Disability Insurance for Independent Contractors | Protect Your Income

- dustinjohnson5

- Jul 18, 2025

- 15 min read

As an independent contractor, you know that your income isn't just a paycheck—it's the engine that powers your entire life and business. That's where disability insurance for independent contractors comes in. Think of it as your financial backstop, a system that provides a steady income if you get too sick or injured to work. This isn't just some optional extra; it's a non-negotiable part of a smart financial plan for any self-employed professional.

Why Your Income Is Your Most Valuable Asset

If you were a traditional employee, a safety net would likely come standard with the job. You’d have paid sick leave and probably an employer-sponsored group disability plan. But as an independent contractor, you’re flying solo. You’re the CEO, the rainmaker, the service provider, and the entire staff all wrapped into one.

When you can’t work, the money just stops. It’s that simple. This stark reality makes your ability to earn a living your single most valuable asset—far more important than your laptop, your tools, or your home office. Why? Because your income is what pays for everything else.

The Real Risks You Face

Most people hear "disability" and immediately picture a catastrophic accident. While those certainly happen, the day-to-day risks are often much more common and just as financially devastating.

Long-Term Illnesses: A serious health issue like cancer or a heart condition could easily sideline you for months, if not years.

Musculoskeletal Problems: Something as common as a severe back injury, a broken bone, or even carpal tunnel syndrome can make it impossible to do your job.

Mental Health Challenges: Conditions like severe depression, anxiety, or burnout are very real and can be just as debilitating as any physical injury, making it impossible to focus and work.

A disabling event isn't a rare occurrence. The stats are sobering: over 25% of today's 20-year-olds will experience a disability before they reach retirement age. For an independent contractor with no safety net, that's a huge vulnerability you just can't afford to ignore.

This isn't just anecdotal. The market itself is shifting as more people recognize this risk. We're seeing significant growth in the disability insurance market, largely driven by freelancers and independent contractors who made up about 11% of new disability insurance policies sold in 2023.

It's Not Just Insurance—It's Income Protection

Try to reframe how you think about this coverage. It’s not just another monthly bill. It’s income protection. It’s a strategic move to ensure that a health crisis doesn’t automatically spiral into a financial disaster. This is the coverage that lets you keep paying your mortgage, buying groceries, and covering your business overhead while you focus on getting better.

Protecting your income with disability insurance is a cornerstone of financial security. Of course, it works best when paired with other smart financial habits. For independent contractors, implementing effective cash flow management strategies is also essential for building a truly resilient business. By combining solid income protection with smart financial planning, you create a powerful foundation for a long and successful self-employed career.

Decoding Your Disability Insurance Policy

Let's be honest, opening a disability insurance policy can feel like you're trying to crack a code. It's packed with jargon and clauses that seem designed to confuse. But once you know what to look for, that intimidating document becomes your roadmap to financial security.

As an independent contractor, these details aren't just fine print—they're the very foundation of your safety net. So, let’s translate the most critical terms into plain English. You'll walk away knowing exactly what makes a policy weak or strong.

The Definition of Disability: The Most Important Clause

At the absolute core of every policy is the definition of disability. This is the rulebook. It spells out exactly what it means to be "disabled" in the eyes of the insurance company, determining whether or not they cut you a check.

There’s no universal standard here, which is why this part is so crucial. For independent contractors and other specialized professionals, the gold standard is an "Own-Occupation" definition. Simply put, this means you're considered disabled if you can no longer perform the main duties of your specific job.

An "Own-Occupation" policy protects the unique skills you’ve spent years building. It understands that a software developer with a hand injury can't do their job, even if they could technically work in a different role.

This is a massive distinction. The alternative, a far less protective "Any-Occupation" definition, only pays out if you can't perform any job you're reasonably suited for. That could mean your claim gets denied because you're able to work a lower-paying job completely outside your field. You didn't build a career just to be forced into any random job, and your insurance shouldn't either.

Key Policy Features You Must Understand

Beyond that core definition, a few other components dictate how your policy will actually behave when you need it most. Getting these right is key to building coverage that truly has your back.

Elimination Period: Think of this as your policy's waiting period. It's the amount of time you have to be disabled before your benefits start. Common options are 30, 60, 90, or 180 days. A longer period will lower your premium, but it also means you'll need a bigger emergency fund to bridge the gap.

Benefit Period: This is how long you’ll receive payments after your claim is approved and the elimination period is over. It could be for a set number of years (like two or five) or, ideally, all the way until retirement age (usually 65 or 67). For true peace of mind, a policy that protects your income until retirement is the most robust choice you can make.

Imagine a self-employed carpenter suffers a serious injury. With a 90-day elimination period, they'd have to cover their own bills for three months. Afterward, their monthly benefit would kick in and continue for their chosen benefit period—maybe for five years or until they can get back to their trade. This is exactly why disability insurance is a non-negotiable for skilled independent contractors.

Supercharge Your Policy with Riders

Riders are essentially upgrades you can add to your base policy for more customized protection. They do add to the cost, but some are so valuable they’re practically essential.

One of the most important is the Cost-of-Living Adjustment (COLA) rider. If you're out of work for years, inflation is a real threat; that $5,000 monthly benefit won't buy as much in ten years as it does today. A COLA rider automatically increases your benefit each year to help your income keep pace with rising costs.

It's also critical to think about mental health coverage. The need has never been greater. In fact, disability claims related to mental health have jumped by 18%, particularly among younger professionals. This trend underscores just how important it is to have a policy that covers all facets of your well-being, not just physical injuries. You can read more about these disability insurance industry statistics and see what they mean for you as a policyholder.

How Much Coverage You Need and What It Costs

When you’re an independent contractor, figuring out disability insurance really boils down to two questions: How much coverage do I actually need, and what’s this going to cost me? Let's get straight to it. This isn't about fuzzy math; it's about protecting the income you work so hard to earn.

The whole point of disability insurance isn't to strike it rich—it's to replace your paycheck so you can keep your life on track while you get better. A great rule of thumb is to get a policy that replaces 60% to 70% of your pre-tax monthly income.

You might be wondering, "Why not 100%?" For one, insurers just don't offer it. But more importantly, the benefits from a personal policy you pay for with after-tax money are typically received tax-free. This means a 60-70% benefit often lands you very close to what you'd normally take home after taxes.

Calculating Your Ideal Coverage Amount

To find your magic number, you first need to get a handle on your essential monthly expenses. We’re not talking about budgeting for vacations or new gadgets; this is about the absolute must-pays that keep your world spinning.

So, grab a notepad or open a spreadsheet and jot down your non-negotiable monthly costs. This list is your financial safety net.

Housing: Your mortgage or rent payment.

Utilities: The basics like electricity, water, gas, and internet.

Food: What you typically spend on groceries each month.

Transportation: Car payments, insurance, gas, and maintenance.

Debt Payments: Any student loans, credit card bills, or personal loans.

Business Overhead: Don't forget this! What business costs—like software subscriptions or insurance—would continue even if you couldn't work?

Once you've tallied everything up, you’ll have a clear baseline for the minimum monthly benefit you need. Aiming for a policy that comfortably covers this total gives you the breathing room to focus on your health, not your bills.

What Determines Your Insurance Premiums

Now for the million-dollar question: what will this actually set you back? Your premium—the amount you pay for your policy—isn't a flat rate. It’s a personalized price based on how much risk the insurance company sees in covering you.

Think of it from their perspective. They're trying to figure out the likelihood of you filing a claim and how long they might have to pay it. The main factors driving your premium include:

Your Age and Health: It’s simple—younger and healthier people almost always get lower rates.

Your Occupation: An office-based consultant will pay less than a roofer. Jobs with a higher risk of physical injury naturally come with higher premiums.

Your Income: The more you earn, the bigger the benefit you need to protect, which nudges the premium up.

Policy Features: A policy that pays out until you're 67 will cost more than one that stops after five years. Likewise, a shorter waiting period (elimination period) or a more protective "Own-Occupation" definition will increase the cost, but they offer far superior coverage.

Here's a crucial piece of advice: The single best thing you can do is lock in a policy when you are young and healthy. This secures lower premiums for the entire life of the policy. If you wait, your rates will only go up as you age and life throws you the inevitable health curveballs.

Let’s look at two real-world contractor profiles to see how this plays out.

Example 1: The Software Developer

Age: 30

Income: $120,000/year

Occupation Risk: Low A young, healthy developer working from a home office is a low risk. Their premium for a top-notch long-term policy will be quite affordable because their biggest threat is likely a non-physical illness or a repetitive strain injury.

Example 2: The Experienced Tradesperson

Age: 48

Income: $90,000/year

Occupation Risk: High A seasoned carpenter or plumber faces a much higher risk of a career-ending injury every single day. That, combined with their age, means their premiums will be higher to reflect the greater statistical chance of a claim.

At the end of the day, the cost of disability insurance for independent contractors is a direct trade-off between price and protection. It can be tempting to go for the cheapest option, but a policy with weak definitions or a short benefit period might just let you down when you need it most.

2. Choosing Between Short-Term and Long-Term Protection

When you start looking at disability insurance, one of the first decisions you’ll need to make is whether to get short-term or long-term coverage. It's not just a matter of timing; these are two completely different kinds of protection, built for very different life events. Getting this right is the key to building a financial safety net without any holes.

Think of it like this: Short-Term Disability Insurance (STDI) is your financial first aid kit. It’s there for the immediate, temporary setbacks. Long-Term Disability Insurance (LTDI), on the other hand, is your comprehensive care plan, designed to support you through serious, potentially life-altering health issues.

The Role of Short-Term Disability Insurance

Short-term coverage is for those disabilities you expect to recover from within a year or less. The waiting period before it starts paying out—often called the elimination period—is typically very short, maybe just 7 to 14 days. That quick turnaround is crucial when you have bills piling up right away.

So, when would you need it? Here are a few real-world examples:

You need a minor surgery and the doctor orders six weeks of bed rest.

You break your leg and can't perform your job for a few months.

You have a complicated pregnancy and need to stop working before the baby arrives.

Because it's for temporary situations, the payout period is also brief, usually lasting from three months up to a year. It’s a fantastic bridge to get you over a rough patch without torching your emergency fund, but it won't help with a career-ending injury.

Long-Term Disability: Your Enduring Safety Net

For independent contractors, this is the big one. Long-term disability insurance is what shields you from a catastrophic illness or injury that could keep you out of work for years—or even permanently.

These policies have a much longer waiting period, often 90, 180, or even 365 days. This is by design. LTDI is meant to kick in after your other resources, like your savings or a short-term policy, have run their course. The real power of LTDI is its benefit period. You can get policies that pay out for five years, ten years, or all the way to your planned retirement age, like 65 or 67.

To quickly see how these two types of insurance stack up, here’s a simple comparison.

Short-Term vs. Long-Term Disability Insurance at a Glance

Feature | Short-Term Disability Insurance (STDI) | Long-Term Disability Insurance (LTDI) |

|---|---|---|

Purpose | Replaces income during a temporary injury or illness. | Replaces income during a prolonged or permanent disability. |

Typical Waiting Period | 7-30 days | 90-365 days |

Typical Benefit Period | 3-12 months | 2 years to retirement age (65/67) |

Common Use Cases | Broken bones, minor surgery recovery, pregnancy. | Cancer, heart attack, severe injury, chronic illness. |

Role in Your Plan | A bridge to cover immediate bills and protect savings. | The core foundation protecting your future earnings. |

While both have their place, the long-term policy is what truly protects your financial future as a contractor.

Creating a Seamless Shield With a Layered Strategy

The smartest approach for most contractors is to layer your protection. You can use your emergency savings to cover your expenses during the long-term policy's waiting period. For example, if you choose an LTDI policy with a 90-day elimination period, you’ll want to have at least three months of living expenses saved up to bridge that gap.

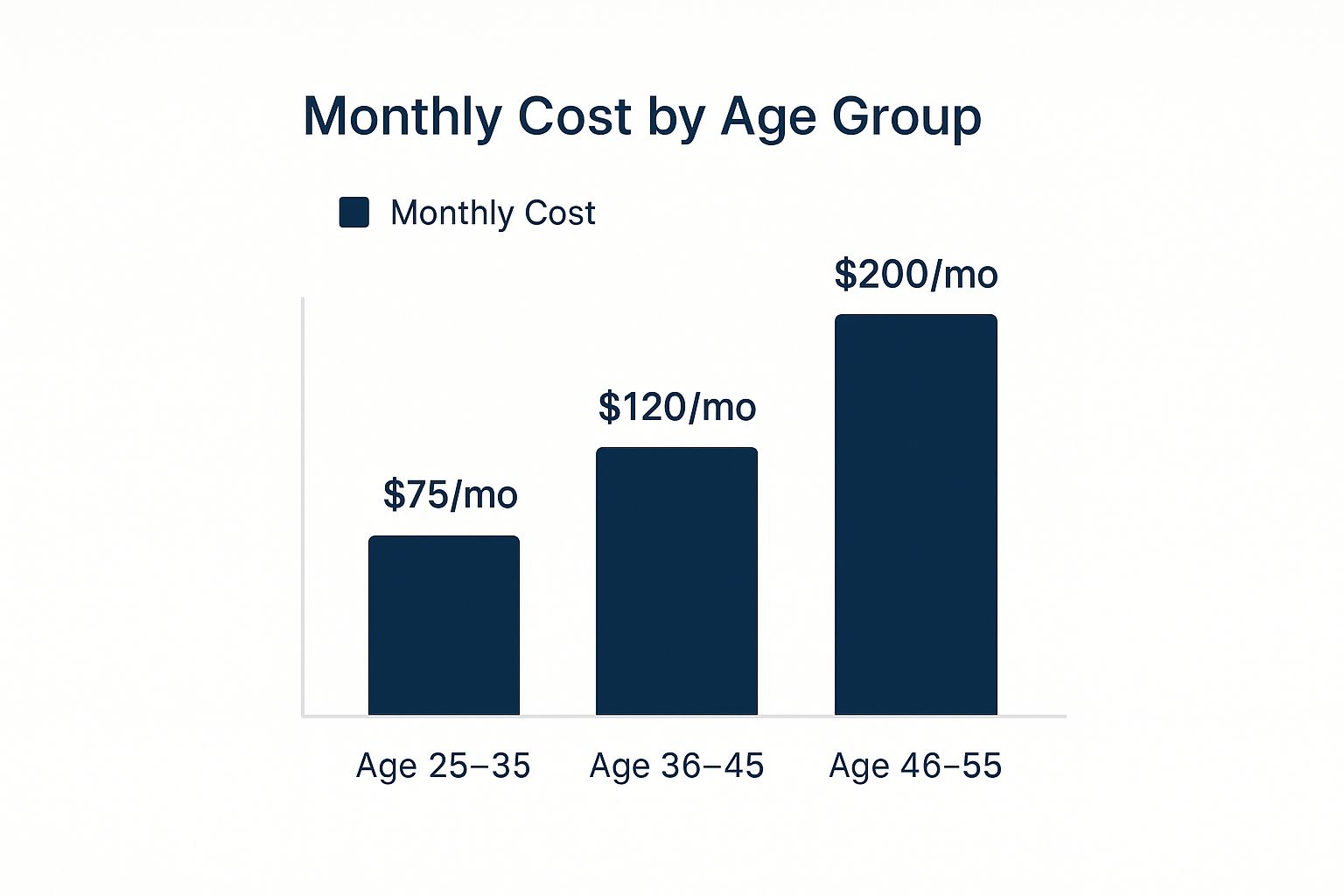

This infographic shows just how much your age can affect what you'll pay in monthly premiums.

As you can see, locking in a policy when you're younger can save you a significant amount of money over the life of the policy. It pays to act early.

By combining your personal savings with a solid LTDI policy, you create a complete financial shield. Your savings handle the immediate crisis, and your insurance takes over for the long haul. This strategy gives you true peace of mind, knowing you’re covered from day one of a disability all the way to retirement.

Your Step-by-Step Guide to Getting a Policy

Okay, so you understand why you need disability insurance. That’s the most important first step. Now, how do you actually get it?

The process can feel intimidating from the outside, but it’s really just a series of straightforward steps. We’ll break down the entire journey for you, turning what seems like a huge project into a manageable task. Think of this as your roadmap, from finding the right partner to signing on the dotted line.

Step 1: Find an Independent Broker You Trust

Here's a pro tip: your first call shouldn't be to a big-name insurance carrier. Instead, you'll want to find a trusted, independent insurance broker.

Think of a broker as your personal advocate in the insurance world. Unlike an agent who represents a single company, an independent broker works for you. They can shop around with multiple carriers to find the policy with the best features and most competitive price for your unique situation as a contractor. They know the market inside and out and can translate all that confusing insurance-speak.

Step 2: Get Your Financial Ducks in a Row

Once you've teamed up with a broker, it’s time to prove your income. This is a standard part of the process—the insurance company needs to see what you earn to figure out how much coverage they can offer.

Getting your documents ready ahead of time will seriously speed things up. You’ll typically need:

Tax Returns: Your last two years of tax returns are the gold standard. Have the full 1040 forms with all the schedules handy.

Profit and Loss (P&L) Statement: A current P&L from your business gives them a snapshot of your recent earnings.

Business Bank Statements: Some insurers might ask for these to verify consistent income deposits.

Since independent contractors aren't covered by traditional employer group plans, they must rely on Individual Disability Insurance (IDI). The industry is definitely taking notice of this growing need. In fact, forecasts show the global disability insurance market is expected to reach $10.33 billion by 2030. You can dig into the numbers in this disability insurance market report to see what it means for freelancers.

Step 3: The Application and Underwriting Process

This is where the insurance company gets to know you. They need to assess their risk in offering you a policy, which involves a few key stages.

The Paperwork Your broker will guide you through the application. It asks for details about your health, job, income, and lifestyle—for instance, whether you smoke or have risky hobbies like skydiving. Be completely honest here. Hiding information can give the insurer grounds to cancel your policy down the road, right when you need it most.

The Medical Exam Most policies require a quick medical exam, but don't worry, it's painless and free. A paramedic comes to your home or office at your convenience to:

Check your height, weight, and blood pressure.

Take small blood and urine samples.

Go over your medical history with you.

The Phone Interview You’ll also have a short, casual phone call with someone from the insurance company. It’s just a chance for them to confirm the details on your application and ask a few follow-up questions. It’s a simple conversation, not a high-pressure interrogation.

Once all this is done, an underwriter reviews your file and puts together a final offer. Your broker will then walk you through it, explain every detail, and help you get your policy in place. With this plan, you’re all set to secure the income protection your career depends on.

Common Questions About Contractor Disability Insurance

Diving into the world of disability insurance always brings up some practical, real-world questions, especially when you’re flying solo as an independent contractor. Without an HR department to give you the rundown, it’s easy to get stuck on the details. This section is here to be that resource for you, answering the most common questions we hear from freelancers and contractors every day.

Think of this as your final walkthrough before signing on the dotted line. We’ll tackle the concerns that often become sticking points so you can move forward with total confidence in your income protection plan.

Are My Disability Benefits Taxable?

This is easily one of the most important—and frequent—questions we get. The answer all comes down to how you pay your premiums.

When you buy your own individual disability policy using after-tax dollars (which is how virtually all contractors pay), any benefit you receive down the road is 100% tax-free. That’s a massive advantage.

Because the benefit check comes to you with no taxes owed, a policy designed to replace 60-70% of your gross income feels much closer to your normal take-home pay. This simple rule dramatically boosts the real-world value of your coverage, making sure the money you need actually lands in your bank account, not Uncle Sam’s.

How Do Policies Handle Pre-Existing Conditions?

A pre-existing condition is just about any medical issue you had before applying for your insurance. During underwriting, the insurance company will take a careful look at your medical history to see what’s there.

Being upfront and honest is always the best approach. When you disclose a condition, the insurer typically has a few ways it can go:

Full Coverage: If your condition is minor and well-managed, they might offer you a standard policy without any strings attached.

Exclusion Rider: This is the most common outcome. The company approves your policy but adds a specific exclusion for your condition. For example, if you have a history of a specific knee injury, the policy would cover you for anything except a disability related to that knee.

Higher Premium: For some manageable but more significant conditions, they might offer you full coverage but charge a higher rate to account for the added risk.

Decline: Unfortunately, if a condition is severe, unstable, or unmanaged, the insurance company may decline to offer coverage.

The best move you can make is to work with an independent broker who knows which carriers are more forgiving for certain health histories. They can shop your case around to find the most favorable outcome.

What Happens If My Income Changes?

Income volatility is the name of the game for contractors. Insurers get it. Most policies are initially based on an average of your last two years of income, which you’ll prove with your tax returns.

But what happens when you land a huge client and your income doubles? You don’t want to be left underinsured.

This is exactly why the Future Increase Option (FIO) rider exists. Sometimes called a Guaranteed Insurability Option (GIO), this rider gives you the right to buy more coverage later on without having to go through medical underwriting again. You just have to show proof of your new, higher income.

Think of the FIO rider as your way to future-proof your policy. You lock in your good health today and give yourself the ability to scale up your safety net as your career and business grow. It’s a must-have for ambitious contractors.

Can I Get Coverage in a High-Risk Job?

Yes, absolutely. But be prepared: your occupation is one of the single biggest factors that determines your cost. Insurers categorize jobs into different risk classes, from 1 (highest risk) to 5 or 6 (lowest risk). An IT consultant working from home is a low risk; a roofer or commercial diver is a high risk.

If your work is physically demanding or puts you in hazardous situations, expect to pay more for coverage. The good news is that some insurance carriers specialize in covering skilled trades and other high-risk professions, and they often offer the most competitive rates. This is another situation where a knowledgeable broker’s expertise is invaluable—they’ll know exactly which company to turn to for your specific job.

More and more professionals are recognizing this need. In the health and tech sectors alone, policy adoption has jumped by 21% in recent years, proving how critical this coverage is becoming. You can dig into more of these disability insurance industry trends to see how the market is evolving.

At the end of the day, getting the right policy isn’t about finding a one-size-fits-all solution, but about tailoring coverage to your unique professional and financial life.

At America First Financial, we believe in protecting your family’s future with insurance solutions that align with your values. We provide straightforward disability insurance options designed to secure your income without the noise of political agendas. Get your free, no-hassle quote in under three minutes and discover the peace of mind that comes with a plan built to protect what matters most. Secure your income today with a partner you can trust at https://www.americafirstfinancial.org.

_edited.png)

Comments