Best Life Insurance for Over 50 a Complete Guide

- dustinjohnson5

- Oct 25, 2025

- 18 min read

For a lot of folks, the best life insurance for over 50 is a term policy that’s just big enough to cover the mortgage or a smaller whole life policy meant to handle funeral costs. But there's no single "best" option—the right choice for you will come down to your personal financial goals, your health, and what fits your budget.

Why Getting Life Insurance After 50 Is a Smart Move

Hitting the half-century mark often brings a new perspective on financial planning. With retirement on the horizon and family needs changing, it's natural to think more seriously about the legacy you'll leave behind. If you're wondering whether you've missed the boat on getting life insurance, the answer is a resounding no.

In fact, buying life insurance after 50 is a common and incredibly strategic decision. It’s a clear-eyed acknowledgment that financial responsibilities don't just disappear as we get older. This shift in thinking is backed up by ownership trends. Recent data shows that among Baby Boomers (aged 60–78), 57% have life insurance—the highest rate of any generation. For comparison, that number is 55% for Gen X and 50% for Millennials, showing how its importance really clicks into place with age. You can find more insights on life insurance ownership statistics to see how you compare.

What Drives the Need for Coverage After 50

At this stage of life, insurance isn't some vague safety net; it's a specific tool for solving specific financial problems. The reasons for getting a policy are often much more focused and practical than they were back in your 30s or 40s.

Instead of trying to replace decades of lost income, the goal now is often about protecting everything you’ve worked so hard to build. The right policy acts as a critical buffer, making sure your loved ones aren't saddled with unexpected financial burdens during an already painful time.

Think of it this way: your life's work—your home, your savings, your family's stability—is an asset worth protecting. Life insurance is the final piece of the puzzle that secures that legacy, no matter what happens.

Common Financial Goals This Coverage Achieves

For most people looking into life insurance over 50, the decision is tied to clear, tangible goals. Pinpointing these objectives is the first step toward finding a policy that truly fits.

To help clarify, here is a breakdown of the most common reasons people in this age group secure coverage.

Key Reasons for Life Insurance After 50

Financial Goal | How Life Insurance Helps | Primary Policy Type |

|---|---|---|

Paying Off Debts | Covers a remaining mortgage, car loan, or credit card balances so they don't pass to your spouse. | Term Life |

Covering Final Expenses | Provides a dedicated payout for funeral, burial, and other end-of-life costs, which can be surprisingly high. | Final Expense (Whole Life) |

Leaving an Inheritance | Delivers a tax-free lump sum to children or grandchildren for a home down payment, college, or financial security. | Whole Life or Universal Life |

Equalizing Inheritances | If a business or property goes to one heir, a policy can provide an equivalent cash benefit to others to keep things fair. | Term or Whole Life |

Understanding these specific applications shows that life insurance after 50 isn't just about what-ifs; it's a powerful tool for ensuring the financial promises you've made are kept.

Term vs. Permanent: A Homeowner's Guide to Life Insurance

Trying to choose between the different types of life insurance can feel a bit like navigating the real estate market. It's confusing at first, but once you understand the core difference, everything clicks into place. The two main options, term and permanent, are a lot like renting versus buying a home.

Think of term life insurance as your rental agreement. You pay for coverage over a specific, set period—your "lease term," which might be 10, 20, or 30 years. It’s straightforward, budget-friendly, and perfect for covering needs that have a clear expiration date.

On the flip side, permanent life insurance is like buying a house. The upfront cost is higher, but it’s an asset that's yours for life. And just like a house builds equity, a permanent policy builds cash value—a living benefit you can actually tap into down the road.

What Is Term Life Insurance?

For most people, term life is the most affordable way to secure a large amount of coverage. If you're over 50, its main job is to cover debts that won't be around forever. Maybe you have 15 years left on your mortgage, or you want to ensure your spouse is covered until they can start collecting full Social Security benefits.

The idea is simple. You pay a fixed premium for the entire term. If you pass away during that window, your family receives a tax-free payout. If you outlive the policy, it just expires. No muss, no fuss.

You won't find any complicated bells and whistles here, like investment accounts or cash value. That very simplicity is what makes it so powerful. It’s pure protection, making it the best life insurance for over 50 when your goal is to cover specific, time-sensitive financial responsibilities.

Getting to Know Permanent Life Insurance

Just as the name suggests, permanent life insurance is designed to cover you for your entire life. As long as you keep paying the premiums, it guarantees a death benefit will be paid out, no matter when you pass away. It's not just a safety net; it's a financial tool.

A portion of every premium you pay gets funneled into a cash value account, which grows over time on a tax-deferred basis. This feature opens up possibilities that term life simply can't offer. You can take out a loan against it, use it to cover your premiums, or even cash out the policy if your financial situation changes.

You’ll generally run into two major types of permanent coverage:

Whole Life Insurance: This is the classic, most traditional option. Everything is locked in from day one—the premium, the death benefit, and the rate at which your cash value grows. It’s incredibly predictable, which makes it a great fit for things like covering final expenses or leaving a guaranteed inheritance for your kids.

Universal Life Insurance: This version introduces more flexibility. You often have the freedom to adjust your premium payments or the death benefit amount as your life changes. The cash value growth is typically tied to current interest rates, which means it has the potential for higher returns, but it comes with less predictability than whole life.

At its core, the difference is about purpose. Term life is for the "what if" scenarios that exist for a set number of years. Permanent life is for the "when," providing a benefit that is certain to pay out eventually.

Making the Right Choice After 50

So, how do you know which path to take? It really boils down to your personal goals. Deciding whether to "rent" or "buy" your coverage depends entirely on the financial job you're hiring that policy to do.

Sometimes seeing the two options side-by-side makes the decision much clearer.

Term vs. Whole Life Insurance at a Glance

This table breaks down the fundamental differences between the two most common choices for those over 50.

Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

Duration | Lasts for a specific term (e.g., 10, 20, 30 years). | Lasts for your entire lifetime. |

Cost | Significantly lower premiums for the same coverage amount. | Higher premiums due to lifelong coverage and cash value. |

Cash Value | No cash value component; it's pure insurance protection. | Builds a tax-deferred cash value you can borrow against. |

Primary Goal | Covering temporary needs like a mortgage or income replacement. | Covering permanent needs like final expenses or leaving a legacy. |

Flexibility | Very little; the policy is set for the term. | More flexible, with options to access cash value. |

In the end, many people over 50 find that a hybrid approach makes the most sense. You could use an affordable term policy to cover the last decade of your mortgage payments while a smaller whole life policy stands ready to handle final expenses.

By using the right tool for each specific job, you can build a solid, secure financial plan that truly protects your family’s future.

How Insurance Companies See You After 50

When you apply for life insurance, especially once you've hit 50, you're not just filling out a form. You’re handing an underwriter a snapshot of your life, and their job is to figure out the risk involved. It’s a lot like applying for a loan—the bank looks at your financial history to guess how you'll handle payments. In the same way, an insurer looks at your health and lifestyle to estimate how long you’re likely to live.

This whole process is called underwriting, and it's the engine that drives life insurance pricing. The underwriter's goal is to determine the odds of you passing away while the policy is active. If they see you as a low risk, you get a lower premium. If they see you as a higher risk, you’ll pay more for the same coverage. It's that simple.

So, What About That Medical Exam?

Let's be honest, the medical exam is what makes most people nervous. It can feel a bit invasive, but knowing what they're looking for helps take the mystery out of it. Think of the exam as the insurance company’s way of getting an objective, nuts-and-bolts look at your current health.

A paramedic will usually pop by to check a few key things:

Your height and weight, which they use to calculate your Body Mass Index (BMI).

Your blood pressure and pulse, giving them a quick read on your cardiovascular health.

A blood sample to check things like cholesterol, blood sugar (glucose), and to see if you're a smoker or use drugs.

A urine sample to screen for similar indicators and check on your kidney function.

This data, along with your application answers and doctor's records, helps the underwriter assign you to a specific risk category.

Finding Your Place: The Health Classification System

Once the underwriting is complete, you'll be assigned a health classification. These ratings are the single biggest factor in determining what you'll pay. The names might change a little from company to company, but the basic structure is pretty standard across the board.

Here’s a breakdown of what they look like, from best to worst:

Preferred Plus/Elite: The gold standard. This is for people in truly excellent health with a squeaky-clean family medical history. You’re the A+ student of the insurance world.

Preferred: You're still in great shape, but maybe your cholesterol is a little high, or there's a minor blip in your family’s health history.

Standard Plus: This is for folks in good health who might have a minor, well-managed condition like high blood pressure that’s under control with medication.

Standard: This is the baseline for the average American. You might be carrying a few extra pounds or have a couple of health issues, but nothing that rings major alarm bells.

Substandard/Table Ratings: If you’re dealing with more significant health challenges, like a history of heart disease or diabetes that isn't well-controlled, you'll likely land here. These ratings come with higher premiums.

The cost difference between these tiers isn't trivial. For example, a 60-year-old man looking for a $250,000, 20-year term policy might pay around $150 per month with a Preferred Plus rating. With a Standard rating, that same policy could easily jump to $250 or more.

Can You Just Skip the Exam?

The medical exam is a real stumbling block for many. In fact, some research shows that 50% of Americans are put off from buying life insurance just because they don't want to go through an exam. This is especially true for older applicants. Insurers get this, so they’ve come up with no-exam policies to make things easier. You can discover more about insurance consumer trends and see how companies are shifting to meet these demands.

Of course, there’s a trade-off. You get convenience, but you’ll almost always pay a higher premium for it. The company is taking on a bit more risk without that medical data, and they price the policy accordingly.

You'll generally find two types of no-exam policies:

Simplified Issue: With this option, you skip the physical exam but still have to answer a pretty thorough health questionnaire. The big win here is speed—you can get approved in days, not weeks. It’s a solid choice if you're in decent health and just want to avoid the hassle of an exam.

Guaranteed Issue: This is the easiest policy to qualify for, period. No medical exam, and no health questions asked. If you’re in the right age bracket (usually 50-85), you’re in. The catch? These policies have much higher costs, offer lower coverage amounts (often capped at $25,000), and include something called a graded death benefit.

A graded death benefit is a critical detail to understand with Guaranteed Issue policies. It means that if you pass away from natural causes within the first two years of the policy, your family won't get the full payout. Instead, they'll receive a refund of the premiums you paid, plus a little interest. Once you're past that two-year mark, the full death benefit is paid.

Ultimately, deciding between a fully underwritten policy and a no-exam option comes down to a personal calculation. You have to weigh your health, your budget, and how much you value convenience.

The Levers That Control Your Life Insurance Premium

Ever wonder why you and your neighbor, both 55, could get wildly different quotes for the same life insurance policy? It's not random. Insurers use a specific set of factors—think of them as pricing levers—to figure out how much you’ll pay. Getting a handle on these levers is the secret to finding great coverage that doesn't break the bank.

It’s a bit like buying a car. You have the big-ticket items that set the baseline price: the model (your policy type), the engine size (your coverage amount), and the warranty (your term length). But after that, a whole host of smaller details come into play, each nudging the final cost up or down.

When you know how these levers work, you're in the driver's seat. You can make smart choices to design a policy that gives you maximum protection for a price you can actually afford.

The Core Pricing Components

Three main decisions you'll make have the biggest impact on your monthly premium. Get these right, and you're well on your way.

Policy Type: As we've seen, term life is always going to be cheaper than a permanent policy for the same payout. Why? Because it only covers you for a set period. Choosing term over whole life is probably the single most powerful lever you can pull to lower your cost.

Coverage Amount (Death Benefit): This one's straightforward. It's the check your family gets. The relationship is direct—a $500,000 policy will cost about twice as much as a $250,000 policy, assuming everything else is the same.

Term Length: For term policies, how long you want the coverage to last matters. A 10-year term is much cheaper than a 20-year term because the insurance company is on the hook for a much shorter window of time.

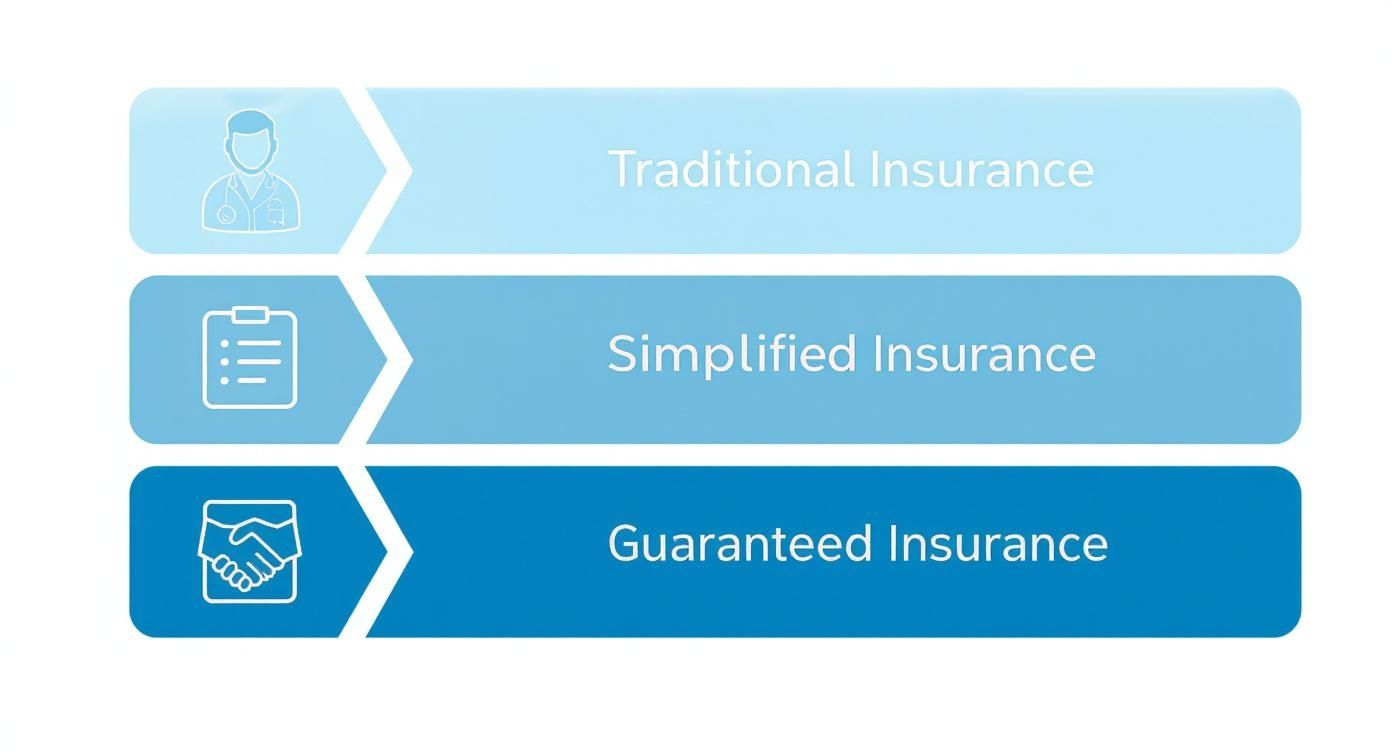

This infographic breaks down the different routes you can take, from a fully underwritten policy to simpler, no-exam options, all of which affect the price tag.

As you can see, the easier it is to get approved (moving from traditional to guaranteed issue), the more you'll pay for the same amount of coverage. That’s the trade-off for the insurer taking on more unknown risk.

Personal Factors That Fine-Tune Your Rate

Once the basic structure of your policy is set, the insurance company gets personal. They dig into your individual profile to get a clearer picture of their risk. This is where the details of your life come into sharp focus.

Your age and gender are the starting blocks. There’s no getting around them. Premiums creep up with every birthday, which is a big reason why it pays to lock in a rate sooner rather than later. And since women statistically live longer than men, they usually get a better deal. For instance, a 55-year-old woman might pay $42 per month for a $250,000 policy, while a man of the same age could be looking at $62.

Of course, your health history is the main event. The health class they assign you—from Preferred Plus for the super healthy down to Substandard—is the most powerful personal lever there is. Even if you have a health condition, showing that it's well-managed can make a huge difference in your rate.

Your premium is a reflection of risk. Every piece of information you provide helps the insurer calculate that risk with greater precision. A clean bill of health and a safe lifestyle signal lower risk, directly translating to lower costs for you.

Finally, your lifestyle choices have a seat at the table. Insurers are curious about your habits and hobbies, because some activities just come with more risk.

Tobacco Use: This is the big one. Smokers can expect to pay three to five times more than non-smokers. It's the single most impactful lifestyle choice you can make when it comes to life insurance costs.

Driving Record: A history of DUIs or a stack of speeding tickets tells an insurer you're a risk-taker, and your premiums will reflect that.

High-Risk Hobbies: Love to scuba dive, fly private planes, or scale mountains? The insurer sees that as an added risk, which could mean a higher rate or even specific exclusions in your policy.

By understanding how all these levers work together—from your policy type to your weekend hobbies—you take back control. You can start making strategic moves to find that sweet spot between rock-solid coverage and a price that fits your life.

How to Choose a Trustworthy Insurance Company

A life insurance policy is a promise, plain and simple. It's a company’s commitment to be there for your family, potentially decades down the road. That makes choosing the right insurer just as critical as picking the right policy. You need absolute confidence that the company is financially solid and has a proven track record of treating its customers right.

Think about it like this: you wouldn't put your life savings into a shaky, brand-new bank. The same principle applies here. You're handing over the responsibility for your family's financial future, so a little homework is non-negotiable.

Look for Financial Strength and Stability

First things first: you need an insurer with deep financial roots. The company you choose has to be able to weather any economic storm and pay out claims without fail. This is where independent rating agencies become your best friend.

These organizations are like the financial watchdogs of the insurance world. They dig into a company's books, investment strategies, and overall business health to assign it a letter grade. It’s a straightforward, objective way to see if an insurer has the financial muscle to keep its promises.

You’ll want to stick with companies that earn high marks from the major players:

A.M. Best: Look for a rating of A- or higher (which they classify as "Excellent").

Moody's: Aim for A3 or better.

S&P Global: Seek out an A- rating or higher.

Seeing these top-tier ratings is a powerful signal that the insurer is built to last and can be trusted to be there when your beneficiaries need them.

Evaluate Customer Service and Claim History

While rock-solid financials are the foundation, they aren't the whole picture. You also want to partner with a company that’s easy to deal with and handles claims with compassion and efficiency. A cheap premium means nothing if your family has to jump through hoops to get the payout they’re entitled to.

A great place to start is the company’s complaint index from the National Association of Insurance Commissioners (NAIC). The NAIC sets the national average complaint index at 1.00. A score below 1.00 is a good sign—it means the company gets fewer complaints than expected for its size. A score above 1.00 is a red flag, suggesting you might run into customer service headaches.

Choosing a carrier is a balance between financial strength and customer experience. A company with a top-tier A.M. Best rating and a low NAIC complaint score is the gold standard, indicating both stability and a commitment to policyholders.

Consider Modern Underwriting and Technology

The insurance industry isn't stuck in the past. As of 2025, the world's top life insurers include 15 companies headquartered in the United States, 17 in Europe, and 14 in the Asia-Pacific region. To compete, many are using new tools like artificial intelligence to make the application process quicker and more precise. For applicants over 50, this is a huge plus. AI can create a more nuanced risk assessment, which can lead to better rates and faster decisions. You can learn more about global insurance trends from S&P Global to see how the landscape is shifting.

As you compare your options, pay attention to which companies have embraced these changes. A smooth online quote tool, a digital application, and simplified underwriting options are all signs of a modern insurer focused on the customer. Finding the best life insurance for over 50 often means finding a carrier that blends old-school financial reliability with new-school convenience.

Your Game Plan for Getting Covered

Thinking about getting life insurance can feel like a huge, complicated task. But if you break it down into a few simple steps, it’s not so intimidating. Let’s walk through the process, one piece at a time, so you can move forward with confidence.

This isn't about getting it done fast; it's about getting it done right. By focusing on one step before moving to the next, you'll find a policy that truly fits your family’s needs without breaking the bank.

Step 1: Figure Out How Much Coverage You Actually Need

Before you even think about looking at quotes, you need a number. How much life insurance is enough? Guessing can be a costly mistake—either you’ll overpay for coverage you don’t need, or worse, you’ll leave your family without enough support.

A simple way to get a realistic estimate is to add up your obligations:

Final Expenses: Funerals and final medical bills aren't cheap. A safe bet is to set aside around $15,000 for these costs.

Debts: What’s left on your mortgage? Add in any car loans, credit card balances, or other outstanding debts you don't want to pass on.

Income Replacement: If your spouse relies on your income, how many years of support would they need to stay on their feet? Multiply your annual income by that number of years.

Add it all up. That’s your target, a real number you can take to the bank.

Step 2: Get Your Information in Order

A smooth application process is all about being prepared. Insurers need to understand your health and personal history, and having all that information ready to go will make things so much easier. You'll save a ton of time and show the insurance company you're a serious applicant.

Think of it like getting your documents ready before you go to the DMV. A little bit of organization beforehand prevents a major headache later and helps the whole process move along much more quickly.

Step 3: Compare Quotes from Different Companies

This is a big one: never, ever take the first quote you see. The price for the same amount of coverage can be wildly different from one company to the next. Every insurer has its own way of looking at risk, and they all have a "sweet spot" for certain ages and health conditions.

Shopping around is the single best way to find a good deal. The best way to do this is by working with an independent agent. They can pull quotes from dozens of top-rated carriers at once, forcing them to compete for your business. It’s the key to finding great protection that's also a great value.

Step 4: Fill Out the Application and Do the Phone Interview

Once you’ve zeroed in on the right company, it’s time to apply. You'll use all the information you gathered in step two to fill out the formal application. After that, expect a brief phone interview, which usually only takes about 20-30 minutes.

On the call, someone from the insurance company will simply confirm the details on your application and ask a few more questions about your health and lifestyle. Just be open and honest. This conversation gives the underwriter everything they need to make a decision. After the call and any required medical exam, your work is done and the ball is in their court.

Your Top Questions About Life Insurance After 50, Answered

Even with all the information out there, you probably still have a few questions rolling around in your head. That's completely normal. Let's tackle some of the most common ones people ask when they're looking for the right life insurance coverage over 50.

Can I Get Covered If I Have a Pre-Existing Condition?

Yes, you absolutely can. It’s one of the biggest myths out there that a health issue automatically disqualifies you.

Common, manageable conditions like high blood pressure or diabetes are rarely a deal-breaker, especially if you're on top of them with medication and regular check-ups. Insurers are really looking for stability and a proactive approach to your health, not a perfect medical record.

If you're dealing with more serious health challenges, don't lose hope. Guaranteed Issue policies are designed for this exact situation. They let you skip the medical exam altogether. The trade-off is usually a smaller death benefit and a two-year waiting period before the full benefit pays out for natural causes, but it's a solid path to getting coverage.

How Much Coverage Do I Actually Need?

This is where you need to ignore the generic online calculators and focus on your specific situation. The right amount of coverage isn't a magic number; it's a practical one based on what you want the money to do.

Think of it as building a financial safety net. You need to figure out exactly what you want it to cover.

Outstanding Debts: Add up things you don't want to leave behind, like the rest of your mortgage, a car loan, or any credit card balances.

Final Expenses: Funerals and related costs can sneak up on a family. A good rule of thumb is to set aside at least $15,000 to cover these without dipping into savings.

Income Replacement: If a spouse or partner relies on your income, how much would they need to maintain their lifestyle? Calculate what that looks like for a few years or more.

Add those numbers up, and you’ll have a realistic target that’s built for your life, not someone else's.

Choosing the right coverage amount is about precision. It’s the difference between buying a tool that’s a perfect fit for the job versus one that’s just close enough. A personalized calculation ensures you’re not overpaying for unnecessary coverage.

Is Term or Whole Life Better for Me?

There’s no single "better" option here. It all comes down to what you need the policy to accomplish. They’re two different tools for two very different jobs.

If your main concern is covering a debt that has a finish line—like a 15-year mortgage—then a 15-year term policy makes the most sense. It’s a direct, cost-effective solution for a temporary need.

On the other hand, if your goal is permanent, like leaving a guaranteed inheritance for your kids or ensuring your final expenses are paid no matter when that day comes, whole life is the tool for the job. It’s built to last a lifetime.

What Happens If I Outlive My Term Policy?

It’s pretty simple: the coverage ends, and so do your payments. Think of it like car insurance—you pay for protection during a specific period, and if you don't have an accident, you don't get the premiums back. You got the peace of mind you paid for.

The key thing to know is that many term policies come with a conversion option. This lets you switch your term coverage to a permanent policy before it expires, without having to go through another medical exam. That's a huge benefit, and it's precisely why it’s so important to match your term length to your longest financial need right from the start.

At America First Financial, we believe in clear, straightforward insurance solutions that protect what matters most—your family and your values. Get a free, no-hassle quote in under three minutes and find the right coverage for your needs. Secure your legacy today at https://www.americafirstfinancial.org.

_edited.png)

Comments