How to Maximize Retirement Savings: Top Strategies

- dustinjohnson5

- Jul 29, 2025

- 17 min read

So, how do you actually maximize your retirement savings? It's not about some secret Wall Street trick. The real answer is a lot simpler: consistently put money into tax-advantaged accounts, make sure you’re grabbing every last dollar of your employer match, and then let compound growth work its magic over time.

This disciplined approach is what truly builds a secure financial future.

Building Your Foundation for Retirement Wealth

To get serious about maximizing retirement savings, you need to start with a rock-solid base. That means opening the right accounts and feeding them consistently, even if you’re starting with small amounts. The real power isn’t in one big, heroic investment; it's in the quiet discipline of steady, long-term saving.

Think of it like building a house. You wouldn't dream of putting up walls before pouring a strong foundation. For your financial future, your 401(k) and an Individual Retirement Account (IRA) are that critical foundation.

Start With Your Employer's 401(k)

For most of us, the retirement savings journey kicks off with an employer-sponsored 401(k). If your company offers one, this is almost always the best place to begin, and for two very good reasons:

It's Automatic: The contributions come right out of your paycheck before you even see the money. This simple "pay yourself first" strategy is hands-down the most effective way to guarantee you’re saving consistently.

The Employer Match: This is the closest thing to free money you will ever find. If your employer offers to match your contributions—for example, 100% of the first 3% you save—you are making an immediate 100% return on that money.

My two cents: Failing to contribute enough to get the full employer match is like turning down a pay raise. It should be your absolute, non-negotiable minimum savings goal.

Supplement With an Individual Retirement Account (IRA)

Once you're contributing enough to your 401(k) to lock in the full employer match, your next best move is often opening an IRA. Why? Because an IRA typically gives you a much wider universe of investment choices than the limited menu in most 401(k) plans. This gives you far more control over building a portfolio that’s right for you.

You'll generally choose between two main types:

Traditional IRA: Contributions might be tax-deductible today, which lowers your current tax bill. You'll then pay income tax on your withdrawals when you retire.

Roth IRA: You contribute with after-tax dollars (so no upfront deduction), but all your qualified withdrawals in retirement are 100% tax-free. That’s a huge advantage, especially if you expect to be in a higher tax bracket later in life.

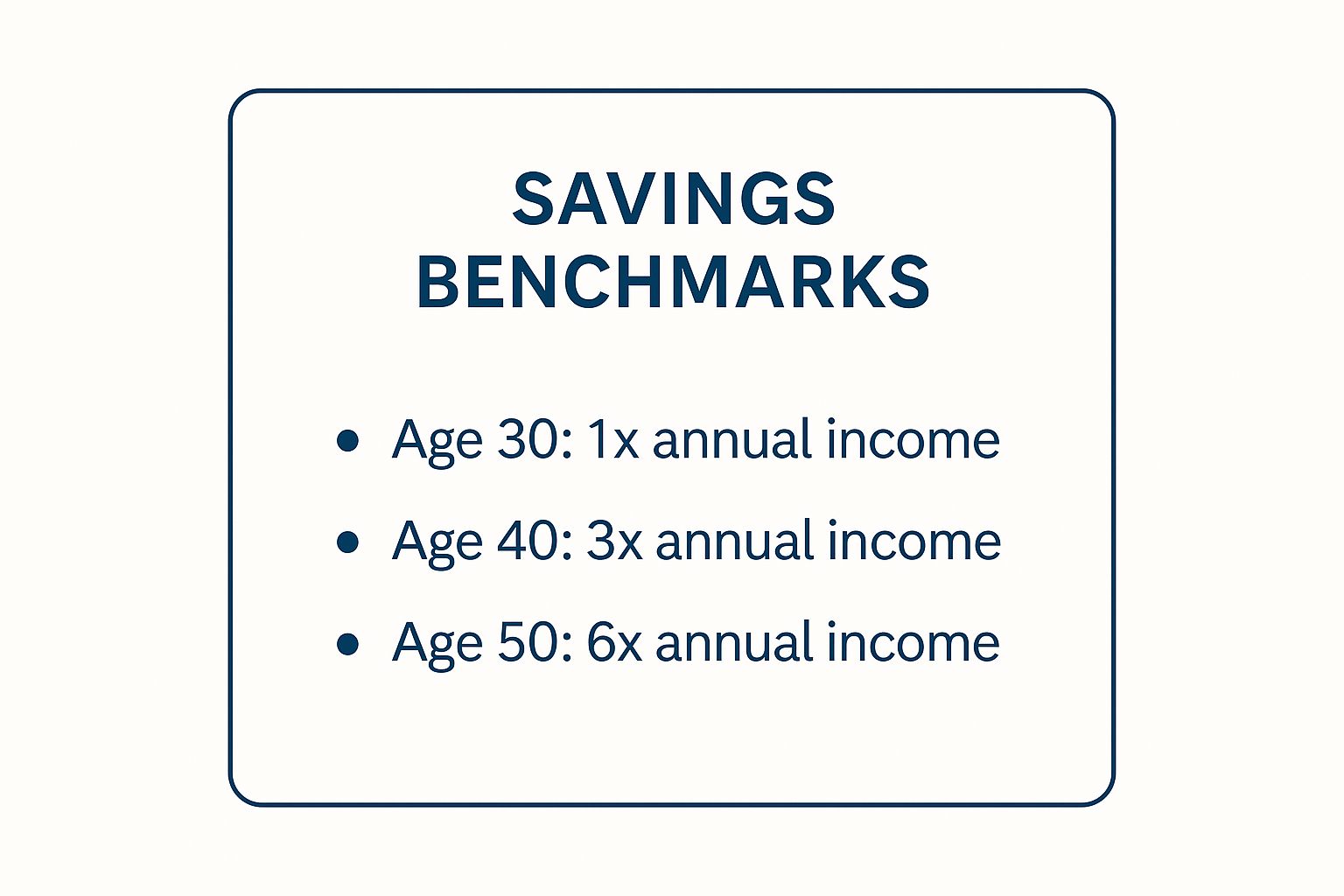

The infographic below gives you a visual on some savings benchmarks to aim for as you grow your nest egg.

These numbers aren't meant to be intimidating; they're meant to show how consistent saving allows your wealth to multiply over the decades. The real lesson here is the incredible power of starting early and just sticking with it.

Key Retirement Savings Accounts at a Glance

Choosing the right account can feel overwhelming, but it boils down to understanding your goals and tax situation. This table breaks down the most common tax-advantaged accounts to help you see which one might be the best fit.

Account Type | Contribution Type | Primary Benefit | Best For |

|---|---|---|---|

401(k) | Pre-tax or Roth | Employer match & automated savings | Employees whose company offers a plan, especially with a match. |

Traditional IRA | Pre-tax | Potential for a current-year tax deduction. | Individuals who want a tax break now or expect to be in a lower tax bracket in retirement. |

Roth IRA | Post-tax | Tax-free growth and tax-free withdrawals in retirement. | Savers who anticipate being in a higher tax bracket in retirement or want tax diversification. |

HSA | Pre-tax | Triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses. | Anyone with a high-deductible health plan looking for a powerful, flexible retirement and healthcare savings tool. |

Each account offers unique advantages. Many savvy savers use a combination of these accounts to optimize their tax strategy and maximize their long-term growth potential.

The proof of this strategy is in the numbers. While the average 401(k) balance hovers around $134,128, that figure jumps to nearly $239,900 for savers in their 60s, a testament to the power of long-term, tax-advantaged growth. It’s also a powerful reminder for everyone to save consistently, as current data reveals a significant gap where women hold about 30% less in retirement savings than men. To see more on these trends, you can explore some essential retirement statistics for 2025.

Supercharge Your Savings With Advanced Contribution Methods

Once you've got the basics down and are contributing regularly, it's time to get serious. We can now explore some powerful techniques that will truly accelerate your savings. Think of these as financial power-ups, especially useful if you feel like you're playing catch-up or have a high income you want to put to work.

Moving beyond standard contributions is where the real magic happens in maximizing your retirement accounts. This is how you unlock the next level of your financial plan.

Use Catch-Up Contributions After Age 50

Life happens. Maybe kids, a mortgage, or a career change put a temporary dent in your savings plan. The good news is the tax code throws you a lifeline once you hit 50. They’re called catch-up contributions, and they let you put away more than the standard annual limits.

For 2025, if you're 50 or older, you can sock away an extra $7,500 into your 401(k) or 403(b). That’s on top of the usual $23,500 limit, bringing your total potential contribution to a hefty $31,000 for the year. This isn't just pocket change; making these extra contributions consistently in the decade before you retire can easily add hundreds of thousands of dollars to your nest egg.

The same goes for IRAs, though on a smaller scale. You can add an extra $1,000 on top of the standard $7,000 limit, for a total of $8,000.

My Take: Don't think of catch-up contributions as just for people who are "behind." I see them as a fantastic chance to turbocharge your savings during what are often your peak earning years. You're simply taking full advantage of the tax-deferred growth while you can.

To really get your retirement fund growing, you might also have other options available. For those in certain countries, a great way to accelerate your savings is by unlocking your salary sacrifice benefits.

The Mega Backdoor Roth For High Earners

So, you're already maxing out your 401(k) and your IRA. What's next? If you're a high-income earner and still want to save more in a tax-advantaged account, the Mega Backdoor Roth strategy can be a complete game-changer. It sounds intimidating, but it’s a pretty straightforward process if your plan allows for it.

Here’s the deal: Your 401(k) plan needs to have two specific features:

It must permit after-tax contributions (which are different from Roth 401(k) contributions).

It must allow for in-service withdrawals or conversions of that after-tax money.

If you have both, you can contribute money to your 401(k) after you’ve already hit your standard contribution limits. This cash lands in a separate after-tax bucket. From there, you immediately roll those funds over into a Roth IRA or Roth 401(k). The result? You’ve just shuttled a large chunk of money into an account where it can grow and eventually be withdrawn 100% tax-free in retirement.

Retirement Power Plays For The Self-Employed

If you work for yourself, whether as a freelancer or a small business owner, you have access to some of the best retirement savings vehicles out there. You're not stuck with the typical employee limits and can often save far, far more.

Let’s look at a quick scenario to see what I mean.

Scenario: A Freelance Designer's Advantage

Meet Sarah, a freelance graphic designer earning $120,000 a year in net income.

If she worked for a large company, she'd be capped at her $23,500 employee contribution (plus a $7,500 catch-up if she's over 50).

But with a Solo 401(k), Sarah gets to contribute as both the "employee" and the "employer."

This dual-role contribution is huge. She can put in her full employee share and then, as the employer, contribute up to 20% of her net self-employment income on top of that. This lets her blow past the limits that apply to traditionally employed people with the exact same income.

Here are a couple of other great options for the self-employed:

SEP IRA: This plan is simple to set up and lets you contribute up to 25% of your net adjusted self-employment income.

SIMPLE IRA: A solid choice for small businesses with a few employees. It allows for both employee and employer contributions, though the limits are lower than a Solo 401(k) or SEP IRA.

These strategies definitely require more hands-on planning, but the payoff can be incredible, dramatically speeding up your journey to a secure retirement.

Aligning Your Investments for Growth and Security

Getting money flowing into your retirement accounts is a huge first step, but it’s only half the battle. If you really want to maximize those savings, you need to make that money work hard for you. This means building an investment portfolio that's carefully aligned with your age, your tolerance for risk, and your long-term goals.

A cornerstone of building real retirement wealth is using proven long-term investing strategies that give your assets room to compound over time. This isn’t about chasing hot stocks or trying to time the market. It’s about building a durable, growth-oriented portfolio that can weather the inevitable ups and downs and deliver results over decades.

Matching Your Portfolio to Your Life Stage

Your investment strategy shouldn't be a "set it and forget it" affair; it needs to evolve right along with you. The asset mix that’s perfect for a 30-year-old is almost certainly too aggressive for someone on the cusp of retirement at 60. This concept is what we call your investment horizon—simply, how much time you have until you need to start drawing on the money.

A longer horizon means you can afford to take on more risk in pursuit of higher returns, knowing you have plenty of time to recover from market downturns. As you get closer to retirement, your focus naturally shifts from aggressive growth toward capital preservation.

Think about these two very different scenarios:

The Aggressive Accumulator (Age 30): A software engineer in her early 30s has a 30+ year runway until retirement. She can build a portfolio heavily weighted toward stocks (equities), maybe even 80% or 90%, to capture maximum long-term growth. Sure, this portfolio will be more volatile, but history has shown that equities provide superior returns over long periods.

The Prudent Pre-Retiree (Age 55): A manager nearing retirement has a much shorter horizon. His primary goal is protecting the nest egg he’s worked so hard to build. He might shift his portfolio to a more conservative mix, like 50% stocks and 50% bonds, to dial down the volatility and generate more stable income.

This adjustment doesn’t happen overnight. It’s a gradual process of dialing down risk as your retirement date gets closer.

Reading the Market Without Overreacting

The financial markets are always sending signals, from interest rate changes to economic growth reports. Learning to interpret these signals—without hitting the panic button—is a crucial skill for any investor. In fact, recent market dynamics offer a powerful lesson in asset allocation.

After a period of high interest rates, the US Federal Reserve began cutting rates in 2025, which happened to coincide with a period of strong stock market performance. US equities returned a stunning 28.1% and global equities delivered 20.3% through late 2024, showing the immense growth potential in stocks during favorable conditions. Even conservative fixed-income investments gave a 2.9% return, proving their value in a balanced strategy.

A Key Takeaway: Market volatility is just a normal part of investing. The single biggest mistake I see investors make is panicking during a downturn and selling low. A well-constructed plan helps you stay disciplined when your emotions are telling you to run for the hills.

The Critical Importance of Rebalancing

Once you’ve set your ideal asset allocation, your job isn't done. Over time, the natural movements of the market will cause your portfolio to drift away from its target.

For instance, if stocks have a fantastic year, they might grow to represent 70% of your portfolio instead of your intended 60%. While that might sound like a good problem to have, it means you're now taking on more risk than you originally planned for.

This is where rebalancing comes in. It’s the simple, disciplined act of periodically buying or selling assets to get your portfolio back to its original target allocation. This process forces you to follow the cardinal rule of investing: buy low and sell high.

You can approach rebalancing in a couple of ways:

Calendar-Based: Simply review and adjust your portfolio on a set schedule, like every quarter or once a year.

Threshold-Based: Rebalance only when an asset class drifts by a certain percentage (say, 5%) from its target.

By regularly rebalancing, you ensure your portfolio remains aligned with your risk tolerance and keeps you on a steady path toward your retirement goals.

Think Globally to Diversify and Protect Your Nest Egg

Keeping your retirement strategy locked within one country's borders is like fishing in a small pond—sure, you might get a bite, but you're missing out on a whole ocean of opportunity. To build a truly resilient portfolio, you need to think globally. This isn't just about finding growth; it's a powerful defense against a downturn in your home market.

Understanding worldwide financial trends used to be the domain of Wall Street pros, but it's now an essential skill for anyone saving for retirement. A huge global shift has been the move away from guaranteed pensions, or defined benefit (DB) plans, toward individual accounts like 401(k)s, known as defined contribution (DC) plans. This puts the responsibility for building a nest egg squarely on our shoulders.

What We Can Learn from the World's Biggest Investors

So, where can we turn for inspiration? A fantastic starting point is to watch what the world's largest pension funds are doing. These funds are at the forefront of sophisticated investment strategies, and their playbook offers powerful lessons for the rest of us. They’re increasingly looking beyond plain-vanilla stocks and bonds to secure long-term returns.

These financial giants have seriously broadened their investment horizons. To shield their massive portfolios from volatility and hunt for better returns, many are shifting significant capital into alternative assets. This includes investments you won't typically see in a standard 401(k) menu:

Private Equity: Investing directly in private companies before they ever hit the stock market.

Infrastructure: Funding essential projects like airports, toll roads, and renewable energy plants.

Private Real Estate: Owning large-scale commercial buildings or apartment complexes.

Hedge Funds: Employing complex strategies designed to make money in any market condition.

The strategy here is simple: diversification. By spreading money across different asset classes and geographic regions, they ensure that a downturn in one area doesn't torpedo their entire portfolio.

Putting Global Diversification into Action

You don't need a billion-dollar fund to apply this logic to your own savings. The lesson is to avoid putting all your financial eggs in one country's basket. If the U.S. market hits a rough patch, having exposure to European or Asian markets can help stabilize your portfolio and protect your hard-earned capital.

Global pension funds are a colossal force, with total assets projected to hit US$58.5 trillion in 2025 across major markets. That figure represents about 68% of the combined GDP of those economies, highlighting their critical role in retirement security. By studying their pivot toward alternative assets and global diversification, you can adopt similar, resilience-building strategies for your own portfolio. You can discover more about these global pension trends and see how they might inform your own plan.

So, how do you actually do this in your 401(k) or IRA? It's much easier than you might think. Most retirement plans offer mutual funds and ETFs (Exchange-Traded Funds) that make global investing incredibly straightforward.

When you review your investment options, keep an eye out for these types of funds:

International Stock Funds: These funds invest in companies based outside your home country, giving you direct exposure to foreign economies.

Global Stock Funds: A broader approach, these invest in companies worldwide, including in your home country.

Emerging Markets Funds: A higher-risk, higher-potential-reward play that focuses on fast-growing economies in places like Asia, Latin America, and Africa.

By strategically dedicating a portion of your portfolio—somewhere between 15% and 30% is a common recommendation—to international funds, you create a far more robust retirement account. It’s one of the most effective moves you can make to protect your nest egg from regional shocks while positioning it for growth, no matter where in the world it’s happening.

Avoiding Common Mistakes That Derail Retirement Plans

Knowing which financial traps to sidestep is just as crucial as picking the right investments. I’ve seen it time and time again: even the most carefully built retirement plan can be completely undone by a few common, yet incredibly costly, mistakes.

Think of this as your field guide to navigating the most frequent retirement blunders. By understanding these pitfalls ahead of time, you can protect your hard-earned savings and keep them on track for the future you actually want.

The Catastrophic Cost of Cashing Out a 401(k)

When you switch jobs, it's so tempting to look at that old 401(k) and see a sudden windfall. That lump sum might feel like the perfect answer for wiping out credit card debt, funding a kitchen remodel, or finally taking that dream vacation.

But cashing it out is one of the most destructive moves you can make for your financial future. Let's break down what that really looks like.

Imagine you've built up a $50,000 balance in your old 401(k). If you’re under age 59½ and decide to cash it out, you’re hit with an immediate 10% early withdrawal penalty. That’s $5,000 gone, right off the top. But it doesn't stop there. The entire distribution is treated as taxable income. If you're in a 22% federal tax bracket, that’s another $11,000 lost to the IRS.

The Reality Check: Your $50,000 nest egg instantly shrinks to just $34,000 after taxes and penalties—and that's before even considering state income tax. You've not only torched a huge chunk of your savings, but you've also sacrificed all the future compound growth that money could have generated.

The smart move, always, is to do a rollover. You can move the funds directly into an IRA or your new employer's 401(k). This keeps your money invested, growing, and completely intact without triggering taxes or penalties.

Playing It Too Safe, Too Early

While it’s wise to dial down the risk as you get closer to retirement, being overly cautious in your 20s, 30s, and even 40s can be just as damaging. Your greatest asset when you're young isn't money—it's time. You have decades to recover from market downturns.

Sticking to "safe" investments like cash or money market funds practically guarantees you're losing purchasing power to inflation year after year. More importantly, you miss out on the incredible engine of compound growth that comes from owning stocks.

Let’s look at a real-world example.

Scenario: A 30-year-old invests $10,000.

Too-Safe Portfolio (2% average annual return): After 35 years, it grows to about $20,000.

Growth-Oriented Portfolio (7% average annual return): After 35 years, that same $10,000 grows to over $107,000.

The difference is just staggering. By trying to avoid short-term market swings, you risk sacrificing a fortune in potential long-term growth.

Ignoring the Slow Drain of High Fees

Fees are the silent killers of wealth. They look tiny on paper—a 1% or 2% expense ratio doesn't sound like much—but over decades, they can devour a shocking portion of your returns. Many actively managed mutual funds, which are common in 401(k) plans, come with high fees that rarely justify their performance.

Consider two investors who both start with $100,000 and earn an average of 7% annually over 30 years.

Investor | Annual Fee | Final Balance | Fees Paid |

|---|---|---|---|

Low-Cost Investor | 0.1% | $729,573 | $12,653 |

High-Fee Investor | 1.5% | $495,302 | $158,168 |

The high-fee investor lost over $234,000 in potential wealth simply because of expenses. The solution? Actively seek out low-cost index funds or ETFs. Dig into your account statements, find the expense ratio for every fund you own, and don't hesitate to switch out of the pricey ones.

Beyond simply saving, it's crucial to understand how to protect your nest egg from unforeseen challenges. For instance, a common concern is what happens if you run into tax trouble. Learning about Can the IRS Take Your 401k? Understanding Your Rights and Protections can provide peace of mind and help you better safeguard your assets.

Your Action Plan for a Confident Retirement

Alright, we've covered a lot of ground. Now it's time to bring it all home and turn these ideas into a clear path forward. Think of this less as a summary and more as your personal roadmap to building a future you can be excited about.

The truth is, reaching financial independence isn’t about some secret formula. It’s about building powerful, consistent habits that you repeat over time.

Doubling Down on the Fundamentals

Your long-term success really comes down to mastering the basics. The goal is to make these core strategies an automatic part of your financial life—things you do without even thinking about them.

Here's what should be at the top of your list:

Max Out When You Can: Funnel as much as you possibly can into your tax-advantaged accounts like a 401(k) or an IRA. Every dollar you contribute today is an employee working for your future self.

Never Walk Away From Free Money: Capturing your full employer match is non-negotiable. It’s the highest, risk-free return on your money you'll ever find. Seriously, don't leave it on the table.

Get Your Accounts Right: The Traditional vs. Roth debate is huge. Make sure your choice aligns with where you think your tax bracket is headed. Keeping more of what you earn is the name of the game.

Spread Your Bets Wisely: A well-balanced portfolio isn't just about stocks and bonds. It's about smart diversification that includes both domestic and international assets. This shields you from market swings and lets you tap into growth wherever it happens.

Remember, building a solid retirement fund is a marathon, not a sprint. The most impactful thing you can do is start today, even with small steps. It's the consistency that builds incredible momentum over the long haul.

Your Immediate Next Steps

Reading is a great start, but action is what actually builds wealth. So, what can you do this week to get the ball rolling?

Do a quick audit. Log into your retirement account. How does your contribution rate look? What are you actually invested in? A five-minute review can be incredibly revealing.

Pick one thing—just one. Don't try to do everything at once. Just implement one new strategy from this guide. Maybe it's bumping your 401(k) contribution by 1% or researching a low-cost international index fund.

Put it on the calendar. Schedule a recurring 15-minute check-in with yourself every three months. This little appointment is your chance to track progress and make sure you're still on the right path.

Your Questions Answered

Once you start putting these retirement strategies into practice, you'll inevitably run into more specific questions. That's a good thing—it means you're getting serious. Here are some of the most common things people ask when they start digging into the details of their financial future.

How Much Do I Really Need to Save for Retirement?

You'll often hear the vague advice, "save as much as you can." While true, that's not very helpful. A much better starting point is the 15% rule.

The idea is to aim to save 15% of your pre-tax income every single year. This isn't just your money, either—it includes any employer match you get. For example, if you make $80,000 a year, your 15% target is $12,000. If your company generously matches your contributions up to 4% of your salary ($3,200), you only need to personally contribute the remaining $8,800, or 11% of your pay, to hit that goal.

My two cents: Think of the 15% rule as a solid baseline, not a hard-and-fast law. If you're starting late or dream of a lavish retirement, you might need to push that number to 20% or even higher. What matters most is getting started with a clear target and bumping it up whenever you can.

Should I Go With a Traditional or a Roth Account?

This is one of the biggest forks in the road for retirement savers, and the "right" answer comes down to one simple question: do you think your tax rate will be higher now or in retirement?

Think Traditional if: You expect to be in a lower tax bracket when you retire. This is often the case for people in their peak earning years who anticipate their income will drop once they stop working. You get a nice tax deduction today when your income—and tax rate—are at their highest.

Think Roth if: You expect to be in a higher tax bracket later on. This is a common scenario for young professionals just starting their careers. By choosing a Roth, you pay the taxes now while your income is relatively low and then get to enjoy completely tax-free withdrawals in retirement when your earnings would have put you in a much higher bracket.

Of course, you don't have to pick just one. Many savvy savers contribute to both, giving themselves tax-diversified income streams in retirement.

What Should I Do With My Old 401(k) From a Previous Job?

When you switch jobs, it's easy to just leave your old 401(k) behind. Out of sight, out of mind, right? This is one of the most common—and costly—mistakes I see people make. You have far better options that give you more control, better investment choices, and potentially lower fees.

The best move for most people is a rollover. Here’s how your options stack up:

Your Move | The Good | The Bad |

|---|---|---|

Roll it into an IRA | You get a massive universe of investment choices, can find lower-cost funds, and consolidate multiple old accounts in one place. | You're the one in the driver's seat, which means you're responsible for managing it. |

Roll it into your new 401(k) | It's simple and keeps all your retirement funds under one roof with your current employer. You might also be able to take out a loan. | Your investment options are stuck within your new plan's menu, which might be expensive or underwhelming. |

Leave it where it is | This is the path of least resistance. It requires zero effort on your part right now. | You could forget about it entirely. You're also stuck with that old plan's fees and limited investment menu. |

Cash it out | You get cash in your pocket. That's about it. | This is almost always a terrible financial decision. You'll get hit with a 10% early withdrawal penalty on top of paying ordinary income taxes, effectively wiping out a huge chunk of your hard-earned savings. |

For the vast majority of people I've worked with, rolling an old 401(k) into a low-cost IRA provides the perfect mix of control, flexibility, and long-term growth.

Navigating the world of insurance and retirement planning can be complex, but you don't have to do it alone. America First Financial offers straightforward insurance products, including annuities and long-term care plans, designed to secure your financial future without the political noise. Get a free, no-hassle quote today to see how we can help protect you and your family.

_edited.png)

Comments