How to Get Life Insurance for a Parent

- dustinjohnson5

- Oct 9, 2025

- 14 min read

Let's be honest, bringing up life insurance with your parents can feel incredibly awkward. But it's a conversation that comes from a place of love and practicality. The trick is to frame it as a collaborative plan to protect the family, not as a somber discussion about the inevitable. A gentle, respectful approach will make all the difference.

How to Talk About Life Insurance with Your Parents

Timing and sensitivity are everything here. You can't just dive into this topic out of the blue or bring it up during a stressful family dinner. The real goal is to create a comfortable space where your parents feel like they're part of a team, not like they're being put on the spot.

I've found it helps to treat this as just one piece of a much larger puzzle about their future wishes and financial health. When you position it that way, it immediately feels less intimidating and more like smart, practical planning.

Setting the Right Tone

How you approach this conversation will almost single-handedly determine its success. You have to be empathetic and patient, because for many, this is a deeply emotional subject. Ditch any language that sounds demanding or hints that they haven't planned properly.

Instead, lean on words like "we" and "us" to create a feeling of partnership. A phrase like, "I was thinking about our family's future, and I'd love for us to make a plan together," is going to land a lot better than, "You really need to get life insurance."

This isn't just about a policy; it's about showing you care. The objective is to make sure everyone feels secure and heard, not just to check a box.

Practical Conversation Starters

Sometimes, the hardest part is just getting the words out. Having a few gentle prompts ready can break the ice without making things uncomfortable. The best opening lines connect the idea of life insurance to something tangible and positive.

Here are a few ways I’ve seen work well:

Focus on legacy: "I was thinking about the grandkids and how amazing it would be to set aside a small gift for their college. I read that a small life insurance policy could be a really simple way to do that."

Frame it as your own journey: "I've been sorting out my own financial planning lately, and it got me thinking about what plans we have in place as a family. Can we find some time to talk about it?"

Tie it to practical costs: "I saw an article saying the average funeral can cost over $9,000 now. It would give me so much peace of mind to know we have a plan for that, so no one has to worry about money at a time like that."

Handling Potential Objections

Don't be surprised if you get some pushback. Your parents might feel it’s too expensive, completely unnecessary, or just a topic they'd rather avoid. The most important thing you can do is listen to their concerns without judgment. More often than not, their hesitation comes from a good place—they don't want to be a burden, or they've heard myths about how these policies work.

If they seem resistant, gently reassure them that this is about creating a safety net that brings peace of mind to everyone. Explain that many modern policies are surprisingly affordable and are specifically designed to cover final expenses, preventing the family from being hit with an unexpected financial blow. Just keep the conversation open, respectful, and centered on your shared family goals.

Calculating Your Parent's Coverage Needs

Once you’ve opened up the conversation, it’s time to get down to the brass tacks: how much coverage does your parent actually need? This isn't a guessing game. It's about taking a clear-eyed look at their financial picture to land on a number that makes sense. The aim is to secure enough to cover what’s necessary without overpaying for a policy that’s bigger than you need.

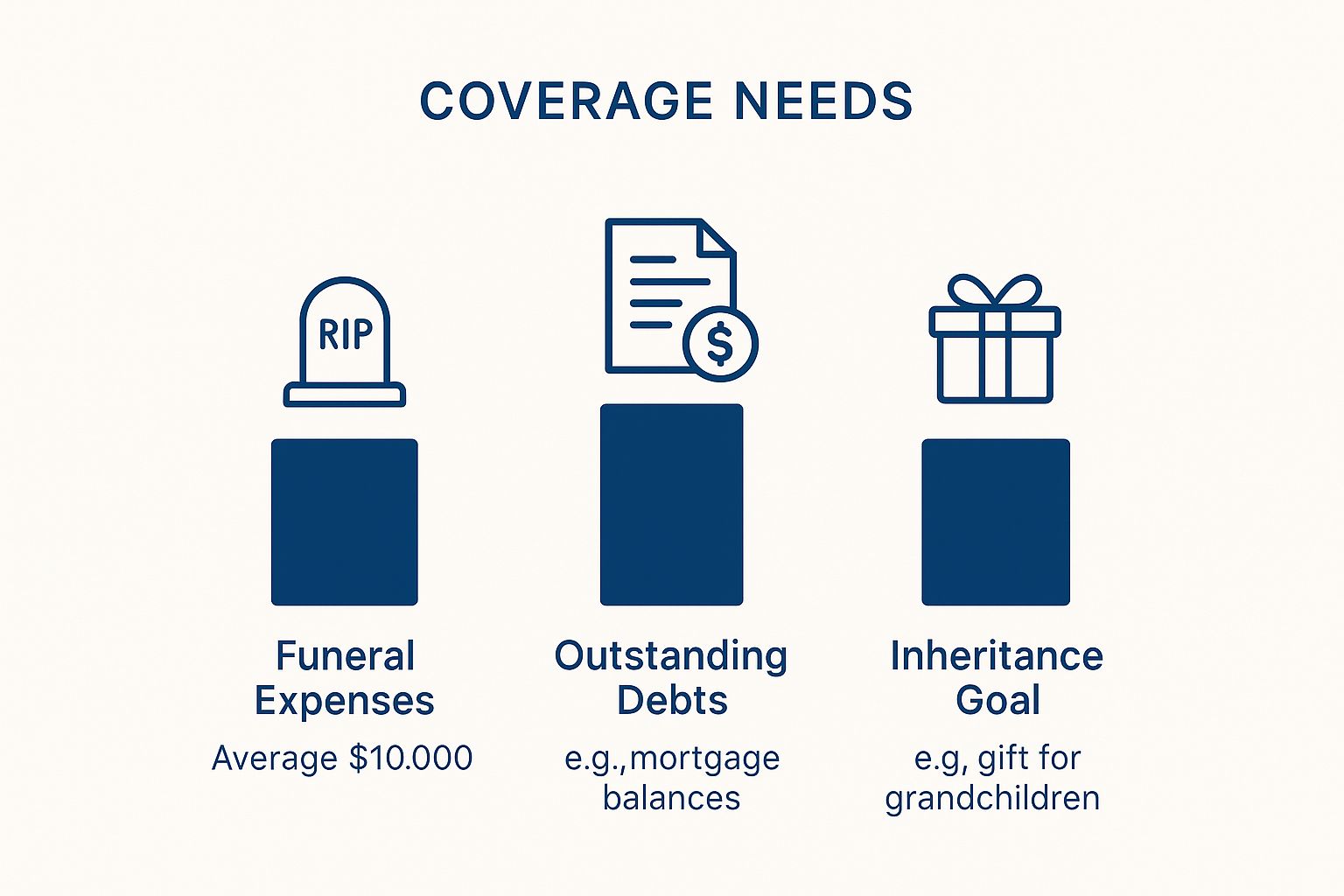

Think about the specific job you want this money to do. Is the main goal simply to handle final expenses? Or are there bigger fish to fry, like a lingering mortgage or medical bills? Maybe your parent just wants to leave a little something behind for the grandkids. Each of these goals points to a different coverage amount.

Identifying Key Financial Obligations

Your first move is to sit down with your parent and make a list of all the costs that would need to be covered. This is where the process gets real, but being thorough now prevents major headaches later.

Here are the most common things to factor in:

Funeral and Burial Costs: These add up faster than you’d think. On average, a funeral can run between $7,000 and $12,000, covering everything from the service to the burial plot and headstone.

Outstanding Medical Bills: Think about any co-pays, deductibles, or final healthcare costs that won't be covered by their primary health insurance.

Remaining Debts: Does your parent have a mortgage, a car loan, or credit card balances? A life insurance payout can keep these debts from falling on the family's shoulders.

Income Replacement: If your parent's spouse or partner depends on their pension or social security income, a policy could provide a crucial buffer to help them adjust.

This infographic breaks down how different goals influence the amount of coverage you might need.

As you can see, the final number can swing wildly depending on what you’re trying to accomplish—from a modest amount for a simple burial to a much larger sum to clear all debts.

Estimating Final Expense Coverage Needs

To get a more concrete number for final expenses, it helps to break down the individual costs. Many people are surprised by the price tags on items they hadn't considered.

Expense Category | Average Cost Range | Notes for Consideration |

|---|---|---|

Funeral Service Fee | $2,300 - $4,000 | This is the basic, non-declinable fee for the funeral home's services. |

Casket | $2,500 - $10,000+ | Cost varies dramatically based on material (metal, wood) and design. |

Embalming/Body Prep | $500 - $1,300 | Not always legally required, but often necessary for viewings. |

Burial Plot | $1,500 - $4,000 | Location is a major factor; urban cemeteries are typically more expensive. |

Headstone/Marker | $1,000 - $3,000 | Simple markers are cheaper, while elaborate monuments can cost much more. |

Burial Vault/Grave Liner | $1,000 - $2,500 | Many cemeteries require this to prevent the ground from sinking. |

Summing these up gives you a realistic baseline. A modest final expense policy of $15,000 to $25,000 is often enough to cover these core costs without financial strain on the family.

Looking Beyond Immediate Debts

Sometimes, a life insurance policy is about more than just paying off bills. It can be a powerful tool for leaving a legacy or ensuring a family's long-term financial health. The global life insurance market is valued at an estimated $3.1 trillion, a number that reflects a growing awareness of financial planning. You can read more about life insurance statistics to see how trends are shifting.

The right coverage amount is the one that meets your specific family goals. It's less about industry averages and more about what provides genuine peace of mind for your situation.

For example, if your parent’s wish is to leave $25,000 to each of their three grandchildren, that’s $75,000 you need to add to your calculation.

By adding up these concrete goals—final expenses, debts, and legacy gifts—you’ll arrive at a realistic coverage target. Having this clear number in mind is crucial before you even start exploring how to get life insurance for a parent and comparing different policies.

Finding the Right Life Insurance Policy

Okay, you've figured out how much coverage your parent needs. Now comes the part that can feel a little overwhelming: matching that number to an actual insurance policy.

You're going to hear a lot of industry jargon thrown around—"term," "whole," and "guaranteed issue" are the big ones. Don't let it intimidate you. Understanding what these terms mean is the key to making a confident decision for your parent. Each policy is designed for different ages and health situations, so what works for a healthy 65-year-old is likely the wrong choice for a 78-year-old with a few health conditions.

Let’s unpack these options so you can see which one truly fits your family.

Comparing Your Main Policy Options

Think of life insurance policies as different tools in a toolbox. Some are for short-term projects, while others are meant to last a lifetime. The best tool always depends on the job at hand.

This isn't just a niche concern; families across the country are prioritizing this kind of financial safety net. Life insurance sales hit record highs in 2021 as more people recognized the need for it. With the United States accounting for nearly 27% of global life insurance premiums, it's clear that this is a mainstream financial planning step. You can dig deeper into global insurance trends to see the bigger picture.

Here’s a rundown of the three most common policies you'll encounter for a parent:

Term Life Insurance: This is the simplest and often most affordable option. You pick a "term"—say, 10, 15, or 20 years—and if your parent passes away during that time, the policy pays out. The catch? It can be tough for older folks, especially those over 70, to qualify for.

Whole Life Insurance: As the name implies, this policy is designed to last their entire life. It never expires as long as you pay the premiums, and it even builds a small cash value over time that can be borrowed against. It’s pricier than term life, but it offers permanent coverage.

Guaranteed Issue Life Insurance: This is a game-changer for parents who might not be in perfect health. It's a type of whole life policy with one huge benefit: no medical exam and only a few health questions, if any. For people within the eligible age range (usually 50-85), approval is practically a sure thing.

Matching the Policy to Your Parent's Situation

Now, let's put this into practice. The theory is nice, but the right choice only becomes clear when you look at real-life scenarios.

Imagine your dad is 68, in good health, and still has 15 years left on his mortgage. A 15-year term life policy could be a perfect, low-cost way to ensure that debt is taken care of if something happens to him.

Key Takeaway: The goal isn't just to buy a policy; it's to solve a specific financial problem. Always align the type of insurance with the primary need, whether it's covering a temporary debt or providing for permanent final expenses.

On the other hand, think about a mom who is 75 and has a history of heart issues. She'd likely be turned down for a traditional term or whole life policy. For her, a Guaranteed Issue policy is the perfect fit. It ensures her funeral costs will be covered, providing incredible peace of mind without a stressful application process.

The table below breaks down these options to help you decide how to get life insurance for a parent.

Comparing Life Insurance Policies for Parents

A comparison of the most common life insurance options for parents to help you choose the right fit.

Policy Type | Best For | Key Features |

|---|---|---|

Term Life | Covering temporary debts (like a mortgage) for healthier, younger seniors. | Lower premiums; coverage for a set period (e.g., 10-20 years); may require a medical exam. |

Whole Life | Lifelong needs like final expenses or leaving an inheritance; building cash value. | Permanent coverage; fixed premiums; includes a savings component that grows over time. |

Guaranteed Issue | Parents with serious health conditions who can't qualify for other policies. | No medical exam; guaranteed approval for certain age groups; lower coverage amounts (typically $5k-$25k). |

Ultimately, looking at your parent’s specific age, health, and financial obligations will point you directly to the policy that makes the most sense.

Navigating the Application and Underwriting

Once you’ve zeroed in on the right policy, you’ve made it to the most hands-on part of the journey: the application. This stage is less about making big decisions and more about getting the details right. It’s where the insurance company does its homework to verify everything, a process they call underwriting.

Your main job here is to help your parent pull together all the necessary paperwork and make sure the application is filled out completely and honestly. A little prep work can make this feel less like a bureaucratic nightmare and more like checking off a to-do list.

Think of the application as the official case you're building for the policy. It’s the detailed snapshot of your parent’s life and health that the insurer will use to make their final decision.

Getting the Essential Documents Together

Before you even start the application, do yourself a favor and collect all the required information in one place. This simple step can save you from frantic last-minute searches for a doctor’s phone number or a Social Security card.

Here’s a quick checklist of what you’ll likely need:

Personal Info: Your parent’s driver’s license, Social Security number, and date of birth.

Medical History: A complete list of their doctors with contact information, any diagnosed health conditions, and all current prescriptions.

Financials: For larger policies, you might need some basic details about their income and net worth.

Existing Policies: If they already have life insurance, have the policy numbers and coverage amounts ready.

Being organized is your best friend here. It not only makes your life easier but also shows the insurer you're serious, which can help keep the process moving smoothly.

The Big Hurdle: Proving Insurable Interest

One of the most critical steps you'll face is proving insurable interest. This is a non-negotiable legal concept. It simply means you have to demonstrate that you would face a direct financial hardship if your parent passed away. It’s the insurance company’s way of making sure the policy isn’t just a gamble.

You can't just take out a life insurance policy on a stranger, and the same principle applies here. You need a legitimate financial reason. Luckily, for an adult child buying a policy for a parent, this is usually pretty straightforward.

You’re not just a concerned child; you're a financial stakeholder. Proving insurable interest connects your financial well-being to your parent's, justifying the need for a policy.

Here are a few real-world examples of how to establish insurable interest:

You will be responsible for their funeral, burial, and other final expenses.

You co-signed a mortgage or other major loan with them.

You regularly provide financial support to help with their living costs.

You would have to take time off work to settle their estate.

This isn’t just a box to check; it’s the legal foundation of the entire policy.

What to Expect When the Underwriter Takes Over

After you hit “submit” on the application, the underwriter starts their work. Their job is to dig in, verify all the information you provided, and calculate the actual risk of insuring your parent. This part of the process can take anywhere from a few days to several weeks, so a little patience goes a long way.

If the policy requires a medical exam—which many do—a paramedical professional will schedule a time to visit, usually right at your parent's home. It’s a pretty simple affair: they’ll measure height and weight, check blood pressure, and take small blood and urine samples. It’s a good idea to let your parent know this is a totally standard part of the process.

Behind the scenes, the underwriter will also be pulling your parent’s medical records and reviewing their prescription history. This is why honesty on the application is so important. Any attempt to hide a condition or a risky hobby can get the application denied or, even worse, cause the policy to be voided later on.

Once the underwriter has all the information they need, the insurance company will issue its final decision. If approved, you’ll get the official policy documents and the final premium amount.

Managing the Policy and Designating Beneficiaries

Once your parent’s life insurance policy is approved, you’re on the home stretch. But don't just file it away and forget about it. A few critical administrative steps are left to make sure the policy actually works as intended when the time comes.

Your very first task? When those official policy documents arrive, read them. Every single page. You need to personally confirm that all the details—names, birthdates, coverage amounts, premium costs—are 100% correct. A simple typo can cause massive headaches and delays for your family later on, so catching it now is a must.

Naming the Right Beneficiaries

This is easily one of the most important decisions in the entire process. The primary beneficiary is the person (or people) who gets the death benefit payout. You can name a single individual or split it by percentage among several people, like you and your siblings.

It’s just as vital to name a contingent beneficiary. Think of this as your backup plan. If the primary beneficiary has passed away or can't accept the money for some reason, the benefit goes directly to the contingent. Without one, the money could get tangled up in your parent’s estate and probate court, which is the last thing you want.

A common mistake is forgetting to name a contingent beneficiary. This simple step provides a crucial fail-safe, ensuring the money gets to your family quickly and smoothly, bypassing the often lengthy and complex probate process.

If you're dealing with more complex family situations, it's also worth understanding how guardianship impacts life insurance policies to sidestep any potential legal snags.

Keeping the Policy Active and Accessible

With your beneficiaries set, the last few tasks are all about logistics and access.

To prevent the policy from accidentally lapsing because of a missed payment, set up automatic payments. Linking it to a bank account is the easiest "set it and forget it" solution and provides real peace of mind.

Finally, figure out where to keep the policy documents. The original hard copy should go somewhere secure, like a fireproof safe or a bank's safe deposit box. Critically, at least one other trusted person—whether that’s you, another beneficiary, or the executor—needs to know exactly where it is. Having a digital or physical copy for your own records is also a smart move. This bit of planning can prevent a frantic, stressful search during an already difficult time.

Your Top Questions About Insuring a Parent, Answered

Even when you've done your homework, a few questions always pop up. It’s completely normal. The process of getting life insurance for a parent can feel a bit tangled, but knowing the answers to the common sticking points makes a world of difference.

Let's walk through some of the questions I hear most often from adult children trying to do the right thing for their families.

Can I Get a Policy on My Mom or Dad Without Them Knowing?

That’s going to be a hard no. You absolutely cannot take out a life insurance policy on a parent without their full consent and participation. This is a strict legal requirement, not just a company policy, and it's in place to prevent all sorts of fraud.

Your parent is the one who will be insured, so they have to sign the application. They'll also need to be part of the underwriting process, which could mean anything from a phone interview to a quick medical exam. Think of it this way: it’s a team effort, and you can’t get the policy across the finish line without them.

What’s This “Insurable Interest” Thing, and Why Does It Matter?

This is another one of those non-negotiable legal concepts. Insurable interest is just a formal way of saying you have to prove that you would be financially impacted if your parent passed away. It’s what stops people from taking out a million-dollar policy on their mailman or a random celebrity.

Fortunately, proving it as an adult child is usually pretty simple. You likely have an insurable interest if:

You’ll be paying for their final expenses (funerals aren't cheap).

You’ve co-signed a mortgage, car loan, or other debt together.

You help support them financially, maybe with rent or medical bills.

You’re essentially showing the insurer that the policy is there for real financial protection, not as a lottery ticket.

Insurable interest is the bridge that connects your financial situation to your parent's life. It’s the "why" that makes the policy legitimate in the eyes of the law and the insurance company.

What Happens if My Parent Gets Denied?

Getting a denial letter is a blow, for sure, but don't panic. It’s not the end of the line. The very first thing you should do is find out exactly why the application was rejected. Insurance companies are required to tell you. Was it a specific health issue? A certain medication they're on?

Once you have that information, you can regroup. Maybe you apply with a different company—some are more lenient with certain conditions, like diabetes or high blood pressure, than others.

If that doesn't work, it's time to look at policies that skip the medical exam altogether. A Guaranteed Issue policy is a fantastic backup plan. As long as your parent is within the eligible age range (usually 50 to 85), approval is practically a sure thing. The death benefits are smaller and the premiums are a bit higher, but it's a solid way to get crucial coverage when standard policies aren't an option.

At America First Financial, we believe in protecting your family with straightforward, reliable insurance solutions free from political agendas. Our goal is to provide peace of mind by securing your family's future. Get a simple, no-hassle quote online in under three minutes and take the first step toward safeguarding what matters most. Learn more and get your free quote from America First Financial.

_edited.png)

Comments