How to Switch Insurance Providers Easily in 3 Steps

- dustinjohnson5

- May 31

- 12 min read

Recognizing the Perfect Moment to Make Your Move

Knowing when to switch insurance providers can significantly impact your finances. It’s not simply about finding a cheaper premium; it’s about ensuring your coverage aligns with your current life stage and financial goals. Sometimes, loyalty to a provider can be more costly than exploring other options. This section helps you identify key moments when switching providers could be beneficial.

Red Flags From Your Current Provider

A sudden, unexplained premium increase is a clear sign to consider switching. While minor premium adjustments are typical, substantial increases without a corresponding increase in coverage warrant investigation. Additionally, deteriorating customer service, such as long wait times, unhelpful representatives, or difficulty filing claims, suggests potential problems. These can lead to frustration and inadequate support when you need it most.

Another red flag is inadequate coverage. Life events like marriage, buying a home, starting a family, or a career change often shift your insurance needs. Your existing policy may no longer provide adequate protection. Regularly evaluating your coverage, especially after significant life changes, ensures it aligns with your evolving requirements.

Market Trends and Life Changes

External factors also create ideal switching opportunities. Market trends play a significant role. For instance, global commercial insurance rates declined by 3% in Q1 2025, the third consecutive quarter of decreases, according to the Marsh Global Insurance Market Index. This downward trend suggests consumers could find lower premiums by exploring alternative providers.

Major life changes also offer natural switching points. Marriage, a new home, or a growing family often require increased coverage or different insurance types altogether. Maintaining coverage during the transition is crucial; a travel insurance comparison can be helpful if needed. These transitions are excellent times to reassess your needs and explore market options. Even career changes can signal a need to re-evaluate, as employer-sponsored plans vary widely.

The Cost of Loyalty

Remaining with an underperforming provider can be surprisingly costly. Beyond premium increases, insufficient coverage can lead to significant out-of-pocket expenses in case of an accident or illness. Ultimately, sticking with a subpar policy might be considerably more expensive in the long run. Proactively evaluating options and switching when necessary ensures you have the right coverage at the best price, protecting your current and future financial well-being.

Mastering The Art of Smart Insurance Shopping

The insurance marketplace can feel overwhelming. However, informed consumers can navigate it with confidence. This involves looking beyond simple online quote comparisons. Smart insurance shopping means understanding industry terms, using effective comparison tools, and identifying reputable providers. This section gives you the knowledge to switch insurance providers and secure the best coverage for your needs.

Deciphering Insurance Jargon

Insurance terminology can be confusing. Understanding key terms like deductibles, copays, and coinsurance is essential for comparing plans. Your deductible is the amount you pay before your insurance coverage begins. A copay is a set fee for a service, while coinsurance is the percentage of costs you share with your insurer after meeting your deductible. Understanding these terms helps you assess the true cost of coverage.

Utilizing Effective Comparison Tools

Comparison tools vary in quality. Some offer basic comparisons, while others provide deeper analysis. Choose tools that let you filter by your needs, such as pre-existing condition coverage. Also, look for tools that include customer reviews and complaint data. These offer valuable insights into real-world experiences.

Researching Provider Strength and Reliability

Research is crucial when switching providers. Check financial strength ratings, which indicate a company's ability to pay claims. Also, examine customer complaint data to understand satisfaction levels. Further research into global insurance market dynamics and online comparison platforms can be beneficial. Discover more insights about global insurance trends. For example, strong life and annuity sales show that consumers are actively seeking better insurance options.

To help organize your research, a comparison framework can be incredibly useful. The table below provides a structure for evaluating potential insurance providers.

Insurance Provider Comparison Framework: A comprehensive evaluation system covering coverage quality, pricing transparency, customer satisfaction scores, and essential policy features.

Evaluation Factor | Current Provider | Option 1 | Option 2 | Priority Level |

|---|---|---|---|---|

Financial Strength | A+ | A | A- | High |

Customer Satisfaction | 4.5/5 | 4/5 | 3.8/5 | High |

Deductible | $1,000 | $500 | $750 | Medium |

Coinsurance | 20% | 10% | 15% | Medium |

Coverage for Pre-existing Conditions | Yes | Yes | Limited | High |

Access to Specific Doctors | Limited | Wide Network | Moderate Network | Medium |

Online Portal & App | Yes | Yes | No | Low |

Premium Cost | $200/month | $250/month | $180/month | High |

This table allows you to directly compare providers across factors you've identified as important. Reviewing the table reveals key differences in financial strength, customer satisfaction, and pre-existing condition coverage, allowing you to make a more informed decision.

Insider Tips for Getting the Best Quotes

Timing matters when getting insurance quotes. Requesting quotes from several providers simultaneously allows for easy comparison and can lead to better offers. Accuracy is also key. Ensure your information is consistent to avoid issues. Having necessary documents ready streamlines the process.

Recognizing Red Flags and Avoiding Costly Mistakes

Beware of warning signs like consistently negative reviews, frequent complaints, or a history of denied claims. Unusually low premiums can also be a red flag, potentially indicating hidden fees or inadequate coverage. Careful evaluation helps avoid costly mistakes and ensures a smooth transition.

Navigating Applications Like a Pro

Switching insurance providers is a significant decision. It's more than just filling out forms; it's about securing the best rates and coverage for your needs. This section provides a comprehensive guide to navigating the application process, highlighting the essential steps for a smooth transition.

Gathering Essential Documents

Before starting any insurance application, take the time to gather all the necessary documents. This proactive approach can significantly streamline the process and minimize potential delays. Required documents typically include personal identification, proof of address, prior insurance information, and any relevant medical or financial records. For instance, when switching car insurance, having your driver's license and vehicle registration on hand will expedite the process.

Presenting Your Information Strategically

How you present your information can impact your insurance rates. Accuracy and thoroughness are paramount. Answer every question honestly and completely. Furthermore, emphasize positive aspects of your profile, such as a clean driving record or a commitment to healthy living. These details showcase your responsible nature to potential insurers.

Understanding Underwriter Priorities

Underwriters assess risk. Understanding their priorities, which vary depending on the type of insurance, is crucial. Car insurance underwriters often focus on driving history, while health insurance underwriters prioritize medical history and pre-existing conditions. By addressing potential concerns proactively, you can present yourself in the most favorable light.

Streamlining the Process for Faster Approval

A well-organized application can significantly expedite approval. Arrange your materials logically and meticulously follow all instructions. This prevents errors and minimizes processing time. A complete and error-free application demonstrates your diligence and increases the likelihood of a swift approval.

Handling Medical Exams and Property Inspections

Certain insurance types necessitate medical exams or property inspections. Knowing what to expect can alleviate anxiety and ensure a smooth process. For example, a life insurance medical exam may involve blood tests and a physical examination. Preparing for these assessments in advance can make the experience less stressful.

Managing Potential Complications

Occasionally, unforeseen complications can arise during the underwriting process. Proactively address any concerns raised by the underwriter. Provide additional documentation or clarification promptly to avoid delays. This proactive communication reinforces your commitment to securing the coverage and can help expedite the approval process. Understanding the intricacies of switching insurance providers empowers you to navigate the application process effectively and increases your chances of obtaining the coverage you need at a price you can afford.

Mastering the Switch Without Missing a Beat

Switching insurance providers can feel overwhelming. But with careful planning and the right timing, you can transition smoothly. This guide provides a helpful timeline and key tips for coordinating your switch, ensuring continuous coverage and avoiding unexpected costs.

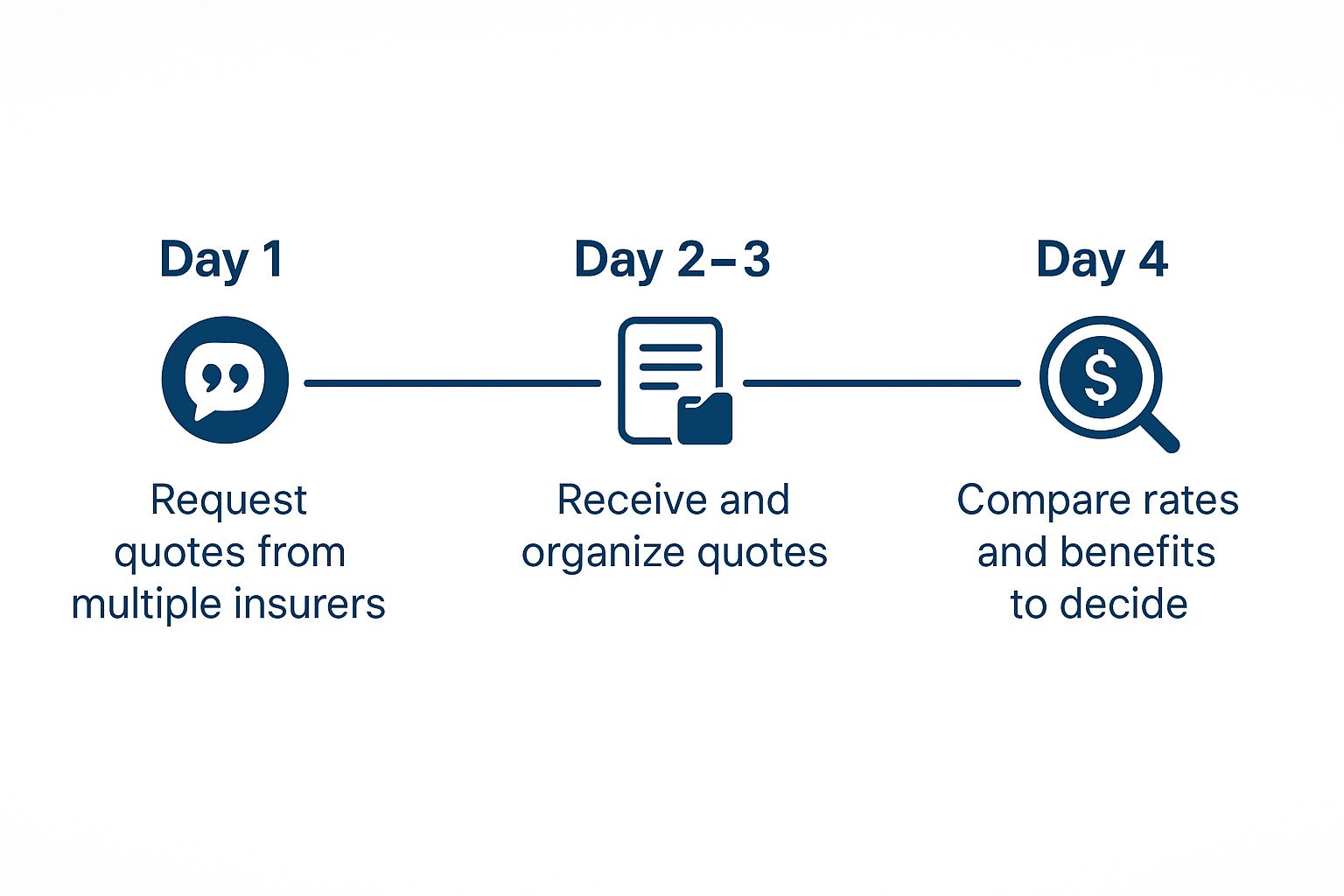

This infographic illustrates the first steps: requesting quotes, organizing them, and comparing rates and benefits. A structured approach to gathering information is essential before making a choice. This method helps ensure you're comparing similar plans and making an informed decision.

Coordinating Start and End Dates

Timing is critical when switching insurance providers. Ideally, your new policy's start date should align with your old policy's end date. This prevents coverage gaps. However, coordinating these dates requires careful planning, particularly if your current policy has specific renewal or cancellation terms.

To ensure a smooth transition, contact both your current and prospective providers to discuss the timing requirements. They can advise on the best approach for aligning your policies.

The Benefits of Overlap Periods

While a seamless transition is the goal, a short overlap in coverage can provide extra security. This overlap, even for a few days, acts as a safety net if unforeseen issues arise. For instance, if there's a processing delay with your new policy, the overlap keeps you covered. This is especially important for health or auto insurance.

While a slight overlap may incur a small additional cost, the peace of mind it provides can be invaluable. Consider this option if you're concerned about potential delays.

Navigating Automatic Renewals and Cancellations

Many insurance policies renew automatically. Understanding your current policy's renewal terms is vital to avoid unwanted charges. Contact your provider to learn about the cancellation process and any penalties for early termination.

Being proactive helps you understand all associated costs and plan accordingly. Don't assume you know the terms; always confirm them directly with your provider.

Managing Payment Timing

Coordinating payments is essential. Be aware of your final payment due date for your old policy and the first payment due date for your new one. This prevents coverage lapses from missed payments.

Some providers offer prorated refunds for unused coverage. Inquire about this to maximize your savings during the switch.

Special Considerations for Different Insurance Types

Different insurance types have unique timing requirements. Health insurance often has specific enrollment periods. Switching outside these periods usually requires a qualifying life event, like marriage or relocation. Auto insurance policies may also have specific cancellation requirements.

Research the specifics for your insurance type to ensure a smooth transition.

To help you visualize the key steps and potential challenges, refer to the table below:

A detailed roadmap showing essential steps, deadlines, and documentation requirements for seamless provider transitions.

Timeline | Action Required | Documentation Needed | Potential Issues |

|---|---|---|---|

2 Months Before Renewal | Research new providers and request quotes | Current policy details, desired coverage levels | Difficulty comparing plans |

1 Month Before Renewal | Compare quotes and select a new provider | Quotes from various providers, policy documents | Unexpected rate increases |

2 Weeks Before Renewal | Finalize application with new provider | Application form, personal information | Delays in application processing |

1 Week Before Renewal | Confirm cancellation of old policy | Cancellation policy, proof of new coverage | Cancellation fees |

Day of Renewal | New policy begins | New policy documents | Discrepancies between expected and actual coverage |

This table outlines the crucial steps involved in switching insurance providers. By following these guidelines, you can minimize potential problems and ensure a seamless transition.

External Factors and Timing Strategies

External factors can also affect timing. Your policy's anniversary date can be a strategic time to switch, potentially reducing cancellation fees. Seasonal trends can also influence rates for certain insurance types. Auto insurance rates, for example, might vary throughout the year.

By understanding these trends and strategically timing your switch, you can maximize potential savings. Careful planning and a proactive approach ensure continuous coverage and a smooth transition.

Smart Money Moves for Maximum Savings

Switching insurance providers can be a complex financial decision. To truly identify potential savings, you need a complete understanding of all the costs involved. This section breaks down these costs, helping you make informed choices when changing insurance.

Calculating the Complete Financial Picture

There's more to the cost of insurance than just the monthly premium. Other factors like application fees, early cancellation penalties, and varying deductibles, copays, and coinsurance can significantly impact your overall expenses. For example, a lower premium might come with a higher deductible. This means lower monthly payments, but higher out-of-pocket costs if you need medical care.

Let's say your current plan has a $500 deductible and a $300 monthly premium. You're considering a new plan with a $250 monthly premium and a $1,000 deductible. While you'd save $50 per month, you'd pay an extra $500 out-of-pocket before your coverage begins if you need to use your insurance. This could easily offset any potential savings. To make the best decision, project your potential medical expenses and compare plans based on their total cost, including premiums, deductibles, and other out-of-pocket expenses.

Minimizing Switching Costs and Maximizing Savings

There are ways to minimize the costs associated with switching insurance providers. Negotiating with your new provider to waive application fees or reduce premiums is a great place to start. Timing your switch to coincide with the end of your current policy can help you avoid early cancellation penalties. Some providers even offer prorated refunds for unused premiums if you switch mid-term.

Managing Premium Refunds and Payment Transitions

When switching providers, understand how your previous provider handles premium refunds. You might receive a refund for the unused portion of your policy. Smoothly managing payment transitions is also essential to avoid gaps in coverage. Setting up automatic payments or reminders for your new policy ensures you don't miss any payments.

Negotiating Better Terms

Don't be afraid to negotiate with your new provider. In a competitive insurance market, providers are often open to offering better rates or waiving fees to attract new customers. This can lead to even more significant savings for you.

Sealing the Deal and Ensuring Everything Works

Switching insurance providers is a multi-step process. It's more than just selecting a plan and completing the application. The final steps are essential for a smooth transition and provide long-term peace of mind. This guide will walk you through canceling your old policy, activating your new one, and confirming everything is working correctly.

Canceling Your Old Policy Gracefully

Once your new insurance policy is active, it's important to promptly cancel your old one. This prevents unnecessary charges and potential complications. However, don't just stop paying your premiums. Instead, contact your former provider directly to officially cancel your policy. This ensures a clean break and avoids potential future issues. Maintaining a positive relationship, even when switching providers, is always a good idea.

Confirming Your New Coverage

After canceling your old policy, immediately confirm your new coverage is active. This is a vital step in the insurance switching process. Carefully review your policy documents and contact your new provider to verify the effective date. Request a certificate of insurance or proof of coverage for your records. This document serves as verifiable proof of your active insurance coverage.

Updating Relevant Parties

Inform all necessary parties about your insurance change. This could include your employer, your bank (if you have automated payments), or any other institutions connected to your previous policy. For auto insurance, be sure to notify your state's Department of Motor Vehicles. For health insurance, update your primary care physician and any specialists you see regularly. This proactive communication helps prevent billing issues and ensures a smooth transition.

Managing Paperwork and Payments

Transferring important documents, such as medical records or claims history, to your new provider is crucial, especially for health insurance, ensuring continuity of care. Redirect any automatic payments to your new policy to avoid missed payments and potential lapses in coverage. Confirm that any automatic payments or reimbursements from your previous policy are correctly transferred to your new one.

Updating Beneficiaries and Additional Insured

If your insurance policy involves beneficiaries or additional insured parties, make sure this information is accurately updated with your new provider. This is particularly important for life insurance policies. Review and update these details to reflect your current wishes and ensure the correct individuals are listed.

Verifying Coverage and Troubleshooting Issues

Test your new coverage to ensure it works as expected. For example, if you have health insurance, schedule a routine check-up to confirm your coverage is processed correctly. Contact your new provider immediately if you encounter any issues. Addressing issues promptly minimizes disruptions and ensures you receive the benefits you are entitled to. Switching insurance providers can also be a good opportunity to review other subscriptions. Consider how to easily change Spotify subscription to optimize your budget.

Maintaining Organized Records

Keep thorough records of your insurance switch. This includes correspondence, policy documents, and cancellation confirmations. These organized documents will be a valuable reference for the future and can be helpful if discrepancies or disputes arise. Organized record-keeping also simplifies future insurance switches.

Avoiding Costly Mistakes and Maximizing Your Success

Switching insurance providers can be a complex process. Making the wrong move can lead to unexpected expenses or gaps in your coverage. This guide uses real-world examples to help you avoid common pitfalls and ensure a smooth transition to a new insurance plan.

Common Mistakes to Avoid

One common mistake is comparing plans without ensuring they offer similar coverage. It’s essential to compare apples to apples, focusing on key features like deductibles, copays, and coverage limits, not just the monthly premium. Overlooking hidden costs, such as application fees or early cancellation penalties, is another frequent error. These seemingly small fees can quickly accumulate. Finally, failing to inform relevant parties about your switch, such as your doctor or employer, can lead to billing issues and administrative headaches.

Actionable Strategies for a Smooth Switch

To avoid these issues, create a checklist of tasks, deadlines, and required documents. This organized approach will keep you on track and minimize the risk of missing crucial steps. Also, maintain open communication with both your current and prospective providers. Ask questions, clarify any uncertainties, and confirm all details in writing to prevent misunderstandings and ensure a seamless transition.

Maintaining Positive Relationships

Even when switching providers, maintain positive relationships. Handle the cancellation process professionally and courteously. Avoid burning bridges, as you may need to interact with your previous provider again in the future. For instance, you might need to request past claims information or documentation for future insurance needs.

Handling Unexpected Complications

Even with careful planning, unexpected problems can occur. Your new policy might not activate on time, or there might be a discrepancy in your coverage. If this happens, contact your new provider immediately and clearly explain the issue. Document all communication, including names, dates, and specific details of your conversations. This documentation can be invaluable if you need to escalate the issue.

Ongoing Monitoring and Future Considerations

Switching insurance providers is an ongoing process. Regularly review your coverage to ensure it still meets your changing needs. Life events like marriage, buying a new house, or starting a family can significantly impact your insurance requirements. Monitor your provider's performance and customer service. Are they responsive to your inquiries and efficient in handling claims? If not, you might consider switching providers again. Just as you evaluated options initially, periodically reassess your coverage and provider to ensure you have the best possible protection at the best possible price.

Protect your family's future with reliable and affordable insurance. Get a free quote from America First Financial in under three minutes and discover how we can help you secure your financial well-being.

_edited.png)

Comments