Cash Surrender Value of Life Insurance Explained

- dustinjohnson5

- Aug 27, 2025

- 17 min read

When you hear "life insurance," you probably think of the death benefit—the money left behind for your loved ones. But what if a policy could also offer a benefit to you while you're still living? That’s where the cash surrender value of life insurance comes into play.

Think of it as a savings account that’s built directly into certain types of life insurance. It's an amount of money you can access by voluntarily ending your policy before it pays out a death benefit. This feature is a game-changer for many, but it's exclusively found in permanent life insurance policies.

What Is Cash Surrender Value in Life Insurance

While the death benefit provides a crucial financial safety net for your family, permanent policies like whole life or universal life have another powerful component: a living benefit known as cash value.

Here’s how it works. Each time you pay your premium on a permanent policy, the money is split. One part covers the actual cost of insuring your life and the insurer's administrative fees. The other part is funneled into a cash value account, which grows over time on a tax-deferred basis.

So, what’s the cash surrender value? It’s simply the amount you'd get back if you decided to cancel—or "surrender"—the policy. This figure is your total accumulated cash value, minus any surrender fees the insurance company might charge or any loans you've already taken against it.

The Home Equity Analogy

One of the easiest ways to grasp this is to think about it like owning a home. With every mortgage payment you make, a slice goes to interest, and the rest builds your home equity. That equity is the portion of your home you actually own, free and clear.

Your permanent life insurance policy works in a very similar way. Your premiums build cash value, which is essentially the equity in your policy. If you were to sell your house, you’d walk away with the equity. If you surrender your life insurance policy, you walk away with the cash surrender value.

The key takeaway is that the cash surrender value represents the tangible, accessible equity you have built within your life insurance policy. It’s your money, available for you to use.

Why Term Life Insurance Is Different

It's really important to draw a line here: not all life insurance policies have a cash value. Term life insurance, for example, is pure protection. It’s designed to cover you for a specific period of time—say, 10, 20, or 30 years—and that's it.

If you outlive the term, the policy expires. There's no payout and no savings account to cash out. This is the fundamental difference that makes understanding the cash surrender value of life insurance so critical. It only exists in policies that combine a death benefit with a savings or investment vehicle, which is the defining feature of permanent life insurance.

Term Life vs Permanent Life Insurance At a Glance

To see these differences side-by-side, let's break down the two main types of life insurance. This table offers a quick comparison of their core features, highlighting why only one type offers a cash surrender value.

Feature | Term Life Insurance | Permanent Life Insurance (e.g., Whole Life) |

|---|---|---|

Coverage Duration | For a specific period (e.g., 20 years) | For your entire life, as long as premiums are paid |

Primary Purpose | Provides a death benefit for a set term | Offers a lifelong death benefit and a savings component |

Premium Cost | Generally lower and fixed for the term | Significantly higher and can be fixed or flexible |

Cash Value | No cash value component | Builds tax-deferred cash value over time |

Surrender Option | Policy lapses with no value if canceled | Can be surrendered for its accumulated cash surrender value |

Ultimately, the choice between term and permanent insurance depends entirely on your financial goals. If you're looking for straightforward, affordable coverage for a specific period, term life is a great fit. But if you want lifelong coverage that also builds a financial asset you can use during your lifetime, a permanent policy with its cash surrender value is the way to go.

How Insurers Calculate Your Cash Surrender Value

So, how do insurance companies actually figure out the check they'll cut you if you decide to walk away from your policy? It might seem like a complicated, behind-the-scenes calculation, but it’s surprisingly straightforward. The cash surrender value of life insurance isn’t some random number they pull out of a hat; it’s based on a simple formula.

Getting a handle on this calculation is crucial. It helps you manage your policy wisely and sets realistic expectations if you ever need to tap into that money. At its core, the math boils down to two key pieces: the total cash value you've built up and any surrender charges the insurer applies.

Think of it like this: you start with your total savings, and then you subtract any early withdrawal fees.

The Foundation: Your Accumulated Cash Value

First, let's talk about the good part—the money you've built up. With any permanent life insurance policy, a slice of every premium you pay gets funneled into a separate cash value account. This account is designed to grow, slowly but surely, over the life of the policy.

This growth comes from two sources: your premium payments and any interest or dividends the insurance company credits to your account. You can always find this number, the accumulated cash value, on your policy statement. It represents the total equity you have in your policy. Just keep in mind, this is the starting point, not necessarily the final amount you'll walk away with, especially in the early years.

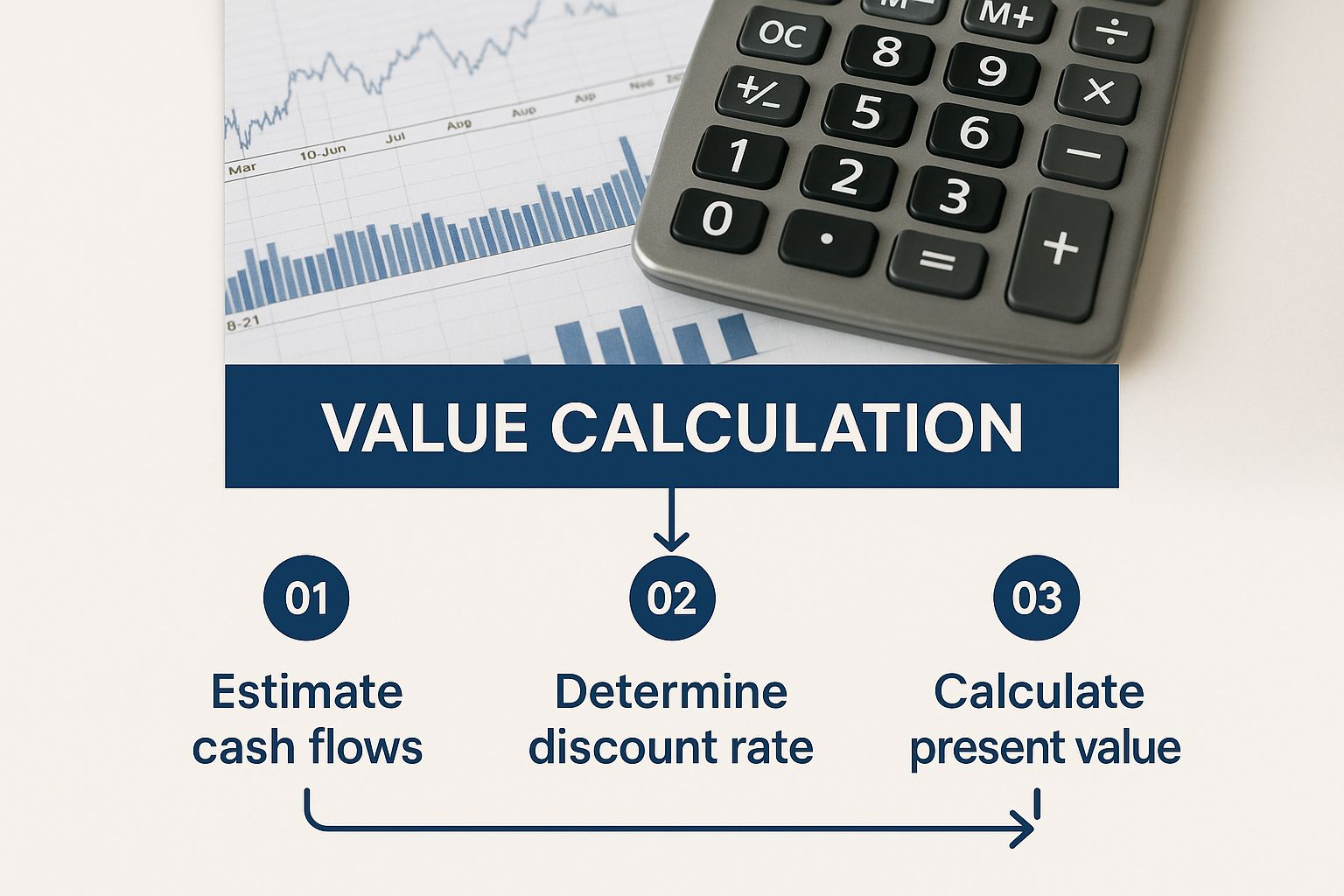

This image breaks down how the final value is calculated.

As you can see, your final payout is simply your accumulated value minus any surrender fees.

The Deduction: Surrender Charges Explained

Now for the other side of the coin: surrender charges. These are basically fees the insurer deducts if you cancel your policy within a certain timeframe, known as the "surrender period." This period is different for every policy but typically lasts anywhere from 7 to 15 years.

So, why do these charges even exist? When an insurer issues you a policy, they have a lot of upfront costs to cover—things like agent commissions, the medical exam, and all the administrative work. The surrender charges are their way of making sure they can recoup those costs if you decide to leave before they've had a chance to.

The Simple Formula: (Total Accumulated Cash Value) - (Applicable Surrender Charges) = Your Final Cash Surrender Value

These fees aren't static. They’re designed to fade away over time, usually starting high in the first few years and then decreasing annually. For example, a policy might have a 10% charge in year one, which drops by 1% each year. After year 10, it disappears completely. Once that surrender period is over, your cash surrender value is the same as your total accumulated cash value.

Let's look at a quick example to see how this plays out in the real world.

Policy Year 5: * Accumulated Cash Value: You’ve built up $10,000. * Surrender Charge: The policy has a 6% fee in year five, which is $600 ($10,000 x 0.06). * Cash Surrender Value: Your final payout would be $9,400 ($10,000 - $600).

Policy Year 11: * Accumulated Cash Value: Your account has now grown to $25,000. * Surrender Charge: The surrender period is over, so the charge is $0. * Cash Surrender Value: You would receive the full $25,000.

This simple math shows exactly why waiting until the surrender period is over can make a huge difference to your bottom line. By understanding both sides of this equation, you can make a much more informed decision about whether surrendering your policy is the right move for you.

The Real Costs of Surrendering Your Policy

Tapping into your policy's cash value can seem like a straightforward way to get your hands on money when you need it. But before you do, you need to understand that “surrendering” your policy isn’t a simple withdrawal—it’s a termination. And it comes with some serious costs that aren’t always obvious at first glance.

We’re not just talking about a single fee here. Pulling the plug on your policy can trigger immediate financial penalties, a surprise tax bill, and most importantly, the permanent loss of the financial safety net you built for your family. You also have to consider the high price of trying to get that protection back down the road.

Understanding Surrender Charges

The first cost you’ll almost certainly run into is the surrender charge. This is a fee the insurance company deducts from your cash value if you cancel the policy within the first 7 to 15 years.

Why do they do this? It's pretty simple: the insurer needs to recover the upfront costs of issuing your policy. Think about the agent's commission, the medical exam (underwriting), and all the administrative work. If you walk away too early, they haven't made that money back through your premiums.

Surrender charges are set up on a sliding scale. They’re at their highest in year one and then slowly decrease each year until they finally vanish. It’s the insurance company’s way of encouraging you to stick with the policy for the long haul.

The Tax Man Cometh

Here’s a cost that catches a lot of people by surprise: taxes. One of the best perks of a cash value policy is that its growth is tax-deferred. But that tax advantage disappears the moment you surrender it for a gain.

The rule is this: if the cash you walk away with is more than the total premiums you've paid in (this is called your "cost basis"), that difference is considered a gain. And that gain is taxed as ordinary income, not at the more favorable capital gains rate.

Let’s look at a quick example:

Total Premiums Paid (Your Cost Basis): You've paid $20,000 over the life of the policy.

Cash Surrender Value Received: The insurer sends you a check for $25,000.

Taxable Gain: The gain is $5,000 ($25,000 - $20,000).

In this scenario, you’d have to report that $5,000 as income on your tax return. Depending on your tax bracket, that could be a significant chunk of money you weren't expecting to pay.

Surrendering a policy is often seen as a last resort because the financial penalties can be substantial. These costs, including surrender charges and taxes, are designed to reflect the long-term nature of life insurance as both a protection and savings tool. Learn more about the financial implications of surrendering policies in a 2012 industry report.

The Highest Cost of All

Honestly, the biggest cost of surrendering your policy has nothing to do with fees or taxes. It’s the permanent loss of the death benefit—the very reason you bought the policy in the first place. This is the money your loved ones were counting on to handle final expenses, pay off the mortgage, or just keep their lives on track without your income.

Once that policy is gone, it’s gone for good. There's no undo button.

This brings us to another painful, long-term reality. If you decide later on that you need life insurance again, you're starting from scratch. You'll be older, which automatically means higher premiums. And if you’ve developed any health issues in the meantime, you could be looking at sky-high rates—or you might not be able to get coverage at all.

Surrendering now might solve a short-term cash crunch, but it could leave your family exposed and make it nearly impossible to replace that critical safety net later on.

Accessing Your Cash Value Without Giving Up Your Policy

Surrendering your policy is one way to get your hands on its cash value, but it's a final move. It completely cancels the death benefit you worked so hard to put in place for your family. A lot of people think this is their only choice when they need cash, but that's simply not true.

Fortunately, there are smarter, more flexible ways to tap into your policy's equity that let you keep your coverage active. These strategies can provide the financial breathing room you need for life’s curveballs without forcing you to sacrifice your family’s long-term security.

Take a Policy Loan

One of the most powerful features of a permanent life insurance policy is the ability to borrow against its cash value. The best way to think about it is like a private, secured line of credit from your insurance company, with your policy’s cash value acting as the collateral.

The process is incredibly simple. There are no credit checks to worry about, no long, complicated applications to fill out, and no one asks what you need the money for. The interest rates are also often much better than what you’d find with personal loans or credit cards. Plus, the loan you receive isn't generally considered taxable income.

You also get a ton of flexibility in how you pay it back. You can make regular payments if you choose, or you can just let the interest accrue. Just remember that any outstanding loan balance and accrued interest will be deducted from the death benefit if you pass away before it’s repaid. It’s a fantastic option for handling a temporary financial need while keeping your primary protection intact.

Make a Partial Withdrawal

If you'd rather not deal with loan interest or repayments, you might want to look into a partial withdrawal, sometimes called a partial surrender. This lets you take out a portion of your cash value directly, with no requirement to pay it back.

This can be an excellent way to get funds for a major expense, like putting a down payment on a house or helping with a child’s college tuition. However, it's critical to understand the consequences. A withdrawal will permanently reduce both your policy’s cash value and its death benefit.

A key tax consideration with withdrawals is that they are generally tax-free up to the amount you've paid in premiums (your "cost basis"). Only the portion of the withdrawal that comes from gains is potentially taxable.

This method gives you direct access to your money, but it demands careful thought about the long-term impact on what your policy will eventually pay out to your beneficiaries.

Use Cash Value to Pay Premiums

What if your biggest financial hurdle is just keeping up with your premium payments? During tight times, the temptation to just let the policy lapse can be strong, but there’s a much better way. You can actually use your accumulated cash value to cover your premium costs.

This feature, often called an "automatic premium loan," can be an absolute lifeline. By instructing your insurer to pull from your cash value, you can keep your policy active without paying a dime out of your pocket.

This ensures your family remains protected even when your personal cash flow is strained. While it will slowly chip away at your cash value, it’s a far better alternative than losing your coverage altogether. It’s the perfect bridge to get you through a rough patch until you can start making payments again yourself.

Comparing Ways to Access Your Life Insurance Cash Value

Deciding which method is right for you comes down to your specific financial situation and what you're trying to accomplish. A loan is perfect for a short-term need that you fully intend to repay. A withdrawal makes more sense for a permanent need where a reduced death benefit is an acceptable trade-off. And using cash value for premiums is a smart defensive play to preserve your coverage when money is tight.

The table below breaks down these three powerful alternatives to fully surrendering your policy, helping you see the trade-offs at a glance.

Method | Impact on Death Benefit | Tax Implications | Policy Status |

|---|---|---|---|

Policy Loan | Reduced by the outstanding loan amount and any accrued interest. | Generally not taxable, unless the policy lapses with a loan greater than the cost basis. | Remains active. |

Withdrawal | Permanently reduced by the withdrawal amount. | Withdrawals up to your cost basis are tax-free; gains are taxable. | Remains active. |

Pay Premiums | Reduced by the amount of cash value used to cover premium payments. | Can have tax implications if structured as a loan and the policy later lapses. | Remains active. |

Each option keeps your policy in force, offering a level of financial flexibility that many policyholders don't realize they have.

Selling Your Policy: A Smarter Alternative to Surrender

Before you jump at your insurance company's offer, you need to know about another powerful option that most people don't even realize exists: a life settlement. This path could put significantly more cash in your pocket than simply surrendering the policy.

A life settlement is straightforward: you sell your existing life insurance policy to a third-party investor. In return, you get a single, lump-sum cash payment. Here's the key part—this payment is almost always more than the cash surrender value, though it's less than the policy's full death benefit.

Unlocking the True Market Value of Your Policy

Think of your life insurance policy like any other asset you own, whether it's a car or a house. When you surrender a policy, you're essentially selling it back to the manufacturer for whatever they decide it's worth. A life settlement, on the other hand, lets you take that policy to an open, secondary market where its real value can be determined.

This creates a massive financial opportunity. Too many policyholders leave a lot of money on the table because they don't explore this route. The difference between what an insurer offers for surrender and what you can get from a life settlement can be huge—sometimes two to four times higher.

Who Qualifies for a Life Settlement?

Now, this option isn't for everyone. Life settlements are designed for a specific group of policyholders who generally meet a few key criteria. While the exact requirements can differ, the best candidates are typically:

Seniors: Usually individuals aged 65 or older.

Policy Size: The policy's face value is generally $100,000 or more.

Change in Health: In many cases, the policyholder's health has changed since they first bought the policy.

These factors are what an investor looks at to figure out the policy's market value. If your life expectancy has shifted or you simply don't need the death benefit anymore, your policy becomes a valuable asset to someone else. A life settlement is your way to unlock that hidden value for your immediate needs, like funding retirement or paying for medical care.

A shocking amount of potential wealth vanishes every year when seniors surrender their policies without ever learning their true market value. Just taking the cash surrender value means you could be walking away from a much, much larger payout.

The cash surrender value is what an insurer pays to get a policy off its books, and it’s often just a fraction of its potential worth. Consider this: of the estimated $200 billion in life insurance that gets lapsed or surrendered each year in the U.S., it could fetch around $50 billion on the secondary market. Instead, policyholders only receive about $12.5 billion in cash surrender value, leaving an incredible $37.5 billion in lost wealth for seniors on the table every single year. You can discover more insights on how life settlements unlock greater value from Harbor Life Settlements.

Why More People Are Cashing In Their Life Insurance Policies

If the thought of tapping into your policy's cash value has crossed your mind, you're definitely not alone. More and more, Americans are choosing to surrender their life insurance policies, a decision often driven by real-world financial pressures and changing personal goals. It's a major financial move, but one that's becoming a common part of the conversation around managing household finances.

Seeing this trend in a broader context can help you frame your own situation. All across the country, people are taking a hard look at their financial toolkits, and permanent life insurance is frequently part of that review. Economic turbulence, unexpected life changes, or simply new priorities can all lead someone to see the cash surrender value of life insurance as a smart way to get their hands on much-needed funds.

The Economic Pressures Driving Policy Surrenders

Several powerful economic forces are pushing people toward this choice. When inflation is high or the job market feels shaky, many families feel the squeeze on their budgets. That big premium payment, once viewed as a responsible long-term investment, can suddenly start to feel like a heavy short-term burden. In times like these, accessing the cash surrender value can be a critical lifeline for covering daily expenses or knocking out high-interest debt.

It’s really just a practical reaction to the economic climate. A recent spike in policy surrenders shows just how many people are leaning on this option. In 2023, total surrender payments in the U.S. skyrocketed to $41.6 billion—a massive 39.1% jump from the year before. That number tells a clear story: a growing wave of policyholders are opting to liquidate their policies for cash now. You can learn more about recent life insurance trends to get the full picture.

How Big Life Changes Shift Financial Priorities

Beyond the economy, it’s often the big personal moments in life that trigger the decision to surrender a policy. These are the times when your financial needs can change in an instant.

Some of the most common life events that lead people to cash in their policies include:

Retirement: Once the kids are financially independent and the mortgage is paid off, you might not need such a large death benefit. The cash value can be a great way to boost your retirement income.

Medical Emergencies: A sudden illness can come with a mountain of medical bills. The cash surrender value provides a ready source of funds to handle these costs without taking on new debt.

Divorce: When a marriage ends, assets often have to be divided. A life insurance policy with a healthy cash value is frequently part of that financial equation.

Paying for College: Many parents find that their policy's cash value is a perfect tool for helping a child pay for their education, sidestepping the need for hefty student loans.

This isn't just a simple transaction; it's a strategic pivot. Policyholders are actively treating their life insurance as a flexible financial asset, one they can adapt to meet their needs while they are still living.

How Income Influences Insurance Decisions

Your income level has a lot to do with whether you own permanent life insurance in the first place, and whether you decide to keep it. Not surprisingly, households with higher incomes are more likely to have this type of policy, which gives them the option to access a cash surrender value down the road. For example, 71% of households earning over $150,000 have life insurance.

On the other end of the spectrum, lower-income households (where only 31% own a policy if they earn under $50,000) are often more exposed to financial shocks. For them, surrendering a policy might not be a strategic move to fund a new goal, but a tough choice made out of necessity. It just goes to show that the decision to cash in a policy is shaped by both opportunity and need, depending heavily on where you stand financially.

Common Questions About Cash Surrender Value

Even with a good grasp of the basics, you probably still have a few questions about how the cash surrender value of life insurance actually works day-to-day. That's completely normal. Let’s tackle some of the most common things people ask, so you can feel confident managing your policy.

Think of this as your go-to reference for clearing up those lingering uncertainties about your policy's cash value.

When Can I Access My Cash Surrender Value?

A lot of people think their cash value is available right away, but it actually takes a while to build up to a useful amount. Most permanent life insurance policies need a few years of steady premium payments before you start seeing any real accumulation.

Why the wait? Insurers use the first few years of premiums to cover their own setup costs. As a result, you typically won't see a significant cash surrender value until you're several years into the policy—often right around the time those surrender charges start to decrease. It’s definitely a long-term benefit, not an instant savings account.

Is the Cash Surrender Value I Receive Taxable?

This is a big one, and the answer really depends on your specific numbers. The good news is that you generally don't pay taxes on the whole amount you get back. Your payout only becomes taxable if the cash you receive is more than the total amount of premiums you've paid. This premium total is called your "cost basis."

Here’s a simple way to look at it:

If Payout < Premiums Paid: The money is just a return of what you put in, so it's not taxed.

If Payout > Premiums Paid: The difference—the part that exceeds what you paid in—is considered a gain and is taxed as ordinary income.

For instance, if you paid $30,000 in premiums over the years and received a cash surrender value of $35,000, you’d only owe taxes on the $5,000 gain.

The tax rules for life insurance are set up to encourage long-term savings. While the money grows tax-deferred inside the policy, cashing it out for a profit means you'll have to pay taxes on those earnings.

What Happens to the Cash Value If I Die?

This is a point of confusion for many policyholders. If you pass away while the policy is still active, your beneficiaries don't get both the death benefit and the cash value. Instead, the insurance company essentially absorbs the cash value, and your beneficiaries receive the policy's full stated death benefit.

The cash value isn't a separate pot of money; it's an internal component that helps fund the death benefit. Its main purpose is to be a "living benefit" that you can access through loans, withdrawals, or by surrendering the policy while you're still alive.

Can I Get a Cash Surrender Value from My Term Life Policy?

The short answer here is a simple no. Term life insurance policies have no cash surrender value whatsoever. They are built for one thing only: to pay a death benefit to your loved ones if you pass away during a specific time frame (the "term").

Because term policies have no savings or investment element, cash value never builds up. Your premiums are spent entirely on the cost of the death benefit coverage. Once the term is up, the policy simply expires with nothing left over, which is exactly why it's so much more affordable.

At America First Financial, we believe in protecting your family's future with clear, honest financial tools that align with your values. If you're looking for life insurance that prioritizes security and traditional American principles, we can help. Get a free, no-hassle quote from America First Financial today and see how we put your family first.

_edited.png)

Comments