A Guide to Financial Planning for Single Parents

- dustinjohnson5

- Jul 8, 2025

- 17 min read

When you're a single parent, "financial planning" isn't just a buzzword—it's your lifeline. It’s how you map out a way to manage your money, build security for your kids, and actually hit your goals, all on one income. This is about taking the reins of your financial life today so you can build a stable, secure future for your family. Think of this guide as your first step from feeling anxious to feeling empowered.

The Realities of Single Parent Finances

Stepping into single parenthood often throws your finances into a tailspin. If you're feeling the weight of it all, you're in good company. It's a huge adjustment, and feeling overwhelmed is completely normal.

In fact, research shows that a staggering 75% of single parents admit to feeling overwhelmed by their new financial reality. That same study revealed the average single parent feels they need to save around $332,705 just to raise a child comfortably. That number alone shows just how heavy the financial pressure can feel.

This guide is built on honest, practical advice from people who have walked this path. We'll look at the common money pressures head-on, using real-world situations to show you that what you're experiencing is shared. But more importantly, we’re going to pivot from that feeling of anxiety to one of empowerment.

Your Personal Roadmap to Financial Confidence

Think of this guide as your personal action plan. We've broken down the journey into clear, manageable parts to help you build real financial resilience.

Crafting a Budget That Actually Works: We’ll ditch the generic advice and show you how to build a budget that truly fits your one-income household.

Building Your Family's Safety Net: Learn the essentials of creating an emergency fund and picking the right insurance to shield your family from life’s curveballs.

Tackling Debt While Saving for the Future: We'll explore smart strategies to pay down debt without having to put your long-term goals, like retirement and college savings, on the back burner.

Smart Financial Moves for Your Situation: Get specific tips designed for the unique economic hurdles that both single mothers and single fathers often face.

Financial planning isn’t about restriction; it's about freedom. It’s the tool that allows you to make choices for your family based on your values and goals, not on financial limitations.

For many, this journey starts right after a major life event. It's crucial to understand how major life changes like divorce can impact your taxes, because this can directly affect your bottom line from day one. Getting a handle on these details helps you start off on solid footing.

Financial stability isn't some far-off dream—it's a goal you can absolutely achieve. It all starts with the right strategies, a proactive mindset, and the confidence to take that first step. This guide is here to walk with you through the process, turning complex financial topics into clear, actionable advice. Let’s get started.

Building a Budget That Actually Works for You

Let's be honest: for a single parent, a budget isn't just some nice-to-have financial tool. It's your command center. It gives you the clarity to make confident decisions when you're the only one bringing in an income. Forget those rigid, one-size-fits-all templates you find online—they were never designed for the beautiful chaos of raising kids on your own. Your budget has to be a living, breathing thing that bends and adapts with you.

This is the very heart of financial planning for single parents because it gets right to your cash flow. If you don't have a crystal-clear picture of what's coming in and what's going out, building for the future feels impossible. The real goal here is to create a system that lowers your stress, not one that adds another chore to your plate.

Financial anxiety is a heavy weight to carry, especially when you are the sole provider. A recent study revealed that 69% of U.S. adults feel anxious or depressed because of financial uncertainty—a feeling that’s often amplified when you’re managing everything solo. You can read the full 2025 Planning & Progress Study from Northwestern Mutual to get a deeper look at how money stress hits families. A functional budget is your best defense against that worry.

Start With Total Income Clarity

First things first: you need to know exactly how much money is coming into your household each month. And I don’t just mean your main paycheck. To get a true average, you have to account for every single source.

Sources of Income to Track:

Primary Job: Your take-home pay after taxes and other deductions are taken out.

Child Support or Alimony: Only count what you consistently receive. If payments are hit-or-miss, it’s safer to budget as if they don’t exist and treat any that arrive as a welcome bonus.

Side Hustles: Track any extra cash from freelance gigs, a part-time job, or apps.

Government Assistance: Include benefits like TANF or SNAP that help cover essential costs.

Add it all up. That final number is your baseline, the foundation for every spending and saving decision you make from here on out.

Redefining Budget Categories for Real Life

The standard budget categories you see everywhere just don't cut it for single-parent families, do they? "Entertainment" feels a little flimsy when you're hit with a surprise school field trip fee, and "Miscellaneous" is a black hole for all those kid-related costs that pop up.

A much better approach is to customize your categories to match your actual life. I find it helps to think in terms of fixed costs, flexible spending, and those expenses that are unique to being a single parent.

Key Insight: Your budget's job is to reflect your life, not to cram your life into generic boxes. If a category isn't working for you, change it. The only good budget is one you'll actually use.

Let's look at a practical way to set this up. The table below isn't just a list of expenses; it's a framework to help you group them, see where your money is really going, and identify where you have some wiggle room.

Sample Single-Parent Monthly Budget Framework

Category | Example Items | Estimated % of Income | Your Monthly Cost |

|---|---|---|---|

Fixed Housing | Rent/Mortgage, Property Taxes, HOA Fees | 30-35% | |

Utilities | Electricity, Gas, Water, Internet, Phone | 5-10% | |

Transportation | Car Payment, Insurance, Gas, Maintenance | 10-15% | |

Food | Groceries, School Lunches | 10-15% | |

Child-Specific | Childcare, After-School Activities, Clothes | 10-20% | |

Personal & Health | Health Insurance Premiums, Co-pays, Toiletries | 5-10% | |

Debt & Savings | Credit Card Payments, Student Loans, Savings | 5-10% |

Think of this table as a starting point. Your percentages might look different, and that's completely fine. Fill in your own numbers to create a snapshot of your unique financial picture.

Adopt a Flexible Budgeting Model

That classic “50/30/20 rule”—where 50% of your income goes to needs, 30% to wants, and 20% to savings—is often unrealistic for single parents. When a "need" like childcare eats up a huge chunk of your income, the numbers just don't work.

A more forgiving and practical method is what I call a 'bare-bones' budget.

Take a moment and list out the absolute, rock-bottom essential expenses you need to cover to keep your household afloat for one month. We’re talking rent/mortgage, utilities, a basic grocery list, and gas to get to work. This total is your survival number.

When you have a month where your income is lower or a big, unexpected bill lands in your lap, you'll know exactly what must get paid. This allows you to cut back on everything else without a shred of guilt. It's a simple strategy, but it brings incredible peace of mind, knowing you have a fallback plan ready for those tight spots.

Creating Your Family's Financial Safety Net

When you’re the sole provider, building a buffer between your family and life’s curveballs isn't just a good idea—it's everything. This financial safety net is what helps you sleep at night, knowing you’re prepared for the "what ifs." It’s something you build one piece at a time, starting with the most critical foundation.

That foundation is your emergency fund. This isn't your vacation fund or savings for a planned purchase. Think of it as a cash reserve strictly for true emergencies, like a sudden job loss, a blown car engine, or a medical bill that comes out of nowhere. Without this cash on hand, any one of those events can send your entire financial world into a tailspin.

You’ll often hear experts recommend saving three to six months of essential living expenses. I know that number can feel overwhelming. You are not alone if that seems impossible right now. The secret is just to start. Don't let the size of the mountain keep you from taking that first step.

Getting Started With Your Emergency Fund

The trick is to make saving feel effortless, something that happens in the background without you even noticing. Even a small, consistent amount adds up faster than you’d think.

Make it Automatic: Set up a recurring transfer from your checking account to a separate high-yield savings account. Schedule it for every payday. Even if it's just $25 per paycheck, start there.

Chase a Mini-Goal: Forget the big number for a minute and focus on saving your first $1,000. Hitting this milestone feels incredible and is enough to handle many common emergencies.

Bank Your Windfalls: Get a tax refund, a bonus at work, or an unexpected support payment? It’s tempting to splurge, but putting that money directly into your emergency fund is a huge win for your future self.

Key Takeaway: Your emergency fund is your first line of defense. It gives you the breathing room to handle a crisis without piling on debt or being forced into a desperate decision. It's the ultimate act of financial self-care for you and your kids.

Insurance: The Non-Negotiable Protections

Once you have your emergency savings started, it's time to add another layer of protection: insurance. For a single parent, two types are absolutely critical—life insurance and disability insurance. They are designed to protect your family from the two worst-case financial scenarios: you passing away or being unable to earn an income.

What would happen to your children if your income vanished tomorrow? That's the terrifying gap life insurance is built to fill. For most single parents, a term life insurance policy is the most practical and affordable option. It covers you for a specific period—say, until your youngest child is out of college and financially independent—ensuring money is there for everything from groceries to tuition.

Equally important is disability insurance. Frankly, your ability to earn an income is your most valuable financial asset. If a serious illness or accident kept you from working for months or even years, disability insurance would replace a large chunk of your income. It's paycheck protection, plain and simple.

Securing Your Child's Future Legally

The last piece of this foundational safety net isn't about money at all—it’s about making your wishes crystal clear. This means creating a will and, most importantly, naming a legal guardian for your children. This is arguably the single most important action you can take as a single parent.

A will is the only legal document that lets you decide who would raise your children if you couldn't. Without one, a judge who doesn't know you or your family will make that decision, and it might not be the person you would have ever chosen.

Finalizing your wishes with essential estate planning forms is a core part of building this security. It formalizes your choices on guardianship and how your assets should be handled. Taking this step brings a profound sense of peace, knowing your child’s future is in the hands of someone you trust completely.

How to Manage Debt and Save for the Future

When you're the sole provider, trying to pay down debt while also saving for the future can feel like an impossible tug-of-war. Every single dollar has a job, and it often feels like there aren't enough to go around. But here's something I've learned from experience: you don't have to choose between getting out of debt and building a secure future. You can, and absolutely should, do both at the same time. The trick is having a solid, actionable strategy.

This part of your financial plan is all about creating momentum. We’ll first get a handle on the debt that might be weighing you down, then we'll pivot to the exciting part—saving and investing for your family's biggest dreams.

Strategies for Tackling Debt

High-interest debt, especially from credit cards, is a real progress killer. You pour money into it each month, but the balance barely seems to shrink. Taking back control starts with picking a proven method that works for your finances and, just as importantly, your personality.

The two most popular approaches are the debt snowball and the debt avalanche.

The Debt Snowball: With this method, you line up your debts from smallest to largest and throw every extra penny at the smallest one first, while making minimum payments on the rest. Once it's gone, you roll that payment amount onto the next-smallest debt. It's less about math and more about psychology—scoring those quick wins provides a huge motivational boost to keep you in the fight.

The Debt Avalanche: This one is all about the numbers. You list your debts by interest rate, from highest to lowest, and attack the one with the highest rate first. This method saves you the most money on interest in the long run, but you might have to wait a bit longer to celebrate your first paid-off account.

Here's how it plays out: Let's say you have a $500 credit card balance at a nasty 22% interest and a $5,000 student loan at 6%. The snowball method would have you crush that $500 debt first for a quick victory. The avalanche method would also have you prioritize the card, but for a different reason: its sky-high interest rate is costing you the most money.

If you're juggling multiple high-interest debts, you might feel overwhelmed. One tool to consider is using personal loans for debt consolidation. This can wrap all your payments into a single, more manageable one, often at a lower overall interest rate.

How to Save and Invest for Major Goals

Once you have a debt plan in motion, you can really start building that savings momentum. This isn't just about stashing cash in a savings account; it's about making your money work for you through smart investing.

First things first: what are you saving for? Give your savings a purpose.

Retirement: So you can actually stop working one day and enjoy it.

College Savings: To give your kids a head start without saddling them with mountains of debt.

A Major Purchase: Maybe it's a more reliable car or a down payment on a house to call your own.

With clear goals, you can start using some incredibly powerful, tax-advantaged accounts to get there faster. These accounts come with major tax perks that help your money grow much more efficiently.

Choosing the Right Accounts for Your Future

Knowing your options is the first step to building real wealth. Let's break down the most common accounts without the confusing jargon.

Account Type | Primary Goal | Key Benefit |

|---|---|---|

401(k) or 403(b) | Retirement | Often comes with an employer match—this is literally free money! Contributions are pre-tax, which lowers your taxable income today. |

Roth IRA | Retirement | You contribute with after-tax money, but your qualified withdrawals in retirement are 100% tax-free. This is a huge deal. |

529 Plan | Education | Your money grows tax-deferred, and withdrawals for qualified education expenses (like tuition and books) are completely tax-free. |

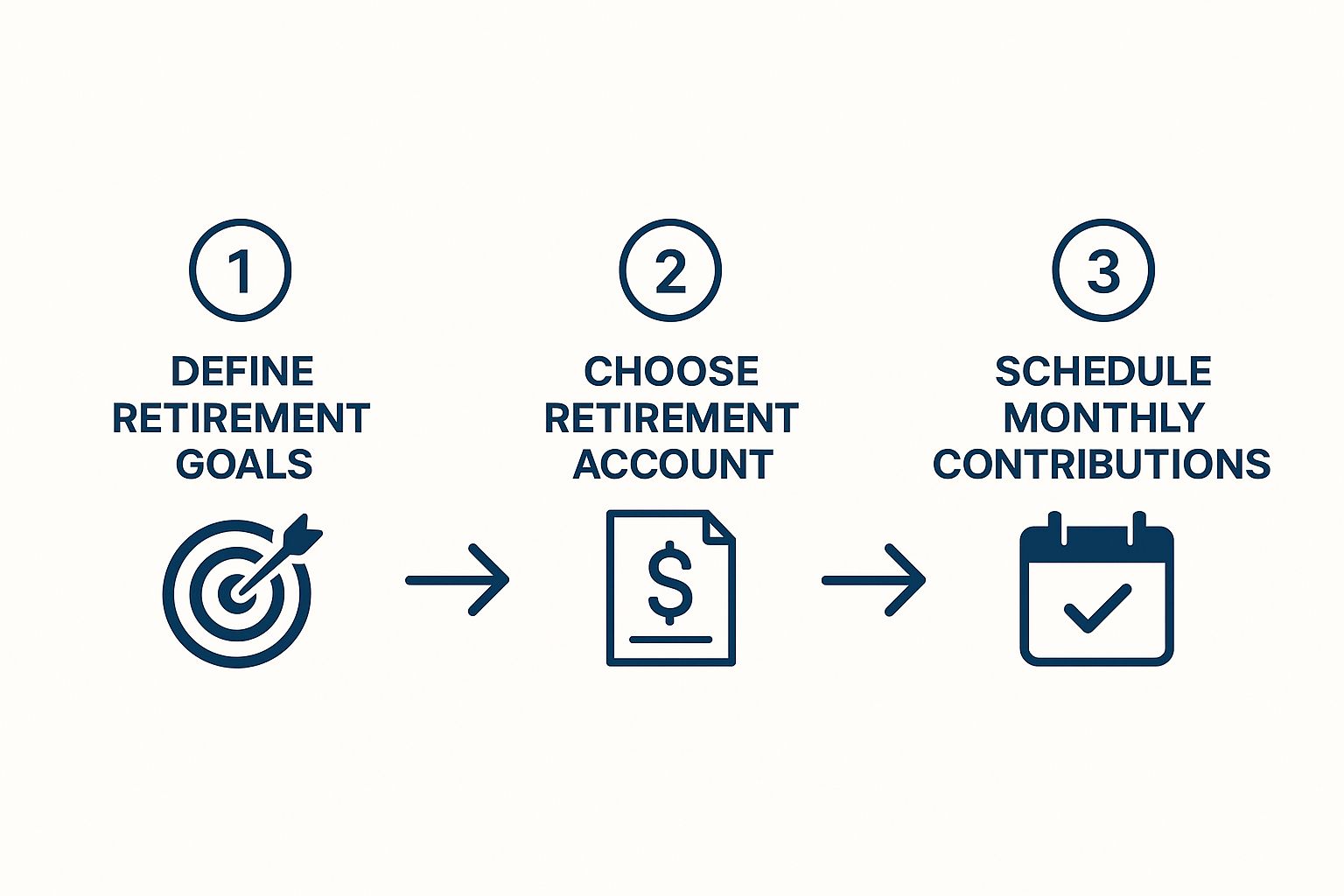

The infographic below breaks down how simple it can be to get your retirement savings off the ground.

It really just comes down to defining your goal, picking the right tool, and then putting it on autopilot.

Even small, consistent contributions can explode into a life-changing amount over time, all thanks to compound interest. This is the magic of your money earning its own money. For instance, a monthly contribution of just $100 could grow to over $140,000 in 30 years, assuming a 7% average annual return.

The most important ingredient is time, which is why starting now—no matter how small—is the most powerful move you can make for your family's future.

Financial Strategies for Single Mothers

As single mothers, we make up the vast majority of single-parent households, and that often means facing a unique set of financial pressures. It can feel overwhelming at times, but with the right game plan, you can build a truly secure future for yourself and your kids. This isn't about focusing on the struggle; it's about tapping into the strength that comes from smart, proactive financial management.

Let's be real about the numbers for a moment. Single mothers often face a significant income gap, earning a median annual income roughly $17,000 less than single fathers. This reality makes it tougher to cover big-ticket items like childcare and healthcare. The most powerful way to counter this is by boosting your own financial literacy—getting comfortable with budgeting, saving, and investing gives you the confidence to take control. You can find more great insights about empowering single parents through financial education on finnyai.com.

This is exactly why a financial plan designed for a single mom’s reality is so important. It’s about more than just tracking expenses; it’s about making strategic moves to get the most out of every single dollar.

Maximizing Your Income and Benefits

Your income is your most powerful wealth-building tool. It’s time to get comfortable advocating for what you’re worth. Before your next performance review, do your homework. Research what others in your role and industry are making and don't be afraid to negotiate. Even a small raise can make a huge difference in your monthly cash flow and how much you can put away for the future.

Beyond your paycheck, take a close look at your employee benefits package. So many valuable perks go unused simply because people don't know they're there.

Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs): These are fantastic. They let you use pre-tax money for medical and even childcare costs, easily saving you hundreds of dollars a year.

Dependent Care FSA: This is a specific account to help you pay for childcare expenses, which for many of us is a massive part of the budget.

Life and Disability Insurance: Your employer might offer group policies at a very low cost. It’s one of the most affordable ways to get that foundational layer of protection for your family.

Key Insight: Start thinking of your benefits package as part of your total compensation. Make a habit of reviewing it every single year to ensure you’re milking it for all it’s worth. It’s like giving yourself an instant raise.

Finding Affordable Childcare Solutions

For most single moms, childcare is either the biggest or second-biggest monthly expense. Finding ways to manage this cost without compromising on quality is absolutely critical.

You have more options than just the traditional daycare center down the street. Look into licensed in-home daycares, as they can sometimes be more affordable. Another great strategy is nanny-sharing with another family to split the cost of one-on-one care. Don't forget to check out programs at local community centers, non-profits, or even churches, which sometimes offer high-quality care at a subsidized rate.

Accessing Financial Assistance and Tax Credits

Please, never assume you don't qualify for help. There are countless federal and state programs out there specifically to support families like ours. These aren't handouts; they're resources you’ve earned through your hard work.

When tax season rolls around, make sure you or your tax preparer are looking into these:

Essential Tax Credits to Explore:

Head of Household Filing Status: This gives you a higher standard deduction and lower tax rates than filing as "Single." It’s a must.

Child Tax Credit (CTC): A major tax credit for each of your kids.

Earned Income Tax Credit (EITC): This is a refundable credit, meaning you can get money back even if you don't owe any taxes. It’s designed for low-to-moderate-income working families.

Child and Dependent Care Credit: This helps you get back a portion of what you spent on childcare so you could work.

By combining these strategies—boosting your income, cutting down major costs like childcare, and using the support systems available—you can create a powerful financial foundation. Every step you take gives you more breathing room and strengthens your family’s future.

Got Questions About Your Finances? Let’s Tackle Them.

Stepping into the world of financial planning as a single parent can feel like navigating a maze. It’s completely normal to have questions—after all, you're the one making all the big decisions. Let's walk through some of the most common concerns I hear from parents in your shoes and get you some clear, practical answers.

"How Can I Possibly Save When My Budget Is Already Maxed Out?"

I get it. When every single dollar seems to have a job before it even hits your account, the idea of saving can feel like a fantasy. The trick is to stop thinking about saving a lot of money and start focusing on building the habit of saving.

The easiest way to make this happen is to "pay yourself first." Right now, set up an automatic transfer from your checking to a separate savings account for every payday. It doesn’t have to be a huge amount. Even $20 or $25 a paycheck makes a real difference because it’s happening automatically. Treat it just like your rent or electric bill—it’s non-negotiable.

Once that's in motion, put on your detective hat and look for the small leaks in your budget. Use a simple app or even a notebook to see where your money is actually going for a month. You might be surprised how much those daily coffees, forgotten subscriptions, or always opting for the brand-name stuff adds up.

A Little Trick I Love: Check if your banking app has a "round-up" feature. It rounds your debit card purchases up to the next dollar and sweeps the change into your savings. It’s a completely painless way to save money you’ll never even notice is gone.

And please, celebrate the small victories. Hitting your first $100 in savings is a huge deal! Seeing that balance start to climb is incredibly motivating and makes it that much easier to keep going.

"What's the Single Most Important Insurance for Me to Have?"

This is a big one. While health insurance is an obvious must-have, for a single parent, your entire financial safety net really comes down to two things: life insurance and disability insurance. These are the two policies that protect your family from a true financial catastrophe.

Your ability to earn an income is your family's biggest asset. Period.

Life Insurance: This is what makes sure your child is taken care of financially if you were to pass away. For most single parents, a straightforward term life insurance policy is the most affordable and sensible option. You get coverage for a specific term, say 20 years, which is usually long enough to see your child become a self-sufficient adult.

Disability Insurance: This is your income protection plan. If you get too sick or injured to work, disability insurance kicks in and replaces a big chunk of your paycheck. It’s what keeps the lights on and food on the table when you can't bring in your salary.

Think of them as a team. Life insurance protects your kids if you’re gone, and disability insurance protects all of you if you’re still here but can’t work. Both are absolutely critical.

"Should I Focus on Paying Down Debt or Saving for Retirement?"

Ah, the classic financial tug-of-war. The truth is, it’s not an either/or question. For a single parent, the best path forward is to do both. It’s a balancing act, because neglecting either one for too long has serious consequences. High-interest debt is like a hole in your pocket, while putting off retirement savings means you miss out on the magic of compound growth.

Here’s a practical way to approach it:

Grab the Free Money First: If your job offers a retirement plan like a 401(k) with a company match, contribute enough to get the full match. This is essentially a 100% return on your money. Never, ever leave this on the table.

Go After Expensive Debt: Once you’ve secured your full match, throw any extra money you can find at your highest-interest debt. This is almost always credit card debt. A focused strategy like the debt avalanche (paying off the highest interest rate first) is the fastest way to knock it out.

Ramp Up Your Savings: After you’ve paid off that toxic debt, you can circle back and increase your retirement contributions. This is also when you can start thinking about other goals, like opening a 529 plan for your child's education.

This balanced approach makes sure you're building a secure future without letting today's debt sink your ship.

"What Are the Must-Have Legal Documents for a Single Parent?"

Your financial plan isn't just about money—it's also about having the right legal protections in place for your child. Honestly, these documents are just as crucial as any insurance policy or savings account.

The most important one, without a doubt, is a will. A will is the only legal document where you can officially name a guardian for your minor child. If you don't have one, a judge will be the one making that life-changing decision, and it might not be the person you would have chosen.

On top of a will, you’ll want two other key documents:

Advance Healthcare Directive (or Living Will): This spells out your wishes for medical care in case you can't speak for yourself.

Durable Power of Attorney: This lets you appoint someone you trust to handle your finances if you become incapacitated.

Getting these documents sorted out gives you incredible peace of mind. It’s a profound act of love and responsibility that ensures your child will always be cared for by the person you trust most, no matter what happens.

At America First Financial, we know that your family’s protection is your number one job. We're here to provide affordable, dependable insurance options like term life and disability coverage, without any of the political noise. You can secure your family’s future with a provider that shares your values. Get a simple, no-hassle quote in less than three minutes and build the financial safety net your family deserves. Learn more and get your free quote from America First Financial today.

_edited.png)

Comments