's death, beneficiaries receive the death benefit entirely free of income and estate taxes, providing significant liquidity and preserving wealth. Distributions can also be taken during the insured’s lifetime via tax-free policy loans.

The key is that the investment gains are shielded from annual income and capital gains taxes, allowing for more powerful compounding over time compared to a traditional taxable investment portfolio.

Who Should Consider a PPLI?

PPLI is exclusively available to accredited investors and qualified purchasers, making it a strategy favored by the wealthiest families and institutional investors. Its high entry point and complexity mean it is best suited for those with significant investable assets. Ideal candidates include:

Ultra-high-net-worth families seeking maximum tax efficiency for alternative investments.

Hedge fund and private equity managers looking to invest in their own funds tax-efficiently.

Business owners who need a liquid, tax-free source of funds to cover estate taxes or business succession costs.

International families with U.S. connections who can leverage PPLI to mitigate U.S. estate and income tax exposure.

To properly implement a PPLI, it's crucial to work with experienced advisors who specialize in this niche. You must also carefully structure the policy to maintain its favorable tax treatment and avoid being classified as a Modified Endowment Contract (MEC).

Wealth Transfer Strategies Comparison Matrix

Trust/Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

Grantor Retained Annuity Trust (GRAT) | High – complex administration and valuations | Moderate – requires legal, tax, appraisal support | Transfers asset appreciation gift-tax free if hurdle exceeded | High-net-worth individuals with high-growth or volatile assets | Estate freeze, gift tax efficiency, retained cash flow |

Charitable Remainder Trust (CRT) | High – complex trust administration | Moderate – needs trust setup and compliance | Income stream, immediate charitable deduction, tax deferral | Individuals with charitable intent seeking income and tax benefits | Income tax deduction, capital gains deferral, steady income |

Family Limited Partnership (FLP) | High – ongoing compliance, documentation | Moderate to high – legal, tax, valuation required | Valuation discounts, centralized asset management | Families wanting control retention and discounted wealth transfers | Valuation discounts, family control, asset protection |

Charitable Lead Trust (CLT) | High – trust administration, tax planning | Moderate – requires tax and legal advice | Income to charity, remainder to family with tax savings | Ultra-high-net-worth with charitable intent and appreciating assets | Gift/estate tax savings, supports philanthropy |

Dynasty Trust | High – long-term complex administration | High – professional trustee and legal resources | Multi-generational wealth preservation, transfer tax minimization | Ultra-wealthy families seeking perpetual wealth transfer | Multi-generational asset protection, transfer tax avoidance |

Intentionally Defective Grantor Trust (IDGT) | High – structured grantor trust complexities | High – requires legal, tax expertise | Estate freeze, removal of growth from estate, extra gifts via tax payments | Wealthy individuals with appreciating assets and ability to pay income taxes | Tax-efficient gifting, estate freeze, income tax leverage |

Qualified Personal Residence Trust (QPRT) | Moderate – fixed term trust with occupancy rights | Moderate – appraisal and legal setup | Gift tax savings on residence, retained occupancy rights | Homeowners with valuable residences wishing reduced gift tax values | Gift tax reduction, continued residence use |

Private Placement Life Insurance (PPLI) | Very High – complex insurance and investment structuring | High – minimum premiums $1M+, ongoing management | Tax-deferred growth, potential tax-free distributions | Ultra-wealthy seeking tax-efficient investing and wealth transfer | Tax-deferred growth, institutional investments, asset protection |

Building Your Legacy with the Right Strategy and Partners

The journey through the landscape of sophisticated wealth transfer strategies reveals a powerful truth: effective legacy planning is not a passive activity. It is an active, deliberate process of aligning your financial resources with your deepest values and your hopes for future generations. We have explored a range of powerful instruments, from the tax-efficient Grantor Retained Annuity Trust (GRAT) and the philanthropically-minded Charitable Remainder Trust (CRT) to the asset-protection benefits of a Family Limited Partnership (FLP).

Each strategy, whether it’s a multi-generational Dynasty Trust or an Intentionally Defective Grantor Trust (IDGT), offers a unique set of tools to achieve specific objectives. The key takeaway is that there is no one-size-fits-all solution. The optimal approach for your family will depend entirely on your specific financial picture, your long-term goals, and the legacy you wish to leave behind. A Qualified Personal Residence Trust (QPRT) might be perfect for preserving a cherished family home, while Private Placement Life Insurance (PPLI) could be the ideal vehicle for tax-advantaged growth for qualified purchasers.

From Knowledge to Action: Your Next Steps

Understanding these options is the crucial first step, but implementation is where a legacy is truly forged. Moving forward requires a clear, actionable plan.

Assemble Your Professional Team: The complexity of these strategies necessitates a team of trusted experts. This includes an estate planning attorney, a certified public accountant (CPA), and a qualified financial advisor. Their coordinated advice is essential for navigating tax codes, drafting legal documents, and ensuring your plan is both effective and compliant.

Define Your Legacy Goals: Before meeting with advisors, take time to clarify what you want to achieve. Do you want to provide for your children's financial independence, fund their education, support a charitable cause, or protect family assets from creditors? Having clear objectives will make the planning process far more efficient.

Address International Complexities: For families with assets, business interests, or heirs located outside the United States, an additional layer of expertise is required. Navigating different tax laws, regulations, and inheritance rules is a specialized field. Seeking expert guidance in cross-border financial planning is critical to ensure your wealth is transferred smoothly and efficiently across borders, preventing unforeseen tax burdens or legal hurdles for your beneficiaries.

Mastering these wealth transfer strategies is more than just a financial exercise; it is an act of profound care and foresight. By taking deliberate, informed action today, you transform the wealth you've built from a simple monetary value into an enduring legacy of support, opportunity, and security for those you love most.

To ensure your estate has the necessary liquidity to cover taxes and other expenses, consider the foundational role of life insurance. For trusted, family-focused insurance and annuity solutions designed to protect your legacy, explore the offerings from America First Financial. Their products can provide the stability and resources your family will need during a critical time.

_edited.png)

Comments