HSA Contribution Limits 2024: Maximize Your Tax Savings

- dustinjohnson5

- Aug 4, 2025

- 9 min read

Let's get right to the numbers. For 2024, the IRS has officially announced the new Health Savings Account (HSA) contribution limits. You can now put away up to $4,150 for self-only coverage or a hefty $8,300 for family coverage.

It's important to remember that this isn't just your contribution limit—it's the total amount that can go into the account for the year, combining what you put in with any contributions your employer makes on your behalf.

Your 2024 HSA Contribution Limits at a Glance

The IRS adjusts these limits annually to account for inflation, and the jump for 2024 was one of the biggest we've seen in a while. This is great news, as it means you can tuck away more tax-free money to cover rising healthcare expenses.

To be precise, the 2024 HSA contribution limits increased to $4,150 for individuals and $8,300 for families. If you want a deeper dive into these inflation-related adjustments, you can find more details from the IRS and see how they might affect your financial strategy.

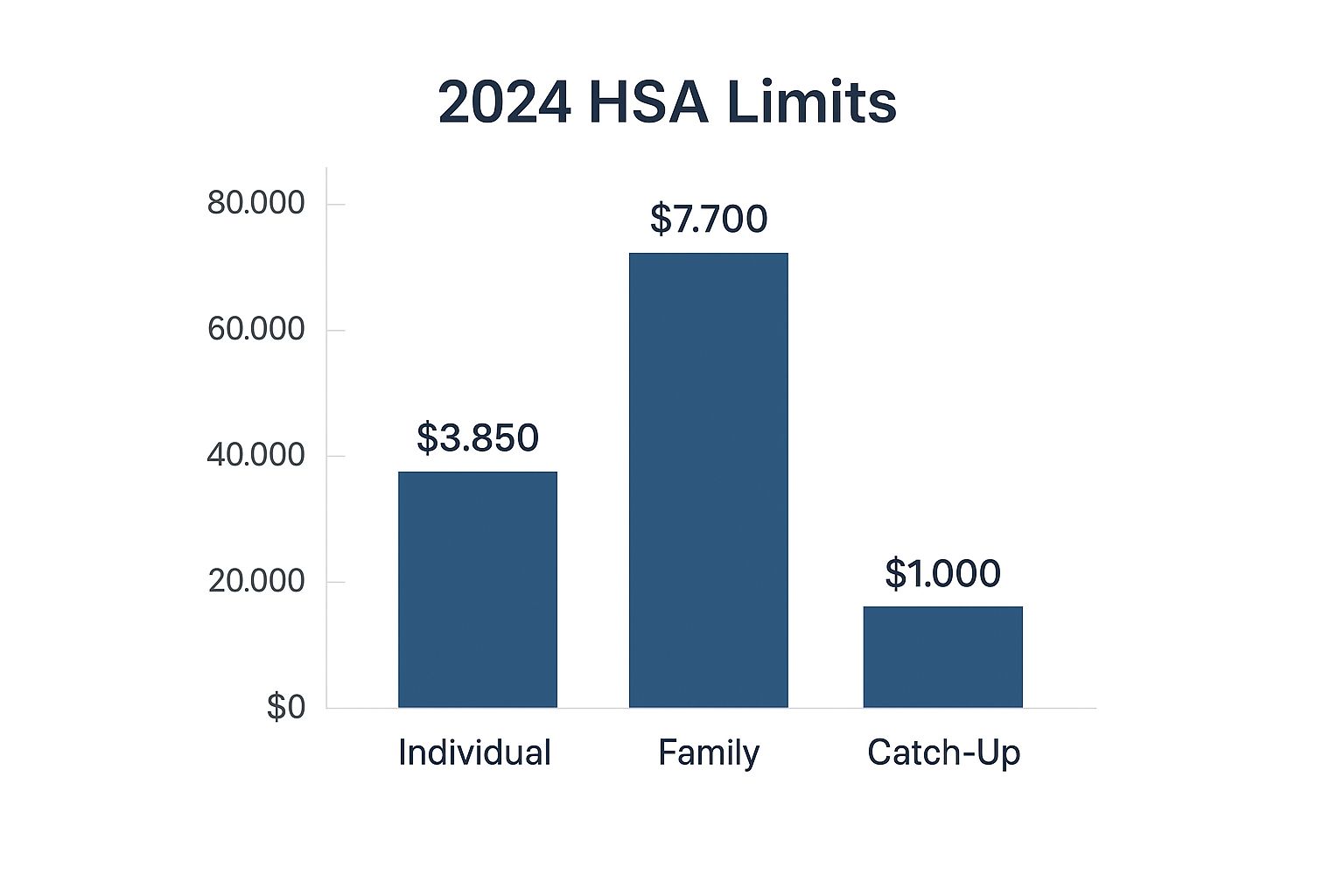

This handy graphic lays it all out visually.

As you can see, the infographic clearly displays the maximums for both individual and family plans, along with the extra catch-up contribution available if you're 55 or older (more on that in a bit).

Thinking about these numbers as hard caps is the best way to approach it. Once you hit that limit from all sources—you, your spouse, your employer—that’s it for the year.

To see just how significant this year's increase is, let's compare the numbers side-by-side.

HSA Contribution Limit Comparison

This table breaks down the changes from last year to this year, making it easy to see how much more you can save.

Coverage Type | Current Year Maximum | Previous Year Maximum | Year-Over-Year Increase |

|---|---|---|---|

Self-Only | $4,150 | $3,850 | $300 |

Family | $8,300 | $7,750 | $550 |

Catch-Up | $1,000 | $1,000 | $0 |

The takeaway here is simple: make sure you don't go over these maximums. Exceeding the limit can trigger tax penalties, which is something we all want to avoid.

Your HSA Is More Than a Savings Account

It’s easy to think of a Health Savings Account (HSA) as just a special piggy bank for doctor visits and prescriptions. But that view misses the bigger picture. In reality, an HSA is one of the most powerful financial tools you can have, designed to both protect your family’s health and build serious long-term wealth.

Think of it less like a simple savings account and more like a supercharged retirement plan specifically for healthcare. The reason it’s so powerful comes down to a triple-tax advantage that you simply can't find in any other account. Once you grasp this, you'll see why an HSA is so much more than a way to pay for your next check-up.

The Unbeatable Triple-Tax Advantage

What makes an HSA stand out? It’s all about how your money is treated from start to finish. This isn't just about stashing cash for a rainy day; it's about making every dollar work harder for you.

Here’s a breakdown of the three tax benefits that make HSAs unique:

Contributions are tax-deductible. The money you put into your HSA can be deducted from your income for the year. This means you lower your overall tax bill right off the bat, giving you an immediate financial win.

Your money grows tax-free. Once inside the HSA, your funds can be invested in stocks, bonds, or mutual funds. All the earnings and growth from these investments are completely tax-free. No capital gains tax, ever.

Withdrawals are tax-free. As long as you use the money for qualified medical expenses—anything from copays and dental work to contacts and chiropractic care—your withdrawals are 100% tax-free.

This incredible combination makes your HSA an unbelievably efficient tool for both managing today's healthcare costs and building a nest egg for whatever comes next.

An HSA is the only account that provides a tax deduction on the way in, tax-free growth, and tax-free withdrawals for qualified expenses. It’s a financial powerhouse.

And here's another key difference: unlike a Flexible Spending Account (FSA), your HSA is not a "use-it-or-lose-it" account. The full balance rolls over year after year. It’s your money, and it stays with you even if you switch jobs, change insurance plans, or retire. This stability is what transforms an HSA from a simple spending account into a true long-term investment vehicle.

How Do You Qualify for an HSA?

So, you've heard about the triple-tax advantage of a Health Savings Account (HSA) and are ready to jump in. That’s great, but not just anyone can open one. Think of it less like a regular savings account and more like a VIP club with specific entry rules. The main ticket you need is a certain kind of health insurance plan.

The absolute must-have for HSA eligibility is being covered by a qualified High-Deductible Health Plan (HDHP). Now, this isn't just any insurance plan that happens to have a high deductible; it has to meet specific standards set by the IRS each year. When you're shopping for plans, understanding your health insurance premium costs is important, but making sure the plan is officially an HDHP is the key that unlocks the HSA door.

For 2024, an HDHP is defined as a plan with:

A minimum annual deductible of $1,600 for an individual.

A minimum annual deductible of $3,200 for a family.

A Few More Rules to Keep in Mind

Having the right health plan is the biggest piece of the puzzle, but there are a few other boxes you need to check. These rules are in place to make sure HSAs are used for their intended purpose—helping people with HDHPs save for medical costs—and to prevent anyone from getting duplicate tax breaks.

The core idea is simple: an HSA is the exclusive partner of an HDHP. If you have other types of health coverage, you generally can't contribute.

So, on top of having a qualified HDHP, you also need to meet these three conditions:

No Other Competing Health Coverage: You can't be covered by another health plan, like a traditional PPO or HMO, that isn't an HDHP. This even applies if you're covered as a spouse on someone else's non-HDHP plan.

You Can't Be Enrolled in Medicare: The moment you sign up for any part of Medicare (even just Part A), your eligibility to contribute to an HSA stops.

You Can't Be Claimed as a Dependent: If someone else, like a parent, can claim you as a dependent on their tax return, you aren't able to open and fund your own HSA.

If you can say "yes" to having an HDHP and "no" to those three disqualifiers, then congratulations! You're eligible to start contributing to an HSA and take full advantage of its powerful tax savings.

Supercharge Your Savings with Catch-Up Contributions

As you get closer to retirement, you start thinking about every dollar in a different light. The good news is, the IRS understands this. They've built a fantastic savings booster right into the HSA rules called a catch-up contribution, specifically designed to help people bulk up their healthcare funds as retirement nears.

If you’re 55 or older by the last day of the tax year, you’re eligible to put an extra $1,000 into your HSA. This isn't part of the regular contribution limit; it's a bonus you can add right on top, giving your savings a serious boost when you need it most.

How Catch-Up Contributions Work in Practice

So, what does this look like in the real world? Imagine a 58-year-old with a self-only health plan. For 2024, they can contribute the standard $4,150 and their $1,000 catch-up amount. That brings their total tax-advantaged contribution for the year to a hefty $5,150.

Now, this is where a lot of people get tripped up, especially married couples. The catch-up contribution is personal. It’s tied to the individual, not the family plan. This means if both you and your spouse are over 55, you can't just drop an extra $2,000 into a single, shared family HSA.

Key Rule: Each spouse who wants to make a catch-up contribution must have their own separate HSA account. You cannot make two catch-up contributions into a single HSA.

This structure is actually designed to help both partners maximize their savings. To make it work, you just need to set it up correctly.

Spouse A (age 57) needs their own HSA to contribute their $1,000 catch-up.

Spouse B (age 60) also needs a separate HSA for their $1,000 catch-up.

You can still split the standard family contribution of $8,300 between those two accounts any way you see fit. But to get the full $2,000 in catch-up savings, you absolutely need two distinct accounts. Taking this step is a simple but powerful way to optimize your family's finances for healthcare in retirement.

The Hidden Power of HSAs in Your Financial Future

Think of a Health Savings Account (HSA) as more than just a place to stash cash for doctor's visits. It’s one of the most powerful and often overlooked tools in modern financial planning. The old view of an HSA as a simple medical piggy bank is fading fast, replaced by the reality that it's a strategic asset for building a secure future.

The numbers tell a compelling story. With consistent contributions and rising hsa contribution limits 2024, these accounts are accumulating serious wealth. By late 2023, Americans held nearly 37 million HSAs, totaling a massive $123 billion in assets. That's a huge 19% jump from the previous year, and experts predict that number will climb to $168 billion by 2026.

Transforming Savings into a Retirement Engine

So, what’s behind this explosive growth? People are finally catching on to the HSA's secret superpower: it can operate a lot like your 401(k), but with even greater flexibility for healthcare costs.

Many account holders don't know that once their balance hits a certain minimum—often just $1,000—they can invest the funds. This is a complete game-changer. Your account instantly transforms from a passive savings pot into an active growth engine for your long-term goals.

Just like with other investment accounts, you can put your HSA dollars to work in a portfolio of stocks, bonds, and mutual funds. The best part? Your money grows tax-free. Over time, this compounding potential makes the HSA an indispensable tool for tackling one of retirement's biggest wild cards: healthcare expenses.

By investing your HSA funds, you're not just saving for future medical bills—you're building a dedicated, tax-free fund to protect your retirement savings from being drained by healthcare costs down the road.

This kind of forward-thinking is what smart financial management is all about. If you want to dive deeper into building a solid financial foundation and see how tools like HSAs fit into the bigger picture, checking out some of the best personal finance books can provide fantastic context and actionable strategies.

Common HSA Questions Answered

Even when you know the rules, using a Health Savings Account in the real world can bring up some tricky situations. Getting the details right is the key to getting the most out of your HSA and keeping everything above board with the IRS.

Let's walk through some of the most common questions people run into.

What Happens If I Contribute Too Much to My HSA?

It’s a surprisingly common mistake. Maybe you switched jobs mid-year or your employer’s contributions were higher than you expected. Whatever the reason, if you contribute more than the annual limit, you'll get hit with a 6% excise tax on that excess amount.

Worse yet, that penalty isn't a one-time thing. It applies every year the extra money sits in your account. The best move is to fix it fast. To avoid the penalty, you’ll need to withdraw the excess funds—plus any earnings they generated—before the tax filing deadline, which is usually April 15th.

Does My Employer's Contribution Count Toward My Limit?

Yes, it absolutely does. Think of the annual HSA limit as one big bucket. Every dollar that goes in, whether from you or your employer, helps fill it up.

For example, let's say you're on a family plan in 2024, so your total limit is $8,300. If your company generously chips in $1,000, you are personally able to contribute up to $7,300. It's crucial to keep an eye on both sources to make sure you don't accidentally go over.

Can I Change My HSA Contribution Amount Mid-Year?

Here’s one of the best parts about an HSA: its flexibility. Unlike many other workplace benefits, you’re not locked into your contribution amount for the whole year.

You can adjust how much you contribute anytime. If you get a raise and want to max out your hsa contribution limits 2024, you can bump up your payroll deductions. If money gets tight, you can scale them back. Just check with your HR department or benefits portal to make the change.

What is the deadline to make HSA contributions? You have until the federal tax filing deadline—typically April 15th of the following year—to make contributions for any given tax year. This gives you a little extra time to get those last-minute contributions in and maximize your tax savings.

At America First Financial, we believe in protecting your family’s financial well-being with clear, dependable insurance solutions. Secure your future with coverage that aligns with your values. Get a straightforward, no-obligation quote in just minutes. Explore your options with America First Financial today.

_edited.png)

Comments