How to Protect Inheritance from Taxes: The Ultimate Guide

- dustinjohnson5

- Oct 10

- 17 min read

Protecting your family’s inheritance from taxes isn't something that just happens. It requires a forward-thinking plan that usually brings together a mix of trusts, smart gifting strategies, and specific types of insurance policies.

Navigating The Complex World Of Inheritance Taxes

Before you can build a fortress around your family's legacy, you have to understand the battlefield. The landscape of inheritance and estate taxes is littered with confusing terms and overlapping laws. Getting a firm grip on these core concepts is the first real step toward protecting what you've spent a lifetime building.

Right off the bat, most people mix up "estate tax" and "inheritance tax," but they are worlds apart. The distinction is critical because it dictates who gets the tax bill.

Estate Tax: Think of this as an "exit tax" on the deceased person's net worth. It's calculated on the total value of the assets before anyone gets a dime. The estate itself pays this tax. The IRS levies a federal estate tax, and a handful of states do, too.

Inheritance Tax: This is a tax paid by the person receiving the money or property. The tax rate often hinges on the heir's relationship to the person who passed away. Spouses and children usually get a break with lower rates or full exemptions, while a cousin or a friend might get hit with a much higher tax. As it stands, only six states have this type of tax.

Knowing the difference here is key. A strategy designed to handle the federal estate tax might do absolutely nothing for a state inheritance tax your nephew has to pay.

Understanding Key Thresholds and Exemptions

The magic number in federal estate planning is the lifetime exemption amount. This is how much you can give away—either during your life or at your death—before federal estate and gift taxes kick in. For 2024, that number is a whopping $13.61 million per person.

That high number means the vast majority of American families won't owe a penny in federal estate tax. But here's the catch: that exemption is set to be sliced in half at the end of 2025 unless Congress steps in. This "sunset" provision makes planning a smart move even for families whose net worth is well below the current limit.

While the federal tax grabs the headlines, it's the state taxes that often blindside families. States with their own estate or inheritance taxes have much, much lower exemption amounts. Some states start taxing estates at just $1 million. It's entirely possible for a family to owe a hefty state tax bill while being completely in the clear on the federal level.

Here’s a quick look at how these taxes differ.

Federal Vs State Inheritance Taxes At A Glance

Tax Type | Who Levies The Tax | Who Pays The Tax | Typical Exemption Levels |

|---|---|---|---|

Federal Estate Tax | U.S. Federal Government | The deceased's estate | Very high (e.g., $13.61 million in 2024) |

State Estate Tax | Certain state governments | The deceased's estate | Much lower (often $1 million to $6 million) |

State Inheritance Tax | A few state governments | The heir/beneficiary | Varies by state and relationship to the deceased |

This table shows why you can't just have a "one-size-fits-all" plan; you have to know the specific rules for your state.

The Building Blocks Of Your Taxable Estate

It’s crucial to know what the government actually counts as part of your estate. It's far more than just the money in your checking account. Generally, your taxable estate includes:

Real estate (your home, rental properties, land)

Investment and retirement accounts like 401(k)s and IRAs

Life insurance payouts (this is a big one that people forget, especially if you personally own the policy)

Business interests

Valuable personal property—think cars, art, and jewelry

A common mistake I see is people underestimating their estate's total value. They'll do the math on their home and investments but forget about a multi-million dollar life insurance policy. That payout alone can push an otherwise modest estate over a state tax threshold, creating a surprise tax liability for the people you wanted to protect.

Here in the United States, the federal estate tax tops out at a punishing 40% for amounts over the exemption. That's why strategies like gifting, setting up trusts, and making charitable donations are so important.

A well-structured plan isn't about illegally dodging taxes; it's about using the legal tools the government provides to ensure your family keeps as much of their inheritance as the law allows. It's the difference between planning ahead and cleaning up a mess later.

To really dig in and protect your legacy, you need to look at a full range of expert-level approaches. You can learn more by exploring these 8 Advanced Estate Planning Tax Strategies for 2025 for some deeper insights.

Using Trusts As Your Primary Asset Shield

When you're serious about protecting your family's inheritance from taxes, trusts are the real workhorses of your financial plan. Think of a trust as a legal and financial safe you build to hold assets for your loved ones. By strategically moving assets into this "safe," you can often pull them out of your taxable estate, keep them away from creditors, and, importantly, sidestep the costly and very public court process known as probate.

Trusts generally come in two flavors: revocable and irrevocable. The difference sounds simple, but it has huge consequences for your tax strategy.

A revocable living trust is flexible. You can change it, add to it, or even completely dismantle it whenever you want. While it's a fantastic tool for avoiding probate, the assets inside are still legally yours for tax purposes. That means it doesn’t do much to shield you from estate taxes.

An irrevocable trust, on the other hand, is a fortress. Once you put assets inside and lock the door, you typically can’t get them back. It’s this very permanence—this giving up of control—that gives it its tax-slashing power. Because the assets are no longer considered part of your estate, they generally fall outside the reach of the IRS.

The Heavy Lifters: Irrevocable Trusts

For significant tax savings, a few specific types of irrevocable trusts are absolutely essential. Each one is designed for a particular job, allowing you to build a tailored defense against taxes.

One of the most powerful is the Irrevocable Life Insurance Trust (ILIT). A lot of people are surprised to learn that a large life insurance payout can actually inflate their estate's value, pushing it over the federal or state tax exemption limits. By making an ILIT the owner and beneficiary of your policy, the death benefit is paid directly to the trust—it never touches your estate. This gives your heirs a pot of tax-free cash to pay any estate taxes owed on less liquid assets, like the family business or the old homestead.

Another brilliant tool, especially for those with assets expected to grow, is the Grantor Retained Annuity Trust (GRAT). This is a go-to strategy for business owners or anyone with a sizable stock portfolio. You place appreciating assets into the trust for a fixed period and, in return, receive a yearly annuity payment. Any growth above a rate set by the IRS passes to your heirs completely free of gift and estate taxes once the trust term ends. It's a proven way to transfer wealth.

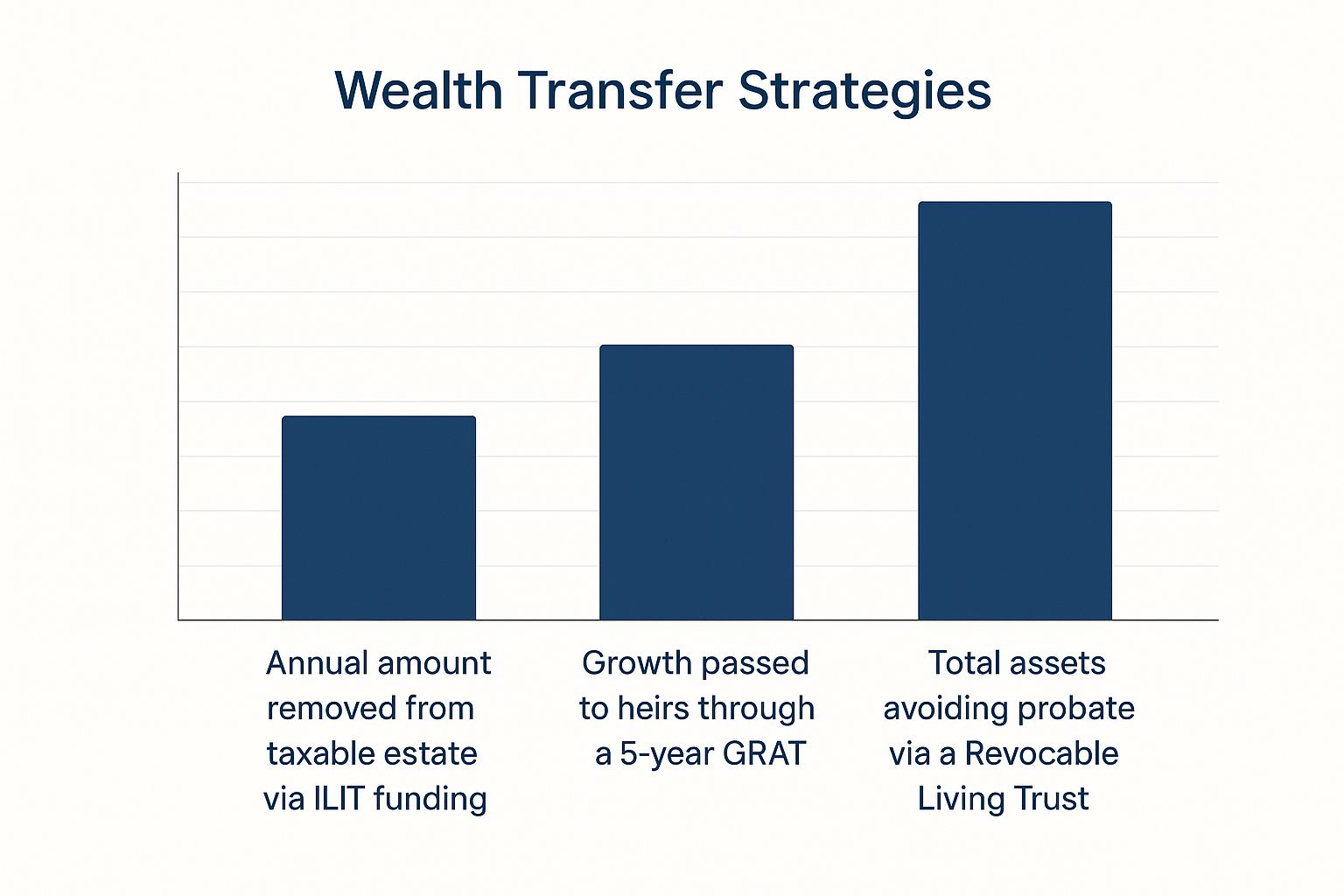

This infographic breaks down how different trusts can work together to cut down your tax exposure and make passing on assets much smoother.

As you can see, there isn't one perfect trust. The real magic happens when you combine them to create a multi-layered plan for preserving your wealth.

Combining Trusts for Maximum Protection

The true art of estate planning isn’t just picking one tool, but layering several to create a cohesive, bulletproof strategy. Different trusts protect different parts of your financial life.

Let's walk through a real-world scenario. Imagine a family with a $15 million net worth. A well-designed plan for them might look like this:

A Revocable Living Trust: This holds their primary home and day-to-day bank accounts. The main goal here is to keep these core assets out of probate, so the transfer to their kids is quick and private.

An ILIT: This trust owns a $5 million life insurance policy. When they pass, that money flows directly to their heirs, completely free of estate taxes, providing instant liquidity.

A GRAT: They place a portfolio of high-growth tech stocks into this trust. Over a five-year term, they could transfer over $2 million in appreciation to their children without even touching their lifetime gift tax exemption.

By layering these instruments, the family doesn't just lower their tax bill. They ensure their heirs have the cash on hand to manage the inheritance without being forced into a fire sale of the family's most cherished assets.

This kind of strategic thinking isn't just an American concern. How families protect their legacies is a global puzzle, with wildly different tax rules from one country to the next. Japan, for instance, has the world's highest estate tax at a whopping 55%, while 15 OECD countries, including Australia and Canada, have no death tax at all on assets passed to immediate family. This international landscape often leads families to seek global financial planning expertise to secure their assets across borders.

In the end, using trusts is all about taking control—control over the tax bite, control over when and how your assets are distributed, and, ultimately, control over the legacy you leave behind.

The Untapped Power Of Strategic Gifting

Sometimes, the smartest way to shield your inheritance from taxes is surprisingly simple: give some of it away while you're still here. This isn't about depleting your accounts; it's about a well-planned approach called strategic gifting. It’s a powerful, often overlooked method for systematically shrinking your taxable estate, making sure more of your wealth stays right where it belongs—with your family.

At the heart of this strategy is the annual gift tax exclusion. Each year, the IRS lets you give a specific amount of money to anyone you choose without it counting against your lifetime estate tax exemption or even requiring you to file a gift tax return. For 2024, that magic number is $18,000 per person.

Here’s where it gets really powerful: a married couple can combine their individual exclusions. This means together, you can gift $36,000 to each recipient, every single year. This opens the door to transferring significant wealth over time, completely tax-free.

Maximizing The Annual Gift Tax Exclusion

Let's look at a real-world scenario. Imagine a couple with two married children and four grandchildren. That’s eight people they can gift to (two kids, their two spouses, and the four grandkids).

By taking full advantage of the annual exclusion, this couple can make a huge dent in their estate.

Amount per recipient: $36,000 (from the couple)

Total recipients: 8

Total annual gift: $288,000

Do that consistently, and in just ten years, they’ve moved over $2.8 million out of their taxable estate. And the best part? They haven't used a single penny of their much larger lifetime exemption, saving it for other assets down the road.

Strategic gifting is not about a single large transaction; it's about the cumulative impact of consistent, planned giving over many years. This patient approach is one of the surest ways to reduce future estate tax liabilities.

To see just how quickly this adds up, take a look at the table below. It shows how a consistent gifting plan can transfer substantial wealth based on the number of family members you include.

Impact Of An Annual Gifting Strategy Over Time

Number of Recipients | Value Transferred in 5 Years | Value Transferred in 10 Years | Value Transferred in 20 Years |

|---|---|---|---|

2 (Two Children) | $360,000 | $720,000 | $1,440,000 |

4 (Two Children and Spouses) | $720,000 | $1,440,000 | $2,880,000 |

8 (Children, Spouses, and Grandchildren) | $1,440,000 | $2,880,000 | $5,760,000 |

As the numbers clearly show, the impact grows dramatically with more heirs and a longer timeline. This simple, disciplined approach can move millions out of your estate, preserving your legacy for generations.

Gifting Beyond Simple Cash

While writing a check is easy, you can get even more tax-saving mileage by gifting assets that are likely to grow in value.

One of the smartest moves is gifting appreciating stocks. When you give stock to your kids, all future appreciation and dividends happen outside of your estate, further reducing your tax burden. For example, if you gift $18,000 worth of stock that later doubles in value, you've effectively removed $36,000 from your future estate.

You can also get creative with assets like a family vacation home. By transferring a small percentage of ownership to each child every year, you can gradually pass the entire property to the next generation without triggering a massive gift tax event.

Charitable Giving As An Estate Planning Tool

Gifting doesn't have to be limited to family. Your charitable goals can also play a key role in protecting your inheritance from taxes while you support the causes you care about.

A classic win-win is donating highly appreciated securities—like stocks, bonds, or mutual funds—that you've held for over a year. You generally get to deduct the full fair market value of the donation from your income taxes and completely avoid paying capital gains on the growth. This is far more tax-efficient than selling the stock first and then donating the cash.

For those wanting a more structured plan, a Charitable Remainder Trust (CRT) is a fantastic tool. You place assets into an irrevocable trust, which then pays you an income for a set period. Once that term is over, whatever is left goes to your chosen charity. This approach gives you an immediate charitable deduction, creates a steady income stream, and takes the assets out of your taxable estate for good.

Protecting Your Legacy With Insurance And Business Planning

While trusts and smart gifting strategies do a lot of the heavy lifting, they aren't the complete picture for protecting your estate. For many families, especially those whose wealth is tied up in illiquid assets like a farm or a family business, insurance and solid business planning are what truly secure the legacy.

These strategies tackle a common, and often devastating, problem: a lack of cash.

When an estate tax bill comes due, the IRS doesn't want a piece of the family business or a few acres of land—they want cash, and they want it promptly. This reality can force your heirs into a fire sale, selling cherished assets for pennies on the dollar just to satisfy the tax man. This is precisely where life insurance plays a critical, strategic role.

But be careful. Just buying a life insurance policy isn't the solution. If you personally own that policy, the death benefit gets added right back into your estate's value. In a cruel twist of irony, the very tool you bought to solve a tax problem could be the thing that pushes your estate over the exemption limit, creating an even bigger tax liability.

The Irrevocable Life Insurance Trust (ILIT) Solution

The proper way to handle this is with an Irrevocable Life Insurance Trust, or ILIT.

Instead of owning the policy yourself, you have the trust own it. This simple change in ownership means that when you pass away, the death benefit is paid directly to the trust—not to your estate. As a result, the entire payout is kept separate and is not counted as part of your taxable estate.

This gives your heirs a ready source of cash that is both income-tax-free and estate-tax-free. They can use these funds to:

Pay any estate taxes that are due.

Settle final debts and expenses.

Buy out a sibling's share in a family property to avoid conflict.

Provide for their own financial security without being forced to sell other assets.

Think of an ILIT as a dedicated emergency fund for your estate. It ensures the cash is there right when it's needed most, preserving the core assets you spent a lifetime building.

Securing Your Business For The Next Generation

If you're a business owner, your company is likely the crown jewel of your estate. Protecting it requires a formal succession plan. Without one, you leave its fate to chance, and your heirs could be forced to sell or even liquidate the business just to cover the tax bill.

A Family Limited Partnership (FLP) is a great way to start transferring ownership to the next generation while you're still in control. You can gift limited partnership interests to your children over time. Because these interests don't come with control and aren't easily sold on the open market, they often qualify for valuation discounts, letting you transfer more wealth while using less of your lifetime gift tax exemption.

Another non-negotiable tool is a Buy-Sell Agreement. This is a legally binding contract that dictates exactly what happens to your share of the business when you die, retire, or become disabled. It pre-determines a price and the terms for the remaining partners or heirs to buy you out.

A Buy-Sell Agreement removes all the guesswork. It prevents disputes among heirs, ensures business continuity, and establishes a clear value for the business for estate tax purposes, which can help prevent a lengthy and expensive valuation battle with the IRS.

These agreements are almost always funded with life insurance. The partners take out policies on each other. When one partner dies, the death benefit gives the surviving partners the immediate cash to buy the deceased's shares from their estate. This creates a clean, tax-efficient transfer of ownership, protecting your life's work and your family’s inheritance all at once.

Costly Estate Planning Mistakes You Must Avoid

Putting together a solid plan to shield your inheritance from taxes is a huge accomplishment. But I’ve seen even the most carefully crafted strategies fall apart because of simple, avoidable missteps. We're not talking about obscure legal loopholes, either. These are the everyday oversights that can trigger surprise taxes, ignite family feuds, and cause real financial pain for your loved ones.

The most common—and damaging—mistake I see is simply failing to update the plan after life throws you a curveball. A marriage, a divorce, the birth of a child, or the death of a spouse completely changes the landscape of your family and finances. An old plan could inadvertently send assets to an ex-spouse or leave a new child out in the cold, creating a legal and emotional mess for your family to clean up.

The Dangers Of Improper Asset Titling

It’s not just about what your will says; it's about how you own your assets. The name on the deed or the account title is critically important. If you get it wrong, you can accidentally funnel assets right back into the probate process, even if you have a trust designed specifically to avoid it.

For instance, let's say you set up a revocable living trust but never get around to formally transferring your home's deed into the trust's name. It's a small clerical detail that's easy to forget. But it means the house isn't actually in the trust. When you pass away, that property will have to go through probate, completely defeating one of the main reasons you created the trust to begin with.

Retirement accounts are another frequent trouble spot. Your will has no power over who inherits your 401(k) or IRA. The only thing that matters is the beneficiary designation form you have on file. It's essential to review these forms regularly to make sure they still reflect your wishes and fit into your overall estate strategy.

Outdated Beneficiary Designations

Forgetting to update beneficiaries on life insurance and retirement accounts is a classic, critical error. Why? Because those designations supersede your will.

Here's a cautionary tale I’ve seen play out in real life: A man divorces and remarries, but never changes the beneficiary on his sizable life insurance policy. When he passes away, the entire payout legally goes to his ex-wife. His current wife and children get nothing from that policy. This isn't some rare, freak occurrence; it happens all the time and leaves families in a devastating position.

An estate plan is not a "set it and forget it" document. Treat it as a living plan that needs to be reviewed at least every three to five years, or immediately following any significant life change.

Another huge risk is skipping the foundational paperwork. One of the most common pitfalls is neglecting to prepare basic estate planning documents like a durable power of attorney for finances and a healthcare directive. Without these in place, if you become incapacitated, your family could be forced into an expensive and stressful court process just to manage your affairs.

The tax consequences of these mistakes can be staggering, especially as property and investment values climb. Over in the United Kingdom, for example, a steep 40% inheritance tax (IHT) kicks in above a certain threshold. Recent data showed the number of estates paying IHT jumped by 13% in a single year, which shows how quickly inflation can push more families into a higher tax bracket. You can find more details about how changing economic conditions affect inheritance tax liability in this report. It’s a stark reminder that a proactive, regularly updated plan is your best defense against having your legacy eroded by taxes.

Common Questions About Protecting Your Inheritance

When you start digging into estate planning, a lot of questions pop up. The rules can feel tangled, and frankly, the stakes are incredibly high for your family. Let’s clear up some of the most common things people ask when they get serious about shielding their legacy from taxes.

Does Everyone Have To Pay Inheritance Tax?

Thankfully, no. Very few estates actually get hit with the federal estate tax. The government sets the exemption bar incredibly high—currently over $13 million per person—so this tax only affects the wealthiest families in the country.

But here’s the catch, and it’s where a lot of people get tripped up: the states. A handful of states have their own estate or inheritance taxes, and their exemption levels are often much, much lower. Some kick in for estates worth as little as $1 million. It's a critical difference.

An estate tax is a tax on the total value of the deceased's assets, paid by the estate before anyone gets a dime.

An inheritance tax is paid by the person who receives the inheritance.

You could be completely in the clear on federal taxes but still find your heirs facing a hefty tax bill from your state. You absolutely have to know your local laws to understand the real picture.

Is a Will Enough To Protect My Assets From Taxes?

A will is non-negotiable—everyone needs one. But on its own, it does absolutely nothing to minimize taxes. Think of a will as simply a letter of instruction telling the court who gets what. It directs the flow of your assets, but it doesn't shield them from the tax man.

Actually cutting down your tax liability requires a proactive strategy. That means using specific legal tools built for this exact purpose, like:

Irrevocable trusts, which can hold assets completely outside of your taxable estate.

A disciplined gifting plan, letting you pass down wealth tax-free, year after year.

Life insurance, often held in a special trust to provide tax-free liquidity.

A will is the foundation of your plan, but it’s just the starting block. It’s not the whole race.

When Is The Best Time To Start Estate Planning?

The simple answer? Right now. This isn't something you do once and forget about. The most effective estate plans are not last-minute emergencies; they are long-term strategies that unfold over years.

So many of the best tax-saving methods require time to work their magic. A smart gifting strategy, for example, needs runway—many years of consistent gifts to significantly reduce a large estate. Some trusts used for long-term care planning have "look-back" periods that can last for years.

Starting early gives you the most options and the greatest control. Waiting too long can box you in, severely limiting your choices and potentially leaving your family with a tax burden that could have been avoided. Even a basic plan today is infinitely better than a perfect plan that never gets made.

Can I Give My House To My Kids To Avoid Taxes?

You can, but this is a move that's absolutely fraught with peril if you don't do it right. Many people think they can just sign the deed over to their kids and call it a day. That's a huge red flag for the IRS.

If you transfer ownership but continue living in the house, the IRS can see that as a transfer with a "retained life interest." What that means in plain English is they can pull the home's entire value right back into your taxable estate, completely defeating the purpose of the gift.

A far more sophisticated and effective approach is a Qualified Personal Residence Trust (QPRT). This is a special kind of trust that lets you transfer the home to your kids' names for tax purposes, while you retain the legal right to live in it for a certain number of years. It’s a powerful way to get the home's future growth out of your estate, but it’s complex and requires an expert to set up correctly.

What Happens With Inheritances From Outside the U.S.?

Getting an inheritance from another country can create some surprising paperwork, even if you don't owe any tax on it. If you're a U.S. citizen and receive a large gift or inheritance from a foreign person, you generally have to report it to the IRS on Form 3520.

Because foreign inheritances aren't typically considered taxable income, many people don't even realize they have this reporting obligation. The penalties for failing to file can be brutal—up to 25% of the value of the inheritance.

The IRS has recently indicated they'll be a bit more lenient, looking for "reasonable cause" before automatically hitting people with penalties for late filings. Still, the requirement is firmly in place. This just goes to show how vital it is to get professional advice if you're expecting assets from abroad. The rules are strict and a simple oversight can be incredibly costly.

At America First Financial, we believe in protecting your family’s future with clear, dependable solutions. Our insurance and financial products are designed to provide security and peace of mind, free from political agendas. Secure your legacy today by getting a straightforward, no-obligation quote.

_edited.png)