Finding the 7 Top Rated Fixed Annuity Companies of 2025

- dustinjohnson5

- Oct 14, 2025

- 18 min read

Navigating the world of fixed annuities can feel overwhelming, especially when your goal is to secure a stable and predictable income stream for retirement. The core challenge isn't just understanding what a fixed annuity is, but identifying which provider offers the financial strength, transparent terms, and reliable returns you need. Many individuals approaching retirement seek a conservative, safe-haven investment to protect their principal while earning a guaranteed interest rate, and finding the right company is crucial to achieving that peace of mind.

This guide is designed to simplify that search. We've compiled a comprehensive roundup of the top rated fixed annuity companies and the best platforms to purchase them from. Instead of spending hours sifting through dozens of insurance carriers and brokerages, you'll find our curated list of the most reputable options in one place. Each profile offers an in-depth look at what makes the provider stand out, including key features, potential pros and cons, and their specific product focus.

Our goal is to provide clear, actionable insights to help you make an informed decision. For each company, we provide direct links and screenshots to streamline your research process. You'll discover a mix of direct providers, independent marketplaces, and specialized brokerages like Fidelity, Charles Schwab, and AnnuityAdvantage. While this guide focuses on finding the right provider, some individuals may benefit from a more holistic approach. For those seeking comprehensive retirement planning services that may include fixed annuities, local resources like Retirement Planners San Mateo can offer personalized financial strategies. Let's explore the providers who can help anchor your retirement portfolio.

1. Retirement | America First Financial

America First Financial delivers a specialized retirement planning service designed to demystify the world of annuities for conservative and patriotic Americans. It stands out by offering expert guidance that helps individuals navigate product selection, ensuring the chosen financial vehicles align perfectly with their long-term security goals and personal values. The platform's core mission is to provide clear, affordable, and politically neutral retirement solutions.

This focus allows America First Financial to carve a unique niche among the top rated fixed annuity companies, appealing directly to those who prioritize family security and financial stability without navigating complex or ideologically driven corporate structures. Their approach is built on providing straightforward advice and personalized strategies, making retirement planning accessible and stress-free.

Why It Stands Out as a Featured Choice

America First Financial distinguishes itself through a combination of tailored guidance, a values-aligned mission, and a user-centric digital experience. Unlike massive, impersonal financial institutions, it provides a more consultative journey, guiding clients through the complexities of annuity selection rather than just presenting a catalog of products. This hands-on approach is particularly beneficial for those new to annuities or seeking a trusted advisor to help build a durable retirement income stream.

The platform’s commitment to politically neutral financial products also resonates with its target audience. By focusing solely on delivering robust and affordable solutions, it removes the noise and distraction often associated with larger corporations, allowing clients to concentrate on what matters most: securing their family's future.

Key Features and Capabilities

Expert Annuity Guidance: The service specializes in helping clients understand and select the best annuity products for their specific needs, from fixed and indexed to immediate and deferred options. This ensures a strategy tailored to individual retirement timelines and risk tolerance.

Values-Driven Approach: The platform is explicitly designed for conservative Americans, offering solutions that reflect principles of family protection and financial prudence.

User-Friendly Online System: Clients can obtain personalized quotes and explore options through an intuitive online portal. This system is designed for quick access without the pressure of aggressive sales follow-ups, empowering users to research at their own pace.

Philanthropic Commitment: A portion of every dollar earned is directed to charitable causes, allowing clients to contribute to community support while securing their own financial legacy. This adds a layer of social value to their financial decisions.

Practical Use and User Experience

Navigating the America First Financial website is a streamlined experience. The platform is designed for clarity and ease of use, enabling prospective clients to request information or a personalized quote with minimal friction. The focus is on education and empowerment, providing easy-to-understand resources that break down complex financial concepts.

To get started, a user would typically fill out a simple online form outlining their retirement goals and financial situation. This initial step provides the firm's advisors with the necessary context to begin crafting a personalized strategy. The subsequent consultation focuses on matching the client with suitable annuity products from highly-rated carriers, ensuring both financial strength and alignment with the client's objectives.

Pros and Cons

Strengths | Weaknesses |

|---|---|

Specialized Guidance for Annuities | Niche Target Audience |

Focuses on helping clients select the best products for their needs. | Services are primarily tailored for conservative customers. |

Values-Aligned and Politically Neutral | Consultation May Be Required |

Offers products that resonate with a specific demographic. | Deeper product details may require a direct conversation. |

User-Friendly Online Access | |

Provides quick, no-pressure quotes and information. | |

Commitment to Philanthropy | |

A portion of profits supports charitable efforts. |

Visit the website: Retirement | America First Financial

2. Fidelity (The Fidelity Insurance Network)

Fidelity is a household name in the investment world, but many are surprised to learn it offers a robust platform for fixed annuities through its Insurance Network. Instead of underwriting its own products, Fidelity acts as a curated marketplace, providing access to annuities from a roster of highly-rated insurance carriers. This model makes it a standout choice for those who value both brand trust and a competitive selection from some of the top rated fixed annuity companies in the industry.

The platform is particularly appealing to existing Fidelity customers who want to see their annuity alongside their other investments, creating a holistic view of their retirement portfolio. The user experience is clean and straightforward, allowing you to easily compare different types of fixed annuities, including Multi-Year Guaranteed Annuities (MYGAs), deferred income annuities, and immediate income annuities.

Key Platform Features

Fidelity’s platform excels in transparency and user support. It provides clear, side-by-side comparisons of rates, carrier financial strength ratings (like A.M. Best and S&P), and product terms. This visibility is crucial for conservative investors who prioritize the long-term stability of the issuing company.

Multi-Carrier Marketplace: Compare offers from multiple vetted insurance companies in one place.

Integrated Custody: Once purchased, your annuity is held at Fidelity, allowing for seamless account aggregation and consolidated statements.

Low Minimums: Access to certain fixed annuity products starts with minimums as low as $5,000 or $10,000, making them accessible for various budget levels.

Helpful Tools: The website features a guaranteed income estimator and state-specific rate lookup tools to help you model potential outcomes.

User Experience and Process

Navigating the Fidelity annuity section is intuitive. You can filter options based on term length and your state of residence. While the initial research and comparison can be done online, completing the purchase typically requires speaking with a licensed Fidelity professional. This "human-in-the-loop" approach can be a significant benefit, ensuring you understand the contract details and that the product aligns with your financial goals.

Practical Tip: Before calling, use Fidelity's online tools to identify two or three annuity options that meet your criteria. This will make your conversation with the representative more efficient and focused on finalizing the best choice for your situation.

Pros | Cons |

|---|---|

Access to a curated list of top-rated carriers. | Purchase process is not fully digital or self-serve. |

Seamless integration with existing Fidelity accounts. | Rates may not be the absolute highest compared to niche or direct carriers. |

Transparent display of financial strength ratings. | Product selection is curated, not exhaustive of the entire market. |

Low investment minimums for certain annuity types. |

Ultimately, Fidelity’s Insurance Network is an excellent choice for individuals who prioritize convenience, brand trust, and the ability to compare reputable options with professional guidance.

3. Charles Schwab Annuities

Charles Schwab is a titan in the brokerage and financial services industry, and its annuity offerings reflect the company's commitment to transparency and client empowerment. Similar to Fidelity, Schwab operates as a platform, providing access to fixed annuities from a carefully selected group of third-party insurance carriers. This approach allows them to offer competitive products from some of the top rated fixed annuity companies while leveraging the trust and robust infrastructure of the Schwab brand.

What makes Schwab particularly noteworthy is its public display of detailed fixed annuity rate tables. This transparency is a significant advantage for consumers in the research phase, as you can easily see and compare current rates for different term lengths and investment tiers without needing to speak to a representative first. This empowers conservative investors to make informed initial decisions based on clear, upfront data.

Key Platform Features

Schwab’s platform is built around providing clear information and professional support. It effectively balances online tools with access to human expertise, making it a strong choice for those who want to do their own research but also value professional guidance.

Public Rate Tables: Schwab openly publishes its fixed annuity rates, sorted by term length (typically 3 to 7 years) and purchase amount, with higher rates often available for investments over $100,000.

Access to A-Rated Carriers: The platform provides access to well-known and financially strong insurers like Midland National and New York Life.

Specialist Support: Clients can connect with Schwab Annuity Specialists who can explain product details, answer questions, and guide them through the application process.

In-Person Assistance: A key differentiator is Schwab's extensive branch network, offering the option for face-to-face consultations for those who prefer in-person financial discussions.

User Experience and Process

The user journey on the Schwab website is straightforward. The annuity section clearly lays out the different types of annuities available, with dedicated pages for fixed, fixed indexed, and income annuities. The publicly available rate tables are a highlight, allowing for quick, at-a-glance comparisons. While you can gather significant information online, the final purchase process involves working with a Schwab specialist to ensure the product is a suitable fit for your financial plan.

Practical Tip: Use the online rate tables to find the term and rate that best aligns with your timeline. Note the rate tiers; if your investment is just below a higher tier (e.g., $95,000 instead of $100,000), it might be worth adding a little more to qualify for the better interest rate.

Pros | Cons |

|---|---|

Transparent, publicly published rates for easy comparison. | Selection is limited to the curated list of carriers Schwab partners with. |

Access to recognizable, A-rated insurance carriers. | Some minimum purchase requirements can be relatively high. |

Support from dedicated specialists and an in-person branch network. | Product availability and specific rates can vary by state. |

Seamless integration for existing Charles Schwab clients. |

Schwab's annuity platform is an ideal solution for investors who value transparency, brand reputation, and the choice between online research and personalized, professional guidance.

Website: https://www.schwab.com/annuities

4. Blueprint Income (Online Annuity Marketplace)

Blueprint Income is a modern, technology-driven marketplace designed to simplify the process of buying a fixed annuity. It operates as a digital-first platform, offering a fully online experience from initial rate shopping to application submission. This streamlined approach makes it an excellent fit for self-directed individuals who want to compare products from some of the top rated fixed annuity companies without the traditional sales pressure.

The platform specializes in various types of fixed annuities, including Multi-Year Guaranteed Annuities (MYGAs) and Fixed Index Annuities (FIAs). Its core value proposition is transparency and ease of use, providing real-time rate comparisons that you can filter by state, investment amount, and term length. This allows users to quickly identify competitive offers and make an informed decision on their own schedule.

Key Platform Features

Blueprint Income’s strength lies in its self-serve quoting engine and clear presentation of product details. The platform displays A.M. Best financial strength ratings prominently alongside each product, empowering users to prioritize carrier stability. Its commitment to a digital workflow sets it apart in an industry often dominated by paper applications and in-person meetings.

Real-Time Rate Shopping: Instantly compare up-to-date rates from multiple insurers based on your specific criteria.

Fully Online Application: The platform guides you through an application process that can be completed in as little as 10 minutes.

Transparent Product Details: Each product page clearly outlines carrier information, term options, A.M. Best ratings, and specific features like caps for FIAs.

Licensed Support: While the process is digital, licensed annuity specialists are available to answer questions and provide assistance.

User Experience and Process

The user interface on Blueprint Income is clean, intuitive, and built for direct comparison. After entering a few basic details, you are presented with a clear list of available annuities. You can lock in a quote and proceed directly to the application online. This removes much of the friction and time associated with the traditional annuity purchasing process, offering a truly modern customer experience.

Practical Tip: Use the platform's filtering tools to narrow down your options first. Pay close attention to the interest calculation method (banded vs. simple) mentioned in the product details to ensure you understand exactly how your returns will be calculated.

Pros | Cons |

|---|---|

Clean, intuitive, and fully digital purchase experience. | Selection is limited to the insurance carriers participating on the platform. |

Easy to compare multiple top-rated insurers side-by-side. | Some products use banded or simple interest structures requiring careful reading. |

Transparent display of product details and carrier ratings. | Less hands-on guidance compared to a dedicated financial advisor. |

Quote-locking feature helps secure a rate during application. |

In summary, Blueprint Income is an ideal platform for tech-savvy retirees and investors who value transparency, control, and the convenience of a fully online process for securing a fixed annuity.

5. AnnuityAdvantage (Independent Annuity Retailer)

AnnuityAdvantage operates as an independent, high-volume annuity marketplace, specializing in helping consumers shop the entire market for the best rates. Unlike a single carrier, its strength lies in providing a transparent, real-time look at yields from dozens of different insurance companies. This makes it an essential resource for rate-focused shoppers looking to maximize their returns by comparing some of the top rated fixed annuity companies alongside lesser-known but competitive providers.

The platform is built around its public "Today's Rates" pages, which are constantly updated for MYGAs, traditional fixed annuities, and fixed index annuities. This allows you to quickly scan the highest available rates for different term lengths, see the issuing company, and view their A.M. Best financial strength rating all in one place. It is an invaluable tool for initial research and competitive analysis before committing to a purchase.

Key Platform Features

AnnuityAdvantage excels at combining digital convenience with human expertise. While you can browse and compare rates freely online, the platform ensures you receive professional guidance to navigate the complexities of annuity contracts and state-specific regulations. This hybrid approach caters to both self-directed researchers and those who want expert validation.

Public Rate Tables: Frequently updated lists show the best rates for various annuity types, terms, and minimum investments, complete with A.M. Best ratings.

Multi-Insurer Shopping: The core service involves searching across a wide network of insurance carriers to find the optimal product for your specific financial needs.

Free Custom Comparison Reports: You can request personalized reports that compare specific annuity products side-by-side, detailing features, fees, and potential returns.

Licensed Agent Consultations: Every transaction is facilitated by a licensed specialist who can answer questions, explain contract details, and handle the application process.

User Experience and Process

The AnnuityAdvantage website is straightforward and rate-driven. You can immediately access the rate tables without providing personal information, making it a low-friction starting point. Once you identify products of interest, the next step is to connect with an agent via phone or by requesting a quote. They will verify state availability, discuss rider options, and walk you through the paperwork.

Practical Tip: Use the online rate tables to create a shortlist of 2-3 annuities with your desired term length and A.M. Best rating (e.g., A- or higher). When you speak with an agent, ask them to generate a custom comparison report for those specific products to see a detailed breakdown.

Pros | Cons |

|---|---|

Easy to scan and compare market-wide rates with A.M. Best grades. | Purchase process is not fully digital and requires agent interaction. |

Human guidance helps navigate contract specifics and state availability. | Some of the highest-yield products may be from mid-tier rated insurers. |

Access to a very broad selection of insurers, not a curated list. | The website's primary focus is on rates rather than educational content. |

Custom comparison reports provide detailed, personalized insights. |

For investors who prioritize securing the highest possible guaranteed yield, AnnuityAdvantage is a powerful tool. It combines the transparency of an online marketplace with the essential service and knowledge of experienced annuity professionals.

Website: https://www.annuityadvantage.com/

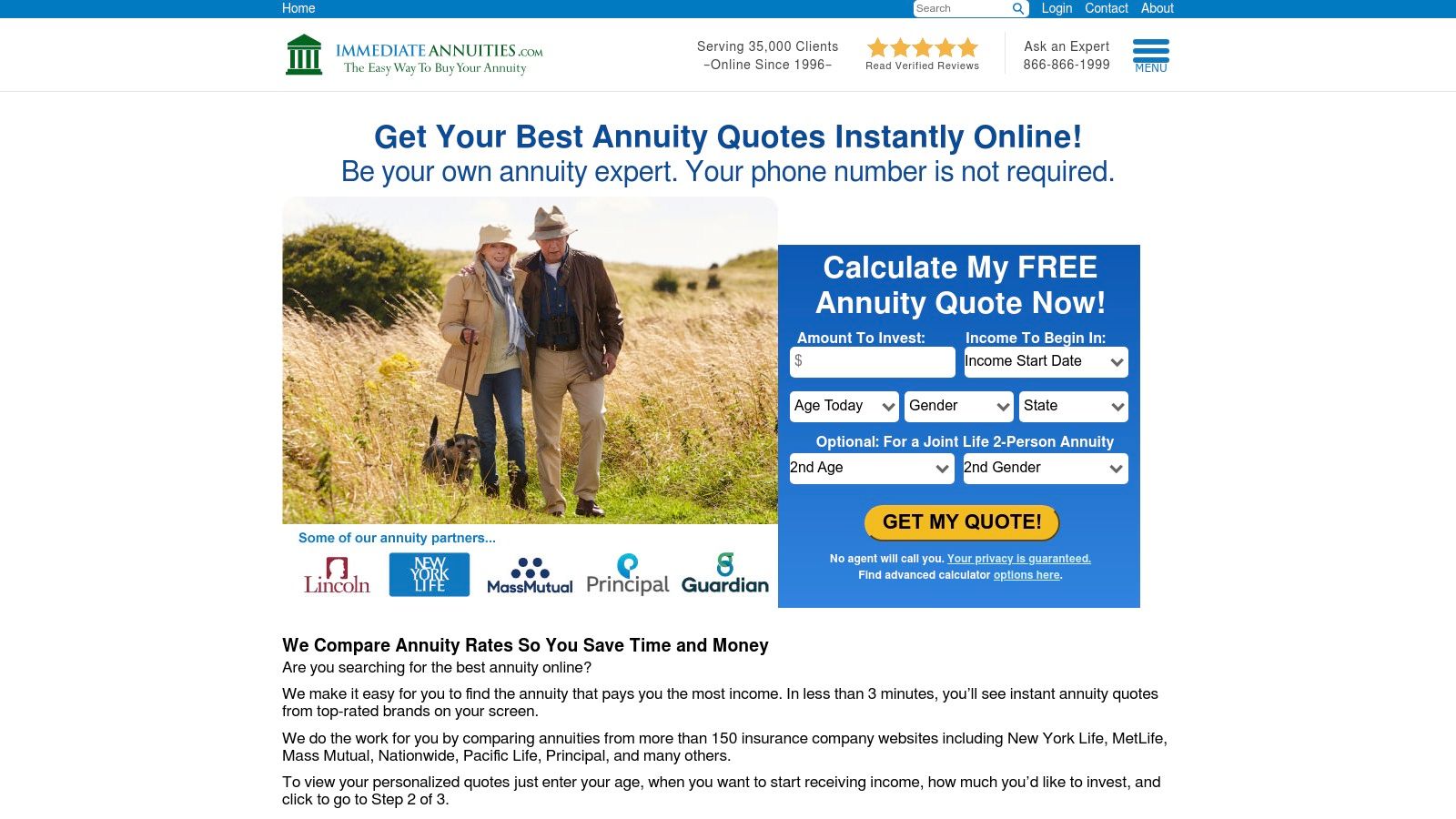

6. ImmediateAnnuities.com (Quote Engine for Income and Fixed)

ImmediateAnnuities.com is one of the oldest and most recognized online annuity quote engines, specializing in providing instant, side-by-side comparisons for income-focused products. While its name highlights immediate annuities, the platform also serves as a valuable resource for those researching traditional fixed annuities and MYGAs. It operates as a direct-to-consumer marketplace, sourcing quotes from dozens of top rated fixed annuity companies to help users benchmark potential returns and guaranteed income streams.

The platform's primary strength lies in its simplicity and transparency, particularly for those prioritizing a reliable retirement paycheck. Users can get an immediate sense of how much guaranteed income their savings can generate from various A-rated carriers like New York Life and MassMutual without having to provide extensive personal information or speak to an agent first. This makes it an excellent starting point for research and comparison shopping.

Key Platform Features

The core of ImmediateAnnuities.com is its powerful and straightforward quoting tool. It allows users to quickly model different scenarios to see how factors like age, gender, premium amount, and payout options affect their potential income. This is especially useful for those planning for retirement expenses.

Instant Income Quotes: Receive real-time quotes for SPIAs and DIAs from a wide range of insurers by entering basic, non-identifying information.

Multi-Insurer Comparisons: View quotes from many different insurance carriers on a single page, complete with their financial strength ratings.

No Mandatory Sales Call: You can view initial quote ranges and carrier names without being forced into a phone call, empowering anonymous research.

Educational Resources: The site offers a deep library of articles, calculators, and guides explaining the mechanics of different fixed and income annuities.

User Experience and Process

The user interface is functional and purpose-built for one thing: getting quotes quickly. You select the type of annuity, enter your state, age, investment amount, and income start date, and the system generates a list of monthly payout amounts from various carriers. While the MYGA shopping experience is less direct than its income annuity tools, it provides educational content and a path to request specific quotes. To finalize a purchase, you will need to connect with one of their licensed specialists.

Practical Tip: Use the quote engine to establish a baseline for what a competitive income payout looks like for your situation. Take a screenshot of the top 3-5 quotes to use as a benchmark when speaking with financial advisors or other companies.

Pros | Cons |

|---|---|

Quick and anonymous way to benchmark guaranteed income rates. | MYGA and fixed deferred annuity shopping is less direct than for income annuities. |

Longstanding reputation with a simple, no-frills interface. | The final purchase process is not fully automated and requires agent interaction. |

Access to quotes from many high-quality, A-rated carriers. | Website design is functional but feels somewhat dated compared to newer platforms. |

Excellent educational content for beginners. |

For individuals whose main goal is to convert a lump sum into a guaranteed lifetime income stream, ImmediateAnnuities.com is an indispensable tool for comparison shopping and initial research.

Website: https://www.immediateannuities.com/

7. StanTheAnnuityMan.com (Independent Brokerage, MYGA Focus)

StanTheAnnuityMan.com is an independent annuity brokerage that has carved out a unique niche by focusing on education and transparency, particularly for Multi-Year Guaranteed Annuities (MYGAs). The platform, led by Stan Haithcock, positions MYGAs as a CD-like alternative, stripping away sales hype in favor of straightforward, contractual guarantees. This education-first approach makes it an essential resource for conservative investors looking for some of the top rated fixed annuity companies without the high-pressure sales tactics.

The website acts as an educational hub and a direct quoting service rather than a fully automated marketplace. Visitors can access a deep library of articles, videos, and books that explain annuity concepts in plain English. The core function is its quoting tool, which allows users to see the best available MYGA rates from various carriers based on their state, investment amount, and desired term length.

Key Platform Features

The platform is designed to empower consumers to make informed decisions by providing the necessary tools and knowledge before they ever speak to an agent. It focuses exclusively on finding the highest contractual guarantees available, aligning with its "will do, not might do" philosophy.

Proprietary Calculators and Quoting Tools: Submit your specific criteria (state, duration, amount) to receive a personalized quote featuring the top MYGA rates from multiple insurance carriers.

Extensive Educational Resources: Offers a vast collection of free books, articles, and podcasts explaining the mechanics of fixed annuities, laddering strategies, and direct comparisons to CDs.

Focus on Contractual Guarantees: The entire methodology is built around securing the best possible fixed rates, making it ideal for risk-averse individuals.

Agent-Assisted Process: While you can gather extensive information online, the final purchase is completed with the guidance of a licensed professional to ensure suitability and proper paperwork.

User Experience and Process

The website is content-rich and encourages users to learn before they act. To get a specific rate, you fill out a simple online form. A representative then follows up with a list of the best contractual rates that match your request, with no obligation to purchase. This two-step process ensures you are connected with a suitable product.

The user experience prioritizes information over a sleek, automated interface. It’s less about instant gratification and more about making a well-researched, confident decision with professional oversight.

Practical Tip: Before requesting a quote, use the site’s educational materials to understand the difference between MYGA durations (e.g., 3-year vs. 5-year). This will help you narrow down your request and have a more productive conversation about your specific financial timeline.

Pros | Cons |

|---|---|

Unparalleled focus on education and consumer advocacy. | Not a fully self-serve or automated purchasing platform. |

Direct access to quotes from a wide range of A-rated carriers. | Public-facing real-time rate tables are less prominent than on some sites. |

Clear, simple explanations of complex annuity products. | The website's design is more functional than aesthetically modern. |

Specializes in finding the highest MYGA contractual guarantees. |

Ultimately, StanTheAnnuityMan.com is a powerful resource for anyone who wants to become an expert on their own annuity purchase. It’s best suited for diligent researchers who value unbiased education and want to ensure they are getting the best possible fixed rate.

Top 7 Fixed Annuity Providers Comparison

Service | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

Retirement | America First Financial | Medium – personalized strategies with some consultation | Moderate – online system plus expert guidance | Secure, stable retirement focused on annuities and family protection | Conservative clients seeking affordable, neutral retirement planning | Politically neutral, philanthropic, family-focused |

Fidelity (The Fidelity Insurance Network) | Medium – requires advisor interaction for final purchase | Moderate – brokerage integration, advisor support | Access to reputable carriers, integrated account views | Buyers wanting multi-carrier annuity comparison with professional support | Multi-carrier marketplace, clear purchase process |

Charles Schwab Annuities | Medium – uses published rates with specialist support | Moderate – in-person and online assistance | Transparent rate comparison with access to top carriers | Investors seeking detailed rate tables and in-branch help | Transparent rates, recognizable brand |

Blueprint Income (Online Annuity Marketplace) | Low – fully digital, self-service platform | Low – online application and real-time quotes | Fast, transparent fixed annuity shopping and purchasing | Tech-savvy users wanting quick, digital annuity transactions | Fully digital, easy insurer comparison |

AnnuityAdvantage (Independent Annuity Retailer) | Medium – agent-assisted purchase | Moderate – agent consultations and custom reports | Market-wide rate comparisons focusing on top yields | Buyers wanting expert guidance across multiple insurers | Detailed rate reports, human guidance |

ImmediateAnnuities.com (Quote Engine for Income and Fixed) | Low – quote engine with minimal initial input | Low – instant quotes without sales calls | Quick income annuity rate benchmarking across carriers | Users wanting fast quotes on immediate income annuities | Fast, direct quote engine, no mandatory calls |

StanTheAnnuityMan.com (Independent Brokerage, MYGA Focus) | Medium – agent involvement required | Moderate – educational resources plus agent support | In-depth MYGA comparisons and education | Investors focused on MYGAs with need for detailed education | Education-focused, clear MYGA comparisons |

Making Your Final Choice: A Strategic Framework for Selecting Your Annuity Partner

Navigating the landscape of fixed annuities can feel complex, but this guide has provided a clear roadmap. We've explored some of the top rated fixed annuity companies and platforms, from established financial giants like Fidelity and Charles Schwab to specialized independent marketplaces like Blueprint Income and AnnuityAdvantage. Each offers a unique approach to securing a stable, predictable income stream for your retirement.

The key takeaway is that the "best" annuity provider is not a one-size-fits-all answer. It is a deeply personal decision that hinges on your specific financial situation, risk tolerance, and long-term goals. Your ideal partner is the one that aligns perfectly with your individual needs, whether that means prioritizing the highest possible interest rate, seeking the most robust customer support, or finding a streamlined digital experience.

Distilling Your Options: A Practical Checklist

As you move from research to decision-making, it's crucial to distill the information into actionable steps. Before you commit your hard-earned capital, use this strategic framework to filter your choices and identify the provider that truly serves your interests.

Reassess Your Core Objective: What is the primary goal for this annuity? Is it to generate immediate, predictable income (SPIA)? Or is it to accumulate wealth on a tax-deferred basis with a guaranteed interest rate (MYGA or traditional fixed)? Your answer will immediately narrow the field. For instance, a retiree needing income now would gravitate toward ImmediateAnnuities.com, while someone with a 5-to-10-year growth horizon might focus on a specialist like Stan The Annuity Man.

Compare Multiple Quotes: Never accept the first offer. Use marketplaces like Blueprint Income or independent agents like AnnuityAdvantage to see quotes from several different insurance carriers side by side. This is the single most effective way to ensure you are getting a competitive rate and favorable terms. A difference of even a quarter of a percentage point can amount to thousands of dollars over the life of the contract.

Scrutinize Financial Strength Ratings: This cannot be overstated. An annuity is only as secure as the insurance company that backs it. Pay close attention to ratings from agencies like A.M. Best (A++ or A+ is ideal), S&P, and Moody's. The providers we've reviewed generally work with highly-rated carriers, but it's your responsibility to verify the rating of the specific company issuing your contract.

Understand All Fees and Surrender Charges: Read the fine print carefully. What are the surrender charge periods and percentages? Are there any administrative fees or rider costs that could diminish your returns? A clear understanding of the complete fee structure is non-negotiable.

Evaluate the Human Element: Do you prefer a self-service digital platform or personalized guidance from a dedicated professional? Your comfort level with technology and desire for expert advice will steer you toward the right model. For many, especially those aligned with patriotic values, working with a dedicated firm like America First Financial can provide an extra layer of confidence and shared principles.

Integrating Annuities into Your Broader Financial Plan

Remember, a fixed annuity is just one component of a comprehensive retirement strategy. It is a powerful tool for creating a reliable income floor, but it should complement your other investments, not replace them. Before committing to an annuity, it's wise to review principles for sound financial planning, such as understanding the broader investment decision-making process. This holistic view ensures that your annuity purchase supports your overall financial well-being and helps you build a resilient, worry-free retirement. By methodically applying this framework, you can move forward with the confidence that you've selected from the very best of the top rated fixed annuity companies and secured a valuable partner for your financial future.

For those who value personalized guidance rooted in conservative principles, America First Financial offers a dedicated approach to fixed annuities. We specialize in helping families secure their retirement with safe, reliable products from the nation's strongest carriers. Discover how our commitment to financial security and American values can help you build a prosperous future by visiting America First Financial today.

_edited.png)

Comments