Compare Rates for Term Life Insurance – Find the Best Policy

- dustinjohnson5

- Aug 9, 2025

- 13 min read

So, you're ready to compare term life insurance rates. The best way to start is by figuring out how much coverage you actually need, gathering some basic personal details, and then plugging it all into a reliable online comparison tool. This lets you see quotes from multiple carriers side-by-side, making it much easier to find an affordable policy that truly fits your family's needs.

Your Guide to Comparing Term Life Insurance Rates

Jumping into the world of term life insurance is all about understanding what makes your rates tick. When you start comparing quotes, you're really just seeing how different insurance companies view your specific risk profile. You'll quickly notice that each insurer uses its own unique formula, which is why you can get wildly different prices for the exact same amount of coverage.

This guide will walk you through the entire process, from that initial research phase all the way to buying your policy. The idea isn't just to find the cheapest option, but to find a policy that gives you genuine peace of mind and real value.

Key Factors That Influence Your Term Life Insurance Rate

Before you even get a quote, it helps to know what the insurance companies are looking at. The variables below are the main drivers behind the final price you'll pay. Getting a handle on these will give you a major head start.

Here’s a quick breakdown of what matters most.

Factor | Why It Matters | Example Impact |

|---|---|---|

Age | It's a direct indicator of life expectancy. The younger you are when you apply, the lower your rates will be. | A healthy 30-year-old will pay a lot less than an equally healthy 50-year-old for the same policy. |

Health | Your complete medical background, from chronic conditions to your family's health history, determines your risk class. | If you're in great health with no major issues, you'll likely qualify for the best "Preferred" rates. |

Lifestyle | Things like high-risk hobbies (think skydiving) or smoking tell an insurer you're a bigger risk to cover. | A smoker should expect to pay 2-3 times more than a non-smoker for the very same coverage. |

Coverage Amount | This is the death benefit—the amount of money your beneficiaries receive. A bigger payout means a higher premium. | A $1 million policy will always cost more than a $250,000 policy for the same person. |

Knowing these factors helps put the quotes you receive into context. Historically, the price differences can be stark. For instance, a healthy 30-year-old non-smoking man in the U.S. might find a 20-year, $500,000 term policy for around $25 to $30 per month.

But age is a powerful factor. Premiums can easily double or even triple with each decade that passes. That same policy could cost somewhere between $100 to $150 per month if you wait until you're 50 to buy it. It's a perfect example of why locking in a rate sooner rather than later is a smart financial move.

Understanding the Factors That Drive Your Rates

When you start comparing term life insurance rates, you're essentially asking different companies to size up your risk level. Each quote you get is their final calculation, translating your personal details into a monthly premium. Getting a handle on what they're looking for is the key to understanding why your quotes look the way they do.

First and foremost, your age is a massive factor. Insurers live by actuarial data, and the numbers don't lie: the younger you are, the less of a risk you represent. It's a simple truth that locking in a policy in your 30s will always be significantly cheaper than waiting until your 50s.

Your health history is right up there in importance. Insurers will do a deep dive, looking at your current weight, blood pressure readings, any past surgeries or illnesses, and even your family's health history. If you've got a clean bill of health, you could land in the top-tier "Preferred" or "Super Preferred" categories, which come with the absolute best rates.

Lifestyle Choices and Occupation

Beyond the basics of your medical chart, your day-to-day habits have a huge say in the final price. Any lifestyle choice that an underwriter sees as risky is going to bump up your premium.

Here are a few of the big ones:

Tobacco Use: This is the most impactful lifestyle factor by a long shot. If you smoke or use other tobacco products, expect to pay two to three times more than a non-smoker for the identical policy.

High-Risk Hobbies: If your weekends are spent skydiving, rock climbing, or scuba diving, insurers will take notice. They see these activities as inherently dangerous and will often tack on a "flat extra"—a set dollar amount per thousand dollars of coverage—to your base premium.

Driving Record: A history of DUIs, multiple speeding tickets, or reckless driving sends up a major red flag. It suggests a comfort with risk, and your rates will reflect that.

Even your job can move the needle. A career that involves a higher degree of physical danger—like being a pilot, a roofer, or a police officer—is going to come with higher premiums to account for the on-the-job risks.

Key Insight: How you manage a health condition matters just as much as having one. For instance, an applicant with well-controlled diabetes might still get standard rates. But someone with the same diagnosis who ignores doctor's orders and has related complications will face sky-high premiums or might even be denied coverage altogether.

It’s a shame, but a lot of people assume term life insurance is too expensive and don't even bother getting a quote. The reality is often surprisingly different. In the United States, about 72% of consumers overestimate what a basic term life policy actually costs. You can explore more life insurance statistics to see just how wide the gap between perception and reality is.

This widespread misconception is exactly why you need to get a real quote instead of guessing. When you compare rates for term life insurance, you get a personalized, concrete number—and for many healthy adults, it's a number that's far more affordable than they ever imagined.

How to Use Online Tools to Compare Quotes Effectively

Let's be honest, the fastest way to compare rates for term life insurance is to jump on a digital quote tool. These platforms pull offers from a whole host of insurance carriers and lay them out for you in one spot. The screenshot above from the America First Financial quote tool shows how straightforward it is—just a few basic details like your state, gender, and birth date to kick things off. Using a tool like this can turn hours of mind-numbing research into a few minutes of productive work.

But here’s the thing: the results you get are only as good as the information you put in. To get a truly useful comparison, you need to be consistent and completely honest about everything from your health to your family's medical history. Think of that first number you see as a ballpark estimate. Your final premium isn't set in stone until after underwriting, where the insurer double-checks every detail.

Getting the Most from Comparison Platforms

You’ll quickly find that not all quote tools are the same. A good one does more than just spit out prices; it gives you the full picture. It should be transparent, showing you quotes from a wide range of providers, not just a handful they’re partnered with. This is the only way to get a real feel for what the market is offering for someone in your situation.

The best platforms also act as an educational resource. They'll have guides or pop-up tips explaining policy features, riders, and the all-important financial strength ratings of the insurance companies.

Crucial Tip: Treat the initial quotes as a starting point, not a final offer. Your rate is not locked in until underwriting is complete. Any inconsistencies between what you stated on your application and what the insurer uncovers will absolutely change your premium.

For instance, if you apply as a non-smoker but your medical exam shows nicotine use, expect your rate to jump significantly. Being upfront saves everyone time and avoids nasty surprises down the road. A quality tool empowers you to make a smart decision, not just a quick one.

Interpreting Your Quote Results

When your quotes pop up on the screen, resist the urge to immediately zero in on the lowest number. The cheapest policy is rarely the best policy for your actual needs.

Here’s a better way to break down your results:

Check the Carrier's Financial Strength: First things first, look for the company's rating from an agency like A.M. Best. You want to see a high rating (A, A+, or A++), which signals that the company has a rock-solid ability to pay claims. That’s the whole point, right?

Review Included Features: Does the policy have a conversion option? This is a huge benefit, as it lets you convert your term coverage to a permanent policy later on, no new medical exam required.

Consider Available Riders: Riders are optional add-ons that can make a world of difference. An accelerated death benefit rider, for example, pays out a portion of your benefit early if you're diagnosed with a terminal illness. A waiver of premium rider can be a lifesaver, covering your payments if you become totally disabled and can't work.

By looking past the price tag, you're not just buying a policy—you're choosing the right protection that truly aligns with your family’s long-term financial security.

A Practical Comparison of Top Insurance Providers

Once you understand what drives your personal insurance costs, it's time to look past the price tag. The cheapest policy is rarely the best one. When you genuinely compare rates for term life insurance, you need to evaluate what each provider really offers, from their financial stability to the fine print in their policies.

The lowest monthly payment might seem like a win, but it could be attached to a company with a shaky future or a policy that’s missing features you’ll wish you had later on. That’s why a side-by-side comparison of the top players is so critical. We’ll look at a few key criteria to help you find the right match for your situation.

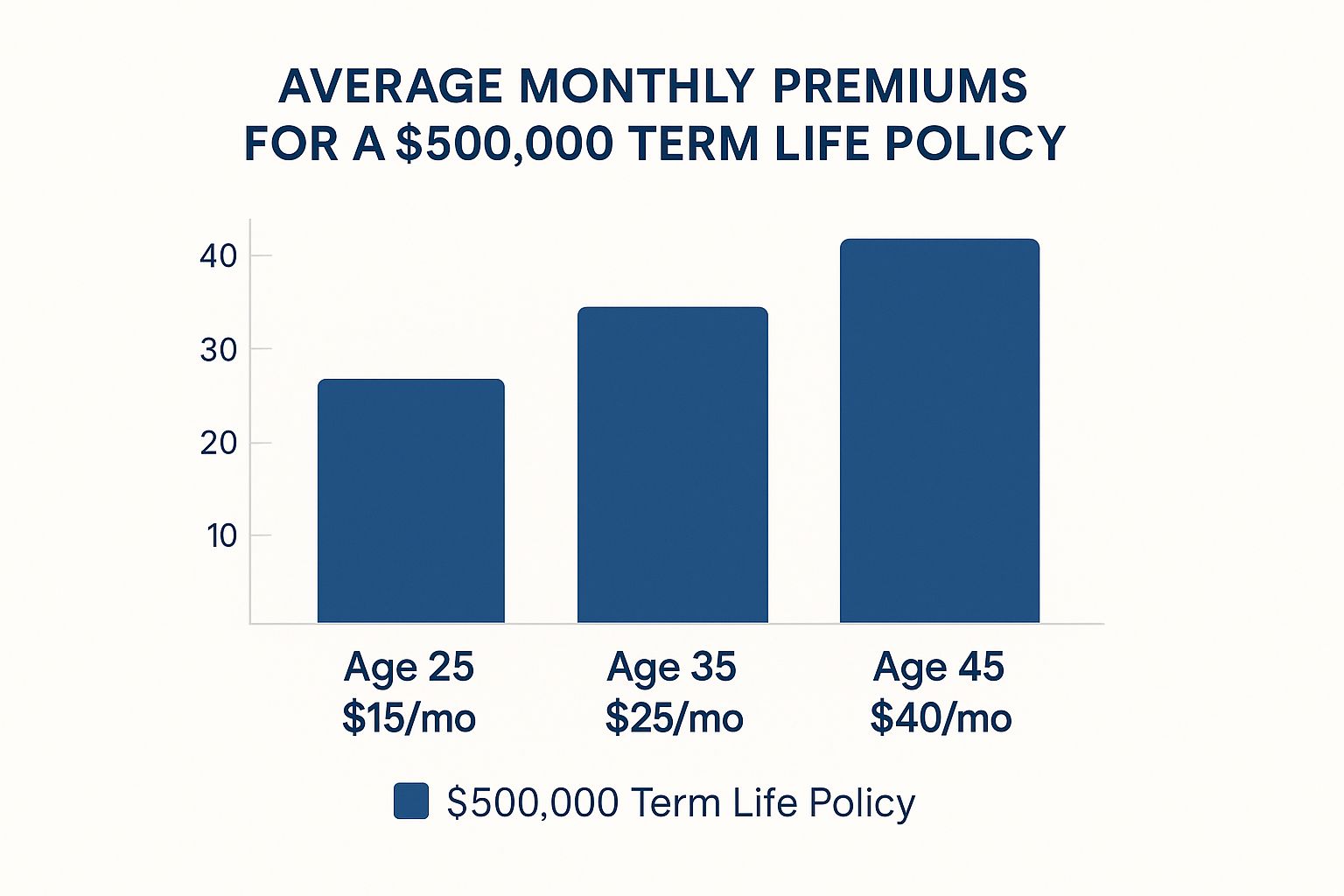

This chart shows just how dramatically age can affect the average monthly premium for a standard $500,000 term policy.

As you can see, the data doesn't lie. Locking in a rate when you're young provides some serious long-term savings.

Evaluating Insurers Beyond Price

A low rate is tempting, but a life insurance policy is a promise—one that may not be called upon for decades. That promise is only as strong as the company's ability to pay the claim. This is where financial strength ratings become an absolute must-check.

You should always look for providers with high marks from independent rating agencies like A.M. Best. A rating of A++ or A+ signals a "Superior" ability to meet their financial obligations, giving you peace of mind that the company will be there for your family when it counts.

Situational Recommendation: If you're young and in good health, you'll likely have your pick of top-rated insurers fighting for your business. But if you have a pre-existing health condition, you might find that one A-rated carrier offers significantly better rates than another. This makes it crucial to balance a company's financial strength with its underwriting specialties.

Side-by-Side Comparison of Leading Term Life Insurers

Now, let's break down how some of the leading insurers stack up based on the metrics that actually matter. This isn't just about the monthly premium; it's a clearer picture of what you’re really buying.

Provider | Financial Strength (A.M. Best) | Key Policy Feature | Ideal For |

|---|---|---|---|

Provider A | A++ (Superior) | Generous Term Conversion Options | Individuals who want the flexibility to switch to a permanent policy in the future without a new medical exam. |

Provider B | A+ (Superior) | No-Exam Policies Up to $2M | Healthy applicants under 50 who prioritize a fast and simple application process without a medical exam. |

Provider C | A (Excellent) | Competitive Rates for Smokers | Tobacco users or individuals with specific, well-managed health conditions who may find better rates here. |

This kind of structured comparison helps you line up a provider's strengths with your own needs. For instance, if you think you might want permanent coverage someday, Provider A’s strong conversion privilege is a huge plus, even if its initial premium is a few dollars more.

On a global scale, the term life insurance market is healthy, with steady growth expected right here in the U.S. That stability is great news for consumers. In fact, the industry's profitability is projected to improve, with return on equity forecasted to hit about 10.7% globally in 2025. This financial health supports competitive pricing and encourages companies to keep innovating. For a deeper dive, you can review the complete global insurance market outlook.

Choosing a Policy for Your Real-World Needs

Comparing rates is an excellent first step, but the numbers on your screen only tell part of the story. A great policy isn't just about a low price; it's about solving a real-world problem. It's the policy that protects your new mortgage or secures your family's future when they need it most.

To bridge that gap between a quote and a policy you can count on, let's walk through a few common scenarios. Think of these as blueprints you can adapt to your own life, helping you weigh cost against the features that truly matter.

The Young Family with a New Mortgage

Let’s start with the Jacksons. They're a couple in their early 30s with a new baby and a brand-new 30-year mortgage. Their number one goal is income replacement. If one of them were to pass away, the other would be left juggling the mortgage, childcare expenses, and saving for college on a single income.

For them, a 30-year term policy is a near-perfect fit. The term length mirrors their biggest financial obligation—the mortgage. Because they’re young and healthy, they can lock in an affordable rate for a substantial death benefit, like $1,000,000. Their focus should be simple: get the most coverage for the lowest premium from an insurer with a high financial strength rating (A or better).

The Single Parent Prioritizing Affordability

Now, picture Maria, a single mom in her late 30s. Her child relies completely on her income, but her budget is tight. For Maria, affordability isn't just a preference; it's the most critical factor. She needs a policy that won’t strain her monthly finances.

A 20-year term is a smart move here. It would protect her child through high school and well into their college years. While a $500,000 policy would be great, a $250,000 policy that she can comfortably afford is infinitely better than no coverage at all. Maria should run quotes for a few different coverage amounts to find that sweet spot where price and protection align.

Situational Insight: The best strategy for someone in Maria’s position is to get a foundational policy in place now. As her income increases over the years, she can always layer on smaller, supplemental policies to boost her overall coverage.

The Business Owner Securing a Loan

Meet David, a 45-year-old small business owner. He's in the process of getting a Small Business Administration (SBA) loan, and the lender requires him to have life insurance as collateral. It's a common requirement to ensure the loan gets repaid even if he dies unexpectedly.

David's needs are highly specific. He needs a policy where the death benefit matches the loan amount, and the term is at least as long as the loan's repayment schedule. This is known as a collateral assignment. For him, the deciding factor might be finding an insurer known for a fast, hassle-free application process to avoid holding up his loan.

The Individual with a Managed Health Condition

Finally, let's look at Sarah. She’s 50 and has high blood pressure, but it's well-managed with medication. She’s worried this condition will make insurance unaffordable or even disqualify her.

For Sarah, the crucial step is to find insurers who look favorably upon her specific condition. Not all carriers view controlled hypertension the same way. By using a robust comparison tool or working with an independent agent, she can pinpoint the company most likely to offer her a "Standard" rate instead of a much pricier "Substandard" one. Honesty and providing detailed medical records during her application will be her best assets.

As you think about how a term life policy fits into your financial picture, it's also wise to seek out general financial planning advice. This helps ensure your insurance choices work in harmony with your broader retirement and investment goals.

Finalizing Your Decision and Applying with Confidence

You’ve done the hard part. You've compared rates, looked at different providers, and now it's time to take that final step and lock in your policy. All that research gives you the confidence to know you're making a solid choice for your family's future. The application is simply the last bridge to cross before your coverage is active.

First things first, get your documents in order. You'll need some basic identification, your doctor's contact information, and a clear picture of your medical history. Having this ready to go from the start makes the whole process smoother and helps avoid any annoying back-and-forth.

Preparing for Underwriting

After you submit your application, it moves into what the industry calls underwriting. This is just the insurance company's formal process for double-checking everything and making sure the risk they're taking on matches what you've told them. For most people, this involves a quick medical exam, which a technician can usually do right at your home or office—super convenient.

So, what happens during the exam? It's pretty straightforward:

They'll check your height, weight, and blood pressure.

They'll take small blood and urine samples.

You'll answer some questions about your lifestyle and health habits.

Honesty is absolutely critical here. If the exam results don't line up with what you put on your application, it can cause problems. You might face higher premiums than you were quoted, or in a worst-case scenario, the company could deny your application altogether.

Key Takeaway: Underwriting is all about confirming the details. When your application and your medical exam tell the same story, the process is seamless, and you end up with a fair and accurate rate.

Once underwriting is complete, you'll get the official policy paperwork. Before you sign anything, read through it carefully. I mean it—every single page. Make sure the coverage amount, term length, premium, and named beneficiaries are exactly what you agreed to. After you sign and make that first payment, your policy is officially active. You can finally breathe easy, knowing you've made a well-researched decision to protect the people who matter most.

As you dive into comparing term life insurance rates, you'll probably find a few questions keep coming up. Getting these sorted out can take a lot of the guesswork and stress out of the process.

Let's tackle some of the most common ones.

How Often Should I Re-Shop My Insurance Rates?

This is a great question. Once you lock in a term life policy, your rate is set for the entire term—that’s one of the best things about it. You won't have to shop around again for that specific policy.

However, your life will change. You should absolutely take a fresh look at your overall coverage needs after big milestones. Think getting married, buying a new house, or welcoming a baby. These are the moments when you need to ask, "Is my current death benefit still enough to truly protect my family?" If not, it's time to shop for a new or additional policy.

Will Getting a Bunch of Quotes Hurt My Credit Score?

Nope, not at all. This is a common myth that holds people back, but you can rest easy.

When an insurance carrier pulls your information for a quote, they're doing a "soft inquiry." This is completely different from the "hard inquiry" that happens when you apply for a mortgage or a new credit card. Soft pulls are invisible to lenders and have zero impact on your credit score.

Key Insight: Don't let fear of a credit score hit stop you from shopping around. Comparing quotes from multiple insurers is the single most effective way to find the most competitive rate. Go ahead and compare freely.

My Health Got Better. Can I Get a Lower Rate?

Yes, you often can! If your health or lifestyle has seen a major upgrade since you first bought your policy, you're not necessarily stuck with that original rate.

Many insurers have a process called reconsideration. Let's say you've lost a significant amount of weight and kept it off, or you finally quit smoking for more than a year. You can ask your insurer to re-evaluate your health class. If they approve the change, you could end up with a lower premium for the rest of your term. It’s always worth asking.

At America First Financial, our goal is to give you clear answers and simple, affordable protection for the people you care about most. You can get a no-obligation quote in just a few minutes and see how we can help you build a secure financial future. Find your rate at America First Financial.

_edited.png)

Comments