Choosing Your Life Insurance Face Value

- dustinjohnson5

- Sep 5, 2025

- 12 min read

When you hear people talk about "life insurance," what they're really talking about is the face value. It's the guaranteed, tax-free payout your family or beneficiaries receive if you pass away.

Think of it as the core promise of your entire policy. It’s the specific dollar amount you’ve insured your life for to make sure your loved ones are protected financially. This single number is the cornerstone of the safety net you're building.

Defining Your Policy's Core Promise

Let's use an analogy. If your life insurance policy is a financial safety net designed to catch your family after a tragedy, the life insurance face value is the actual size of that net. It's the official payout amount printed right on your policy documents, often called the death benefit.

You decide on this amount when you first buy the policy. It becomes the foundational number that insurance companies use to figure out your premiums. A bigger face value—say, $1,000,000 versus $100,000—means a much larger benefit for your family, but it also means you'll pay higher premiums along the way.

The face value is the whole reason you buy life insurance. It’s the lump-sum payment meant to replace your income, clear debts like a mortgage, and help your family keep their standard of living without your financial support.

It's really important to get this straight: the face value is different from other terms you might hear, like "cash value."

Face Value vs. Cash Value

One of the biggest mix-ups in life insurance is the difference between face value and cash value. They sound similar, but they do completely different jobs.

Here's the simple breakdown: the face value is the money your loved ones get after you’re gone. The cash value, on the other hand, is a savings feature you can access while you're still alive, but it's only available in permanent policies like whole or universal life.

To make this crystal clear, let's look at a quick comparison.

Face Value vs Cash Value at a Glance

Feature | Face Value (Death Benefit) | Cash Value |

|---|---|---|

Purpose | Payout to beneficiaries upon the insured's death. | A savings/investment component for the policyholder. |

Who It's For | Your beneficiaries (family, estate, etc.). | You (the policyholder). |

When It's Paid | After you pass away. | Can be accessed while you are still living. |

Policy Types | Included in all life insurance (term and permanent). | Only available in permanent policies (e.g., whole life). |

Primary Goal | To provide a financial safety net for your loved ones. | To accumulate funds you can borrow or withdraw. |

Essentially, the face value is for them (your family), while the cash value is a feature for you. Understanding this distinction is the first and most critical step in picking the right kind of life insurance for your needs.

Calculating the Right Coverage for Your Family

Figuring out how much life insurance you need isn't just about picking a random, big number. It's about building a financial safety net that's custom-fit for your family, one that ensures they can carry on and hit their future goals, even without your income. Guessing won't cut it; you need a solid plan.

A really practical way to get started is with the DIME method. It's a simple acronym that helps you remember the four biggest financial pillars your policy should support.

Breaking Down the DIME Method

Using the DIME method makes sure you don't miss any major financial responsibilities. It covers Debt, Income, Mortgage, and Education. Let's look at what each one means for your total face value.

Debt: First, add up all your debts besides the mortgage. We're talking credit card balances, car payments, student loans—any personal loans. The idea is to wipe these off the books so your family isn't saddled with them.

Income: How many years of your salary would your family need to stay afloat? A good rule of thumb is to multiply your annual income by 10 to 15 years. You can tweak this based on your partner's career or how young your kids are.

Mortgage: For most families, the house is the biggest asset and the largest bill. You’ll want to add the entire remaining balance of your mortgage to the total. This gives your loved ones the security of a paid-off home.

Education: If you have kids, their education is probably a huge priority. You'll need to estimate the future cost of college or vocational school for each child. Be realistic—a four-year public university degree can easily top $100,000 per child down the road.

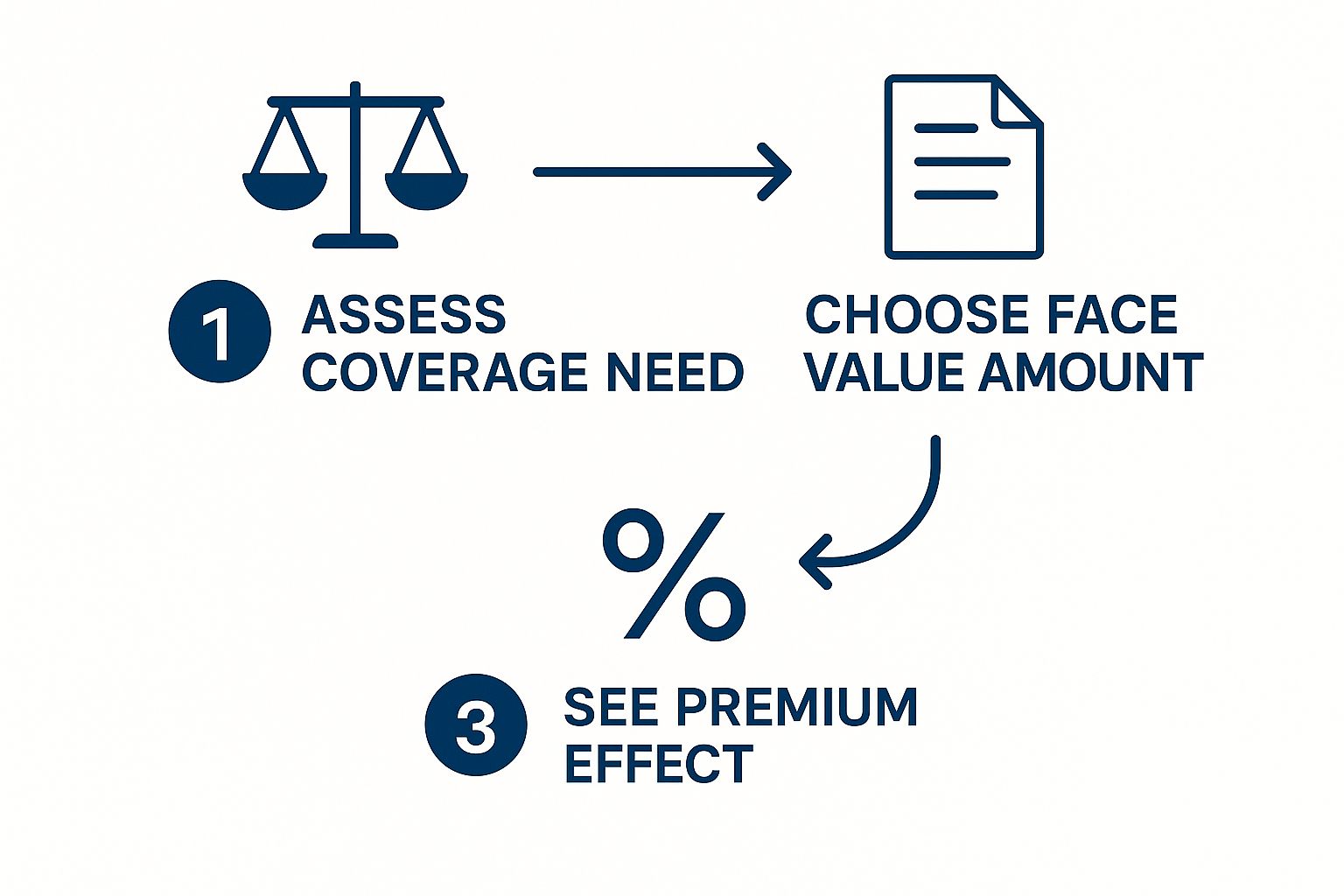

As you can see, figuring out your family's actual needs is the first step. That number directly informs the face value you choose, which then determines what you'll pay in premiums.

Putting It All Together

Once you've got a number for each of those categories, you just add them up. It’s pretty straightforward.

Let's run through a quick example to see it in action.

Example Calculation:

Debt: $30,000 (from car loans and credit cards)

Income: $750,000 (a $75,000 salary multiplied by 10 years)

Mortgage: $220,000 (what's left on the home loan)

Education: $200,000 (for two kids to go to college)

Total Face Value Needed: $1,200,000

This process gives you a concrete, personalized number. It's not just a shot in the dark; it's a figure that’s directly tied to your family’s actual financial life and their future.

The whole point of life insurance is to replace the economic value you bring to the table. That’s more than just a paycheck—it's your ability to eliminate debt and fund huge life goals.

One last thing: don't forget to factor in final expenses. Funerals and other end-of-life costs can run anywhere from $7,000 to $12,000 on average. It's smart to add this on top of your total so your family isn't hit with an immediate financial burden during an incredibly tough time. When you're calculating coverage, it's also important to see how your policy fits into your larger financial picture, including wills and estate planning.

Factors That Shape Your Insurance Policy

While you get to decide on the right life insurance face value for your family, the insurance company has its own math to do. They need to figure out how much to charge you for that coverage, and it all boils down to risk. Insurers are essentially making an educated guess on their chances of paying out a claim, and they look at a few key areas of your life to get their answer.

Unsurprisingly, your age and health are the two biggest pieces of the puzzle. A younger, healthier person is statistically less likely to pass away, which means lower risk for the insurer and, in turn, much more affordable premiums for you. This is exactly why so many financial experts advise getting life insurance when you’re young—you can often lock in a great rate for the long haul.

If you wait until you're older or after health issues have surfaced, the insurance company sees a greater chance of having to pay out the policy sooner. That increased risk is reflected in higher premiums.

Your Lifestyle and Occupation Matter

It’s not just about what’s in your medical charts; insurers are also interested in how you live your life. Lifestyle choices are a huge deal. A smoker, for example, can expect to pay two to three times more than a non-smoker for the very same face value.

Your job and hobbies also get a close look. Someone with a desk job is going to get a better rate than a commercial fisherman or a roofer. Any activity the insurer considers high-risk—think scuba diving, private piloting, or even rock climbing—can push your rates up or even make it harder to get the full amount of coverage you want.

At the end of the day, the insurer is asking one simple question: What’s the likelihood we’ll have to pay out this policy? Everything from your family's health history to your weekend hobbies helps them calculate an answer and set your price.

Policy Type Determines Cost and Value

The type of policy you buy also plays a massive role in what you'll pay for a given face value. The two main options work very differently.

A term life policy is pure and simple protection. You get a large face value (like $1 million) for a set period—say, 20 or 30 years—in exchange for a relatively low premium. It’s designed to do one job: provide a financial safety net if you die during that term.

On the other hand, a whole life policy is built to last your entire life and comes with a savings account feature known as cash value. This gives you permanent coverage and an asset that grows over time, but the premiums are substantially higher for the same face value.

The importance of this financial protection has never been more apparent. After the pandemic, life insurance awareness soared, pushing industry-wide premiums to a record $15.9 billion in 2024. This isn't just a number; it shows a real shift in how families are thinking about their financial security. You can find detailed market data on the trend at LIMRA.com.

Let's Bust Some Common Life Insurance Myths

When you're trying to figure out the right life insurance face value, it's easy to run into some bad advice. A lot of common "wisdom" out there can actually lead you down the wrong path, leaving your family with far less protection than they need. Let's clear the air and bust a few of the biggest myths.

Myth 1: "My Life Insurance from Work is Plenty"

It's a fantastic perk to get life insurance through your job, but don't make the mistake of thinking it's enough. Most employer-provided plans are pretty basic, often just a flat amount or maybe one or two times your annual salary.

Think about it. Could one year's salary really pay off the mortgage, cover daily expenses for years to come, and maybe even put the kids through college? Almost certainly not. Plus, that coverage is tied to your job. If you switch companies or get laid off, that safety net disappears, often right when you're most financially vulnerable.

Myth 2: "Just Follow the 10x Your Income Rule"

You’ve probably heard this one before: just buy a policy that’s "seven to ten times your income." It sounds simple, but it's a dangerously oversimplified guess that doesn't know a thing about your life.

This kind of rule of thumb completely ignores the specifics that matter most—your mortgage balance, your car loans, credit card debt, and your unique goals, like saving for retirement or funding a college education. A much smarter approach is to use a needs-based calculation like the DIME method. That way, your life insurance face value is built on your family's actual numbers, not a generic formula.

A policy's face value should be a precise financial tool, not an estimate. Tailoring it to your family’s specific liabilities and future needs is the only way to guarantee true peace of mind.

Myth 3: "The Payout is Always Exactly the Face Value"

This is a critical one. Many people assume the number on the front of the policy—the face value—is the exact check their family will get. But that's not always the case.

The final payout, which is officially called the death benefit, can sometimes be smaller than the face value. This usually happens if you’ve tapped into the policy's value while you were alive.

Policy Loans: If you have a permanent life policy and borrow against its cash value, any amount you haven't paid back gets deducted from the final payout. For example, if you took a $50,000 loan against a $500,000 policy, your beneficiaries would receive $450,000.

Unpaid Premiums: It's also common for an insurer to subtract any overdue premium payments from the death benefit if you pass away during the policy's grace period.

Knowing how these things work is key. It ensures the financial safety net you're building for your family is as strong as you think it is and delivers the full support you intended.

The Growing Global Need for Financial Protection

Deciding to buy life insurance feels like a deeply personal choice, and it is. But it’s also part of a much bigger story playing out all over the world. More and more, families are realizing just how critical a strong financial safety net is, turning a private decision into a massive global trend. We're not just talking about individual policies here; we're seeing a collective shift toward building more financial stability and planning ahead.

So, what's behind this? A few powerful forces are at play. As financial literacy improves and economies develop, particularly in emerging markets, people are building wealth and looking for smart ways to protect it. They no longer see a substantial life insurance face value as just another bill, but as a crucial tool to shield their family’s hard-won prosperity from life's curveballs.

A Worldwide Embrace of Financial Security

The numbers tell a powerful story. In 2024, the global life insurance market hit an estimated value of $3.1 trillion. To put that in perspective, that’s a huge jump from $1.9 trillion back in 2017. That climb represents a compound annual growth rate of about 7.3%, showing just how much the demand for this kind of protection has skyrocketed. You can dig deeper into these numbers with in-depth market research on Feather-Insurance.com.

And this momentum isn't stopping anytime soon. Experts project the market will swell to an estimated $4 trillion by 2028. The United States remains a huge part of this, making up nearly 27% of all global life insurance premiums. The data makes one thing crystal clear: securing a financial future is a universal goal that doesn't care about borders.

Understanding this global context really drives home the wisdom in your own financial planning. When you choose an adequate life insurance face value, you're joining a worldwide movement that recognizes just how vital this is for building resilient families and communities.

Connecting Your Policy to a Bigger Picture

This massive global demand gets right to the heart of what life insurance is for—providing a measure of certainty in an uncertain world. It’s a practical way to ensure that all the progress you've made isn't erased by a single, tragic event. Think of your policy as your family's shield, keeping future goals like college tuition and mortgage payments on track, no matter what happens.

Of course, a policy is just one piece of the puzzle. Getting a handle on your complete financial picture, which includes thoughtful end-of-life planning, is key to being fully protected. Resources like Your Guide to End of Life Planning can offer some incredibly valuable perspective on this. By putting a good policy in place, you're doing more than just protecting your own; you're taking part in a global effort to build a more financially secure world, one family at a time.

Answering Your Top Insurance Questions

Even after you've picked the perfect life insurance face value, life happens, and new questions come up. Think of this as your go-to guide for those lingering "what if" scenarios. We'll make sure you feel confident about the protection you’ve put in place for your family.

Here, we'll give you clear, straightforward answers to the questions we hear all the time. This should help you feel more comfortable managing your policy for the long haul.

Can I Change the Face Value of My Life Insurance Policy?

Yes, you often can, but how you do it really depends on the kind of policy you have. It's not always a quick phone call, because any change affects how the insurance company views your risk.

If you have a term life policy, lowering your coverage is usually pretty simple. But if you want to increase the face value, you'll almost certainly need to go through a new application and medical exam. The insurer needs to make sure you're still in good health for the higher amount.

Permanent policies like whole life sometimes give you a bit more flexibility. Still, any increase will require proving your insurability and will definitely mean higher premiums. The best first step is always to pull out your policy documents or just call your insurance advisor.

Is the Life Insurance Face Value the Same as the Death Benefit?

That's a fantastic question, and one that trips a lot of people up. They’re very closely related, but not always identical. People often use the terms interchangeably, but in the insurance world, they have specific meanings.

The face value is the original benefit amount stated in your policy contract. The death benefit is the actual check your beneficiaries receive.

So, why would they be different? The death benefit is simply the face value minus anything you owe against the policy.

Policy Loans: If you borrowed from your policy’s cash value and haven't paid it back, that loan amount gets deducted.

Unpaid Premiums: Any premiums that were due will also be subtracted from the final payout.

In some rare cases, certain policy riders could actually make the death benefit larger than the original face value.

How Does Inflation Affect My Policy's Face Value?

Inflation is the silent killer of any long-term financial plan, and your life insurance policy is no different. A $500,000 face value might feel like a massive safety net today, but it will have a lot less buying power 20 or 30 years from now.

To fight back against this, some policies offer what's called a cost-of-living adjustment (COLA) rider. This handy feature automatically increases your face value over time, often tied to an inflation index, helping your coverage keep its value. It’s a really smart option to consider, especially if you’re buying a policy when you're young.

It's also wise to keep an eye on the bigger economic picture. While your life insurance payout is often tax-free, understanding potential inheritance tax implications is crucial for larger estates. Ensuring your policy's face value remains adequate is more important than ever.

At America First Financial, we believe in providing clear, dependable protection that aligns with your values. Secure your family’s future with a life insurance policy designed to provide peace of mind without the political noise. Get a free, no-hassle quote online in under three minutes and take the first step toward true financial security. Visit us today at https://www.americafirstfinancial.org.

_edited.png)

Comments