Converting Term Life to Whole Life Insurance Explained

- dustinjohnson5

- Aug 26, 2025

- 13 min read

Switching your term life insurance to a whole life policy is a big financial decision, but it's one you can usually make without needing a new medical exam. This feature, often called a conversion privilege, lets you trade your temporary coverage for a permanent policy that builds cash value. The trade-off? A much higher premium.

Why Bother Converting Term Life to Whole Life?

Most people start with term life insurance for a simple reason: it's affordable and straightforward. It covers you for a specific term, say 20 or 30 years, which is perfect when you're raising a family, paying off a mortgage, and have a tight budget.

But life doesn't stand still. The financial plan that made sense for a 30-year-old just starting out might look completely different for a 55-year-old eyeing retirement. The reasons for converting are almost always personal, driven by a shift in financial goals or life circumstances.

It's a well-trodden path for those who opted for budget-friendly term coverage early on but now want the stability and savings component of a whole life policy. With the global term life insurance market expected to reach $2.4 trillion by 2032, having the flexibility to convert is more important than ever. It's what allows people to lock in permanent coverage without having to prove their health all over again. You can dig into these market trends over at Allied Market Research.

You Want Coverage That Lasts a Lifetime

One of the biggest motivations is simply the desire for a death benefit that never expires. As the end of a term policy gets closer, the thought of losing that safety net can be nerve-wracking. Converting ensures your beneficiaries get a payout no matter when you pass away. That’s a level of peace of mind a temporary policy just can't offer.

Your Health Has Changed

This is a huge one. Maybe you've developed a chronic health condition since you first bought your policy. Trying to qualify for a new insurance policy now could be incredibly difficult—or flat-out unaffordable. This is where the conversion privilege really shines.

Your conversion privilege lets you lock in permanent coverage based on the health rating you had when you first bought the policy. You get to skip a new medical exam, effectively securing your insurability before it becomes a problem.

You Want to Build a Financial Asset

Beyond just a death benefit, many people look to whole life insurance as another tool in their financial toolkit. The policy builds up a cash value on a tax-deferred basis, which you can later tap into through loans or withdrawals to supplement your retirement income. It effectively becomes another asset in your portfolio.

Let's look at a few real-world examples of when a conversion makes a ton of sense:

You Need to Plan Your Estate: If you've built up a sizable estate, a whole life policy can provide the ready cash your heirs will need to pay estate taxes without being forced to sell off assets like a family home or business.

You Have a Lifelong Dependent: For parents of a child with special needs, a permanent policy is often used to fund a special needs trust, guaranteeing that funds will be there to provide care for their child's entire life.

You're on Firmer Financial Ground: Maybe your income has jumped significantly since you first got your term policy. The higher premiums of a whole life policy might have been out of reach then, but now they fit comfortably within your budget and align with your long-term financial strategy.

Understanding The Financial Shift In Premiums And Value

Let’s be direct: the first thing you’ll notice when you convert from term to whole life insurance is the sticker shock. Your premiums are going to go up. A lot. But it's crucial to understand why. This isn't just an arbitrary price increase; it’s a complete change in what your policy is and what it does for you.

You're shifting from a straightforward, temporary safety net to a permanent, multi-faceted financial tool.

Think about it like renting versus buying a house. Your term policy was like an affordable lease—it gave you the protection you needed for a specific period. Converting to a whole life policy is like buying the home. The monthly payments are much higher, but you're no longer just paying for shelter. You're building equity. In the world of life insurance, that equity is called cash value.

This cash value component is a game-changer. It’s a living benefit, where a portion of every premium you pay goes into a savings-like account. This account grows at a guaranteed rate, tax-deferred, and becomes a financial asset you can access later in life. It's this powerful combination—lifelong protection plus wealth accumulation—that drives the higher cost.

Breaking Down The Premium Difference

To really grasp the financial commitment, it helps to look at some real-world numbers. Let's take the example of a healthy, 35-year-old non-smoker who wants a $500,000 policy.

A standard 20-year term policy for this person might run about $360 a year. Now, for a whole life policy with the same $500,000 death benefit, the annual premium could jump to around $7,045. That's a significant leap—we're talking more than 19 times the cost of the term policy.

This higher premium doesn't just vanish. It’s actively working for you, funding both the permanent death benefit and the policy’s growing cash value. It's an investment in a permanent asset.

Term vs Whole Life At A Glance For a $500,000 Policy

This table really puts the differences side-by-side, showing exactly what you're paying for when you make the switch. It's a classic case of cost versus features.

Feature | Term Life (20-Year) | Whole Life (Permanent) |

|---|---|---|

Primary Goal | Provides affordable coverage for a fixed period. | Offers lifelong protection and builds cash value. |

Premium Cost | Lower, fixed for the term. | Significantly higher, but fixed for life. |

Cash Value | None. It's pure insurance protection. | Yes, grows at a guaranteed rate, tax-deferred. |

Policy Duration | Expires after the term (e.g., 20 years). | Lasts your entire lifetime. |

As you can see, the trade-off is clear: low-cost, temporary coverage versus a higher-cost, permanent asset with living benefits.

Thinking ahead is key. You need to consider how this policy will ultimately be used. For instance, some people specifically earmark their policy as life insurance coverage for final expenses, and knowing this helps ensure the plan you choose will truly meet that need down the road.

The Concept Of The Break-Even Point

When discussing whole life, you'll inevitably hear the term "break-even point." This is a critical milestone. It’s the moment when the policy's cash value has grown to equal the total amount of premiums you've paid in.

Reaching this point isn't a quick process. You need to be patient. It often takes 10 to 15 years, and sometimes longer, depending on the specific policy details and the insurance company.

Converting to whole life is a long-term play, not a get-rich-quick scheme. The high costs in the early years are an investment in future value, security, and financial flexibility. It demands a long-range perspective.

Before you hit that break-even point, if you were to surrender the policy, you’d get back less than you put in. But once you cross that threshold, your policy essentially becomes a self-sustaining asset. From that point on, it continues to grow in value beyond your own contributions. Understanding this timeline is absolutely essential for setting realistic expectations and committing to the strategy.

How to Navigate the Conversion Process

So, you're ready to make the switch from temporary coverage to a lifelong asset. The good news is that converting your term policy to a whole life policy is usually more straightforward than people think. It’s less about jumping through hoops and more about following a clear, methodical path to upgrade your financial protection.

Start with Your Current Policy

First things first: find your original term life insurance documents. Somewhere in that fine print, you’ll find a clause called the conversion privilege or conversion option. This little section is your road map. It tells you everything you need to know about your right to convert.

Pay close attention to the deadline. It's often tied to a specific age, like 65 or 70, or a certain number of years into your policy term. I can't stress this enough: missing this window is one of the most common and costly mistakes people make. Pinpointing your deadline is priority number one.

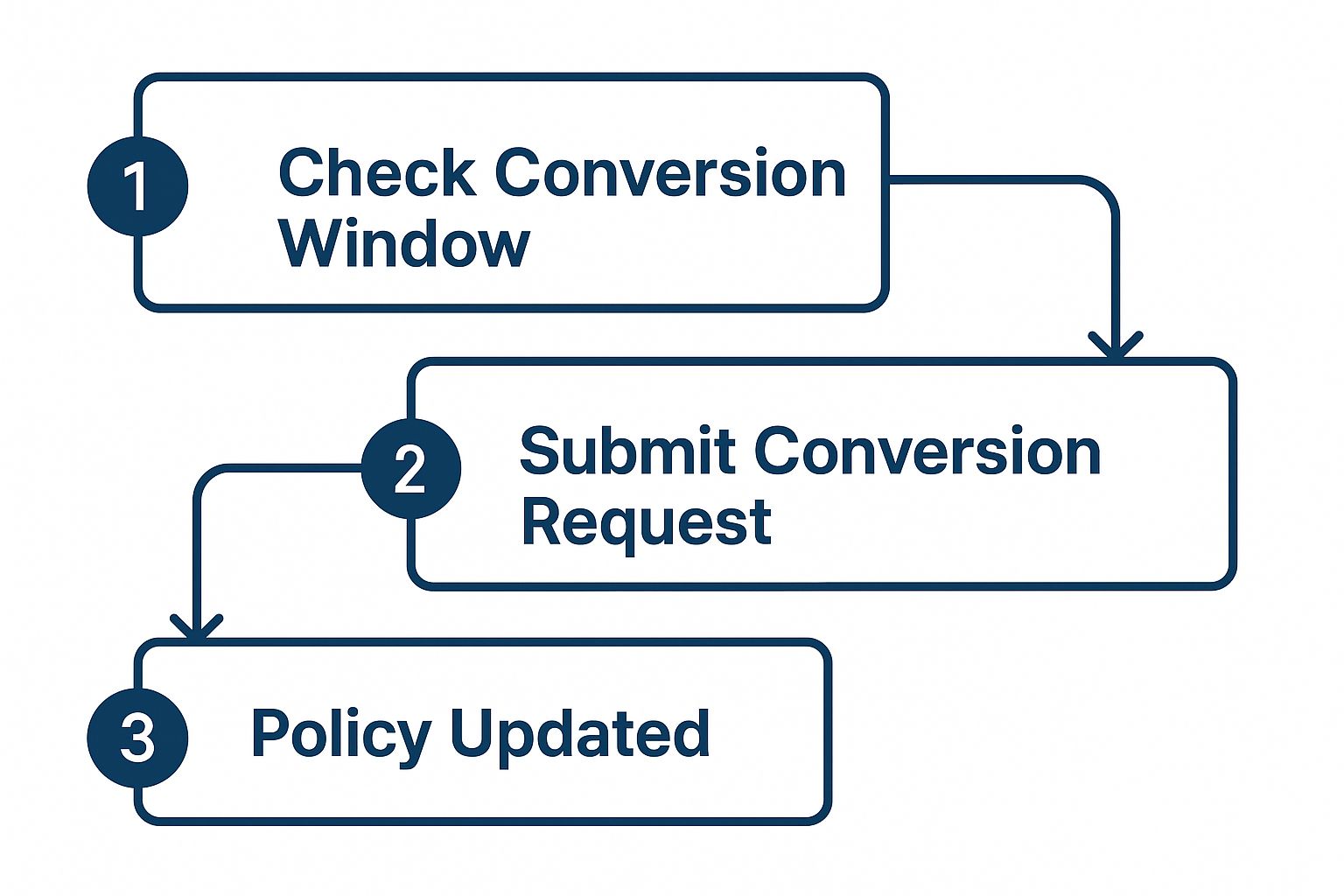

This visual breaks down the typical three-phase flow of a conversion.

As you can see, the journey from term to whole life follows a logical sequence, starting with confirming you're eligible and ending with the new policy in hand.

Talk to Your Insurer

Once you've confirmed you’re within the conversion window, it’s time to get on the phone with your insurance agent or the carrier directly. Think of this as a fact-finding mission, not a high-pressure sales call. You're in the driver's seat.

Your goal here is simple: gather the information you need to make a smart decision. Kick things off by clearly stating, "I'm interested in exercising the conversion privilege on my term life policy, number [your policy number]."

From there, have a few key questions ready:

What permanent policy options can I convert to (e.g., whole life, universal life)?

Could you please provide a policy illustration for a whole life policy with the same death benefit?

Is it possible to do a partial conversion, and if so, what would that look like?

What are the next steps and what paperwork is involved?

This initial conversation sets the tone for the entire process. Walking in prepared with these questions ensures you get the specific details you need to move forward confidently.

The best part about using your conversion privilege? No new medical exam. Your new premium will be based on your current age, but your health rating is locked in from when you first bought the policy. This is a huge advantage if your health has changed.

Review the New Policy Illustration

After that call, the insurer will send over a policy illustration. This is a critical document. It’s a detailed, year-by-year projection of how your new whole life policy is expected to perform. While it's not a contract, it’s your most important tool for making this decision.

The illustration will show you two main components: the guaranteed cash value and the projected death benefit. The guaranteed column is your worst-case scenario—the absolute minimum values your policy will have. You'll also see non-guaranteed columns that project higher values based on potential dividends (if it's a participating policy).

When you're looking this over, think long-term. See what the cash value is projected to be in 10, 20, and 30 years. Also, look for the "break-even" point—the year your cash value is forecast to equal the total premiums you’ve paid in. This helps you grasp the policy's real value as a long-term asset.

Complete the Paperwork

If the numbers in the illustration align with your budget and financial goals, the final step is the paperwork. This part is mostly administrative. You won’t be answering invasive health questions or digging up medical records.

Typically, you just need to sign a conversion application and arrange the payment method for your new, higher premium. It’s a simple process, but you'll want to be meticulous. Double-check all the details before you sign.

Once you submit everything and the insurer processes your request, they will issue your new whole life policy. Just like that, your conversion is complete.

Key Questions to Ask Before You Convert

Switching from term to whole life insurance isn't just a minor tweak to your paperwork; it's a significant financial shift. Before you dive in, you need to take a hard look at whether this move truly fits your long-term plan and, just as importantly, your budget. The higher premiums aren't temporary—they're a lifelong commitment, and you have to be absolutely sure you can handle them without putting a strain on everything else.

The first question is always the most direct: can I comfortably afford this for the next 30, 40, or even 50 years?

If you find yourself hesitating, don't sweat it. That doesn't mean the idea is off the table. This is exactly where a partial conversion comes into play, and it’s a strategy I’ve seen work beautifully for many clients.

Let's say you have a $750,000 term policy. Converting the whole thing might be a budget-buster. Instead, you could convert just $250,000 to whole life and keep the remaining $500,000 as term. This hybrid approach secures a permanent, cash-value-building policy while keeping your total premium payments from getting out of control.

Does This Move Match Your Financial Goals?

Next, you have to get crystal clear on why you’re doing this. Are you just trying to guarantee a death benefit for your family, no matter when you pass away? Or are you looking for a financial tool that can help you build wealth and plan your estate? Your answer changes everything.

If you just need a death benefit: Sticking with your term policy, or maybe shopping for a simple permanent policy like guaranteed universal life, could be a much more affordable route.

If you want a tax-advantaged asset: This is where whole life shines. Its cash value growth can become a powerful resource for supplementing your retirement income or creating a pool of money to handle estate taxes.

Thinking through your "why" is the most critical part of this. Are you patching a short-term hole or laying a permanent piece of your financial foundation? That answer will point you to the right product.

Remember, this decision doesn't happen in a vacuum. The money you put toward higher whole life premiums is money you can't put into other investments, like stocks, bonds, or real estate. You have to weigh the slow-and-steady, guaranteed growth of a policy’s cash value against the higher potential (but unguaranteed) returns you might get somewhere else.

Could a Brand-New Policy Be a Better Deal?

Finally, don’t get tunnel vision and assume converting your existing policy is the only option. If you're still in great health, it pays to see what's out there.

You'd have to go through the underwriting process again, but you might be surprised. It's entirely possible you could find a brand-new permanent policy with a better rate or more modern features that are a better fit for where you are in life today.

Research actually shows that a blended approach can be incredibly effective. A 2025 study found that households holding both term and permanent life insurance were 5.58 times more likely to feel financially secure after the loss of a primary breadwinner than families with no coverage at all. You can dive into the details on Ohio State University's news site. This just goes to show how a smart combination, like a partial conversion, can build a much stronger financial safety net.

Common Conversion Mistakes and How to Avoid Them

By far, the biggest mistake is procrastination. People wait too long. Every convertible term policy has a built-in deadline, a firm conversion window, and if you miss it, that ship has sailed for good. The option to convert simply vanishes. This usually happens when life gets busy, the decision gets pushed to the back burner, and by the time you're ready to act, the opportunity is long gone.

Not Really Getting the New Policy

Another pitfall is jumping into the new whole life policy without truly understanding it. You can't just think of it as your old policy with a higher price tag; it’s a completely different kind of financial tool. Many people don't dig into the details of how the cash value actually accumulates or what the real-world implications of taking out a policy loan are.

This lack of clarity can lead to some major disappointment later on. You might assume your cash value will soar, only to find it's chugging along at the minimum guaranteed rate. Or you might get hit with surprise interest charges when you borrow against your policy, not realizing how that worked.

Your policy illustration is the most important document you'll see. Don't just give it a quick scan—pore over it. Make sure you understand the gap between the "guaranteed" numbers and the "non-guaranteed" projections. Have your agent explain the year-by-year breakdown until it makes perfect sense.

Biting Off More Than You Can Chew

It’s natural to want to convert the full amount of your term policy, but this can be a fast track to financial trouble. Someone with a $1 million term policy will likely get sticker shock when they see the premium for a $1 million whole life policy. It’s often just not a realistic or sustainable number for most household budgets.

Locking yourself into a premium you can't comfortably handle is a huge gamble. If you start missing payments, your policy could lapse. That means you'd lose your coverage entirely and could forfeit all the money you’ve already paid in. A partial conversion is often a much savvier move.

Here’s how you can steer clear of these common blunders:

Know Your Deadline: The first thing you should do is find the conversion expiration date in your policy documents. Circle it, put it in your digital calendar, and set a reminder.

Study the Illustration: Don't be shy about this. Demand a detailed policy illustration and ask your agent to walk you through it line by line until you’re confident you understand it.

Be Honest About Your Budget: Think beyond today. Can you truly afford this new premium five, ten, or even twenty years from now? Plan for the long haul.

Explore a Partial Conversion: Ask about converting just a piece of your term coverage. This lets you secure some permanent life insurance without completely upending your budget.

Common Questions About Converting Your Life Insurance

When people start looking into converting their term life policy, a few key questions always come up. Let's get right into the answers you're probably looking for.

Do I Have to Go Through Another Medical Exam?

This is the number one question I get, and the answer is almost always a resounding no. The biggest perk of a conversion privilege is that you get to skip the medical exam entirely.

Your new whole life policy is issued based on the health rating you locked in when you first bought your term policy. Think about that for a moment. It's a huge benefit, especially if your health has changed over the years. You get to keep your original, potentially better, health classification without having to go through new bloodwork or physicals. It’s what makes converting term life to whole life such a powerful move.

Are My Premiums Going to Go Up?

Yes, they will, and it’s usually a significant jump. You're not just getting a small adjustment; you're fundamentally switching from a temporary product to a permanent one. Your new, higher premium covers two things: a death benefit that lasts your entire life and a cash value account that grows over time.

It's important to know that your new premium is calculated based on your age at the time you convert, not your age when you first bought the term policy. That's a big reason why waiting until the very end of your conversion period isn't always the best financial strategy.

The good news? Once your new whole life premium is set, it's fixed. It will never increase for the rest of your life, giving you predictability and permanence in your financial plan.

What if I Can’t Afford to Convert the Whole Policy?

That's a very common scenario, and you absolutely have options. It’s called a partial conversion, and it’s a smart strategy many people use. You don’t have to convert the entire death benefit of your term policy all at once.

For example, if you have a $500,000 term policy but the premiums for a $150,000 whole life policy fit your budget better, you can do exactly that. Most insurance companies are flexible and will let you secure a smaller permanent policy while keeping the rest of your coverage as term. This creates a great hybrid approach, blending lifelong security with what you can comfortably afford.

At America First Financial, we believe in clear, straightforward insurance solutions that protect your family and your future. If you're ready to explore your options without any political spin, get a simple, no-hassle quote from us today. Find the right plan for your needs at https://www.americafirstfinancial.org.

_edited.png)

Comments