Is Life Insurance Premium Tax Deductible? Find Out Now

- dustinjohnson5

- Aug 6, 2025

- 13 min read

It's one of the most common questions people ask about their finances: are life insurance premiums tax-deductible? For most of us, the answer is a simple and direct "no." The Internal Revenue Service (IRS) puts these payments in the same bucket as other personal expenses, like your mortgage or grocery bill.

But that's not the whole story. When you step into the world of business, the rules of the game change completely.

The Quick Answer on Life Insurance Tax Deductions

When you buy a personal life insurance policy, you're using your own after-tax money to create a financial cushion for your family. Since the core purpose is personal protection, the government doesn't let you write off the premiums on your tax return. The IRS is quite clear on this, classifying them as non-deductible personal expenses. You can learn more straight from the source on how the IRS treats personal expenses.

Things look very different from a business perspective, though. Companies often take out life insurance policies for very specific, strategic reasons—like offering a benefits package to employees or insuring against the loss of a critical executive. When the policy serves a legitimate business purpose, the premiums can often be deducted as a necessary cost of doing business.

Key Takeaway: It all boils down to the why. If the policy is for your family's protection, it's personal and not deductible. If it serves a clear business need, it often is.

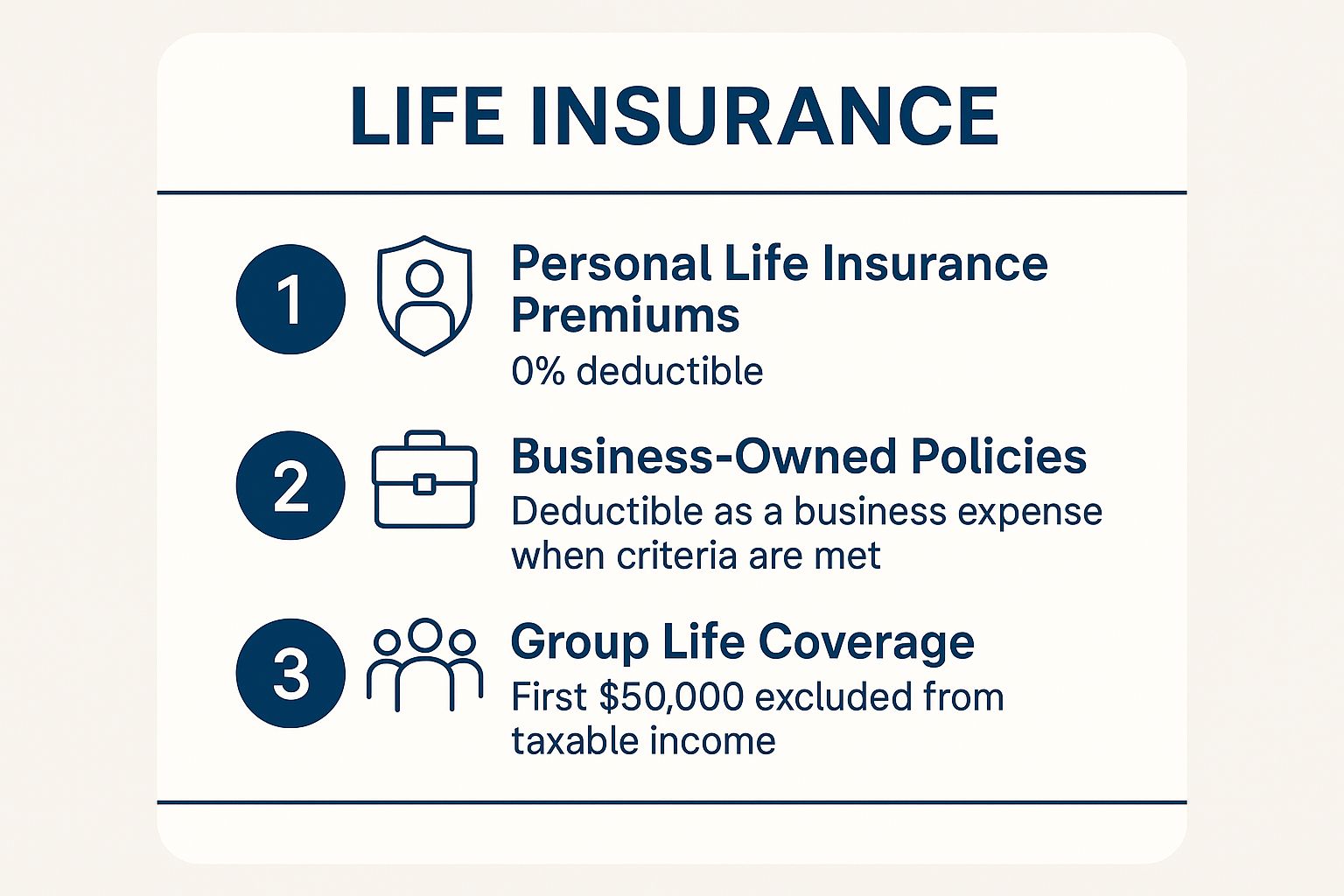

This visual gives you a great snapshot of when life insurance premiums might be deductible.

As you can see, the line is drawn pretty clearly between policies for individuals and those for businesses that meet certain IRS criteria. Getting a handle on this fundamental difference is the first real step to understanding the tax rules for your own life insurance.

Before we get into the nitty-gritty for each scenario, let's put them side-by-side for a quick comparison.

Life Insurance Premium Deductibility at a Glance

To make this even clearer, here's a simple table that breaks down the most common situations you'll encounter. It's a handy reference for seeing who gets to deduct their premiums and under what circumstances.

Policyholder Type | Is Premium Tax Deductible? | Key Conditions |

|---|---|---|

Individual / Personal | No | Premiums are considered a personal expense and must be paid with after-tax dollars. |

Business (Group-Term) | Yes | Policy must be part of an employee benefits plan. Coverage over $50,000 can have tax consequences for the employee. |

Business (Key Person) | Yes, with conditions | The business cannot be the direct or indirect beneficiary of the policy for the premiums to be deductible. |

Alimony / Divorce Decree | No, generally | The Tax Cuts and Jobs Act of 2017 eliminated this deduction for divorce or separation agreements executed after 2018. |

This table shows that while personal policies are straightforwardly non-deductible, business-related insurance is much more nuanced. The devil is truly in the details, especially when it comes to who benefits from the policy.

Why Your Personal Policy Premiums Aren't Deductible

So, you're wondering, "can I deduct my life insurance premiums on my taxes?" When it comes to a personal policy meant to protect your family, the IRS has a very firm—and very consistent—answer: no. The logic here is pretty simple, and it all comes down to the clear line the tax code draws between a personal benefit and a business expense.

Let's use an analogy. You can't write off your grocery bill, even though food is obviously critical to your survival. The IRS views your personal life insurance policy in much the same way. It’s a personal financial choice you make to secure a private benefit: a financial safety net for your family.

The Personal Expense Rule

At its heart, the money you pay for your term or whole life insurance policy is classified as a personal expense. This means you're paying those premiums with after-tax dollars—the money left in your bank account after Uncle Sam has already taken his share from your paycheck.

The government sees this as you using your own funds to buy a personal product, just like you would a car or a family vacation. Since the whole point of the policy is to benefit your chosen beneficiaries, like your spouse or kids, it doesn't qualify as a deductible business expense.

The core principle is straightforward: If an expense serves a personal need, you generally can't deduct it. Protecting your family is a personal goal, so the premiums are a personal cost.

This is a crucial distinction to grasp. While not getting a deduction might feel like a letdown, it actually paves the way for a much more significant tax advantage later on.

Personal Life Insurance's Real Tax Superpower

Here’s where the trade-off gets good. Really good. While you don't get a tax break for paying the premiums, the eventual payout from the policy gets incredible tax treatment.

Thanks to Section 101(a) of the Internal Revenue Code, the death benefit paid to your beneficiaries is almost always 100% income-tax-free.

This is the true tax magic of personal life insurance. It means that if you have a $500,000 policy, your loved ones receive the full $500,000. They don't have to report it as income or worry about a massive tax bill. For most families, this tax-free windfall is infinitely more valuable than a small annual deduction would ever be.

How Businesses Can Deduct Life Insurance Premiums

While the answer is a hard "no" for individuals wanting to deduct life insurance premiums, the story is completely different in the business world. For a company, a life insurance policy isn't just a personal safety net; it’s a strategic financial tool. Businesses use it for everything from employee compensation to ensuring stability and planning for succession. When structured correctly, the premiums can absolutely be a valid and deductible business expense.

This isn't just a U.S.-centric idea. It reflects a broader global approach to taxation. An analysis by the Organization for Economic Cooperation and Development (OECD) points out that while individual premiums are treated as personal spending, policies bought by a business are often recognized as legitimate operational costs. This makes the premiums deductible in many contexts. You can dig into their research on taxing insurance companies for more details.

The entire strategy hinges on one thing: demonstrating a clear business purpose. So, let’s get into the specific scenarios where this powerful tax advantage can be unlocked.

Group-Term Life Insurance for Employees

One of the most straightforward ways for a business to deduct life insurance premiums is by offering group-term life insurance as an employee benefit. In today's competitive market, it's a fantastic perk that helps you attract and keep great people.

When a company provides this coverage as part of a formal benefits package, the premiums are generally 100% tax-deductible for the business. The IRS sees it as an ordinary and necessary business expense, no different than paying for health insurance or contributing to a 401(k) plan.

The deal gets even sweeter for the employees.

The first $50,000 of coverage provided by the company is usually a tax-free benefit. The employee doesn't have to report its value as income.

If the coverage goes above $50,000, the cost for the extra amount (which the IRS calculates using a specific table) is considered "imputed income" and becomes taxable to the employee.

This creates a true win-win situation. The business gets a full tax deduction, and the employee receives a valuable benefit, almost entirely tax-free.

Key Person Insurance and Buy-Sell Agreements

Beyond standard employee benefits, businesses often turn to life insurance to shield themselves from major financial shocks. This is where you see policies like key person insurance and those used to fund buy-sell agreements.

The Crucial IRS Rule: For a business to deduct premiums on policies like key person insurance, the business itself cannot be the direct or indirect beneficiary. If the company stands to receive the tax-free death benefit, the premiums are not deductible.

This is a very common point of confusion, so let’s break it down. Think of it like this: the IRS won't let you get a tax deduction for an investment (the premiums) that will eventually pay you back with tax-free money (the death benefit). That’s a classic case of "double-dipping," and the tax code is designed to prevent it.

So, when can a business deduct these types of premiums?

Employee-Owned Policies: If the policy is part of a compensation package where the employee actually owns the policy and gets to name their own beneficiary, the premiums can be deductible for the business as a form of employee compensation.

Split-Dollar Arrangements: Some highly specialized split-dollar life insurance plans may allow certain parts of the premium payments to be deducted. These are complex and absolutely require careful planning with an experienced tax professional to set up correctly.

As you can see, the question "is life insurance premium tax deductible" gets a very different answer when you shift from a personal to a business perspective. While most of us can't claim this deduction, businesses have several legitimate paths to turn insurance into a tax-advantaged asset for both employee compensation and long-term company protection.

Uncovering Rare Exceptions for Individuals

While the rule against deducting personal life insurance premiums is pretty solid, the tax code always has a few dusty corners with some very specific exceptions. For most people, these won't ever come into play. Still, knowing about these niche scenarios gives you the full picture and ensures you don't overlook a potential deduction, however rare.

Think of the standard "no deduction" rule as the main highway. These exceptions are the little-known back roads that only a handful of people will ever need. They're narrow, specific, and come with a strict set of directions you have to follow perfectly. The most common of these rare situations involves court-ordered payments stemming from a divorce.

Alimony and Court-Ordered Policies

Before a major tax overhaul a few years back, one of the clearest individual exceptions was tied to alimony. If a divorce decree finalized before December 31, 2018, required one person to pay the premiums on a life insurance policy for their ex-spouse's benefit, those payments could be deducted as alimony.

Important Tax Law Change: The Tax Cuts and Jobs Act of 2017 (TCJA) completely did away with the alimony deduction for any divorce or separation agreements made after 2018. This means this specific life insurance exception is now a legacy rule that only applies to older, pre-2019 agreements.

For those whose divorce decrees fall into that grandfathered, pre-2019 window, here’s how it worked:

It Had to Be Court-Ordered: The life insurance policy had to be explicitly mandated by the official divorce decree. A verbal agreement wouldn't cut it.

Ownership Was Key: The ex-spouse receiving the alimony had to be the owner of the policy, and the person paying the premiums could not be a beneficiary.

Treated Like Alimony: The premium payments were handled just like regular cash alimony. They were deductible for the payer and, on the flip side, counted as taxable income for the person receiving the benefit.

If your divorce agreement is from before 2019 and has this kind of provision, that's a detail worth bringing up with your tax pro. For any agreements from 2019 on, this deduction is off the table.

Life Insurance as Business Loan Collateral

Here’s another highly specific exception that can pop up: using a personal life insurance policy as collateral for a business loan. This is one of those situations where the line between a personal and a business expense gets a little blurry.

Let’s say you're a sole proprietor and you take out a loan to buy new equipment for your business. If the bank requires you to assign a life insurance policy to them as security for that loan, the IRS might—and I stress might—let you deduct the premiums.

The rules here are incredibly strict. The premium payments must qualify as an ordinary and necessary business expense. To make your case, you have to prove that the lender made the policy a non-negotiable condition for the loan and that the policy's only purpose is to secure that specific business debt.

This isn't a deduction you can just casually claim. It demands meticulous documentation to keep the IRS happy, so it’s absolutely essential to talk it over with a financial advisor before you even think about trying it.

A Global View on Life Insurance Tax Rules

When you ask, "Are my life insurance premiums tax-deductible?" you're really asking a question specific to the U.S. tax code. But it's easy to forget that the American system is just one way of doing things. Taking a quick trip around the world reveals a completely different picture and shows that tax policy is always a choice, not a given.

In many countries, governments actively use their tax systems to nudge citizens toward buying life insurance. They see it as a vital tool for creating widespread financial stability. So, unlike the U.S. model, which generally classifies personal premiums as a non-deductible expense, other governments treat it as a public good worth incentivizing. This global context really helps you understand the why behind different tax laws.

How Other Countries Encourage Coverage

It might surprise you just how many governments offer tax breaks for life insurance. A wide-ranging study confirmed that these kinds of fiscal incentives are an incredibly popular policy tool all across the globe.

In fact, according to a massive dataset covering 132 countries, roughly 47% of them (62 in total) allow policyholders to deduct life insurance premiums from their income tax. That means nearly half the countries surveyed provide a direct tax benefit to make coverage more affordable for their citizens. You can dig into the complete findings in this World Bank report on fiscal incentives for long-term life insurance development.

This highlights a fundamental difference in philosophy. While the U.S. provides its major tax advantage on the back end—the tax-free death benefit—many other nations choose to help on the front end by making the premiums themselves more manageable through deductions.

This global perspective drives home the point that the U.S. approach is just one of many. Different countries weigh the economic benefits differently, with many concluding that a direct tax deduction is the best way to promote individual and family security.

Why This Global Context Matters

Knowing that other countries successfully use tax deductions for life insurance adds some valuable perspective. It proves there isn't one "right" way to structure tax law around this financial product. It all comes down to a nation's specific economic goals and social priorities.

For those of us in the U.S., this insight actually reinforces the unique value proposition of American life insurance:

No Deduction, But a Tax-Free Payout: You're essentially trading an annual premium deduction for something far more powerful: an income-tax-free death benefit for your loved ones.

Simplicity for Individuals: For personal policies, the U.S. rule is refreshingly straightforward, sparing most people from complex tax calculations every year.

Seeing how policies differ around the world helps you appreciate the specific trade-offs and benefits of the system you're in. It's a great reminder that the tax treatment of your policy is just one part of a much larger economic strategy.

Frequently Asked Questions on Life Insurance and Taxes

Once you get a handle on the basic rules, the real-world questions start popping up. It's completely normal. The intersection of taxes and life insurance is full of specific scenarios, and getting clear, straightforward answers is what helps you make smart financial moves.

This FAQ section is designed to tackle the most common questions I hear from clients. We'll cut through the jargon and give you the direct answers you need to navigate your own situation with confidence.

If I Can't Deduct My Premiums, Is the Death Benefit Taxable?

In almost all cases, no. This is the single biggest tax advantage of having personal life insurance. While you don't get to write off the premiums you pay, the money your beneficiaries receive—the death benefit—is typically 100% income-tax-free.

Think of it as a trade-off the tax system makes. Instead of a small annual deduction, your family gets a much more powerful benefit later on. If you have a $1 million policy, your loved ones get the full $1 million. They don't have to report it as income, and they don't owe federal taxes on it. For most families, this is a financial lifeline.

Are there exceptions? Of course, but they're rare and usually involve complex situations, like a policy being sold to a third party (a "transfer-for-value"). For the vast majority of personal policies, you can count on this crucial tax-free benefit to protect your family's future.

Can I Deduct Premiums I Pay for My Spouse or Child?

This is a great question, but the answer is a simple no. Paying for a life insurance policy on someone else, like your spouse or child, doesn't change the underlying tax rules.

The IRS views these payments as a personal expense, the same as if you were buying the policy for yourself. The ability to deduct a premium always comes down to the purpose of the policy. Since protecting a family member is a personal goal, not a business one, the premiums are paid with after-tax money and can't be written off.

For those looking to make sure their life insurance fits perfectly into their broader financial picture, using professional wills and estate document preparation services can be invaluable. It helps ensure the policy works in concert with your entire legacy plan.

How Much Group Life Insurance Premium Can My Business Deduct?

When it comes to group life insurance offered by an employer, the rules are very generous for the business. As an employer, you can generally deduct the full premium cost for the group-term life insurance you provide to your team. The IRS treats this as a standard cost of doing business, just like health insurance or 401(k) contributions.

The tax picture for the employee is also great, but there's an important threshold to know.

Tax-Free Perk: The first $50,000 of coverage you provide is a completely tax-free benefit for the employee. They pay nothing for this valuable protection.

Taxable Excess: If you offer more than $50,000 in coverage, the cost of the extra insurance becomes taxable income for the employee. This is called "imputed income," and the IRS has a specific formula to calculate its value.

The bottom line: The business gets a full deduction, and the employee gets a significant, tax-free benefit. It's a win-win that makes group-term life insurance a highly efficient way to compensate your team.

What Records Do I Need to Deduct Business Life Insurance Premiums?

If your business is claiming a deduction for life insurance premiums, documentation is everything. The IRS needs to see proof that the expense is legitimate, so keeping meticulous records isn't just a good habit—it's essential. You have to be ready to justify the deduction.

Here’s what you absolutely need to keep on file:

The Policy Itself: A complete copy of the life insurance contract.

Proof of Payment: Canceled checks, bank statements, or wire transfer confirmations for every premium paid.

Documentation of Business Purpose: This is the most critical part. You need official records that spell out why the policy exists. For group-term insurance, this would be your formal employee benefits plan documents. For key person insurance, it might be board meeting minutes that explain the employee's vital contribution to the company.

Most importantly, you must be able to prove that your business is not a direct or indirect beneficiary of the policy. If the company is set to receive the tax-free death benefit, the premiums are not deductible. Period.

At America First Financial, we believe in providing clear, straightforward protection for your family's future, free from outside noise. Our commitment is to offer reliable term life, disability, and health care plans that safeguard your assets and support your financial stability. Secure your family's future with a partner that shares your values. Get a quick, no-hassle quote online in under three minutes and discover the peace of mind that comes with dependable coverage. Find your plan today at https://www.americafirstfinancial.org.

_edited.png)

Comments