Financial Planning for Seniors: Secure Your Golden Years

- dustinjohnson5

- Jun 12

- 14 min read

Why Everything You Know About Retirement Has Changed

Think back to how your parents envisioned retirement: a gold watch, a steady pension check, and a comfortable 10-15 years of enjoying life. This picture, once the classic American dream, feels almost outdated now. Today’s retirement landscape looks vastly different, demanding a fresh approach to financial planning for seniors.

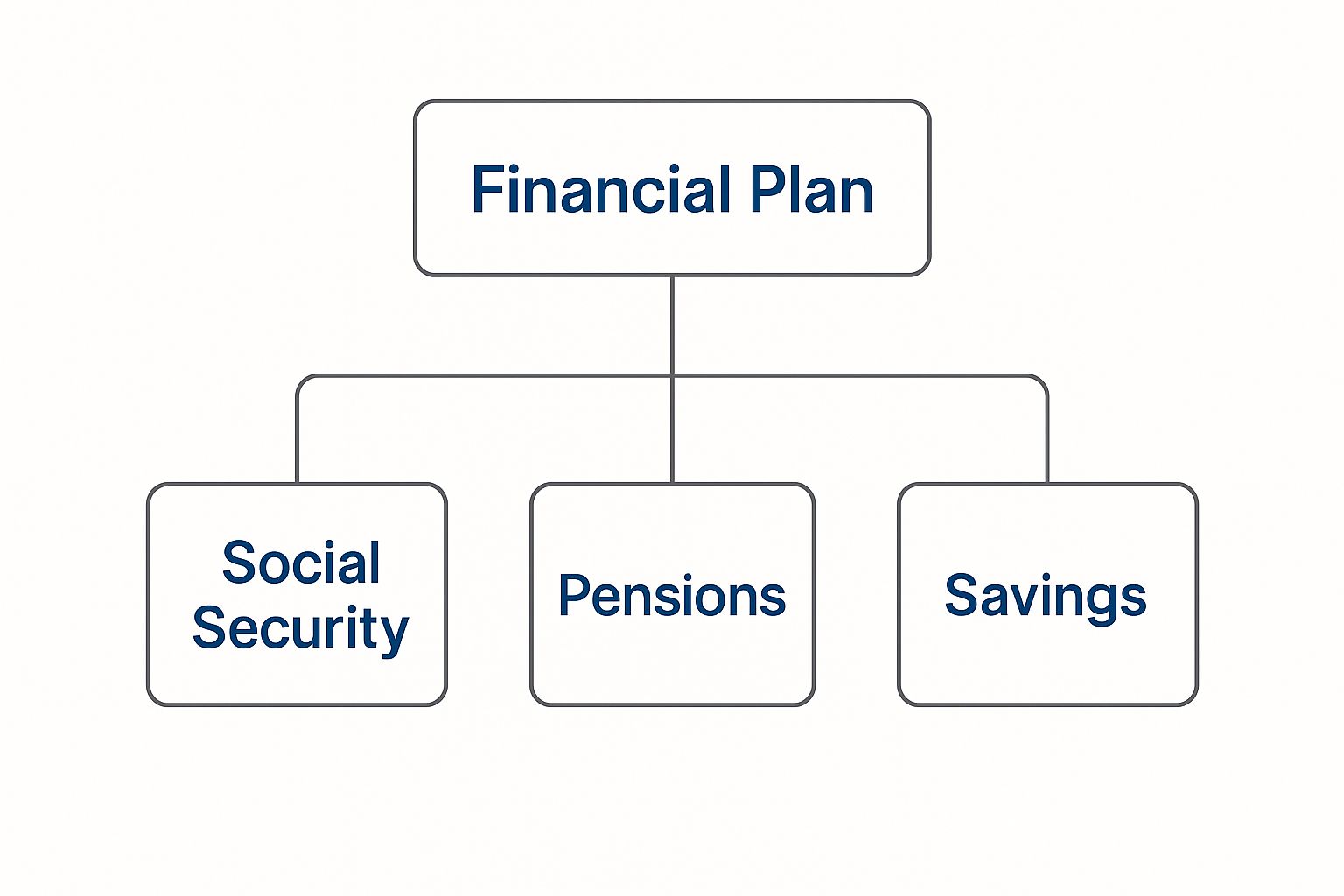

The image below highlights this fundamental shift in how we fund retirement:

Notice how pensions have taken a backseat, while personal savings now play a much bigger role alongside Social Security. This move towards self-funded retirement means we need to be more proactive and informed about our financial planning. Plus, we're living longer! Retirement can easily stretch over 20-30 years, not the traditional 10-15. This calls for a more robust financial plan that can adapt to longer lifespans and the expenses that come with them.

The Shifting Sands of Pension Plans

The transition from defined benefit pension plans (which guarantee a specific monthly payment) to defined contribution plans (like 401(k)s) has put the responsibility of saving squarely on our shoulders. Imagine two people: one with a guaranteed pension and the other relying on a 401(k). The pensioner enjoys predictable income, while the 401(k) holder's future depends on market performance and their own investment choices. This change underscores the vital role of sound financial planning, especially as we approach our senior years.

This shift has placed a heavy burden on individuals to manage their own savings and navigate the ups and downs of the market, making informed investment decisions essential for a secure retirement. By 2050, the number of people aged 65 and over worldwide is expected to more than double to 1.6 billion. This will put immense pressure on existing retirement systems to support these longer lifespans. For a deeper dive into these demographic shifts, take a look at this report: Discover more insights.

Let's consider another perspective on the complexity of pensions:

This screenshot offers a glimpse into the different types of pension plans and the challenges they face. The constantly changing rules and different plan structures emphasize the importance of getting personalized financial advice as we age. Furthermore, the old rule of thumb – aiming for 70% of your pre-retirement income – might not be enough anymore, considering we’re living longer and healthcare costs are rising.

To illustrate how retirement planning has changed, let’s examine this comparison:

Traditional vs. Modern Retirement Planning Comparison A side-by-side comparison showing how retirement planning has evolved from traditional pension-based systems to modern self-directed approaches.

Aspect | Traditional Model | Modern Model | Impact on Seniors |

|---|---|---|---|

Primary Income Source | Defined Benefit Pension Plans | Defined Contribution Plans (401(k), IRA), Social Security, Personal Savings | Increased responsibility for managing investments and savings. |

Planning Focus | Relying on employer-provided pensions. | Self-directed planning, active investment management, multiple income streams. | Requires greater financial literacy and proactive engagement. |

Longevity | Shorter retirements (10-15 years). | Longer retirements (20-30+ years). | Need for larger retirement nest eggs to cover increased lifespan and potential healthcare costs. |

Risk Management | Employer bore investment risk. | Individual bears investment risk. | Importance of diversification, risk assessment, and potentially professional financial advice. |

This table highlights the significant shift in responsibility from employer to individual. Seniors now need to be more involved in shaping their financial future.

Adapting to the New Reality

Simply saving more money isn’t the answer. We need to become smarter investors, understanding how to allocate assets, diversify our portfolios, and manage risk. We also have to consider rising healthcare expenses, a major factor that can impact our retirement budget.

A comprehensive financial plan is more important than ever. This means having a flexible income strategy, planning for healthcare costs proactively, and truly grasping how today's financial world works.

The Dangerous Gap Between Confidence and Reality

This image, from the State Street Global Advisors 2025 Global Retirement Reality Report, highlights a concerning disconnect: many pre-retirees feel confident about their retirement plans, even as economic uncertainty grows. This gap between perception and preparedness is the crux of why realistic financial planning for seniors is so vital.

Many seniors envision a relaxing retirement filled with travel and time with loved ones. This optimistic outlook is natural, but it can sometimes obscure a dangerous gap between feeling prepared and actually being ready. Think of it like planning a cross-country road trip using a faded map from years ago. You might feel confident, but without updated information and a clear understanding of current conditions, things could easily go wrong.

Why Confidence Can Be Misleading

Several factors contribute to this disconnect. One common pitfall is underestimating future healthcare costs. Many rely on outdated information or assume Medicare will cover everything, which is rarely the case.

Another common mistake is overestimating the impact of Social Security benefits. These payments are designed to replace only a portion of pre-retirement income. Relying solely on Social Security can lead to a significant income shortfall.

Life also throws curveballs. Unexpected job loss, illness, or family emergencies can derail even the most meticulous plans. These unforeseen circumstances underscore the need for a flexible and resilient financial strategy.

Furthermore, recent surveys reveal a growing trend: While American workers generally maintain a positive outlook on retirement, anxieties about inflation, healthcare costs, and financial planning increase as retirement age draws closer. Since December 2024, there's been an eight percent drop in those planning to retire before 65, while the number expecting to retire at 70 or older has risen. You can explore these shifting retirement expectations in more detail here: Discover more insights. This trend highlights the growing need for thorough and adaptable financial planning for seniors.

Bridging the Gap: A Reality Check

So, how can seniors bridge this potentially hazardous gap? It starts with a thorough retirement reality check. This involves honestly assessing your current financial picture: income, assets, and debts.

Next, project your future expenses. Factor in realistic estimates for healthcare, housing, and daily living. By comparing your projected needs with your available resources, you can pinpoint potential shortfalls and develop strategies to address them.

This process, while sometimes challenging, is crucial for building genuine confidence rooted in facts, not just hopeful thinking.

Creating Income Streams That Actually Last

This screenshot from the Social Security Administration website offers a valuable glimpse into the world of retirement benefits. It underscores the importance of seeing these benefits not as your sole income source, but as a piece of a larger retirement puzzle. Understanding eligibility and estimating your potential benefits are key steps in building a solid financial plan.

Think of your retirement income not as a stagnant pond, but as a flowing river. It needs constant management and replenishment to meet your needs over what could be two or three decades. This means strategically converting your savings into a reliable income stream that can withstand market ups and downs and the erosive effects of inflation.

Beyond the 4% Rule: Flexible Withdrawal Strategies

Many approaching retirement are familiar with the 4% rule. This rule of thumb suggests withdrawing 4% of your investment portfolio each year. While it offers a simple starting point, it's not a one-size-fits-all solution. A fixed withdrawal rate ignores the realities of market fluctuations and evolving spending habits. Imagine a market downturn – a fixed 4% withdrawal could drain your nest egg much faster than anticipated.

Thankfully, more adaptable withdrawal strategies exist. A variable withdrawal strategy, for example, adjusts to market conditions. Withdraw less when the market dips, and more when it thrives. This helps protect your principal while still providing income. A dynamic withdrawal strategy takes this a step further, factoring in other income sources like Social Security and pensions to determine the appropriate withdrawal amount.

Asset Allocation in Retirement: Balancing Growth and Income

Retirement investing is all about balance. You need income to cover expenses, but you also need your portfolio to continue growing to keep pace with inflation. This is where asset allocation comes in. It's about strategically distributing your investments across different asset classes.

A typical retirement portfolio often includes a mix of stocks, bonds, and cash. Stocks offer growth potential, bonds provide income and stability, and cash serves as a readily available reserve for short-term needs. The ideal mix depends on your individual risk tolerance and income requirements. Someone comfortable with more risk might allocate a larger portion to stocks, while someone prioritizing stability might favor bonds and cash.

Tax-Efficient Withdrawal Strategies: Minimizing Your Tax Burden

Withdrawing from your retirement accounts isn't always straightforward. Traditional 401(k)s and IRAs are taxed as ordinary income, while Roth accounts offer tax-free withdrawals. Strategic withdrawals from different accounts can significantly reduce your tax burden. For instance, withdrawing from a Roth account during a low-income year can minimize your overall tax liability. Don't forget about tax credits and deductions specifically for seniors – these can further lighten the load. Smart tax planning is a crucial element of a sound retirement financial plan.

Managing Cash Flow in Retirement: Creating a Sustainable Budget

One of the biggest shifts in retirement is managing expenses without a regular paycheck. Building a realistic budget becomes paramount. This means tracking your spending, identifying areas to cut back, and creating a plan to cover essential costs like housing, healthcare, and daily living. Think of your budget as a roadmap, guiding your spending and keeping you on track.

Life throws curveballs. An emergency fund acts as a safety net, helping you handle unexpected expenses like medical bills or home repairs without depleting your retirement savings. Being prepared for the unexpected is a key aspect of responsible financial planning for seniors.

Let's take a closer look at different income sources and how to optimize them:

Senior Income Sources and Optimization Strategies

Income Source | Average Annual Yield | Optimization Strategy | Risk Level | Liquidity |

|---|---|---|---|---|

Social Security | Varies | Maximize benefits by delaying claiming until full retirement age or later. | Low | High |

Pensions | Varies | Understand your pension plan options and choose the payout structure that best suits your needs. | Low | Moderate |

401(k)/IRA Withdrawals | Varies | Utilize tax-efficient withdrawal strategies and consider diversifying investments. | Moderate | Moderate |

Annuities | Varies | Compare different annuity options and choose one with favorable terms and fees. | Low to Moderate | Low |

Part-time Work | Varies | Explore opportunities that align with your interests and skills. | Low | High |

Rental Income | Varies | Properly manage rental properties and consider reinvesting profits. | Moderate | Moderate |

This table summarizes various income sources available to seniors, their potential yields, and strategies to optimize them. Remember, each source carries different levels of risk and liquidity. Consider these factors when planning your retirement income strategy.

Smart Technology for Smarter Money Decisions

Forget the outdated image of seniors struggling with technology. Today's seniors are embracing digital tools to take control of their financial future. You don't have to be a tech expert to benefit. Let's explore how technology can truly empower your retirement planning, cutting through the digital noise and focusing on what really matters.

Budgeting and Expense Tracking

Imagine a personal financial assistant diligently categorizing every expense and gently nudging you if you're veering off budget. That's the power of budgeting apps. User-friendly tools like Mint, Personal Capital, and YNAB (You Need a Budget) provide a clear window into your cash flow, allowing you to set budgets and track your progress with ease.

Think of it like a digital checkbook, but much smarter. These apps not only record your spending but also analyze it, revealing patterns you might not have noticed. For example, you might discover you're spending more on dining out than you realized. This newfound awareness empowers you to make conscious choices, like cutting back on restaurant meals and redirecting those funds towards your retirement savings.

Mint, for instance, offers a visual snapshot of your income and expenses, neatly categorized for easy analysis. This clear overview helps you pinpoint areas where you could be saving more effectively.

Investment Management and Portfolio Optimization

Technology is also reshaping how we manage our investments. Robo-advisors offer algorithm-driven portfolio management, customized to your risk tolerance and financial goals. They handle tasks like rebalancing and tax-loss harvesting, often at a lower cost than traditional financial advisors.

Think of them as automated investment managers, working tirelessly behind the scenes to optimize your portfolio. They help you diversify your investments, ensuring you're not putting all your eggs in one basket. Many platforms also offer educational resources to boost your investment knowledge.

Early Problem Detection and Financial Alerts

Financial planning software acts as a vigilant watchdog for your finances. These tools scan your transactions, flagging potential issues like unusual account activity or upcoming bills.

It's like having a financial early warning system, alerting you to potential problems before they snowball. Imagine receiving a notification that a recurring bill has unexpectedly increased. You can address the issue immediately, preventing a small problem from becoming a major headache.

The Rise of AI-Powered Financial Advice

As technology evolves, so does its role in financial planning. Advanced technologies and data analytics are paving the way for more personalized and efficient retirement strategies. AI is increasingly integrated into financial planning, helping seniors make informed decisions about their retirement portfolios. Learn more about these trends.

AI-powered tools are emerging that can provide tailored financial advice, analyze market trends, and even suggest ways to optimize your investment strategy. These tools are making sophisticated financial guidance more accessible and affordable.

Security and Privacy: Protecting Your Financial Data

Of course, with the convenience of technology comes the responsibility of protecting your data. Strong passwords, two-factor authentication, and reputable security software are your first line of defense. Be cautious about sharing sensitive information online and regularly review your account statements for any unauthorized activity. By taking these precautions, you can confidently enjoy the benefits of technology while minimizing the risks.

Healthcare Costs That Can Break Your Budget

This screenshot from Medicare.gov offers a helpful starting point for understanding Medicare coverage. Navigating Medicare is a big part of financial planning for seniors, and this site is packed with essential information on enrollment, benefits, and costs. But importantly, it also highlights the need to think about costs beyond what Medicare covers.

Retirement should be about enjoying your time, not stressing about finances. But unfortunately, healthcare expenses can put a real dent in your retirement savings. Consider this: the average retired couple today could spend upwards of $300,000 on healthcare throughout their retirement. This eye-opening number shows just how important it is to factor healthcare costs into your senior financial planning.

Understanding the Gaps in Medicare Coverage

Medicare offers valuable coverage, but it doesn't cover everything. There are gaps, especially when it comes to things like long-term care and certain prescription drugs. Think of Medicare like a safety net, a good one, but with some holes that need patching. Medigap, a type of supplemental insurance, can help fill these gaps. These plans cover some of the out-of-pocket expenses Medicare doesn't, like copayments, coinsurance, and deductibles.

One of the biggest healthcare expenses seniors face is long-term care. This includes services like nursing home care, assisted living, and in-home care. These costs can quickly wipe out your savings, potentially undoing decades of hard work in just a few short years. Imagine a sudden illness requiring extensive care. Without proper planning, the financial burden can be overwhelming.

Strategies for Managing Healthcare Costs

The good news is there are tools and strategies to help manage these costs. Health Savings Accounts (HSAs) let you put money aside tax-free for qualified medical expenses. It's like having a special savings account just for healthcare. Another option is long-term care insurance. This type of insurance can help cover the costs of long-term care services, protecting your nest egg from unexpected drains.

Also, exploring different prescription drug plans and comparing prices can really help you save. Many drug companies offer assistance programs if you’re having trouble affording your medications. Being a proactive healthcare consumer can make a real difference.

Planning for the Unexpected

Estimating your potential healthcare costs is a vital part of senior financial planning. Think about things like your current health, family history, and lifestyle. We can't predict the future, but understanding your risk factors can help you prepare. It's like creating a cushion in your budget for potential healthcare bumps in the road. It's not about being negative; it's about being ready. By factoring healthcare costs into your overall financial plan, you can approach retirement with confidence and peace of mind. This proactive approach will let you enjoy your retirement without constantly worrying about healthcare expenses derailing your financial security.

Protecting Your Legacy and Family's Future

Estate planning. It's a topic many of us avoid, perhaps thinking it's only for the wealthy. But really, it's about ensuring your wishes are respected and your family isn't left with a mountain of legal and financial complexities when you're gone. Think of it as a final act of caring and responsibility for your loved ones.

This Wikipedia screenshot highlights the key aspects of estate planning. Notice it's not just about who gets what. It covers healthcare decisions and what happens if you can't make decisions for yourself – crucial elements often overlooked. This illustrates the need for a well-rounded plan to truly protect your legacy and provide for your family.

Essential Components of Estate Planning

Estate planning goes far beyond simply writing a will. It's about creating a comprehensive roadmap for your future. Here are the cornerstones:

Wills: This legal document directs how your assets are distributed after you pass away. It's essential for ensuring your wishes are carried out and minimizing potential family disputes.

Power of Attorney: Imagine you're unable to manage your finances due to an illness. A Power of Attorney designates a trusted person to make financial and legal decisions on your behalf. It's like having a trusted advocate in your corner when you need it most.

Healthcare Proxy: Similar to a Power of Attorney, but for healthcare decisions. This document appoints someone to make medical choices for you if you cannot. It ensures your medical wishes are honored, even if you can't communicate them.

Living Will (Advance Healthcare Directive): This outlines your preferences for medical treatment, especially end-of-life care. It guides your healthcare proxy and doctors on what kind of treatment you do or do not want.

Advanced Estate Planning Strategies

For more complex situations, there are additional tools to consider:

Trusts: These are legal entities that hold and manage assets for beneficiaries. Think of them as designated safe-keepers. They can help minimize estate taxes, shield assets from creditors, and provide for beneficiaries with special needs.

Gifting: Strategically gifting assets while you're alive can reduce your taxable estate and provide financial assistance to your loved ones.

Charitable Giving: You can incorporate charitable giving into your estate plan to support organizations you believe in and potentially reduce estate taxes.

Common Estate Planning Mistakes and How to Avoid Them

Many families encounter preventable challenges because of common estate planning oversights, such as outdated documents or unclear communication. These mistakes can lead to costly legal battles and emotional stress for your family during a difficult time. Addressing these issues early can save your family thousands in legal fees and months of frustration. Regularly reviewing and updating your estate plan is crucial, especially after major life events like marriage, divorce, or the birth of grandchildren.

Open Communication: The Heart of Estate Planning

Estate planning is also about having open and honest conversations with your family. Discussing your wishes, explaining your decisions, and addressing any concerns can significantly reduce stress and potential conflicts in the future. While sometimes difficult, these conversations are vital for ensuring your family understands and respects your intentions. It's about creating a smoother transition and preserving family harmony during a challenging time. Balancing your current financial needs with your desire to leave a lasting legacy is at the heart of estate planning. It's about ensuring your present financial security while also making provisions for your family's future.

Your Personal Financial Security Action Plan

Knowledge is one thing, but putting it into action is where the real magic happens. This section is all about turning our discussions into a personalized action plan for your financial future. We’ll build a step-by-step roadmap, setting achievable deadlines and figuring out how to hold ourselves accountable. Think of it as your personal launchpad for taking control of your financial well-being.

Conducting a Financial Health Checkup

Just like visiting the doctor for a checkup, a financial checkup helps you catch potential issues early. First, gather your financial documents: bank statements, investment accounts, insurance policies, and any debt information. Then, list your income sources and regular expenses. This creates a snapshot of your current financial health, showing both your strengths and areas that might need a little TLC. It’s like taking inventory—knowing what you have is the first step to managing it wisely.

Prioritizing Your Financial Planning Tasks

Planning your finances, especially as you get older, can feel overwhelming. The trick is to break it down into smaller pieces. What are your biggest concerns right now? Is it managing debt, making sure your retirement income lasts, or getting your estate plan in order? Prioritize these tasks based on how urgent and important they are. For example, if retirement is just around the corner, creating a sustainable income plan becomes a top priority.

Setting Realistic Deadlines and Building Accountability

Deadlines are like a friendly nudge to keep you focused and moving forward. Set realistic timeframes for each task. Instead of a vague goal like "get my finances in order," set a specific deadline like "review my investment portfolio by the end of next month." Accountability is equally important. Sharing your goals with a trusted friend or family member can provide valuable support and encouragement along the way.

Seeking Professional Guidance

This screenshot from the Certified Financial Planner Board website shows their search tool for finding certified professionals.

Finding the right financial advisor can make a world of difference. A Certified Financial Planner (CFP) can offer personalized advice tailored to your unique situation. It’s often best to look for a fee-only advisor to avoid potential conflicts of interest that can come with commission-based compensation. Don't hesitate to interview several advisors to find the best fit for you. Ask about their experience working with seniors, how they charge, and their general approach to financial planning. This resource from the Certified Financial Planner Board can help you locate qualified advisors in your area.

Celebrating Milestones and Adapting Your Plan

It's important to acknowledge your progress! Celebrating milestones, no matter how small, reinforces good habits and keeps you motivated. Life is full of unexpected twists and turns, and your financial plan should be flexible enough to adapt. Review and update it regularly, particularly after significant life changes like retirement, relocation, or changes in health. This ongoing process ensures your plan stays relevant and effective in meeting your evolving needs. Contact America First Financial for insurance solutions designed to protect your family and financial well-being.

_edited.png)

Comments