How to Choose an Insurance Agent You Can Trust

- dustinjohnson5

- Jul 15, 2025

- 10 min read

Finding the right insurance agent isn't just another box to check on your to-do list. It’s one of the most important decisions you'll make for your financial security. You're not just buying a policy; you're hiring a professional advocate who will stand in your corner when things go wrong.

Why Picking the Right Insurance Agent Is So Crucial

In a world filled with confusing policies and fine print, a good agent acts as your personal translator and risk advisor. They bridge the gap between you and the massive insurance companies, making sure the coverage you pay for is actually the coverage you need.

Think of them as a financial guard for your biggest assets—your home, your car, your business, your family's future. A sharp agent will spot risks you’d never see on your own. Maybe you live in an area that was just re-zoned as a flood risk, or your current liability coverage is dangerously low for your new home-based business. Catching these gaps before a disaster is what separates a great agent from a mere salesperson.

Your Agent is Your Advocate During a Claim

You truly see an agent's value when you have to file a claim. Let's be honest, dealing with a car wreck, a house fire, or a serious health issue is stressful enough. The last thing you want is to fight with an insurance adjuster.

This is where your agent steps up. They guide you through the claims process, handle the complicated paperwork, and advocate to make sure you get a fair and prompt payout. That kind of support is priceless when you're already at your wit's end.

A truly skilled agent offers you:

A Custom Risk Profile: They take the time to understand your life and pinpoint exactly what kind of protection you need.

Policy Demystification: They'll walk you through the confusing jargon—deductibles, exclusions, endorsements—and explain what it all means in plain English.

Long-Term Partnership: Life changes. You buy a new house, have kids, or start planning for retirement. A great agent schedules regular check-ins to make sure your coverage evolves with you.

The right agent isn't trying to make a quick sale. They're focused on building a long-term relationship grounded in trust and a genuine understanding of your needs. Their guidance is a critical part of a solid financial foundation.

The insurance industry is massive. The global market for insurance brokers and agents was valued at around USD 323 billion in 2023 and is expected to keep climbing. This isn't just a random statistic; it shows that more and more people are realizing they need expert help to navigate the complexities of insurance. You can read more about these market trends to see why professional guidance has become so essential.

Captive vs. Independent Agents: Which Is Right for You?

As you start looking for an insurance agent, you'll quickly realize they come in two main flavors: captive agents and independent agents. Figuring out this distinction is probably one of the most important first steps you can take. It directly impacts the options and advice you'll receive.

A captive agent works for just one insurance company. Think of them as a dedicated specialist for a single brand, like State Farm or Allstate. They know their company's products backward and forward. If you already have a strong preference for a specific national insurer and love the idea of keeping all your policies in one place, a captive agent can be a fantastic choice. They make the process simple and direct.

On the other side of the coin, you have the independent agent. These folks work for you, not an insurance company. They partner with multiple insurers, which gives them the flexibility to shop around and find the best fit for your specific needs and budget.

Making the Call: Who Should You Work With?

So, how do you decide which type is best for your family? It boils down to your personal situation and what you prioritize.

Let's say your insurance needs are pretty straightforward—a standard home policy and coverage for two cars. If you're happy with a major brand and its customer service, a captive agent offers a clean, efficient path to getting the coverage you need.

But what if your situation is a bit more complicated? Maybe you run a small business from home, own a unique property like a historic house, or have a not-so-perfect driving record. This is where an independent agent really shines. They have the resources to find a niche insurer that specializes in your exact circumstances, something a captive agent just can't do.

An independent agent’s biggest advantage is choice. By comparing policies from several different carriers, they can piece together a protection plan that’s comprehensive and cost-effective. A captive agent is structurally limited to the products offered by their single company.

There's no single "correct" answer here. The goal is to align the agent's business model with your own financial strategy. Ask yourself: do you value brand loyalty and simplicity, or do you prefer having access to the broader market and more customized solutions? Your answer will point you toward the right partner to help protect your family's future.

Verifying an Agent’s Credentials and Experience

When you're trusting someone with your financial protection, "trust but verify" should be your mantra. Before you sign any paperwork or even get too deep into conversation, it's crucial to do a little homework on the agent. This isn't about being cynical; it's about being smart and ensuring you're working with a legitimate professional.

First things first: check their license. Every single agent is required by law to be licensed in your state. You can usually confirm this in just a few minutes on your state's Department of Insurance website. It's the most basic check, but it's a non-negotiable one. Think of it as your first line of defense.

Once you've confirmed they're licensed, you can dig a bit deeper. Look for professional designations—those acronyms you often see after an agent's name. They aren't just for show; they signify a serious commitment to the profession.

What Those Letters After Their Name Actually Mean

An agent who has pursued advanced designations has invested their own time and money to gain a deeper understanding of insurance and financial planning. It shows they've gone far beyond the minimum requirements.

Here are a couple of the most respected ones you might see:

CIC (Certified Insurance Counselor): An agent with a CIC has passed rigorous exams covering the full spectrum of insurance—personal, commercial, and life and health. It’s a sign of a well-rounded expert.

CLU (Chartered Life Underwriter): This is a top-tier designation for specialists in life insurance and estate planning. It means they have mastered complex strategies for protecting your family and legacy.

Seeing credentials like these tells you the agent is dedicated to their craft. They've put in the work to become a true professional, which often means you'll get more thoughtful and effective advice.

Finally, make sure their experience is the right kind of experience for you. It's not just about how many years they've been in the business. An agent who has spent 15 years specializing in commercial trucking policies probably isn't the best person to advise you on a family life insurance plan.

To truly gauge an agent's integrity and background, you might even consider more thorough checks. For example, some people use court record checks for added peace of mind, especially when significant financial assets are involved. Ask them directly about their typical client and what kinds of policies they handle day-to-day. Their answer will tell you if their expertise truly lines up with what you need to protect.

Gauging an Agent's Reputation and Local Knowledge

A truly great insurance agent does more than just sell policies; they understand your world. This is where local knowledge becomes a game-changer. An agent who lives and works in your community will be tuned into risks that someone in a national call center a thousand miles away would never even consider.

Think about it. They’ll know that a new subdivision is being built in a potential wildfire corridor. They'll be up-to-date on recent changes to local liability laws that could impact your home-based business. This kind of grounded insight means your coverage isn't just a generic template—it's built for your reality.

This is especially critical in North America, which commanded a 30.5% share of the insurance agent market in 2023. A big reason for this is the maze of local and state regulations. Consumers need experts who can navigate these specific rules, not just provide a one-size-fits-all policy. You can get a deeper sense of how regional factors influence the industry by reviewing the full market analysis on grandviewresearch.com.

How to Research a Local Agent

Doing a little homework on an agent's reputation is time well spent. A solid local standing is one of the best signs of reliability and quality service. You aren't just looking for a licensed professional; you're looking for a respected partner in your local business community.

Don’t just take their word for it. While the testimonials on an agent's website are a start, you need to dig for the real story. Unfiltered feedback from multiple sources will give you the most accurate picture of how they treat clients, especially when it’s time to file a claim.

Ready to start your research? Here are a few practical places to look:

Check Multiple Review Sites: Go beyond a quick Google search. Check out their profile with the Better Business Bureau (BBB) and look at other local business directories for a more complete view.

Ask for References: A confident, established agent shouldn't hesitate to connect you with a few long-term clients. Hearing directly from other customers is invaluable.

Look for Community Involvement: Do you see their name sponsoring a local little league team? Are they active in the Chamber of Commerce? This kind of engagement often points to a real, long-term commitment to the community they serve.

What to Ask Before You Sign on the Dotted Line

Your first few conversations with a potential insurance agent are your golden opportunity to look past the sales pitch and see who you’re really dealing with. This is your interview, and your goal is to figure out if you're talking to a genuine advisor or just a salesperson chasing a commission.

To do this, you need to ask questions that cut to the chase—questions that reveal their actual process, their depth of knowledge, and how they truly treat their clients. Generic questions will only get you generic, rehearsed answers.

For instance, instead of asking something vague like, "Are you experienced?" try a more specific approach. "Tell me about a time you handled a complicated claim for a client in a situation like mine." This prompts a real story, not just a simple "yes." A solid answer will be full of detail, showing you their problem-solving skills in action. If they get dodgy or vague, that’s a major red flag.

Questions That Uncover a True Partnership

Beyond handling claims, you need an agent who is proactive. Your life doesn't stand still, and your insurance coverage shouldn't either. The questions you ask now can tell you everything about the service you'll receive later on.

Here are a few essential questions to have in your back pocket:

How often will we review my policies, and what does that process look like? A great agent won't just sell you a policy and disappear. They'll have a set process, usually an annual review, where they check for new discounts, assess life changes (like a new car or a home renovation), and make sure your coverage still makes sense.

What can I expect after I become a client? What's your onboarding process? This question reveals a lot about their organization and dedication to service. A good response should sound something like, "I'll walk you through setting up your online account, introduce you to my service team, and we'll go over the key parts of your policy so you know exactly who to call and what's covered from day one."

If I have to file a claim, what is your role? You're listening for one thing here: advocacy. The right agent will tell you to call them first. They should position themselves as your guide and champion, the person who will help you navigate the claims process with the insurance company from start to finish.

This is your chance to see if they're a partner or a policy-pusher. Spotting the difference is crucial. I've put together a quick cheat sheet to help you recognize the signs.

Red Flags vs. Green Flags When Choosing an Agent

Red Flag (Warning Signs) | Green Flag (Positive Indicators) |

|---|---|

Focuses only on the lowest price. | Explains the value of coverage, not just the cost. |

Uses confusing jargon without explaining it. | Takes the time to explain policy details in plain English. |

Can't provide specific examples of helping clients. | Shares relevant stories and case studies. |

Doesn't ask you many questions. | Asks detailed questions to understand your unique needs. |

Is hard to get a hold of during the sales process. | Is responsive, communicative, and sets clear expectations. |

Think of this as your gut-check guide. An agent who ticks the boxes on the right is someone who is invested in your long-term security, not just in making a quick sale.

Key Takeaway: A top-tier agent sees themselves as your long-term risk advisor. Their answers should be packed with real-world examples of how they’ve helped people, showing a client-first mindset that goes far beyond just selling you a policy.

This principle of due diligence isn't just for insurance. It highlights the importance of asking critical questions before financial commitments of any kind. These conversations are foundational to your financial well-being and ensuring you have the right people in your corner when you need them most.

Answering Your Lingering Questions About Choosing an Agent

Even after you’ve done your research, a few last-minute questions can pop up, making that final decision feel a bit overwhelming. Let’s tackle some of the most common ones I hear so you can feel completely confident in your choice.

How Do Agents Get Paid?

This is a big one. Most of the time, insurance agents earn a commission paid by the insurance company after you purchase a policy. This means you don’t typically write them a separate check for their services.

That said, you should always feel comfortable asking an agent to explain exactly how they're compensated. Transparency is key, and a good agent will have no problem breaking it down for you.

Does a Higher Premium Mean Better Service?

Not necessarily. A great agent’s real value is in finding that sweet spot between solid coverage and a fair price. While a more expensive policy might include higher limits or specific protections you truly need, the price tag itself is no guarantee of a better agent or superior service. The focus should always be on the value you receive.

How Does Technology Fit In?

The global insurance market is massive—valued at around USD 8 trillion—and technology is changing how agents serve their clients. Today’s best agents do more than just sell; they use modern tools to analyze your needs, compare complex options, and deliver personalized recommendations. If you're curious about the industry's scale, you can discover more about the global insurance industry on Statista.

Key Insight: Don't hesitate to ask a potential agent about the technology they use. Do they have an online portal for documents? Can you meet virtually? An agent who embraces modern efficiencies is often better equipped to provide prompt, client-focused service.

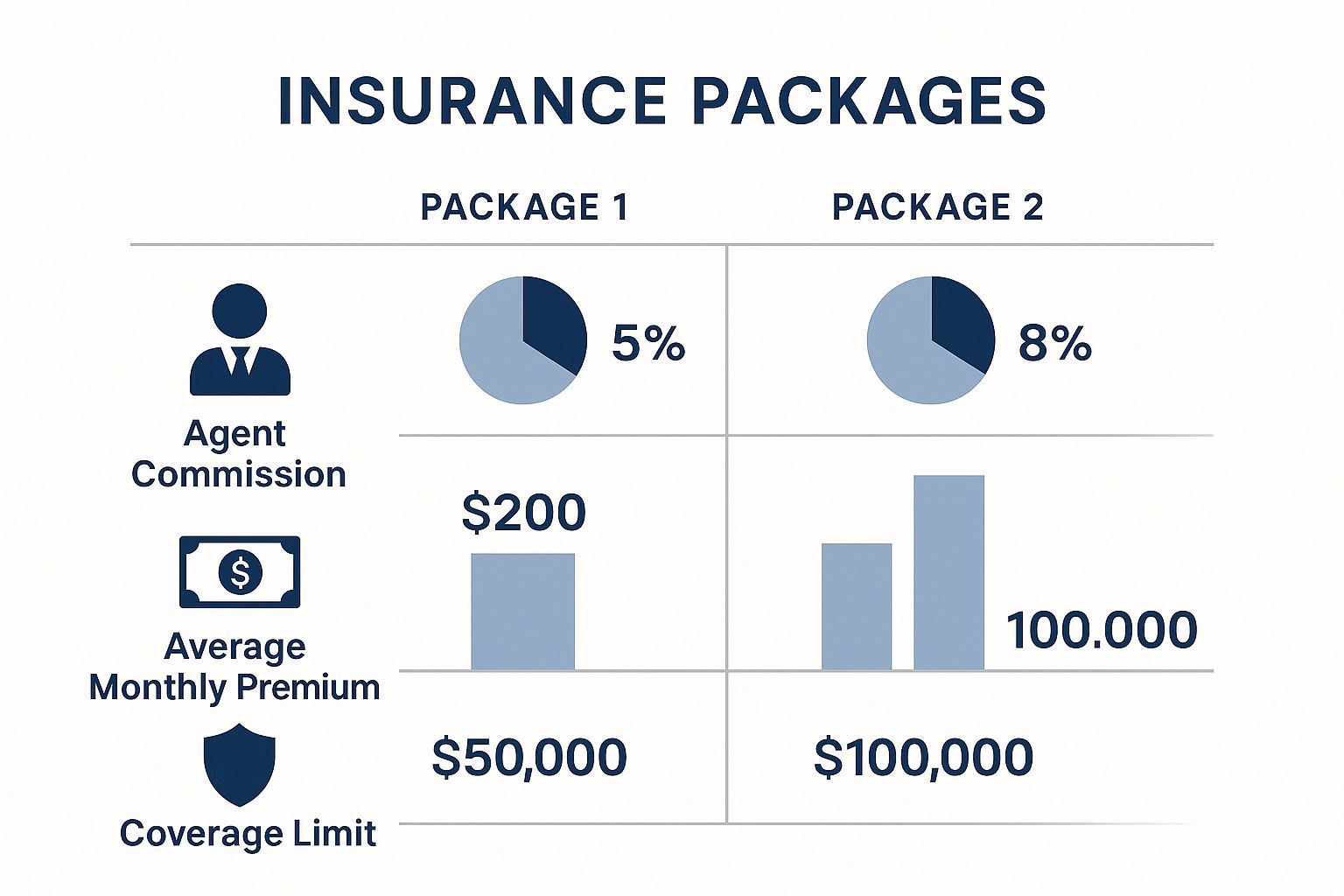

This image below gives you a glimpse into how different policy packages can look, comparing things like premiums, coverage levels, and potential commissions.

As you can see, a higher premium often buys you higher coverage limits. It also shows how an agent's commission might be structured differently depending on the policy.

At America First Financial, we believe you deserve clear answers and affordable protection that reflects your values. We're here to help you secure your family's future with insurance solutions built for patriotic Americans. You can get a no-hassle quote in under three minutes by visiting https://www.americafirstfinancial.org.

_edited.png)

Comments