How to Protect My Assets: Top Smart Strategies

- dustinjohnson5

- May 2, 2025

- 14 min read

Why Asset Protection Matters More Than Ever

Safeguarding your assets is now more critical than ever. The financial world presents evolving challenges to your financial security. What worked to protect your wealth in the past might not be enough against modern threats. Consider the rise of cyber attacks, increasingly complex litigation, and the constant risk of economic instability. Understanding asset protection is no longer a luxury, but a necessity.

Understanding the Growing Need for Asset Protection

Asset protection is crucial in today's complex global economy. For example, global public and private market assets hit $250.6 trillion by the end of February 2025. However, market volatility quickly led to a significant decline. This demonstrates the importance of safeguarding assets, as even small market shifts can have major financial consequences. For a deeper dive into these statistics, see: Learn more about Global Assets

The legal landscape also adds to this complexity. Lawsuits are more frequent, and judgments can be substantial, potentially wiping out your savings. A proactive asset protection plan is essential to defend against these legal threats.

The Impact of Inadequate Asset Protection

Failing to protect your assets can be devastating. Without a plan, even the most careful investors can face significant losses from unforeseen circumstances. Understanding the risks and taking steps to mitigate them is paramount.

Visualizing the Growing Importance of Asset Protection

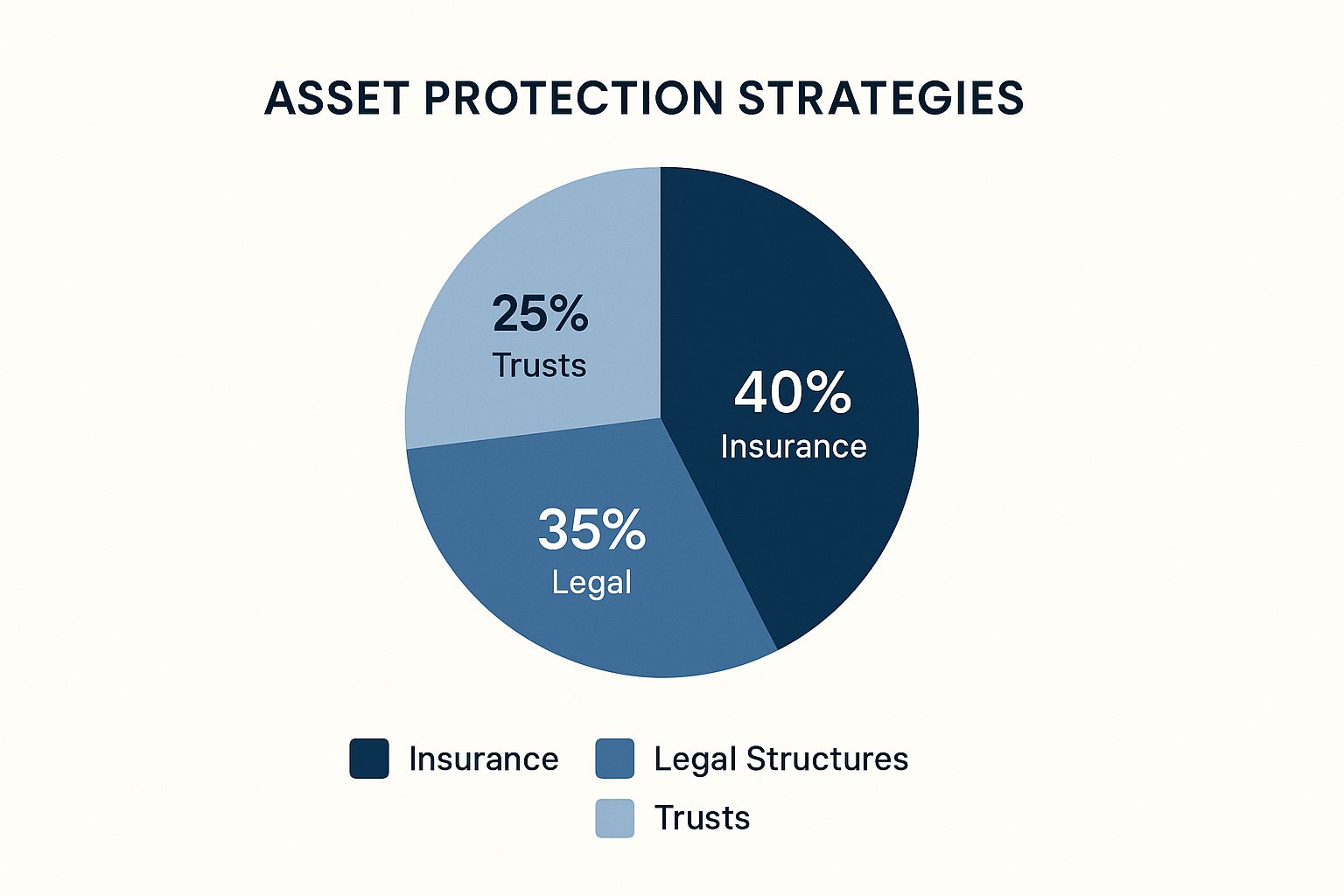

The following data chart illustrates the growing need for robust asset protection strategies by comparing potential asset loss under different scenarios.

(Infographic will be inserted here)

Scenario 1: No Asset Protection: Without any asset protection strategies, potential losses can reach as high as 80% in cases of litigation or economic downturn.

Scenario 2: Basic Asset Protection: Basic measures, like insurance coverage, can reduce potential losses to around 50%, demonstrating the benefit of some protection.

Scenario 3: Comprehensive Asset Protection: A comprehensive plan, including legal structures, insurance, and diversification, can significantly lower potential losses to approximately 20%.

This data chart clearly shows how increased asset protection leads to decreased potential loss. Proactive planning and strategic implementation are crucial for safeguarding your wealth. A comprehensive approach is the most effective way to protect your future.

Mapping Your Asset Landscape: What You Really Need to Protect

Before implementing any asset protection strategies, it's essential to understand exactly what you're protecting. This starts with a comprehensive inventory of all your assets. This process not only clarifies what you own but also highlights potential vulnerabilities and opportunities for protection. Think of it as creating a detailed map of your financial landscape – essential for building strong defenses.

Identifying and Categorizing Your Assets

Creating an asset inventory is more than just a simple list. It involves categorizing your assets to understand their unique characteristics and the specific threats they face. This categorization is key to prioritizing your protection efforts.

Liquid Assets: This category includes readily available funds like cash, checking accounts, savings accounts, and easily liquidated investments. These assets are essential for covering short-term needs and financial emergencies.

Investment Assets: These assets are held for long-term growth and include stocks, bonds, mutual funds, and retirement accounts such as 401(k)s. Protecting retirement accounts can be complex, especially with the increasing popularity of alternative assets like cryptocurrency within these plans.

Personal Property: This encompasses tangible items like your home, vehicles, jewelry, and other valuables. Protecting these assets often involves insurance policies and various security measures.

Business Interests: If you own a business, its entire value, including equipment, inventory, and intellectual property, requires specific protection. This is particularly critical during events like divorce, where business interests can be a major point of contention.

Assessing Your Risk Profile

Just as your asset portfolio is unique, so is your risk profile. Several factors contribute to the overall level of risk your assets face.

Professional Risks: Certain professions, such as medical or legal practices, inherently carry higher liability risks.

Family Situation: Your family situation, including marriage, divorce, or having dependents, can significantly impact your asset vulnerability.

Investment Portfolio: The composition of your investment portfolio influences your risk profile. High-risk investments in volatile markets require different protection strategies than stable, long-term investments.

Understanding these factors is crucial for developing an effective asset protection plan tailored to your specific circumstances.

To help visualize and categorize your assets based on their risk level and corresponding protection needs, the following table provides a helpful framework:

Asset Risk Assessment Matrix

This table helps readers categorize their assets by risk level and protection needs

Asset Type | Risk Level | Protection Priority | Recommended Strategies |

|---|---|---|---|

Checking Account | Low | Medium | FDIC Insurance, Fraud Monitoring |

Primary Residence | Medium | High | Homeowners Insurance, Security System |

Stock Portfolio | High | High | Diversification, Portfolio Management |

Business Ownership | High | High | Liability Insurance, Legal Structures |

Jewelry | Medium | Medium | Insurance, Secure Storage |

This table highlights the varying levels of risk associated with different asset types and suggests appropriate protection strategies. Remember to tailor these recommendations to your individual circumstances.

Prioritizing Your Protection Efforts

Once you've mapped your assets and assessed your risk profile, you can prioritize which assets require the most immediate and robust protection. This strategic approach prevents overspending on unnecessary measures while ensuring your most valuable and vulnerable assets are adequately secured. Some assets, like certain retirement accounts, might already have some legal protection, while others could be significantly exposed.

For example, the protection strategies for your primary residence will likely differ from those for a speculative investment. Prioritization ensures efficient resource allocation and maximizes the effectiveness of your asset protection plan, safeguarding your financial future.

Legal Structures That Actually Shield Your Assets

Protecting your assets involves more than just insurance and diversified investments. It requires strategically using legal structures as protective barriers between your personal wealth and potential liabilities. This section explores how these structures function and how they can enhance your financial security and teach you how to protect your assets effectively.

Understanding the Power of Legal Structures

Think of legal structures as a firewall for your finances. They create a separation between your personal assets and potential claims, similar to how a corporation separates the owners' personal liability from the business's debts. This separation is vital for safeguarding wealth, especially during lawsuits or business downturns.

Exploring Different Types of Protective Structures

Several legal structures offer various levels of asset protection. The best choice depends on individual circumstances and goals. Here are a few common options:

Limited Liability Companies (LLCs): A popular choice for small business owners, LLCs provide liability protection by separating business debts and liabilities from the owner's personal assets. If the business is sued, the owner's personal assets are generally protected.

Trusts: Trusts offer a flexible way to manage and protect assets. They involve transferring asset ownership to a trustee who manages them for designated beneficiaries. Different trust types, like revocable and irrevocable trusts, offer varying protection levels. Assets in an irrevocable trust are typically shielded from creditors.

Partnerships: Limited partnerships (LPs) and limited liability partnerships (LLPs) offer some liability protection for partners while maintaining certain tax advantages. This structure is often seen in professional practices like law firms and medical partnerships.

Choosing the Right Structure for Your Needs

The ideal legal structure for asset protection depends on factors like the types of assets owned, risk tolerance, and long-term financial goals. A family business might benefit from an LLC, while a complex investment portfolio might be better protected within a trust structure.

Domestic vs. Offshore Structures: Separating Fact From Fiction

Choosing between domestic and offshore structures adds another layer to asset protection planning. While offshore accounts are sometimes linked to tax evasion, they can offer legitimate asset protection benefits. However, they also involve increased complexity and regulatory scrutiny. Consulting with legal and financial professionals is crucial to determine if an offshore structure is appropriate and aligns with your overall asset protection strategy.

Implementing and Maintaining Your Chosen Structure

Setting up a legal structure is only the first step. Proper maintenance is essential for continued protection. This includes adhering to the structure's specific requirements, such as maintaining proper documentation and operational formalities. Failure to do so can compromise the intended protection. For example, not keeping business and personal expenses separate in an LLC can expose personal assets to liability.

Choosing the right legal structure isn't one-size-fits-all. Consult a qualified professional at America First Financial to determine the best strategy for your situation. They can explain the nuances of each structure and guide you through implementation and maintenance to ensure genuine, long-term asset protection.

Insurance Strategies That Form Your Protection Foundation

Protecting your assets with legal structures is essential, but it's only one piece of the puzzle. A robust insurance strategy acts as your initial defense against numerous potential threats. Think of insurance as the bedrock upon which other protection methods are built. However, a surprising number of people are underinsured, leaving their valuable assets vulnerable.

Understanding the Role of Strategic Insurance

Insurance isn't simply about paying premiums; it's about strategically utilizing insurance products to mitigate specific risks. Experts in asset protection often employ targeted policies to create a comprehensive safety net. This approach extends beyond basic homeowners and auto insurance to address specific vulnerabilities your assets may face.

For example, Guaranteed Asset Protection (GAP) Insurance is one product used to protect assets. The GAP Insurance market is experiencing growth, with a predicted compound annual growth rate (CAGR) from 2025 to 2033. This growth highlights a broader movement toward more sophisticated asset protection strategies. You can find more detailed statistics here: Find more detailed statistics here.

Identifying and Addressing Coverage Gaps

Many individuals believe their current insurance coverage is sufficient. However, dangerous gaps often exist. One common oversight is inadequate liability coverage. If you're sued and the judgment surpasses your policy limits, your personal assets are directly at risk. Identifying these gaps is paramount for effective asset protection.

Types of Specialized Insurance Policies

Besides standard homeowners and auto insurance, consider these specialized policies:

Umbrella Insurance: This policy provides supplemental liability coverage beyond your existing policies, safeguarding your assets in the event of a significant lawsuit.

Professional Liability Insurance: This protects professionals, such as doctors and lawyers, from lawsuits stemming from their professional practice. This coverage is frequently essential for mitigating career-specific risks.

Business Insurance: If you own a business, various types of business insurance, including property, liability, and product liability insurance, are crucial for protecting both business assets and personal wealth.

Determining Appropriate Coverage Levels

Finding the right amount of coverage is key. Too little coverage leaves you underinsured, while too much means you're overpaying. Factors to consider include the total value of your assets, your individual risk profile, and the potential costs associated with lawsuits or other liabilities.

Coordinating Multiple Policies

Many people hold multiple insurance policies, including home, auto, and life insurance. Coordinating these policies ensures comprehensive coverage, avoiding overlaps and gaps. Life insurance, for instance, can protect your family's financial future by replacing your income if you pass away, indirectly protecting your assets.

Navigating Claims Processes Effectively

Understanding how to navigate insurance claims processes is as crucial as having the right coverage. This involves thoroughly documenting damages, maintaining clear communication with the insurance company, and understanding your policy's exclusions. Policy exclusions define specific circumstances where the insurance company will not pay a claim, so awareness of these is critical.

By strategically incorporating insurance as a cornerstone of your asset protection plan, you elevate it from a simple expense to a powerful shield for safeguarding your wealth. Remember, comprehensive asset protection involves multiple layers of defense, with insurance providing a critical foundation. For personalized advice, consult a qualified insurance professional at America First Financial. They can help you assess your unique needs and develop a comprehensive insurance strategy aligned with your overarching asset protection goals.

Defending Your Digital Worth: Beyond Basic Cybersecurity

Protecting your physical assets is essential. But safeguarding your digital worth requires a different strategy. It’s more than just having antivirus software. It's about understanding the vulnerabilities of digital assets like cryptocurrency, intellectual property, and online businesses.

These assets often need specialized protection that goes beyond traditional methods. Those who effectively protect their wealth recognize this and use robust systems to secure their digital holdings.

Protecting Various Digital Assets

Digital assets encompass a broad range of items. Each requires specific protection strategies. Cryptocurrency, for example, needs secure storage like hardware wallets and strong passwords.

Intellectual property, like trademarks and copyrights, requires proper registration and monitoring to prevent infringement. Online businesses must prioritize data security and secure payment processing.

Failing to address these specific needs can expose you to significant financial risks. Consider a small business owner storing customer data on an unsecured server. A data breach could lead to financial losses from lawsuits and reputational damage, severely impacting the business's value. This highlights the need for tailored security measures based on the specific digital asset.

To illustrate the varying needs of digital asset protection, let's look at the following comparison:

Introduction to the table below: The following table, "Digital Asset Protection Comparison," details the varying approaches necessary for securing diverse types of digital assets. This comparison outlines the security measures, implementation difficulty, effectiveness, and associated costs for each asset type.

Digital Asset Type | Security Measure | Implementation Difficulty | Effectiveness | Cost |

|---|---|---|---|---|

Cryptocurrency | Hardware Wallet | Moderate | High | Moderate |

Cryptocurrency | Strong Passwords/Seed Phrases | Low | High | Low |

Intellectual Property (Trademarks/Copyrights) | Registration with Relevant Authorities | Moderate | High | Moderate |

Intellectual Property (Trademarks/Copyrights) | Ongoing Monitoring for Infringement | Moderate | Moderate | Moderate |

Online Business Data | Secure Server with Encryption | Moderate | High | Moderate |

Online Business Data | Regular Data Backups | Low | High | Low |

Online Business Transactions | Moderate | High | Moderate |

Key takeaway: As evident in the table, while some measures are relatively simple to implement (like strong passwords), others require more effort and investment (like setting up a secure server). Balancing security, ease of implementation, and cost is essential for effective digital asset protection.

Multi-Layered Security and Practical Implementation

Protecting your digital worth involves a multi-layered approach. This includes several key practices:

Strong Passwords: Use unique and complex passwords for every online account. Password managers can help manage this.

Two-Factor Authentication: This adds an extra layer of security, making unauthorized access difficult even if a password is compromised.

Regular Software Updates: Keeping software updated patches security vulnerabilities. This prevents exploitation by malicious actors.

Data Backups: Regular data backups ensure your information is recoverable, even after a cyberattack or hardware failure.

Implementing these measures might seem complex. However, many user-friendly tools and services are available. Begin with the basics and gradually build a strong security system tailored to your digital portfolio.

Addressing Common Vulnerabilities

Understanding common vulnerabilities is critical for effective protection. Phishing attacks, malware, and ransomware are prevalent threats. Vulnerabilities within 401(k) plans, especially with cryptocurrency investments, highlight the need for increased vigilance and regulatory oversight.

This underscores the importance of cyber insurance. The global cyber insurance market has grown significantly, from $7 billion in 2020 to about $13 billion in 2023, with projections to reach $22.5 billion by 2025. This demonstrates a growing awareness of cyber risk management. Learn more about cyber insurance statistics.

Evaluating Cyber Insurance Options

Choosing the right cyber insurance requires careful evaluation. Look beyond marketing and focus on policy features that genuinely protect your digital holdings. Coverage for data breaches, ransomware attacks, and business interruption are essential. Just as you carefully review insurance for physical assets, apply the same diligence to cyber insurance.

By implementing these strategies, you shift from reactive to proactive digital security, protecting your digital worth. Contact a qualified professional at America First Financial for personalized guidance.

Strategic Diversification That Actually Works

Diversification is about more than just spreading your investments across various stocks. It's a crucial strategy for protecting your assets, building resilience against market fluctuations and other potential threats. This section explores how strategic diversification, moving beyond basic investment approaches, becomes a vital part of a comprehensive asset protection plan.

Diversification Across Asset Classes

Think of your assets as a team. You wouldn't want a basketball team made up entirely of one position. Similarly, concentrating your wealth in a single asset class, like real estate, exposes you to considerable risk if that market takes a downturn.

Strategic diversification involves holding a mix of asset classes, such as:

Real Estate: While a valuable asset, real estate can be difficult to sell quickly.

Stocks: These offer growth potential, but can also experience significant price swings.

Bonds: Generally seen as more stable than stocks, bonds provide a fixed income stream.

Commodities: Investing in resources like gold or oil can help offset the effects of inflation.

By diversifying your investments across these different classes, you lessen the impact of any single market downturn. For example, if the stock market crashes, your bond and real estate holdings can help mitigate the losses.

Geographic Diversification: Expanding Your Horizons

Just as diversifying across asset classes is important, so is geographic diversification. Holding all your assets in one country exposes you to political or economic instability within that specific region. Consider international investments and real estate in different countries to reduce these risks. This approach safeguards your wealth from events impacting a single location.

Diversification Through Ownership Structures

Using various ownership structures provides an additional layer of protection. Legal structures like LLCs and trusts can create a barrier between your personal assets and potential liabilities. Diversifying your ownership across these structures enhances your overall asset protection plan.

Balancing Protection With Growth

While protection is paramount, maintaining reasonable growth is also key. Diversification that focuses solely on preservation might not keep up with inflation. Your diversification strategy should balance safeguarding assets with achieving reasonable returns. This requires carefully evaluating your risk tolerance and long-term financial objectives.

Alternative Investments: Understanding the Risks and Rewards

Alternative investments, such as private equity, hedge funds, or cryptocurrency, can offer the potential for higher returns. However, they also come with increased risks. Carefully assess whether these investments align with your protection goals and risk tolerance. They can enhance diversification but also introduce unnecessary complexity and volatility if not fully understood. Some 401(k) plans now include cryptocurrency investment options, but these are often seen as high risk due to price fluctuations, bankruptcies, and the risk of fraud.

Implementing and Stress-Testing Your Diversification Strategy

Building a diversified portfolio is an ongoing process, not a one-time event. Regularly review and adjust your strategy based on market conditions, changes in your risk profile, and evolving financial goals. Stress-testing your portfolio by simulating various market downturns or economic shocks can help reveal vulnerabilities and strengthen your overall asset protection strategy. Ensuring sufficient liquidity—access to readily available funds—is also critical for navigating financial challenges and capitalizing on unexpected opportunities.

By adopting a strategic and well-considered approach to diversification, you create a robust shield for your assets, protecting your financial future and working toward long-term financial stability. Consulting a financial advisor at America First Financial can offer personalized guidance for developing a diversification strategy tailored to your specific needs and risk tolerance.

Building Your Protection Plan: From Strategy to Action

Protecting your assets isn't simply about understanding the theory. It requires putting a solid plan into action. This section offers a roadmap for building a cohesive asset protection system, integrating the elements previously discussed. You'll learn how to navigate common implementation challenges and sequence your protection measures for maximum impact, even when working with a limited budget. This is where you transition from simply knowing how to protect your assets to actually doing it.

Sequencing Your Protection Measures

Asset protection isn't a one-size-fits-all approach. It's a multi-layered process, much like building a house. You wouldn't install the roof before the foundation. Similarly, certain asset protection measures should take precedence. For instance, foundational elements like insurance should be addressed before exploring more complex legal structures like trusts or offshore accounts.

Securing a strong insurance foundation protects against immediate risks, such as liability claims or property damage. This establishes a base level of security, allowing you to build further protection with legal and financial strategies.

Working With Professionals

Seeking professional guidance is often essential. However, it's important to approach this strategically. Just as some 401(k) plans lack sufficient oversight of newer investments like cryptocurrency (as highlighted by the U.S. Government Accountability Office's findings), you must actively participate in managing your financial well-being. Don't blindly rely on advisors; stay informed and ask questions.

Finding the Right Advisor: Seek professionals who understand your specific needs and prioritize your best interests.

Avoiding Unnecessary Costs: Be cautious of advisors promoting expensive services or products that don't align with your goals.

Recognizing Red Flags: If an advisor seems more focused on their commission than your protection, it's time to seek a new advisor.

One clear red flag is an advisor pressuring you into complex investment strategies you don't fully understand, especially those with high fees. Prioritize transparency and understanding in all your financial relationships.

Regularly Reviewing and Updating Your Plan

Your asset protection plan isn't static; it should adapt to your changing circumstances. As your assets grow, laws change, or your family situation evolves, so too should your protection needs. Life events like marriage, divorce, or inheritance significantly impact your asset protection requirements.

Annual Reviews: Review your plan comprehensively at least once a year.

Adjusting to Life Changes: Update your plan to reflect major life events, such as starting a new business or receiving a substantial inheritance.

Staying Informed: Keep up-to-date on changes in relevant laws and regulations.

This proactive approach ensures your plan remains effective in safeguarding your wealth, adapting to the dynamic nature of your financial life. By following these steps, you create a dynamic and adaptable asset protection system that truly protects what you've built. It’s about actively building a plan that provides lasting security. Contact the experts at America First Financial for personalized guidance and support in building a secure future. They offer affordable protection options designed to meet your specific needs, ensuring both peace of mind and financial stability.

_edited.png)

Comments