Appeal Insurance Denial: How to Win Your Coverage Case

- dustinjohnson5

- May 28

- 13 min read

The Real Story Behind Rising Insurance Denials

The frustration of receiving an insurance denial is a common experience. Many patients feel lost in a complex system of paperwork and procedures. This isn't just anecdotal; data reveals a troubling trend of increasing denials across the healthcare landscape. To understand this rise, it's important to grasp the current state of the insurance industry. You can explore this topic further with this helpful resource: Insurance.

Decoding the Denial Data

The growing number of claim denials impacts both patients and healthcare providers, adding another layer of complexity to an already intricate system. In 2023, denial rates for in-network claims varied significantly between insurers, ranging from a low of 1% to a high of 54%. This disparity highlights the inconsistencies in access to care. Furthermore, denials have continued to climb, with a 16% increase between 2018 and 2024. This increase disproportionately affects coverage for essential medications like insulin and albuterol. More detailed statistics can be found here: Learn more about insurance claim denials. Appealing a denial is not just about a single claim; it’s about navigating a system struggling with rising costs and changing coverage policies.

To help illustrate the variations in denial rates, let's examine the following table:

Insurance Denial Rates by Major Insurers

Comparison of denial rates across different insurance companies to help patients understand industry patterns

Insurance Company | Denial Rate (%) | Common Denial Reasons | Appeal Success Rate |

|---|---|---|---|

Company A | 5% | Lack of pre-authorization, coding errors | 60% |

Company B | 22% | Medical necessity disputes, out-of-network services | 45% |

Company C | 12% | Administrative errors, missing documentation | 75% |

Company D | 35% | Experimental treatments, non-covered services | 30% |

This table uses hypothetical data for illustrative purposes. Actual denial rates and appeal success rates can vary significantly.

As the table demonstrates, denial rates and the reasons behind them can differ substantially between insurance companies. Understanding these differences can be crucial when navigating the appeals process.

The Impact of Financial Pressures

The rise in insurance denials is often linked to the financial pressures facing insurance providers. Increasing healthcare costs, coupled with attempts to manage spending, often result in more rigorous claim scrutiny. Insurance companies, facing budgetary constraints, scrutinize every expense, including claims. This cost-control strategy, however, often creates obstacles for patients seeking necessary medical care. Understanding these financial realities helps patients anticipate potential challenges during the appeals process and develop stronger arguments for their case.

Understanding Your Rights in the Appeals Process

Navigating the appeals process requires understanding your rights and the steps involved. While the process may seem overwhelming, remember that appealing a denial is often a right and a vital step in accessing needed healthcare. Understanding the specific reasons for a denial, such as "medical necessity" or other policy details, is the first step in building a strong appeal. By understanding the rationale behind the denial, you can tailor your approach and improve your chances of a successful appeal.

How AI Is Secretly Deciding Your Healthcare Fate

Artificial intelligence (AI) is increasingly influencing healthcare decisions, often without patients even realizing it. Insurance companies are adopting complex algorithms to automate claim processing, striving for greater efficiency. However, this focus on speed can sometimes compromise accuracy and patient well-being. This section explores how AI impacts healthcare decisions and helps you identify and challenge denials issued by automated systems.

Recognizing the Signs of AI Involvement

How can you determine if an insurance denial resulted from an algorithm versus a human review? One key indicator is a generic, formulaic denial letter lacking specific medical justification. An extremely quick turnaround time, suggesting automated processing, is another red flag. For instance, receiving a denial within hours of submitting a claim likely signals minimal human oversight. Also, denials repeatedly citing pre-authorization as the sole reason, even when you have obtained it, can indicate AI-related issues. These clues can inform your appeal strategy.

The Alarming Trend of AI-Driven Denials

The growing reliance on AI in claims processing has had a significant impact on denial rates, directly affecting access to vital healthcare services. This isn't just a theoretical concern; it's a measurable reality. Major insurance companies like UnitedHealthcare have reported denial rates around 33%. Other companies such as Cigna, Aetna, and Anthem Blue Cross Blue Shield aren't far behind, with rates ranging from 17% to 30%. This trend is concerning because it suggests that the pursuit of efficiency through AI may be hindering, rather than improving, access to necessary care. Find more detailed statistics here. Understanding how to appeal an insurance denial is becoming more important than ever.

Leveraging AI Knowledge in Your Appeal

Knowing that AI might be involved in the denial process allows you to tailor your appeal strategically. Instead of simply reiterating medical necessity, highlight the specific details of your case that an algorithm might overlook. Include comprehensive medical records, personalized letters from your physician, and emphasize the human impact of the denial. By doing this, you're essentially showing the system where its automated processes failed and advocating for a more thorough, individualized review of your situation. Understanding how AI works can empower you to create a compelling appeal that gets past automated barriers and reaches human decision-makers who have the authority to overturn the denial.

The Hidden Costs That Make Fighting Denials Essential

Beyond the immediate financial hit, an insurance denial can set off a chain reaction of problems impacting your overall well-being. These hidden costs often go unnoticed, yet they are vital to understanding the true importance of appealing denials. These ripple effects can reach your physical health, emotional state, family life, and even career stability.

The Domino Effect of Delayed or Denied Care

When necessary treatments are delayed or denied, manageable conditions can escalate into serious health crises. Imagine a patient with diabetes who loses coverage for their insulin. This disruption could lead to dangerously high blood sugar, potentially requiring hospitalization and incurring far greater expenses than the original prescription.

Similarly, a child with asthma denied coverage for an inhaler could experience severe breathing difficulties, leading to emergency room visits and possibly long-term health issues. The impact of insurance claim denials on patients' health and finances is substantial. Clinically, denials cause treatment delays, leading to suboptimal management of medical conditions and potentially preventable complications. Explore this topic further. This highlights the critical connection between timely access to care and positive health outcomes.

Beyond the Physical: The Emotional and Social Toll

The stress of fighting for needed healthcare takes a heavy emotional toll. The constant worry, frustration, and feeling of helplessness can lead to anxiety, depression, and even despair. These struggles can also affect family life. Spouses and children may absorb a patient's frustration, causing strained relationships and increased tension at home.

Appealing a denial also demands significant time and effort, potentially impacting job performance and leading to missed work. This can jeopardize income and career stability, adding another layer of complexity to an already difficult situation.

The Long-Term Financial Ramifications

While the immediate cost of a denied treatment is clear, the long-term financial repercussions are often overlooked. Delayed care can lead to more severe health problems down the road, requiring more expensive interventions and higher healthcare costs over time.

For example, a denial for a preventative screening could delay the diagnosis of a serious illness. This could make treatment far more complicated and expensive in the future. The financial strain of handling a denial can deplete savings, increase debt, and create long-term financial instability for individuals and families. This makes appealing insurance denials not just a matter of principle, but a critical step in protecting your long-term financial health.

Your Step-By-Step Appeal Insurance Denial Strategy

The appeals process can be intimidating, but a strategic approach can significantly increase your chances of success. This section provides a practical guide, breaking down the process into manageable steps, offering helpful tips, and providing you with the tools to effectively appeal a denied insurance claim.

Crafting a Compelling Appeal Letter

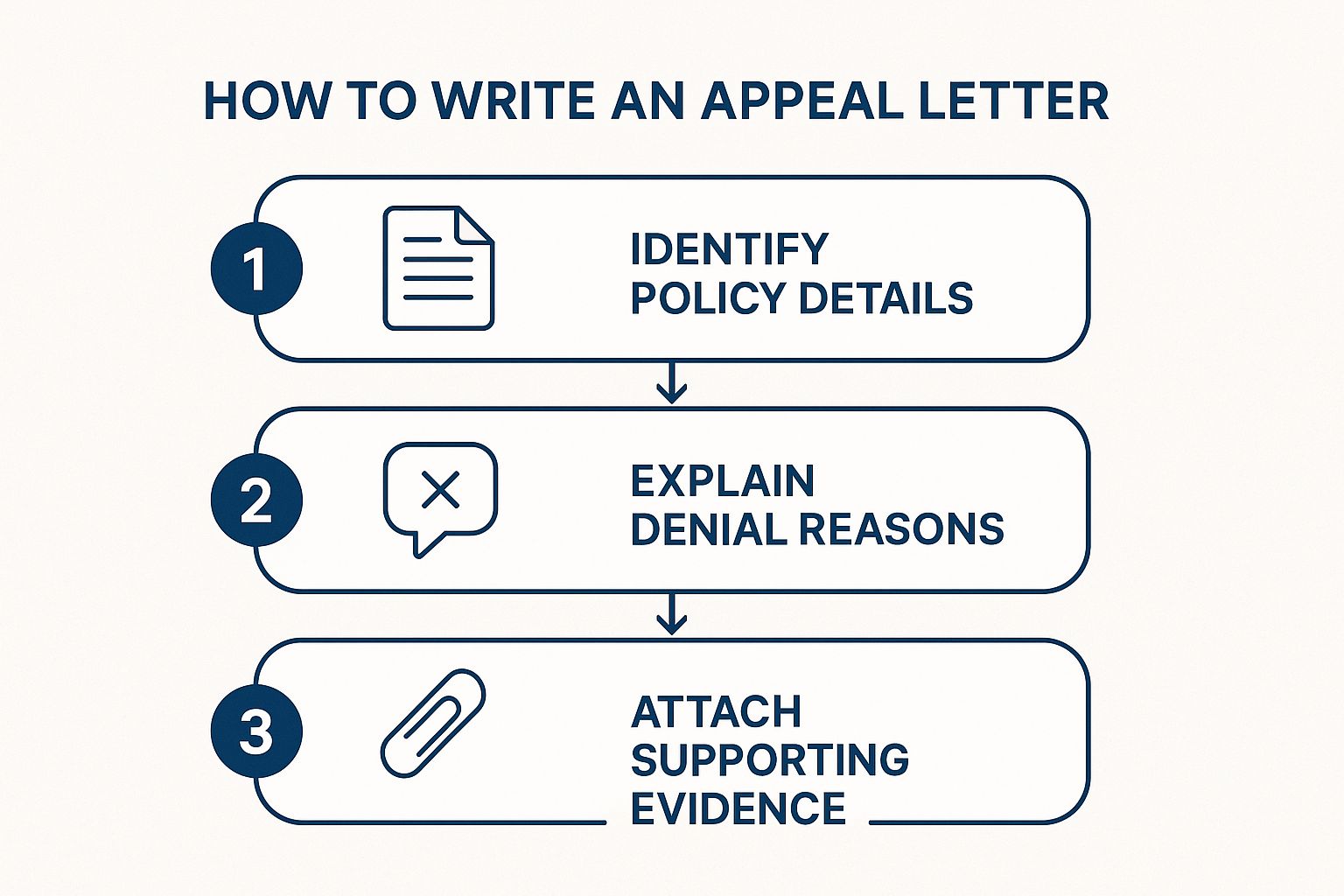

Your appeal letter is the foundation of your case. It must be clear, concise, and persuasive, presenting a strong argument for reconsideration. Visualize this process in three steps:

This infographic illustrates the key components of an effective appeal letter. It emphasizes understanding your policy, explaining the denial reasons, and providing strong supporting evidence. A well-crafted appeal letter connects your policy details to the denial reasons and supports your argument with solid evidence.

Identify Policy Details: Begin by carefully reviewing your insurance policy. Pinpoint the specific clauses related to your denied claim. Highlight discrepancies between the denial reason and your policy's coverage. This demonstrates your understanding of the policy and strengthens your position.

Explain Denial Reasons: Clearly explain why your claim was denied. Address each reason individually, offering counter-arguments and detailed explanations. For instance, if the denial cites "medical necessity," provide documentation from your physician explaining why the treatment is medically necessary.

Attach Supporting Evidence: Gather all relevant documentation to bolster your appeal. This might include medical records, physician letters, test results, or other pertinent information. Organize your evidence logically and clearly label each document for easy review. This streamlined presentation adds weight to your appeal.

Understanding Timelines and Following Up

Timelines are crucial in the appeals process. Most insurance companies have a specific timeframe (often 30 days) for filing appeals. Missing the deadline could jeopardize your appeal. Track all deadlines carefully and submit your appeal promptly. After submission, regularly follow up with the insurance company to check on the status and provide any requested information. Persistence is essential, as appeals can be time-consuming. Regular communication keeps your case active and demonstrates your commitment.

Additional Strategies for Success

Leverage Your Physician's Support: A strong letter of support from your doctor can significantly impact the outcome. Ask your physician to clearly articulate the medical necessity of the treatment and its relevance to your overall health.

Identify Weaknesses in the Denial Letter: Scrutinize the denial letter for inconsistencies, errors, or vague language. These can be used to your advantage in the appeal.

Organize and Track Your Progress: Develop a system for organizing your appeal documents and tracking communication with the insurance company. This ensures easy access to information and helps you stay organized.

Maintain Momentum: The appeals process can be challenging. Stay focused on your goal and the potential benefits of a successful outcome to maintain motivation.

By following these steps and employing these strategies, you will be prepared to navigate the insurance appeals process and improve your chances of obtaining the necessary coverage. Appealing a denial can be difficult, but it's often essential for receiving important healthcare services.

Winning Tactics That Turn Denials Into Approvals

Successfully appealing an insurance denial often requires a strategic approach. While a doctor's diagnosis is essential, understanding the appeals process, the mindset of insurance reviewers, and persuasive communication can significantly improve your chances of a successful outcome. This section explores proven tactics to help turn denials into approvals. For veterans navigating the VA system, a similar strategic approach applies when they choose to appeal a VA decision.

Deconstructing the Denial Letter

The first step toward a successful appeal is a thorough analysis of the denial letter. This goes beyond simply understanding the stated reason. It involves dissecting the language used, identifying inconsistencies or vague justifications, and pinpointing weaknesses in the insurer's argument.

For example, a denial based on “lack of medical necessity” without specific examples or supporting evidence offers a strong basis for your counter-argument. This detailed analysis allows you to craft a targeted response addressing the insurer's concerns with compelling evidence.

The Power of Partnership: Engaging Your Healthcare Provider

Your healthcare provider is a crucial ally in the appeals process. Their expertise and documentation are invaluable. A detailed letter from your doctor explaining the medical necessity of the treatment and its potential health impact strengthens your appeal.

Your provider can also offer insights into the insurer's reasoning and suggest specific documentation to bolster your case. This collaboration ensures a strong medical perspective and provides a powerful counterpoint to the insurance company's assessment.

Escalation and External Review: Knowing Your Options

Understanding the insurance company's appeals levels and external review options is vital. If your initial appeal fails, don't be discouraged. Most insurers offer multiple internal review levels, including peer-to-peer reviews. These reviews allow your physician to speak directly with a medical professional at the insurance company.

If internal appeals are exhausted, explore external review options through your state's insurance department. Knowing your options empowers you to pursue every avenue for overturning the denial.

Mastering the Art of Persuasion

A successful appeal requires a compelling narrative. Present your case clearly and concisely, using language that resonates with reviewers. Focus on the human impact of the denial, explaining how it affects your daily life and ability to function.

Remember, insurance reviewers are individuals. While bound by guidelines, they can be persuaded by well-reasoned arguments and compelling stories. This humanizes your case, encouraging reviewers to see the individual behind the claim.

Strategic Documentation: Evidence That Speaks Volumes

The documentation you include significantly impacts your appeal’s success. Gather all relevant medical records, test results, and physician statements supporting your claim. Organize the information logically for easy review.

Clear, concise, and well-organized evidence increases your appeal’s credibility. Consider including supporting literature or research that validates the treatment's medical necessity. This strengthens your argument and demonstrates the validity of your claim.

To help you strategize your appeals, the following table outlines effective approaches based on common denial types:

Appeal Success Strategies by Denial Type

Action plans and success rates for different types of insurance denials to optimize your appeal approach

Denial Type | Primary Strategy | Required Documentation | Average Success Rate |

|---|---|---|---|

Lack of Medical Necessity | Demonstrate the treatment's direct impact on improving your specific health condition. | Physician's statement detailing the medical necessity, supporting research studies, and documentation of your condition's impact on your daily life. | 50-70% |

Experimental or Investigational Treatment | Prove the treatment is established and accepted within the medical community for your condition. | Published research articles, clinical trial results, and expert opinions supporting the treatment's efficacy. | 30-50% |

Pre-existing Condition | Show that the current condition is separate from the pre-existing condition or that the treatment is necessary despite the pre-existing condition. | Medical records documenting the distinct nature of the current condition, physician's statement clarifying the treatment's necessity, and relevant diagnostic test results. | 40-60% |

Non-Covered Service | Argue that the service is medically necessary and essential for your health and well-being. | Physician's statement emphasizing the medical necessity, documentation of alternative treatments tried and failed, and evidence supporting the denied service's effectiveness. | 20-40% |

This table provides a general overview, and individual success rates can vary. The key takeaway is to tailor your approach and documentation based on the specific denial reason.

When To Bring In The Professionals Who Win Appeals

Appealing a denied insurance claim can be a daunting process. While self-advocacy is important, sometimes professional help can significantly increase your chances of a successful appeal and reduce your stress. This section explores the key indicators that it might be time to seek expert assistance.

Recognizing Your Need for Reinforcements

Even the most carefully crafted appeals can be denied. If you've already gone through all the internal appeal levels within the insurance company without a resolution, it’s a strong sign that you should consider getting professional help. Also, if the denial involves a complex medical condition or a large sum of money, the potential consequences are greater, making expert guidance essential.

Consider seeking professional help if the denial letter is confusing or uses a lot of technical terms. This can make it hard to understand the reasons behind the denial, and an expert can help clarify the situation and build a more compelling case. Finally, your personal situation, like a serious illness or significant stress, can make it difficult to effectively advocate for yourself. In these cases, a professional can take on some of the burden and allow you to focus on your health and well-being.

Weighing the Costs and Benefits of Professional Help

Hiring professionals, such as patient advocates or attorneys, does involve costs. However, the potential benefits can significantly outweigh the expenses. A successful appeal can provide access to essential medical treatments, potentially preventing further health problems and saving you money in the long run.

For example, a patient advocate specializing in insurance denials may charge a fee. However, their expertise could result in thousands of dollars in approved treatments. This potential return on investment makes professional assistance a valuable option, especially for expensive procedures or long-term care.

Different Types of Advocates: Navigating Your Options

There are different types of professionals who can help with insurance denials. Patient advocates, also known as insurance navigators, can guide you through the appeals process, help organize your medical records, and effectively communicate with the insurance company.

Healthcare attorneys offer legal expertise, which can be especially important for complicated cases or when legal action is required. Non-profit organizations, such as the Patient Advocate Foundation, also offer valuable resources and support for patients dealing with denials and appeals. Understanding these options lets you choose the best support for your individual circumstances.

Preparing for External Reviews and Legal Challenges

Professional help is extremely valuable when preparing for external reviews conducted by independent medical examiners or state insurance departments. Advocates and attorneys are familiar with how to best present your case, making sure all required documentation is included and presented persuasively.

They can also help you manage potential legal issues, protecting your rights and ensuring a fair process. This expert preparation significantly improves your chances of success during these important stages of the appeal.

Maintaining Your Well-being During the Appeals Process

The appeals process can be lengthy and stressful. While professionals handle the details of your case, focus on taking care of yourself. Prioritize a healthy lifestyle as much as possible.

Consider joining support groups or seeking counseling to manage stress. Don’t forget the importance of continuing your medical care during the appeal. Your advocate can help you explore options for temporary insurance coverage or financial assistance programs to ensure you receive the necessary medical care throughout the appeals process. By protecting your physical and emotional health, you'll be better prepared to manage the challenges of the appeals process.

Key Takeaways

Your journey to a successful insurance appeal begins now. This section distills the essential steps into actionable takeaways, providing a roadmap for navigating the process and achieving the best possible outcome.

Organize and Strategize

Before appealing, thoroughly understand the reason for the denial. Is it medical necessity, a coding error, or something else entirely? This knowledge is crucial for tailoring your response and building a strong case.

Gathering all relevant documentation is your next step. Compile medical records, physician letters, test results, and policy details. Organize these materials logically. A well-organized case demonstrates preparedness and strengthens your argument.

Finally, pay close attention to deadlines. Insurance companies have strict timelines for appeals, typically 30 days. Missing a deadline can severely impact your chances of a successful appeal.

Craft a Powerful Appeal

Write a clear and concise appeal letter explaining the denial's impact on your health and well-being. Avoid medical jargon and focus on the human element of your situation. A personal touch can make a difference.

Enlist your doctor's support. A strong letter from your physician detailing the medical necessity of the treatment adds significant weight to your appeal. This professional backing can be invaluable.

Carefully review the denial letter. Scrutinize it for inconsistencies or vague language. Pointing these out can weaken the insurer's argument and strengthen your own.

Seek Support and Stay Persistent

Familiarize yourself with your rights and the different levels of appeal available. This includes internal reviews and external options through your state's insurance department. Knowing your options is empowering.

If the process becomes overwhelming or involves a complex medical condition, consider seeking assistance from a patient advocate or a healthcare attorney. Professional guidance can be especially helpful in challenging situations.

Appealing an insurance denial can be stressful. Prioritize your well-being throughout the process. Maintain a healthy lifestyle, seek emotional support if needed, and, importantly, continue your medical care.

Ready to secure the coverage you deserve? Visit America First Financial for affordable, reliable insurance options that prioritize your family’s well-being and financial stability. Get a free quote in under three minutes and discover the difference of insurance that aligns with your values.

_edited.png)

Comments