Family Life Insurance Tips for Securing Your Family's Future

- dustinjohnson5

- Jun 3

- 13 min read

Understanding What Your Family Really Needs

Family life insurance. It's a common term, but what does it truly mean for your family's well-being? It's not about complicated financial instruments. It's about providing peace of mind, ensuring your loved ones are financially secure if the unexpected occurs. It’s about safeguarding your children's education and ensuring your spouse can remain in your home. Ultimately, it involves open discussions about your family's financial vulnerabilities and building a solid safety net.

Evaluating Your Specific Needs

Every family has unique financial obligations and long-term goals. A single parent's needs will differ significantly from those of a dual-income family with several children. This means a generic life insurance policy won't suffice. You need a strategy customized for your family’s specific circumstances.

Consider your debts: Think about your mortgage, student loans, car loans, and other outstanding balances. Life insurance can help cover these, preventing them from becoming a burden on your family.

Factor in future expenses: Consider upcoming costs like college tuition, weddings, or your spouse's retirement. These expenses can arrive quickly, and life insurance can help guarantee they're covered.

Account for daily living expenses: Don't overlook everyday costs such as groceries, utilities, and childcare. These continue even after a loss, and life insurance can provide the financial stability your family needs.

The Growing Importance of Family Life Insurance

The demand for family life insurance is increasing worldwide. The global life insurance market reached a value of $3.1 trillion in 2024 and is projected to reach $18.03 trillion by 2034. This growth reflects a growing awareness of life insurance’s vital role in financial planning. Explore this topic further. Shifting family dynamics and economic uncertainties make planning for unforeseen events more critical than ever.

Moving Beyond Individual Coverage

Family life insurance is distinct from individual policies. It recognizes the interconnected financial responsibilities within a family and seeks to protect everyone, not just one person. This often means exploring multiple policies or riders to address each family member's needs comprehensively. This understanding is fundamental to building a robust financial safety net.

Choosing The Right Coverage Type For Your Family

Protecting your family's financial well-being is paramount. Life insurance is a key component of that protection, but the variety of coverage options can be daunting. This section breaks down the common types of family life insurance, helping you choose the best fit for your family's needs, budget, and future goals.

Term Life Insurance: Affordable Protection For Specific Periods

Term life insurance offers coverage for a set time, such as 10, 20, or 30 years. This is often the most budget-friendly option, ideal for young families needing substantial coverage without steep premiums. If the insured person passes away within the policy term, beneficiaries receive the death benefit. This makes term life insurance excellent for covering obligations like mortgages or replacing income during crucial years. However, coverage ends when the term expires unless renewed, often at a higher rate.

Whole Life Insurance: Lifetime Coverage and Cash Value Growth

Unlike term life insurance, whole life insurance provides coverage for life as long as premiums are paid. It also accumulates cash value that can be borrowed against or withdrawn. This makes whole life a more intricate financial product, suited for families wanting both a death benefit and long-term savings. While offering lifelong protection and cash value potential, whole life insurance usually has higher premiums than term life.

Universal Life Insurance: Flexibility For Changing Needs

Universal life insurance offers lifelong coverage with greater flexibility than whole life. It allows adjustments to premiums and death benefits within limits, adapting to changing financial situations. This flexibility can be valuable for families expecting income changes or evolving needs. However, universal life policies can be complex and may have higher premiums than term life.

Specialized Policies: Tailored Support For Specific Situations

Besides these common types, other policies address specific needs. Family income benefit (FIB) policies provide regular payments to beneficiaries over a period, rather than a lump sum. This can effectively replace a deceased parent's income, providing consistent support.

To help you further compare the different types of life insurance, we've compiled the following table:

Family Life Insurance Coverage Types Comparison

A detailed comparison of different life insurance types showing coverage features, benefits, costs, and ideal family situations.

Coverage Type | Key Features | Best For | Average Cost Range | Cash Value |

|---|---|---|---|---|

Term Life Insurance | Fixed premium and death benefit for a specific term (e.g., 10, 20, or 30 years). Most affordable option. | Young families, those with temporary needs like mortgage protection. | $25-$50/month per $500,000 coverage (varies by age, health, term length) | None |

Whole Life Insurance | Lifelong coverage. Guaranteed cash value growth. | Long-term financial security, estate planning. | $200-$500/month per $500,000 coverage (varies by age, health) | Guaranteed |

Universal Life Insurance | Flexible premiums and death benefits. Cash value growth potential. | Families with changing financial needs, those seeking more control over their policy. | $100-$300/month per $500,000 coverage (varies by age, health, policy specifics) | Potential for growth |

Family Income Benefit (FIB) | Regular income payments to beneficiaries over a set period. | Replacing a deceased parent's income stream. | $50-$150/month per $2,000 monthly income benefit (varies by age, health, benefit period) | None |

The table above highlights the key differences and similarities between each type of family life insurance, allowing you to easily compare features, costs, and suitability. Choosing the right policy depends on your specific financial circumstances and goals.

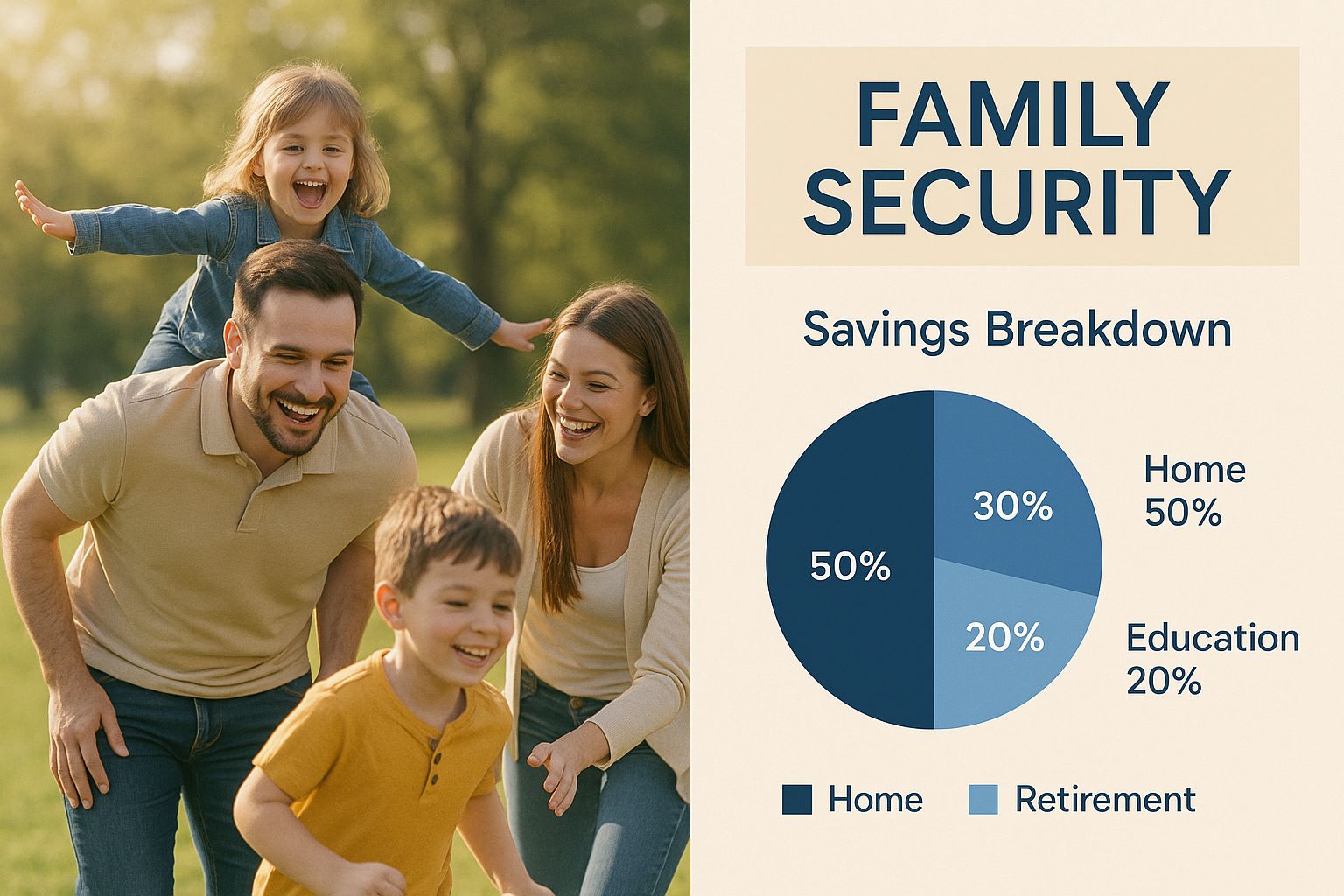

This infographic depicts a happy family enjoying time together, representing the security life insurance provides. It emphasizes that life insurance offers more than financial protection; it provides peace of mind. Knowing your loved ones are cared for allows families to focus on life's precious moments. Choosing the right life insurance helps ensure your family’s financial stability, regardless of what the future holds.

Calculating Coverage That Actually Protects Your Family

Choosing the right amount of life insurance for your family is a critical decision. It's not about selecting a random number. Instead, it's about understanding your family's unique financial situation and making sure their needs are met if you were to pass away. This section offers practical methods to calculate coverage that provides real security.

The Income Replacement Approach

A common strategy is the income replacement approach. This method calculates how much money your family would need to replace your income if you were no longer around. For instance, if you make $75,000 a year and want to replace 10 years of income, you would need $750,000 in coverage. This helps guarantee your family can maintain their current standard of living.

Eliminating Debt: Protecting Your Family From Financial Burdens

The debt elimination strategy centers on paying off outstanding debts such as mortgages, student loans, and auto loans. This approach prevents these financial responsibilities from burdening your family after you're gone. Combining your total debt with your income replacement calculation offers more complete protection.

Planning For The Future: Education and Retirement

Thinking ahead to future expenses, like college tuition and retirement savings, is also key. Estimate these costs and include them in your overall coverage calculation. For example, think about how much you have saved for college already, and how much more you expect to need. This careful approach helps you customize your family life insurance to prepare for important milestones.

Factoring in Other Important Considerations

Beyond the core methods, think about these additional factors:

Spouse's earning potential: If your spouse works, their income can help offset the required coverage. However, it's wise to consider potential career interruptions if they take on the role of primary caregiver.

Stay-at-home parent contributions: It’s important to put a monetary value on the contributions of a stay-at-home parent, such as childcare and managing the household. These services often require paid help if the stay-at-home parent is no longer there.

Inflation's impact: Remember that costs tend to increase over time due to inflation. Account for a realistic inflation rate to ensure your coverage remains sufficient. This helps preserve the true value of your policy benefits.

Avoiding Common Mistakes

Families sometimes make errors when figuring out coverage amounts. Two common errors are significantly under-insuring the main income earner and forgetting about the effects of inflation on future expenses. By considering these factors carefully, you can ensure your family will have the financial support they require.

Why Families Are Prioritizing Life Insurance Now

Something fundamental has shifted in how families view financial security. Recent market trends reveal a move beyond traditional approaches to life insurance, driven by economic realities and a growing awareness of their financial vulnerability. This section examines the increasing demand for family life insurance.

Economic Uncertainty and Evolving Workforce Dynamics

Economic uncertainty and job market volatility play a significant role in this shift. The rise of the gig economy also impacts access to traditional employer-provided benefits, leaving many families responsible for securing their own safety nets. Understanding the costs associated with building an online presence, such as website design costs, can help families make more informed financial decisions.

Re-Evaluating Financial Safety Nets

Recent global events, such as the COVID-19 pandemic, have dramatically reshaped family priorities. In the United States, the life insurance market experienced a significant surge following the pandemic. In 2021, life insurance sales reached record-high growth rates, a phenomenon not seen in over 40 years. This heightened awareness has led families to re-evaluate existing financial safety nets and identify potential gaps in their coverage.

The Growing Life Insurance Market

By 2024, U.S. life insurance premiums were projected to reach $15.9 billion, setting a new record. The market is expected to maintain its upward trajectory, with a projected compound annual growth rate (CAGR) of 9.40% from 2025 to 2034. More detailed statistics on this growth can be found here. Many families are now turning to family life insurance to address these vulnerabilities and provide a greater sense of security.

Demographic Trends and Modern Financial Challenges

Demographic trends also play a role in life insurance decisions. Delayed parenthood extends the period of financial responsibility for families, while longer lifespans necessitate extended coverage periods. Modern financial challenges, such as the complexities of remote work and managing multiple income streams, require adaptable insurance strategies. These shifts prompt families to reassess their insurance needs and seek solutions tailored to their specific circumstances.

Adapting to Change and Embracing New Opportunities

Families are adapting their insurance strategies to navigate these changes. They are actively addressing the unique challenges of modern family structures and taking advantage of new opportunities available within the insurance marketplace. This proactive approach enables families to achieve greater financial security and peace of mind, knowing they are protected regardless of what the future may hold.

Hidden Benefits That Make Life Insurance Even Smarter

Family life insurance is often viewed as a safety net, a way to protect loved ones after you're gone. But it can offer much more than just a death benefit. Savvy families recognize life insurance as a powerful tool for building financial stability and creating a brighter future. Let's explore some of these often-overlooked advantages.

Building Cash Value: A Foundation For Future Goals

Certain life insurance policies, such as whole life insurance, offer a cash value component. This feature allows your policy to grow in value over time, similar to a savings account. This accumulating cash value can become a substantial asset, providing funds for a variety of needs.

You could, for instance, use this cash value to supplement your retirement income. It could also help cover your children's education expenses, or even manage unexpected financial emergencies. Having access to these funds can provide significant peace of mind.

Accelerated Death Benefits: Accessing Funds During Critical Times

Another key benefit is the accelerated death benefit. This feature allows policyholders facing a terminal illness to access a portion of their death benefit while they are still living. This access can be essential for covering medical expenses, managing end-of-life care, or simply ensuring financial comfort during a challenging time. Families facing a health crisis can utilize their life insurance to alleviate immediate financial burdens, allowing them to focus on their health and well-being.

Riders: Enhancing Your Coverage For Specific Needs

Many policies offer riders, which are optional add-ons that provide supplemental protection. These riders often address specific situations that could impact your family's financial security.

Disability Income Rider: This rider provides a monthly income if you become disabled and are unable to work. This additional coverage can help maintain financial stability, ensuring bills are paid even if your regular income is interrupted.

Critical Illness Rider: This rider offers a lump-sum payment if you are diagnosed with a covered critical illness, such as cancer or a heart attack. These funds can help cover substantial medical expenses and other associated costs.

Estate Planning and Business Succession Strategies

Life insurance can also play a key role in estate planning. The death benefit can help cover estate taxes, ensuring your assets are distributed to your heirs according to your wishes.

For business owners, life insurance is vital for business succession planning. It can provide the necessary funds for a partner to buy out your share of the business, guaranteeing the company's continued operation.

Supporting Causes You Care About

Life insurance can even extend to charitable giving. By designating a charity as your beneficiary, you can provide them with a meaningful donation upon your passing. This approach can create a lasting legacy for both your family and the organizations you value.

By understanding these often-overlooked benefits, families can develop a more comprehensive understanding of life insurance. It becomes more than just a death benefit; it evolves into a versatile financial tool that can support their long-term goals, aspirations, and provide essential protection for their loved ones.

Finding The Right Insurance Partner For Your Family

Choosing the right life insurance policy for your family is a significant decision. Equally important is selecting the right insurance company. This choice can have a lasting impact on your family's financial well-being. This section will guide you through evaluating potential insurers and finding the best coverage for your loved ones.

Evaluating Financial Strength and Stability

The financial strength of an insurance company is a critical factor. This refers to their ability to pay out claims, potentially decades down the line. Independent rating agencies such as A.M. Best, Moody's, and Standard & Poor's, assign ratings that reflect a company's financial stability. Look for insurers with high ratings, preferably "A" or better. This ensures the company will be able to meet its obligations when your family needs them most.

Customer Service That Matters

While financial strength is paramount, excellent customer service should not be overlooked. Dealing with a life insurance claim is inherently stressful. A company with responsive and empathetic customer service can significantly ease this burden. Research online reviews and testimonials to understand other customers’ experiences.

Asking The Right Questions

Before committing to a policy, ask potential insurers key questions:

What is your claims payout history?

What is your claims process like?

What support do you offer during the claims process?

Can you provide customer service examples?

These questions can reveal an insurer's commitment to its policyholders.

Understanding Policy Details and Working With Professionals

Thoroughly review policy illustrations and contract terms. Pay close attention to the fine print, especially regarding coverage exclusions and limitations. Consider working with a qualified insurance agent or financial advisor. They can clarify complex terminology, answer your questions, and help you compare policies to find the best fit. This is especially valuable for families with unique financial situations.

Red Flags To Watch For

Be wary of insurers exhibiting these red flags:

Pressuring you into a quick decision

Unusually low premiums

Consistently poor customer service reviews

Lack of transparency about financial strength

These warning signs could indicate potential issues down the road. Finding the right family life insurance partner requires careful research and consideration. By evaluating financial strength, customer service, and policy details, and seeking expert guidance, you can confidently secure the best protection for your family.

Choosing a provider like America First Financial (https://www.americafirstfinancial.org) offers affordable protection for families. Their commitment to financial security and user-friendly online quote system can simplify the decision-making process.

To help you in your research, the following table summarizes key factors to consider when evaluating life insurance companies:

Key Factors for Evaluating Life Insurance Companies Essential criteria and rating factors to consider when selecting a life insurance provider for your family

Evaluation Factor | Why It Matters | How to Research | Red Flags to Avoid |

|---|---|---|---|

Financial Strength | Ensures the company can pay future claims | Check ratings from agencies like A.M. Best, Moody's, and S&P | Ratings below "A", negative financial news |

Customer Service | Simplifies the claims process and provides support | Read online reviews and testimonials | Consistently poor reviews, difficulty contacting representatives |

Policy Details | Determines the extent of your coverage | Review policy illustrations and contracts carefully | Unclear language, numerous exclusions, limited benefits |

Company Reputation | Reflects overall reliability and ethical practices | Research company history and news articles | History of regulatory issues, negative press, lawsuits |

By carefully considering these factors and researching potential insurers, you can make an informed decision and choose a life insurance partner that will provide reliable protection for your family's future.

Your Family Protection Action Plan

Protecting your family's future begins with understanding your needs and taking proactive steps. This section offers a clear roadmap to securing your family's financial well-being with life insurance. It's about transforming knowledge into a concrete plan, empowering you to safeguard your loved ones.

From Consideration To Coverage: A Step-by-Step Guide

Moving from considering life insurance to actually securing a policy requires a structured approach. Here’s a practical guide to navigating the process:

Assess Your Needs: Determine your family's current and future financial obligations. This includes mortgage payments, outstanding debts, anticipated education costs, and daily living expenses.

Choose the Right Coverage: Select the type of life insurance that best aligns with your needs and budget. Term life insurance offers affordable coverage for a specific period, while whole life insurance provides lifelong protection and potential cash value accumulation.

Calculate Coverage Amount: Determine the appropriate death benefit to adequately protect your family. Consider income replacement, debt elimination, and future expense planning.

Find the Right Insurer: Evaluate insurance companies based on financial strength, customer service, and policy details. For insights on selecting the right partner, visit the Tevello Blog.

Gather Necessary Documents: Prepare required documents such as proof of income, identification, and medical records. This preparation can streamline the application process.

Complete the Application: Fill out the insurance application accurately and honestly. Be prepared to undergo a medical exam, a standard part of the underwriting process.

Review and Finalize: Carefully review the policy details before finalizing the agreement. Ensure the coverage, beneficiaries, and premium payments meet your expectations.

Open Communication: Talking To Your Family

Discussing life insurance can be a sensitive but essential step. These conversations ensure everyone understands the plan and their role:

Be Transparent: Openly explain why you're getting life insurance and how it benefits the family. Transparency builds trust and understanding.

Address Concerns: Listen to family members' concerns and address them patiently. Answer questions honestly and offer reassurance about the financial security life insurance provides.

Involve Everyone: Include all family members in the decision-making process, particularly older children. This fosters a sense of shared responsibility.

Maintaining Your Coverage: Adapting to Life's Changes

Life insurance isn't a static decision. Regularly review your coverage as your family evolves:

Update Beneficiaries: Ensure your beneficiaries are up-to-date and reflect your wishes. Life changes like marriage, divorce, or the birth of a child require beneficiary updates.

Adjust Coverage Amount: As your financial obligations change, adjust your coverage accordingly. A higher income, a larger mortgage, or a growing family might necessitate increased coverage.

Review Policy Annually: Review your policy each year to ensure it still meets your needs. Look for any changes in premiums, benefits, or policy terms.

Troubleshooting and Staying Informed

Address any potential issues proactively. For example, missed premium payments can lapse your policy, leaving your family unprotected. Contact your insurer immediately if you foresee difficulty making a payment. Stay informed about changes in the insurance market and any regulatory updates that might affect your coverage.

Securing your family's future involves more than just understanding life insurance. It requires a proactive approach, open communication, and a commitment to maintaining your coverage over time. By taking these steps, you can create a strong financial safety net, providing lasting peace of mind.

Ready to secure your family's future? Get a free quote from America First Financial today and experience the peace of mind that comes with knowing your loved ones are protected: [https://www.americafirstfinancial.org](https://www.americafirstfinancial.org)

_edited.png)

Comments