8 Asset Protection Strategies for 2025

- dustinjohnson5

- May 16, 2025

- 22 min read

Protecting Your Future: A Guide to Asset Protection

Building a secure financial future requires proactive planning. This listicle explores eight key asset protection strategies to help safeguard your wealth. Learn how irrevocable trusts, LLCs, FLPs, retirement plans, homestead exemptions, insurance, offshore planning, and advanced entity structuring can protect your assets from creditors, lawsuits, and other threats. Understanding these asset protection strategies is crucial for long-term financial stability and peace of mind.

1. Irrevocable Trusts

Irrevocable trusts stand as a powerful asset protection strategy, offering significant benefits for conservative American families, individuals approaching retirement, and anyone prioritizing long-term financial security. This legal arrangement involves transferring assets into a trust that, as the name suggests, cannot be easily modified or revoked without the consent of the beneficiaries. This fundamental characteristic separates the assets from your personal ownership, creating a formidable barrier against future creditors and potential lawsuits. This separation also carries significant estate tax advantages, making irrevocable trusts a crucial tool for preserving wealth across generations.

Several types of irrevocable trusts cater to different needs. Asset Protection Trusts (APTs) are specifically designed to shield assets from creditors. Charitable Remainder Trusts (CRTs) provide an income stream to beneficiaries while ultimately benefiting a chosen charity, offering both financial and philanthropic advantages. Special Needs Trusts (SNTs) safeguard assets for beneficiaries with disabilities without jeopardizing their eligibility for government assistance. Whether domestic, based within the United States, or offshore, offering enhanced protection from certain legal jurisdictions, the structure best suited for your situation depends on your specific asset protection strategies and goals.

Pros:

Strong Protection: Irrevocable trusts offer robust protection against future creditors and lawsuits, shielding your hard-earned assets from unforeseen circumstances.

Estate Tax Benefits: By removing assets from your estate, irrevocable trusts can significantly reduce or even eliminate estate tax liability, preserving wealth for your heirs.

Asset Preservation: Irrevocable trusts ensure the long-term preservation of assets for your chosen beneficiaries, providing financial security for future generations.

Privacy: The details of an irrevocable trust are not part of the public record, offering a layer of privacy for your financial affairs.

Cons:

Loss of Control: Once assets are transferred, you relinquish direct control over them. This requires careful consideration and planning.

Inflexibility: Modifying the terms of an irrevocable trust is difficult, if not impossible, requiring foresight during its establishment.

Cost: Setting up and maintaining an irrevocable trust can involve substantial legal and administrative expenses.

Complexity: Irrevocable trusts have complex tax implications that necessitate professional guidance from an experienced estate planning attorney.

Examples and Tips:

The Rockefeller family’s strategic use of generation-skipping trusts exemplifies the long-term benefits of irrevocable trusts for wealth preservation. Domestic Asset Protection Trusts (DAPTs) in states like Nevada, South Dakota, and Delaware, along with foreign trusts in jurisdictions like the Cook Islands, Nevis, and Belize, offer varied levels of asset protection depending on individual needs. When considering this asset protection strategy, it’s crucial to establish the trust well before any legal claims arise to avoid issues with fraudulent transfer laws. Choose your trustees wisely – individuals or corporate entities with financial expertise and impeccable integrity are essential for effective management. Regularly review trust provisions with legal counsel to ensure they align with your evolving circumstances.

When and Why to Use This Approach:

Irrevocable trusts are particularly beneficial for individuals with significant assets who are concerned about potential future liabilities, whether from lawsuits, business ventures, or unforeseen circumstances. They are also a powerful tool for those seeking to minimize estate taxes and ensure the smooth transfer of wealth to their heirs. For conservative American families, individuals approaching retirement, and those seeking to protect their financial legacy, an irrevocable trust offers a robust and sophisticated approach to asset protection. Remember to consult with a qualified estate planning attorney to determine the best strategy for your specific needs and circumstances.

2. Limited Liability Companies (LLCs)

Limited Liability Companies (LLCs) stand as a cornerstone of asset protection strategies, blending the liability shield of corporations with the tax advantages of partnerships. This hybrid structure creates a crucial legal separation between your personal and business assets, safeguarding your personal wealth from business debts and lawsuits, and often vice-versa, through a concept known as "charging order protection." This protection essentially limits creditors of an LLC member to a charging order against distributions, rather than allowing them to seize the underlying assets of the LLC itself. This makes LLCs a powerful tool in comprehensive asset protection planning.

LLCs offer several key features attractive to those seeking asset protection: limited liability for members/owners, pass-through taxation by default (avoiding double taxation), charging order protection in many states, flexibility in management (member-managed or manager-managed), and the ability to hold multiple assets in separate LLCs (compartmentalization). When establishing an LLC for asset protection, particularly one with multiple members, it's crucial to have a well-drafted founder's agreement to outline ownership, responsibilities, and other key legal aspects. This agreement, as highlighted in IndieMerger's Founder's Agreement Template: Essential Guide for Startups, helps prevent future disputes and ensures smooth operation of your LLC.

Pros:

Strong Protection of Personal Assets: Shields personal wealth from business liabilities, offering peace of mind for individuals and families.

Potential Protection of Business Assets: In many states, charging order protection also shields business assets from personal creditors.

Tax Flexibility: LLCs can elect different tax treatments, maximizing tax efficiency based on individual circumstances.

Simplicity and Affordability: Relatively simple and inexpensive to form compared to other asset protection strategies like trusts.

Asset Compartmentalization: Using separate LLCs for different assets creates an additional layer of protection, isolating risk.

Cons:

Varying State Laws: The level of charging order protection varies significantly across different states.

Maintenance and Formalities: Proper maintenance and adherence to corporate formalities are crucial to avoid "piercing the corporate veil," which could expose personal assets.

Ongoing Fees: LLCs have annual filing requirements and associated fees.

Limited Scope of Protection: May not protect against all liabilities, such as professional malpractice or personal guarantees on debts.

Examples of Successful Implementation:

Real Estate Investors: Using Series LLCs to hold each property in a separate compartment, preventing one property's liabilities from affecting others.

Medical Professionals: Forming Medical Practice LLCs to protect personal assets from malpractice lawsuits, in addition to holding personal assets in separate LLCs.

Family Wealth Preservation: Family LLCs can hold and protect family assets, facilitating planned transfers to future generations while minimizing estate taxes.

Tips for Maximizing LLC Asset Protection:

Strategic Location: Form your LLC in a state known for strong charging order protection, such as Wyoming, Nevada, or Delaware.

Maintain Corporate Formalities: Keep meticulous separate finances and records for the LLC, including separate bank accounts and operating agreements.

Strong Operating Agreement: Craft a comprehensive operating agreement that strengthens asset protection provisions and clearly defines member roles and responsibilities.

Multi-Member Structure: Multi-member LLCs often offer stronger protection than single-member LLCs in certain states.

Compartmentalize Assets: Use separate LLCs for high-risk assets or different business ventures to limit potential liability exposure.

By understanding the nuances of LLCs and employing these strategies, individuals and families can create a robust asset protection plan that secures their wealth for the future. This approach is particularly beneficial for conservative American families, individuals approaching retirement, and anyone prioritizing long-term financial security. LLCs provide a valuable layer of protection in today's litigious environment, ensuring that hard-earned assets are shielded from unforeseen circumstances.

3. Family Limited Partnerships (FLPs)

Family Limited Partnerships (FLPs) are a powerful asset protection strategy particularly well-suited for conservative American families seeking to preserve and transfer wealth across generations. As part of a comprehensive asset protection plan, FLPs offer a structured approach to safeguarding family assets while minimizing tax liabilities and maintaining family control. This makes them a valuable tool for individuals approaching retirement, those concerned about the future financial security of their family, and anyone looking for sophisticated estate planning solutions.

An FLP is a type of partnership with two distinct classes of partners: general partners and limited partners. General partners, typically the parents or founders, retain control over the partnership's assets and management. Limited partners, often children or other family members, have ownership interests but limited control over day-to-day operations. This structure is key to the asset protection benefits of the FLP.

How FLPs Work for Asset Protection:

The core of an FLP's asset protection stems from the limited liability afforded to limited partners and the charging order limitations offered by many states. If a limited partner faces a lawsuit or creditor claim, the creditor typically cannot seize the partnership assets directly. Instead, they may obtain a charging order, which grants them the right to the limited partner's distributions from the partnership. However, the general partners retain control over these distributions, effectively shielding the underlying assets from the creditor's reach. This structure discourages creditors while allowing the family to retain control and enjoyment of the assets.

Features and Benefits:

Two Classes of Partners: This distinction between general and limited partners is crucial for both asset protection and management control.

Valuation Discounts: Limited partner interests are often valued at a discount for gift and estate tax purposes due to their lack of control and marketability. This allows for significant tax savings when transferring wealth to future generations.

Centralized Management: FLPs provide a centralized platform for managing diverse family assets, from real estate holdings to business interests.

Simplified Wealth Transfer: Transferring limited partnership interests is generally easier and more tax-efficient than transferring individual assets.

Preservation of Family Control: The general partners retain significant control over the assets, ensuring they remain within the family's purview.

Examples of Successful Implementation:

Succession Planning: Family-owned businesses frequently utilize FLPs as part of their succession planning strategies. This allows for a gradual transfer of ownership to the next generation while maintaining business continuity.

Real Estate Holdings: Transferring a real estate portfolio into an FLP can provide significant asset protection and estate tax benefits.

Multi-Generational Wealth Transfer: High-net-worth families, like the Waltons of Walmart fame, have effectively used FLPs for transferring significant wealth across multiple generations.

Pros and Cons:

Pros:

Protection from creditors through charging order limitations

Centralized family asset management

Estate and gift tax advantages

Simplified wealth transfer

Preservation of family control

Cons:

More complex to establish and maintain than basic LLCs

Requires careful ongoing compliance with partnership formalities

IRS scrutiny of valuation discounts

May not be suitable for frequently accessed assets

Cannot include personal-use assets like primary residences

Actionable Tips for Utilizing FLPs:

Form in a state with strong charging order protection. Consult with an experienced attorney specializing in asset protection.

Establish a legitimate business purpose beyond just asset protection. Document the purpose clearly in the partnership agreement.

Hold regular partnership meetings and meticulously document all decisions.

Strictly avoid commingling personal and partnership assets. Maintain separate bank accounts and records.

Engage a qualified appraiser for valuation discounts. This is critical for minimizing tax liabilities.

Establish the FLP well before any potential claims arise to avoid fraudulent transfer issues.

When and Why to Use an FLP:

An FLP is a valuable asset protection strategy when you are seeking to:

Protect assets from potential future liabilities.

Minimize estate and gift taxes.

Facilitate a smooth transfer of wealth to future generations.

Maintain family control over significant assets.

FLPs offer a robust and sophisticated approach to asset protection. However, their complexity necessitates careful planning and ongoing compliance. Consulting with experienced estate planning and legal professionals is crucial for maximizing the benefits and mitigating the potential risks.

4. Qualified Retirement Plans: Shielding Your Savings for a Secure Future

Protecting your hard-earned assets is a crucial part of financial planning, especially for conservative American families and individuals approaching retirement. Qualified retirement plans, including 401(k)s, IRAs, and pension plans, offer a powerful asset protection strategy, combining tax advantages with significant legal safeguards under both federal and state laws. This makes them an essential component of any comprehensive financial plan. These plans deserve a prominent place in any asset protection strategy because they offer a legally sanctioned way to shield your savings from potential creditors and lawsuits, ensuring a secure financial future.

How They Work:

Qualified retirement plans function as a protected haven for your savings. Contributions made to these accounts are often tax-deductible (traditional 401(k)s and IRAs), reducing your current taxable income. The money grows tax-deferred, meaning you won't pay taxes on the earnings until you withdraw them in retirement. More importantly, these accounts are generally shielded from creditors in bankruptcy proceedings. Depending on your state's laws, they may also offer substantial, even unlimited, protection from civil judgments. This protection stems from the Employee Retirement Income Security Act of 1974 (ERISA) for employer-sponsored plans and specific provisions within the Bankruptcy Abuse Prevention and Consumer Protection Act. State laws offer varying degrees of protection for IRAs and other retirement accounts not covered by ERISA.

Features and Benefits:

Federal Protection under ERISA: Employer-sponsored plans like 401(k)s often receive robust protection under ERISA.

Bankruptcy Protection: Federal law generally protects retirement assets in bankruptcy.

State-Specific Protections: IRAs and other similar plans receive varying levels of protection depending on state law.

Tax-Advantaged Growth: Assets grow tax-deferred, maximizing your savings potential.

Protection for Beneficiaries: In many states, the protection extends to beneficiaries who inherit the accounts.

Pros and Cons:

Pros:

Strong Federal Protection: Qualified plans often offer robust, and sometimes unlimited, protection.

Bankruptcy and Lawsuit Protection: Shields your savings from creditors and judgments.

Tax Benefits: Reduces your current tax burden and allows for tax-deferred growth.

Simplicity: Protection is inherent in the plan structure; no complex legal maneuvering is required.

Cons:

Contribution Limits: The IRS sets annual contribution limits, restricting the amount you can protect.

Varying Protection Levels: Different account types (ERISA vs. non-ERISA) have different protection levels.

State-Specific IRA Protection: The level of protection for IRAs varies significantly by state.

Early Withdrawal Penalties: Accessing funds before retirement age often incurs penalties.

Required Minimum Distributions (RMDs): You are required to begin withdrawing funds after a certain age.

Examples of Successful Implementation:

O.J. Simpson: Despite facing substantial civil judgments, O.J. Simpson's NFL pension remained protected.

Doctors: Many doctors maximize contributions to defined benefit plans to shield assets from potential malpractice lawsuits.

Entrepreneurs: Solo 401(k)s provide asset protection for business proceeds, offering peace of mind for small business owners.

Actionable Tips for Asset Protection with Retirement Plans:

Maximize Contributions: Contribute the maximum allowed amount to your retirement plans annually.

Prioritize Employer-Sponsored Plans: These often offer the strongest protection under ERISA.

Research State Laws: Understand the specific protections for IRAs in your state.

Avoid Prohibited Transactions: Certain transactions can jeopardize the protected status of your accounts. Consult with a financial advisor.

Consider Roth Conversions Carefully: Roth conversions can offer tax advantages in retirement, but they may impact asset protection depending on your state.

Maintain Separate Accounts: Keep your protected retirement funds separate from other assets.

When and Why to Use This Approach:

Utilizing qualified retirement plans as an asset protection strategy is particularly beneficial for:

Conservative American families: Provides a secure foundation for long-term financial stability.

Individuals approaching retirement: Safeguards retirement savings from unforeseen events.

High-income earners: Offers significant tax advantages and asset protection benefits.

Professionals facing potential lawsuits (doctors, lawyers): Shields assets from professional liability claims.

Small business owners: Protects business proceeds through plans like Solo 401(k)s.

By leveraging the power of qualified retirement plans, you can build a secure financial future while enjoying significant tax advantages and peace of mind knowing your assets are protected. For specific guidance on maximizing the asset protection potential of your retirement plans, consult with a qualified financial advisor. They can help you navigate the complexities of different plans and state laws to create a personalized strategy that meets your unique needs and goals. Experts like financial advisor Ed Slott, retirement planning specialist Jane Bryant Quinn, and the educational resources offered by Fidelity Investments and Vanguard can provide valuable insights into this important aspect of financial planning.

5. Homestead Exemptions: Shielding Your Home from Creditors

Homestead exemptions are a powerful asset protection strategy, particularly for conservative American families and individuals approaching retirement concerned about preserving their wealth. These state-level legal provisions safeguard a portion or all of your primary residence's value from creditors, offering a layer of protection against unforeseen financial hardships. As one of the oldest and most accessible asset protection strategies, homestead exemptions provide peace of mind by ensuring your family home remains secure. They work by legally designating your primary residence as "homestead" property, thereby shielding it from certain debt collection efforts. This protection can range from minimal to unlimited, depending on your state of residence.

Homestead exemptions are particularly relevant for those seeking to build a secure financial future, allowing them to protect a significant portion of their net worth. This is especially important for individuals approaching retirement who want to safeguard their assets from potential medical expenses or lawsuits. The stability afforded by homestead exemptions resonates with the values of conservative American families, offering a sense of security and control over their financial well-being.

Features and Benefits:

Protection Varies by State: Protection levels differ drastically by state, from unlimited protection in states like Florida and Texas to more limited protection in others. This variability makes research crucial.

Primary Residence Protection: Generally, homestead exemptions apply only to your primary residence, not secondary homes or investment properties.

Acreage Limitations: Some states impose acreage limits on homestead properties, restricting the amount of land protected.

Formal Declaration: Many states require a formal declaration to claim the homestead exemption. This is a simple but necessary step.

Protection for Surviving Spouse: Often, the homestead exemption extends to the surviving spouse, preserving the family home after the homeowner's death.

Pros:

Simplicity: Establishing a homestead exemption typically involves only residency and filing a declaration, with no complex legal structures required.

Low Cost: Implementation is generally free or involves minimal filing fees.

Substantial Protection: In states with generous exemptions, significant home equity can be shielded.

Complementary Strategy: Homestead exemptions work well in conjunction with other asset protection strategies for comprehensive protection.

Cons:

Limited Applicability: Protection is limited to the primary residence and doesn't extend to other assets.

Ineffective Against Certain Liens: It won't protect against mortgage foreclosure, property tax liens, or mechanic's liens.

Residency Requirements: Continuous residency is usually necessary to maintain protection.

Federal Bankruptcy Limits: Federal bankruptcy laws may override state homestead exemptions in some cases.

Examples of Successful Implementation:

O.J. Simpson famously used Florida's unlimited homestead exemption to protect his mansion from civil judgments.

Many wealthy individuals relocate to states like Florida or Texas specifically for their generous homestead exemptions.

Individuals filing for bankruptcy in Texas have been able to retain million-dollar homes while discharging other debts.

Actionable Tips:

Research Your State's Laws: Understand your state's specific homestead exemption limits, requirements, and any acreage restrictions.

File the Declaration: If required in your state, file the homestead declaration promptly.

Consider Relocation: If you have significant assets to protect, consider relocating to a state with a robust homestead exemption.

Be Aware of Bankruptcy Residency Requirements: Note the 1215-day (approximately 3.3 years) residency requirement for full homestead protection in bankruptcy proceedings.

Avoid Fraudulent Transfers: Don't attempt to transfer assets into your home equity right before anticipated legal trouble, as this can be challenged in court.

Combine with Other Strategies: For assets exceeding the exemption limit, integrate homestead exemptions with other asset protection measures for more complete protection.

Homestead exemptions deserve a place on this list because they provide a foundational level of asset protection accessible to most homeowners. For budget-minded individuals and families, particularly those nearing retirement, leveraging this state-provided protection is a prudent step towards securing their financial future. This resonates deeply with patriotic individuals who value protecting their hard-earned assets and ensuring their family's well-being.

6. Insurance Strategies: Your Frontline Defense for Asset Protection

Insurance is a cornerstone of any robust asset protection strategy, acting as the first line of defense against potential financial devastation. It works by transferring specific risks from you to an insurance company in exchange for regular premium payments. By strategically utilizing various insurance policies, you can safeguard your hard-earned assets from a multitude of threats, ensuring your family's financial future remains secure. This proactive approach is crucial for conservative American families, individuals approaching retirement, and anyone prioritizing financial stability.

How Insurance Protects Your Assets:

Insurance essentially creates a financial safety net. When a covered event occurs, such as a car accident, a lawsuit, or a house fire, the insurance company steps in to cover the costs, up to the policy limits. This prevents you from having to deplete your savings, liquidate investments, or even worse, face crippling debt. For budget-minded insurance shoppers, this protection offers peace of mind knowing that a single unfortunate event won't derail their financial goals.

Types of Insurance for Asset Protection:

Several insurance types play a vital role in a comprehensive asset protection plan:

Liability Insurance: This covers costs associated with accidents or incidents where you are found legally responsible for another person's injuries or property damage. This is essential for homeowners, drivers, and business owners.

Umbrella Insurance: This provides an extra layer of liability protection beyond the limits of your underlying policies (e.g., auto and homeowners). For high-net-worth individuals, a $5-10 million umbrella policy is a common recommendation.

Professional Malpractice Insurance: For professionals like doctors, lawyers, and accountants, this coverage protects against claims of negligence or errors in their professional services. Physicians, for example, often carry multi-million dollar malpractice policies.

Directors & Officers (D&O) Insurance: This protects the personal assets of company directors and officers against lawsuits alleging wrongful acts in their management roles.

Specialized Policies: These cover specific risks, such as Employment Practices Liability Insurance (EPLI) for businesses, protecting them from employee lawsuits.

Life Insurance (Cash Value): Beyond providing a death benefit, certain life insurance policies, like whole life or universal life, accumulate cash value over time. In states like Florida, this cash value often receives statutory protection from creditors, offering an additional layer of asset protection and a vehicle for wealth accumulation. This resonates particularly well with individuals approaching retirement seeking secure financial strategies.

Pros and Cons of Insurance Strategies:

Pros:

Immediate Protection: Coverage begins as soon as your policy is issued.

Affordability: Premiums are generally manageable compared to the potential costs of lawsuits or other covered events.

Defense Costs Coverage: Many policies cover legal defense costs, even if the claim is ultimately denied.

Creditor Protection (Specific Policies): Cash value life insurance and annuities often enjoy creditor protection in certain states.

First Line of Defense: Insurance acts as the initial barrier, protecting your other assets.

Cons:

Coverage Limitations and Exclusions: Policies have specific coverage limits and may exclude certain events.

Ongoing Premium Costs: Maintaining coverage requires continuous premium payments.

Policy Maximums: Policy limits may be insufficient in cases of catastrophic claims.

Covered Events Only: Protection only applies to events specifically covered by the policy.

Insurer Financial Stability: The financial health of the insurance company is crucial for ensuring claims payment.

Actionable Tips for Utilizing Insurance Strategies:

Layer Coverage: Combine primary policies with umbrella coverage for comprehensive protection.

Regular Review: Review your coverage limits annually, especially as your net worth increases.

Understand Exclusions: Carefully review policy exclusions and fill any gaps with specialized coverage.

Check Financial Ratings: Choose insurers with strong financial strength ratings (e.g., A.M. Best, Standard & Poor's).

Explore Cash Value Life Insurance: Consider cash value life insurance for potential creditor protection and wealth accumulation, especially in states offering strong statutory protection.

Maintain Continuous Coverage: Avoid gaps in protection by ensuring continuous policy coverage.

Insurance strategies are a vital component of asset protection, providing a crucial first line of defense and peace of mind for conservative American families and individuals seeking to preserve their financial well-being. By understanding the various insurance options available and implementing a tailored strategy, you can effectively protect your assets and secure your financial future.

7. Offshore Asset Protection Strategies

Offshore asset protection strategies, while complex and often scrutinized, offer a potentially powerful layer of defense against creditor claims, lawsuits, and judgments. This approach involves strategically placing assets in legal structures established in foreign jurisdictions with favorable asset protection laws. This deserves a place on this list because, for certain high-net-worth individuals or those in high-risk professions, it can provide the strongest shield available against future unforeseen liabilities. It's important to understand that this is a complex area and not suitable for everyone.

How it Works:

Offshore asset protection operates on the principle of legal separation and jurisdictional barriers. By placing assets under the control of a foreign entity, such as an offshore trust, international business company (IBC), or within a foreign bank account, you leverage the legal sovereignty of that jurisdiction. This makes it significantly more difficult, and sometimes impossible, for domestic courts to enforce judgments against those assets. Creditors would have to navigate the legal system of the foreign jurisdiction, often facing higher burdens of proof, shorter statutes of limitations on fraudulent transfer claims, and potentially unfamiliar legal precedents.

Examples of Successful Implementation:

Cook Islands Trusts: These trusts have a strong track record of withstanding legal challenges from U.S. courts, providing robust protection for beneficiaries' assets.

Nevis LLCs: The jurisdiction of Nevis has established creditor-friendly laws that require substantial bonds (often $100,000 or more) before a creditor can even initiate legal action against a Nevis LLC. This acts as a strong deterrent to frivolous lawsuits.

Asset Protection for High-Risk Professionals: Professionals like surgeons, real estate developers, and business owners facing significant litigation risks often employ offshore strategies to protect their personal wealth from professional liabilities.

Pros and Cons:

Pros:

Highest level of asset protection available: Offshore strategies can offer the strongest protection against future unforeseen liabilities.

Foreign courts often don't recognize U.S. judgments: This creates significant jurisdictional hurdles for creditors.

Higher burden of proof for creditors: The legal environment in many offshore jurisdictions favors asset holders.

Potential for legitimate tax planning opportunities (with proper structuring): While not a primary focus for U.S. citizens, careful planning can optimize tax efficiency.

Privacy advantages: Offshore structures can offer greater privacy and confidentiality than domestic alternatives.

Cons:

High setup and maintenance costs: Establishing and maintaining offshore structures involves significant legal and administrative expenses.

Complex reporting requirements (FBAR, FATCA): U.S. citizens and residents have strict reporting obligations to the IRS regarding foreign assets.

Significant IRS scrutiny: Offshore accounts and structures are subject to increased scrutiny by the IRS, requiring meticulous compliance.

No inherent tax advantages for U.S. citizens without proper structuring: Offshore structures do not automatically reduce U.S. tax liabilities. Improper structuring can lead to severe penalties.

Potential contempt of court issues if not established well in advance: Establishing structures after a claim arises can be viewed negatively by courts.

Reputational considerations: While legal, offshore strategies can sometimes be perceived negatively.

Actionable Tips:

Establish structures well before any potential claims arise (ideally 2+ years): This demonstrates proactive planning rather than an attempt to evade existing creditors.

Work with specialized attorneys familiar with both domestic and international law: Expert legal counsel is crucial for navigating the complexities of offshore planning.

Maintain meticulous compliance with U.S. reporting requirements (FBAR, FATCA): Transparency with the IRS is essential to avoid penalties.

Choose jurisdictions with strong track records of judicial independence and asset protection: Research and select reputable jurisdictions with a history of upholding asset protection laws.

Select reputable trustees and financial institutions: Work with experienced and trustworthy professionals in the chosen jurisdiction.

Consider hybrid approaches combining domestic and offshore strategies: A multi-layered approach can provide enhanced protection.

Maintain transparency with tax authorities: Full disclosure and proper reporting are crucial for avoiding legal issues.

When and Why to Use This Approach:

Offshore asset protection is typically considered by individuals with significant assets who face heightened risks of litigation or creditor claims. This might include:

High-net-worth individuals: Protecting accumulated wealth from potential future liabilities.

Business owners and entrepreneurs: Shielding personal assets from business risks.

Professionals in high-risk fields (e.g., doctors, lawyers, real estate developers): Protecting against malpractice lawsuits or professional liability claims.

Important Considerations for Conservative American Families:

For conservative American families, it's crucial to weigh the potential benefits of offshore asset protection against the complexities and perceived reputational risks. Open and honest communication with a qualified legal advisor is essential to determine if this strategy aligns with their values and financial goals. Full compliance with U.S. tax and reporting requirements is paramount. While offering significant protection, this approach requires a commitment to meticulous record-keeping and transparency with U.S. authorities. It's not a strategy to hide money, but rather to safeguard it within the bounds of the law.

8. Advanced Entity Structuring

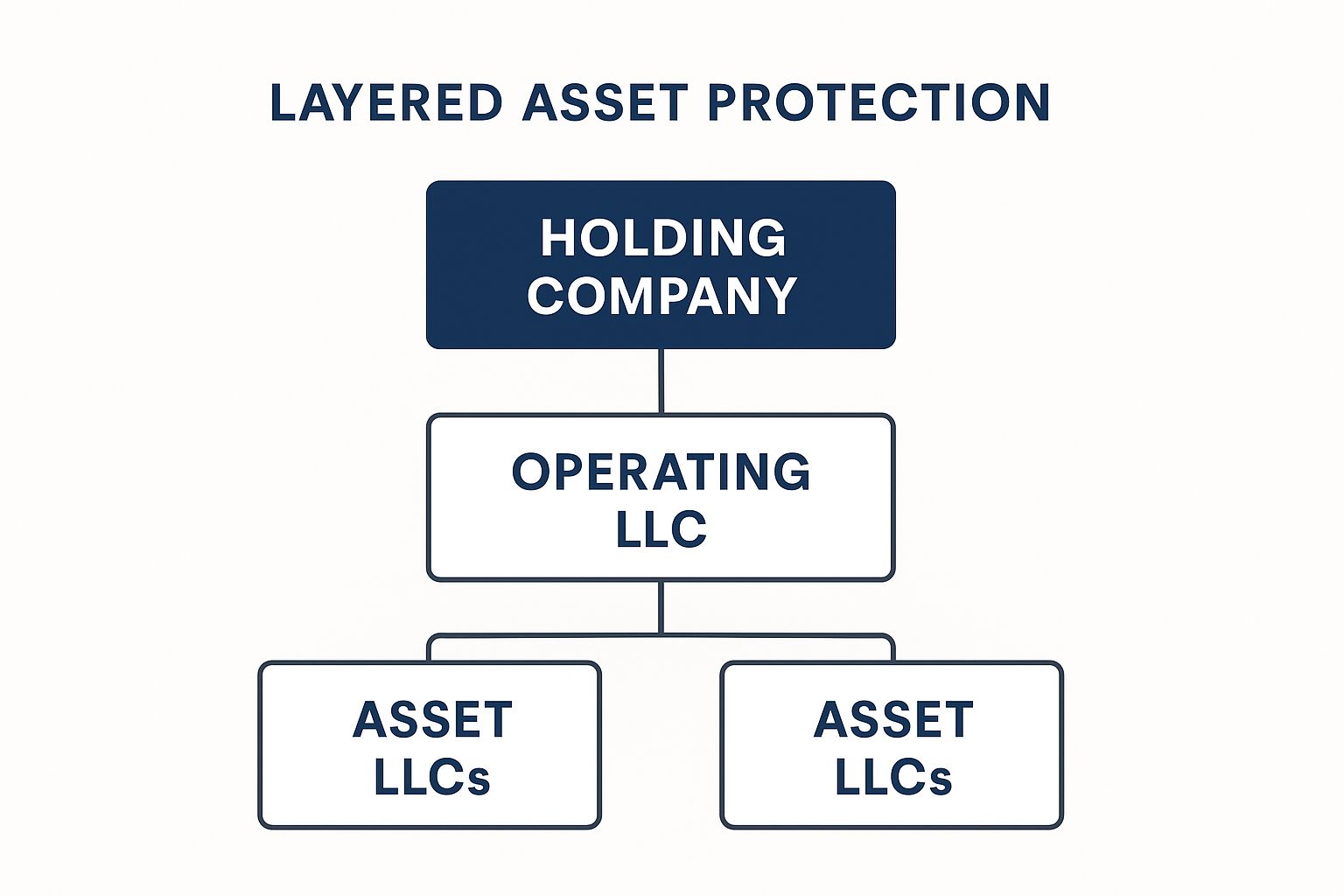

For those seeking robust asset protection strategies, advanced entity structuring offers a powerful, albeit complex, solution. This approach goes beyond basic incorporation and involves establishing multiple interconnected legal entities, such as corporations, LLCs, and partnerships, often across different jurisdictions. The goal is to create a layered defense, compartmentalizing assets and making it significantly more difficult for creditors to reach them. This strategy is sometimes referred to as "equity stripping" or creating a "corporate veil" because it separates valuable assets from liability-generating activities, while allowing the beneficial owner to maintain practical control.

The infographic above visualizes a simplified example of advanced entity structuring. It depicts a hierarchical structure with the beneficial owner at the top, followed by a holding company, and finally, operating companies and asset-holding entities. This visual representation clarifies how separating operational activities from asset ownership provides a layer of protection. The holding company acts as a shield, preventing liabilities incurred by the operating companies from directly impacting the assets held in the separate entities.

Advanced entity structuring offers several key features: multiple layers of entities in strategically chosen jurisdictions, a combination of holding companies and operating entities, the strategic use of debt instruments between entities, cross-collateralization techniques, separate management companies, and the frequent use of Nevada or Wyoming entities for enhanced privacy and charging order protection. For example, a real estate investor might place each property in a separate LLC, managed by another LLC, all owned by a holding company. This structure safeguards individual properties from potential liabilities arising from other investments. Similarly, professionals can separate their practice operations from equipment and real estate holdings, providing comprehensive protection.

This approach provides numerous benefits: increased legal barriers for creditors, compartmentalization of assets to prevent "cross-contamination" of liability, maintenance of practical control while reducing legal ownership, business continuity advantages, incorporation of multiple jurisdictions' protective features, and enhanced privacy. These benefits are particularly appealing to conservative American families, individuals approaching retirement, and anyone valuing financial security.

However, advanced entity structuring is not without its drawbacks. It requires a higher level of complexity in formation and maintenance, increased ongoing compliance costs, and strict adherence to corporate formalities to maintain the legal separation of entities. It can also appear suspicious if not established for legitimate business purposes and may trigger unwanted tax consequences if not properly structured. Courts may disregard structures deemed to be solely for asset protection, emphasizing the importance of legitimate business reasons for the chosen structure.

Pros:

Creates multiple legal barriers for creditors.

Compartmentalizes assets.

Maintains practical control while reducing legal ownership.

Provides business continuity advantages.

Enhances privacy.

Cons:

Complex formation and maintenance.

Higher compliance costs.

Requires strict adherence to corporate formalities.

Can appear suspicious if lacking legitimate business purposes.

Potential tax consequences.

Tips for Successful Implementation:

Ensure legitimate business purposes for each entity.

Document all inter-entity transactions with formal agreements.

Maintain separate books, records, and accounts for each entity.

Hold regular meetings and document corporate decisions.

Work with specialized attorneys familiar with multiple jurisdictions.

Balance complexity against practical management needs.

Regularly review and update structures as laws change.

This strategy is particularly relevant for individuals with significant assets, complex business structures, or those operating in high-liability industries. While not a "one-size-fits-all" solution, advanced entity structuring offers a powerful level of asset protection when implemented correctly. Consulting with experienced professionals like corporate attorney Garrett Sutton, tax strategist Sandy Botkin, or asset protection specialist Aaron Young, and utilizing services like Wyoming Corporate Services and Nevada Corporate Headquarters is crucial for navigating the complexities and ensuring the structure's effectiveness. This method deserves its place on this list because it provides a comprehensive, albeit sophisticated, approach to safeguarding wealth for those who need it most.

Asset Protection Strategies Comparison

Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

Irrevocable Trusts | High – legal setup and ongoing management | High – professional trustees, legal and tax advisors | Strong asset protection from creditors and estate tax reduction | Estate planning, asset preservation, creditor protection | Strong creditor protection, estate tax benefits, privacy |

Limited Liability Companies (LLCs) | Moderate – formation plus proper maintenance | Moderate – state filings, operating agreements | Protection of personal/business assets, tax flexibility | Business asset protection, real estate, family wealth | Liability shield, tax flexibility, relatively simple to form |

Family Limited Partnerships (FLPs) | High – complex partnership structure | Moderate to high – legal setup, compliance | Creditor protection with centralized family asset management | Family wealth transfer, centralized management | Control retention, tax benefits, creditor charging order protections |

Qualified Retirement Plans | Low – established plan setup/administration | Low to moderate – contributions, plan management | Strong creditor protection with tax advantages | Retirement planning, asset protection of retirement funds | Federal protection, tax benefits, relatively easy setup |

Homestead Exemptions | Low – dependent on state law requirements | Low – no cost or minimal filing | Protection of primary residence equity from creditors | Homeowners needing protection of primary residence | Simple, cost-free protection, often unlimited in some states |

Insurance Strategies | Low to moderate – choosing and maintaining policies | Moderate – ongoing premium payments | Immediate protection against covered risks | Liability risk coverage, malpractice, umbrella protection | Immediate coverage, affordable defense costs, statutory exemption for some products |

Offshore Asset Protection | Very High – complex international legal work | Very High – multi-jurisdiction compliance, reporting | Highest level of asset protection beyond domestic reach | High-risk professionals, high net worth, complex asset strategies | Superior protection, foreign court hurdles, privacy |

Advanced Entity Structuring | Very High – multi-entity, multi-jurisdiction setup | High – ongoing legal, accounting, and compliance costs | Multiple layers of asset protection and liability separation | Complex asset portfolios, business continuity, privacy | Multiple legal barriers, compartmentalization, enhanced privacy |

Securing Your Tomorrow: Implementing Your Asset Protection Plan

Protecting your assets isn't just about wealth preservation; it's about securing the future you've worked so hard to build. From utilizing tools like irrevocable trusts and LLCs to leveraging homestead exemptions and exploring sophisticated asset protection strategies like offshore trusts and advanced entity structuring, this article has provided a comprehensive overview of key methods to safeguard your financial well-being. The most important takeaway is that a proactive approach, tailored to your specific needs, is crucial. Mastering these asset protection strategies empowers you to navigate potential risks, from lawsuits to economic downturns, ensuring your financial legacy remains intact for generations to come. This provides peace of mind, allowing you to focus on what truly matters: enjoying your life and providing for your loved ones.

Remember, implementing these strategies requires careful consideration and professional guidance. Laws and regulations surrounding asset protection strategies are complex and can change, highlighting the need for regular review and adjustments to your plan. To further bolster your financial security and explore insurance solutions that complement your asset protection plan, connect with America First Financial. Their expertise can provide tailored guidance and help secure your financial future. Visit America First Financial today to learn more about how their services can enhance your asset protection strategy.

_edited.png)

Comments