How to Find Cheap Insurance: Tips to Save Money Today

- dustinjohnson5

- Aug 2

- 12 min read

Finding affordable insurance feels like a chore, but it doesn't have to be. The real secret isn't some complex financial wizardry; it's about being strategic. By combining smart comparison shopping with a hunt for hidden discounts and a few tweaks to your own risk profile, you can genuinely cut your costs. It's less about luck and more about knowing where to look and what to ask for.

Your Game Plan for Cheaper Insurance

Let's face it, no one gets excited about paying for insurance, but overpaying is even worse. The great thing is, you likely have more control over your premiums than you realize. Securing better coverage for less money is entirely possible when you have a solid plan.

This guide moves past the generic advice you've heard before. We'll start with the most powerful move you can make: effective comparison shopping. Then, we'll dive into uncovering discounts many people miss and show you how small personal adjustments can lead to significant long-term savings.

The Clear Path to Lower Premiums

The journey to cheap insurance starts with a simple shift in mindset—you're in the driver's seat. Insurers are in constant competition for your business, and modern technology makes it easier than ever to see who truly offers the best deal.

Using online comparison platforms is, without a doubt, one of the most effective ways to slash your costs. In fact, industry analysts estimate that shoppers can save 10-20% on average just from this one step. Thanks to better underwriting, insurers can reward lower-risk individuals with cheaper rates, but it's up to you to put your profile out there to get those offers.

Key Takeaway: Think of this as your inside look at how the insurance game is played. A proactive approach puts you in the best position to win—by paying less for the essential protection you need.

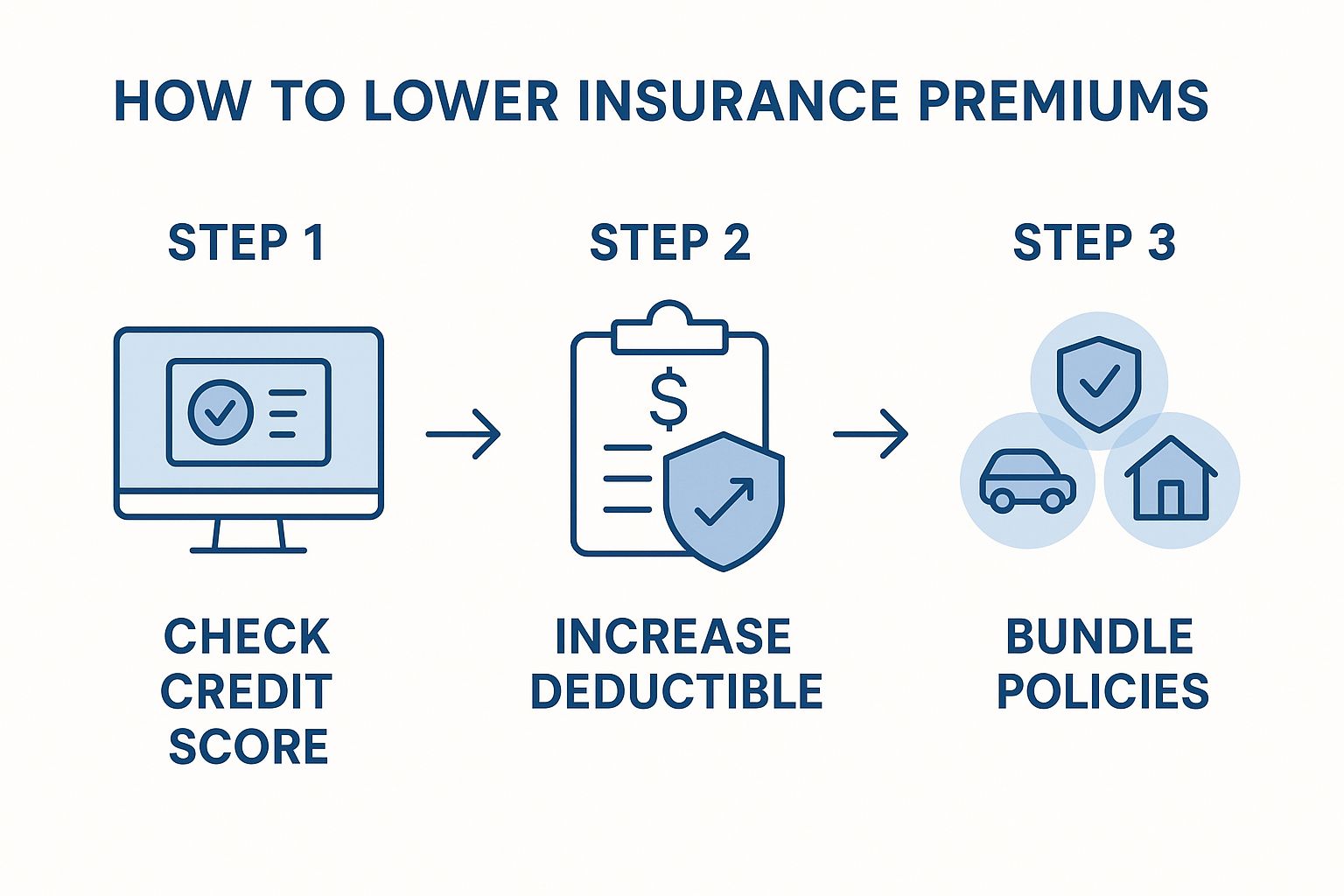

Here's a quick summary of the most effective ways to lower what you pay for insurance.

Your Quick Guide to Lower Insurance Premiums

This table breaks down the best strategies for finding cheaper insurance. I've ranked them based on how much you can potentially save and how easy they are to implement right away.

Strategy | Potential Savings | Key Action |

|---|---|---|

Shop Around Annually | High | Use comparison sites to get multiple quotes before renewing your policy. |

Bundle Your Policies | Medium to High | Combine home and auto insurance with the same provider for a multi-policy discount. |

Increase Your Deductible | Medium | Choose a higher out-of-pocket amount to lower your monthly premium. |

Ask for Discounts | Low to Medium | Inquire about discounts for a clean driving record, home security systems, or group affiliations. |

These actions, especially when combined, can make a real difference in your annual insurance costs. It’s about being an active, informed consumer rather than a passive one.

Of course, finding savings on insurance is just one piece of the puzzle. For a broader perspective on managing your money, check out these excellent tips to assist with the rising cost of living. Taking control of your finances in multiple areas creates a powerful, positive ripple effect.

Become a Pro at Insurance Comparison Shopping

Let's be honest, finding cheap insurance isn't just about grabbing the lowest quote you can find. The real goal is to find the best value—that sweet spot where you have the right amount of coverage from a reliable company, all at a price that doesn't break the bank. It's a skill, and like any skill, you get better with practice.

There are a few different paths you can take to hunt for a policy. Each one has its own pros and cons, and savvy shoppers often use a mix of all three.

Choosing Your Shopping Method

You’ve got options when it comes to gathering quotes. Let's break down the main approaches.

Online Comparison Sites: These aggregators are your go-to for speed. You can plug in your information once and get a handful of quotes back in minutes. It’s a great way to get a quick snapshot of the market. Just remember, not every insurance company plays on these sites, so you might be missing out on some hidden gems.

Independent Agents: Think of a good independent agent as your personal insurance guide. They can offer tailored advice, help you navigate the jargon, and pull quotes from multiple carriers on your behalf. Since they work with various companies, they can often find options you wouldn't discover on your own.

Going Direct to the Insurer: Sometimes, the best deals are found by going straight to the source. Visiting an insurer's website directly can unlock special discounts or policy bundles you won't see anywhere else. This takes a bit more legwork since you're doing the research one by one, but the payoff can be worth it.

For something as important as auto or home insurance, I always recommend getting at least three to five quotes. This gives you a solid benchmark and ensures you’re not overpaying. A smart strategy is to start with an online tool for a baseline, then talk to an independent agent and check out one or two direct carriers to cover all your bases.

This image breaks down some of the most effective ways to lower your premiums.

As you can see, you have more control than you might think. From bundling policies to adjusting your deductible and even minding your credit score, there are plenty of levers to pull.

Timing your search can also make a real difference. The insurance market fluctuates, and being aware of broader trends can give you an edge.

For instance, a recent report from Marsh's Global Insurance Market Index noted that global insurance rates dropped by 4%—the fourth straight quarter of decline. While U.S. rates held steady, this kind of global softening makes for a more competitive environment. When insurers compete, you win.

Find Hidden Discounts Most People Overlook

When you're trying to find cheaper insurance, never just accept the first quote you get. Insurance companies have a whole menu of discounts available, but here's the catch: they rarely advertise them all. Many of these savings go unclaimed simply because people don't know they exist, let alone think to ask for them.

It's time to dig deeper than the usual multi-policy or good-student discounts. The really significant savings are often buried in less obvious places. You might be surprised by what you qualify for, from your job to the safety features in your car and home.

Uncovering Savings at Home and Work

Your everyday life—both personal and professional—can be a goldmine for discounts. Insurers love to reward responsible people and those in low-risk professions, but they won't know unless you tell them.

Many companies offer affinity discounts if you're a member of a specific organization or work in certain fields. I've seen teachers, engineers, and first responders get better rates because they're considered statistically lower risk. It’s always worth asking your agent if your employer, alumni association, or any other professional group has a partnership deal.

Pro Tip: Don't expect your agent to be a mind reader. Be proactive. Tell them your profession, what groups you belong to, and any safety upgrades you've made. Every little detail is a potential key to unlocking a discount.

The security of your home is another big one. Insurers will often cut your premium if your home is well-protected. For example, investing in smart home security systems can lead to some really nice savings on your homeowner's policy. Make sure to point out specifics like:

Smoke detectors and carbon monoxide alarms

Deadbolt locks on every exterior door

A professionally monitored burglar alarm system

Fire extinguishers placed in high-risk areas, like the kitchen

Vehicle and Policy-Specific Discounts

Car insurance has its own unique set of potential price cuts. If your vehicle has anti-lock brakes, multiple airbags, or an anti-theft device, you need to make sure your insurer is aware of it. Driving less than the average person? That's another common one—low-mileage drivers can often get a discount.

Finally, think about how you pay. Something as simple as setting up automatic payments or paying your full premium upfront can sometimes shave a few percentage points off the total. Loyalty can pay off, too. Sticking with the same insurer for several years often earns you a "persistence" discount for being a long-term customer.

What Insurers See When They Look at You

Ever wonder what goes into your insurance quote? It’s not a number pulled out of thin air. Insurers are building a risk profile on you, and a whole lot of personal details go into that calculation. If you want to find genuinely affordable insurance, you have to first understand what they're looking at.

Think of it this way: the less risky you appear, the less you'll pay. The good news is you have more control over this than you might think.

It’s More Than Just Your Driving

We all know a clean driving record helps, but insurers dig a lot deeper. One of the biggest factors, especially for home and auto policies, is something called a credit-based insurance score. It’s not the same as the FICO score you check before a big purchase, but it’s built from similar data in your credit report. From an insurer's perspective, this score helps predict the likelihood you'll file a claim.

I've seen firsthand how improving this score can lead to real savings. Simple habits, like consistently paying your bills on time and keeping your credit card balances low, can make a significant difference when your policy comes up for renewal.

Your claims history is another big piece of the puzzle. It’s not just about one company; insurers share this information. If you've filed several claims in the past, even for minor incidents, you can get flagged as a higher risk. This can follow you from one insurer to the next, making it tough to get a good rate anywhere.

A Quick Tip from Experience: Before you file a small claim, do the math. Sometimes, it’s cheaper in the long run to pay for a minor repair out-of-pocket than to risk a premium hike for the next three to five years.

Where You Live Makes a Difference

Your address says a lot to an insurance company. They aren't just looking at your driving habits; they're looking at the risks associated with your specific neighborhood.

For instance, they'll analyze ZIP code data on things like:

Local crime statistics: Higher rates of vehicle theft or home break-ins in your area? That often means higher premiums for you.

Weather risks: If you live in a place known for hail, hurricanes, or flooding, your home insurance rates will reflect that increased risk.

Traffic and accident data: Even if you're the safest driver on the road, living in a ZIP code with a high number of accidents can bump up your auto insurance costs.

Getting a handle on these personal factors is your first, most powerful step. When you actively work to present a lower-risk profile, you’re not just shopping for cheaper insurance—you’re earning it.

Choosing the Right Coverage and Deductibles

Everyone wants to save money on insurance, but chasing the absolute lowest premium can be a trap. I've seen it happen too many times: that "cheap" policy ends up being incredibly expensive when a real claim comes along. True value isn't about the monthly payment; it's about smart protection that won't leave you high and dry.

A rock-bottom price often hides dangerously high deductibles or gaping holes in your coverage. The real trick is to find that sweet spot—a premium that fits your budget but is backed by a policy strong enough to handle a genuine crisis.

Matching Your Deductible to Your Finances

Your deductible is what you agree to pay out-of-pocket before the insurance company steps in. Bumping it up is one of the fastest ways to slash your premium, but it's a move you have to make carefully.

The big question to ask yourself is, “What's the most I could comfortably pay out tomorrow without causing a financial meltdown?”

Let's say you have a solid $2,500 emergency fund. Sticking with a $500 deductible is probably too conservative; you're paying a higher premium for protection you don't necessarily need. In that scenario, you could confidently raise your deductible to $1,000 or even $1,500, enjoy the savings on your premium, and know you can cover the cost if something happens.

The goal is to set your deductible just high enough to get a meaningful discount on your premium, but low enough that paying it wouldn't wreck your finances.

Don't Skimp on Liability Coverage

While tweaking your deductible is a savvy financial move, cutting corners on your liability coverage is a mistake you can't afford to make. This is the part of your policy that protects your assets if you're at fault in an accident that injures someone or damages their property. Medical bills and lawsuits can be financially devastating.

Here are a few areas where you should never cut corners:

Bodily Injury Liability: This covers medical bills and lost wages for others. State minimums are often shockingly low and wouldn't come close to covering the costs of a serious accident.

Property Damage Liability: This pays to repair or replace someone else's car or property. Just like with bodily injury, getting more than the minimum is a very smart move.

Uninsured/Underinsured Motorist: This is your safety net. It protects you and your family if you're hit by a driver who has no insurance or not enough to cover your bills.

Getting the right coverage means knowing your policy inside and out. For instance, understanding your auto insurance appraisal clause can be a game-changer if you disagree with your insurer's damage estimate after a crash. At the end of the day, smart insurance is about being prepared, not just being cheap.

Why Timing Your Insurance Purchase Matters

Finding a good deal on insurance isn't just about what you buy—it's very much about when. I see it all the time: people treat their policy like a subscription they can set and forget. Honestly, that’s a surefire way to leave hundreds of dollars on the table every year.

Your insurance needs aren't static; they shift and change right along with your life. These moments are your golden opportunities to re-evaluate what you're paying for and hunt down a better rate. A big life change almost always alters your risk profile in the eyes of an insurer, and that can translate directly into savings.

Seize the Moment After Big Life Changes

Think of major life milestones as built-in reminders to go insurance shopping. When your life looks different, your old policy probably doesn't fit anymore. More importantly, insurers might suddenly see you as a much safer bet.

Here are the classic moments when you should absolutely be comparing quotes:

Getting Married: Insurers love stability, and getting married often signals just that. You'll likely see a dip in your car insurance rates. This is also the perfect time to bundle policies with your spouse, which can unlock some serious multi-policy discounts.

Buying a Home: This is a huge financial step, and it's also a major insurance milestone. Bundling your new homeowners policy with your auto insurance is one of the most reliable ways to get a hefty discount from a single carrier.

Improving Your Credit Score: Did you work hard to bump up your credit score by 50 or 100 points? Don't let that effort go unrewarded. Insurers use credit-based insurance scores to predict risk, so a better score can directly lead to lower premiums.

The bottom line is this: never let your policy renew on autopilot. Use life's big moments as a trigger to actively shop around. You hold all the cards when your circumstances have improved.

It’s not just about personal changes, either. Broader market trends can also create windows of opportunity. For instance, even when the economy gets a little shaky, the insurance industry tends to stay pretty stable. This resilience can sometimes push insurers to compete more aggressively for your business with better pricing. If you're curious about the bigger picture, the International Association of Insurance Supervisors' mid-year report offers some great insights into how the market impacts what you pay.

Answering Your Top Questions About Finding Affordable Insurance

When you're on the hunt for cheap insurance, you're bound to run into a few tricky questions. Getting straight answers to these common sticking points is the key to making a smart choice instead of a costly mistake. Let’s clear up some of the things people ask most often.

How Often Should I Actually Shop for New Insurance?

I always tell people to get into the habit of shopping for new quotes at least once a year. Think of it as an annual financial checkup. It’s the perfect time to do it—right before your current policy is about to renew automatically. This simple step keeps your current provider on their toes and lets you see if a better deal has popped up elsewhere.

Beyond that yearly review, you absolutely need to shop around after any major life change. These are moments when your insurance needs and risk profile shift, often in your favor.

Moving to a new zip code

Buying a different car

Getting married or divorced

A big jump in your credit score

Any of these events can unlock significantly lower rates. Don't wait for your renewal; seize the opportunity to save as soon as it happens.

My Two Cents: Never, ever let your policy renew on autopilot. A quick annual review and shopping after a life event are your two most powerful moves for locking in cheaper insurance.

Will Filing a Small Claim Really Hurt My Rates?

In almost every case, yes. Filing a small claim will likely lead to a rate increase when your policy renews. Insurers save their best rates and claim-free discounts for customers who don't file claims. The moment you file one, no matter how small, you can lose that valuable status.

Here’s a real-world example: Let's say you have a $500 deductible and the damage to your car is $700. If you file a claim, the insurance company only pays out $200. But here's the kicker—the rate hike you'll probably see could easily cost you far more than that $200 over the next few years. You end up paying more in the long run. It's often smarter to handle minor damages yourself to protect your premium.

Is Bundling My Home and Auto Insurance Always the Cheapest Option?

Bundling is usually a great strategy for saving money. Insurers love it when you trust them with more of your business, and the multi-policy discount is typically one of the biggest they offer. For most people, this is the clearest path to a lower overall bill.

However, it's not a universal rule. I've seen situations where a company specializing in just auto insurance offers such a rock-bottom rate that it beats even a bundled price from a competitor. The only way to be certain is to do the legwork. When you're comparing, get quotes for both the bundled package and for separate policies from different carriers. It's a little extra effort, but it guarantees you're finding the absolute best deal for your situation.

At America First Financial, we're committed to providing clear answers and reliable coverage that honors your values. If you're looking for insurance that protects your family's future without all the typical industry noise, we're ready to assist. You can get a simple, no-obligation quote in minutes and discover how we can serve you. Find your plan today.

_edited.png)

Comments