How to Choose Insurance Coverage That Fits Your Life

- dustinjohnson5

- Sep 4, 2025

- 16 min read

Before you even think about comparing policies or getting quotes, the most important work happens right at your own kitchen table. Choosing the right insurance isn't about finding the cheapest premium; it's about taking a hard, honest look at your life—your assets, your debts, and the people who count on you—to figure out what truly needs protection.

Think of it as building a personal risk profile. This first step ensures you're shopping for a real solution to a real problem, not just buying an off-the-shelf product.

Start By Assessing What You Actually Need to Protect

It’s tempting to jump straight into the weeds of policy features and costs, but the best plans are always built on a solid foundation of self-awareness. What are you really trying to safeguard? The answer is different for everyone because no two lives are the same.

This isn’t about fuzzy financial goals. It's about getting concrete and making a detailed inventory of your life. Imagine you’re drawing a map of your financial world. You’ve got your assets on one side—your house, your savings, your investments, and your ability to earn an income. On the other side are your liabilities and responsibilities—the mortgage, car payments, student loans, and the financial security of your family.

That gap between what you have and what you owe? That's where your risk lives.

Building Your Personal Risk Profile

A personal risk profile is simply a clear picture of what could go wrong financially and who would feel the impact. It shifts your thinking from a reactive "I guess I need insurance" to a proactive "I need a plan to protect these specific things." To start building yours, just ask yourself a few pointed questions.

Your answers will immediately start to shine a light on the gaps insurance is meant to fill. For example, a young couple who just took on a $400,000 mortgage has a very clear and significant liability. If one partner’s income were to suddenly disappear, the other would be left struggling with a massive debt. For them, term life insurance to cover that mortgage balance is a no-brainer.

Let's look at a few other real-world scenarios:

The Gig-Economy Worker: A freelance web developer's income is directly tied to their ability to work. An unexpected injury that keeps them away from their keyboard for a few months could be financially devastating. For this person, disability insurance isn't a "nice-to-have"—it's an absolute necessity to keep the lights on while they recover.

The Near-Retiree: Someone in their early 60s has spent a lifetime building a nest egg. Their biggest financial threat isn't a mortgage anymore; it's the staggering cost of long-term care, which could drain their retirement savings in a hurry. Long-term care insurance becomes the priority to shield those hard-earned assets.

Your financial situation has its own unique fingerprint. This initial assessment is all about pinpointing your biggest vulnerabilities so you can shop for coverage that solves a specific problem, not just checks a box.

Cataloging Your Assets and Liabilities

To make this less abstract, create a simple balance sheet. You can't protect what you don't measure, and understanding your financial standing is the first step. Using tools for tracking your net worth can bring a ton of clarity to this process.

Just list everything you own that has value and everything you owe.

What to Protect (Your Assets):

Income: Your ability to earn a living is almost always your most valuable asset.

Home: Both the physical structure and the equity you've built up over time.

Savings & Investments: This includes retirement accounts (401k, IRA), brokerage accounts, and your emergency fund.

Vehicles: Cars, boats, or any other valuable modes of transport.

What to Cover (Your Liabilities):

Mortgage or Rent: The non-negotiable cost of keeping a roof over your head.

Debts: Car loans, student debt, and outstanding credit card balances.

Dependents: The cost of raising your children, supporting a spouse, or caring for aging parents.

Future Costs: Things like college tuition for your kids or even your own final expenses.

Doing this simple exercise gives you a clear, data-driven starting point. You’ll stop wondering how to choose insurance and start seeing exactly what kind of protection makes sense for your stage of life. This foundation is key to preventing you from buying too little coverage—or worse, wasting money on policies you don’t even need.

Decoding Insurance Policies and Technical Jargon

Stepping into the world of insurance can feel like trying to decipher a legal document written in another language. The jargon is thick, the concepts feel abstract, and the fine print seems to go on forever. But here’s the thing: learning to speak the language of insurance is the only way to choose your coverage with real confidence. It’s what lets you see past the sales pitch and understand what you're actually buying.

This isn’t just about memorizing definitions. It’s about connecting those terms to your wallet. When you understand what a deductible really is, for instance, you can intelligently weigh the trade-off between a lower monthly bill and what you’ll have to pay out-of-pocket if you ever need to file a claim.

The Core Pillars of Personal Insurance

Before you get lost in the details of a specific policy, it helps to zoom out and look at the big picture. The global insurance market isn’t just massive—it saw an 8.6% growth spurt in 2024, ballooning to a premium income of EUR 7.0 trillion worldwide—it’s also highly segmented. Knowing the main categories helps you figure out where your priorities should be. You can find more details in the 2024 Global Insurance Report on allianz.com.

Most people build their financial safety net around these four pillars:

Life Insurance: This is all about replacing your income for the people who depend on it. If you have a partner, kids, or even aging parents who rely on you financially, life insurance gives them a lifeline if you’re no longer there. It's the largest market segment for a reason, making up EUR 2,902 billion in global premiums.

Health Insurance: In today’s world, this is non-negotiable. It’s your shield against the staggering costs of medical care, from a routine doctor’s visit to unexpected surgery. A single medical emergency can derail your finances for years without it.

Homeowners/Renters Insurance: This protects your home and everything in it from disasters like fire, storms, or theft. Just as important is the liability coverage it includes—that’s what protects you financially if someone gets hurt on your property.

Auto Insurance: In most places, it’s the law. This covers your liability if you cause an accident, but it can also cover repairs to your own car, depending on the policy you choose.

Each one is designed to tackle a different kind of risk, and together they form the foundation of your financial security.

Think of insurance not as a single product, but as a toolkit. You wouldn't use a hammer to fix a leaky pipe; similarly, you need the right type of policy to protect against specific financial risks.

Translating the Terms That Matter Most

Alright, let's get into the nitty-gritty. Every policy you look at will be built around a few key terms. These are the levers that control how much you pay versus how much the insurance company pays when something goes wrong.

The language of insurance can be a bit dry, but understanding these core terms is the key to comparing policies effectively. Below is a quick rundown of the vocabulary you'll see again and again.

Term | What It Means | How It Affects You |

|---|---|---|

Premium | The fixed amount you pay (monthly, quarterly, or annually) to keep your policy active. | This is your regular, predictable cost. It's the "subscription fee" for your coverage. |

Deductible | The amount you must pay out-of-pocket for a covered claim before the insurer pays anything. | A higher deductible usually means a lower premium, but you'll pay more upfront if you file a claim. |

Policy Limit | The absolute maximum amount the insurance company will pay out for a single covered loss. | If your limit is too low, you could be on the hook for thousands of dollars beyond what your policy covers. |

Co-pay | A flat fee you pay for a specific service, like a doctor's visit or prescription (common in health insurance). | This is a fixed, known cost for routine services. For example, you might have a $25 co-pay for a specialist visit. |

Coinsurance | The percentage of costs you share with your insurer after you've met your deductible. | With an 80/20 plan, the insurer covers 80% of the bill, and you're responsible for the remaining 20%. |

Getting comfortable with this handful of terms transforms a confusing legal document into a clear contract. You'll know exactly where your financial responsibility begins and ends—and that's the most powerful position to be in when choosing a policy that truly works for you.

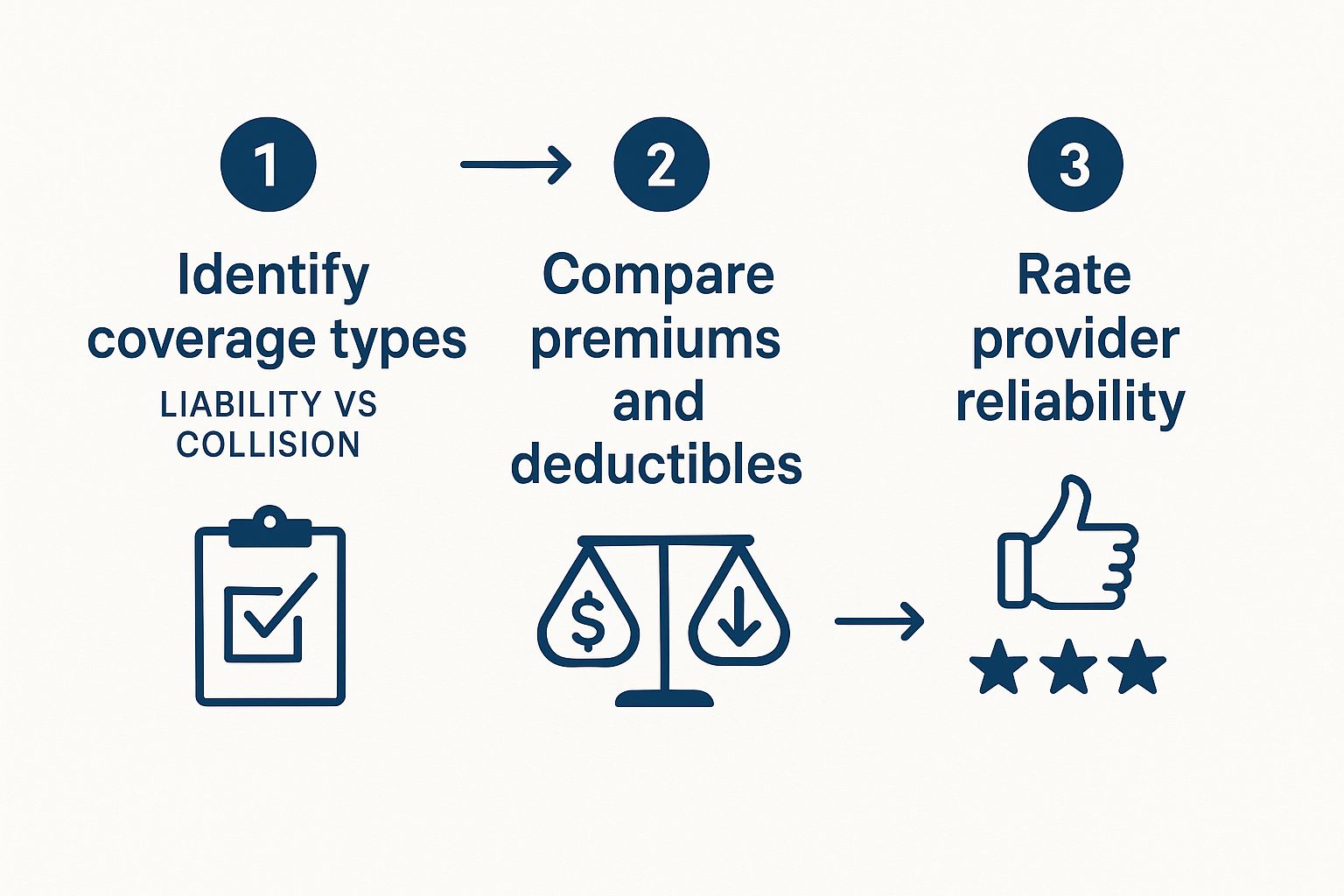

How to Compare Policies Beyond the Price Tag

It's so easy to fall into the trap of just grabbing the insurance policy with the lowest monthly premium. We've all been there. But honestly, that's one of the biggest mistakes you can make. The true value of an insurance policy isn't the number on your monthly bill; it's what happens when you actually have to use it. A cheap plan with huge coverage gaps can leave you in a serious financial hole when you're already stressed out.

To really get what you're paying for, you have to look past that initial quote. This means getting into the nitty-gritty of coverage limits, deductibles, and, most importantly, the exclusions—the fine print that tells you what your insurer won't cover.

Look Deeper Than the Premium

Let’s walk through a common scenario. Imagine you're comparing two auto insurance policies for the same car and driver.

Policy A costs $95 a month.

Policy B costs $120 a month.

At first glance, Policy A looks like a no-brainer. But let's pull back the curtain. Policy A comes with a steep $2,000 collision deductible, whereas Policy B's is a much more manageable $500. On top of that, Policy A doesn't include rental car reimbursement, a handy feature that's standard in Policy B.

Now, say you get into a fender-bender that causes $5,000 in damage. With Policy A, you'd be on the hook for that $2,000 deductible and you'd have to pay for your own rental car while yours is in the shop. With Policy B, you'd only pay $500, and your rental would be covered. That "cheaper" policy would have just cost you an extra $1,500 out of pocket from a single accident.

The best policy isn't the one with the lowest monthly payment. It's the one that offers the most robust protection for a reasonable cost, saving you from financial disaster when it matters most.

This process of looking beyond the price is crucial. You're not just buying a monthly service; you're buying peace of mind.

As you can see, comparing costs is just one piece of the puzzle. You also have to weigh what you're getting for your money and who you're trusting to be there for you.

To make this clearer, let's lay out our example policies side-by-side.

Policy A vs. Policy B Feature Comparison

Feature | Policy A (Lower Premium) | Policy B (Higher Premium) |

|---|---|---|

Monthly Premium | $95 | $120 |

Collision Deductible | $2,000 | $500 |

Rental Reimbursement | Not included | Included |

Out-of-Pocket After Accident | $2,000 + rental costs | $500 |

This kind of direct comparison shows just how misleading a low premium can be. The extra $25 a month for Policy B buys you $1,500 in savings on your deductible alone, not to mention the convenience of a covered rental.

Factors That Don't Show Up on a Quote Sheet

Some of the most critical parts of an insurance policy aren't found on the quote summary. These "intangibles" really shape your experience, especially when you need to file a claim.

Financial Stability: Your policy is only as solid as the company backing it. I always check an insurer's rating from an independent agency like A.M. Best. You want to see a rating of "A" or better, which signals they have the financial strength to pay claims without issues.

Customer Service Reputation: How does the company actually treat its customers? Before you commit, spend a few minutes reading online reviews and checking consumer reports from sources like J.D. Power. If a company is a pain to deal with for simple billing questions, imagine how they'll be during a stressful claim.

Claims Handling Efficiency: This is where the rubber meets the road. A great insurer processes claims smoothly, keeps you in the loop, and pays out fairly without making you jump through hoops. A bad claims process can drag on for months, adding a ton of stress to an already tough situation.

While you're comparing, it's also a great idea to look for expert tips on how to lower insurance premiums without giving up important coverage. Sometimes a few simple tweaks can make a much better policy fit your budget.

How Economic Shifts Can Affect Your Coverage

Your insurance policies aren't just pieces of paper; they exist in the real world, where powerful economic forces like inflation and market volatility can quietly chip away at their value. Choosing the right coverage is never a "set it and forget it" decision. It’s about understanding that your financial protection has to adapt to a constantly changing economy.

Think about it this way: the home you insured five years ago would cost a fortune more to rebuild today. If your coverage hasn't kept up with skyrocketing construction and material costs, you could be facing a massive financial hole after a total loss. This is the very real danger of being underinsured.

An economic downturn or a stretch of high inflation can hit your policies in ways that aren't immediately obvious, making it critical to stay informed and get ahead of the problem.

Inflation: The Silent Coverage Killer

Inflation is one of the biggest, yet most overlooked, threats to your insurance. As the price of everything goes up, so does the replacement cost of your most important assets, like your home and vehicles.

Let's look at your homeowner's policy. Say it was written to cover the $350,000 it cost to build your home back in 2020. Today, that same amount might only cover 80% of the rebuilding cost thanks to inflated lumber, labor, and supply prices. A major fire could leave you on the hook for the remaining 20%—a gap that could easily top $70,000.

This isn't just a homeowner's problem. The same principle applies everywhere:

Auto Insurance: With the rising costs of car parts and skilled labor, even minor repairs are getting more expensive. This puts upward pressure on premiums and means you could blow past your coverage limits after a serious accident.

Life Insurance: The death benefit on a life insurance policy is a fixed number, but the purchasing power of that money shrinks every year. A $500,000 policy that felt like a rock-solid safety net a decade ago might not be enough to cover your family's mortgage, college costs, and living expenses today.

Market Volatility and Your Insurer’s Health

Beyond just inflation, broader economic turbulence can also impact your insurance choices. When the stock market is volatile, it directly affects the investment portfolios of insurance companies. This can influence their financial strength, how they price their policies, and even their willingness to take on new risks.

Staying on top of the current financial climate is crucial. As we've seen in our recent August 2025 Economic and Financial Market Update, market trends can have a direct ripple effect on insurance policies and costs. An unstable economy can lead to more conservative underwriting from insurers, sometimes making it harder to secure the coverage you need.

The numbers back this up. Global insurance premium growth is expected to slow to just 2% in 2025, a significant drop from 5.2% in 2024, reflecting these macroeconomic challenges. In the U.S., factors like trade tariffs have directly pushed up claim costs for auto and construction insurance. You can dive deeper into these trends by checking out the full Sigma report from Swiss Re.

When the economy feels shaky, the financial strength of your insurer matters more than ever. You need to be with a company that can weather the storm and pay claims reliably, no matter what the market is doing.

Future-Proofing Your Financial Protection

So, what can you actually do to shield your coverage from these invisible economic pressures? The trick is to be proactive and build some resilience right into your insurance plan.

Here are a few smart, actionable strategies to put in place:

Add an Inflation Guard Endorsement: This is a simple but incredibly powerful rider you can add to your homeowner's policy. It automatically adjusts your dwelling coverage limit each year to keep pace with inflation, making sure your protection grows as rebuilding costs do.

Stick with Financially Strong Insurers: Before you ever sign a policy, check the insurer’s rating from an independent agency like A.M. Best. You’re looking for companies with an “A” rating or higher—it’s a clear signal that they have a proven history of financial stability.

Make Annual Reviews a Habit: Don’t just let your policies auto-renew without a second glance. Set aside 30 minutes each year to review your limits. This is especially important for life, home, and disability insurance, where you need to make sure your coverage still aligns with your current assets, income, and family needs.

If you start treating your insurance as a dynamic financial tool instead of a fixed annual bill, you'll be in a much better position for long-term security. By staying aware of economic shifts, you can make smart adjustments that keep your family and your assets properly protected, no matter what the future holds.

Making Your Final Choice and Planning for the Future

After all that digging and comparing, you’ve likely landed on a policy that feels right. This is the moment you make the decision with confidence, knowing you’ve put in the work.

Before you sign on the dotted line, it's smart to do one last, careful pass over the details. Think of it as a final pre-flight check. You’re making sure the premiums, the start date, and the claims process are all crystal clear. This simple step prevents any nasty surprises later on.

Your Final Decision Checklist

To be absolutely sure, run through these last few checkpoints. It’s a quick way to confirm the policy in front of you matches the needs you identified from the very start.

Confirm Coverage Limits and Deductibles: Do the final numbers line up with your quotes? You want to be positive that your liability limits are high enough and your deductible is an amount you could actually pay out-of-pocket without a problem.

Review Exclusions One More Time: Every policy has things it won’t cover. Give that exclusions section one last look to ensure there aren't any deal-breakers you might have missed, like a specific type of water damage being excluded from a home policy.

Understand the Claims Process: When things go wrong, who do you call? Know the number and have a basic idea of the first steps to get a claim rolling.

Check Your Personal Information: It sounds simple, but a small typo in a name or address can create major hassles down the road. Make sure every personal detail is 100% accurate.

Once you’ve ticked these boxes, you can sign with peace of mind. But your job isn’t quite done yet.

Insurance Is Not a "Set It and Forget It" Purchase

One of the biggest mistakes people make is thinking that buying insurance is a one-and-done deal. The truth is, your life doesn't stand still, and neither should your coverage. A policy that was perfect for you as a single renter will be seriously lacking once you become a homeowner with a growing family.

Think of your insurance plan as a living document. It has to be reviewed and adjusted as you move through life to make sure your protection is always relevant and strong.

Treat your insurance as an active part of your financial health. Discovering you're underinsured in the middle of a crisis is a scenario you want to avoid at all costs.

Key Milestones That Demand a Policy Review

Some life events are so significant they should act as automatic reminders to get on the phone with your insurance agent. These moments change your assets, your risks, and your responsibilities in a big way.

Plan to revisit your coverage whenever you:

Get Married or Divorced: Merging or separating households and assets means your auto, home, and life insurance policies need a complete overhaul.

Have or Adopt a Child: A new dependent changes everything. It’s time to take a hard look at your life and disability insurance to protect their future.

Buy a New Home: This is likely the biggest asset you'll own. Your policy has to accurately reflect its value and any unique risks, like living in a flood zone.

Change Jobs or Get a Raise: A major jump in your income impacts how much disability and life insurance you need. Your income replacement coverage has to keep up with your salary.

Start a Business: Most personal policies won't touch business-related liabilities. You’ll need to explore commercial insurance to protect your new venture.

By staying on top of these life changes, you make sure your financial safety net remains solid, ready to support you and your family through whatever comes next.

A Few Final Questions About Choosing Insurance

Even after doing your homework, it’s completely normal to have a few more questions pop up before you sign on the dotted line. Navigating the world of insurance can feel complex, and it’s smart to clear up any lingering uncertainties.

Think of this section as a final check-in. We’ve rounded up some of the most common questions people have at this stage to give you the confidence you need to make the right call.

How Often Should I Review My Insurance Policies?

It’s a good practice to give all your policies a quick look-over at least once a year. This annual check-up helps you catch any rate adjustments or policy tweaks from your insurer that you might have missed.

But certain moments in life demand a more immediate review. Major life events can completely change your financial situation and what you need to protect, often making your current coverage obsolete.

Be sure to get in touch with your agent right away if you:

Get married or divorced

Welcome a new child to your family

Buy a new home or vehicle

Land a big promotion or switch careers

Start running a business out of your home

Think of these milestones as clear signals that it's time to re-evaluate your protection.

Is Bundling Insurance Always the Cheapest Option?

Combining policies, like your home and auto insurance, with the same company can often land you a nice discount. Insurers like to reward loyalty, so bundling is definitely something you should look into.

However, "often" doesn't mean "always." I've seen plenty of situations where you can actually get a better overall deal by cherry-picking policies from different, specialized companies. For instance, one carrier might have unbeatable auto rates for your specific driving record, while another offers more robust homeowners coverage for your neighborhood at a better price.

The only way to know for sure is to do a little comparison shopping. Get quotes for both a bundled package and for individual policies from a few different insurers. Then, lay out the total costs, coverage limits, and deductibles side-by-side to see which path truly gives you the most value.

What’s the Difference Between a Captive and an Independent Agent?

Knowing the difference here can make your whole insurance shopping experience a lot smoother. It really comes down to how you prefer to shop.

A captive agent works exclusively for a single insurance company, think of big names like State Farm or Allstate. They know their company's products inside and out and can be a fantastic resource if you already know which insurer you want to go with.

An independent agent, on the other hand, isn't tied to any one carrier. They work with multiple insurance companies. This lets them act as your personal shopper, bringing you a variety of quotes and policy options from across the market.

If you want someone to compare a wide range of options for you, an independent agent is probably your best bet.

The Bottom Line: There’s no single “best” type of agent—it all boils down to your personal shopping style. A captive agent offers deep expertise on one brand, while an independent agent provides a broader market comparison.

I Don't Live in a Flood Zone, So I Can Skip Flood Insurance, Right?

This is one of the most common—and dangerous—misconceptions out there. Let me be clear: standard homeowners insurance policies do not cover damage from flooding. You need a separate, specific flood insurance policy to be protected.

According to FEMA, a surprising amount of flood damage happens in areas considered to have low or moderate risk. The fact is, only about 4% of homeowners nationwide actually carry flood insurance, which leaves millions of families completely exposed to financial disaster.

Even if you aren't in a high-risk zone where flood insurance is mandatory, it's a smart investment. Federal disaster assistance, if it's available at all, is often a loan you have to repay and rarely covers the full cost of rebuilding.

At America First Financial, we believe insurance should be straightforward and dependable. Our goal is to protect what matters most—your family and your future—with a process that's clear and hassle-free.

_edited.png)

Comments