Catch Up Contributions 401k: Maximize Your Retirement Savings

- dustinjohnson5

- Sep 15, 2025

- 13 min read

Ever wonder if you've saved enough for retirement? It's a common concern. But for those over 50, there's a powerful tool designed to help you power-boost your savings: 401k catch up contributions.

Think of it as a dedicated express lane that opens up on your retirement journey, just when you might need it most.

Your Guide to Supercharging Retirement Savings After 50

Staring down the final stretch to retirement can feel a little intimidating, especially if you look at your savings and wish the balance were higher. You're definitely not alone. Many people hit their highest earning years later in their careers, often right as big expenses like a mortgage or college tuition are finally winding down. This creates a golden opportunity to really ramp up your savings.

This guide is all about one of the best tools you have for this exact situation: the 401k catch up contribution. We'll cut through the financial jargon and show you exactly how this provision works—the what, why, and how of making these extra contributions.

A New Era for Retirement Savers

Recent legislation, particularly the SECURE 2.0 Act, has brought some significant updates that expand these savings opportunities. The changes introduced new tiers and rules that can seem a bit confusing at first, but our goal is to give you a clear, straightforward roadmap. It’s never too late to make a huge difference in your financial future.

This special provision was created to help people who may have had career interruptions, started saving later in life, or simply want to pack away as much as possible in their highest-earning years.

Whether you're just hitting 50 or you're in your early 60s, getting a handle on these rules is key. We're going to cover:

The basics of catch up contributions and how they're different from your regular 401k savings.

The specific eligibility rules you’ll need to meet to take advantage of them.

The new contribution limits, including the "super catch-up" for certain age groups.

Actionable strategies to fit these extra savings into your budget without feeling the pinch.

We'll show you how to use these rules to build a more secure and comfortable retirement. For a wider view on building a complete pension strategy for retirement that optimizes all your accounts, this guide is a great resource. By the time you're done here, you’ll have the confidence and knowledge to supercharge your savings and approach your golden years with much greater peace of mind.

What Exactly Are 401k Catch-Up Contributions?

Let's cut through the financial jargon. Think of the standard 401k contribution limit as a highway with a firm speed limit for every driver. But once you hit age 50, the IRS opens up an express lane just for you. This lane lets you put the pedal down and save for retirement at a much faster pace.

These catch-up contributions aren't some new, complicated investment fund you have to sign up for. They're simply extra contributions you're allowed to make to your existing 401k, right on top of the annual limit that applies to everyone else. It’s a powerful feature designed to help you supercharge your savings, especially during what are often your peak earning years.

So, why does this express lane even exist? The government gets that life rarely follows a neat and tidy financial script. Maybe you started saving later than you'd hoped, took a few years off to raise a family, or navigated a career change that put saving on the back burner. Catch-up contributions are your chance to make up for lost time.

How They Differ from Regular 401k Contributions

The key difference here is a matter of sequence. You can only start making catch-up contributions after you've already hit the regular, employee-wide contribution limit for the year.

Think of it as filling two buckets:

First Bucket (Standard Limit): Everyone, regardless of age, can fill this bucket up to the standard employee deferral limit set by the IRS each year.

Second Bucket (Catch-Up): If you're 50 or older and you've already filled the first bucket to the brim, you can start pouring savings into this second one, up to the separate catch-up limit.

This tiered system gives older workers a clear and distinct advantage. It's a mechanism specifically designed to help them seriously bulk up their nest egg as the retirement finish line gets closer.

At its heart, the idea is simple: give people nearing retirement a way to sock away more money in their tax-advantaged accounts, helping them build a more secure future.

For instance, let’s say the standard 401k limit is $23,000 and the catch-up limit is $7,500. A 52-year-old employee could put away a grand total of $30,500. Meanwhile, their 45-year-old colleague is capped at $23,000. Over just a few years, that difference can add up to tens of thousands of extra dollars in retirement savings.

The Purpose Behind the Provision

With people living longer and retirements stretching out over decades, the ability to save more has become crucial. Catch-up contributions were introduced to address this reality, giving older Americans a fighting chance to boost their savings. The rules have been tweaked and updated over the years, and you can see how the limits have evolved by checking out the history of 401k limits on Fidelity.com.

Ultimately, these catch-up contributions offer a huge strategic advantage. They provide the flexibility to save aggressively when it counts the most, helping you close any savings gaps and build the financial cushion you'll need for the years ahead.

Understanding the Contribution Limits and Tiers

To build a powerful retirement savings strategy, you need to know the numbers. Think of your 401(k) contributions like different gears in a car—each one is designed to help you accelerate your savings, especially as you get closer to retirement.

Let's break down the contribution limits and tiers you'll want to master.

The Foundation: The Standard Employee Limit

The starting point for everyone is the standard employee contribution limit. This is the maximum amount any eligible employee, regardless of age, can sock away in their 401(k) each year directly from their paycheck. The IRS tweaks this number from time to time for inflation, so it's always a good idea to check the latest figure annually.

This limit applies to your direct salary deferrals and is the bedrock of your retirement savings plan. For many people, the goal is simply to max this out every single year if they can.

The First Boost: The Regular Catch-Up Contribution

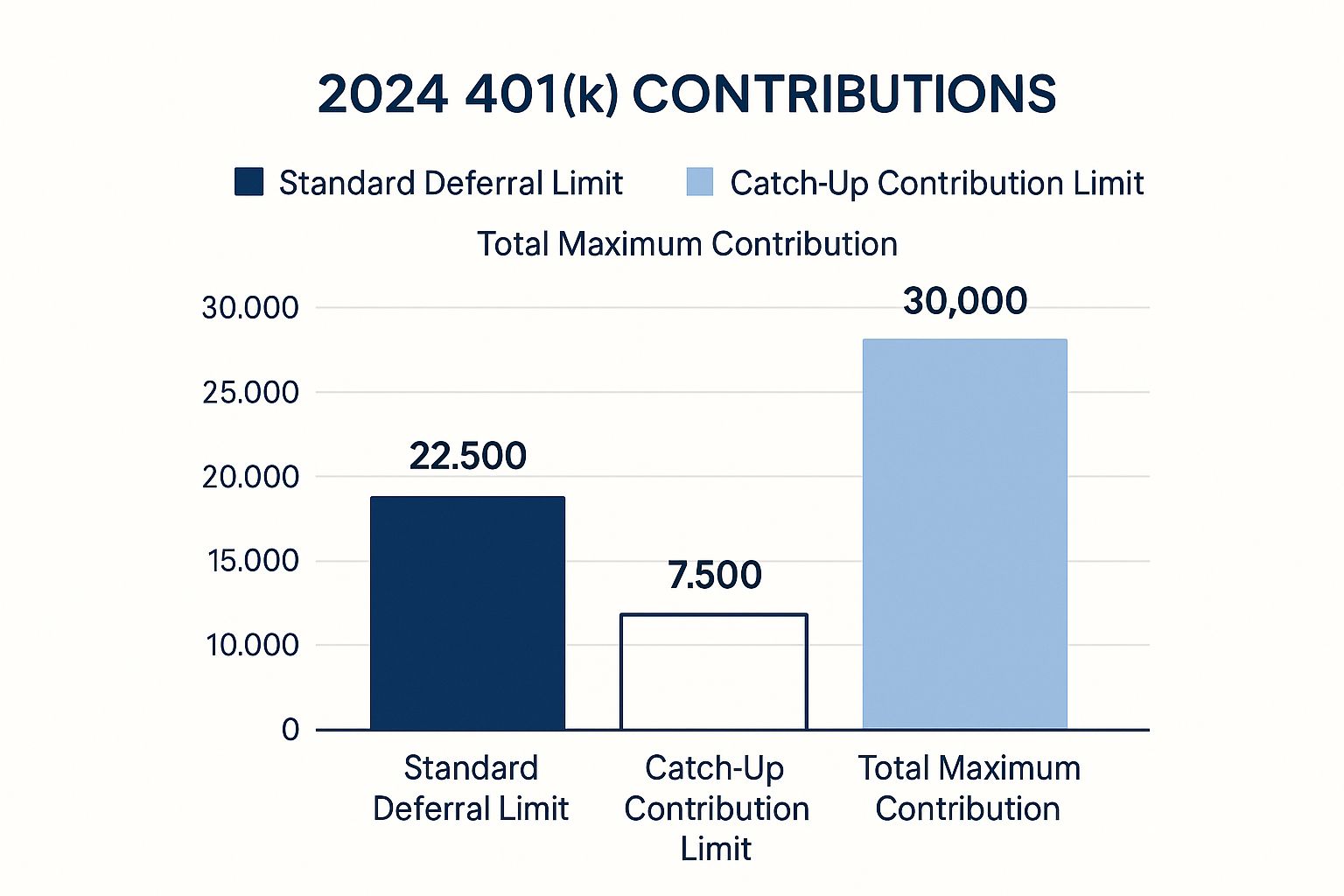

Things get interesting once you hit age 50. As soon as you turn 50 (or will before the year is over), you unlock the next tier: the standard catch-up contribution. This is an extra amount you can save on top of the standard limit. For 2024, this lets savers aged 50 and older put away an additional $7,500.

This rule exists for a good reason. Your 50s and 60s are often your peak earning years, making it the perfect time to make up for lost ground or really step on the gas with your savings.

This infographic shows just how much of a difference that extra contribution can make.

As you can see, the ability to make catch-up contributions gives your total annual savings potential a significant leg up.

The New "Super Catch-Up" Provision

A game-changing new rule is coming our way thanks to the SECURE 2.0 Act. Starting in 2025, an even more generous savings tier opens up for a very specific age group. This new “super catch-up” is designed for those who are on the final stretch to retirement.

If you are aged 60, 61, 62, or 63, you'll be able to contribute an even larger amount. The limit is set to be the greater of $11,250 or 150% of the regular catch-up amount for that year. That's a 50% increase over the standard catch-up—a massive opportunity to turbocharge your savings. You can learn more about 2025 401(k) contribution rules on epwealth.com to get the full scoop on this change.

The "super catch-up" creates a powerful, four-year savings window for people aged 60 to 63, giving them a chance to make substantial progress right before they plan to retire.

401(k) Contribution Limits at a Glance

To see how all these tiers fit together, this table provides a clear breakdown of the different contribution limits based on age.

Age Group | Standard Employee Limit | Additional Catch-Up Allowed | Total Employee Contribution |

|---|---|---|---|

Under 50 | $23,000 (for 2024) | $0 | $23,000 |

50-59 | $23,000 (for 2024) | $7,500 (standard catch-up) | $30,500 |

60-63 | $23,500 (projected 2025) | $11,250 (super catch-up) | $34,750 |

64+ | $23,500 (projected 2025) | $7,500 (standard catch-up) | $31,000 |

It’s important to remember that these numbers only cover what you can contribute from your own pocket. Any matching funds or profit sharing from your employer are separate and get added on top of this, all subject to an overall plan limit.

By understanding these distinct tiers, you can build a more precise and effective plan to maximize your 401(k) catch-up contributions and work toward a more secure financial future.

Are You Eligible? Let's Break Down the Rules

Knowing the contribution limits is one thing, but figuring out if you actually qualify to use them is where the rubber meets the road. The eligibility rules for 401(k) catch-up contributions are mostly straightforward, but a few nuances can catch people by surprise. Let's walk through exactly what you need to know to make sure you can take full advantage of this incredible savings boost.

The Age 50 Milestone

The biggest and most important rule is all about your age. To make catch-up contributions, you have to be age 50 or older.

The good news? The IRS gives you the entire calendar year to qualify. It doesn't matter if your 50th birthday is on January 1st or December 31st—if you hit that milestone anytime during the year, you're eligible for the full year.

This means you can get a head start. For instance, if you turn 50 in November, you don’t have to wait. You can begin making those extra contributions right from the start of the year, as long as you’re on track to hit your regular 401(k) contribution limit first.

Double-Check Your Plan Allows It

While the IRS sets the guidelines, it's not a federal mandate for every single 401(k) plan to offer catch-up contributions. The reality is that the vast majority of them do because it's a highly valued feature for employees. Still, it's always smart to confirm.

Your go-to document for this is the Summary Plan Description (SPD). Your employer is required to provide this, and it lays out all the nitty-gritty details of your retirement plan. If you can't put your hands on it, don't worry—a quick call or email to your HR department or the plan administrator will clear things up.

Just ask a simple question: "Does our 401(k) plan allow catch-up contributions for employees age 50 and over?" Taking a minute to verify this gives you the confidence to move forward.

A Big Change for High-Income Earners: The Roth Rule

There's a major new rule on the horizon that will change the game for high earners making 401(k) catch-up contributions. This change, part of the SECURE 2.0 Act, ties your catch-up strategy directly to your income.

Beginning in 2026, if your FICA wages from the prior year were over $145,000 (this number will be adjusted for inflation), any catch-up contributions you make must go into a Roth 401(k) account. This means you'll be making those extra contributions with after-tax money.

This mandatory Roth rule applies to everyone making catch-up contributions, whether you're in the standard age 50+ group or the new "super catch-up" group for ages 60-63.

So, what does that practically mean?

Pre-Tax (Traditional) Savings: You get a tax break now by lowering your current taxable income, but you'll pay income tax on withdrawals when you retire.

Post-Tax (Roth) Savings: You pay the taxes today, but your qualified withdrawals in retirement—including decades of investment growth—are 100% tax-free.

This new rule essentially front-loads the tax bill for high earners on their catch-up savings. You lose the immediate tax deduction, but in exchange, you're building a bucket of money that can be a powerful source of tax-free income in retirement. This is a significant shift, and as detailed in an analysis on Newfront.com, it's prompting many employers to update their payroll and plan systems.

If you're a high earner and your plan doesn't currently have a Roth 401(k) option, your employer will need to add one for you to continue making catch-up contributions once this rule kicks in. It's more important than ever to know your plan's features and stay in the loop about upcoming changes.

Putting Your Catch-Up Contributions to Work: Practical Strategies

Knowing the rules is one thing, but actually putting that money to work is how you build a secure retirement. So, let's move from theory to action. How do you weave these extra catch up contributions 401k into your real-world financial life? The trick is to make it feel less like a sacrifice and more like an automatic, wealth-building habit.

Timing is Everything: Seizing Your Savings Window

Life has a funny way of opening up opportunities to save more, especially as you get older. For many people, their 50s and 60s represent a perfect storm of financial opportunity. Your earning power is at its peak, while some of your biggest expenses are finally disappearing. This creates a golden window to get serious about saving.

Think about these common life milestones—they are prime time for boosting your 401(k):

The Kids Fly the Coop: That last college tuition payment is made, or your children are finally financially self-sufficient. Suddenly, a huge chunk of your monthly budget is free. Before it gets absorbed elsewhere, redirect it straight into your retirement account.

The Mortgage is Gone: Wiping out your mortgage is a game-changer. Imagine taking that entire monthly house payment and sending it directly to your 401(k) instead. It’s a powerful move that can dramatically accelerate your savings without you even feeling the pinch.

You Land a Late-Career Raise: A big promotion or salary bump in your 50s is fantastic news. The smartest thing you can do is immediately increase your 401(k) deferral before you get used to that bigger paycheck. Pay your future self first.

Finding the Room in Your Budget

Okay, so where does the extra money actually come from? It often feels like there’s no room to spare, but a few small, intentional tweaks can make a massive difference. It all starts with an honest look at where your money is going right now.

The single best tactic, bar none, is to automate it. Set up your catch up contributions 401k to come directly out of your paycheck. When the money never even touches your checking account, you remove the temptation to spend it. This is the classic "pay yourself first" strategy, and it works because it makes saving completely effortless.

Think of it as putting your retirement savings on autopilot. You make one simple decision today to bump up your contribution, and the system handles the rest, consistently building your nest egg with every single paycheck.

The Big Question: Traditional vs. Roth Contributions

One of the most important decisions you'll make is whether to contribute on a pre-tax (Traditional) or post-tax (Roth) basis. The choice really boils down to a simple trade-off: do you want a tax break now, or do you want tax-free income later?

Traditional (Pre-Tax): This is the classic approach. Your contributions lower your taxable income today, which can feel great during your peak earning years. The catch is that you’ll owe income tax on every dollar you pull out in retirement.

Roth (Post-Tax): With a Roth, you pay the taxes now on your contributions. The incredible payoff comes later: all your qualified withdrawals in retirement, including all the investment growth over the years, are 100% tax-free.

So, which is right for you? It often depends on where you think your tax bracket will be in the future. If you expect to be in a lower tax bracket in retirement, the Traditional 401(k) is compelling. But if you think you’ll be in a similar or even higher bracket—or if you just love the idea of tax-free certainty—the Roth is a powerful tool. It's worth noting that for high-income earners, new rules are coming that will require catch-up contributions to be made on a Roth basis anyway.

Common Questions About Catch-Up Contributions

As you start getting serious about your retirement strategy, the big-picture concepts give way to practical, real-world questions. Getting straight answers to these is what gives you the confidence to take action. Let's dig into some of the most common questions people have about catch-up contributions 401k and clear up any confusion.

Do I Need to Fill Out a Special Form?

This is easily one of the most frequent questions, and for good reason—no one wants more paperwork. Do you need to hunt down some special "catch-up" form to start making these extra contributions?

Thankfully, the answer is almost always no. The system is designed to be incredibly seamless.

Your catch-up contributions are handled through the exact same payroll deferral process you already use for your regular 401k savings. Once you hit the standard contribution limit for the year, any additional money you put in automatically spills over and starts counting toward your catch-up limit. All you need to do is tell your 401k provider (usually through their online portal) or your HR department that you want to increase your contribution percentage or dollar amount.

The system is built to be "hands-off." You just set your desired contribution rate, and your plan's recordkeeper automatically handles the accounting, classifying the funds correctly once you pass the standard annual limit.

What Happens If I Change Jobs Mid-Year?

Switching employers is a normal part of a career, but it can throw a wrench in your contribution tracking. If you were saving in a 401k at your old job and then start a new one, how do the limits work?

The key thing to remember is that IRS limits for catch-up contributions 401k follow you, the individual, not your employer. The annual limit applies across all 401k plans you contribute to in a single calendar year. It doesn't reset just because you get a new W-2.

For example, let's say you put $20,000 into your 401k at Company A before leaving in July. When you start at Company B, you don't get a fresh limit. You need to keep a close eye on your total contributions across both jobs to make sure you don't accidentally go over the IRS maximum for the year. It’s your responsibility to monitor that combined total.

Can I Make Catch-Up Contributions to an IRA Too?

This is a fantastic question because it gets at an important detail in retirement planning. While you can make catch-up contributions to both a 401k and an IRA, they operate on completely separate tracks with their own rules and limits.

401k Catch-Up: Has a much higher limit—$7,500 for those 50 and older in 2024.

IRA Catch-Up: The limit is quite a bit lower—just an extra $1,000 for those 50 and over in 2024.

Contributing the catch-up amount to one doesn't affect your ability to contribute to the other. If you're eligible, you can absolutely max out your catch-up contributions 401k and make the additional catch-up contribution to your IRA in the same year, as long as you meet the IRA's income requirements.

Do Employers Match My Catch-Up Contributions?

Whether your employer matches these extra contributions is a million-dollar question—or at least a several-thousand-dollar one! It has a huge impact on your total savings. Unfortunately, the answer is usually no, but this really comes down to your specific plan's rules.

Most employer matching formulas are tied to a percentage of your salary, not the total dollar amount you contribute. A typical setup is a company matching 50% of your contributions up to 6% of your salary.

Once you've contributed that 6%, the match usually stops for the year. It doesn't matter if you keep contributing all the way to the standard limit or even into the catch-up zone. But every plan is different. The only way to know for sure is to check your Summary Plan Description (SPD) or ask your plan administrator directly about the matching policy.

Navigating your financial future requires a partner you can trust. America First Financial provides clear, dependable insurance and retirement solutions designed to protect your family and your values, free from politically charged influences. Secure your legacy with a team that puts your financial security first.

Get a free, no-hassle quote in under three minutes by visiting https://www.americafirstfinancial.org.

_edited.png)

Comments