Best Long Term Care Insurance Companies for Your Future

- dustinjohnson5

- Sep 8, 2025

- 16 min read

Long term care insurance is one of those financial tools you hope you never need, but it can be an absolute lifesaver if you do. It's designed to cover the high costs of care—think in-home assistance, assisted living, or a nursing home stay—that your regular health insurance or Medicare won't touch. Essentially, it’s a safeguard for your retirement nest egg, preventing it from being wiped out by unexpected, long-term health needs.

When you start looking for the right policy, you'll want to dig into a company's financial strength, what their policies actually cover, and how they handle claims.

Why Long Term Care Insurance Is So Important

Let's be realistic: a lot of us are going to need some form of long term care as we get older. Without a plan in place, the costs can be staggering, often forcing families to burn through their life savings just to pay for care. That’s precisely the problem Long Term Care (LTC) insurance is built to solve—it gives you a structured way to prepare for those potential bills.

To really get a handle on any policy, you need to understand a few key parts. These are the levers you can pull to find the right balance between what you pay in premiums and the coverage you get.

The Building Blocks of a Policy

Every LTC insurance plan is built on a few core components. Getting these right is the key to creating a policy that fits your needs and budget.

Daily or Monthly Benefit Amount: This is the maximum dollar amount your policy will pay out for your care, either per day or per month. A bigger benefit means more complete coverage, but it also means a higher premium.

Benefit Period: This is the total length of time your policy will pay benefits, which could be anywhere from two years to the rest of your life. A longer period gives you more protection if you face a prolonged illness.

Elimination Period: Think of this as a deductible, but measured in time. It’s the number of days you have to pay for your own care before the insurance company starts paying. Most people choose 30, 60, or 90 days.

To put this in perspective, the national median cost for a private room in a nursing home is now north of $100,000 per year. LTC insurance is designed to tackle that risk head-on, so a major health event doesn't wreck your entire financial future.

What Kind of Care Is Covered?

Thankfully, today's LTC policies are much more flexible than they used to be. They're designed to cover you in a variety of settings, so you can get help wherever you feel most comfortable.

Care Setting | Description of Services Covered |

|---|---|

In-Home Care | Pays for skilled nurses, therapists, or home health aides to help with daily activities right in your own house. |

Assisted Living | Covers care in facilities that offer housing and meals along with support services for people who need help but not round-the-clock nursing. |

Nursing Home Care | Provides benefits for 24-hour skilled nursing and rehab services in a licensed facility. |

Hospice Care | Includes palliative care and support focused on comfort and quality of life for individuals with a terminal illness. |

At the end of the day, having LTC insurance is about peace of mind. It’s knowing that if you ever need care, you can get high-quality support without putting an immense financial and emotional burden on your family. It's a powerful tool for protecting both your assets and your dignity.

How to Evaluate Top Long Term Care Insurance Companies

Choosing the right long-term care insurance company is just as important as picking the right policy. A policy is only as good as the company standing behind it, and you need a solid framework to look past the marketing fluff and focus on what really matters: long-term stability and service.

This isn’t a short-term purchase. You could be paying premiums for 20 or 30 years before you ever file a claim. You need to know that the insurer will be financially sound and ready to pay out when that day finally comes.

Understanding Financial Strength Ratings

First and foremost, look at the company’s financial strength. You're trusting them with your future, so their financial health is non-negotiable. Independent rating agencies like AM Best, Moody's, and Standard & Poor's (S&P) do the heavy lifting for you by providing these crucial assessments.

In the insurance world, AM Best is the gold standard. Their ratings give you an objective, third-party view of an insurer’s financial stability and its ability to actually pay its claims.

Here’s a quick rundown of what their grades mean:

A++ and A+ (Superior): The best of the best. These companies have an exceptional ability to meet their financial promises.

A and A- (Excellent): Indicates a very strong capacity to meet obligations, though they might be slightly more sensitive to major economic downturns.

B++ and B+ (Good): These companies have a good ability to pay claims but are more vulnerable when the economic landscape gets rocky.

When you’re comparing the best long term care insurance companies, I strongly recommend sticking with those rated A or higher from AM Best. A top-tier grade points to a long history of smart financial management and a rock-solid balance sheet—exactly what you want for a long-term commitment.

For example, as we look at 2025, Mutual of Omaha is a top player for traditional long-term care insurance, boasting an A+ rating from AM Best for its incredible financial strength and benefit flexibility. On the hybrid side, Nationwide often leads the pack with its CareMatters plan, which also carries an A+ rating. And then you have New York Life, which holds the highest possible A++ rating, signaling unmatched financial stability for both its traditional and hybrid policies. You can find a great breakdown of these and other top-rated insurance companies on Insurance and Estates.

Evaluating Rate Stability and History

Beyond financial ratings, a company’s history with premium increases tells a story. While no insurer can promise your rates will never go up, some have a much better track record than others. If a company has a history of hitting policyholders with steep or frequent rate hikes, it's a major red flag for your long-term budget.

Do a little digging into a company's rate increase history over the past ten years. An insurer that has kept premiums relatively stable is one that likely priced its policies responsibly from the very beginning.

Assessing the Claims Process and Customer Service

Finally, think about what happens when you actually need to use the policy. When you or your family are in a vulnerable position, the last thing you want is to fight with a claims department. A smooth, supportive claims process is absolutely essential.

Here’s what to look for:

Customer Reviews: Read what real policyholders are saying, paying close attention to comments about their claims experience.

Dedicated Support: Does the company assign you a dedicated claims specialist to walk you through the process? This can make a world of difference.

Clarity and Simplicity: Are the rules for filing a claim laid out in plain English? Confusion is your enemy here.

A company that gets high marks in these three areas—financial strength, rate stability, and customer service—is one you can truly depend on for the long haul. This methodical approach ensures you're making a decision based on hard evidence, not just a clever sales pitch.

Comparing the Best Traditional LTC Insurance Providers

When you start digging into traditional long-term care insurance, you’ll find a few names that consistently come up. These are the specialists, the companies that have stayed focused on stand-alone LTC policies. Their entire business is built around one thing: funding your future care.

This kind of focused expertise often results in policies with more meaningful features and a better grasp of what people actually need. Unlike hybrid products that combine life insurance with care benefits, a traditional plan is a pure instrument. You pay premiums to build a dedicated fund for potential care expenses, plain and simple.

Let’s put two of the top players in this market, Mutual of Omaha and National Guardian Life (NGL), under the microscope.

H3: Mutual of Omaha: The Leader in Flexibility

Mutual of Omaha has earned its reputation as a leader. They bring rock-solid financial strength to the table and pair it with a policy structure that you can really customize. This makes them a fantastic option for both individuals and couples who want to dial in their coverage to match their specific needs.

Their policies are well-regarded for offering a wide array of benefit periods and inflation protection riders. For instance, a healthy 55-year-old couple could add a shared care rider, which lets them pool their benefits. If one spouse uses up their entire benefit amount, they can start drawing from their partner's pool—a critical safety net when care needs last longer than expected.

Key Differentiator: The real standout for Mutual of Omaha is its cash benefit alternative. Policyholders have the option to take up to 30% of their monthly benefit as a cash payment, with no strings attached on how it's spent. This is huge. It gives you the freedom to pay an informal caregiver, like a family member, or cover other care-related costs that a standard policy might not.

This cash option is a game-changer. It acknowledges that good long-term care isn't just about paying for certified nurses and facilities; it’s about having the resources to maintain your quality of life on your own terms.

H3: National Guardian Life: The Specialist for Couples

National Guardian Life, or NGL, is another powerhouse in the traditional LTC space. They are known for stability and for creating truly innovative features designed for partners planning together. Founded way back in 1909, NGL has more than a century of experience, which is backed up by strong financial ratings that give policyholders peace of mind.

NGL has cemented its place as a leading provider, holding nearly $5 billion in assets as of 2024. The company maintains an A (Excellent) rating from AM Best, which was reaffirmed in July 2024, signaling its robust financial health. Their flagship EssentialLTC policy, launched in 2016, is built on this foundation of industry expertise. In 2025, NGL introduced a distinctive “third pool” shared care benefit. This allows couples to access their two individual benefit accounts plus an additional, third account if they purchase an inflation protection rider. You can learn more about NGL's unique approach from industry resources like LTC News.

This “third pool” concept is an incredibly powerful tool for couples. Let's say each partner has a $300,000 benefit pool. With this rider, they don’t just share access to each other's $300,000. They also unlock an additional $300,000 joint pool, creating a massive $900,000 in total potential benefits.

Traditional LTC Policy Feature Comparison

Seeing the key features side-by-side really helps clarify which provider might be a better fit for your situation. Here’s a quick look at how these two industry leaders stack up based on their core strengths.

Provider | AM Best Rating | Key Policy Feature | Ideal For... |

|---|---|---|---|

Mutual of Omaha | A+ (Superior) | Flexible Cash Benefit Alternative and robust shared care options. | Individuals wanting maximum flexibility and the ability to use benefits for informal care. |

National Guardian Life | A (Excellent) | Unique "third pool" shared benefit for couples, maximizing joint coverage. | Couples planning together who want to create the largest possible combined benefit pool. |

So, what’s the takeaway? The best choice really boils down to your personal circumstances and what you value most.

If you prioritize the freedom to receive cash to direct your own care, Mutual of Omaha’s flexible policy is probably the way to go. But if you’re planning as a couple and your main goal is to maximize the total amount of money available for both of you, NGL’s innovative shared benefit structure is tough to beat.

Taking a Closer Look at Hybrid Life and Long Term Care Insurance

One of the biggest hang-ups people have with traditional long term care insurance is its "use it or lose it" design. You could pay premiums faithfully for decades, but if you never need care, that money is simply gone. This is exactly why hybrid policies—which bundle life insurance with a long term care (LTC) rider—have become such a popular alternative.

These products are built to solve that exact problem by guaranteeing that the money goes somewhere. If you need long term care, the policy pays out your death benefit early to cover those expenses. If you pass away without ever needing care, your beneficiaries get the full death benefit, just like with any standard life insurance policy.

This dual-purpose approach offers incredible peace of mind. You know your premiums are always building toward a guaranteed benefit, one way or another. That makes hybrid plans a fantastic tool for protecting your assets and planning your legacy, especially for those who want to prepare for care costs without taking an inheritance off the table for their loved ones.

How Do Hybrid Policies Actually Work?

Think of a hybrid policy as a life insurance contract with a powerful add-on. You usually fund them with a single lump-sum premium or through a series of payments over a defined term, like ten years. This is quite different from the lifelong premium payments required by most traditional plans.

Once it's funded, the policy gives you three potential outcomes:

Long Term Care Benefit: If you need qualifying care, the policy pays out a monthly benefit, which is drawn down from your total pool of funds.

Death Benefit: If you never touch the LTC benefit, your heirs receive a tax-free death benefit.

Return of Premium: If your circumstances change and you need to walk away, many policies let you surrender the contract and get some or all of your premium payments back.

This flexibility is a huge part of the appeal. It completely removes the risk of paying for something you might never use, which is a major roadblock for so many people when they consider traditional LTC insurance.

Comparing Top Hybrid Policy Providers

When you look at the hybrid market, two of the most respected names you'll encounter are Nationwide and New York Life. Both offer top-tier products, but they’re built differently and cater to different priorities. Digging into their approaches shows you the kind of nuances you need to look for when comparing the best long term care insurance companies.

Nationwide's CareMatters II policy is widely known for its cash indemnity benefits. What this means is that once you qualify for care, Nationwide simply sends you a check for your full monthly benefit. You have total freedom to spend it however you see fit—on formal care from an agency, paying a family member to help out, or even making modifications to your home.

This level of control can be a game-changer. If someone prefers to have a trusted family member provide their care instead of a stranger from an agency, a cash indemnity plan like Nationwide's gives them the financial freedom to make that happen without needing to save and submit receipts for reimbursement.

On the other hand, New York Life's Asset Flex operates mostly on a reimbursement basis. It’s still quite flexible, but you have to submit receipts for qualified care expenses to get your money. The trade-off? New York Life’s standout feature is its unmatched financial stability, holding the highest possible A++ rating from AM Best. For someone who prioritizes the absolute long-term security of their insurer above all else, this can be the deciding factor.

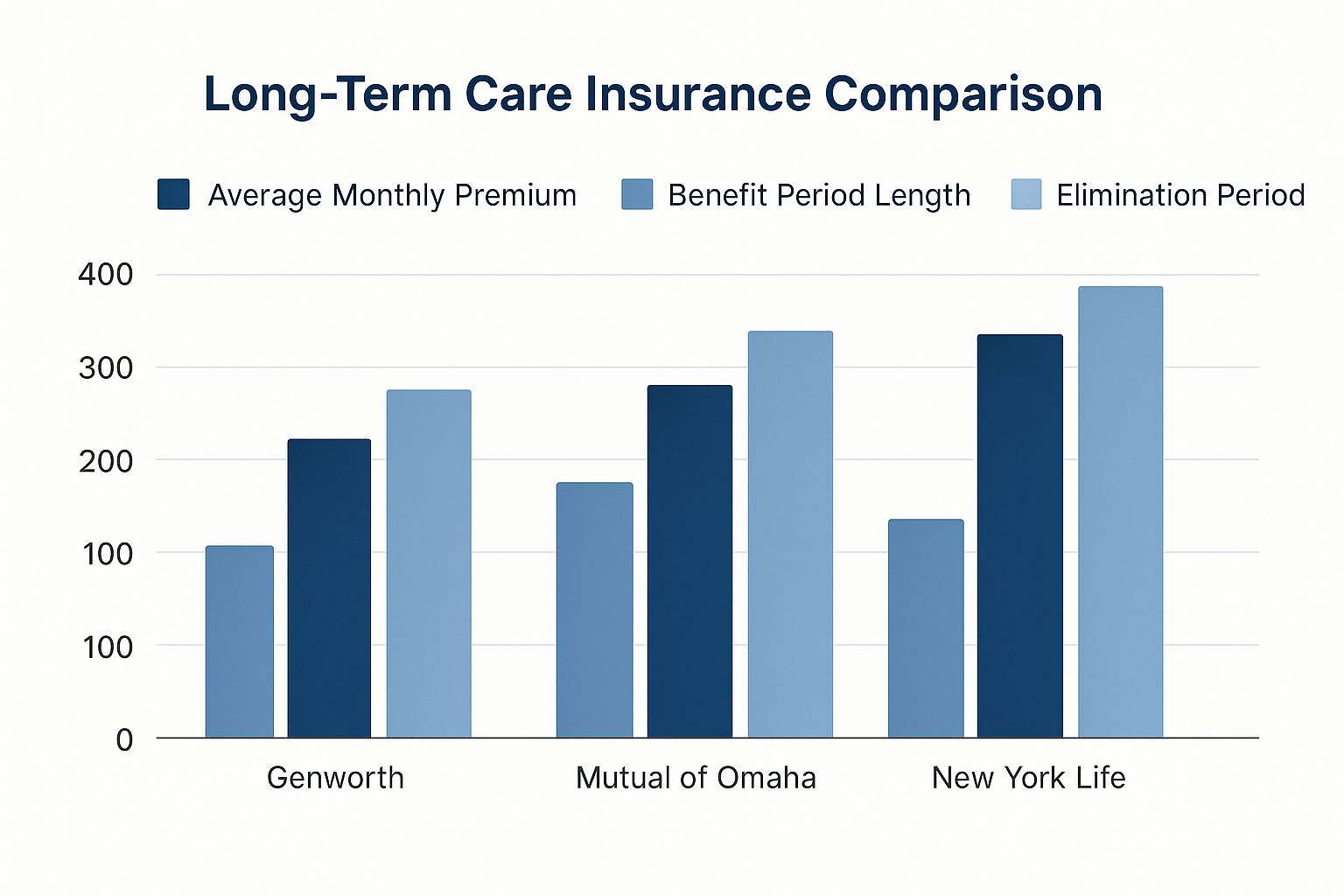

This chart gives you a simplified visual of how different policy features can create very different plans among top insurers.

As the data shows, while the premium cost is always a key consideration, things like the length of the benefit period and the initial elimination period create important trade-offs when designing your coverage.

Making the Right Hybrid Choice

The decision between a cash indemnity and a reimbursement model really boils down to your personal comfort level and priorities.

Let’s imagine a real-world scenario: A 60-year-old woman wants to protect her $1.5 million estate for her children, but she’s also worried about how a long illness could wipe out her savings.

If she prizes maximum control and simplicity during a potential claim, Nationwide's cash benefit model would likely be the perfect fit. She wouldn't have the added stress of tracking every single expense.

If her number one concern is the rock-solid, long-term solvency of the insurance company and she’s fine with the process of submitting receipts, New York Life's A++ rated policy might give her more confidence.

At the end of the day, hybrid policies offer a compelling "either/or" benefit. You either use the funds for your own care, or you pass them on to your heirs. That guarantee gets rid of the single biggest hesitation people have with traditional LTC planning and offers a secure, flexible solution for today's financial realities.

Finding Niche Solutions for Specialized Coverage

The long-term care insurance market isn't a one-size-fits-all world. While the big names offer great traditional and hybrid policies, some people just don't fit the typical mold. This might be because of a tight budget, specific health issues, or simply wanting a more straightforward, targeted plan.

This is where niche insurance providers come into play. They fill the gaps by offering specialized solutions for these unique situations. By focusing on specific demographics or policy types, they provide a valuable lifeline for people who might otherwise go without coverage. Looking into these options can be the key to finding the best long-term care insurance for your personal circumstances.

Balancing Cost and Coverage Flexibility

Let's be honest: cost is a huge factor. A comprehensive policy that covers everything from home health aides to full-time nursing home care can be incredibly expensive. For many people, the main goal isn't having every single option covered, but making sure they have a safety net for the most expensive, catastrophic scenarios—like a long stay in an assisted living facility.

This is the exact trade-off that specialized policies are designed for. They let you focus your coverage on what worries you most, which brings the premium down to a much more manageable level. It's a strategic move, accepting some limitations in exchange for affordability.

Situational Recommendation: If your retirement budget is tight but you have a strong family support system for potential in-home care, a facility-only policy can be a smart compromise. It protects your assets from the high costs of institutional care while allowing you to rely on informal support for less intensive needs at home.

A Closer Look at Facility-Only Policies

Providers like Bankers Life have carved out a niche by offering different tiers of coverage. As a specialized retirement insurer, Bankers Life provides two main types of LTC insurance: a comprehensive policy—covering nursing homes, assisted living, home care, and adult day care—and a facility-only policy. This second option, while more affordable, cuts out home care entirely. Despite the trade-offs, their products serve a range of needs, especially for seniors with different care preferences. You can read more about these specialized insurance offerings and how they compare.

A facility-only policy is exactly what it sounds like. It only pays benefits for care you receive in a licensed setting, such as:

Assisted Living Facilities: For those who need help with daily activities but not constant medical supervision.

Nursing Homes: For individuals requiring 24/7 skilled nursing care.

Memory Care Units: Specialized facilities designed for individuals with dementia or Alzheimer's.

By stripping out the coverage for in-home care, these policies can dramatically lower the premium. This makes them a very attractive choice for budget-conscious people who still want to protect their life savings from being wiped out by a lengthy facility stay.

The obvious downside, of course, is the lack of coverage for care at home. With more and more seniors wanting to age in place, that's a significant trade-off to weigh. If you go this route, you're essentially betting that any care you need will be serious enough to require moving into a facility, or that you have other ways to pay for help at home. It’s a focused strategy, but for the right person, it provides essential protection right where it's needed most.

How to Choose the Right Long Term Care Company

Picking the right long term care insurance company isn’t about finding some universally “best” option. It’s about finding the best fit for you—your finances, your health, and your family’s future.

This means taking everything we’ve discussed—financial ratings, claims reputations, policy fine print—and looking at it through the lens of your own life. Once you do that, you can confidently narrow down the choices and find a policy that truly makes sense.

Connecting Your Profile to the Right Policy

Your age, health, and family situation will point you toward certain types of policies. Let’s walk through a few real-world scenarios to see how this works.

For a Healthy Couple in Their 50s: Your main goal is likely protecting each other. A traditional policy with a powerful shared care rider is often the best move. NGL's "third pool" benefit is a great example, as it creates a separate pool of money you can both draw from. This ensures one spouse's extended care needs don't wipe out the benefits saved for the other.

For a Single Individual Nearing Retirement: You’re probably thinking about protecting your assets while also leaving something behind. A hybrid life/LTC policy shines here. It offers a two-for-one solution: you get coverage for care if you need it, but if you don't, your premiums turn into a tax-free death benefit for your beneficiaries. It's a win-win.

For Someone with a Family History of Needing Care: If you feel there's a strong chance you'll need care, you want flexibility above all else. A policy with a cash indemnity benefit, like those from Nationwide, gives you total control. You receive a check and can use it as you see fit—even to pay family members for informal care—without the hassle of submitting receipts.

Final Takeaway: The best policy is the one that solves your biggest worry. Whether that’s protecting your spouse, guaranteeing an inheritance, or maintaining control over your care, let that primary concern be your guide.

Seek Professional Guidance

Trying to sort through all the details can be a heavy lift, and you shouldn’t have to do it alone. The most important final step is to talk with a qualified, independent financial advisor who knows the ins and outs of long-term care planning.

A true professional can give you objective advice based on your entire financial situation. They'll help you run quotes from multiple top-rated insurers and build a policy that fits your budget and your life. At America First Financial, we can connect you with experienced advisors who will help you lock in your financial future with confidence.

Common Questions About Long-Term Care Insurance

Thinking about long-term care insurance brings up a lot of questions. It's a big decision, after all. Let's walk through some of the most common ones I hear from clients to give you a clearer picture.

What's the Best Age to Apply for Coverage?

The sweet spot for buying long-term care insurance is usually your mid-to-late 50s. At this age, you're more likely to be in good health, which means you can sail through the underwriting process and lock in a much lower premium.

If you wait until you're in your 60s or 70s, you’ll almost certainly face higher costs. More importantly, the chances of being denied coverage due to a new health condition go up significantly. Applying earlier gives you the best shot at an affordable policy.

How Does the Underwriting Process Work?

Getting approved for an LTC policy is a detailed process. Insurers need to get a full picture of your health to figure out the likelihood you'll need care down the road.

Expect to go through a few steps:

A deep-dive health questionnaire covering everything from your medical history to your daily habits.

A review of your medical records straight from your doctors.

A phone interview or even an in-person assessment to chat about your current health and check your cognitive function.

Having a clean bill of health is key. Things like existing dementia, poorly managed diabetes, or a recent stroke are often automatic disqualifiers.

A word of advice: be completely honest on your application. Insurers cross-reference everything. Any little inconsistency between what you say and what your medical records show can cause major delays or even get your application denied.

Can I Deduct My LTC Insurance Premiums on My Taxes?

Yes, in many cases you can, but you have to follow the IRS rules. You can count a portion of your long-term care insurance premiums as a medical expense. These expenses are deductible if they total more than 7.5% of your adjusted gross income (AGI).

How much you can deduct also depends on your age. In 2024, for instance, someone between 61 and 70 can deduct up to $4,770. If you're over 70, that limit jumps to $5,960. The IRS adjusts these caps for inflation each year, so it's a nice financial perk. Just make sure to talk to a tax advisor to see how it applies to your specific situation.

Figuring out long-term care insurance is a crucial part of protecting your financial future. At America First Financial, we focus on clear, straightforward coverage that protects your family and your savings. Get your free, no-hassle quote today and see how we can help you plan for a secure future.

_edited.png)

Comments