Create Generational Wealth: Your Family's Legacy Blueprint

- dustinjohnson5

- Jun 24, 2025

- 17 min read

Understanding the Generational Wealth Mindset

Before we get into the nitty-gritty of investment accounts and estate plans, let's talk about something more fundamental: the generational wealth mindset. This isn't about pulling in a seven-figure salary or getting a lucky inheritance. It's a deep shift in how you see money, time, and your family's future. It’s the difference between earning a living and building a legacy.

Most of us are conditioned to think about our own careers, saving for retirement, and maybe leaving a small inheritance for our kids. That's a solid starting point, but it's not true generational thinking. The generational wealth mindset looks beyond your own life. It forces you to ask, "How can the choices I make today open doors for my grandchildren and their children?" It's about planting financial trees whose shade you might never enjoy yourself.

This long-term view changes everything. Instead of just saving money, you start to focus on acquiring assets—things that can grow and make money on their own, like a family business, rental properties, or a well-managed stock portfolio.

From High Earner to Wealth Builder

It’s a huge misunderstanding that high earners automatically become wealthy. You can make an incredible salary but have very little to show for it if your lifestyle costs keep rising with every pay bump. On the other hand, wealth builders, even those with more modest incomes, know that the secret isn't just what you make, but what you keep and—more importantly—what you grow.

Let's imagine a real-world scenario with two neighbors, both earning $150,000 a year.

Family A is focused on looking wealthy. They buy a bigger house than they need, lease new cars every few years, and go on flashy vacations. They contribute to their retirement accounts, but most of their income is eaten up by their lifestyle.

Family B lives comfortably but well within their means. They invest the difference between their income and expenses aggressively. They bought a modest home and are focused on paying it off early. Instead of a new car payment, they put that money into a low-cost index fund each month.

Twenty years down the road, Family A has a nice house with a mortgage and a decent retirement fund. Family B has the same, but they also have a multi-million-dollar investment portfolio that's now spinning off significant passive income. That portfolio is the foundation of their family’s legacy.

The Power of a Global Perspective

This focus on long-term growth isn't just a personal strategy; it's happening on a global scale. The conditions for building wealth are always changing, shaped by economic forces around the world. To give you some context, recent data shows that global personal wealth grew by 4.6% in 2024, picking up speed from the previous year. Even more impressive, since the year 2000, net worth has climbed at an annualized rate of about 3.4% after factoring in inflation and debt.

Understanding these broader trends helps you see where the opportunities are. Take a look at this table to see how wealth growth varies by region and what that might mean for your own strategy.

Region | 2024 Growth Rate | Key Drivers | Generational Wealth Potential |

|---|---|---|---|

North America | 5.5% | Strong equity markets, tech sector growth | High potential through stock market investments and entrepreneurship. |

Europe | 3.8% | Real estate appreciation, stable economies | Strong, especially through property ownership and diversified portfolios. |

Asia-Pacific | 4.2% | Rising middle class, technological innovation | Rapidly growing; offers opportunities in emerging markets and tech. |

Latin America | 2.1% | Commodity prices, economic reforms | More volatile but offers high-growth potential for savvy investors. |

Africa | 2.9% | Natural resources, infrastructure development | Emerging potential; long-term plays in resources and development. |

Regional comparison of wealth growth rates and their implications for generational wealth building |

This table shows that while North America is leading the charge, growth is happening everywhere. These numbers highlight the importance of starting early, no matter how small. The sooner your money is invested in assets, the more time it has to compound and ride these global economic waves. You can explore these findings in more detail by reading this global wealth trends report from UBS.

Ultimately, the goal is to build a financial engine that works for your family, around the clock, for generations. This mindset is the true starting line for anyone serious about creating lasting wealth.

Strategic Investment Approaches That Actually Work

Having the right mindset is a great start, but a powerful investment engine is what truly drives the mission to build wealth for generations. This is where we go beyond the simple advice of "save more than you spend" and dig into the specific strategies successful families use to make their money work for them, year after year. It's less about chasing hot stocks and more about a disciplined, strategic approach to your assets.

Portfolios built to last are designed for both resilience and growth, balancing different asset types so they can perform well no matter what the economy is doing. This isn’t just about owning some stocks and bonds; it's about understanding how different assets behave and combining them to create a stable foundation. We're seeing real opportunities for those who are properly positioned. For instance, in 2024, the number of people worldwide with wealth over $10 million grew by 4.4%, with North America seeing a 5.2% jump. This growth came from strong returns in equities and attractive yields on cash holdings, proving that a well-allocated portfolio can thrive. You can find more details in Knight Frank's 2025 Wealth Report.

Building Your Investment Foundation

The goal is to own a collection of assets that consistently beats inflation, ensuring your family's buying power actually grows over time. While every family's needs are different, a solid foundation usually includes a mix of these core components:

Broad-Market Index Funds: Think of these as the workhorses of your portfolio. By owning a low-cost fund that tracks an entire market index, like the S&P 500, you get instant diversification. You're essentially betting on the long-term growth of the economy without having to pick individual winners.

Real Estate: Whether it's owning rental properties directly or investing in Real Estate Investment Trusts (REITs), property offers a potent mix of cash flow, appreciation, and significant tax benefits. It’s also a fantastic shield against inflation.

Dividend-Paying Stocks: Companies with a long track record of paying and increasing their dividends provide a reliable income stream. Reinvesting these dividends is a key ingredient for compounding, creating a snowball effect that can dramatically expand your wealth over the decades.

Growth-Oriented Assets: Stability is crucial, but you also need assets with the potential for higher returns to really move the needle. This might include investments in small-cap stocks, emerging markets, or even private equity, depending on your risk tolerance and how long you plan to invest.

The secret isn't just owning these assets, but maintaining discipline. Reinvesting all dividends and capital gains is absolutely essential—it's the fuel that supercharges compounding. Just as important is staying invested during market downturns. This is what separates successful investors from everyone else. When others are panicking and selling, that's often the prime opportunity to buy quality assets at a discount.

Unlocking Tax-Advantaged Growth

One of the biggest missed opportunities I see is people underusing tax-advantaged accounts. The government provides these powerful tools to encourage saving and investing, and they are critical for building wealth over the long haul.

Account Type | Key Tax Benefit | Best For |

|---|---|---|

401(k)/403(b) | Tax-deferred growth; employer match | Maximizing employer contributions and automating retirement savings. |

Roth IRA | Tax-free growth and withdrawals | Building a pot of tax-free income for retirement, which is incredibly powerful for younger investors. |

HSA (Health Savings Account) | Tax-free contributions, growth, and withdrawals for medical expenses | Creating a "triple tax-advantaged" fund for healthcare costs, which can double as a supplemental retirement account. |

529 Plan | Tax-free growth for education expenses | Funding future education costs for children or grandchildren. Recent rule changes also allow rollovers to a Roth IRA. |

Let me give you a real-world example of how powerful this is. Imagine a parent helps their teenager open a Roth IRA and agrees to match their summer job earnings. If they contribute just $7,000 a year for the four years of high school, that money could grow to over $1.25 million by retirement, assuming an 8% average return, without another dime being added. This is how smart, practical strategies create a tangible, lasting legacy.

Real Estate Strategies for Multigenerational Wealth

There's a powerful reason property is so deeply woven into the fabric of nearly every family legacy: real estate is a unique asset. It’s one of the few investments you can live in, rent out for income, watch appreciate over time, and borrow against. This combination makes it a formidable engine to create generational wealth and a reliable shield against inflation.

Successful families don't just buy a primary home; they think of property as a portfolio. They understand how to use leverage—that is, using borrowed capital to increase the potential return of an investment—to acquire assets that generate more wealth. This strategic approach is what separates passive homeownership from active wealth building. For anyone looking to build with tangible assets, learning about real estate investing is a vital step toward securing your family's financial future.

Practical Ways to Start Building with Property

You don’t need to be a mogul to begin. The key is starting with a clear strategy that matches your current financial standing and long-term goals.

House Hacking: This is one of the most accessible entry points. The idea is to buy a multi-unit property (like a duplex or triplex), live in one unit, and rent out the others. The rental income helps cover—or completely pays for—your mortgage. Think of a young family buying a fourplex. They live in one unit while the rent from the other three covers all property expenses and even puts a little extra cash in their pocket each month. After a few years, they can refinance to pull out equity and use that as a down payment on their next property.

The BRRRR Method: This acronym stands for Buy, Rehab, Rent, Refinance, Repeat. An investor buys a distressed property below market value, renovates it to force appreciation, and then rents it to a tenant for cash flow. The next step is a cash-out refinance, which pulls the initial investment back out. This allows them to use the same pot of money to "repeat" the process on another property. It's a powerful way to scale a portfolio without needing huge amounts of new capital for each purchase.

Long-Term Rentals: This is the classic approach. It involves buying single-family homes or condos in areas with strong job growth and desirable schools. The goal here is steady, reliable cash flow and long-term appreciation. While less intensive than the BRRRR method, this strategy offers a stable foundation for a family’s real estate holdings.

The Tax Advantages You Can't Ignore

Real estate comes with tax benefits that are nearly unmatched by other asset classes, which is why it’s so central to preserving wealth over time.

Tax Advantage | How It Works | Impact on Generational Wealth |

|---|---|---|

Depreciation | You can deduct a portion of the property's cost from your taxable income each year, even as the property's market value goes up. | This reduces your annual tax bill, freeing up more cash to reinvest or pay down debt faster. |

1031 Exchange | This allows you to sell an investment property and defer paying capital gains taxes by rolling all the proceeds into a new, similar property. | You can grow your real estate portfolio indefinitely without the tax drag, letting your entire investment compound. |

Deductible Expenses | Mortgage interest, property taxes, insurance, repairs, and maintenance costs are all tax-deductible against your rental income. | This maximizes your net cash flow and improves the overall return on your investment. |

By getting comfortable with these strategies, families can build a portfolio of properties that not only produces income and grows in value but also passes from one generation to the next with incredible tax efficiency. This is how you transform a simple asset into a perpetual legacy.

Insurance and Risk Management for Wealth Protection

Gathering assets is a fantastic accomplishment, but the real measure of generational wealth is its ability to withstand life's curveballs. Building a financial legacy without a safety net is like putting up a beautiful house without a roof—sooner or later, a storm will cause major damage. Insurance is that roof. It’s a component that’s often seen as just another bill, but it's really a powerful tool for protecting what you've built and passing it on efficiently.

To truly safeguard wealth for future generations, you need to go beyond your investment portfolio and build a complete safety net for your family's financial well-being. This involves putting in place effective investment risk management strategies that shield your hard-earned assets from life's most common and costly risks.

Core Insurance for a Resilient Legacy

Think of insurance as your wealth's first line of defense. Every family's needs are different, but a strong protection plan usually stands on a few essential pillars.

Permanent Life Insurance: This isn't your standard term life insurance. Permanent policies, like whole life or universal life, play a dual role. They offer a tax-free death benefit to your heirs, which is a fantastic way to transfer wealth without triggering estate taxes. They also build a cash value that grows tax-deferred. You can borrow against this cash value, often tax-free, to seize opportunities or handle emergencies without selling your primary investments.

Disability Insurance: Your ability to earn an income is your single greatest asset, especially when you're in the wealth-building phase. Disability insurance steps in to replace a large chunk of your income if you can't work due to illness or injury. Without it, a family might have to start selling off assets—the very ones meant for the next generation—just to pay the mortgage and buy groceries.

Umbrella Liability Insurance: This is one of the most affordable yet powerful ways to shield your assets from lawsuits. Your homeowner's or auto insurance might cap out at $300,000 to $500,000 in liability coverage. If a legal judgment goes above that, your personal assets are fair game. An umbrella policy adds millions in extra liability protection for a surprisingly low cost, acting as a critical firewall between a lawsuit and your family's future.

Advanced Strategies for Preservation

As your financial picture becomes more complex, so do the methods needed to protect it. That's when more specialized tools come into the picture, designed not just for protection but for strategically positioning your wealth for the long haul.

Strategy | How It Works | Generational Wealth Impact |

|---|---|---|

Annuities | An annuity is a contract with an insurance company designed to provide a guaranteed income stream, often for life. It's a defense against the risk of outliving your money. | By covering your essential living costs in retirement, annuities allow your other investments to stay untouched, growing for your heirs. |

Long-Term Care (LTC) Insurance | This policy covers the staggering costs of nursing homes, assisted living, or in-home care. With annual costs easily topping $100,000, a long-term care event can wipe out an estate. | LTC insurance prevents this massive drain on your assets, making sure the inheritance you planned for your family actually gets to them. |

Irrevocable Life Insurance Trust (ILIT) | When you place a life insurance policy inside an ILIT, the death benefit is no longer considered part of your taxable estate. You fund the trust with annual gifts to cover the premiums. | This is a sophisticated move that provides a large, tax-free sum of cash to your heirs. They can use this money to pay estate taxes or for any other purpose, without it being taxed first. |

Weaving these insurance strategies into your overall estate plan is essential. When properly aligned, insurance acts as the ultimate backstop, ensuring that life's unexpected turns don't derail your legacy and providing cash exactly when your family needs it most. It’s about securing the future you’ve worked so hard to create.

Estate Planning Strategies That Preserve Your Legacy

Building a healthy portfolio is a fantastic achievement, but it's really only half the job done. The other, and arguably more important, part is making sure that wealth successfully makes its way to the next generation. This is where estate planning enters the picture—it's the strategic playbook for creating generational wealth that actually lasts. Without a smart plan, a lifetime of work can be seriously worn down by taxes, legal fees, and avoidable family disagreements.

This isn’t just a "what if" scenario. Shocking studies reveal that 70% of family wealth is gone by the second generation, and a staggering 90% has vanished by the third. This often happens because the transfer itself is messy and inefficient. A proper estate plan involves a clear understanding of how assets will be passed down, including getting to grips with inheritance tax implications. This thoughtful process ensures your legacy is preserved, not squandered.

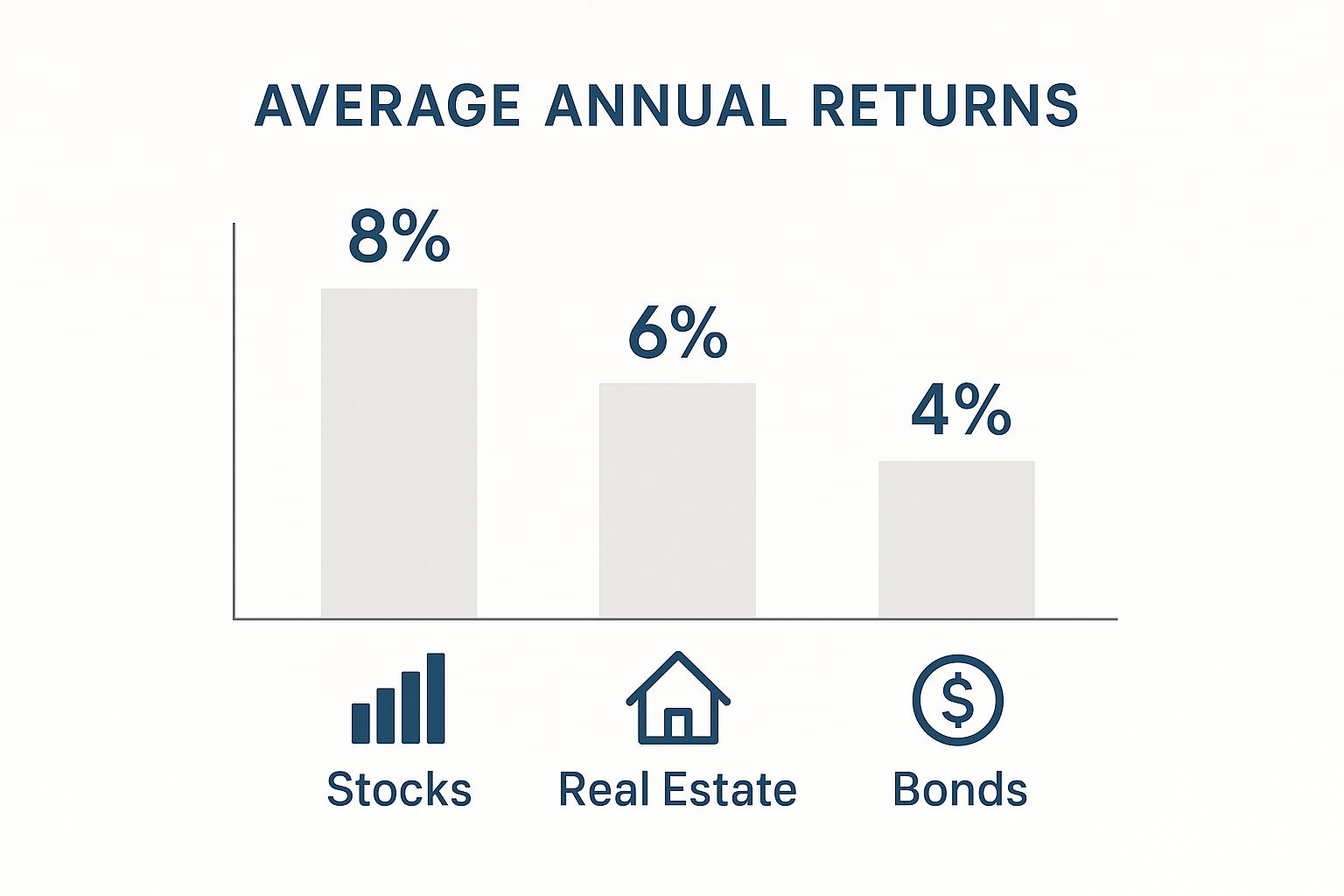

This infographic breaks down the average annual returns of different asset classes—these are the very building blocks of the estate you're looking to protect.

As the data shows, a diversified portfolio, especially one with a strong allocation to stocks, is key to growing the assets your estate plan will ultimately shield for your loved ones.

Essential Tools for Your Estate Plan

A well-designed estate plan uses specific legal instruments to direct your assets exactly where you want them, all while minimizing taxes and keeping things private. A simple will is a start, but families who are serious about their legacy use more structured and powerful tools.

Here's a look at some of the most common and effective tools we see families use:

Revocable Living Trust: Think of this as the foundation of modern estate planning. You transfer ownership of your major assets—like your home, investments, or business interests—into the trust. The best part? You still control everything during your lifetime. When you pass, a successor trustee you've hand-picked distributes the assets according to your wishes, completely bypassing the expensive and public probate court process.

Irrevocable Trusts: For larger estates, these are powerful tools for protecting assets and cutting down the tax bill. Once you place assets into an irrevocable trust, they are legally no longer yours. This is a huge advantage as it can shield them from potential creditors and, crucially, removes them from your taxable estate. A popular strategy is the Irrevocable Life Insurance Trust (ILIT), which allows a large life insurance payout to go to your heirs completely tax-free.

Durable Power of Attorney: This document is an absolute must-have. It gives someone you trust the authority to make financial decisions for you if you become incapacitated. Without one, your family might have to endure a long and costly court battle just to handle basic things like paying your bills.

To help you see how these tools fit different needs, here’s a quick comparison of the most common estate planning vehicles.

Estate Planning Tools Comparison: Choosing the Right Strategy

Comparison of different estate planning vehicles and their benefits for generational wealth transfer

Planning Tool | Tax Benefits | Control Level | Best For | Setup Complexity |

|---|---|---|---|---|

Will | Minimal; assets are part of the taxable estate. | Full control during lifetime. | Basic asset distribution for smaller, uncomplicated estates. | Low |

Revocable Living Trust | No direct estate tax savings, but avoids probate costs. | Full control; can be amended or revoked. | Avoiding probate, privacy, managing assets if incapacitated. | Moderate |

Irrevocable Trust | Significant; removes assets from the taxable estate. | No direct control once assets are transferred. | High-net-worth individuals, asset protection, tax reduction. | High |

Dynasty Trust | Shields wealth from estate taxes for multiple generations. | Trustee controls assets based on trust terms. | Preserving wealth for many generations, long-term family legacy. | Very High |

Durable Power of Attorney | N/A | Designates an agent to act on your behalf. | Everyone; essential for managing finances if incapacitated. | Low |

Each tool serves a specific purpose, and the right combination depends entirely on your family's unique situation, assets, and long-term goals.

Advanced Strategies for Lasting Impact

For families with significant assets, the conversation moves beyond basic trusts to more advanced strategies designed to preserve wealth across multiple generations. One of the most effective tools for this is the dynasty trust. This is a long-term trust engineered to last for generations—or even forever in some states. It allows wealth to grow and be distributed to beneficiaries without being hit by estate taxes with each new generation.

Imagine a family sets up a dynasty trust with $5 million. The trust invests that capital, and the earnings can support grandchildren's education, help great-grandchildren start businesses, or cover other family needs for decades to come. The original principal remains protected and continues to grow, providing a financial backbone for the family line indefinitely.

These strategies are more relevant now than ever. Projections show that an incredible USD 83 trillion will be passed to younger generations over the next 20 to 25 years. You can discover more insights about these global wealth trends from UBS. This massive shift means more families have the chance to create a lasting legacy—if they plan correctly. By putting the right legal structures in place, you can ensure your family is a beneficiary, not a casualty, of this historic transfer of wealth.

Tax Optimization Strategies for Long-Term Wealth

Building wealth is an offensive game of smart investing, but preserving it requires a rock-solid defense against your biggest long-term opponent: taxes. Over the years, taxes can quietly chip away at your returns, putting a serious drag on the compounding engine you’ve worked so hard to build. Mastering tax optimization isn't about finding shady loopholes; it’s about legally and ethically structuring your finances to protect your family's legacy. This is a critical piece of the puzzle to create generational wealth that lasts.

Smart Moves to Minimize Your Tax Drag

Let's go beyond the standard deductions and dive into the strategies that really move the needle over the long haul. These are the kinds of adjustments that separate good financial plans from great ones. One of the most powerful tools in your kit is tax-loss harvesting. This means you sell investments that have dropped in value to realize a loss. You can then use that loss to cancel out capital gains from your winning investments, shrinking your overall tax bill.

For example, say you realized a $10,000 gain from selling one stock, but you have another investment that's down $8,000. By selling the loser, you only have to pay taxes on $2,000 of net gains. It’s a smart way to turn market downturns into tax-saving opportunities.

Another game-changing strategy is strategic asset location. This is just a fancy way of saying you should put the right investments in the right accounts. Here’s how to think about it:

Tax-Advantaged Accounts (like 401(k)s, Roth IRAs): These are the perfect homes for your high-growth, tax-inefficient assets. Investments that kick off a lot of taxable income each year, like high-yield bonds or actively managed mutual funds, can grow inside these accounts without the constant drain of annual taxes.

Taxable Brokerage Accounts: These accounts are a better fit for your more tax-efficient investments. Think buy-and-hold individual stocks or broad-market index funds that mostly generate long-term capital gains, which are taxed at a friendlier rate.

By thoughtfully placing your assets, you can dramatically cut down on the taxes you pay over your lifetime, leaving more money to compound for the next generation.

Long-Term Vision for Tax Efficiency

Beyond harvesting losses and locating assets, your tax strategy should be part of the fabric of your entire financial life. Managing capital gains is a great example. Instead of selling a big winner all at once and getting hit with a huge tax bill, you could sell it off in smaller pieces over several years. This tactic can help you stay in lower tax brackets and make your tax liability much more predictable.

Tax diversification is another important principle. This just means spreading your money across different account types: taxable, tax-deferred (Traditional IRA/401k), and tax-free (Roth IRA). This approach gives your heirs amazing flexibility. If they face a high-tax year in the future, they can draw from a Roth account completely tax-free. In a lower-income year, they might pull from a traditional account and pay taxes at a lower rate.

Finally, think about how charitable giving and business ownership can fit into your plan. Donating appreciated stock to a charity lets you take a tax deduction for its full market value while completely avoiding the capital gains tax you’d owe if you sold it. For entrepreneurs, structuring your business as an S-corp or LLC can provide major tax benefits over being a sole proprietor. This allows more profit to be reinvested into growing the business—and, in turn, your family’s wealth. An effective tax plan isn’t a one-and-done setup; it's a living strategy that grows with you and adapts to new tax laws, ensuring your legacy is protected.

Your Generational Wealth Action Plan

Knowing the pieces of a financial legacy is one thing, but putting them into action is what truly matters. Let’s turn that theory into a practical roadmap you can start on today. A family fortune isn't built in one fell swoop; it comes from a series of smart, disciplined moves made over time. It helps to think of this as a journey with three main phases: Foundation, Acceleration, and Preservation. Your job is to figure out which phase you're in and what moves to make.

Mapping Your Journey

The first leg of the journey, the Foundation phase, is all about getting the basics right. This is where you build a rock-solid financial base, no matter your income. The main goals here are to get an emergency fund in place, crush any high-interest debt, and set up automatic savings and investments. For insurance, your focus should be on protecting your ability to earn with great disability coverage and getting enough term life insurance to care for your family if the unexpected happens.

With a solid foundation beneath you, it's time to enter the Acceleration phase. The game changes here from defense to offense. The goal is to aggressively grow your net worth. You'll want to ramp up your investment contributions, maybe look into real estate like a first rental property, and take advantage of every tax-advantaged account you can. This is also when you should add an umbrella liability policy to protect your growing nest egg. The mindset shifts from just saving money to actively acquiring assets that generate income.

Finally, you reach the Preservation phase. Your attention now turns to protecting the wealth you've worked so hard to build and making sure it passes smoothly to the next generation. This usually means working with professionals to create a detailed estate plan, often built around a trust. You might convert term life insurance policies to permanent ones for tax-free wealth transfer and look into long-term care insurance to ensure a health crisis doesn't wipe out your savings.

Keeping Your Plan on Track

To create generational wealth, you need to stay accountable. This is not a "set it and forget it" kind of plan.

Regular Check-ins: Sit down with your spouse quarterly to go over your budget, track your progress, and adjust your goals.

Build Your Team: You can't do this alone. As your wealth increases, you'll need a trusted team: a financial advisor, a sharp accountant, and an estate planning attorney.

Educate the Next Generation: Real generational wealth is about passing on knowledge, not just money. Get your kids involved in age-appropriate talks about finances. This is the single most important thing you can do to ensure your family's hard work lasts for generations.

Protecting the future you're building is not optional. At America First Financial, we provide the essential insurance products—from life and disability to long-term care—that act as the backbone of a strong family legacy. Get a no-hassle quote today and secure your family's financial future with a partner who shares your values.

_edited.png)

Comments