A Guide on How to Reduce Healthcare Costs

- dustinjohnson5

- Jul 13, 2025

- 14 min read

It’s a feeling most of us know all too well: the stress of opening a medical bill and wondering how you'll manage it. But what if you could get ahead of those costs? The truth is, you absolutely can. The key to reining in healthcare expenses isn't some secret formula; it's about being proactive.

Think of it as a combination of smart financial planning, prioritizing your health before you get sick, and becoming a savvy consumer. It’s a series of small, informed choices that add up to significant savings over time.

Your Guide to Lowering Medical Expenses

This guide is designed to be your roadmap. We’ll walk through the most effective, real-world strategies for lowering your medical bills. It’s not about finding a single magic trick, but about developing a consistent habit of being an engaged and informed patient.

Every decision you make—from the doctor you choose to the way you review a bill—has a financial impact. This has never been more critical, especially with global medical costs projected to climb by an alarming 10.4% in 2025. That number alone shows just how urgent it is to take control of your healthcare spending now.

Building Your Financial Toolkit

Before we dive into specific healthcare tactics, it all starts with a solid financial foundation. The best way to handle unpredictable medical expenses is to have a plan. This is where skills like mastering budgeting become so important. A well-crafted budget helps you set aside funds for healthcare, so you're not caught off guard by an unexpected bill.

This guide will lay out the key areas where you can make the biggest difference. To get started, let’s look at a high-level overview of the strategies we'll be covering.

Key Strategies for Healthcare Cost Reduction

Strategy Area | Primary Goal | Key Actions |

|---|---|---|

Insurance Optimization | Align your plan with your actual health and financial needs. | Compare premiums, deductibles, and out-of-pocket maximums; utilize HSAs/FSAs. |

Preventive Care | Avoid costly treatments by staying healthy. | Get annual check-ups, screenings, and vaccinations; maintain healthy habits. |

Informed Consumerism | Ensure you never overpay for services or medications. | Compare prices, negotiate bills, review for errors, and use prescription-saving tools. |

By focusing on these three pillars, you can build a comprehensive approach to managing your health and your wallet.

The most affordable medical bill is the one you never get in the first place. When you shift from simply reacting to illness to proactively managing your health, you prevent both physical and financial pain.

Let's break down what this really looks like in practice. We'll be focusing on:

Smart Insurance Choices: This goes way beyond just picking the plan with the lowest monthly premium. It’s about finding coverage that genuinely fits your life.

A "Prevention First" Mindset: Using wellness checks, screenings, and healthy lifestyle choices to head off serious (and expensive) conditions before they start.

Active Consumer Habits: This means doing your homework. You'll learn to research prices, question bills for mistakes, and truly understand your benefits so you only pay for what you should.

Choosing the Right Health Insurance Plan for You

Your health insurance plan is the bedrock of your family's healthcare budget. If you get it wrong, it’s like building a house on sand—one unexpected medical event can cause your financial stability to crumble. To really get a handle on your healthcare spending, you have to look past the sticker price of a plan and dig into how it will actually work for your life.

Too often, people just pick the plan with the lowest monthly payment. But I've seen it time and again: the "cheapest" plan on paper rarely ends up being the most affordable choice over the course of a year.

Look Beyond the Premium

That monthly premium is just the tip of the iceberg. The two numbers that really determine your financial risk are your deductible (what you pay out-of-pocket before your insurance starts paying) and your out-of-pocket maximum (the absolute most you’ll have to spend in a plan year).

Think about these two very different scenarios:

A healthy single person: If you typically only visit the doctor for your annual physical, a High Deductible Health Plan (HDHP) can be a fantastic tool. The premiums are low, and you can stash the money you save into a tax-free Health Savings Account (HSA) to cover future medical bills.

A family managing a chronic condition: Now, imagine a family where a child has asthma or a parent has diabetes. They'll have frequent specialist visits and recurring prescription costs. For them, a plan with a higher premium but a lower deductible often makes much more sense. They'll hit that deductible quickly, and then the insurance will cover the bulk of those ongoing expenses.

The trick is to honestly assess your family's typical medical needs. Pull out last year's records. How many doctor visits did you have? What prescriptions did you fill? This real-world data is your best guide.

Understanding Different Plan Structures

The alphabet soup of insurance plans—PPO, HMO, HDHP—can be overwhelming, but each letter has a direct impact on your wallet and your freedom.

Plan Type | Key Feature | Best For |

|---|---|---|

PPO (Preferred Provider Org) | Gives you the flexibility to see out-of-network doctors, though it will cost you more. | Families who want a wide choice of specialists and are willing to pay for that freedom. |

HMO (Health Maintenance Org) | Requires you to stay within a network of doctors and get referrals to see specialists. | People who are comfortable with a more structured approach in exchange for lower costs. |

HDHP (High Deductible Health Plan) | Pairs low premiums with a high deductible and is often linked to a powerful HSA. | Healthy individuals focused on minimizing monthly expenses while saving for the future. |

A PPO offers you flexibility, while an HMO is built around cost control. Neither one is universally "better"—the right fit truly depends on your family's unique health and financial picture.

Choosing the right health plan isn't about finding the lowest sticker price. It's about calculating your total potential annual cost—premiums plus the maximum you could pay out-of-pocket—and finding the balance that protects your health and your finances.

It’s also worth remembering the bigger picture. When governments don't invest enough in public health, those costs often get passed down to us. In 2022, a staggering 141 countries spent less than 5% of their GDP on public health. This kind of underfunding is a key reason why so many of us face high out-of-pocket expenses. You can learn more about these global healthcare funding gaps and see how they affect household budgets.

Using Preventive Care to Avoid Future Costs

When it comes to healthcare, the cheapest problem is the one you never have. It might sound a little obvious, but leaning into preventive care is one of the most powerful financial strategies you can adopt. Instead of waiting for something to go wrong, you take active steps to keep serious—and seriously expensive—conditions from taking root in the first place.

Think of it like owning a car. You get regular oil changes and tune-ups because they’re a heck of a lot cheaper than replacing a blown engine down the road. It’s the same logic with your health. Annual check-ups, screenings, and vaccinations are small, manageable investments that can help you sidestep six-figure hospital bills for things like advanced heart disease or diabetes.

Thanks to the Affordable Care Act, most health plans are required to cover a whole list of preventive services at no cost to you. That means no copay, no coinsurance, and you don't even have to meet your deductible first. You're essentially being handed free maintenance for your body—it's a benefit too many people overlook.

Maximize Your Free Health Benefits

The first step is simply knowing what you're entitled to. While the specifics can vary a bit from plan to plan, most insurance policies include a core set of benefits designed to catch health issues early.

Annual Wellness Visits: This is your dedicated time each year to sit down with your doctor, go over any concerns, and get personalized advice on staying healthy.

Crucial Health Screenings: This covers tests for things like high blood pressure, cholesterol, diabetes, and different types of cancer (like mammograms and colonoscopies).

Immunizations: Keeping up with vaccines for illnesses like the flu, tetanus, and pneumonia is a ridiculously simple way to ward off serious sickness.

The link between prevention and cost isn't just theoretical. Global healthcare spending soared to $9.8 trillion in 2021, a figure heavily influenced by the rise of chronic diseases—many of which are entirely preventable. This staggering number shows just how critical it is for us to shift our focus from just treating sickness to actively preventing it.

Lifestyle as a Financial Tool

Your daily choices have a direct and powerful impact on your future medical bills. Every healthy meal, every workout, every good night's sleep is like making a deposit into your financial well-being account. Good nutrition and regular activity aren't just about feeling good in the moment; they are cornerstone strategies for slashing your risk of developing expensive chronic conditions later in life.

Getting to the bottom of unhealthy habits, like learning how to stop emotional eating, is also a huge piece of the puzzle for both long-term health and financial savings. Building sustainable, healthy routines is one of the most dependable ways to keep future costs in check.

So, how do you put this into action? Get practical. Pull out your calendar and schedule your annual physical right now. Block out time for any screenings your doctor recommends based on your age and health history.

The next time you see your doctor, have a direct conversation. Ask them, "What are the most important things I can do this year to stay healthy?" A simple question like that changes the entire dynamic. Your doctor shifts from being someone who just fixes problems to a genuine partner in protecting your long-term health and, by extension, your finances.

Becoming a Savvy Healthcare Consumer

It used to be that patients just showed up, got treated, and paid whatever bill arrived in the mail. That's a surefire way to overspend today. The real secret to lowering your healthcare costs is to stop being a passive patient and start acting like an informed consumer. This means doing your homework long before you see a bill.

Think about it: you wouldn't buy a car without comparing prices, so why do it for an MRI? The cost for the exact same medical procedure can swing wildly between facilities, sometimes even in the same zip code. Before you book any non-emergency service, do a little digging. Most insurance companies now have price transparency tools right on their websites that let you see the estimated cost for anything from blood work to knee surgery at different in-network hospitals.

Always Stay In-Network and Ask for Estimates

One of the easiest ways to get hit with a shocking bill is to accidentally go out-of-network. It happens more than you think. You might have a procedure with an in-network surgeon, only to find out the anesthesiologist they used wasn't covered by your plan. It’s on you to double-check that every single provider touching your case—from the lab to the radiologist—is in your network.

For any planned procedure, get on the phone with the provider's billing office. Just ask them, "Can you give me a good-faith estimate for this service based on my insurance?" It does two things: it gives you a ballpark figure and lets them know you're paying attention.

Taking control of your healthcare spending is about asking the right questions before, during, and after you receive care. A simple inquiry about cost or network status can save you from a surprise bill worth hundreds or even thousands of dollars.

Taming Prescription Drug Costs

Prescription costs can feel overwhelming, but you have more control here than you probably realize. A few smart habits can make a huge difference in what you pay at the pharmacy counter.

Go Generic: This is the easiest win. Always ask your doctor if a generic version is available and right for you. They have the same active ingredients as brand-name drugs but often cost a tiny fraction of the price.

Shop Around: Don't just fill your prescription at the closest pharmacy. Use an app or website to compare prices in your area. You’d be shocked at how much the cost for the same pill can vary from one pharmacy to the next.

Look for Savings Programs: If you need an expensive brand-name drug, head straight to the manufacturer's website. They often have patient assistance programs or copay cards specifically designed to lower the cost for patients.

Part of this consumer mindset is knowing all your options. For some conditions, this might even involve exploring clinical trial opportunities. Being fully informed helps you make the best call for your health and your finances.

And don't forget telemedicine. For routine check-ins or minor sicknesses, a virtual visit is almost always cheaper and far more convenient than heading into a clinic. It saves you time, travel, and money.

Get Ready to Negotiate That Medical Bill

When a high medical bill shows up, it's easy to feel overwhelmed. That number can look final and absolute, but I’ve learned from years of experience that it’s often just a starting point. Think of it less as a demand and more as the beginning of a conversation. A huge part of lowering your healthcare costs is learning how to confidently handle the bill after you’ve received care.

The very first thing you should always do? Ask for a detailed, itemized bill. Don't even think about paying from a summary statement. You have a right to see every single charge, from the Tylenol they gave you to the operating room fee. This document is your treasure map for finding errors and potential savings.

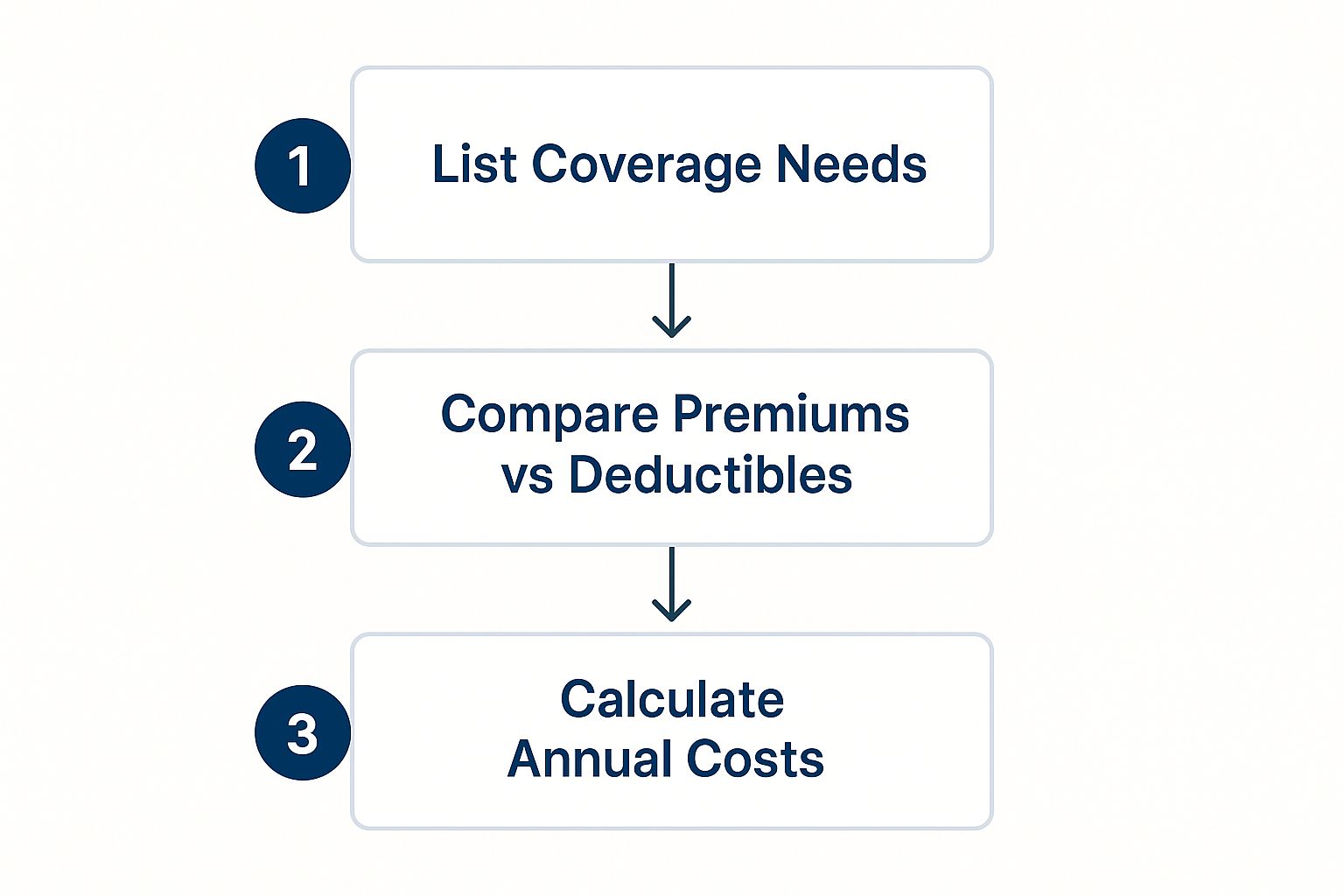

Making smart choices about your health plan from the start can prevent a lot of these billing headaches down the road. It all begins with understanding your own needs.

As you can see, taking the time to compare plans and calculate your true costs upfront means fewer nasty surprises when the bills finally arrive.

Put on Your Detective Hat and Find the Errors

Once you have that itemized bill in hand, it's time to scrutinize it. You might be surprised to learn that medical billing errors are incredibly common. You’re not being a pest by checking for mistakes; you’re being a smart, responsible patient.

Here are a few of the most common red flags I see all the time:

Duplicate Charges: Were you billed twice for the exact same lab test or medication? It happens more than you'd think.

Incorrect Quantities: The bill says you received three units of a drug, but you know you only got one.

Services Never Rendered: Is there a charge for a specialist consultation or an X-ray that never actually took place?

Upcoding: This is a sneaky one. It’s when a provider bills for a more complex, expensive version of the service you actually received.

If anything looks fishy, circle it. Your next move is a call to the provider’s billing department.

To help you get organized, here’s a simple checklist I use to review bills methodically. It ensures you don't miss any of the common problem areas.

Medical Bill Review Checklist

Checklist Item | What to Look For | Action to Take If Found |

|---|---|---|

Personal Information | Misspellings in your name, wrong policy number, or incorrect date of service. | Call the billing office immediately to correct the information, as this can cause claim denials. |

Duplicate Charges | The same service or supply listed multiple times on the same day. | Highlight the duplicates and ask the billing department to remove the extra charges. |

Phantom Services | Charges for procedures, tests, or consultations you never received. | Firmly state that the service was not rendered and request its removal from the bill. |

Coding Mismatches | Vague codes or codes that seem too complex for your visit (e.g., billing for a complex surgery consult for a simple follow-up). | Ask for a clarification of the CPT code and why it was used. If it's wrong, request a correction. |

Unbundled Charges | Separate charges for items that should be included in a single procedure fee (e.g., gloves, basic supplies). | Inquire if these items are part of a standard procedure package and should be bundled. |

Incorrect Quantities | Being billed for more units of medication or supplies than you were given. | Point out the discrepancy and ask for the quantity to be corrected to reflect what you actually received. |

Going through your bill with a checklist like this turns a daunting task into a manageable one. It gives you a clear plan of attack.

Making the Call That Can Save You Money

When you dial that number, remember that your attitude is everything. Be polite but firm, and stay calm. Begin by clearly explaining any specific errors you found using your checklist.

If there aren't any obvious errors, the conversation shifts to pure negotiation. Don't be shy—it's completely normal to ask for a better price.

Here are a few scripts that work wonders:

The Prompt-Pay Pitch: "If I can settle the full balance today over the phone, what kind of prompt-pay discount can you offer me?" Providers often prefer a guaranteed smaller payment now over a larger, uncertain one later.

The Insurance Rate Check: "I'm calling to confirm I'm being charged the discounted rate you've negotiated with my insurance company, not the full 'chargemaster' rate."

The Payment Plan Request: "This amount is more than I can handle at once. Can we set up an interest-free payment plan to make this more manageable?"

Remember, medical billing is a business, and even the biggest players have issues. A 2022 study of Medicare Advantage plans found that billing complexities and other administrative snags led to $2.2 billion in excess costs. If systemic issues exist on that massive scale, it’s entirely reasonable for you to question your own individual bill.

If you’re facing a very large bill or a particularly complicated case, you might want to call in a professional. A patient advocate is a specialist who negotiates on your behalf. They often work on commission, taking a percentage of what they save you, which means there’s little to no upfront risk. By taking these deliberate steps, you can transform a moment of financial dread into a real opportunity to save a significant amount of money.

Answering Your Top Questions About Healthcare Costs

As you start to take control of your medical expenses, a lot of questions pop up. It's completely normal. Getting good answers is the first step toward feeling confident about the choices you're making for your family. Let's walk through some of the most common questions I hear.

Can I Really Negotiate a Hospital Bill?

Yes, you can—and you absolutely should. Most people don't realize that the price on a medical bill isn't set in stone. Think of it as the opening offer in a negotiation.

The first move is always to ask for a detailed, itemized bill. You'd be surprised how often you'll find errors, like being charged twice for the same thing or for a service you never even got.

Once you’ve reviewed it, call the hospital's billing department. Stay calm and polite, but be firm. Here are a few things you can say:

"I'm prepared to pay the full balance today. Is there a prompt-pay discount you can offer?"

"This bill is more than I can handle at once. Can we set up an interest-free payment plan?"

"I'm facing some financial hardship right now. Do you have a financial assistance program I could apply for?" Many hospitals do, but you often have to ask.

Are High-Deductible Health Plans a Good Way to Save Money?

They can be a fantastic way to save, but they aren't the right fit for everyone. It really comes down to your health and your finances.

A high-deductible health plan (HDHP) is usually a smart bet for people who are relatively healthy and don't visit the doctor often. The trade-off is simple: you pay a much lower monthly premium. The real superpower of an HDHP, though, is that it makes you eligible for a Health Savings Account (HSA)—a tax-free way to save for medical expenses.

On the other hand, if you or someone in your family has a chronic illness or you know you'll need regular medical care, a traditional plan with a lower deductible and higher premium might actually save you money in the long run. You'll hit your deductible sooner, which means your insurance starts paying its share earlier in the year.

What Is the Best Way to Save on Prescription Drugs?

There's no single magic bullet for high prescription costs, so you have to attack it from a few different angles.

Your first conversation should always be with your doctor. Don't be shy about asking, "Is there a generic version of this?" or "Is there a different, less expensive drug that would work just as well for me?"

Next, put on your comparison-shopping hat. The price for the exact same pill can be wildly different from one pharmacy to the next. Before you fill anything, check a price comparison tool like GoodRx to see who has the best price in your neighborhood.

Finally, check the source. For expensive brand-name medications, go straight to the drug manufacturer's website. They often have patient assistance programs or copay cards that can slash your costs, sometimes saving you hundreds of dollars a month.

At America First Financial, we believe protecting your family's health and finances shouldn't be complicated or compromised by political agendas. We provide clear, affordable healthcare plans designed to secure your well-being. Get a no-hassle quote in under three minutes and find the right coverage for your family's needs at https://www.americafirstfinancial.org.

_edited.png)

Comments