How to Change Insurance Companies: Easy Step-by-Step Guide

- dustinjohnson5

- May 20, 2025

- 10 min read

Why Smart Consumers Change Insurance Companies

Changing insurance companies can be a smart way to manage your finances. While finding the lowest price is a key factor, it's not the only one. Smart consumers understand there are several important indicators that it might be time to shop around for new insurance options. This proactive approach helps them find better coverage and potentially save money.

Recognizing the Signals for Change

One clear sign it's time to switch is a significant increase in premiums without a corresponding increase in coverage. This “premium creep” can happen slowly, making it hard to notice. Another indicator is a negative claims experience. If your insurance company makes filing a claim difficult or denies legitimate claims, it might be time to consider a new provider.

Life changes also frequently require changes in insurance coverage. Major events like marriage, having a child, buying a new home, or even a job change can trigger the need for different insurance policies or different levels of coverage. These events are good opportunities to re-evaluate your insurance needs.

The Impact of Market Dynamics

Market conditions and pricing trends also play a role in the decision to change insurers. Shifts in the market can create opportunities for consumers to secure better deals. For example, in early 2025, the global commercial insurance market saw its third consecutive quarter of rate declines, with a 3% overall reduction. This followed seven years of increases.

However, US casualty insurance experienced an 8% rate increase due to the rising severity of claims and large jury verdicts. This highlights how market dynamics can drastically impact the insurance landscape. For more detailed statistics, you can visit the Global Insurance Market Index.

Seeking Better Service and Value

Beyond price and life changes, the quality of customer service can also be a reason to switch insurance companies. Poor responsiveness, difficulty contacting customer service representatives, or unhelpful interactions can signal that a change is necessary. Smart consumers recognize the importance of proactively managing their insurance.

Regularly reviewing your coverage and comparing options can offer significant long-term advantages, ensuring you have the right protection at the best price. This approach helps you avoid paying too much for insufficient coverage and allows you to benefit from better offers when they arise.

Finding Your Perfect Insurance Match

Switching insurance providers requires more than just gathering online quotes. It demands a thoughtful, systematic approach to ensure you find a company that truly meets your individual needs. This means looking beyond attractive marketing and delving into the details that truly matter.

Evaluating Financial Stability and Consumer Feedback

A crucial first step is assessing an insurance company's financial strength. This confirms they possess the resources to pay out claims when you need them. Also, pay attention to actual consumer feedback. Go beyond simple star ratings and explore what customers say about the claims process and customer service.

These details offer valuable insights into an insurer's reliability and performance. It's about understanding how the company operates in real-world scenarios.

Understanding Policy Details and Identifying Potential Issues

Understanding the specific language within an insurance policy is vital. Look for potential issues like exclusions or limitations that could impact your coverage. This careful review helps you make well-informed decisions based on the actual policy terms, not just the sales pitch.

For example, some policies may exclude certain events or limit payout amounts. Knowing these specifics beforehand can prevent unexpected surprises later.

Before introducing a detailed comparison table, let's review some key market trends and influences impacting insurance decisions.

The insurance landscape is influenced by economic factors. Consumer confidence and market conditions can affect how individuals approach insurance. During 2024-2025, the global insurance market experienced volatility with fluctuations in inflation and interest rates. This led to cautious consumer behavior regarding switching insurers. As reported in the McKinsey Global Insurance Report 2025, consumer confidence remained unstable despite an economic growth cycle bottoming out.

To help you navigate this complex landscape, the following table outlines essential factors to consider when comparing insurance providers:

Insurance Company Comparison Factors

Essential factors to consider when comparing potential insurance providers

Comparison Factor | Why It Matters | How to Evaluate |

|---|---|---|

Financial Stability | Ensures the company can pay out claims | Check independent ratings agencies like A.M. Best |

Consumer Satisfaction | Provides insights into customer service and claims handling | Read reviews and testimonials |

Policy Coverage | Determines what is and isn't covered | Carefully examine the policy wording for exclusions and limitations |

Price | Affects your budget | Compare quotes from multiple providers |

Claims Process | Impacts how smoothly claims are handled | Research the company's reputation for claims processing |

Customer Service | Influences your overall experience | Contact the company and assess their responsiveness |

This table helps you organize your research and compare insurance providers based on factors relevant to your needs. By considering these elements, you'll be better equipped to choose a company that aligns with your priorities.

Creating a Personalized Comparison Strategy

Developing a personalized comparison strategy is key to finding the right insurance fit. Consider what matters most to you and weigh those factors accordingly. This personalized approach ensures you prioritize the elements most important to your individual needs.

Coverage Options: Does the policy offer the specific protections you require?

Price: Is the premium competitive and affordable?

Customer Service: Are representatives responsive and helpful?

Claims Process: Is filing a claim straightforward? What's the company's reputation for fair and efficient claim payouts?

Investigating Claims Payout History and Exploring Negotiation Tactics

Research the insurer's actual claims payout history. Look for reviews and testimonials from other policyholders to understand their experiences. Before switching, explore potential negotiation strategies.

You might be surprised at the potential discounts or savings available by simply asking. By thoroughly considering these elements, you can confidently navigate the process of changing insurance companies and choose the best fit for your specific circumstances.

The Hidden Economics of Switching Insurers

Switching insurance companies can seem enticing, especially with the promise of lower premiums. However, it's essential to delve beyond the advertised price and consider the potential hidden costs. These often-overlooked expenses can significantly impact your actual savings. A thorough understanding of the complete financial picture is vital before making a switch. When evaluating insurance for long-term security, comparing various options is key. Veterans, for example, have specific needs. Explore this helpful guide: life insurance options for veterans.

Understanding Potential Costs and Penalties

One common hidden cost is the cancellation penalty. Some insurance companies impose a fee for terminating a policy before its expiration date. You might also forfeit any accumulated loyalty discounts from your existing insurer.

These seemingly minor charges can accumulate and diminish any potential savings from a lower premium with a new provider. Therefore, factoring these costs into your decision is crucial.

For instance, imagine your current insurer offers a 10% loyalty discount. Switching to a new company with a slightly lower premium might seem appealing. However, if you incur a cancellation fee and lose your loyalty discount, the switch could negate any savings. A comprehensive cost analysis is essential.

Timing Your Switch for Maximum Savings

Timing is another critical factor. Switching mid-policy can often incur higher penalties. Conversely, waiting until your policy's renewal date often allows you to bypass these fees entirely.

Some insurance companies offer promotional periods with reduced introductory rates. Aligning your switch with these promotions can unlock substantial initial savings. This adds a strategic element to the decision-making process.

Analyzing Cost-Benefit and Coverage Differences

A lower premium might seem attractive, but it's crucial to compare coverage details. Ensure the new policy offers comparable protection to your current plan. Reducing coverage to save money might appear beneficial in the short term. However, it could result in higher out-of-pocket expenses if you need to file a claim.

Understanding industry trends is also important. For example, in the US, group life insurance sales experienced an 8% year-over-year growth in Q4 2023, with new premiums increasing steadily. Yet, Q1 2024 saw a 2% decrease in workplace life insurance premiums. You can delve deeper into these statistics here: Deloitte Insurance Industry Outlook. This illustrates the fluctuating nature of the insurance market and reinforces the need for careful evaluation when changing providers.

To help illustrate the potential financial implications of switching insurance, let's review the following table:

Potential Costs When Switching Insurance

Common financial considerations and potential expenses when changing insurance companies

Cost Type | Typical Range | How to Minimize |

|---|---|---|

Cancellation Fee | 0 - 250 (varies greatly by provider and policy type) | Review your current policy or contact your insurer to understand potential fees. |

Lost Loyalty Discounts | 5% - 20% of premium | Factor in the potential loss of discounts when comparing premiums. |

Administrative Fees (New Policy) | 25 - 75 (can be waived by some companies) | Inquire about potential administrative fees with the new insurer. |

Short-Term Rate Increases | Variable, depends on market conditions and policy type | Compare not only initial premiums but also projected future rate increases. |

This table summarizes some common costs associated with switching insurance. By understanding and minimizing these potential expenses, you can make a more informed and financially sound decision. A well-planned switch can lead to genuine savings, but it’s crucial to consider the entire economic equation.

The Seamless Switch: Your Step-by-Step Transition Blueprint

Changing insurance companies can feel like a daunting task. However, with a structured approach, the process can be quite simple. This section offers a clear roadmap, informed by insights from insurance professionals, to guide you through a smooth and efficient transition.

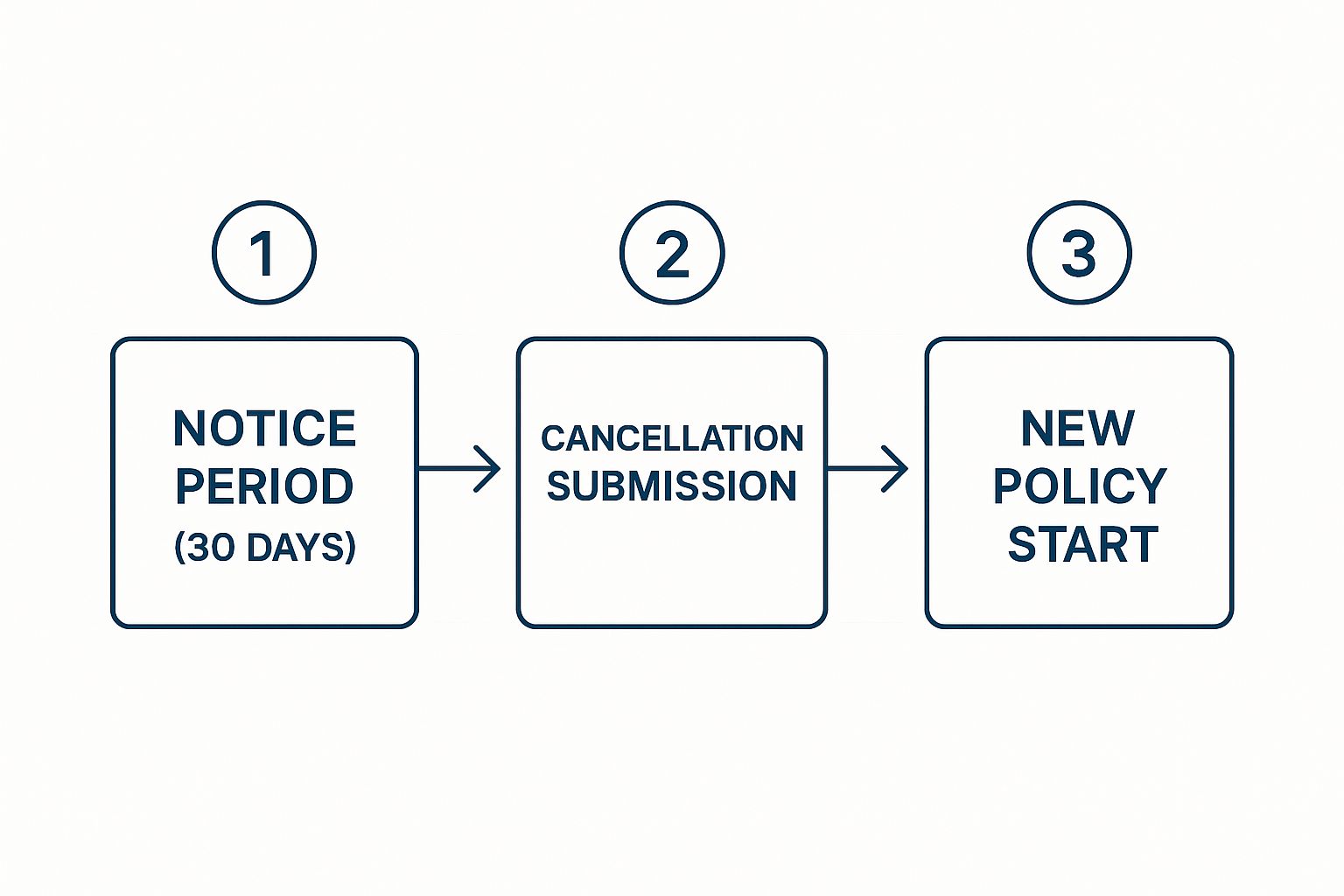

This infographic highlights the three key phases involved in changing insurance companies: the notice period, cancellation submission, and the activation of your new policy. These steps ensure a seamless transition and maintain continuous coverage, allowing you to navigate the switch with confidence.

Step 1: The Notice Period (30 Days)

Most insurance companies require a 30-day notice period before you can cancel an existing policy. This is a critical first step. Contact your current insurer to confirm their specific requirements. This provides ample time to finalize your new policy and prevents any gaps in your coverage.

Confirm Cancellation Terms: Be sure to understand any potential penalties or fees associated with canceling your policy mid-term.

Review Existing Policy: Take the time to review your current coverage details. This will help ensure your new policy offers comparable protection.

Begin Shopping: Start researching new insurance providers and compare quotes to find the best fit for your needs.

Step 2: Cancellation Submission

Once your new policy is finalized and ready to go, formally submit your cancellation request to your existing insurer. This ensures a clean break and helps avoid unwanted charges. Maintaining clear documentation is essential in this phase.

Obtain Written Confirmation: Request written confirmation of your cancellation from your current insurer. This serves as proof of the termination date and can help prevent billing discrepancies.

Review Final Bill: Carefully review the final bill from your previous insurer to make sure there are no unexpected or incorrect charges.

Confirm New Policy Activation: Double-check with your new insurer that your policy is active and your coverage has officially begun.

Step 3: New Policy Start

With your old policy successfully canceled, your focus should shift to managing your new coverage. This includes confirming all the details and keeping your documents organized. A systematic approach now will save you potential hassle later.

Policy Document Review: Carefully review all the documents received from your new insurer. Ensure the coverage details align with what you agreed upon.

Set Up Payment: Establish automatic payments to avoid missed premiums and ensure continuous, uninterrupted coverage.

Organize Documents: Create a digital or physical file to store your new policy documents for easy access when needed.

Streamlining Your Transition and Managing Documentation

While these steps are straightforward, careful execution is important. Overlooking seemingly small details can sometimes lead to complications. This section provides resources to make the entire process even smoother.

Downloadable Communication Templates: Access professionally crafted templates to assist you in canceling your existing policy and communicating with your new provider.

Documentation Checklist: Use this checklist to gather all the necessary information, ensuring a streamlined process and avoiding delays or coverage gaps.

Digital Organization Techniques: Implement practical strategies for electronically storing and managing your insurance documents for easy retrieval in the future.

By following this step-by-step blueprint and utilizing the resources provided, changing insurance companies becomes a manageable and straightforward task. This organized approach empowers you to secure the right coverage with confidence and avoid common pitfalls.

Avoiding The Costly Mistakes Insurance Switchers Make

Changing insurance companies can save you money, but it's easy to make mistakes. Understanding these pitfalls can help you avoid costly surprises and make the switch smoothly.

Verify Your Coverage

Don't assume your new policy matches your old one. Policies often have slight differences. Compare premiums, of course, but also carefully review policy documents. Pay close attention to coverage limits, deductibles, and exclusions.

For example, one policy might cover rental car costs after an accident, while another doesn't. Such a seemingly small difference can lead to unexpected expenses. Always verify every coverage detail before confirming the switch.

Document Everything

Keep records of all communication with both insurance companies. This includes emails, letters, and notes from phone calls. This documentation is vital if discrepancies arise.

Imagine your old insurer bills you after you've switched. Proof of your cancellation request helps resolve the issue quickly. Documentation safeguards you against billing errors and disputes.

Watch Out For Red Flags

Be cautious if your new premium seems unusually low. Double-check for adequate coverage. Unresponsive or unhelpful customer service can signal larger problems.

Contingency Planning: What If Something Goes Wrong?

Even with the best planning, problems can occur. Your new policy might not start on time, leaving a gap in coverage. A contingency plan is crucial.

Overlap Coverage: Briefly overlap your old and new policies for uninterrupted protection. The small added cost outweighs the potential financial risk.

Maintain Communication: Stay in contact with both companies to address any issues promptly and avoid delays. This proactive approach keeps the process moving.

Escalate Concerns: If problems persist, contact a supervisor or a regulatory agency. This ensures your concerns are heard and addressed appropriately.

By understanding these pitfalls and taking preventative measures, you can switch insurance companies confidently, avoid costly mistakes, and ensure a smooth transition.

Mastering the Unique Challenges of Each Insurance Type

Changing insurance companies requires careful consideration, and the process varies significantly depending on the type of insurance. Switching auto insurance is different from changing health insurance, and life insurance has its own unique requirements compared to homeowners insurance. Understanding these differences is essential for a smooth and successful transition.

Auto Insurance: Navigating Coverage and State Regulations

Switching auto insurance often begins with understanding your state's minimum coverage requirements. Some states have specific liability limits, while others operate under no-fault laws that impact how accidents are handled. Knowing these regulations is crucial for choosing the right coverage. Also, consider additional features like accident forgiveness and roadside assistance when comparing different policies. Finally, time your switch carefully to prevent lapses in coverage, as driving uninsured can result in fines and other penalties.

Health Insurance: Timing and Network Considerations

Health insurance changes frequently revolve around specific enrollment periods, such as Open Enrollment or Qualifying Life Events. Missing these designated times can make switching providers significantly more challenging. Thoroughly review provider networks to ensure your preferred doctors are included in any new plan. Also, pre-existing conditions require careful attention, as coverage for them can differ substantially between insurance companies. Those interested in emerging trends in the health and wellness sector may find valuable insights in resources like this: Care Health Market Trends Investing In Wellness.

Life Insurance: Policy Type and Beneficiary Designations

Changing life insurance policies often requires understanding the various policy types available, such as term life and whole life insurance. Each type offers different advantages and disadvantages. When switching life insurance providers, remember to update your beneficiary designations to reflect your current wishes. Additionally, if your current policy includes a cash value component, carefully consider how a switch might impact that accumulated value.

Homeowners Insurance: Property Value and Risk Assessment

Changes in homeowners insurance often involve reassessing your property's value. Factors like recent renovations or fluctuations in the local real estate market can influence how much coverage you need. Consider your home's location and potential risks, such as flood or earthquake exposure. These factors can affect both policy pricing and available coverage options. Make sure your new policy provides adequate protection for your belongings and liability.

The Importance of Personalized Guidance

This personalized approach acknowledges that each type of insurance presents unique complexities. Understanding these nuances helps ensure a smooth transition and the right coverage for your individual needs. Strategic timing, such as aligning your switch with policy renewal dates or open enrollment periods, can potentially save you money. By understanding the intricacies of each insurance type, you can navigate the switching process efficiently, securing optimal coverage and avoiding unnecessary costs and complications.

Looking for an insurance provider that prioritizes your family's security and financial stability while upholding traditional American values? Explore the offerings at America First Financial. They offer a range of options, from term life and disability insurance to comprehensive health care plans, tailored to meet the specific needs of conservative American families and individuals. Get a quick and easy online quote in under three minutes and discover how America First Financial can provide the financial protection you need while staying true to your values.

_edited.png)

Comments