Life Insurance for a Married Couple: Secure Your Future

- dustinjohnson5

- Sep 17, 2025

- 16 min read

When you get married, your finances and futures become one. Life insurance is the financial safety net that catches your surviving partner, protecting them from shared debts and the sudden loss of your income. It's a fundamental tool for making sure the plans you've made together can still happen, offering real peace of mind for the future you're building.

Why Life Insurance Is a Cornerstone of Your Marriage

Without that foundation, the surviving spouse is left trying to carry the weight of everything you built on their own. It’s not just about replacing a paycheck; it’s about creating stability during one of life's most challenging moments.

Protecting Your Shared Financial World

Let's picture a couple, Alex and Jordan. They've just bought their first house, share a car loan, and are thinking about kids. Their finances are completely intertwined. If Alex were to pass away unexpectedly, Jordan would be solely responsible for the mortgage, the car, and all their other bills on just one income.

Life insurance is designed to solve this exact problem. It provides a tax-free cash payout, known as a death benefit, that your partner can use for immediate and long-term needs:

Covering final expenses, like funeral costs or leftover medical bills.

Paying off the mortgage so they don't have to worry about losing their home.

Wiping out shared debts, including car loans, student loans, or credit card balances.

Replacing lost income to help maintain the family's standard of living.

Life insurance is more than a financial product; it’s an act of partnership. It’s a tangible way of saying, "I will protect you and the life we’ve built, no matter what happens."

This kind of protection is a big deal. The global life insurance market was valued at $3.1 trillion in 2024, which shows just how vital it is for families everywhere. In the U.S., about 51% of adults have some form of coverage, but many admit they don't have enough. This gap is why it's so important for couples to sit down and have this conversation. You can find more global life insurance trends and statistics at Feather Insurance.

An Investment in Each Other's Future

When you buy life insurance as a couple, you’re not just planning for the worst; you're investing in the promises you've made to each other. It’s what ensures that big dreams—like sending a child to college or enjoying a secure retirement—can still come true.

By putting a policy in place, you’re actively protecting your partner’s future and preserving the financial stability you've both worked so hard to build.

Choosing Your Policy: Individual vs. Joint Coverage

When you’re married, one of the first big decisions you'll make about life insurance is how to structure it. Should you each get your own policy, or share a single one? It's a bit like deciding on bank accounts—some couples keep everything separate for autonomy, while others merge their finances into a joint account for shared goals.

There's no single "right" answer here. The best choice really boils down to your family's specific financial picture and what you want the insurance to accomplish. Let's walk through the options so you can figure out what makes the most sense for you.

The Case for Individual Policies

This is the most straightforward route: one policy for you, one for your spouse. Each policy is a separate contract with its own coverage amount, term length, and beneficiaries. This setup gives you maximum flexibility and control.

For instance, if one of you is the primary breadwinner, their policy might be significantly larger to replace that lost income. The other's policy could be tailored to cover crucial contributions like mortgage payments, childcare, and running the household. It allows you to customize the protection to fit each person's role.

Key Takeaway: With individual policies, you get two separate death benefits. If the unthinkable happened and both partners passed away, your beneficiaries—like your children—would receive two distinct payouts, creating a much stronger financial safety net.

This structure is also much cleaner if life takes an unexpected turn. In the event of a divorce, you each just keep your own policy. There's no messy process of trying to split or cancel a shared asset. It’s a simple, adaptable solution.

Understanding the Two Types of Individual Coverage

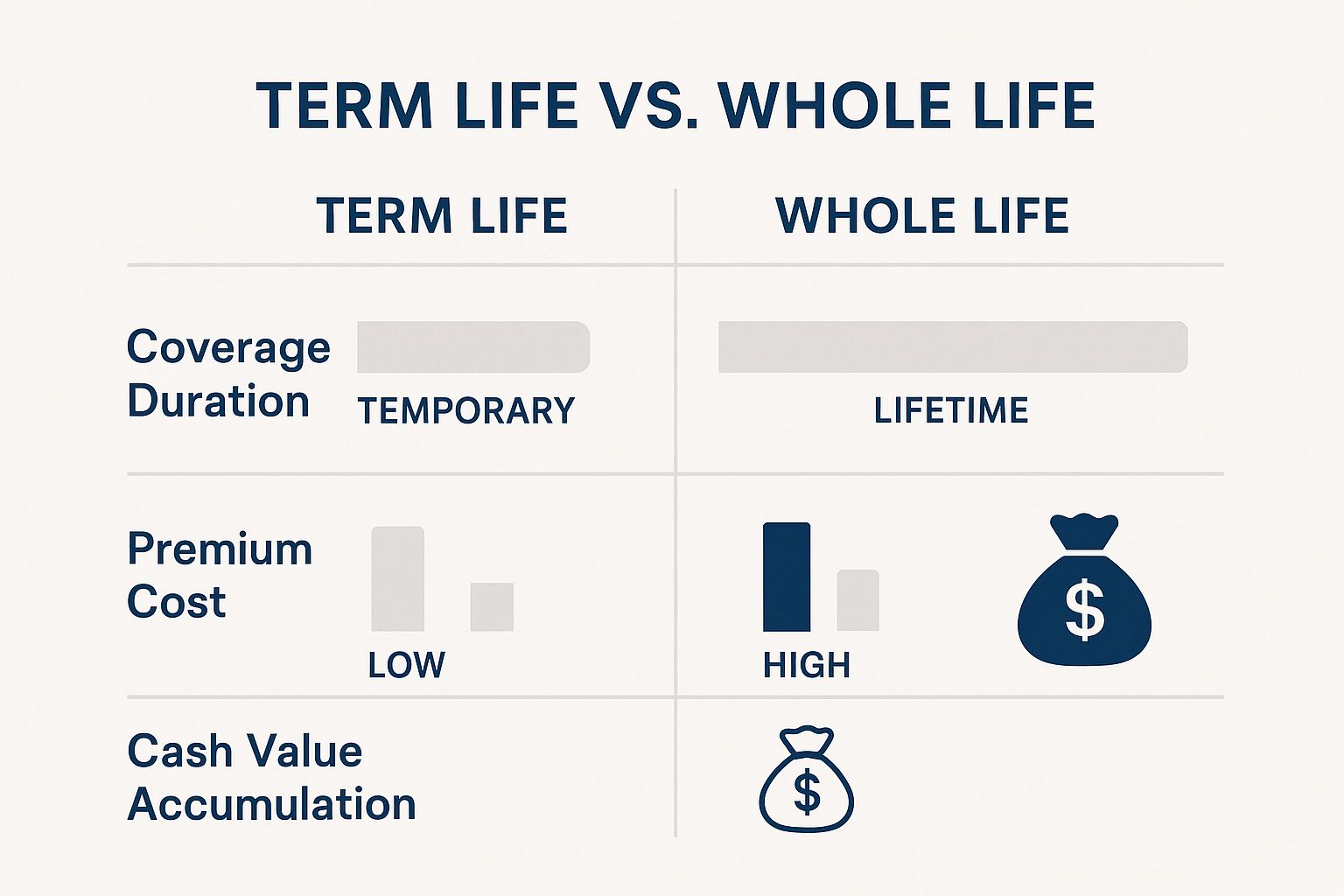

Most individual policies fall into two buckets: Term Life and Whole Life. Think of it like renting versus buying a house. One is for a specific period, and the other is for good.

The image below gives you a great visual on how they stack up in terms of how long they last, what they cost, and whether they build cash value.

As you can see, Term Life is the more affordable, "for now" option, while Whole Life is a permanent fixture that includes a savings-like component.

It's crucial that both of you are part of this conversation. For a long time, there’s been a noticeable gender gap in life insurance coverage. The 2025 Insurance Barometer Study pointed out that 54% of men have life insurance, while only 48% of women do. Making sure both spouses are adequately protected is fundamental to a truly solid financial plan. You can discover more insights about life insurance ownership trends in the full study.

The Alternative: Joint Life Insurance

A joint policy is a single plan that covers two people, and it often comes with a slightly lower premium than buying two separate policies. That "two-for-one" price can sound appealing, but there's a huge string attached: it almost always pays out only once.

There are two main flavors of joint life insurance for couples:

First-to-Die: This policy pays the death benefit when the first spouse passes away. The surviving partner gets the money, but then the policy ends. This leaves the survivor without any coverage, forcing them to find a new policy at an older age, which will inevitably be more expensive.

Second-to-Die (Survivorship): This one works the opposite way. It only pays out after both spouses are gone. It’s not meant to provide for the surviving partner at all. Instead, it’s a specialized tool for estate planning, typically used to pay estate taxes or to leave a large, tax-free inheritance for the kids.

To help clarify the trade-offs, let's compare these options side-by-side.

Individual vs. Joint Life Insurance Policies Compared

Feature | Individual Policies (2 separate policies) | Joint First-to-Die Policy | Joint Second-to-Die (Survivorship) Policy |

|---|---|---|---|

Payout | Two separate death benefits; pays out upon each partner's death. | One death benefit; pays out only when the first partner dies. | One death benefit; pays out only after both partners die. |

Cost | Generally more expensive than a single joint policy. | Typically cheaper than two individual policies. | Often the most affordable option for a given death benefit. |

Flexibility | High. Coverage amounts and terms can be customized for each person. | Low. A single policy for both, with one set coverage amount. | Low. A single policy designed for a specific purpose. |

After First Death | Surviving partner's policy remains active and unchanged. | The policy terminates, leaving the surviving partner uninsured. | The policy remains active, but the premium may increase. |

In Case of Divorce | Simple. Each partner keeps their own policy. | Complicated. The policy must usually be canceled or one person must buy the other out. | Complicated. Similar issues as First-to-Die. |

Best For | Most couples, especially those with children or different income levels. | Couples with a specific, short-term shared debt, like a mortgage. | High-net-worth couples focused on estate planning and inheritance. |

While joint policies have their niche uses—like covering a mortgage or for complex estate planning—their inflexibility is a major drawback. The single-payout structure, combined with the complications that arise from divorce, is why individual policies are the more common and practical choice for the vast majority of married couples looking for comprehensive protection.

How to Calculate Your Actual Coverage Needs

Figuring out how much life insurance to buy can feel like pulling a number out of thin air. You've probably heard the old "buy ten times your annual income" rule, but honestly, that's just a shot in the dark. It’s a generic starting point that completely ignores your family’s unique financial situation.

A far better approach is to turn this guessing game into a straightforward math problem. By calculating a specific number based on your real-world debts and future expenses, you can land on a coverage amount that truly fits.

This way, you’re not overpaying for a policy you don’t need or, worse, leaving your family underprotected. A fantastic tool for this is the DIME formula. It’s a simple acronym that stands for Debts, Income, Mortgage, and Education. Let's walk through it.

D Is for Debts

First things first, let's clear the slate. Tally up every single non-mortgage debt you have. The idea here is to give your surviving partner a fresh start, free from the weight of any outstanding bills that could complicate their life.

Your list should cover everything:

Credit Card Balances: The total amount you owe across all your cards.

Car Loans: What’s left on any vehicle financing.

Student Loans: Don't forget these—both federal and private loans count.

Personal Loans: Any other unsecured loans you might have.

Let’s imagine you have a $12,000 car loan, $30,000 in student loans, and $5,000 on your credit cards. Your "D" total is $47,000. That's the first piece of our puzzle.

I Is for Income Replacement

Next up is income. The goal is to create a financial buffer that lets your family maintain their lifestyle without your paycheck. You need to decide how many years they'll need that support. A good rule of thumb is to plan for enough years to get your youngest child out on their own.

To get your number, just multiply your annual salary by the number of years you want to cover. If you make $70,000 a year and want to replace that income for 15 years, your "I" amount is $1,050,000. This ensures that daily life can continue without immediate financial strain.

M Is for Mortgage

For most of us, our home is our biggest asset and our largest monthly bill. One of the most powerful things a life insurance payout can do is eliminate that mortgage payment. It provides incredible stability and peace of mind.

This one is easy: just check your latest mortgage statement for the outstanding balance. If you still owe $250,000, that’s your "M" number. Adding this to the calculation means your family will always have a roof over their heads, free and clear.

Your Total So Far:Using our running example:* Debts: $47,000* Income: $1,050,000* Mortgage: $250,000* Subtotal: $1,347,000

E Is for Education

Finally, if you have kids, you have to think about their future. College isn't getting any cheaper, and planning for it now means their dreams won't be derailed if you're not around to help pay for them.

Estimate what a four-year degree might cost for each child. Budgeting $100,000 to $150,000 per child is a realistic starting point, depending on whether you're aiming for public or private university. So, if you have two children, you might add $250,000 for your "E" total.

Once you have all four numbers, you just add them up. For our example couple, the grand total comes to $1,597,000. This isn't a random guess; it's a personalized figure that gives you a solid, confident target for your life insurance for a married couple.

It's also worth noting that as couples plan for the long haul, many look beyond basic life insurance. Exploring Long Term Care Insurance options can add another critical layer of financial protection, ensuring that future healthcare costs don't wipe out the savings you've worked so hard to build.

What Really Determines Your Life Insurance Rate?

When an insurance company gives you a quote, they’re essentially placing a bet. Their underwriters are trying to answer one big question: how risky is it to insure you? The answer they come up with sets your premium, which is the price you pay for your policy.

Think of it like getting a car loan. The lender pulls your credit score to gauge how likely you are to pay them back. An insurance underwriter does something similar, but instead of looking at your finances, they build a personal risk profile. Let's pull back the curtain on the factors that shape this profile and, ultimately, your final cost.

Age and Health: The Two Big Ones

Your age and health are, without a doubt, the most influential factors in life insurance pricing. It’s a simple matter of statistics for the insurer. Younger applicants are, on average, further from the end of their lives, which makes them less of a risk.

This is why a healthy couple in their 30s will almost always lock in a significantly lower rate than a couple in their 50s buying the very same coverage.

Your current health is equally critical. The underwriting process will dig into:

Your present health condition, usually confirmed through a medical exam with blood and urine tests.

Your family's medical history, checking for hereditary issues like cancer or heart disease.

Any chronic conditions you manage, like diabetes, high cholesterol, or high blood pressure.

Insurers rely heavily on these medical evaluations, which really underscores the importance of health screenings. Taking control of your health isn't just good for you—it can directly lower what you pay for insurance.

How Your Lifestyle Choices Play a Part

Your day-to-day habits paint a picture for the insurer, and certain choices can signal a higher risk, bumping up your premiums.

The biggest lifestyle red flag is tobacco use. Smokers often pay two to three times more for life insurance than non-smokers. Underwriters will also look at your alcohol consumption, any history of substance abuse, and even your driving record. A history of DUIs or a pattern of reckless driving will definitely raise your rates.

Your premium is a direct reflection of your calculated life expectancy. Healthier choices and a lower-risk lifestyle translate into a longer expected lifespan, making you cheaper to insure.

Your Job and Hobbies Can Move the Needle

What you do for a living—and for fun—also gets factored into the equation. If you have a high-risk job like a pilot, logger, or construction worker, you can expect to pay more than someone with a quiet desk job.

The same logic applies to your hobbies. If you're into skydiving, rock climbing, or deep-sea scuba diving, the insurer sees that as an added liability. It won't necessarily disqualify you from getting a policy, but it will probably cost you a bit more.

The demand for life insurance for married couples also responds to the economy. For example, the U.S. life insurance new annualized premium saw an 8% jump in early 2025, hitting $3.9 billion. This shows that more and more families are seeking this financial protection. You can discover more life insurance statistics on Bankrate to see how these broader market trends might shape your policy costs.

Navigating the Application Process as a Team

Let's be honest, applying for life insurance can feel like a mountain of paperwork and a barrage of personal questions. But it doesn't have to be a drag. When you tackle it together as a couple, you can transform a tedious task into a really positive step toward building your financial future.

Think of it as a joint project. You’ll be gathering documents, answering health questions, and likely scheduling a medical exam. Going through the process side-by-side not only makes it less of a chore but also reinforces that you’re in this together, looking out for one another.

Gathering Your Information

Before you even start an application, the first move is to get all your ducks in a row. Insurers need a complete snapshot of your financial and medical lives to figure out your policy. A little prep work here saves a ton of headaches later.

Set aside an evening to pull together the following for both of you:

Personal Info: You'll need the basics, like Social Security numbers and driver's license numbers.

Financial Details: Jot down your annual incomes, an estimate of your net worth, and any details on life insurance policies you already have.

Medical History: Make a list of your doctors' contact info, any significant health conditions (past and present), surgeries, and current prescriptions.

Having this ready beforehand makes filling out the actual forms a breeze.

The Medical Exam and Why Honesty is Everything

For most policies, a quick medical exam is part of the deal. A technician will come to your home or office to record your height, weight, and blood pressure, and take small blood and urine samples. It's essentially a mini-physical to confirm the information you provided.

Here’s a great tip for couples: schedule your exams back-to-back. You can get them both knocked out on the same morning and be there to support each other. It turns what feels like a solo test into a shared, and far less intimidating, experience.

Crucial Tip: Be completely honest on your application. It might be tempting to downplay a health issue or conveniently forget to mention you smoke, hoping for a better rate. Don't do it. Insurers have ways of finding out, and if they discover you've been untruthful, they can cancel your policy. Full transparency is the only way to guarantee your family gets the protection you're paying for.

Reviewing and Submitting Your Application

After you've filled everything out and the exams are done, sit down together for one final review. This is your chance to catch any typos or mistakes. Double-check that names are spelled right, the beneficiaries are correct, and every question has been answered.

Hitting "submit" is a big moment. You’ve just taken a massive, proactive step to protect each other and the life you're building. Securing life insurance for a married couple is about more than just a financial safety net; it’s a powerful act that strengthens the very foundation of your partnership. You're ready for the future, together.

When Should You Review and Update Your Coverage?

Getting life insurance is a huge step toward protecting your family’s future, but it’s definitely not a "set it and forget it" task. The best way to think about your policy is like a financial snapshot of your life. As your family grows and your life changes, that snapshot needs updating to reflect your new reality.

A policy that made perfect sense when you were newlyweds might not be nearly enough after you buy a house and have a couple of kids. As your life gets bigger, so do your financial responsibilities. Sticking with an old policy is like trying to navigate a new city with a ten-year-old map—you're probably not going to end up where you need to be.

Key Milestones That Should Trigger a Policy Review

Some life events completely change your financial picture. When these happen, they should be your automatic trigger to pull out that life insurance policy and see if it’s still doing its job. A quick check-in ensures your life insurance for a married couple remains a solid safety net.

Think of these moments as financial checkpoints:

Buying a Home: For most of us, a mortgage is the biggest debt we'll ever have. You’ll want to make sure your policy has enough coverage to pay it off, so your spouse and kids don't have to worry about losing the family home.

Having a Child: A new baby means a new person is completely dependent on you. Suddenly, you need to account for decades of expenses, from diapers and daycare all the way to college tuition. Your coverage needs to grow with your family.

Getting a Big Raise or a New Job: When your income goes up, your family’s lifestyle usually adjusts to match. Your policy should be updated to replace that larger income, ensuring your family can maintain their standard of living.

Paying Off a Major Debt: Finally finished with those student loans or paid off the mortgage? That's fantastic! It might mean you can actually reduce your coverage and lower your monthly premiums.

A Simple Checklist for Your Policy Check-In

Keeping your policy in sync with your life isn’t as complicated as it sounds. Just make it a habit to sit down together every year or two—or after any of the milestones above—and run through a quick review. This simple step prevents your financial protection from becoming outdated.

Your life insurance policy is a living document meant to protect your family's dynamic future. It needs to adapt as you do, reflecting your achievements, new responsibilities, and shifting goals. Reviewing it regularly is one of the most responsible things you can do for the people you love.

Use this easy checklist to guide the conversation:

Re-calculate Your Coverage Amount: Use a simple method like the DIME formula to see if your current death benefit is still enough to cover your Debts, Income, Mortgage, and Education goals.

Check Your Beneficiaries: Are the right people listed? Have you had more children? Maybe you need to set up a trust for a minor. Just confirm all the details are still correct.

Assess the Term Length: If you have term life insurance, does the policy's end date still line up with your longest financial responsibility, like when the mortgage will be paid off or your youngest kid graduates college?

Making these regular check-ins a routine ensures your life insurance policy will always be there to do what it’s supposed to do: provide unshakable protection and peace of mind for your family, whatever comes your way.

Common Questions from Married Couples

Even after you've done your homework, a few questions about how life insurance works in real-life situations will probably pop up. That’s completely normal. Nailing down these last few details is what will make you feel truly confident about your family's financial plan.

Let's walk through some of the most frequent questions we hear from married couples and give you some straight answers.

What Happens to Our Joint Policy If We Divorce?

This is a big one, and it's smart to think about it ahead of time. If you have a first-to-die policy, you'll have to figure out what to do with it as part of the divorce settlement. Some insurance companies might allow you to split the policy into two separate ones, but that's not a given—it really depends on the fine print in your original contract.

In many cases, your only choice might be to cancel the policy altogether. For second-to-die policies, which are often set up for estate planning, things can get even stickier. Your best move is always to call your insurance company first, and then talk it over with a financial advisor to see what your options are.

Does a Stay-at-Home Parent Need Life Insurance?

Yes, absolutely. It's easy to overlook the massive economic contribution a stay-at-home parent makes just because it doesn't come with a W-2. Just think about the cost of hiring people to do all those jobs: childcare, cooking, cleaning, driving kids around. Those are real expenses that can add up fast.

A life insurance policy for a non-working spouse gives the surviving partner the money needed to cover these essential services. It’s a financial cushion that prevents a difficult time from becoming a full-blown financial crisis, giving your family a chance to adapt without that added stress.

Can We Get Different Coverage Amounts?

You can, and this is exactly why choosing individual policies often makes the most sense. It’s pretty rare for two partners to have the exact same income and financial obligations. Individual policies let you tailor the coverage to what each person actually needs.

For instance:

The spouse with the higher income might need a larger policy to ensure their full salary is replaced.

The other spouse's policy could be sized to specifically cover the mortgage, pay off any other debts, and handle future childcare costs.

This way, you're building a plan that's efficient and perfectly suited to your family's reality, not just paying for a one-size-fits-all policy.

Every family’s financial picture is different. The ability to tailor coverage amounts with individual policies is one of the most effective ways to build a protection plan that truly fits your life, not a generic formula.

Is My Employer-Provided Insurance Enough?

Group life insurance through work is a great perk, and you should definitely sign up for it. But it's almost never enough to provide the long-term security a family truly needs. Most workplace policies only offer a benefit equal to one or two times your annual salary.

Even more importantly, that coverage usually isn't portable. If you leave your job, you lose your insurance. That’s why we always recommend having a private life insurance policy that you own and control. It stays with you no matter where your career takes you, providing the stable foundation your family can always rely on.

At America First Financial, we provide straightforward life insurance options that protect your family's future without the political noise. Get a clear, no-hassle quote online in just a few minutes. Secure your family’s financial future with us today.

_edited.png)

Comments