Essential Guide: Health Insurance After Retirement

- dustinjohnson5

- Jun 27, 2025

- 19 min read

Finally, you’ve reached retirement. It’s a time for new adventures and well-earned relaxation, but it also marks a major shift in how you'll handle your healthcare. When your employer-sponsored plan ends, what comes next? Simply put, health insurance after retirement is the new combination of coverage you'll assemble to protect your health and finances.

Your First Look at Health Insurance After Retirement

Stepping away from a work-based health plan means you're now in charge. It can feel like a big responsibility, but think of it less like navigating a maze and more like charting a course. With the right map, you can confidently choose the best path forward for your unique needs and budget. This guide will be your map.

The choices you make from here on out will directly shape your financial security and access to medical care for years to come. For most people, this transition brings significant changes in both how you're covered and what you'll pay.

Understanding the New Landscape

The change can feel sudden. One day, your health insurance is a relatively straightforward employee benefit; the next, you're tasked with building your own coverage from several different pieces. This shift is happening in a world where retirement itself is changing—in fact, 33% of Americans now expect to retire later than they originally planned, a trend that can certainly influence insurance decisions and timing. You can dig deeper into these retirement trends and their financial implications.

The key is to start by understanding the fundamental building blocks available to you. These options are the foundation of nearly every retiree's healthcare strategy.

Think of it this way: Original Medicare is your home's foundation—it's strong and absolutely essential. But to be fully protected from the elements, you'll likely need to add walls and a roof, like supplemental plans, to feel completely secure.

The Core Components of Retiree Healthcare

Your journey into post-retirement health insurance will introduce you to several key players. Getting to know them now will make your decisions much easier when the time comes.

The main options generally fall into a few categories:

Medicare (Parts A & B): This is the federal government's health insurance program for people 65 and older. For most, it serves as the base of their retirement health plan.

Medicare Advantage (Part C): These are all-in-one plans offered by private companies. They bundle all your Medicare benefits together and often include extra perks like dental, vision, and hearing coverage.

Medigap (Medicare Supplement Insurance): Also sold by private insurers, these policies help pay for the out-of-pocket costs—the "gaps"—that Original Medicare doesn't cover, like deductibles and coinsurance.

Retiree & Private Plans: Some people are fortunate enough to have access to a health plan offered by their former employer. Others who retire before 65 might need to look at private insurance options to bridge the gap until they are Medicare-eligible.

Our goal is to help you replace any anxiety with clarity. By understanding how these pieces fit together, you can build a healthcare strategy that brings security, affordability, and, most importantly, peace of mind to your retirement years.

Key Retirement Health Insurance Options at a Glance

To simplify these concepts, let's break down the main paths you can take. The table below gives you a quick snapshot of each option, its primary role, and who it’s generally best suited for.

Coverage Option | Primary Purpose | Best For Retirees Who... |

|---|---|---|

Original Medicare (Parts A & B) | Provides foundational hospital and medical coverage from the federal government. | Are turning 65 and want broad access to doctors and hospitals nationwide who accept Medicare. |

Medicare Advantage (Part C) | Offers an all-in-one, managed-care alternative to Original Medicare, often with extra benefits. | Prefer predictable, low monthly premiums and are comfortable with using a specific network of providers. |

Medigap (Supplement Insurance) | Fills in the "gaps" in Original Medicare by covering deductibles, copayments, and coinsurance. | Want to minimize out-of-pocket costs and prefer the freedom to see any doctor who accepts Medicare. |

Retiree Health Plan | Provides employer-sponsored group health coverage for former employees. | Are fortunate to have this benefit from a former employer, as it often coordinates well with Medicare. |

Private Insurance (e.g., ACA) | Serves as a bridge to Medicare for those who retire before age 65. | Need comprehensive health coverage during the years between leaving their job and becoming Medicare-eligible. |

This table is a starting point. As we go through this guide, we'll dive into the details of each option so you can see precisely how they work and which combination might be the perfect fit for you.

Understanding Medicare: Your Healthcare Foundation in Retirement

For most Americans hitting retirement age, Medicare is the big one—the cornerstone of their healthcare plan. But let's be honest, all the different "parts," rules, and deadlines can feel like you're trying to solve a puzzle with half the pieces missing.

The trick is to stop thinking of it as a confusing mess. Instead, see it as a predictable system you can build on to get the exact coverage you need.

Think of it this way: Original Medicare is the solid, reliable foundation of your retirement healthcare "house." It's absolutely essential and provides critical support, but it's not the whole structure. To be truly protected from life's financial storms, you'll need to add some walls and a roof—that's where supplemental plans come in.

So, let's start by laying that foundation, piece by piece.

Medicare Part A: Your Hospital Insurance

First up is Medicare Part A, which most people know as "hospital insurance." This is the part of Medicare that kicks in when you have a major medical event that requires you to be an inpatient.

Simply put, Part A is your safety net for the big, facility-based stuff. Its main job is to help cover the costs for:

Inpatient hospital stays: This covers your semi-private room, meals, and nursing services when you're formally admitted.

Skilled nursing facility care: If you need short-term, skilled care after a qualifying hospital stay, Part A helps pay. This isn't for long-term custodial care, though.

Hospice care: For a terminal illness, Part A covers services focused on comfort and symptom management.

Home health care: If you're homebound and need specific skilled care, Part A can provide coverage under certain rules.

Here's the good news. For most people, Part A is premium-free. If you or your spouse worked and paid Medicare taxes for at least 10 years (which equals 40 quarters), you've already paid for it over your working life.

But—and this is a big but—it’s not completely free. Part A has a deductible you have to meet for each "benefit period." In 2024, that deductible is $1,632. A benefit period isn't a calendar year; it starts the day you're admitted and ends when you haven't received any inpatient care for 60 consecutive days. This means if you have the misfortune of being hospitalized more than once in a year, you could end up paying that deductible multiple times.

Medicare Part B: Your Medical Insurance

Next is Medicare Part B, your "medical insurance." If Part A covers where you stay, Part B covers what the doctors do. This is the part of your coverage you’ll interact with most often for all your routine and preventive care.

Part B is the real workhorse for your day-to-day health needs, helping pay for a huge range of medically necessary services and supplies.

This includes things like:

Doctor visits, whether it's a regular check-up or you're trying to figure out what's wrong.

Outpatient care, like procedures you'd have at an ambulatory surgery center.

Durable medical equipment, such as walkers or wheelchairs.

Ambulance services.

Preventive care, including flu shots, mammograms, and other cancer screenings.

Unlike Part A, everyone pays a monthly premium for Part B. The standard premium for 2024 is $174.70, although that amount can be higher if your income is above a certain threshold. Part B also has its own annual deductible ($240 in 2024). After you've paid that, you're generally on the hook for 20% of the Medicare-approved cost for most services.

Key Takeaway: Original Medicare (Parts A and B) provides a strong base, but it leaves you exposed to some significant out-of-pocket costs. That 20% coinsurance has no annual limit, which is precisely why most retirees choose to buy additional coverage to fill in those gaps.

Why Enrolling on Time Is So Important

This is one deadline you don't want to miss. Your Initial Enrollment Period (IEP) is a critical seven-month window to sign up for Medicare. It starts three months before the month you turn 65, includes your birthday month, and wraps up three months after.

If you miss this window and don't have other qualifying health coverage (like from an employer), you could be hit with late enrollment penalties that last a lifetime.

For instance, the Part B penalty can tack an extra 10% onto your monthly premium for each full 12-month period you were eligible for Part B but didn't sign up. This isn't a one-and-done fee; it’s a permanent addition to your premium for as long as you have the coverage.

The official Medicare website is your best friend here. It's the primary source for unbiased information, with tools to check your eligibility, find your enrollment window, and compare plans directly.

It’s also smart to keep an eye on the bigger picture. The entire U.S. health insurance sector is navigating some choppy waters right now, with shifts in Medicare Advantage rates and people using more medical services. These trends could eventually affect plan costs down the road. You can learn more about these evolving insurance industry dynamics from industry experts.

Getting a firm grasp on these foundational concepts is your first, most important step toward making a smart, confident choice for your retirement healthcare.

Choosing Your Path: Medigap vs. Medicare Advantage

Once you're enrolled in Original Medicare, you’ll hit your first major fork in the road. While Parts A and B form a solid foundation for your hospital and medical care, they were never meant to cover 100% of your costs. You're still on the hook for deductibles and a potentially steep 20% coinsurance with no annual cap.

This is where your real health insurance after retirement strategy begins. You have to decide how you're going to handle those gaps. You essentially have two main options: stick with Original Medicare and add a Medigap plan, or switch to an all-in-one Medicare Advantage plan.

Think of it like buying a car. You can get the reliable base model (Original Medicare) and then add the specific upgrades you want, like a top-tier sound system or advanced safety features (Medigap). Or, you could just buy the fully-loaded luxury package where everything is bundled together from the start (Medicare Advantage). Neither is inherently better—the right choice comes down to your budget, health needs, and what you value most.

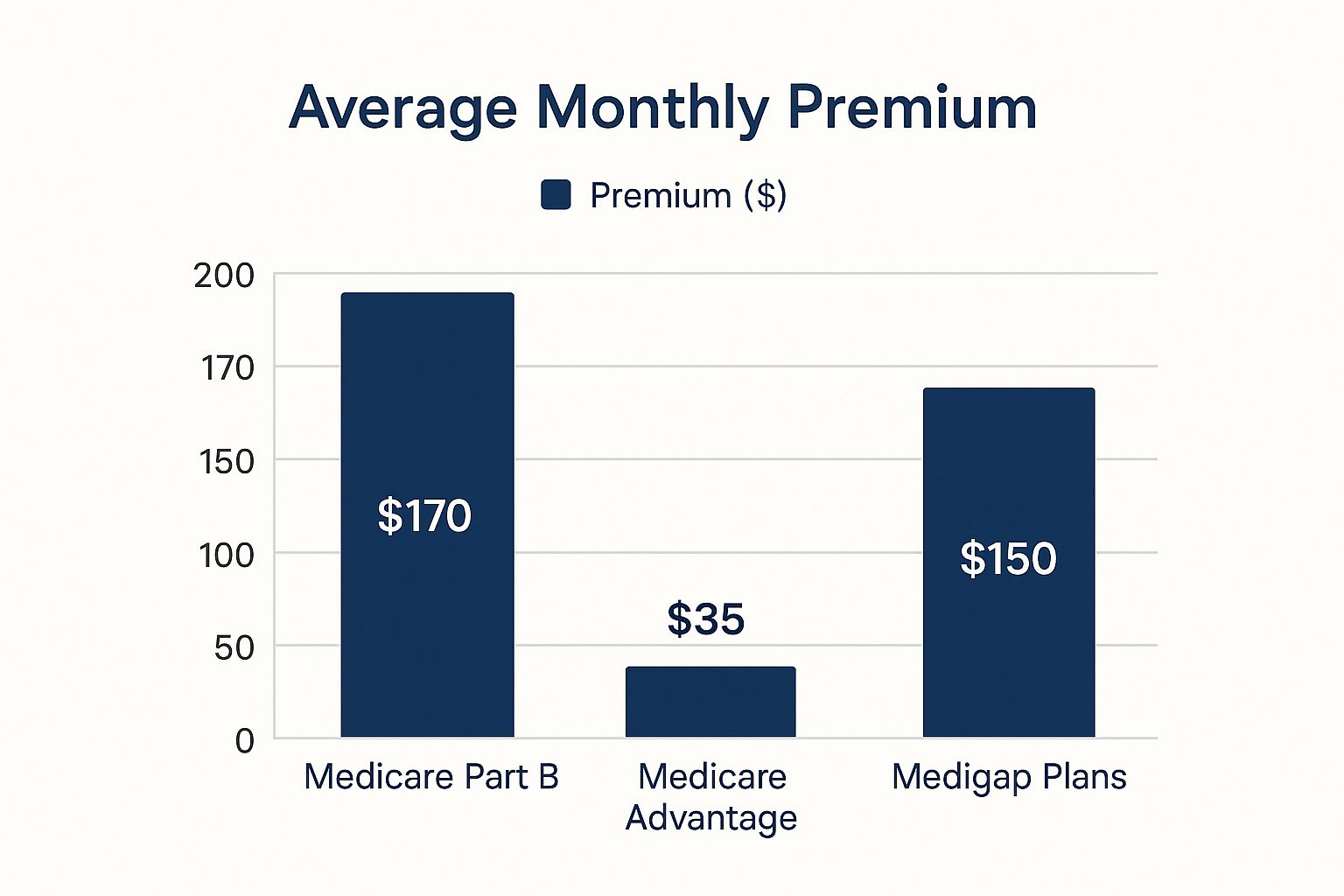

The chart below shows how monthly premiums tend to stack up, which is a big part of the equation for most people.

As you can see, the costs are quite different. Medigap plans have a higher price tag each month, while many Medicare Advantage plans boast very low or even $0 premiums.

What Is a Medigap Plan?

Medigap, also known as Medicare Supplement Insurance, is a separate policy you buy from a private company that works with your Original Medicare. Its only job is to fill in the cost-sharing "gaps" that Medicare Parts A and B leave behind.

These gaps can be significant and include things like:

Hospital deductibles and coinsurance under Part A

The 20% coinsurance and annual deductible for Part B

Coinsurance for stays in a skilled nursing facility

Emergency medical care when you're traveling abroad

Medigap plans are standardized by the government and are labeled with letters, like Plan G or Plan N. This is a huge help, because it means a Plan G from one insurer has the exact same core benefits as a Plan G from another. The only differences are the monthly premium and the company's reputation for service.

The biggest selling point for the Medigap route is freedom. With Original Medicare and a Medigap plan, you can go to any doctor or hospital in the entire country that accepts Medicare. No networks, no gatekeepers, and usually no referrals needed to see a specialist.

Of course, that freedom isn't free. You'll pay a separate monthly premium for your Medigap policy on top of your Part B premium. The trade-off is that you get incredibly predictable healthcare costs. Once your premiums are paid, you often have very little—or nothing—to pay out-of-pocket when you actually get medical care.

Understanding Medicare Advantage Plans

The other path is Medicare Advantage, which you'll often hear called Part C. These plans are a totally different way to get your Medicare benefits. Instead of using the government-run program, you choose a private insurance plan that’s been approved by Medicare to deliver your care.

These plans bundle everything together: Part A (hospital), Part B (medical), and in most cases, Part D (prescription drugs), all in one neat package. The government pays the private insurance company a fixed amount each month to manage your health services.

If you had insurance through an employer, these plans will feel familiar. Most operate as an HMO (Health Maintenance Organization) or a PPO (Preferred Provider Organization), which means you generally have to use doctors, hospitals, and pharmacies that are in the plan's network to keep your costs down.

For many retirees, the main attraction is the extra perks. These plans often include benefits that Original Medicare simply doesn't cover, such as:

Routine dental, vision, and hearing coverage

Prescription drug coverage (Part D) built right in

Gym memberships or fitness programs like SilverSneakers

An allowance for over-the-counter items like vitamins and bandages

While many Medicare Advantage plans have low or even $0 monthly premiums, you are still responsible for your monthly Part B premium. Your out-of-pocket costs show up as copayments or coinsurance whenever you see a doctor or get a service. The good news is that every plan has an annual maximum out-of-pocket limit, which acts as a critical financial safety net.

A Head-to-Head Comparison

Choosing between Medigap and Medicare Advantage means weighing your priorities. There’s no secret "best" plan for everyone; it’s about what works for your life. Do you value low monthly payments or the freedom to see any doctor? This table puts the key differences side-by-side to help you see the trade-offs more clearly.

Feature | Medigap (Medicare Supplement) | Medicare Advantage (Part C) |

|---|---|---|

Doctor Choice | Total freedom. See any doctor or use any hospital in the U.S. that accepts Medicare. No referrals are typically needed. | Restricted to a local network. You must use doctors and hospitals within the plan’s network for the lowest costs. May require referrals. |

Monthly Costs | Higher premiums. You pay a monthly premium for both Part B and the Medigap plan. | Lower premiums, often $0. You still have to pay your monthly Part B premium. |

Out-of-Pocket Costs | Highly predictable. Once premiums are paid, you have very low or no costs when you receive care, depending on your specific plan. | Variable costs. You pay copays and coinsurance for services until you hit the plan's annual out-of-pocket maximum. |

Extra Benefits | None. Medigap only covers the gaps in Medicare Parts A & B. You need a separate Part D plan for prescriptions. | Yes, this is a major draw. Plans often include dental, vision, hearing, and prescription drug coverage all in one. |

Travel | Excellent coverage. You're covered anywhere in the U.S. and some plans offer foreign travel emergency care. | Very limited. Network restrictions mean you may only be covered for true emergencies when traveling outside your plan's service area. |

Ultimately, this is one of the most personal financial decisions you'll make for your retirement. If your top priority is having the widest possible choice of doctors and predictable expenses, a Medigap plan is probably your best bet. But if you're comfortable with a network and want an all-in-one plan with a low premium and extra benefits, a Medicare Advantage plan could be the perfect fit.

Navigating Your Options Beyond Medicare

While Medicare is the foundation of healthcare for most Americans after retirement, the path isn't always a straight line to age 65. Some people retire early, others have access to military or employer benefits, and many just need a solid plan to bridge the gap. Figuring out these alternatives is key to weaving a complete healthcare safety net for yourself.

Your personal situation—when you retire, if you served in the military, or what your former job offers—is what really dictates your options. Let's walk through the most common scenarios you might encounter outside of a standard Medicare enrollment.

Retiring Before 65: The ACA Marketplace Bridge

If you’ve decided to hang up your work boots before you’re eligible for Medicare, you'll need a reliable health plan. For many early retirees, the Health Insurance Marketplace, established by the Affordable Care Act (ACA), is the perfect solution. Think of it as a sturdy bridge that gets you from your last day on the job to your 65th birthday.

The ACA Marketplace is where you can shop for and compare private health insurance plans. Most importantly, these plans are forbidden from denying you coverage or jacking up your rates because of a pre-existing condition.

You might even qualify for financial help, depending on your retirement income:

Premium Tax Credits: These are subsidies that can make a huge dent in your monthly premium costs.

Cost-Sharing Reductions: If your income falls within a certain bracket, you could get a plan with lower deductibles, copayments, and out-of-pocket maximums.

This support makes private insurance a very real and often affordable choice for those years just before you qualify for Medicare.

Employer-Sponsored Retiree Health Plans

A lucky few retirees still have access to health coverage through a former employer. These plans are less common than they used to be, but if you've got one, it's a fantastic asset. How it meshes with Medicare, however, depends entirely on the plan's specific rules.

It's a common mix-up, but state retirement systems (like NYSLRS in New York) don't actually provide your health insurance. They usually just handle the premium deductions. For real answers about your coverage, you need to talk to your former employer or the plan administrator directly.

Once you turn 65, these plans typically work with Medicare in one of two ways:

As a Secondary Payer: Original Medicare steps in as your primary insurance, paying first on any bills. Your retiree plan then helps cover some of the leftover costs, almost like a Medigap policy would.

As a Medicare Advantage Plan: Some large companies offer their own private Medicare Advantage (MA) plans, available exclusively to their retirees.

If you have a retiree health plan waiting for you, your first step should be to call your old benefits department. You need to get the exact details on how it will coordinate with Medicare.

COBRA: A Temporary Fix

The Consolidated Omnibus Budget Reconciliation Act, or COBRA, lets you keep your exact same employer-sponsored health plan after you leave your job. It’s a temporary lifeline, usually lasting for up to 18 months, that provides a seamless transition without having to change doctors or plans.

There's a catch, though: COBRA is almost always incredibly expensive. You're on the hook for the full premium, plus a 2% administrative fee.

The rules get a little tricky when Medicare enters the picture. If you become eligible for Medicare after you’ve already started COBRA, you can technically keep your COBRA coverage. But the moment you enroll in Medicare, your COBRA plan will likely end. It is absolutely critical to sign up for Medicare when you first become eligible—even if you're on COBRA—to dodge those permanent late enrollment penalties.

Other Important Coverage Sources

Beyond these more well-trodden paths, there are a few other specialized programs that offer vital health coverage to specific groups of retirees.

VA Health Care: If you served in the active military and received an honorable discharge, you could be eligible for VA health benefits. You can use VA care on its own or have it work right alongside your Medicare coverage.

TRICARE For Life: This is a fantastic program for military retirees and their families who are enrolled in Medicare Parts A and B. It acts as a "wraparound" plan where Medicare pays its share first, and then TRICARE For Life steps in to cover most of what's left.

Finally, it's wise to think about other healthcare needs you might face down the road, like long-term care. Understanding what makes essential home health care so valuable can help you prepare for a wider range of scenarios. By exploring every avenue available, you can ensure your health insurance after retirement is as complete and well-suited to you as possible.

How to Budget for Healthcare in Retirement

Choosing the right insurance plan is a huge step, but it’s really just one piece of the puzzle. Now comes the part that keeps your retirement finances on track: figuring out how to actually pay for it all. Creating a realistic healthcare budget is one of the most powerful things you can do to protect your financial stability for years to come.

It's easy to get tunnel vision and focus only on the monthly premium—it’s the most predictable number, after all. But a truly effective budget looks at the whole picture, anticipating all the costs that can pop up when you least expect them.

Look Beyond the Monthly Premium

To build a financial plan that can weather any storm, you have to think about your total potential spending. A rock-bottom premium might look great on paper, but it could mask much higher out-of-pocket costs when you actually need to see a doctor or fill a prescription.

Your total healthcare spending is made up of several moving parts:

Deductibles: This is the amount you pay out of your own pocket before your insurance plan even starts to chip in.

Copayments and Coinsurance: These are the fixed fees or percentages you'll pay for everything from a routine check-up to a major hospital stay.

Out-of-Pocket Maximum: Think of this as your financial safety net. It’s the absolute most you'll have to pay for covered services in a single year, protecting you from catastrophic bills.

Prescription Drug Costs: The price you pay for your specific medications can vary dramatically depending on your Part D or Medicare Advantage plan.

Thinking this way is more important than ever, especially with healthcare costs on the rise. In fact, a recent global medical trends survey projects that medical costs in North America could jump by 8.7% in 2025 alone, which really highlights why a comprehensive budget is non-negotiable.

Account for Costs Medicare Won't Cover

One of the most common budgeting traps is assuming Medicare will handle everything. While Original Medicare is a lifesaver for major hospital and medical bills, it was never designed to cover it all. It leaves some significant—and very common—expenses entirely up to you.

These are the services you will almost certainly have to pay for yourself, unless you have a robust Medicare Advantage plan or separate private insurance.

Key Insight: Imagine your budget has two columns. The first is for predictable insurance costs like premiums. The second is for potential out-of-pocket costs and services Medicare doesn’t cover. A true financial picture needs both.

Make sure your budget has room for these common non-covered expenses:

Routine Dental Care: This includes everything from cleanings and fillings to major work like crowns and dentures.

Vision Exams and Eyeglasses: Medicare typically only steps in for eye care related to medical conditions like glaucoma or cataracts, not routine exams.

Hearing Aids: These essential devices can cost thousands and are not covered by Original Medicare.

Long-Term Care: This is custodial care—help with daily activities like bathing and dressing—which isn't considered medical care by Medicare.

Smart Strategies for Funding Your Healthcare

Once you have a realistic estimate of your total annual healthcare costs, you can start planning how to pay for them. One of the most powerful tools at your disposal is a Health Savings Account (HSA). If you were enrolled in a high-deductible health plan during your working years, hopefully, you were able to build one up.

That HSA money is yours to keep, and you can use it tax-free for qualified medical expenses at any time—even after you're on Medicare. This account can become your dedicated war chest for covering deductibles, copayments, and those surprise dental and vision bills.

Another great strategy is creating a dedicated "sinking fund" or a separate savings account just for healthcare. By setting money aside specifically for this purpose, you ensure the funds are always there when you need them most.

Alright, let's get down to brass tacks. You've done the research, and now it's time to put that knowledge into practice. This isn't just a checklist; it's your game plan for moving from theory to reality and locking in your health coverage for retirement.

Your Step-by-Step Retirement Enrollment Checklist

First things first, you need to know your deadline. This is your Medicare Initial Enrollment Period, or IEP. It's a critical seven-month window that opens three months before you turn 65, includes your birthday month, and closes three months after. Getting this date wrong can cost you, as late enrollment penalties can stick with you for life. So, circle it, highlight it, and set a reminder.

With your timeline locked in, your next job is to take a good, honest look at your personal health situation.

Get a Handle on Your Health and Prescription Needs

Start by gathering all your health-related details. I mean everything.

List your medications: Write down every single prescription drug you take. Note the name, the dosage, and how often you get a refill. Don't forget to jot down your go-to pharmacy.

List your providers: Make another list of all your doctors, specialists, and the hospitals you prefer. This is non-negotiable.

This little bit of homework is invaluable. Your provider list is your "must-have" sheet when you start comparing different Medicare Advantage plans and their networks. If you discover that your top priority is the freedom to see any doctor who takes Medicare, this exercise will make it crystal clear why Original Medicare plus a Medigap plan might be the right path for you.

Pro-Tip: You don't have to figure this out in a vacuum. Every state offers a State Health Insurance Assistance Program (SHIP). These are fantastic, free resources staffed by trained volunteers who provide unbiased, one-on-one counseling. They can help you make sense of the options available right where you live.

Once you have your personal health profile ready, you're armed with the information you need to start comparing plans effectively.

Compare the Plans in Your Area

Your best friend in this process is the official Medicare Plan Finder tool on Medicare.gov. This is the government's free, comprehensive resource for comparing every Medicare Advantage (Part C) and Prescription Drug (Part D) plan in your zip code.

When you plug in that list of prescriptions you made, the tool does the heavy lifting. It calculates your estimated yearly costs for each plan, so you can see the real financial picture beyond just the monthly premium. You can also filter plans to check if your favorite doctors are included in their network.

For Medigap plans, the approach is a bit different because the benefits are standardized by the government. The same Medicare website has a tool to find companies that sell Medigap policies in your state. Here, your mission is to shop for the best price. Once you've decided on a plan letter (like the popular Plan G or Plan N), you'll compare the monthly premiums from different insurance companies to find the most competitive rate.

After you've done your comparisons, all that's left is to make your final choice, submit your application, and keep an eye on your mailbox for your new insurance cards. By taking it one step at a time, you can navigate this process with confidence, knowing you've built a solid plan to protect both your health and your wallet in the years ahead.

Your Top Retiree Healthcare Questions, Answered

Let’s be honest—the details of health insurance after retirement can be tricky. You’ve got questions, and that's completely normal. Here are some straightforward answers to the things people most often ask.

What if I Retire Before I Turn 65?

This is a big one. If you decide to retire before you're eligible for Medicare at age 65, you'll have a gap in coverage that you need to fill.

The most popular path for early retirees is getting a plan through the Health Insurance Marketplace, which was set up by the Affordable Care Act (ACA). Depending on what your income looks like in retirement, you might even qualify for subsidies that make your monthly payments much more manageable. Think of it as a solid bridge to get you safely to your Medicare years.

Can I Change My Mind About My Plan Later On?

Yes, you can, but it’s not always a simple swap. Your ability to change plans really depends on the path you choose from the start.

If you have a Medicare Advantage plan, you get a chance to switch to a different Advantage plan or go back to Original Medicare every year during the Open Enrollment Period (that's from October 15 to December 7).

But—and this is a big "but"—if you start with Medicare Advantage and later want to switch to Original Medicare plus a Medigap policy, you might hit a roadblock. Once your one-time Medigap open enrollment window closes, insurance companies can look at your health history. They can legally deny you a policy or charge you a lot more if you have pre-existing conditions.

The Bottom Line: That first choice between Medicare Advantage and Medigap is a major decision with lasting effects. Switching from an Advantage plan to a Medigap plan down the road isn't a guaranteed option.

Are My Health Insurance Premiums Tax-Deductible?

They can be, yes. The IRS lets you deduct medical expenses—and this includes your premiums for Medicare Part B, Part D, Medigap, and Advantage plans—but only the amount that is more than 7.5% of your adjusted gross income (AGI). It's a nice potential perk, but keep in mind you'll need to itemize your deductions on your tax return to actually claim it.

At America First Financial, we believe in protecting your family’s future with clear, dependable insurance solutions free from political agendas. Secure your health and financial stability with coverage designed for patriotic Americans. You can get a no-hassle quote in under three minutes and find the right plan for your retirement. Learn more and get protected today.

_edited.png)

Comments