Estate Planning 101: Secure Your Family's Future Today

- dustinjohnson5

- Jul 10

- 17 min read

Let's get right to the heart of what estate planning really is. It’s simply the process of creating a clear, legal plan for your assets—what you own—for the day you’re no longer here or if you become unable to make decisions for yourself. It’s not a tool for the ultra-wealthy; it’s a fundamental act of love for anyone who has a family to protect.

Why Estate Planning Is for Everyone

We need to clear up a common myth right away: estate planning isn't just for people with sprawling mansions and massive investment portfolios. If you own a home, have a savings account, or simply want to make sure your kids are taken care of, you need an estate plan. Honestly, it's one of the most profound and responsible gifts you can leave for the people you love.

Think of it as a detailed instruction manual you’re leaving behind. This manual ensures your wishes are followed to the letter, shielding your family from the stress of public court battles, family arguments, and financial headaches that could have easily been avoided.

The Cost of Doing Nothing

When you don't have a plan, you're essentially handing over all the big decisions to the state. This forces your family into a long, public, and often expensive court process called probate. A judge, who has never met you, will follow a rigid set of state laws to divvy up your assets. Their decisions might be the complete opposite of what you actually wanted.

An estate plan puts you in the driver’s seat. It replaces the government’s impersonal rules with your personal, heartfelt instructions, guaranteeing your legacy is handled exactly as you see fit.

Even though it’s so important, a surprising number of people put it off. Surveys consistently show that about 6 in 10 American adults don't even have a basic will. As of early 2025, that means only about 33% of us have created essential documents like a will or trust. This leaves a staggering two-thirds of families at risk of facing a complicated legal mess during what is already an incredibly painful time. You can review more details about these estate planning statistics and their impact on American families.

Key Reasons to Start Estate Planning Today

Starting the process is a powerful act of foresight and protection. For those who've served our country, navigating unique circumstances and specialized benefits makes comprehensive estate planning for veterans especially critical. But no matter your background, the peace of mind you gain is immeasurable.

Here's a quick look at why getting a plan in place is so important.

Benefit | What It Means for Your Family |

|---|---|

Protect Your Beneficiaries | You decide who gets what, ensuring your spouse, kids, or other loved ones are provided for exactly as you wish. |

Avoid Probate Court | A well-crafted plan can keep your estate private and out of the courts, saving your family significant time, money, and stress. |

Minimize Family Conflict | Clear, written instructions leave no room for guessing, which helps prevent disagreements and preserves family harmony. |

Plan for Incapacity | You can appoint someone you trust to manage your finances and health care if you ever become unable to do so yourself. |

Ultimately, these benefits boil down to one thing: taking care of your family and making sure your final wishes are honored. It’s about leaving behind a legacy of peace, not a legacy of problems.

Understanding Your Core Estate Planning Documents

Think of them as specialized tools in a workshop. You wouldn't grab a hammer to turn a screw, right? In the same way, each of these documents is designed for a particular task. Let's break down what they are and, more importantly, what they do for you.

Last Will and Testament: The Personal Instruction Manual

The Last Will and Testament, or just a "will," is usually the first thing people think of with estate planning. The best way to understand it is as your personal instruction manual for what happens after you’re gone. It’s a legally binding document where you get the final say.

A will's primary jobs are to:

Name an Executor: This is the person you trust to be in charge of everything. They’ll be responsible for carrying out your instructions, from paying final bills to making sure your property gets to the right people.

Designate Beneficiaries: This is where you state exactly who gets what. Clearly naming who inherits your home, savings, or treasured family heirlooms is the best way to prevent confusion and family arguments down the road.

Appoint Guardians for Minor Children: If you have young kids, this is probably the single most important reason to have a will. You get to name the person or people you trust to raise your children if something happens to you.

If you don't have a will, you're leaving these crucial decisions up to a court. The state will follow a rigid legal formula that likely won’t match what you actually wanted.

Trusts: The Secure Asset Container

A Trust is another powerful tool, but it works very differently from a will. Think of a trust as a secure container you create to hold your assets. You get to write the rulebook for how everything in that container is managed and handed out, both during your life and after.

One of the biggest benefits of a trust is that the assets inside it almost always avoid the probate process. This means your family can get their inheritance faster, more privately, and usually with fewer legal fees compared to a will alone. You appoint a "trustee" to manage the container according to your rules.

A will is a public letter to a judge that goes through probate. A trust is a private contract with your family that stays out of court.

There are two main flavors of trusts you'll hear about:

Revocable Trust: This one is flexible. You can change it, move assets in or out, or even get rid of it completely while you're alive. It's the most popular choice for most families' estate plans.

Irrevocable Trust: Once this trust is set up and funded, it’s generally set in stone. The trade-off for giving up that control is much stronger protection from creditors and potential tax advantages.

Powers of Attorney: Appointing Your Trusted Deputies

Life is unpredictable. What happens if an accident or illness leaves you unable to make decisions for yourself? That’s where Powers of Attorney (POAs) come in. These documents let you appoint a "trusted deputy"—legally called an agent—to make critical decisions on your behalf.

There are two key types you need:

Financial Power of Attorney: This gives your agent the power to handle your money matters if you can't—things like paying your mortgage, managing investments, and dealing with your bank.

Medical Power of Attorney (or Healthcare Proxy): This lets your agent make healthcare decisions for you if you become incapacitated. They are the person who will talk to doctors and advocate for your wishes.

It's important to know that these documents are only for when you are living. Their power ends the moment you pass away.

Living Will: Your Healthcare Roadmap

Finally, there’s the Living Will, which is sometimes called an Advance Healthcare Directive. This is your healthcare roadmap. It’s a formal document where you state what kind of medical treatments you would or would not want if you were terminally ill or permanently unconscious.

A living will speaks for you when you can't. It answers the toughest questions—like whether you want life support such as a ventilator or feeding tube. This takes an incredible emotional weight off your family, so they don’t have to guess what you would have wanted during a crisis.

Putting together a complete plan often means looking beyond just these documents. Using something like a comprehensive end-of-life planning checklist can be a huge help in making sure every detail, from your will to your healthcare wishes, is thoughtfully addressed.

Choosing Between a Will and a Trust

When you first dip your toes into estate planning, one of the biggest questions that comes up is whether you need a will or a trust. It’s a common sticking point, and honestly, it can feel a little overwhelming. But the choice gets a lot simpler once you understand what each one is designed to do.

At its heart, the decision comes down to what you want for your family and your legacy. Are you focused on privacy? Do you want to avoid the courts? Or is a simple, straightforward plan all you need?

Let’s boil it down. I often tell my clients to think of it like this:

A will is a letter to the court, while a trust is a private contract with your family.

This one idea is the key to understanding almost every other difference between them.

Wills: The Public Path Through Probate

A Last Will and Testament is a formal legal document spelling out your final wishes for who gets what. Simple enough, right? The catch is that for a will to have any legal power, it must first be validated by a court in a process called probate.

This court supervision means your will becomes a public document. Anyone can look it up and see a general inventory of the assets it controls. For many folks with straightforward finances and family situations, a will is a perfectly fine—and cost-effective—tool. Its primary job is to appoint an executor to settle your affairs and make sure your property ends up in the right hands.

Trusts: The Private and Controlled Route

A revocable living trust, on the other hand, is built from the ground up to keep your estate out of court. It’s a private agreement. When you create one, you transfer ownership of your major assets—like your house, investment accounts, or business interests—from your name into the name of the trust.

You still have complete control over everything, but on paper, the trust owns it. Because you don't technically own those assets when you pass away, there’s nothing for the probate court to get involved with. The whole process is handled privately by a person you name as your successor trustee. This gives you much more control, not just over who inherits, but also how and when they receive their inheritance.

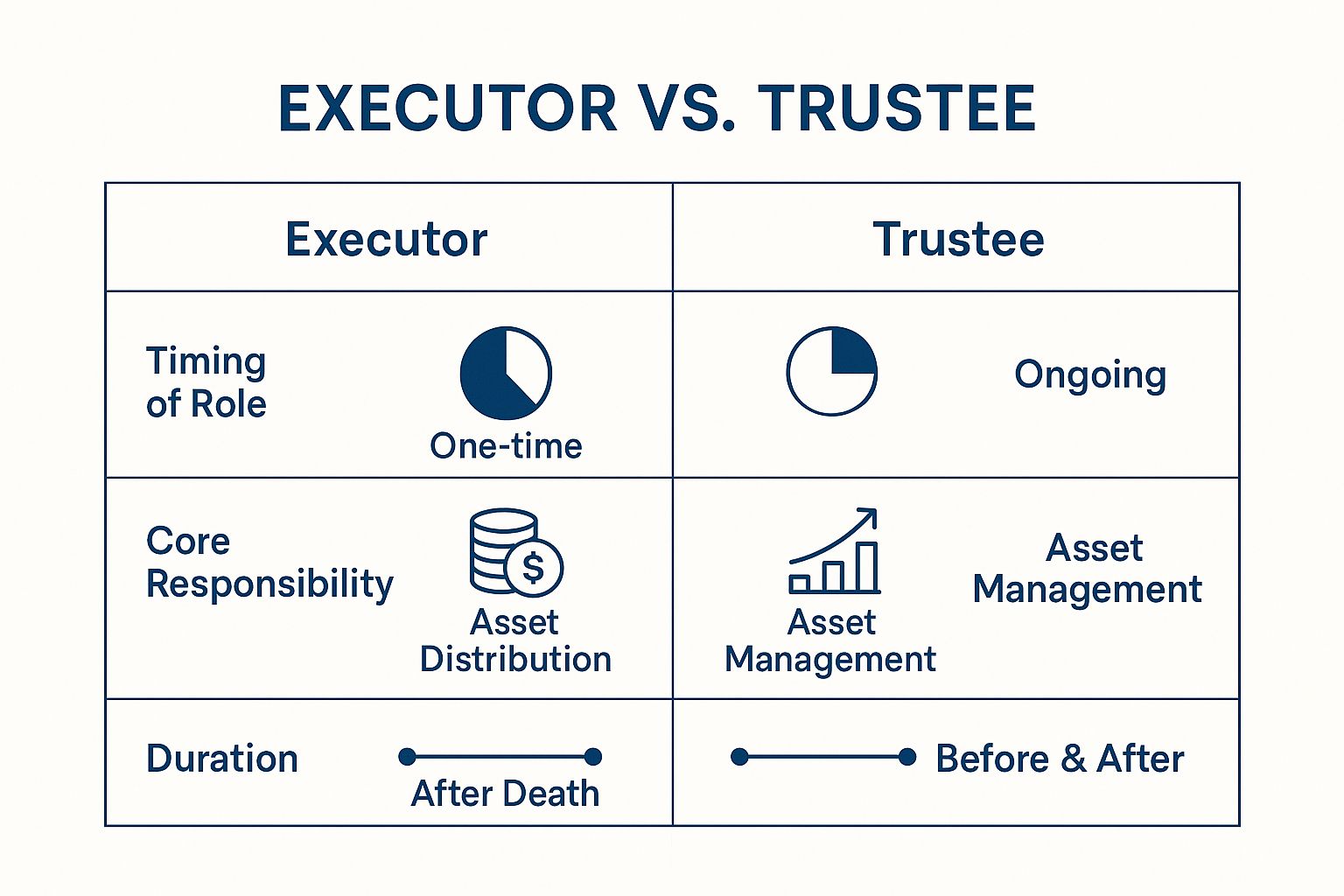

This image really helps clarify the different jobs of an executor (for a will) and a trustee.

As you can see, an executor's role is a short-term project that kicks in after you're gone. A trustee's job, however, can be a long-term management role that can even start while you're still living if you become unable to manage things yourself.

Comparison of Wills and Trusts

So, which one is right for you? It helps to see them side-by-side. This table breaks down the key differences that matter most to families.

Feature | Last Will and Testament | Revocable Living Trust |

|---|---|---|

Probate Process | Required. Your estate has to go through the public court system, which can be slow and expensive. | Avoided. Assets in the trust pass privately to your heirs without court intervention, saving time and money. |

Privacy | Public record. Your will and a list of your probate assets are available for anyone to see. | Completely private. The details of your trust and the assets it holds are kept confidential. |

Control Over Distribution | Limited. Assets are typically distributed outright to beneficiaries once probate is over. | Highly flexible. You can set specific rules for inheritance, like age milestones or funds for education. |

Incapacity Planning | Does not help. A will only works after you die. It provides no plan if you become incapacitated. | Effective. Your successor trustee can step in to manage trust assets for you if you become unable to do so. |

Cost to Create | Lower upfront cost. It's generally less expensive to have a will drafted and signed. | Higher upfront cost. It costs more to set up and requires the extra step of "funding" it by transferring assets. |

Effectiveness at Death | Effective for assets in your name. It directs the probate of assets you personally own at death. | Effective only for funded assets. The trust only controls assets you've formally transferred into its name. |

Ultimately, understanding these trade-offs is what leads to a confident decision.

The primary reasons families I work with choose a trust are to sidestep probate, protect their privacy, and maintain more control over how their legacy is managed for the next generation. A trust can be especially useful for blended families, allowing you to provide for a current spouse while making sure your children from a prior marriage are also taken care of.

Likewise, if you own property in more than one state, a trust can save your family a massive headache by avoiding separate probate cases in each state. Talking through your specific situation with a professional is always the best way to figure out which path makes the most sense for you.

How to Create Your First Estate Plan

Alright, now that we’ve covered the essential documents, it's time to roll up our sleeves and put a plan in motion. Taking on your first estate plan can feel like a massive undertaking, but I promise it's not as intimidating as it sounds.

Think of it as a series of straightforward, manageable steps. If you focus on one piece at a time, you'll build a solid, reliable plan that protects your family and upholds your values with confidence. Let's walk through it together.

Step 1: Take Inventory of Your Assets

First things first: you can’t decide where your property goes if you don’t have a clear picture of what you actually own. This initial step is all about creating a complete financial snapshot. It’s not just about the big-ticket items; it’s about everything.

Grab a notepad or open a spreadsheet and start listing everything of value. Be thorough.

Real Estate: This includes your primary home, any vacation properties, rental units, or raw land you own.

Financial Accounts: List all your checking and savings accounts, CDs, brokerage accounts, and, of course, your retirement plans like 401(k)s and IRAs.

Tangible Personal Property: Think about your vehicles, furniture, art, jewelry, firearms, and any valuable collections.

Digital Assets: Don't forget about your social media accounts, domain names, online businesses, or any cryptocurrency holdings.

When you're cataloging your possessions, getting an accurate valuation is key, especially for unique items. For example, knowing how to find the value of antiques can make a real difference in ensuring your plan is both fair and precise.

Step 2: Define Your Goals and Beneficiaries

With your full inventory in hand, now comes the "why." What do you want your estate plan to achieve? This is where you make the heart-of-the-matter decisions about who will inherit your assets.

Your beneficiaries are the people, charities, or organizations you want to receive your property. Precision is your best friend here. Instead of a vague note like "to my children," list each child by their full legal name. This simple act of clarity can prevent a world of confusion and potential disputes down the road.

Step 3: Choose Your Key People

An estate plan is not self-executing. It relies on people you trust to see it through. You’ll need to hand-pick individuals for a few critical roles. Choose with care—these people should be responsible, organized, and, above all, trustworthy.

Selecting the right people is one of the most important decisions in estate planning. Your executor, trustee, and guardians are the stewards of your legacy, entrusted to act on your behalf when you no longer can.

Here are the key roles you'll need to fill:

Executor (or Personal Representative): This is the person who will manage your will and guide your estate through the probate process.

Trustee (if you create a trust): This person or institution is responsible for managing the assets held inside your trust for the benefit of your beneficiaries.

Guardian for Minor Children: If you have children under 18, this is the person you name to care for them. It's arguably the most important decision a parent can make.

Agent for Powers of Attorney: You'll need to name one person to make financial decisions (Financial POA) and another for healthcare choices (Medical POA) if you become incapacitated.

Step 4: Draft and Finalize Your Documents

Once you've made these foundational decisions, it's time to get everything down on paper in legally binding documents. Generally, you have two options: work with an experienced estate planning attorney or use a reputable online service.

For most families with straightforward goals, an online service can work well. However, if your situation is more complex—say, you own a business, have a blended family, or have a significant net worth—investing in a skilled attorney is almost always the wiser choice.

After the documents are drafted, they must be signed and witnessed according to your state’s specific laws. This isn't just a suggestion; it's a requirement for the documents to be legally valid. Skipping this formal process can render your entire plan useless.

Finally, store the signed originals somewhere safe and secure, like a fireproof safe or a bank's safe deposit box. And just as importantly, make sure your executor knows exactly where to find them when the time comes.

Planning for Modern Assets and Family Dynamics

A solid estate plan has to do more than just account for the house and the bank accounts. These days, our lives are filled with digital possessions and family situations that simply weren't common a generation ago. If your plan ignores these modern realities, you're leaving behind major gaps that can cause real confusion and heartache for the people you love most.

This is where estate planning 101 gets real. We need to make sure your plan is built for the world we live in now, covering everything from your social media presence to the unique dynamics of a blended family. These modern assets and relationships are every bit as important as the traditional wealth you've worked so hard to build.

Accounting for Your Digital Footprint

Take a moment and think about how much of your life exists purely online. We're talking about social media profiles, email accounts, online banking portals, cloud photo storage, and even cryptocurrency wallets. Without a specific plan for them, these assets can get locked away forever after you're gone—or worse, fall into the wrong hands.

To handle this, your estate plan should name a digital executor. Think of this person as your trusted “digital key master.” Their job is to access, manage, and eventually close or transfer your online accounts exactly as you've instructed. This simple step protects your sentimental digital property from being lost and safeguards your identity.

The whole world of estate planning is changing fast. By 2045, an estimated $84 trillion is set to pass between generations, and a huge chunk of that wealth will be digital. Yet, there's a disconnect: while 80% of high-net-worth individuals own digital assets, very few have actually included them in their plans. Fewer than 25% of Americans have even designated beneficiaries for their digital estates. You can discover more insights about these 2025 estate planning trends to see why this is such a critical new frontier.

Navigating Modern Family Structures

The classic "one-size-fits-all" estate plan just doesn't cut it anymore because family today looks a lot different than it did fifty years ago. It is absolutely vital that your documents reflect your unique family situation with crystal clarity.

Your estate plan must be a precise reflection of your family as it exists today, not as a generic template assumes it to be. Ambiguity is the enemy of family harmony.

Here are just a few common situations that demand careful, specific planning:

Blended Families: If you have children from a previous marriage, a simple will could accidentally disinherit them. Using a trust is often a much better strategy, as it allows you to provide for your current spouse while legally guaranteeing your children receive their intended inheritance later on.

Unmarried Partners: No matter how many years you've built a life together, the law may not recognize your long-term partner's right to your property without explicit legal documents. A clear, legally sound plan is the only way to protect them.

Providing for Pets: For many of us, our pets are beloved members of the family. You can add instructions to your will or even create a dedicated "pet trust" to set aside funds and name a caregiver, making sure your furry friends are cared for and loved for the rest of their lives.

Keeping Your Estate Plan Current Through Life's Changes

Going through the process of creating your estate plan is a huge accomplishment. You’ve taken a monumental step to protect your family and your legacy. But one of the most common—and costly—mistakes I see people make is filing it away and never looking at it again.

Think of your estate plan as a living, breathing set of instructions, not a historical document carved in stone. It needs to adapt and evolve right along with you. It’s a bit like the routine maintenance on your car; you wouldn't just drive it for 100,000 miles without an oil change and expect it to run smoothly. Your plan needs regular tune-ups to ensure it still reflects your wishes and works as intended when your family needs it most.

Key Events That Demand a Plan Review

Some life events are so significant they can instantly make parts of your plan obsolete, or worse, cause outcomes you never would have wanted. A plan that was perfect for your family five years ago might be completely unsuitable today.

It's absolutely critical to pull out your documents and schedule a review with your advisor after any of these major changes:

Marriage or Divorce: Getting married gives your new spouse legal rights you'll need to account for. A divorce might automatically nullify gifts to an ex-spouse in a will, but it won't in other documents, like life insurance policies. You have to be thorough.

Birth or Adoption: When a new child or grandchild joins the family, they aren't automatically included. You have to add them by name to make your intentions clear.

Death of a Beneficiary or Fiduciary: If someone you named in your plan—whether a beneficiary, executor, or trustee—passes away, you must officially name a successor.

Major Financial Changes: Coming into a large inheritance, selling a business, or even buying a vacation home can throw off the entire structure of your plan.

Moving to a New State: This is a big one. Estate and inheritance laws can vary dramatically from state to state. Your perfectly valid Texas will might have serious complications in California.

An outdated estate plan can be as dangerous as having no plan at all. It can create family conflict and lead to outcomes that are the exact opposite of what you intended, all because it no longer matches the reality of your life.

The 3-5 Year Check-Up

Even if your life feels stable and you haven't had any of those major upheavals, a good rule of thumb is to sit down and review your plan every three to five years.

Laws change. Family dynamics shift. Your own feelings about how you want to leave your legacy might even change. This simple habit keeps your estate planning 101 foundation strong, guaranteeing your instructions are always current and your family is always secure.

Your Top Estate Planning Questions, Answered

Even with a solid grasp of the basics, it's completely normal for questions to pop up. Estate planning is a deeply personal journey, full of details unique to your family. Let's walk through some of the most common questions I hear to help you move forward with confidence.

How Much Does an Estate Plan Cost?

This is the big one, and the honest answer is: it depends.

For straightforward situations, you can create a solid plan using a quality online service for just a few hundred dollars. It's a fantastic, affordable option for many families. If you bring an attorney on board, the cost will naturally be higher, typically landing somewhere between $1,500 and $5,000. For those with more complex needs, like a family business or substantial assets, the price can increase from there.

But here’s the most critical number to think about: the cost of doing nothing. The expenses your family could face from probate court, legal squabbles, and taxes that could have been avoided will almost always be far, far greater than the upfront cost of getting a plan in place.

What Happens If I Die Without a Will?

If you pass away without a will, the legal term for it is dying "intestate." This means the state steps in to decide who gets your assets. They follow a cold, rigid formula called intestate succession, and a judge you've never met will have the final say.

This court-mandated process almost never mirrors what you would have actually wanted. It doesn't care about your specific wishes, cherished friendships, or the unique dynamics of your family. It's a one-size-fits-all solution that rarely fits anyone.

Do I Need an Attorney to Create a Will?

Not necessarily. If your family life is straightforward and your assets are modest, a do-it-yourself will from a reputable online platform can be a perfectly sound and cost-effective choice. These tools have opened the door for many Americans to get essential protections in place.

However, I strongly advise seeking professional legal counsel if your situation has more moving parts. You'll want an attorney in your corner if you:

Own a business

Have a blended family

Own property in more than one state

Have a high net worth

An experienced attorney ensures all those important nuances are locked down and legally airtight.

Interestingly, we're seeing some new trends in how people approach this. A 2025 report found that 34% of men now have a will compared to just 29% of women. It also revealed that about 20% of Americans now trust AI-generated advice for estate planning. You can discover more insights from this 2025 estate planning report to see how things are changing.

How Often Should I Review My Estate Plan?

Think of your estate plan as a living document, not something you carve in stone and forget. It needs to evolve as your life does. A good rule of thumb is to pull it out and give it a thorough review every three to five years.

More importantly, you need to update it immediately after any major life event. Don't wait. These events include:

Getting married or divorced

Welcoming a new child or grandchild

The death of anyone named in your plan (like a beneficiary or executor)

A significant swing in your financial situation, up or down

Moving to a new state with different laws

Keeping your plan current ensures it always reflects your life, your wishes, and your values.

At America First Financial, we believe your family's future deserves to be protected with financial solutions that align with traditional American values. You can secure your legacy with insurance products designed for stability and peace of mind, without any political noise. Take the first step toward safeguarding what you've worked so hard to build—get a straightforward quote online in under three minutes from America First Financial today.

_edited.png)