Life Insurance for Young Parents A Practical Guide

- dustinjohnson5

- Jul 4, 2025

- 18 min read

Bringing a new baby home changes everything. Suddenly, you're not just responsible for yourself anymore—your world revolves around this tiny human. With all that joy comes a new sense of duty, and that’s where life insurance becomes one of the most important conversations you can have. It’s not about expecting the worst; it's about building a financial safety net to guarantee your family's future is secure, no matter what happens.

Why Young Parents Need Life Insurance Right Now

The moment you become a parent, you have people who depend entirely on your income and support. This shift isn't just emotional, it's a massive financial one. Think of life insurance as a promise to your family—a plan B that kicks in if you're no longer around to provide for them.

It’s the tool that ensures your partner isn't left struggling to pay the mortgage, that your kids’ everyday needs are covered, and that bigger dreams like college are still on the table.

The Urgency for New Parents

Honestly, the best time to get life insurance is right after you have a baby. Why the rush? Because your two biggest advantages are your age and your health. Insurance companies offer much lower prices—or premiums—to younger, healthier applicants. A healthy 30-year-old will pay significantly less than a 45-year-old for the exact same amount of coverage.

Getting a policy now allows you to lock in an affordable rate for decades. You're covering your family during their most critical years, from paying off the house to funding education.

Making this decision is one of the most powerful moves you can make for your new family's security. It's a fundamental part of building a stable future. For more essential guidance for new parents, it's worth exploring resources that understand the unique challenges and responsibilities of this stage of life.

To really drive this home, here's a quick breakdown of why this is such a critical step.

Table: Why Life Insurance Is a Non-Negotiable for New Parents

Concept | Why It Matters for Young Parents | Real-World Example |

|---|---|---|

Income Replacement | It ensures your family can maintain their current lifestyle without your salary. | The death benefit can cover monthly bills, groceries, and childcare costs, preventing financial hardship. |

Debt Coverage | Your family won't inherit your debts, like a mortgage or student loans. | The policy can pay off the remaining $250,000 on your home loan, so your family can stay in their house. |

Future Goals | It protects long-term dreams you have for your children. | A portion of the benefit can be set aside in a trust or savings account to fund your child's college education. |

Peace of Mind | Knowing your family is protected provides invaluable emotional security. | You can sleep better at night knowing a plan is in place, freeing you to enjoy the present moment with your kids. |

Ultimately, life insurance gives you control over your family's financial destiny, even in your absence.

The Millennial Mindset Gap

Despite how crucial it is, there’s a strange disconnect, especially with the generation starting families today. While a staggering 80% of millennials agree that life insurance is important, only about 52% actually have a policy.

What's even more concerning?

A tiny 10% of those with coverage feel they have enough.

A shocking 44% admit they would be financially devastated if the primary earner passed away.

This "knowing vs. doing" gap creates a huge vulnerability for young families. Life insurance closes that gap by providing a lump-sum, tax-free payment that can immediately stabilize a family's finances. It's the straightforward answer to the tough question, "How will my family get by without me?"

Term vs. Whole Life Insurance: The Parent's Dilemma

When you start looking into life insurance, you'll quickly find yourself at a crossroads: term or whole life? Both promise to protect your family, but they get there in completely different ways. Getting a handle on this key difference is the first step to making a smart, confident choice for the people you love.

Let's try a simple analogy. Term life insurance is like renting a house. You get all the protection you need for a set period of time—the "term"—which you choose upfront. These terms are typically 10, 20, or even 30 years. It’s straightforward, incredibly affordable, and designed to cover you when your financial responsibilities are at their peak, like when the kids are young and you've just taken on a mortgage.

Whole life insurance, on the other hand, is like buying a house. It's a permanent policy you own for your entire life, as long as you keep up with the payments. It's quite a bit more expensive, but it also builds equity in the form of a cash value account that grows over time.

For most young parents, the goal is simple: get the biggest possible safety net for the lowest cost while the kids are growing up. This is exactly where term life insurance really shines.

Why Term Life Is Often the Best Fit for Young Parents

When your budget is being pulled in a million directions—from diapers and daycare to saving for the future—every dollar counts. Term life insurance was practically made for this stage of life. Because it’s pure protection without the complex investment piece you find in whole life, the premiums are dramatically lower.

That affordability is a game-changer. It means a young family can lock in a substantial death benefit—we're talking $500,000 or even $1 million—for a monthly payment that doesn't break the bank. This ensures that if the unthinkable were to happen, there’s more than enough money to handle the big financial weights.

Think about it. The major responsibilities of young parenthood usually have a clear timeline:

Raising Children: Your kids will likely be financially independent in about 20-25 years.

Paying Off the Mortgage: Most home loans are set for 15 or 30 years.

Covering College Costs: This is a major future expense that falls within a specific window of time.

A 20- or 30-year term policy lines up perfectly with these milestones. It provides a powerful safety net precisely when your family needs it most.

When Whole Life Might Make Sense

While term life is the go-to for the vast majority of young families, whole life isn't without its purpose. It's just a different tool for a different job. Think of it less as just protection and more as a financial asset. Its cash value grows tax-deferred, and you can even borrow against it or make withdrawals later in life.

Whole life is a lifelong financial commitment with much higher premiums. It's typically a better fit for high-income earners who have already maxed out their other retirement accounts (like a 401(k) and an IRA) and are searching for additional tools for estate planning or wealth accumulation.

For a young parent just starting out, the steep cost of whole life usually forces a tough trade-off. To afford it, they often have to settle for a much smaller death benefit, which could leave their family dangerously underinsured during their most financially vulnerable years.

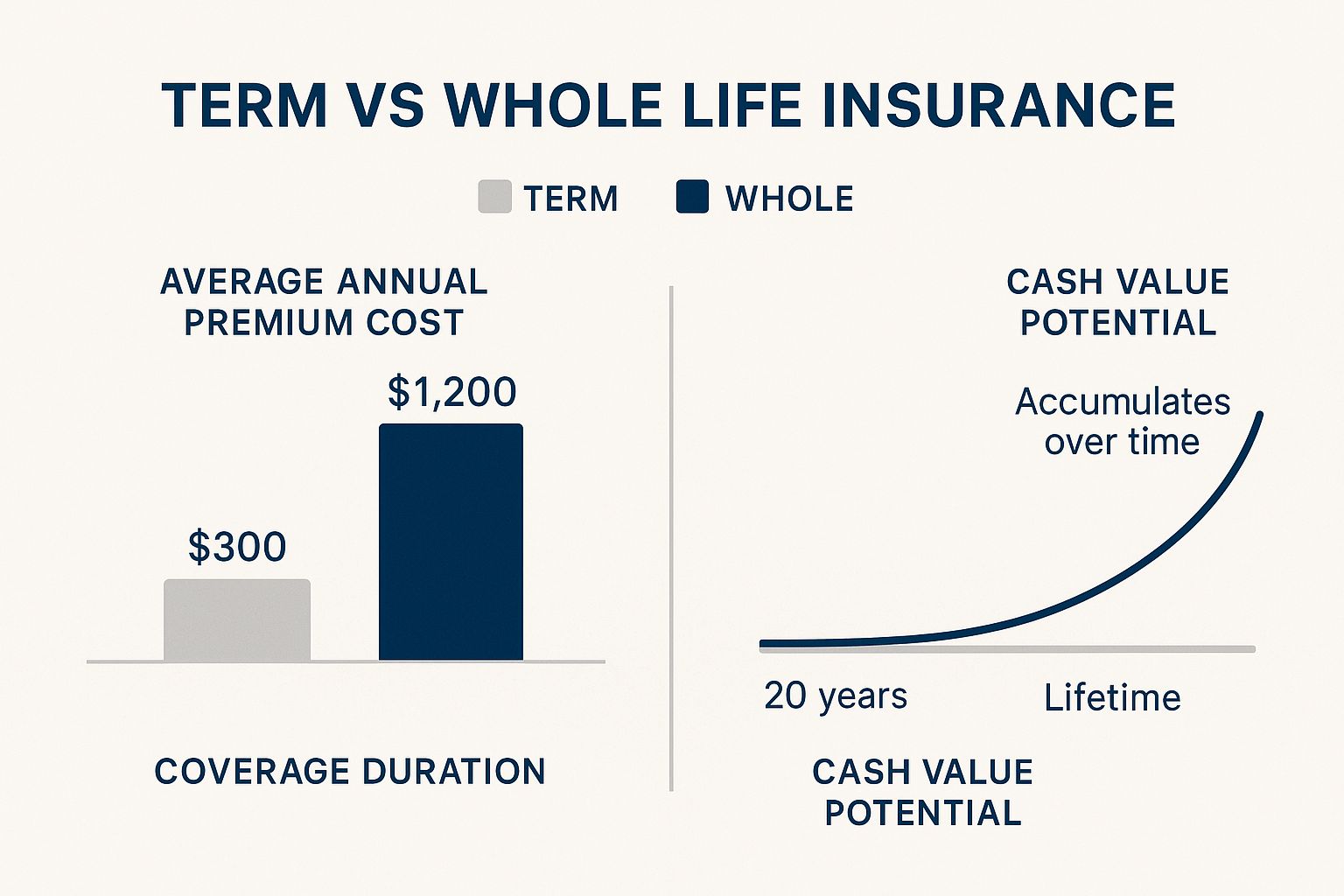

This infographic breaks down the core differences in cost, duration, and financial benefits at a glance.

The key takeaway is clear: for the same budget, term life provides substantially more immediate protection for your family.

Term vs. Whole Life Insurance: A Comparison for Parents

To make this crystal clear, here’s a table that lays out the key differences side-by-side, helping you see which one aligns with your family’s needs right now.

Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

Primary Purpose | Provides a large death benefit for a specific period (e.g., 20 or 30 years) to cover temporary needs like a mortgage and raising children. | Provides a lifelong death benefit and doubles as a savings/investment tool with a growing cash value. |

Cost | Significantly lower premiums. You get a much larger amount of coverage for your money. | Substantially higher premiums. A large portion of the payment funds the policy's cash value. |

Duration | Temporary. Coverage lasts for a set term. If you outlive the term, the policy simply expires. | Permanent. Coverage lasts for your entire life, as long as you continue to pay the premiums. |

Cash Value | No cash value. It's pure insurance protection, which is why it's so affordable. | Builds cash value over time on a tax-deferred basis. You can borrow against or withdraw from it. |

Best For... | Young families on a budget who need maximum protection for the lowest cost during their highest-need years. | High-net-worth individuals who have maxed out other investment vehicles and are focused on estate planning. |

Ultimately, the choice comes down to your primary goal. Are you looking for affordable, high-limit protection for a specific period, or a lifelong financial tool with a built-in savings component?

A Practical Comparison for Parents

Let’s put some real numbers to this. Imagine a 30-year-old parent who wants to make sure their family is covered with a $750,000 policy.

With a Term Policy: For a 30-year term, they might expect to pay around $40-$50 per month.

With a Whole Life Policy: The premium for that same $750,000 death benefit could easily be $400-$500 per month, or even more.

For most young families, that comparison makes the decision pretty easy. The first option frees up hundreds of dollars every single month—money that can be put toward other critical financial goals like building an emergency fund, saving for retirement, or investing for college.

This popular approach even has a name: "buy term and invest the difference." It’s a strategy that lets you get all the protection your family needs while you actively build wealth in other accounts that you own and control.

Calculating How Much Coverage Your Family Truly Needs

Figuring out the right amount of life insurance can feel like trying to hit a moving target in the dark. How much is enough? The real goal isn't just to cover a funeral; it's to build a financial safety net that lets your family continue their lives without your income holding everything together.

Thankfully, you don't need a complex financial degree to get a realistic number. A fantastic rule of thumb that I always recommend to young families is the DIME method. It’s a simple way to make sure you don't miss any of the big pieces of the puzzle.

D Is for Debt

First things first, let's talk about debt. Think of any loan that isn't your mortgage—car payments, student loans, credit cards. These debts don't just vanish if you pass away, and they can become a huge, immediate weight on your family's shoulders.

Your first job is to add up every single one of these balances.

Student Loans: Both federal and private loans that a spouse or cosigner might be on the hook for.

Car Payments: The total left to pay on all your family vehicles.

Credit Card Balances: What you currently owe on any cards.

Personal Loans: Any other outstanding personal or private loans.

Tallying this up gives you the first piece of your DIME calculation. This number ensures your loved ones can wipe the slate clean from day one.

I Is for Income Replacement

This is the big one. Your ability to earn an income is your most valuable financial asset, and your policy needs to replace it for a period of time. Ask yourself: how long would my family need my salary to keep their world turning?

A good starting point is to cover your income for the years until your youngest child flies the nest. For most people, that’s somewhere between 10 to 20 years.

For example, if you make $70,000 a year and want to provide that income for 15 years, you’d need $1,050,000 for this part of the calculation ($70,000 x 15). This lump sum is what keeps the lights on and the pantry full.

This isn't just about paying bills; it's about giving your family stability and preventing them from having to make drastic, painful life changes during an already difficult time.

M Is for Mortgage

For most families, their home is their anchor—and their biggest debt. The "M" in DIME is simple: your life insurance should be enough to pay off the mortgage entirely.

Imagine the peace of mind in knowing your family can stay in their home, in their neighborhood, surrounded by their friends and support system, without ever worrying about a foreclosure notice. Just grab your latest mortgage statement, find the outstanding balance, and add that number to your running total.

E Is for Education

Finally, let's look to the future. If sending your kids to college is part of your dream for them, you need to plan for it. With the cost of tuition always on the rise, this is a legacy you can secure.

You don't need an exact figure, but a solid estimate is crucial. A common target is $100,000 to $150,000 per child for a four-year degree, but you can adjust this up or down based on your family's aspirations.

Putting It All Together and Avoiding Common Mistakes

Once you have a number for Debt, Income, Mortgage, and Education, just add them up. That final sum is a personalized, realistic estimate of the coverage your family actually needs. It’s a far cry from a random number pulled out of thin air.

Still, it's easy to see why people get overwhelmed. Recent studies show that only 33% of Gen Z and Millennial parents feel knowledgeable about life insurance. In fact, 40% of Gen Z parents and 29% of Millennial parents say confusion over how much coverage to buy is a primary reason they don't have a policy at all. You can dive deeper into these life insurance statistics and see just how critical this clarity is.

Before you settle on a final number, remember two last things:

Don't Forget Inflation: The value of a dollar today won't be the same in 10 or 20 years. It’s smart to pad your final calculation by an extra 10-20% to give your family a buffer against rising costs.

Insure the Stay-at-Home Parent: The work a stay-at-home parent does is incredibly valuable. Think childcare, cooking, cleaning, and managing the entire household. If they were no longer there, you'd have to pay someone for those services. A separate policy for a non-working spouse is absolutely essential.

What Factors Determine Your Life Insurance Premiums

Ever wondered why your life insurance quote looks completely different from your friend’s? Insurance companies don't just pull these numbers out of thin air. They have a methodical process called underwriting, which is basically their way of figuring out how much risk is involved in insuring you.

Think of it like applying for a mortgage. A lender digs into your financial health to gauge the risk of loaning you money. In the same way, an insurer examines your personal profile to predict the likelihood of a claim. So, let’s peel back the curtain and see exactly what they’re looking at.

Your Age and Health Are Paramount

At the top of the list, you’ll always find two things: your age and your health. It really boils down to simple statistics. The younger and healthier you are, the less of a risk you pose to the insurance company. This is precisely why getting life insurance for young parents is such a smart financial decision—applying in your late 20s or 30s lets you lock in incredibly low rates for decades.

When you apply, the insurer is going to dig into a few key areas:

Your Medical History: They’ll review your health records, paying close attention to any pre-existing conditions like diabetes or heart issues.

Your Family’s Health History: If serious hereditary conditions run in your immediate family, that can also play a role in your rates.

The Medical Exam: Most policies require a quick paramedical exam. It’s no big deal—they just check your height, weight, blood pressure, and take small blood and urine samples.

A clean bill of health here directly translates into major savings over the life of your policy.

Lifestyle Choices That Impact Your Rate

Your day-to-day habits and hobbies also help paint a picture of your overall risk profile. Insurers are naturally interested in choices that could impact your longevity. The good news is that you have direct control over these factors, meaning you can take proactive steps to get a better rate.

For instance, being a non-smoker is one of the single biggest things you can do to lower your premium. Insurance carriers see tobacco use as a massive health risk, and as a result, smokers often pay two to three times more for the very same coverage as non-smokers.

Other lifestyle factors that come into play include:

High-Risk Hobbies: If you're into skydiving, deep-sea scuba diving, or rock climbing, be prepared for it to bump up your premium.

Driving Record: A history of DUIs or a long list of speeding tickets signals a higher risk to insurers.

Occupation: A desk job is seen as far less risky than working in construction, logging, or commercial fishing.

The key takeaway is this: demonstrating a safe and healthy lifestyle is your best tool for locking in the most affordable life insurance. Even something as simple as quitting smoking for at least a year before you apply can make a world of difference to your final price.

The Policy Itself Drives the Cost

Finally, the specific details of the policy you build will, of course, affect the price tag. This is where you get to customize your coverage to perfectly match your family’s needs and budget.

Type of Insurance: As we covered earlier, a term life policy will always be dramatically more affordable than a whole life policy.

Coverage Amount: It’s simple logic—a $1,000,000 policy is going to cost more than a $500,000 one. This is why getting your coverage calculation right is so crucial.

Term Length: A 30-year term will have a higher monthly premium than a 10-year term because the insurer is committed to covering you for a much longer period.

By understanding how all these pieces fit together, you can see that the underwriting process isn’t a mystery. It's just a way to arrive at a fair price based on your unique situation. And for most young parents, the outcome is fantastic news: top-notch, high-value protection is far more affordable than they ever imagined.

Customizing Your Policy With Riders for Family Protection

Think of a standard life insurance policy as the solid foundation of a house. It’s reliable and does its job, but you can always add features to make it a better fit for your family. In the world of life insurance, these add-ons are called riders.

Riders are one of the best ways to personalize your coverage, turning a basic policy into a financial safety net that addresses your specific worries. For young parents, a few of these riders are especially powerful, offering an extra layer of protection right when you need it most.

Essential Riders for Young Parents

Let’s be honest, parenthood comes with a long list of "what-ifs." The right riders can help you build a policy that silences some of those worries, from protecting your kids directly to making sure your own coverage stays in place if you can't work.

Here are three of the most valuable riders for families with young children:

Child Rider: This is a fantastic option for growing families. For a very small additional cost, you can add a modest amount of term life coverage for all of your children under one rider. This includes any kids you have in the future, automatically. The coverage isn't meant to replace an income, but it provides a financial cushion for funeral expenses or allows you to take time off work to grieve without the added stress of lost wages.

Waiver of Premium Rider: What if a serious illness or disability leaves you unable to work and earn an income? This rider is a lifesaver. If you become totally disabled, the insurance company will waive your premium payments, but your policy remains active. It’s a safety net for your safety net, ensuring your family’s protection doesn’t disappear during a major life crisis.

Accelerated Death Benefit Rider: Often included at no extra cost, this rider allows you to access a portion of your own death benefit while you're still alive if you're diagnosed with a terminal illness. These funds are unrestricted, meaning you can use them for anything—paying for medical treatments, hiring in-home care, or even taking a final family trip to create precious memories.

Think of these riders as specific tools for specific jobs. You might not need every tool in the toolbox, but knowing they’re available lets you build a truly robust financial shield for your family.

Seeing Riders in a Real-World Scenario

Let's put this into practice. Imagine a young father, Mark, who has a term life policy with these three riders. If Mark gets into an accident and becomes permanently disabled, the Waiver of Premium rider kicks in. He stops paying his monthly premiums, but his family’s life insurance protection remains fully intact.

Down the road, if his young daughter needs a major, unexpected surgery, the Child Rider could provide a small benefit to help cover their out-of-pocket medical bills. Years later, if Mark were diagnosed with a terminal illness, the Accelerated Death Benefit would give him early access to his policy's funds, allowing him to manage his care with dignity.

These small additions provide immense peace of mind. It’s important to note that life insurance adoption isn't equal across the board; for instance, men are more likely to have life insurance than women (57% vs. 46%), even though women are a vital part of the workforce. You can explore more life insurance statistics and trends from MoneyGeek to see the bigger picture. By adding the right riders, both parents can ensure their policy is as comprehensive and effective as possible.

How to Buy Your First Policy Without the Headache

Let's be honest, buying life insurance sounds about as fun as a trip to the DMV. But it doesn't have to be a confusing, drawn-out process. Once you understand the steps, you can move from feeling uncertain to feeling confident that your family is protected.

Think of it like getting ready for a big project. A little prep work upfront makes everything else go smoothly. Before you start shopping, pull together some basic info:

Your date of birth, height, and weight.

A general overview of your personal and family medical history.

Details about your job, income, and any adventurous hobbies (think scuba diving or rock climbing).

A list of any medications you currently take.

Having this ready will save you a ton of time. You’ll be able to breeze through the initial forms and focus on what really matters—finding the right policy.

Get Quotes and Compare Your Options

Okay, now it's time to see what's out there. You wouldn't buy the first car you test drive, and the same goes for life insurance. The best move is to get quotes from several different companies. Working with an independent agent or using a trusted online comparison tool is a great way to see multiple offers at once.

As you compare, don't just fixate on the monthly price tag. A cheap policy isn't a good deal if it doesn't actually meet your needs. Make sure you're comparing policies with the same term length and death benefit. This is the only way to do a true "apples-to-apples" comparison and find the best life insurance for young parents.

Navigate the Application and Medical Exam

Once you've zeroed in on an insurer, it's time to fill out the official application. This is where the information you gathered earlier becomes your best friend. Be completely upfront and honest. It might be tempting to fudge a detail to get a better rate, but inaccuracies now can lead to a denied claim later, which defeats the whole purpose.

Most policies, especially term life, will require a quick medical exam. I know, it sounds like a hassle, but it's surprisingly simple and convenient. A medical professional comes to you—at home or even at your office—at a time that works for your schedule.

Here’s what to expect:

They'll check your height, weight, and blood pressure.

They’ll go over your medical history with you.

They'll take small blood and urine samples.

That's it. The whole thing is usually done in less than 30 minutes, and the insurance company covers the cost. This little check-up helps them verify your health and give you the best possible rate.

Check the Insurer’s Financial Health

This last step is one that people often skip, but it’s critical. A life insurance policy is a long-term promise. You need to be sure the company you choose will actually be around to keep that promise, potentially decades from now.

So, how do you check? You can look up a company's financial strength rating from independent agencies.

One of the most trusted names in the business is A.M. Best. You're looking for insurers with a rating of "A" (Excellent) or higher. This grade means the company has a strong, stable financial foundation and is fully capable of paying its claims.

Taking a few minutes to verify this gives you incredible peace of mind. You'll know you’ve not only picked the right policy but also a rock-solid company to back it up.

Answering Your Top Life Insurance Questions

Once you get a handle on the basics of life insurance, a few more specific questions almost always pop up. Let's tackle some of the most common ones that young parents ask, so you can feel confident making your next move.

Does My Stay-at-Home Partner Really Need Life Insurance?

Yes, absolutely. This is one of the most common and dangerous misconceptions out there. It's easy to think that only the breadwinner needs a policy, but the economic value a stay-at-home parent provides is immense. Think about it: they are the full-time childcare provider, household manager, cook, and so much more.

If they were to pass away, the surviving parent would be hit with a sudden, massive financial burden. You'd have to start paying for daycare, cleaning services, and all the other tasks your partner handled. A life insurance policy for a non-working partner gives you the funds to cover these new expenses without derailing your family's stability during an already devastating time.

Should I Just Stick With My Life Insurance From Work?

While the group life insurance offered by your employer is a great perk, it’s rarely enough and comes with some serious strings attached. First, the coverage is usually pretty basic—often just one or two times your annual salary. For a family with kids and a mortgage, that's just a drop in the bucket.

Even more importantly, that policy isn't truly yours. It’s typically not portable, which is a fancy way of saying you can't take it with you. If you switch jobs, get laid off, or start your own business, that coverage vanishes instantly, leaving your family exposed.

Think of work insurance as a nice little bonus, not your main safety net. The real security comes from owning a private policy that you control. It sticks with you no matter where your career takes you, ensuring your family is protected without interruption.

When Is the Best Time to Review My Policy?

Your life insurance policy isn't a "set it and forget it" kind of thing. Life changes, and your coverage should change with it. A good practice is to give your policy a quick check-up every few years or, more importantly, after any major life event.

For young parents, these are the big moments that should trigger a review:

Welcoming another child into the family

Buying a new home and taking on a bigger mortgage

Getting a major pay raise or promotion

Taking on significant new debt, like a business loan

Each of these events shifts your financial picture. Taking a few minutes to review your policy ensures the protection you bought yesterday is still strong enough for the family you have today.

At America First Financial, our mission is to help families like yours find straightforward, affordable protection. You can get your free life insurance quote today in under three minutes and gain the peace of mind that comes from knowing you’ve secured your loved ones' future.

_edited.png)

Comments