A Guide on How to Withdraw from 401k The Smart Way

- dustinjohnson5

- Aug 13, 2025

- 13 min read

Thinking about dipping into your 401(k)? It's a big move, and honestly, it’s a bit more involved than just asking for your money. You'll need to get in touch with your plan administrator, wade through some distribution paperwork, and really get a handle on the tax bite.

Whether you're cashing out after leaving a job, facing a genuine financial hardship, or have finally hit retirement age, the journey always starts with your specific plan's rules.

Your Guide to Accessing Your 401(k) Funds

Tapping into your retirement nest egg isn't something to take lightly. This isn't just about the money you need today; it's about the financial security you're building for tomorrow. Before we jump into the "how-to," it's crucial to know who's involved: you, your employer (or a former one), and the financial institution that actually manages the plan.

Your first step, and the most important one, is to contact your plan administrator. They hold the keys to the kingdom and will give you the exact forms and instructions you need to follow. Every single 401(k) plan has its own unique quirks, so don't assume your process will be the same as a friend's or relative's.

Understanding the Gravity of the Decision

Let’s be clear: a 401(k) withdrawal isn't like pulling cash from an ATM. It's a financial decision with ripples that can affect your retirement for years to come. You're not just taking out the principal; you're also giving up all the future growth that money could have earned. It's a classic case of opportunity cost, and it's a much bigger deal than most people realize.

Unfortunately, more and more people are feeling the pinch and see an early withdrawal as their only way out.

We're seeing a record high in hardship withdrawals. Economic pressures have pushed nearly 4.8% of account holders to take money out before they're retirement age, which really shows the financial strain families are under right now.

This is exactly why you have to go into this with your eyes wide open. It's so much more than a simple cash request. You've got to wrap your head around a few key things:

Tax Consequences: Any money you withdraw is considered taxable income. A large withdrawal could easily bump you into a higher tax bracket for the year, meaning you'll hand over more to Uncle Sam than you expected.

Early Withdrawal Penalties: If you're younger than 59½, the IRS will likely hit you with an extra 10% penalty on top of your regular income taxes. Ouch.

Repayment Rules: This isn't a 401(k) loan. A withdrawal is a one-way street; once the money is out, you generally can't put it back.

Taking the time to explore these factors isn't just a suggestion—it's essential. You can dig deeper into what's happening nationwide by checking out these recent findings on 401(k) withdrawal rates.

When Can You Actually Get Your Hands on Your 401(k) Money?

Before we even get into the "how" of withdrawing from a 401(k), we need to talk about the "when." Think of your 401(k) less like a savings account and more like a fortress built for your future. The IRS has set up some pretty strict rules around when you can open the gates, and getting the timing wrong can cost you big time in penalties.

The simplest way to access your funds is by hitting a milestone age. Once you reach age 59½, you've crossed the finish line. At this point, you can generally start taking money out of your 401(k) without facing that nasty 10% early withdrawal penalty. You'll still owe regular income tax on the withdrawals, of course, but the extra penalty is off the table.

Common Reasons You Can Access Your Funds

Age isn't the only trigger. Several major life events can give you access to your 401(k) dollars. One of the most common is simply leaving your job. Whether you quit, get laid off, or officially retire, you can usually tap into the 401(k) you had with that specific company.

This brings up a powerful but often misunderstood provision: the "Rule of 55." If you leave your employer during or after the calendar year you turn 55, you can take distributions from that specific 401(k) without the 10% penalty. It's a fantastic option for early retirees, but remember, it only applies to the plan sponsored by the employer you just left, not to any older 401(k)s you might have.

Another key qualifying event is becoming totally and permanently disabled. If a medical condition prevents you from working, the IRS allows penalty-free access to your retirement savings, which can be an absolute financial lifeline.

What About a Financial Emergency? Understanding Hardship Withdrawals

So, what if you're in a serious financial bind but don't meet any of those criteria? You might be able to take what's called a hardship withdrawal. But let's be clear: the IRS definition of a "hardship" is very specific and narrow. This isn't for a new car or a vacation.

Your plan might permit a hardship withdrawal for situations like these:

Major Medical Bills: Paying for significant medical care for you, your spouse, or your dependents that isn't covered by insurance.

Buying a Home: Covering the down payment or other costs to purchase your main home (but not for making mortgage payments).

Paying for College: Covering tuition, fees, and room and board for the next 12 months for yourself, your spouse, or your kids.

Avoiding Eviction or Foreclosure: Needing funds to prevent being kicked out of your primary residence.

Funeral Costs: Paying for the burial or funeral of a parent, spouse, child, or dependent.

Emergency Home Repairs: Covering the cost of fixing major damage to your home from something like a fire or flood.

Tapping your retirement for a hardship should always be your absolute last resort. You have to demonstrate that you have an "immediate and heavy financial need" and have exhausted all other reasonable sources of money. On top of that, you can only withdraw the exact amount required to meet that need.

This isn't just a theoretical option; a lot of people are doing it. A recent survey showed that 34% of U.S. workers have dipped into their retirement savings early. The top reasons were financial emergencies (31%), home improvements (24%), medical bills (24%), and paying off other debts (24%). You can get more insights from the full workforce outlook survey.

Before you make any moves, your first call should be to your 401(k) plan administrator. They’ll give you the final word on what your specific plan allows and exactly what kind of proof you'll need to provide.

The True Cost of a 401k Withdrawal

When you're thinking about taking money from your 401(k), the first question is usually, "How much will I actually get?" The honest answer? It's always less than you think. A 401(k) withdrawal isn't a simple bank transaction; it's a taxable event with immediate costs that can seriously dent your nest egg.

The first hit comes right away. When you request a withdrawal, your plan administrator is required by law to withhold a flat 20% for federal income taxes. That means on a $10,000 withdrawal, you only walk away with $8,000 upfront. This catches a lot of people by surprise.

Keep in mind, that 20% is just an initial payment toward your total tax bill. Your actual tax rate for the year could be higher depending on your total income. If it is, you'll have to make up the difference when you file your taxes, which can lead to a very unwelcome bill from the IRS.

The Painful 10% Early Withdrawal Penalty

If you're under the age of 59½, the costs get even steeper. On top of regular income tax, the IRS typically tacks on a 10% early withdrawal penalty. This is their way of strongly discouraging you from tapping into your retirement savings before you're actually supposed to.

Let's put some real numbers to this. To get a clearer picture of the immediate financial hit, here’s a breakdown of what a $10,000 early withdrawal might actually cost you.

Estimated Cost of a $10,000 Early 401k Withdrawal

Description | Amount | Notes |

|---|---|---|

Initial Withdrawal Request | $10,000 | The starting amount from your account. |

Mandatory Federal Withholding (20%) | -$2,000 | Held back by your plan administrator immediately. |

Additional Federal Tax (2% estimate) | -$200 | Assuming a 22% total tax bracket. You owe this at tax time. |

Early Withdrawal Penalty (10%) | -$1,000 | This is a penalty, not a tax. It's an extra cost. |

Total Federal Taxes & Penalties | $3,200 | The total amount you've lost to the government. |

Net Cash in Your Pocket | $6,800 | The amount you're left with after federal costs. |

As you can see, your $10,000 withdrawal quickly shrinks to just $6,800. And this table doesn't even factor in state income taxes, which could reduce your take-home amount even more.

The Hidden Cost of Lost Growth

The biggest cost, however, is the one you won't see on any statement: opportunity cost. When you pull money out of your 401(k), you're not just losing the cash. You're giving up all the future compound growth that money could have earned for you over decades.

A small withdrawal today can create a massive hole in your retirement future. That $10,000 you withdraw could have grown to $50,000 or more over the next 20 to 30 years, depending on market returns. This lost potential is the true, hidden cost of an early withdrawal.

This is especially critical when you consider how much Americans have saved. By early 2025, U.S. retirement assets reached an incredible $43.4 trillion. A huge chunk of that—$12.2 trillion—was in defined contribution plans like 401(k)s, according to the Investment Company Institute. You can find more details in the U.S. retirement assets data on ici.org.

Every dollar you remove is a dollar that stops working for you. Before you make a move, seriously weigh the immediate need against the long-term financial security you’re sacrificing. The price is almost always higher than it first appears.

Getting Your Money: A Practical Guide to the 401(k) Withdrawal Process

So, you've done your homework, weighed the pros and cons, and confirmed you're eligible to take money out of your 401(k). Now it's time for the practical part: actually getting your hands on the funds. This process isn't overly complicated, but it does require careful attention to detail.

Your first move is to get in touch with your plan administrator. This is the company that manages the 401(k) plan for your employer—think big names like Fidelity or Vanguard, or sometimes smaller, specialized firms. They're the gatekeepers who have all the specific rules and forms you'll need.

Not sure who your administrator is? The easiest way to find out is by looking at a recent account statement. You can also usually find their contact info on your company's HR portal, or just ask someone in your HR department. This is your starting line.

Tackling the Paperwork

At the heart of any withdrawal is the distribution request form. Whether it's a slick online portal or a paper form you have to mail in, this is where you make it official. Take your time here. I've seen simple mistakes on these forms cause frustrating delays.

You'll need to provide some basic but crucial information:

Your Details: Full name, current address, Social Security number, and your date of birth.

The "Why": You have to state your reason for the withdrawal. Be specific. Is it because you've reached age 59½? Are you no longer with the company? Or are you claiming a specific hardship?

The Amount: Clearly indicate if you're taking out a specific dollar amount, a percentage, or the entire balance.

One of the most common pitfalls I see is a mismatch between the reason someone selects and what their plan actually allows. For instance, you can't just check the "hardship" box without having the documentation to back it up according to your plan's specific rules. Always, always double-check your plan's guidelines before you hit submit.

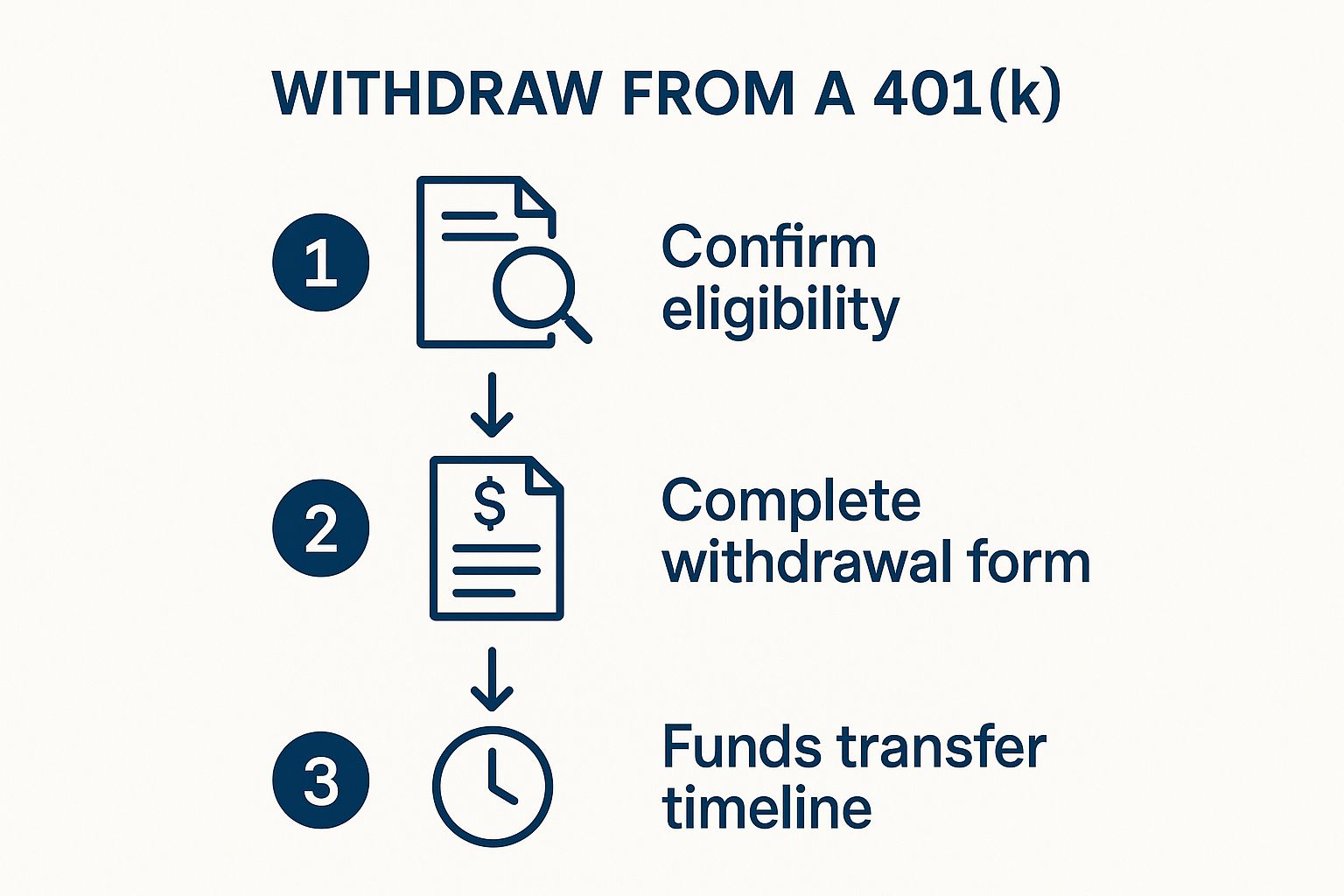

This graphic gives a good high-level overview of the typical journey, from confirming you're good to go to actually getting the money.

While the flow looks simple enough, the real-world timeline can have some variability.

The Waiting Game: When Will You Get Paid?

Once your forms are submitted, the clock starts ticking. How you've chosen to receive your money will play a big role in how long you wait. You'll usually have the choice between a direct deposit into your bank account or a physical check in the mail.

A piece of advice from experience: If you have the option, always go with direct deposit. It's not just faster; it's infinitely more secure. You don't have to worry about a check getting lost, stolen, or delayed by snail mail, which can easily add a week or more to the process.

From start to finish—submitting the request to seeing the cash in your account—you can generally expect it to take between five and ten business days. But be prepared for that timeline to stretch. If there's an error on your form or your request needs a special review (like for a complex Qualified Domestic Relations Order or a tricky hardship claim), it could easily take several weeks.

Keep an eye on the status of your request. Most administrators have an online portal where you can track its progress, or you can simply give their service center a call for an update.

Smarter Alternatives to a 401(k) Withdrawal

Before you even think about withdrawing from your 401(k), I urge you to stop and consider every other possibility. I've seen it time and time again: tapping into your retirement funds should be the absolute last option on your list, not the first place you turn for cash. The long-term damage almost always outweighs the short-term fix.

One of the most common and, frankly, better alternatives is a 401(k) loan. This isn't the same as a withdrawal. When you take a withdrawal, that money—and all its potential for future growth—is gone forever. A loan, on the other hand, is just you borrowing from yourself.

Sure, you’ll pay interest, but here’s the key difference: that interest goes directly back into your own retirement account, not into a bank’s pocket. It’s a way to keep your retirement engine idling instead of shutting it off completely.

401(k) Loan vs. Withdrawal: A Quick Comparison

Let’s put this in perspective. A withdrawal is like permanently firing soldiers from your financial army. A loan is more like sending them on a temporary assignment; they come back, and they even bring reinforcements in the form of the interest you paid.

Feature | 401(k) Withdrawal | 401(k) Loan |

|---|---|---|

Repayment | Not possible; funds are gone forever. | Required, with interest paid back to your own account. |

Taxes | Taxed as ordinary income. | No taxes are due if the loan is repaid on time. |

Penalties | A 10% penalty typically applies if under 59½. | No penalties are applied if repaid according to terms. |

Impact | Permanently reduces retirement savings and growth. | Temporarily reduces your investment balance but is restored. |

A withdrawal is a permanent, wealth-destroying event. A loan, when managed responsibly, is a temporary bridge. The key difference is that a loan preserves your retirement principal, giving it the chance to recover and grow once the loan is repaid.

Exploring Other Financial Tools

Your 401(k) isn't the only piggy bank you have. Depending on your specific needs and overall financial picture, other tools might be a much better fit.

Before you make a final decision on how to withdraw from your 401(k), really look into these options:

Home Equity Line of Credit (HELOC): If you're a homeowner with some equity built up, a HELOC can be a great resource. It gives you a revolving line of credit, often with a much lower interest rate than you'd find on a personal loan, making it perfect for ongoing or unexpected costs.

Personal Loans: Banks and credit unions offer unsecured personal loans that can provide a one-time lump sum. The interest rates might be a bit higher, but they don't jeopardize your retirement savings or put your home on the line.

Negotiating with Creditors: Sometimes, the most effective solution is to go straight to the source of the problem. A simple phone call to your creditors could lead to a new payment plan, a temporary reduction in payments, or even an offer to settle the debt for less. You'd be surprised how often this works.

Making a major financial move like this requires you to understand the long-term consequences of each path. Using a Monte Carlo Simulation Financial Guide can be incredibly helpful for modeling how different choices might play out over time.

Each of these alternatives comes with its own set of pros and cons. Your job is to weigh them carefully against the very high, and often hidden, cost of raiding your 401(k). By exhausting every other avenue first, you protect the nest egg you've worked so hard to build.

Your Top 401(k) Withdrawal Questions Answered

Even with a good grasp of the basics, real-world situations often bring up specific questions about getting money out of your 401(k). Let's walk through some of the most common scenarios I see, so you can make your next move with clarity.

Can I Take Money From My 401(k) While I'm Still Working There?

This is a big one, and the short answer is: probably not. Most of the time, you can't access your 401(k) money while you're still an active employee at the company sponsoring the plan.

However, there are a couple of major exceptions you should know about.

You've reached age 59½. Many plans offer what's called an "in-service" distribution once you hit this magic number. It lets you start taking money out, penalty-free, even if you’re still on the payroll.

You're facing a true financial hardship. If you have an "immediate and heavy financial need" that the IRS recognizes (like major medical bills or avoiding foreclosure), your plan might allow a hardship withdrawal.

The key thing to remember is that these options are entirely up to your employer. You absolutely have to check your plan’s official documents or get in touch with your plan administrator to see what’s possible for you.

What Exactly Is the "Rule of 55" for 401(k)s?

The Rule of 55 is a fantastic IRS provision, but it’s easy to get the details wrong. It lets you sidestep the usual 10% early withdrawal penalty if you leave your job—for any reason, be it quitting, a layoff, or early retirement—in the same year you turn 55, or any year after.

The most critical part of this rule is that it only works for the 401(k) plan tied to the employer you just left. It won't help you with 401(k)s from old jobs or any IRAs you own.

So, while you get to avoid that nasty 10% penalty, the money you withdraw is still considered regular income. You'll owe federal and state income tax on every dollar. It’s a powerful tool for early retirees, but you have to use it correctly.

Will I Owe State Taxes on My 401(k) Withdrawal?

Yes, in almost every case. When you take money from your 401(k), it’s not just the IRS that sees it as income—your state government does, too. Your plan administrator might offer to withhold for state taxes, but sometimes they don't, leaving you on the hook.

How much you'll owe depends entirely on where you live. A few states have no income tax at all. Others, like Illinois, don't tax most retirement income. But in a state like California, that withdrawal gets taxed at your normal income tax rate. To prevent a painful surprise when you file your return, talking to a local tax pro is always a smart move.

How Long Does It Take to Actually Get the Money From a 401(k)?

Once you've submitted all your paperwork correctly, you can generally expect the money to arrive within five to ten business days. That window accounts for the time it takes to process your request and for the funds to be transferred.

A few things can speed this up or slow it down:

Your Plan Administrator: Some are just more efficient than others.

The Reason for the Withdrawal: A straightforward withdrawal after age 59½ is usually faster than a hardship claim that requires someone to review all your supporting documents.

How You Get Paid: Direct deposit is the clear winner for speed, often hitting your account a day or two after processing is complete. If you opt for a physical check in the mail, you could be waiting an extra week or more.

Planning for your financial future is more than just saving; it's about having a trusted partner who shares your values. At America First Financial, we provide insurance and retirement solutions designed to protect your family and secure your assets, free from political agendas. Get a straightforward, no-hassle quote today and see how we put your family's security first. Explore your options at https://www.americafirstfinancial.org.

_edited.png)

Comments