How to Generate Income in Retirement A Practical Guide

- dustinjohnson5

- Jun 28, 2025

- 17 min read

When we talk about generating income in retirement, we're really talking about building a resilient and diversified financial plan. This isn't just about one thing; it's a smart mix of three core ideas: making your existing assets work harder, finding fulfilling part-time work, and creating reliable passive income streams that don't demand all your time.

Shifting Your Mindset From Saving to Earning

The old idea of retirement—a complete stop after a 40-year career—is fading fast. For most people today, a secure and genuinely enjoyable retirement means actively generating new income, not just slowly draining a finite savings account. Think of this guide as your roadmap to building a durable income strategy that goes way beyond a single pension or 401(k) withdrawal.

This shift isn't just a trend; it's a practical necessity. The numbers tell the story. A 2019 Fidelity survey revealed that median retirement readiness scores were hovering in the low 70s to low 80s out of a possible 150, which is a clear sign that many people are facing a potential income gap in their later years.

The Three Pillars of Retirement Income

The thought of generating new income in retirement can feel a little daunting, but it really boils down to three manageable strategies. You don't have to be an expert in all of them. In my experience, even blending two can create a surprisingly strong financial safety net.

Let's break them down:

Making Your Assets Work for You: This is all about turning your nest egg from a static pile of cash into a dynamic income engine. We're talking about things like dividend stocks, creating bond ladders, and setting up smart, structured withdrawal plans.

Engaging in Flexible Work: Here, you leverage a lifetime of skills for part-time consulting, freelance projects, or maybe even a small business built around a passion. This approach offers more than just money; it provides mental engagement and valuable social connection.

Creating Passive Income Streams: This means building sources of revenue that, once established, operate with minimal day-to-day effort. Think rental properties, digital products you create once and sell forever, or even monetizing a hobby you've had for years.

To give you a clearer picture, I've put together a table that summarizes these core pillars. It's a handy way to see how each approach works and who it might be best for.

Key Retirement Income Pillars at a Glance

Income Pillar | Primary Method | Best For Retirees Who... |

|---|---|---|

Asset-Based Income | Investing in dividend stocks, bonds, annuities, and structured withdrawals from retirement accounts. | ...have a significant nest egg and prefer a hands-off approach managed by financial instruments. |

Active Income | Part-time work, consulting, freelancing, or starting a small "encore" business. | ...want to stay mentally and socially engaged, have valuable skills, and prefer a predictable cash flow. |

Passive Income | Rental properties, creating digital products (eBooks, courses), or affiliate marketing. | ...are willing to put in upfront work for long-term rewards and want income that isn't tied to their time. |

This table helps illustrate that there's no single "right" way to do it. The best strategy is the one that fits your life, your assets, and your goals.

The most successful retirement income plans I've seen are never static. They are living, breathing strategies that adapt to market changes, hedge against inflation, and ultimately support the lifestyle you've worked so hard to achieve.

Building a Diversified Approach

The real goal here is to create a portfolio of income streams, not just bet everything on one source. A retiree might combine their Social Security benefits with dividends from an investment portfolio and some extra cash from a small online business they run from home. This layered approach provides incredible security; if one stream takes a hit, the others are there to pick up the slack.

For a wider view of different strategies for generating profit, you can find some fantastic ideas that are easily adapted to a retirement plan. By exploring different methods, you can tailor a strategy that aligns perfectly with your financial goals, your comfort with risk, and your personal passions. This guide will walk you through real-world examples and actionable steps for each of these pillars.

Turn Your Nest Egg Into a Reliable Paycheck

After a lifetime of saving, your nest egg is more than just a number on a statement. It's a powerful engine, fully fueled and ready to start. The real key to a confident retirement is figuring out how to flip the switch and turn that accumulated capital into a predictable, reliable income stream. This isn’t about chasing risky bets; it's about putting smart, structured strategies to work.

That feeling of uncertainty when the regular paychecks stop is completely normal. The good news? You're now in a position to create your own paycheck. With a solid plan, your portfolio can start paying you monthly or quarterly, giving you the financial footing you've worked so hard for.

You’ve spent decades building this wealth, and now it's time to put it to work for you. The tools you need are most likely already in your possession. A huge chunk of retirement income comes from individual retirement accounts (IRAs) and defined contribution (DC) plans like 401(k)s. In fact, as of early 2025, these accounts held a staggering $29 trillion in assets in the United States alone. That breaks down to $16.8 trillion in IRAs and $12.2 trillion in DC plans. This immense pool of capital can be strategically turned into annuities, systematic withdrawals, or other periodic payments. You can explore more data on these retirement assets to see just how foundational they are to American retirement security.

Setting Up a Systematic Withdrawal Plan

One of the most straightforward ways to create an income is with a systematic withdrawal plan (SWP). Think of it as putting yourself on a payroll, paid from your own investments. You simply decide on a fixed amount to pull from your investment accounts—like an IRA or a brokerage account—on a regular schedule you set, whether it's monthly or quarterly.

For instance, say you have a $750,000 portfolio and figure out you need an extra $2,500 a month to live comfortably. You could set up an SWP to automatically sell a small portion of your holdings and transfer that cash to your bank account. The trick is to land on a withdrawal rate that your portfolio can sustain for the long haul, factoring in expected investment returns and inflation.

A classic rule of thumb has been the 4% Rule, which suggests withdrawing 4% of your initial portfolio value each year, adjusting for inflation. While it’s a great starting point, this percentage isn't one-size-fits-all. It’s crucial to tailor it to your personal situation, age, and what the market is doing.

Building an Income Stream with Dividends

Another powerful strategy is to focus your portfolio on companies that pay dividends. These are small slices of a company's profits paid out directly to shareholders. By building a portfolio packed with high-quality, dividend-paying stocks, you can generate a regular income stream without ever touching your original investment.

The real beauty of this approach is its potential for growth. Many financially sound companies don't just pay dividends; they aim to increase them over time. This means your retirement income could actually grow, helping you stay ahead of the corrosive effects of inflation.

Here’s what that might look like in practice:

Dividend Aristocrats: These are S&P 500 companies with a proven track record of increasing their dividend for at least 25 consecutive years, which is a strong signal of financial health.

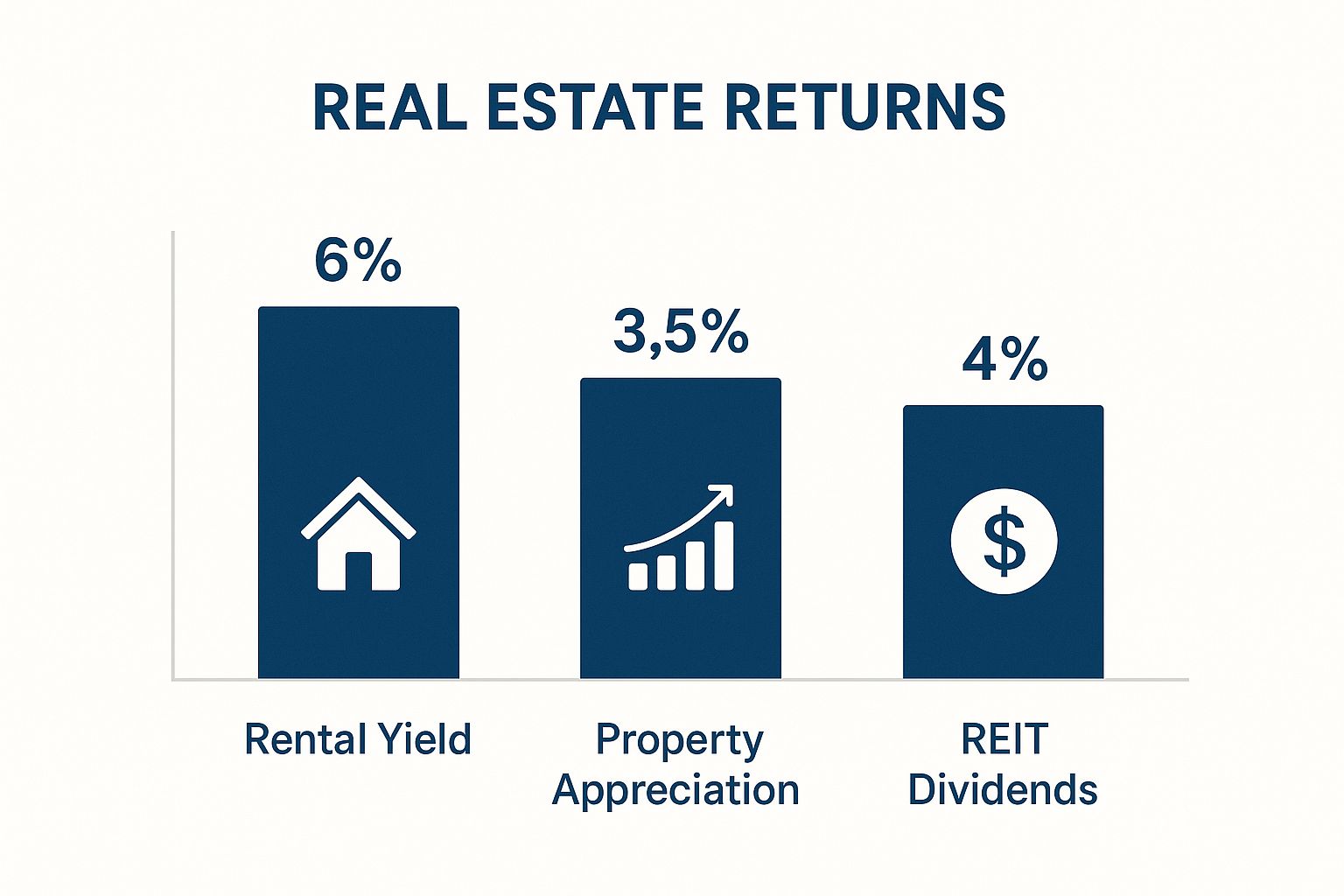

Real Estate Investment Trusts (REITs): These companies own and operate properties that generate income, from apartment buildings to shopping centers. By law, they must distribute at least 90% of their taxable income to shareholders as dividends.

Dividend-Focused ETFs: For instant diversification, you can invest in exchange-traded funds (ETFs) that hold a broad basket of hundreds of dividend-paying stocks, spreading your risk.

Creating Predictability with a Bond Ladder

If safety and predictability are at the top of your list, a bond ladder is an excellent tool. This strategy involves buying multiple bonds that mature on different, staggered dates. As each bond matures, you can either reinvest the principal into a new, longer-term bond at the "end" of the ladder or simply use the cash for your living expenses.

Let's imagine you build a five-year bond ladder. You'd buy bonds maturing in one, two, three, four, and five years. Every year, one bond matures, giving you a predictable lump sum of cash. This structure is also a smart way to manage interest rate risk. If rates go up, you can reinvest your maturing bond at that new, higher rate. If they fall, your other bonds are still locked in at the older, more favorable rates. It's a balanced approach that creates a reliable flow of income while protecting your principal—a true bedrock for any retirement plan.

Earn on Your Own Terms with Flexible Work

For a lot of us, retirement doesn't mean hanging up our hats for good. It's more about shifting gears—trading the rigid 9-to-5 grind for work that feels more fulfilling, flexible, and, of course, adds a nice cushion to our finances. Tapping into a lifetime of professional experience is often the most direct path to generating a solid income stream after leaving your primary career.

This isn't some fringe idea; it's a huge trend. Working past the traditional retirement age has become a major source of income for millions. In fact, workforce participation among people aged 65 and older is growing faster than any other group. These aren't just any jobs, either. They're often part-time roles, consulting projects, and freelance gigs that give you control over your schedule.

Turn Your Experience into a Consulting Gig

Think about it: you've spent decades solving problems, managing projects, and building expertise. That knowledge is an incredibly valuable asset, and businesses are more than willing to pay for it. Starting a consulting or freelance business lets you package that expertise and sell it on your own terms. This is an especially popular path for retired professionals from fields like marketing, finance, HR, or IT.

The first step is to pinpoint your most marketable skill. What were you always the go-to person for? Maybe you had a knack for turning around struggling projects or for simplifying complex software for your team. Whatever it was, that's your product now.

You don't have to launch with a huge marketing budget. Start by simply reaching out to your existing professional network. A quick email or LinkedIn message to former colleagues letting them know you're available for project-based work can be surprisingly effective. It's often the warmest leads that land you your first few clients.

How to Price Your Consulting Services

Figuring out what to charge is often the biggest hurdle. You don't want to sell yourself short, but you also need to be competitive. A good place to start is by looking at what you earned in your last full-time role.

Here's a simple formula to get a baseline hourly rate:

Start with your final annual salary (let's say it was $100,000).

Divide that by 2,080, which is roughly the number of work hours in a year. That gives you an hourly equivalent of about $48/hour.

Now, multiply that figure by 2 or 3 to cover things you're now responsible for, like self-employment taxes, health insurance, and other business overhead. Your target rate would fall somewhere between $96 and $144 per hour.

This is just a starting point. Your final rate should reflect your industry, how complex the work is, and the real value you're bringing to your clients. Don't be afraid to charge what decades of experience are truly worth.

Exploring the World of Flexible Work

Consulting is a fantastic option, but it's far from the only one. The modern workplace offers a whole menu of ways to earn money without being tied down to a full-time commitment. The trick is to find a role that fits the lifestyle you want to live now. If you're ready to see what's out there, learning how to find remote work from home jobs is a great way to begin your search.

Finding the right fit depends on your goals for income, flexibility, and skill set. Here’s a quick comparison of some popular options for retirees.

Comparing Flexible Work Options in Retirement

Work Option | Typical Income Range | Flexibility Level | Key Skills Needed |

|---|---|---|---|

Consulting/Freelancing | $50 - $150+ per hour | High | Deep industry expertise, project management, client relations |

Part-Time Job | $15 - $35 per hour | Medium | Varies by role; often specific technical or customer skills |

Gig Economy Work | Varies (project-based) | High | Creative skills (writing, design) or specific task skills |

Seasonal Roles | $15 - $25 per hour | Low to Medium | Customer service, retail, tax knowledge (depending on job) |

Ultimately, the best choice is the one that aligns with your personal and financial needs, allowing you to enjoy a productive and fulfilling retirement.

Before you jump in, it’s smart to understand how this new income might affect other things, like your pension or Social Security benefits. Some state retirement systems, for example, have an earnings limit, though these rules often go away once you reach age 65 or if you're working for a private company. Always do a quick check on the specific rules that apply to you. Making sure your hard work pays off without any surprise setbacks is key to making this strategy work for you.

Turn Your Passions into Passive Income

While having a flexible job in retirement is great for staying sharp and bringing in some extra cash, the real game-changer is passive income. I’m talking about money that shows up in your bank account with very little day-to-day work from you. It’s what lets you truly enjoy your freedom, whether that means traveling the world or just sipping coffee on your porch without financial stress.

Setting these streams up takes some work upfront—either your time or your money—but the payoff can completely reshape your retirement. You're essentially building assets that work for you 24/7. This strategy is the key to generating income in retirement while maximizing your personal freedom.

Earning from Real Estate

Real estate is one of the most time-tested ways to create a passive income stream. Owning a rental property can mean a steady, predictable check arriving every month. It's a classic for a reason. For those looking to get started, it's wise to explore rental income opportunities to get a clear picture of the tax side and potential profits.

Of course, let's be realistic: "passive" doesn't mean you do absolutely nothing. Being a landlord comes with responsibilities like finding good tenants, dealing with the occasional leaky faucet, and keeping the books. But you can make it much more hands-off by hiring a property management company. They typically charge 8-12% of the monthly rent, a fee most retirees I know consider a bargain for not having to deal with late-night repair calls.

A smart move I’ve seen many retirees make is to downsize their own home and turn their previous, larger house into a rental. They leverage an asset they already own—often with a paid-off mortgage—to create a brand new income stream.

A big question you'll face is whether to go with a long-term rental or a short-term vacation rental. They are very different beasts.

Factor | Long-Term Rental | Short-Term (Vacation) Rental |

|---|---|---|

Income Stream | Consistent, predictable monthly cash flow. | Potentially higher but often seasonal and far less stable. |

Management | Lower intensity with fewer tenant turnovers. | Very hands-on, with constant cleaning, bookings, and guest service. |

Wear and Tear | Generally lower, as one tenant lives there. | Higher due to frequent turnover and guests in "vacation mode." |

Initial Costs | Standard prep for a new tenant. | Higher, as you need to fully furnish it and pay for professional photos. |

While a vacation property on a site like Airbnb can be quite profitable, it's much closer to running a small business than a passive investment. For a genuinely hands-off experience that fits a relaxed retirement, a long-term rental with a good property manager is usually the way to go.

Monetize Your Lifelong Skills and Hobbies

What if you don't have the cash for a down payment? Don't worry. Your lifetime of knowledge and passion is an incredibly valuable asset. You can turn almost any skill into a source of passive income by creating something once that sells over and over again.

Think about it. If you've spent 30 years perfecting your craft—whether it's woodworking, photography, or even gardening—there are people out there who will happily pay to learn from your experience.

Here are a few practical ideas I've seen work wonders:

Write a Digital Guide or eBook: Are you the neighborhood garden guru? Put together a simple guide on "Growing Organic Tomatoes in Small Spaces." Once you create the PDF, you can sell it forever on a simple website or a platform like Gumroad.

Sell Your Creative Work: If you’re a photographer, you can license your photos on stock sites like Adobe Stock or Shutterstock. You get a royalty every time someone downloads your work. The same principle applies to musicians selling royalty-free jingles or artists selling digital prints.

Design a Simple Online Course: You don't need a fancy studio. With just a smartphone and some basic editing tools, you can record a series of lessons on a topic you know inside and out—from baking the perfect sourdough to mastering spreadsheet formulas.

The best part? The startup costs are incredibly low. Your main investment is your time and expertise. Once your digital product is created and available for sale, the income it generates is almost entirely passive, trickling in as new people find your work. It's a wonderfully accessible way to build an income stream in retirement.

Smart Money Management for Retirees

Bringing in new income is a fantastic achievement, but it's really only half the battle. The other, equally crucial half is managing that money intelligently. This is where you make sure every single dollar is working as hard as you did to earn it. The focus shifts from just making money to building real, lasting financial security.

The goal here is to create a financial framework that's both strong and adaptable. It has to handle your everyday expenses, absorb life's inevitable curveballs, and safeguard your purchasing power for the long haul. Think of it as your personal playbook for a financially sound retirement.

Crafting a Flexible Retirement Budget

The word "budget" can make people cringe, picturing rigid spreadsheets and zero fun. But a retirement budget is a different beast altogether. It's a living, breathing spending plan built for a life that’s no longer dictated by a predictable paycheck. Your income might now trickle in from several different places at various times of the month.

A great way to get a handle on this is the bucket budgeting method. It's a simple but powerful way to sort your expenses into three main categories. This makes it so much easier to see where your money's going and make adjustments on the fly.

Fixed Needs: This bucket is for your non-negotiables—the bills that have to be paid every month. We're talking about your mortgage or rent, utilities, insurance premiums, and groceries.

Variable Wants: Here's where your lifestyle spending lives. This includes things like dining out, travel, hobbies, and entertainment. This is the most flexible part of your budget and the first place you can trim back if you need to tighten your belt.

Future Savings & Goals: This bucket is your financial shock absorber and dream fund. It's for big, unexpected costs, major purchases like a new vehicle, or helping your grandkids with college someday.

When you split your spending this way, you gain incredible clarity. If a big, unplanned expense pops up, you know you can pull from your "Future Savings" bucket without putting your essential bill money at risk.

Keeping More of Your Money with Tax-Smart Strategies

Taxes can be one of the biggest silent wealth-killers in retirement. Every dollar that goes to the IRS is a dollar you can't use for yourself. That's why understanding how to generate income in retirement with an eye on tax efficiency is absolutely critical. How you take your money out matters—a lot.

A well-regarded approach is to be strategic about the order in which you tap your accounts. Many financial pros recommend the following sequence to help lower your tax bill over your lifetime:

Taxable Accounts First: Begin by drawing from standard brokerage or savings accounts. Here, your profits are typically taxed at long-term capital gains rates, which are often much friendlier than ordinary income tax rates.

Tax-Deferred Accounts Next: After that, you can start tapping into traditional IRAs and 401(k)s. Remember, withdrawals from these are taxed as ordinary income, so you'll want to manage them carefully to stay in a lower tax bracket.

Tax-Free Accounts Last: Finally, turn to your Roth IRAs and Roth 401(k)s. Qualified withdrawals from these are 100% tax-free. They are your financial superpower, so it pays to let them grow untouched for as long as possible.

This withdrawal strategy gives your most valuable accounts—especially your Roths—the maximum amount of time to grow without the drag of taxes. It’s a forward-thinking plan that can save you a significant amount of money over a 20 or 30-year retirement.

Guarding Against Retirement’s Biggest Risks

Finally, smart money management is also about playing good defense. You have to protect your income from the big three risks that can derail even the most carefully laid plans: inflation, healthcare costs, and longevity risk (the very real possibility of outliving your savings).

To counter inflation, you need to have income sources with growth potential, like stock dividends that tend to increase over time or part-time work that comes with pay raises. For healthcare, locking in a solid plan, like those offered by America First Financial, is key to making your medical expenses more predictable.

And to combat longevity risk? Your diversified income plan is your ultimate shield. By layering Social Security, investment withdrawals, and maybe some income from a side gig, you build a resilient financial structure. This ensures that if one income stream falters, your entire financial security doesn't collapse, giving you the peace of mind to truly enjoy the retirement you’ve worked so hard for.

Common Questions About Retirement Income

Once you start putting a retirement income plan into motion, a whole new set of questions inevitably bubbles up. It's one thing to have a strategy on paper, but it's another to navigate the real-world financial nuances of retirement life. Let's tackle some of the most common concerns I hear from retirees, so you can move forward with confidence.

Think of this as your go-to guide for those nagging "what if" scenarios. We'll clear up the gray areas and give you the straightforward answers you need.

How Much Can I Earn While Receiving Pension Benefits?

This is a big one, especially for folks looking to stay active with part-time work. The answer really hinges on the type of pension you have. Public pensions, in particular, often come with specific rules about working after you've officially retired.

A great example is the New York State and Local Retirement System (NYSLRS). If you're a retiree under 65 and decide to go back to work for another public employer in the state, you'll likely run into an earnings limit. Right now, that's $35,000 a year. Go over that, and your pension checks could be put on pause.

But—and this is a big but—these rules have key exceptions. That limit usually vanishes once you hit 65. It also typically doesn't apply if you start your own business or work for a private company. The most important thing you can do is get your hands on the specific guidelines for your own pension plan before you accept a job offer. Don't leave it to chance.

Will My New Income Affect Social Security?

Yes, it can, but the timing is what really matters. This only becomes a factor if you start taking your Social Security benefits before you reach what the government calls your full retirement age (FRA). Your FRA depends on when you were born, but for most people nearing retirement today, it’s between 66 and 67.

If you're working and collecting benefits before your FRA, you'll need to pay attention to the annual earnings limit. For 2024, that number is $22,320. If your income from your job exceeds that amount, Social Security will temporarily withhold $1 in benefits for every $2 you earn over the limit.

Here's the key takeaway: This isn't lost money. When you finally reach your full retirement age, the Social Security Administration will recalculate your benefit and increase your monthly payment to give you credit for the benefits that were withheld earlier.

The best part? The month you hit your FRA, that earnings limit goes away completely. You can earn as much as you like from that point on without seeing a single penny withheld from your Social Security check.

Is It Better to Pay Off My Mortgage?

Ah, the classic retirement debate. I've seen clients land firmly on both sides of this fence, and honestly, there are compelling reasons for each approach. The "right" answer comes down to your personal finances and, just as importantly, your personality.

For many people, the psychological win of being completely debt-free is priceless. Eliminating that monthly mortgage payment frees up a huge chunk of your cash flow, making your budget simpler and dramatically reducing financial stress. It’s a guaranteed financial victory—a "return" equal to whatever your mortgage interest rate was.

On the flip side, some financial experts would argue that if you have a low-interest mortgage—say, 3% or 4%—your money might work harder for you elsewhere. By keeping the mortgage, you can invest the cash you would have used to pay it off. The goal is to earn a higher return in the market (perhaps 7-8% over the long term) than the interest you're paying on the loan, effectively growing your net worth faster.

Here’s a quick breakdown of the two mindsets:

Action | The Upside (Pros) | The Downside (Cons) |

|---|---|---|

Pay Off Mortgage | Guaranteed return on your money, incredible peace of mind, and a simpler budget. | Ties up a lot of cash that could be invested, you might miss out on higher market returns. |

Keep Mortgage | Keeps cash free for investing, gives you the potential to out-earn your mortgage rate. | You’re still carrying debt, and those potential market returns are never guaranteed. |

There’s no one-size-fits-all answer here. It’s a personal call that pits the math against your emotional comfort.

Navigating the complexities of retirement income and protection is easier with a trusted partner. At America First Financial, we offer clear, affordable insurance solutions designed to safeguard your family and your assets, free from political agendas. Secure your term life, long-term care, and health care plans with a company that shares your values. Get a no-hassle quote from America First Financial in under three minutes and discover the peace of mind that comes with being prepared.

_edited.png)

Comments