How Much Life Insurance Do I Need? Find Out Now

- dustinjohnson5

- May 8, 2025

- 12 min read

Why Most People Get Their Life Insurance Coverage Wrong

Calculating your life insurance needs is a crucial financial decision, yet many people make mistakes. This often comes from a reluctance to think about mortality and a misunderstanding of how life insurance works. Many put off these important conversations, believing they have ample time or that their current coverage is adequate. This procrastination can have serious repercussions, leaving families financially vulnerable after an unexpected loss.

Overlooking Future Needs and Changing Circumstances

A common mistake is failing to plan for future needs. Young families often focus on immediate expenses, overlooking long-term costs like college tuition. Life changes such as marriage, divorce, or having a child significantly impact insurance needs. However, many neglect to re-evaluate their policies after these milestones, leading to gaps in their coverage.

Relying on Inadequate Coverage Sources

Overreliance on workplace life insurance is another issue. While employer-provided coverage is a benefit, it's rarely enough for long-term family needs. These policies are often tied to your job, so coverage ends if you change employers. The coverage amount, typically a multiple of your salary, may not cover debts, mortgage payments, and future expenses. This leaves families underinsured. In the United States, only about 60% of Americans have some life insurance. Furthermore, 33% believe they're underinsured, highlighting a gap between perceived and actual coverage. Find more detailed statistics here.

Misunderstanding the True Purpose of Life Insurance

Many misunderstand the fundamental purpose of life insurance. It's not just about replacing income, but also about providing a financial safety net. This includes paying off debts like mortgages and student loans and providing for future expenses like education. Failing to account for these obligations can leave families struggling. Think of life insurance as a financial bridge, helping your family navigate difficult times and secure their future. This requires a comprehensive approach, going beyond simple online calculators and considering all your family's financial obligations.

Income Replacement: Building Your Protection Foundation

Many people rely on the oversimplified advice to "multiply your salary by ten" when figuring out how much life insurance they need. While this offers a quick estimate, it often misses the mark in accurately reflecting a family’s true financial needs. Financial experts recommend a more nuanced approach, carefully weighing several key factors to arrive at a more precise and personalized coverage amount.

Factoring in Your Unique Financial Landscape

Income replacement is crucial when calculating the right amount of life insurance coverage. It aims to provide your family with the financial means to maintain their lifestyle if you were to pass away. Simply multiplying your salary by a fixed number ignores key variables like your career trajectory, your spouse’s earning potential, and future lifestyle expectations.

For example, a single-income family with young children will have significantly different income replacement needs compared to a dual high-income household approaching retirement. The time frame for which your income needs replacing also plays a vital role. A younger person may need coverage for several decades to ensure their family's financial well-being until their children become self-sufficient. Someone nearing retirement, however, might opt for a shorter coverage period, focusing on bridging the gap until their retirement savings become accessible. The growth of the global group life insurance market highlights increasing investment in this type of protection. This market is projected to grow from $132.3 billion in 2024 to $146.27 billion in 2025, reflecting a compound annual growth rate (CAGR) of 10.6%. Factors driving this growth include an aging population, employment growth, and regulatory changes.

Tailoring Income Replacement to Family Dynamics

Effective financial planners carefully adjust income replacement figures based on unique family dynamics. Consider the difference between a single parent and a dual-income family. A single parent's life insurance needs are generally higher to provide complete financial support for their children. A dual-income family, conversely, might need a lower percentage of joint income replacement, assuming the surviving spouse would continue working.

The following table illustrates how these factors might be applied:

The table below, "Income Replacement Strategy Comparison," shows how different family situations can affect income replacement calculations.

Family Situation | Replacement Percentage | Years to Replace | Key Adjustment Factors |

|---|---|---|---|

Single-Income Family | 80-100% | 20-30 years | Childcare costs, future education |

Dual-Income Family | 50-70% | 15-25 years | Mortgage, shared expenses, debt |

Single Adult, No Children | 20-50% | 5-15 years | Debt, final expenses, potential caregiving |

Nearing Retirement | Minimal-50% | 5-10 years | Supplementing retirement savings |

As you can see, the replacement percentage and years to replace vary significantly based on individual circumstances.

Accounting for Future Financial Realities

It's important to account for inflation and changing earning potential when considering income replacement. Inflation reduces the purchasing power of money over time, so your future income replacement needs will likely be greater than they are now. Your earning potential may also increase during your career.

Factoring in potential salary growth is thus vital in determining the correct coverage amount. Generic online calculators frequently overlook these dynamic elements, potentially leading to insufficient coverage. This underscores the importance of a personalized approach, working with a financial advisor to create a comprehensive, future-proof income replacement strategy.

Mapping Your Family's Financial Obligations Beyond Income

While income replacement is the cornerstone of your life insurance needs, it's not the entire picture. Concentrating solely on income can create significant blind spots, leaving your family financially vulnerable. To accurately calculate the amount of life insurance required, you need to map out all of your family’s financial obligations.

Identifying and Quantifying Obligations

Effective financial planners look beyond basic income replacement. They analyze all current and future financial responsibilities. This includes obvious debts like mortgages, but also less apparent obligations that can have a major impact on your family’s financial stability.

For instance, consider childcare or eldercare costs. If a stay-at-home parent passes away, the surviving family may need to hire outside help, resulting in considerable expense. These costs are frequently overlooked in standard life insurance calculations. Also, consider future costs like college tuition or the financial requirements of dependents with special needs. Accurately quantifying these obligations is critical for choosing the right amount of coverage.

Building Your Financial Obligation Inventory

Begin by developing a thorough list of your family’s financial obligations. This inventory should encompass the following:

Outstanding Debts: Mortgages, car loans, student loans, credit card debt, and any other personal loans.

Future Expenses: Projected college tuition, anticipated wedding costs, and funds set aside for future family needs.

End-of-Life Costs: Funeral expenses, estate taxes, and any associated legal fees.

Potential Caregiving Needs: An estimated cost of childcare, eldercare, or care for special needs dependents, if applicable.

Business Obligations: If you own a business, include business debts, succession planning costs, and the potential financial impact on your family.

Prioritizing Coverage Needs

It’s not necessary to fully cover every financial obligation with life insurance. Some obligations, like retirement savings, may already have dedicated funding. Others, like smaller debts, can potentially be handled with existing assets or the surviving spouse's income.

The goal is to prioritize. Determine which obligations require complete coverage and which can be partially covered by other means. This focused approach allows you to strategically use your insurance coverage to ensure the greatest protection where it’s most critical. For example, paying off the mortgage might be a higher priority than completely funding a child's college fund, as losing the family home could create significant financial hardship.

Assessing Your Complete Financial Footprint

By understanding your complete financial footprint, including both income replacement and all other financial obligations, you can avoid being underinsured. While you may appear to have sufficient coverage based solely on income, you could be unknowingly leaving your family vulnerable. This comprehensive approach guarantees that your life insurance truly reflects your family's financial situation and offers a complete safety net. This detailed assessment helps you answer the question, "How much life insurance do I need?" with confidence and precision, giving your family the financial security they deserve.

How Life Stages Transform Your Insurance Requirements

Your life insurance needs are not set in stone. They change and grow alongside your personal and financial situations. Understanding these changes is key to ensuring you have the right coverage at every stage of your life. Much like your wardrobe changes with the seasons, your insurance needs adjustments as you navigate life's milestones. This proactive approach to updating your coverage is vital for avoiding gaps that could leave your family financially vulnerable.

Key Life Events and Their Impact on Coverage

Several significant life events often signal a need to review your life insurance coverage. Buying a home, for instance, adds a major financial responsibility—your mortgage—that you should consider when determining your coverage amount. Similarly, career transitions, especially those with a significant income change, require adjustments to your coverage to maintain your family's current lifestyle. The birth of a child or adding new family members are prime examples of times when increasing your life insurance becomes critical to securing your growing family's future. To help organize your finances, consider using a budgeting template. Many helpful Notion budget templates are available.

Adapting Your Coverage: Strategies For Success

Successfully adjusting your life insurance involves more than just increasing or decreasing the amount. It requires a careful evaluation of your changing financial situation and the various obligations you might face. For example, many families consult with financial advisors to develop personalized strategies that reflect their unique circumstances. Additionally, understanding overall life insurance trends can provide valuable perspective. The global life insurance market, valued at $3.1 trillion in 2024, highlights how widely recognized the importance of life insurance is. Explore this topic further. This knowledge can inform your decisions about how much life insurance you need by offering insights into larger financial trends.

Navigating Transition Periods and Unique Family Structures

Certain, often overlooked, life stages create increased vulnerability and demand careful planning. Transitional times, such as a career change or becoming empty nesters, can introduce unexpected financial strains. Likewise, unique family structures like blended families or families with dependents who have special needs present distinct insurance considerations. For instance, a blended family may need specific arrangements to ensure fair distribution of benefits to children from prior relationships. Individuals with special needs dependents frequently require lifelong financial assistance, making long-term care planning within their insurance strategy crucial. These diverse scenarios emphasize the need for personalized insurance plans that address specific needs and evolving family dynamics.

Recalibrating Needs: Addressing Specific Circumstances

Major life events also trigger a need to re-evaluate your life insurance coverage. Marriage, divorce, career shifts, or transitioning into an empty nest each present unique financial implications. Marriage, for example, might involve merging finances and sharing responsibilities, requiring a joint approach to insurance. Divorce, conversely, could necessitate separate policies to protect the financial security of each individual and any children involved. Career changes can affect income and future earnings, calling for adjustments to your coverage amount. Becoming empty nesters might also offer a chance to reassess coverage, as some financial burdens lessen, potentially freeing up resources for other financial goals. Each of these life changes underscores the ever-changing nature of insurance needs and the importance of periodic reviews. Understanding how these transitions influence your overall financial security empowers you to adjust your coverage proactively and safeguard your family’s well-being.

The DIME Method: Your Complete Coverage Calculation Blueprint

As your life stages change, so do your insurance needs. For veterans, understanding these evolving needs is particularly important, and resources like the Veteran Life Insurance Options guide can be invaluable. Going beyond simple online calculators, the DIME method, standing for Debt, Income, Mortgage, and Education, provides a comprehensive framework often used by financial professionals. This method helps you calculate your required coverage, preventing the common issue of underinsurance.

Breaking Down the DIME Components

Let's explore each element of the DIME method and how it contributes to a thorough coverage calculation. This approach moves past simply multiplying your salary by an arbitrary number, providing a personalized assessment tailored to your family's financial situation.

Debt: This encompasses all outstanding debts excluding your mortgage. Think car loans, student loans, credit card balances, and personal loans. Accounting for these debts ensures they won’t burden your family after you're gone.

Income: Consider how many years your family would require financial support and multiply that by your annual income. This replaces lost income and maintains your family’s current lifestyle.

Mortgage: Calculate your mortgage's remaining balance. Including this ensures your family can stay in their home without financial hardship.

Education: Estimate the future cost of your children's education, from kindergarten through college. This helps you secure their future educational opportunities.

To further illustrate how the DIME method translates these needs into concrete coverage amounts, let's look at some practical examples. The table below breaks down each component, highlighting common oversights and demonstrating how each factor impacts the total coverage amount.

DIME Formula in Action Real-world examples showing how the DIME method transforms abstract needs into concrete coverage amounts

DIME Component | What Most People Miss | Calculation Approach | Impact on Total Coverage |

|---|---|---|---|

Debt | Smaller debts like credit card balances | Sum all debts outside of mortgage | $15,000 |

Income | Potential future salary increases | Current annual income x years of support needed (e.g., 10 years) | $500,000 |

Mortgage | Potential future increases in home value | Outstanding mortgage balance | $250,000 |

Education | The rising cost of college | Estimated total cost per child x number of children | $100,000 |

This table demonstrates how each component contributes to a final coverage amount. As you can see, considering all four aspects offers a much more realistic estimate of your family's needs than simply focusing on income replacement alone.

Visualizing Your Coverage Needs

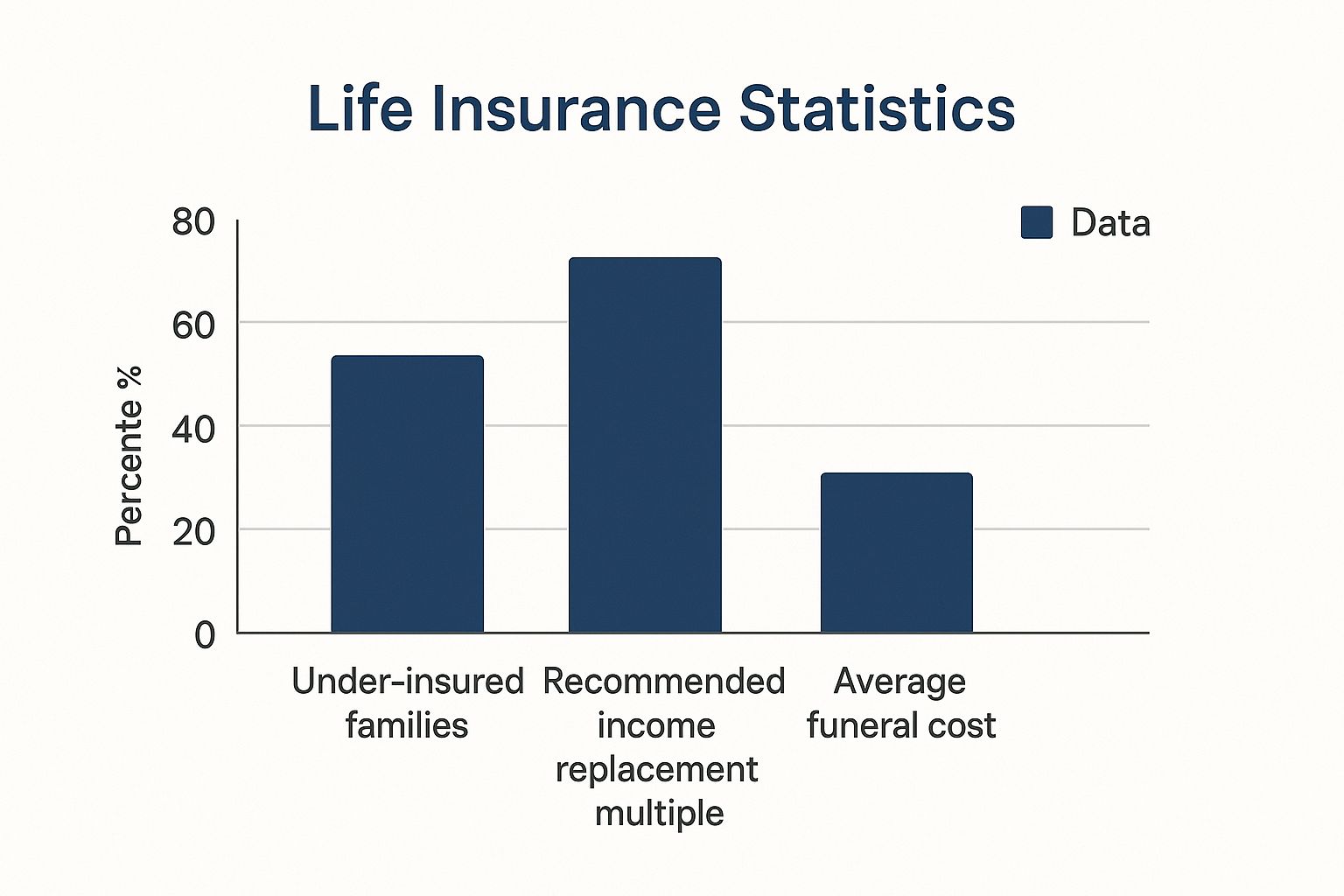

The infographic below visually represents the gap between adequate insurance coverage and the realities many families face. It compares the percentage of under-insured families with recommended income replacement multiples and average funeral costs.

This infographic emphasizes the importance of thorough life insurance planning. Many families are significantly underinsured, underestimating both necessary income replacement and the costs of final expenses and ongoing financial obligations.

Addressing Blind Spots with DIME

The DIME method addresses critical blind spots overlooked by simpler calculators. It considers family-specific obligations beyond just income replacement. For instance, a basic calculator may consider your salary, but the DIME method encourages you to think about the cost of replacing a stay-at-home parent’s services, like childcare, adding essential context to your calculations.

Documenting Your Calculations for Clarity

After completing your DIME calculations, document your process and reasoning. This record helps your beneficiaries understand the rationale behind your coverage amount and allocate the funds effectively. This transparency assists your family in managing their finances during a difficult time. This documented approach clarifies how your life insurance directly aligns with your family’s future financial well-being. By accounting for these factors, the DIME method provides a precise and personalized way to calculate your required life insurance, ultimately protecting your family’s financial future.

Making Your Ideal Coverage Actually Affordable

Finding the right life insurance coverage can sometimes reveal higher-than-expected premiums. But securing sufficient protection doesn’t have to break the bank. Financial planners use several proven strategies to maximize coverage while managing costs. This section explores those approaches, guiding you toward a balance between comprehensive protection and affordability.

Strategic Approaches to Affordable Coverage

Several strategies can help make your ideal life insurance coverage more budget-friendly. One common method is coverage laddering. This involves purchasing multiple smaller policies with varying term lengths, rather than one large policy. This approach allows you to align coverage with specific needs and timeframes.

For example, a shorter-term policy could cover your children's education expenses, while a longer-term policy could cover your mortgage. This targeted approach offers flexibility and potential cost savings.

Another useful strategy is policy blending. This involves combining different types of life insurance, such as term life insurance and whole life insurance, to balance affordability and long-term benefits. Term life insurance provides coverage for a specific period and is generally the less expensive option. Whole life insurance offers lifelong coverage and can build cash value, but typically comes with higher premiums.

By strategically blending these types of insurance, you can address both immediate and long-term needs effectively.

Finally, consider the strategic use of riders. Riders are supplemental additions to your policy that offer extra benefits. Some riders can help lower premiums, while others enhance your coverage for specific needs like critical illness or disability. Carefully selecting relevant riders can significantly improve the value of your policy.

Identifying Areas for Coverage Adjustments

Optimizing your life insurance coverage involves carefully evaluating areas where you can potentially reduce coverage without compromising essential protection. This requires prioritizing your financial obligations and assessing their impact on your family’s financial well-being.

For example, you might prioritize paying off the mortgage over fully funding a child’s college education. Losing the family home would create a more immediate financial hardship than student loan debt.

High Priority: Mortgage payoff, income replacement for a specific timeframe

Medium Priority: College funds, other outstanding debts

Lower Priority: Existing savings, other assets

Phasing in Coverage and Maximizing Value

As your income increases, you can gradually increase your life insurance coverage. This phased approach lets you adjust your coverage over time, avoiding early financial strain while still working toward a more secure financial future. It also allows for flexibility as your needs change.

Choosing the right policy features is also crucial for maximizing value. For instance, a family with young children might prioritize a policy with a waiver of premium rider. This ensures coverage continues even if the policyholder becomes disabled and can no longer afford premiums.

Understanding available policy types and features helps you make informed decisions about which options best align with your family’s unique needs and financial situation. This allows you to customize your coverage and optimize your spending. By evaluating the cost-effectiveness of different policy structures, you can find the best fit for your specific circumstances and timeline.

Are you ready to secure your family's future with affordable and reliable life insurance? Get a free quote from America First Financial today! America First Financial is dedicated to providing financial security for conservative American families, offering tailored plans without the influence of modern political agendas. With a quick and easy online quote system, you can find the perfect coverage to protect your loved ones and ensure peace of mind.

_edited.png)

Comments