Asset Protection Insurance Tips to Safeguard Your Assets

- dustinjohnson5

- May 13, 2025

- 12 min read

The Real-World Impact of Asset Protection Insurance

Asset protection insurance isn't just about safeguarding your belongings. It's a crucial safety net for your financial future. This type of insurance helps individuals and families mitigate the risks associated with potential liabilities and unforeseen events. It protects hard-earned assets, such as your home, savings, and investments, from being used to satisfy debts or judgments. Understanding how this protection works in real-world scenarios is vital for making informed financial decisions.

Understanding Asset Protection in Practice

Imagine being involved in a car accident where you're found liable for damages exceeding your standard auto insurance coverage. Without asset protection insurance, your personal assets could be at risk. With the right coverage, however, a significant portion of your assets can be shielded from creditors.

Umbrella insurance, for example, extends liability coverage beyond the limits of your auto or homeowners insurance. This provides an extra layer of protection, particularly important for individuals with substantial assets.

Asset protection insurance is also crucial for protecting business interests. Lawsuits and unforeseen events can threaten a company’s stability and put its assets at risk. Asset protection insurance can mitigate these risks, acting as a buffer against potential financial losses. This allows businesses to operate with more confidence, knowing their assets are protected.

The Growing Importance of Specialized Coverage

Asset protection insurance comes in various forms, each designed for specific risks. Guaranteed Asset Protection (GAP) insurance, for example, covers the difference between a vehicle's actual cash value and the outstanding loan balance. This is especially useful if a vehicle is totaled or stolen soon after purchase. If your car is totaled, and the insurance payout is less than the loan balance, GAP insurance covers the difference.

The global GAP insurance market is expected to grow, with a projected compound annual growth rate (CAGR) for 2025 to 2033. This growth is driven by increasing vehicle purchases and financial concerns. GAP insurance has historically been more common in vehicle financing markets like the US and the UK, with adoption increasing in other regions. Explore this topic further: Learn more about GAP Insurance market growth.

Building a Secure Financial Foundation

Asset protection insurance is more than just reacting to potential threats. It’s a proactive strategy for building a secure financial future. By protecting your assets, you safeguard your financial stability and create a foundation for long-term growth. This enables you to pursue investment opportunities with greater confidence, knowing your assets are protected. Ultimately, asset protection insurance provides peace of mind, allowing you to focus on your financial goals without constantly worrying about potential losses.

Navigating the Asset Protection Insurance Landscape

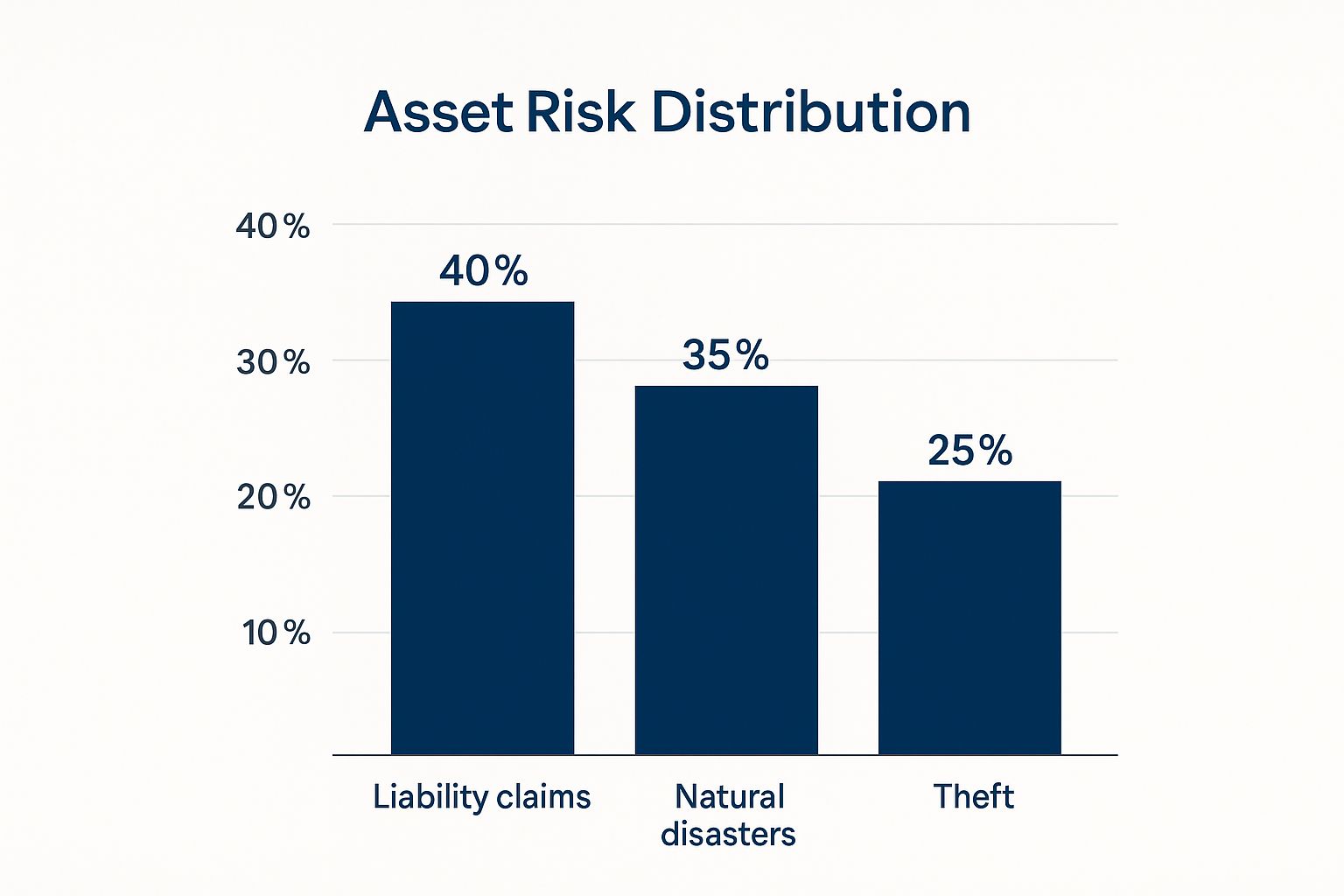

The infographic above illustrates the distribution of asset risks, categorized by liability claims, natural disasters, and theft. Liability claims represent the largest risk at 40%, followed by natural disasters at 35%, and then theft at 25%. This data underscores the need to consider a variety of potential threats when planning an effective asset protection strategy.

Beyond Basic Insurance: Specialized Protection

Standard homeowners or auto insurance policies offer essential protection, but often fall short of addressing specific vulnerabilities. Asset protection insurance provides specialized coverage tailored to these unique risks. For instance, Guaranteed Asset Protection (GAP) insurance safeguards car owners from financial loss if their vehicle is totaled or stolen. It covers the difference ("gap") between the insurance payout and the outstanding loan balance, which is particularly helpful due to rapid vehicle depreciation.

Creditor protection insurance, another specialized type of coverage, shields assets from seizure in lawsuits or bankruptcy proceedings. This is especially valuable for business owners and high-net-worth individuals looking to protect their wealth. Valuable possessions like jewelry, art, or collectibles often require separate high-value asset coverage. This type of policy frequently uses agreed-upon values to guarantee adequate compensation in case of loss or damage.

Layering Protection Strategies for Comprehensive Security

Building a robust asset protection plan involves carefully evaluating your financial situation and risk tolerance to determine the appropriate combination of insurance products. Combining multiple strategies creates a comprehensive safety net, but it's crucial to avoid redundant coverage. Umbrella insurance, for example, offers broad liability protection. Pairing it with targeted high-value asset coverage provides comprehensive protection without unnecessary overlap. Think of it as building a house: basic insurance forms the foundation, while specialized coverage acts as the walls, roof, and other essential components.

To illustrate the differences and benefits of various asset protection insurance types, the table below provides a helpful comparison.

Introduction to the Table: The following table outlines several key asset protection insurance types, offering a quick reference for comparing coverage, cost, and best-use scenarios.

Insurance Type | Primary Coverage | Typical Cost Range | Best For | Notable Limitations |

|---|---|---|---|---|

Homeowners Insurance | Damage to home and belongings from covered perils (fire, theft, etc.) | $500 - $2,000 per year | Homeowners | Specific limits on certain items (jewelry, art); may not cover flood or earthquake |

Auto Insurance | Liability and damage related to auto accidents | $500 - $1,500 per year | Vehicle owners | Coverage limits may not be sufficient for serious accidents |

Umbrella Insurance | Liability coverage beyond underlying policies | $100 - $500 per year | Individuals with significant assets | Requires underlying liability coverage |

GAP Insurance | Difference between auto loan balance and insurance payout after total loss | $20 - $50 per year | Car owners with loans | Only covers the loan balance, not the full vehicle replacement value |

High-Value Asset Insurance | Agreed-value coverage for specific items (jewelry, art, etc.) | Varies based on item value | Owners of valuable items | Requires appraisal and specific documentation |

Creditor Protection Insurance | Protection of assets from seizure in lawsuits or bankruptcy | Varies based on coverage amount | Business owners, high-net-worth individuals | May have exclusions for certain types of debts or legal actions |

Key Insights from the Table: As the table demonstrates, each insurance type plays a distinct role in asset protection. Understanding these distinctions allows for a more tailored and effective strategy.

Identifying and Addressing Coverage Gaps

Understanding the limitations of each policy is vital to prevent potential gaps in coverage. Some policies exclude certain types of losses or have specific requirements for filing claims. Thoroughly reviewing policy details and seeking professional advice can help identify and address potential vulnerabilities. Many successful investors consult with financial advisors to align their insurance strategy with their overall wealth preservation plan. Proactively addressing coverage gaps strengthens financial security and contributes to a more robust financial future.

GAP Insurance: Your Defense Against Depreciation

Financing a vehicle often necessitates a specific kind of asset protection. This is where Guaranteed Asset Protection (GAP) insurance becomes essential. GAP insurance protects you from the depreciation that occurs as soon as you drive a new car off the dealer's lot. This section explores how GAP insurance can potentially save you thousands after an accident or theft.

Bridging the Gap Between Loan and Value

A car's value depreciates quickly, particularly in the first few years of ownership. If your car is totaled or stolen, your standard auto insurance policy will typically pay only the current market value. This amount can be substantially less than what you still owe on your auto loan. GAP insurance covers this difference – the "gap." For example, if your loan balance is $20,000, but the insurance payout is $15,000, GAP insurance would cover the $5,000 difference.

Real-World Claim Scenarios: The Value of GAP Coverage

Over time, the difference between your loan balance and your vehicle's insured value can increase. This makes GAP insurance particularly valuable early in the loan term. Consider this scenario: you buy a new car and finance $30,000. A year later, the car is totaled. The market value has dropped to $25,000, but you still owe $28,000. Without GAP insurance, you would be responsible for the $3,000 difference, even though you no longer have a car.

Maximizing Value and Avoiding Coverage Pitfalls

GAP insurance offers the most value when the loan balance is high relative to the vehicle's market value. This is usually the case soon after purchase. As you pay down your loan, the gap, and the need for GAP insurance, may decrease.

When considering GAP insurance, compare options from both dealerships and independent insurance providers. Dealerships frequently offer GAP insurance when you purchase a vehicle, but their prices might be higher. Independent insurance companies may offer more competitive rates. Compare coverage details and restrictions. Some policies have exclusions or limitations that could affect your coverage. Negotiating terms and carefully reviewing policy details can help you save money while ensuring sufficient protection. Ask questions and compare policies to find the best option for your individual needs. Understanding these nuances will help you maximize the value of your GAP coverage.

Building a Financial Fortress With Asset Protection

Asset protection insurance isn't just a safety net; it's a crucial element of a comprehensive wealth management strategy. It's about proactively safeguarding your assets, allowing you to pursue growth opportunities with greater confidence. This section explores how strategic asset protection can fortify your financial future.

Integrating Protection With Growth

Think of asset protection insurance as the bedrock of your financial well-being. By securing your existing wealth, you create a solid foundation for pursuing higher-return investments. For instance, with adequate protection, you might be more inclined to allocate a greater percentage of your portfolio to growth stocks or explore potentially lucrative real estate ventures. Understanding how depreciation impacts your assets is also key, and Guaranteed Asset Protection (GAP) insurance can help bridge the gap. A deeper understanding of this concept can be found here: Understanding Depreciation in New Zealand.

Layering for Multi-Dimensional Security

Savvy investors frequently employ a combination of asset protection tools to create a multi-layered security approach. This involves strategically combining different types of insurance with robust legal structures. Umbrella insurance, for example, provides broad liability coverage, while establishing a trust can shield assets from creditors. Used together, these create a formidable defense against a range of potential threats.

Tax Optimization and ROI

Effective asset protection planning also considers tax implications. Certain insurance products and legal structures offer tax advantages, which can significantly enhance your overall returns. When evaluating these strategies, calculating the true return on investment (ROI) is paramount. This means looking beyond just the premiums paid and factoring in potential tax benefits and the long-term value of protecting your wealth.

The insurance industry, including the asset protection sector, is expected to experience continued growth. By 2025, the global insurance industry's return on equity (ROE) is projected to reach 10.7%, up from an estimated 10% in 2024. This growth is attributed to factors like higher investment yields and rising premiums driven by inflation and supply chain challenges. Deloitte Insights - Insurance Industry Outlook provides further detail on these market trends. While GAP insurance is a niche segment, it benefits from these broader industry advancements, including digital tools and a focus on risk management, both of which contribute to competitive pricing and comprehensive coverage.

Adapting to Life Stages and Market Shifts

Your asset protection needs will inevitably change over time. As your financial situation evolves, your family structure changes, and market conditions fluctuate, so too should your protection strategy. Regularly reviewing your coverage and consulting with a financial advisor can help ensure you maintain optimal protection without incurring unnecessary expenses. This proactive approach allows you to navigate life's transitions and market volatility while maintaining a strong financial position. By anticipating potential risks and adapting to new realities, you can build a secure and prosperous future.

The Future of Asset Protection: Trends Reshaping Coverage

The asset protection insurance landscape is in constant flux, influenced by emerging technologies and shifting risk profiles. Keeping up with these changes is essential for safeguarding your financial well-being. Understanding these shifts empowers you to make informed decisions about protecting your valuable assets. Let's delve into some key trends shaping the future of asset protection insurance.

The Power of Predictive Analytics

Insurers are increasingly leveraging predictive analytics to assess risk with greater accuracy. This involves examining large datasets to identify trends and forecast future events. This enables more personalized pricing and customized coverage options. Instead of depending solely on general demographic information, insurers can now factor in individual behaviors and characteristics.

This can translate into lower premiums for individuals deemed lower risk. This shift towards personalized risk assessment holds significant potential for cost savings for policyholders.

Digital Platforms and Enhanced Flexibility

Digital platforms are revolutionizing how we interact with insurance providers. Online portals and mobile applications are simplifying policy management, claims filing, and information access. This improved accessibility enhances coverage flexibility.

Some insurers are introducing on-demand or usage-based insurance, empowering policyholders to tailor coverage to their immediate requirements. This move towards digital platforms streamlines the entire insurance process, making it more efficient and user-friendly.

Global Market Trends and Data-Driven Underwriting

The asset protection insurance sector is also aligning with broader industry movements. The emphasis on data-driven underwriting and risk management is a prime example. In the first quarter of 2025, the global insurance market showcased resilience amidst geopolitical uncertainties, with significant investment in data analysis tools. You can find a detailed overview in the Global Insurance Market Overview Q1 2025.

This data-centric approach enables insurers to fine-tune risk assessment and adapt to emerging trends. This has a direct impact on asset protection insurance, as insurers strive to optimize their offerings based on evolving risk profiles, particularly in volatile regions. Advanced data analytics empowers insurers to better assess and manage risk, ultimately enhancing value for policyholders.

Emerging Protection Products and Digital Assets

The nature of assets and ownership structures is changing rapidly. This has spurred the development of innovative insurance products designed to protect previously uninsurable assets. For example, with the rise of digital assets like cryptocurrency, specialized insurance products are emerging to safeguard against theft or loss.

As you build your digital presence, strong security measures are essential. Explore website security best practices to protect yourself against evolving cyber threats. This evolution in coverage is crucial for staying ahead of the curve in the dynamic landscape of asset ownership.

The following table provides a concise overview of some emerging trends:

Emerging Trends in Asset Protection Insurance

Analysis of key trends affecting the asset protection insurance market, including adoption rates and potential impact on consumers

Trend | Current Adoption Rate | Potential Impact | Timeline for Mainstream Adoption |

|---|---|---|---|

Predictive Analytics | Increasing steadily | More personalized pricing and coverage | Next 3-5 years |

Digital Platforms | High and rapidly growing | Enhanced accessibility and flexibility | Already mainstream |

Data-Driven Underwriting | Growing rapidly | More accurate risk assessment | Next 2-3 years |

Specialized Products for Digital Assets | Emerging | Protection for new asset classes | Next 5-7 years |

This table highlights the varying stages of adoption and potential influence of these trends on the asset protection insurance market. While some, like digital platforms, are already widespread, others, such as specialized products for digital assets, are still in their nascent stages. Understanding these timelines helps individuals and businesses prepare for the future of asset protection.

Navigating Economic Volatility

Economic conditions significantly influence insurance availability and pricing. During periods of market instability, premiums may rise, and coverage choices may become more restricted. Understanding how economic shifts affect your asset protection strategy is crucial.

By keeping informed about economic developments and consulting with a financial advisor, you can better protect your assets, irrespective of market fluctuations. This proactive approach ensures your assets remain secure even during uncertain economic times.

Crafting Your Perfect Asset Protection Strategy

Protecting your assets isn't simply about having insurance; it's about developing a comprehensive plan. This involves a thorough understanding of your financial situation, potential risks, and the strategies available to mitigate those risks. It means going beyond a generic sales pitch and creating a truly personalized approach. This section provides a practical framework for building your own robust asset protection strategy.

Assessing Your Risk Exposure

Before selecting any insurance policy, you need to accurately assess your risk exposure. This goes beyond simply creating an inventory of your assets. It requires careful consideration of potential liabilities. Ask yourself some critical questions: What's the likelihood of being sued? What are the potential costs associated with a lawsuit? What specific risks are associated with your profession or lifestyle? For example, a doctor faces different liability risks than a teacher, and a business owner has different concerns than an employee.

Decoding Policy Language and Identifying Gaps

Insurance policies can be notoriously complex. Understanding the fine print is absolutely essential. Pay close attention to clauses that exclude certain types of losses or stipulate conditions that could lead to claim denials. For example, some policies may exclude coverage for natural disasters or have specific requirements for documenting losses. Failing to grasp these crucial details can leave you vulnerable when you need coverage the most. Expert-developed evaluation frameworks, like those available from Policygenius, can be invaluable in navigating this complexity. These frameworks often provide structured checklists and key questions to consider when analyzing policy language.

Negotiating for Better Coverage

Don't hesitate to negotiate with insurance providers. Many people assume premiums are fixed, but that's often not the case. By being informed and assertive, you can often secure better coverage terms without paying higher premiums. For instance, you might be able to increase your liability limits or lower your deductible simply by asking. Also, consider bundling multiple policies with the same insurer, as this can often result in discounts.

Independent Advisors vs. Direct Insurers

Choosing the right approach to purchasing insurance can have a significant impact on both your coverage and cost. Working with an independent advisor offers several advantages. Advisors typically have access to multiple insurance companies, allowing them to compare policies and find the best fit for your individual needs. However, going directly to an insurer can sometimes be a more cost-effective option. The key is to understand the trade-offs associated with each approach and choose the one that best aligns with your priorities.

Coordinating Multiple Policies

Many individuals hold multiple insurance policies—homeowners, auto, umbrella, etc. Effectively coordinating these policies is crucial to avoid overlaps and gaps in coverage. Overlapping coverage means you're paying for protection you don't need, while gaps leave you vulnerable to specific losses. Imagine having two health insurance policies that cover the same medical expenses—this is an unnecessary cost. Conversely, a gap in your car insurance could leave you financially responsible for significant damages.

Implementation Timelines and Cost-Saving Strategies

Building an effective asset protection strategy takes time. Develop a realistic implementation timeline based on your financial resources and your individual risk tolerance. Prioritize acquiring essential coverage first, and then gradually add additional layers of protection as your budget allows. Also, explore potential cost-saving strategies such as increasing deductibles, bundling policies, and taking advantage of discounts for safety features or a good driving record. These strategies can help you optimize your insurance spending without compromising your overall protection.

Ready to secure your financial future with comprehensive asset protection? Visit America First Financial today for a free quote and personalized guidance. Don't leave your assets vulnerable—take control of your financial security now.

_edited.png)

Comments