Annuity Retirement Income: Secure Your Financial Future

- dustinjohnson5

- May 24

- 14 min read

Breaking Down Annuity Income: Beyond the Basics

Annuities have evolved significantly. They're no longer simple pension alternatives. Instead, they've become sophisticated retirement solutions designed to meet a variety of financial needs. For many, the predictable income an annuity offers provides a sense of financial security. However, the increasing complexity of annuities requires careful consideration.

Understanding the Value Proposition of Annuities

Financial advisors often emphasize the peace of mind associated with annuity retirement income. This steady income stream offers a buffer against market fluctuations, a particularly valuable feature during economic downturns. The annuity market in the United States is currently experiencing rapid growth. Projected to reach $388.42 billion by 2029, the market is growing at a CAGR of 5.98%.

This growth is driven by increased demand for stable retirement income amidst market volatility and rising inflation. Annuity purchases in the US are at their highest point since 2008, with insurers raising payouts and guarantees to keep up with this demand. For a deeper dive into the market's growth, you can find more statistics in the United States Annuity Market Report. This surge in popularity highlights the increasing importance of financial security in retirement planning.

It's important to remember that not all annuity features are equal. Some provide critical protections, while others can be costly additions with little real benefit to your retirement security. Knowing the difference is essential.

Key Annuity Features to Consider

When evaluating annuities for retirement income, several key features warrant careful examination. Focusing on your overall well-being in retirement is important, and incorporating things like fitness can play a role. Even something like a high-end sling trainer can contribute to your long-term health. But back to annuities, here's what to look for:

Guaranteed Income: This is the core appeal of many annuities, providing a reliable income stream for a specific period or even a lifetime.

Death Benefit: Some annuities include a death benefit, which pays a lump sum to your beneficiaries after your passing.

Inflation Protection: With the persistent threat of inflation, this feature becomes increasingly vital, helping your income maintain its purchasing power over time.

Flexibility: Certain annuities provide flexible payout options, allowing you to adjust your income stream to meet changing needs.

These features can significantly influence an annuity's suitability for your retirement plan. Carefully analyzing each aspect is a crucial step in the decision-making process.

Navigating the Complexities of Annuity Income

Determining if annuity retirement income is the right choice for you requires careful planning and thoughtful consideration. Understanding how annuities function and how they integrate into your broader retirement strategy is paramount. Comparing different annuity types and their associated fees is also crucial for finding the best fit. This careful analysis helps you maximize your retirement income and achieve your financial objectives. Consulting a qualified financial advisor can offer personalized guidance, empowering you to make well-informed decisions about your retirement future.

Why Annuity Retirement Income Is Having a Moment

Annuities are steadily gaining traction as a reliable retirement income solution. This renewed interest isn't a coincidence. A confluence of factors, particularly the prevailing economic conditions, contributes to this resurgence. Let's delve into the reasons behind the growing popularity of annuity retirement income.

Market Volatility and the Appeal of Guaranteed Income

Market fluctuations often create anxiety for individuals planning their retirement. This uncertainty naturally leads people to seek the predictable and guaranteed income that annuities offer. For instance, a fixed annuity provides a predetermined interest rate, ensuring a consistent income stream irrespective of market performance. This stability is especially attractive for those nearing retirement or already enjoying their retirement years.

Growing concerns about persistent inflation further enhance the appeal of guaranteed annuity retirement income. With the increasing cost of living, retirees worry about their savings maintaining their purchasing power. Certain annuity products, such as those with inflation-adjusted payouts, help mitigate this risk. This protection allows retirees to maintain their standard of living even when prices rise.

The Impact of Rising Interest Rates

Rising interest rates are a significant driver of the current annuity resurgence. Higher rates directly translate into higher annuity payouts. This means retirees receive a larger guaranteed income stream for the same initial investment. This simple fact makes annuities a much more compelling option for those looking to maximize their retirement income.

For example, during the first half of 2025, annuity rates for lifetime guaranteed income retirement plans reached their highest levels in recent years. This trend followed a period of fluctuating interest rates, fueled by insurers competing to attract pension savers. In some instances, rates for a healthy 65-year-old in the UK exceeded 7%. This means a £100,000 investment could generate over £7,000 annually for life. You can learn more at Pensions Age.

This increase in payout rates presents a strong incentive for individuals considering annuity retirement income. The potential for higher, guaranteed income makes annuities an appealing tool for securing financial stability throughout retirement. This shift also reflects broader changes in how people approach retirement planning in the current economic climate.

To further illustrate the benefits of current annuity rates, let's examine a comparison of historical and current rates:

The following table compares historical annuity rates with current rates for different age groups, demonstrating how today's rates offer more favorable terms for retirees.

Age Group | Historical Average Rate (5 years ago) | Current Average Rate | Percentage Increase | Annual Income on $100,000 |

|---|---|---|---|---|

55-64 | 4.5% | 6.2% | 37.8% | $6,200 |

65-74 | 5.0% | 7.0% | 40% | $7,000 |

75+ | 5.5% | 7.8% | 41.8% | $7,800 |

As the table shows, current annuity rates provide substantially higher payouts compared to just five years ago. This increase in income potential can significantly impact a retiree's financial security.

The Psychological Factor: Peace of Mind in Uncertain Times

Beyond the financial advantages, the psychological comfort offered by guaranteed annuity retirement income is invaluable. The assurance of a consistent income stream, regardless of market volatility or economic downturns, provides a strong sense of security. This peace of mind allows retirees to focus on enjoying their retirement years without constantly worrying about their financial situation.

This psychological aspect plays a significant role in the growing popularity of annuities, especially among those approaching retirement. It represents a shift in priorities, with an increased focus on stability and peace of mind over potentially higher but riskier investment returns. For many, the guaranteed income provided by annuities represents not just financial security but emotional well-being, as well.

Finding Your Perfect Annuity Income Match

Not all annuities are created equal. When planning for retirement income, understanding the nuances of each annuity type is crucial. We'll break down the differences between fixed, variable, indexed, immediate, and deferred annuities to help you determine which best aligns with your retirement goals.

Matching Annuity Types to Retirement Goals

Different annuities cater to various retirement objectives. For retirees prioritizing stability, a fixed annuity offers a guaranteed, predictable income stream. If you're comfortable with some risk for potentially higher returns, a variable annuity, linked to market performance, might be suitable.

Indexed annuities offer a balance between growth and protection. They provide growth potential tied to a market index while offering some protection against losses. Your income needs also influence your choice. An immediate annuity begins payments soon after purchase, ideal for supplementing income right after retirement. A deferred annuity allows tax-deferred growth before payments start, suitable for those still accumulating savings.

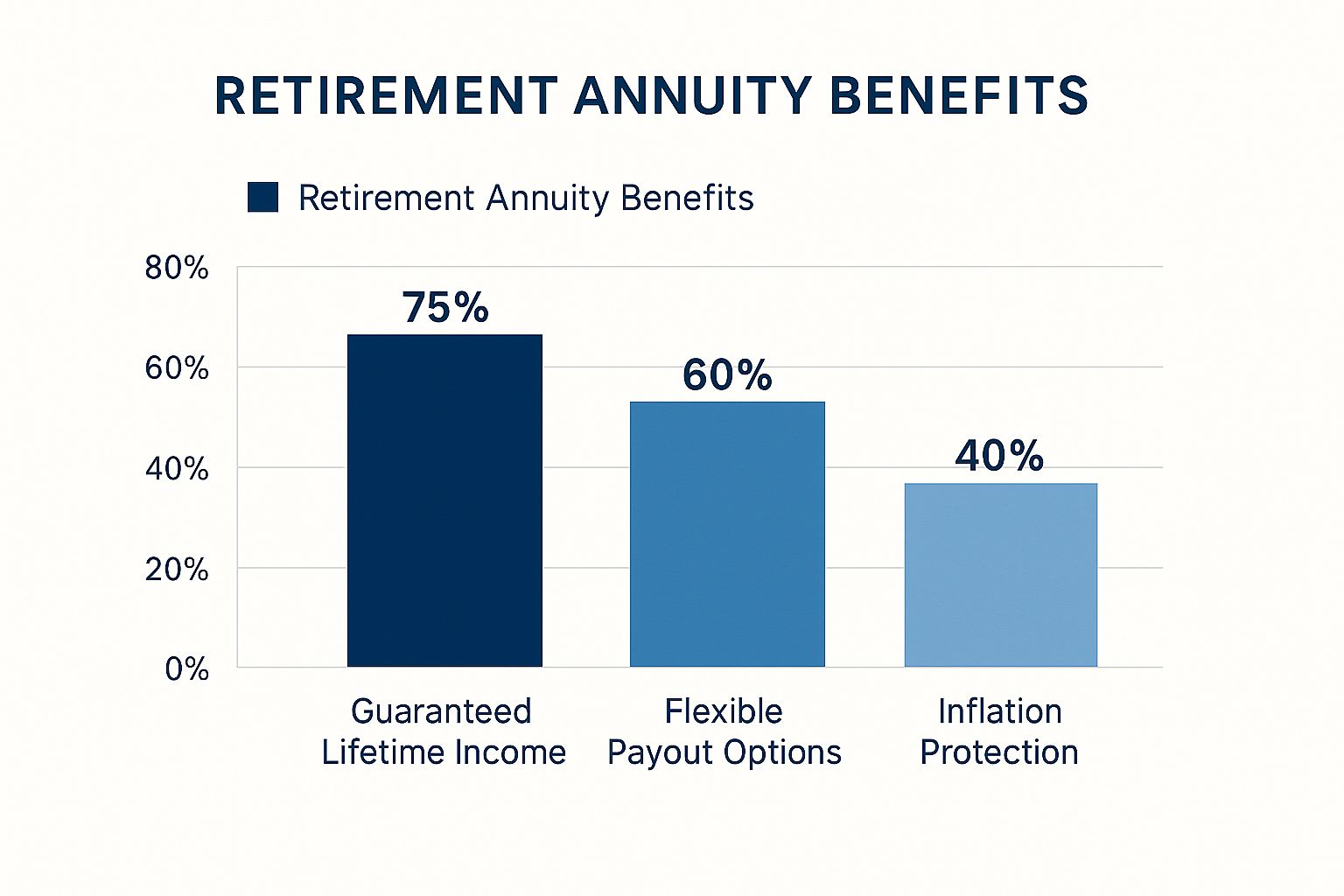

The infographic above highlights the perceived benefits of annuities. Guaranteed Lifetime Income leads at 75%, followed by Flexible Payout Options (60%) and Inflation Protection (40%). This underscores the importance of security and adaptability in retirement income planning.

To further illustrate the different types of annuities and their suitability for various retirement strategies, let's examine the following comparison table:

Annuity Types Comparison for Retirement Income

Annuity Type | Income Predictability | Growth Potential | Liquidity | Protection from Market Downturns | Best For |

|---|---|---|---|---|---|

Fixed | High | Low | Low | High | Risk-averse retirees seeking stable income |

Variable | Low | High | Medium | Low | Retirees comfortable with market risk and seeking higher potential returns |

Indexed | Medium | Medium | Medium | Medium | Retirees seeking a balance between growth and protection |

Immediate | High | Low | Low | High | Retirees needing immediate income supplementation |

Deferred | Medium | Medium | Medium | Medium | Retirees still accumulating savings and seeking tax-deferred growth |

This table provides a concise overview of each annuity type's key features and helps retirees choose the best option for their specific needs.

Real-World Annuity Strategies for Retirement Success

Retirees often utilize specific annuity types to address particular financial challenges. A lifetime income annuity can alleviate the fear of outliving savings by providing guaranteed income for life. For those anticipating significant healthcare expenses, an annuity with a cost-of-living adjustment (COLA) rider can help protect income from inflation.

Some retirees combine different annuity types for a balanced approach, ensuring both stability and flexibility. For instance, Daniel Levenstein, a retired arts administrator, combined multiple Charitable Gift Annuities (CGAs) with Social Security and retirement funds to create a multifaceted income stream that supported his philanthropy while securing his financial future.

Understanding Annuity Costs and Features

Beyond the basic types, evaluating annuity costs is essential. Income features often come with associated fees. A guaranteed lifetime withdrawal benefit offers security but might reduce overall returns. Surrender periods impose penalties for early withdrawals. Carefully consider these factors to make informed decisions.

Unnecessary riders can erode returns. Some riders might offer benefits you don't need, adding unnecessary expense. Scrutinize each rider and determine its value for your situation. A long-term care rider, for example, might be more cost-effectively addressed through separate long-term care insurance.

By understanding annuity types, costs, and features, you can make informed decisions aligned with your retirement plan. This careful analysis empowers you to create a secure and sustainable income stream. At America First Financial, we offer a range of annuity options designed to meet the unique needs of conservative American families. Learn more about how we can help you build a secure retirement.

Global Shifts Reshaping Annuity Retirement Income

The world of retirement planning is constantly evolving. Several key global shifts are dramatically changing how we approach securing our financial future, especially when it comes to annuity retirement income. These shifts are impacting everything from product development to how we access these essential financial tools.

The Aging Global Population and the Demand for Guaranteed Income

One of the most significant changes is the increasing age of the population in developed countries. This demographic shift creates a significant demand for guaranteed income products, such as annuities. As lifespans increase, so does the risk of outliving one’s savings. This necessitates secure income streams that last a lifetime. This rising demand encourages insurance companies around the globe to innovate and modify their annuity products. For instance, some insurers are creating products that specifically address longevity risk, guaranteeing income for life, regardless of how long someone lives.

The growing retiree population also influences how financial technology integrates with annuities. Digital platforms like Fidelity make it easier for people to research, compare, and purchase annuities online, offering greater accessibility and convenience.

This ties directly into the expanding global annuity market. The market is predicted to reach $8.12 billion by 2029, representing a CAGR of 5.9%. Factors like longer lifespans, increasing healthcare expenses, and concerns regarding public pension systems fuel this growth. By 2030, the global population aged 65 and older is projected to surpass 1 billion, further increasing the demand for annuities. Learn more about the growing annuity market. These trends create a powerful combination of demographics and market forces that shape the future of retirement income.

Innovation in Annuity Products

The increasing demand for annuity retirement income fuels innovation among insurance providers. Insurers are creating new products and features to meet the evolving needs of retirees. These innovations include more flexible payout options, enhanced death benefits, and solutions that aim to protect against inflation.

For example, some annuities now include income riders that allow retirees to increase their payments to keep pace with the rising cost of living. Other innovations emphasize personalization, enabling individuals to customize their annuity income streams to better align with their specific retirement plans. This focus on flexibility and personalization is a direct response to the increasing demand for more tailored retirement solutions.

The Role of Financial Technology

Financial technology, or Fintech, plays a vital role in increasing access to and simplifying annuity retirement income. Digital platforms make the process of purchasing annuities more efficient. These platforms frequently provide educational materials and tools to help individuals understand how annuities work. Fintech also allows for more personalized annuity solutions. This level of customization empowers retirees to design income streams that precisely match their specific needs and objectives.

These advancements in financial technology reduce barriers and make annuity retirement income more accessible to a broader range of people. At America First Financial, we recognize the importance of these changing needs and provide annuity solutions specifically designed for conservative American families.

Creating Your Annuity Retirement Income Blueprint

Now that we understand the various aspects of annuities, let's personalize this knowledge and integrate it into your retirement plan. This section will guide you in transforming general annuity concepts into a practical, tailored strategy. We'll explore proven methods used by successful retirees, including the effective "bucketing" approach. As you develop your retirement blueprint, you might also find inspiration in innovative digital asset strategies, similar to those discussed in Why I Acquired .queensland: My Vision for Web3 and Queensland.

The Bucketing Approach: Segmenting Your Retirement Funds

The bucketing approach offers a structured way to organize your retirement savings. It involves dividing your funds into separate "buckets," each assigned to a specific time frame and financial goal.

This method enables strategic allocation based on your short-term, mid-term, and long-term needs. For instance, one bucket might hold easily accessible cash for immediate expenses. Another might contain investments geared towards growth, intended to fund later retirement years.

Annuities can play a crucial role in this strategy, particularly within the long-term income bucket. They can provide a guaranteed income stream to cover essential expenses throughout retirement.

Determining Your Annuity Allocation: A Personalized Approach

How much of your portfolio should be allocated to annuities? There's no one-size-fits-all answer. It depends on several personal factors.

Your existing income sources, like Social Security or pensions, are key considerations. Your lifestyle and anticipated future expenses, such as healthcare, also play a role.

Finally, consider your legacy goals. What do you wish to leave behind for loved ones? If a significant inheritance is a priority, a smaller annuity allocation might be appropriate. This leaves more of your portfolio available for potentially higher-growth investments.

Balancing Guaranteed Income and Flexibility: Real-World Examples

Striking the right balance between guaranteed annuity income and other assets, such as investments, is essential. This ensures both financial security and flexibility during retirement. Let's look at some real-world examples.

Daniel Levenstein, a retired arts administrator, combined multiple Charitable Gift Annuities (CGAs) with Social Security and retirement funds. This strategy not only secured his income but also supported his philanthropic interests.

Another approach involves using a fixed annuity to cover essential expenses, while maintaining a separate investment portfolio for discretionary spending and potential growth.

Integrating Annuities with Your Existing Retirement Resources

Annuities shouldn't exist in a vacuum. Integrating them with other retirement resources maximizes their benefits. This includes coordinating annuity income with Social Security and pension payments.

The timing of your annuity purchases matters too. A deferred annuity provides tax-deferred growth while you're still accumulating savings. A immediate annuity supplements your income as you approach retirement.

Actionable Frameworks and Planning Worksheets

Structured planning tools can further assist you in designing your personalized annuity retirement income strategy. These resources offer step-by-step guidance, helping you determine your income needs and evaluate your risk tolerance.

Online retirement planning worksheets and calculators can help estimate future expenses and calculate your required income. These tools empower you to take control of your retirement planning and build a secure future.

Tax-Smart Strategies for Annuity Retirement Income

The effectiveness of your retirement income plan often depends on how tax-efficient it is. Understanding the tax implications of annuities is essential for maximizing your retirement nest egg. This section explains how annuity taxation works, offering practical strategies to minimize your tax burden and keep more of your money.

Decoding Annuity Taxation: Qualified vs. Non-Qualified

A key difference in annuity taxation lies between qualified and non-qualified annuities. Qualified annuities, often purchased within retirement plans like 401(k)s, grow tax-deferred. This means you won't pay taxes on the growth until you begin receiving income. However, withdrawals during retirement are taxed as ordinary income.

Non-qualified annuities, purchased with after-tax dollars, offer a different tax advantage. While the growth is still tax-deferred, only the earnings portion of your withdrawals is taxed. This can provide significant tax benefits, especially if you expect to be in a lower tax bracket in retirement.

Timing Is Everything: Strategic Purchases and Distributions

Timing plays a vital role in minimizing your tax burden with annuities. Purchasing a non-qualified annuity earlier in your career allows for a longer period of tax-deferred growth. For qualified annuities, delaying withdrawals for as long as possible maximizes tax-deferred compounding.

Coordinating annuity income with other retirement accounts can also create optimal withdrawal sequences. For example, withdrawing from taxable accounts first, then tax-deferred accounts like 401(k)s, and lastly from tax-free Roth accounts, can help minimize your overall tax liability. This strategy, however, requires careful planning and may benefit from professional financial advice.

Maximizing Spendable Income: Real-World Scenarios

The strategic use of qualified vs. non-qualified annuities significantly impacts your spendable retirement income. Imagine two individuals, each with $100,000 in annuity retirement income. One has a qualified annuity, the other a non-qualified annuity. The individual with the non-qualified annuity is likely to have more spendable income due to how their withdrawals are taxed. Only the earnings are taxed, preserving more of their principal.

Consider the case of Daniel Levenstein, a retired arts administrator. He strategically combined Charitable Gift Annuities (CGAs) with Social Security and retirement funds. This provided him with a consistent income stream while also giving him tax benefits for his charitable contributions. His approach highlights the importance of coordinating various income sources and leveraging tax advantages.

Avoiding Common Tax Mistakes with Annuities

While annuities offer valuable tax advantages, certain mistakes can reduce these benefits. One common error is withdrawing from a non-qualified annuity before age 59 1/2. This triggers a 10% early withdrawal penalty, on top of regular income taxes.

Another mistake is misunderstanding the tax implications of annuity riders. Some riders, like guaranteed lifetime withdrawal benefits, might change how your withdrawals are taxed. Understanding these details is essential for making sound decisions and avoiding unforeseen tax consequences. Consulting with a qualified financial advisor can provide personalized guidance in navigating annuity taxation. At America First Financial, we help conservative American families understand these complexities and create a tax-efficient retirement income plan.

Bulletproofing Your Retirement With Annuity Income

Securing guaranteed retirement income with an annuity is a significant step. However, the real work begins with ensuring that income retains its value throughout your retirement years. This means protecting your annuity income from inflation, market volatility, and the possibility of outliving your assets (also known as longevity risk).

Safeguarding Your Purchasing Power: Inflation Protection Strategies

Inflation can severely diminish the purchasing power of your annuity income. If everyday expenses, such as groceries, double in cost over a decade, your income needs to keep pace to maintain your standard of living. For instance, if your annuity pays $50,000 annually and inflation averages 3% yearly, that $50,000 will have the buying power of roughly $27,700 after 20 years.

Fortunately, strategies exist to mitigate this risk. Some annuities offer cost-of-living adjustment (COLA) riders, which automatically increase your payments over time. While valuable, these riders often come with a higher initial cost.

Another approach is annuity laddering. This involves purchasing several annuities that mature at different times. As each annuity matures, you can reinvest it, potentially at higher rates. This helps capture some of the benefits of rising interest rates and offset the effects of inflation.

Navigating Market Uncertainty and Longevity Risk

Fixed annuities offer predictable income regardless of market downturns. Variable annuities, however, are subject to market fluctuations. Several features can help manage this variability. A guaranteed lifetime withdrawal benefit (GLWB) rider ensures you can withdraw a set percentage of your initial investment every year, no matter how the market performs. This provides downside protection while still allowing for potential growth.

Longevity risk, the risk of outliving your savings, is a serious concern. A lifetime annuity directly addresses this, guaranteeing income for the rest of your life. This provides peace of mind, ensuring your retirement funds will last.

Contingency Planning: Preparing for the Unexpected

Unexpected events, such as health crises or market crashes, can derail even the best retirement plans. Contingency planning is essential. This might include building an emergency fund or adding a long-term care rider to your annuity.

Diversifying your investments beyond your annuity provides another layer of security. Combining the steady income from a fixed annuity with investments in stocks and bonds allows for both stability and growth potential.

Emerging Annuity Products and Expert Insights

The annuity landscape is constantly changing. Financial advisors and retirement specialists recommend exploring newer annuity products designed to address modern retirement challenges. These include annuities with more flexible payout options and products that combine guaranteed income with long-term care benefits.

Some emerging annuities, for example, let you adjust your income stream as your needs change. This offers valuable flexibility if you face unexpected expenses. Consulting a qualified financial advisor can provide personalized guidance on these new products and help you determine if they fit your retirement goals.

Preparing for a secure retirement takes careful planning and thoughtful consideration. It's like building a house: you need layers of protection. A solid foundation is critical, and that's where guaranteed annuity retirement income comes in. By following these strategies, you can build a retirement income plan designed to last. Secure your family’s financial future today with America First Financial and discover our range of annuity options tailored for conservative American families.

_edited.png)

Comments