Life Insurance for New Parents: Protect Your Family Today

- dustinjohnson5

- Jun 29, 2025

- 12 min read

The moment you hold your new baby, your entire world shifts. Suddenly, providing for their future isn't just a vague idea—it's everything. Life insurance is the financial bedrock that makes that future secure. Think of it less as another monthly expense and more as a promise to your family that they'll be okay, no matter what. It’s your financial safety net, plain and simple.

Your First Step to Family Financial Security

Becoming a parent turns abstract financial concepts into urgent, tangible needs. That protective instinct you feel is powerful, and translating it into a practical plan is one of the most loving and responsible things you can do.

It’s a step many new parents know they need to take. Research shows that while 80% of Millennials see the need for life insurance, a staggering 44% feel financially unprepared if a primary breadwinner were to pass away. This isn't just a statistic; it's a real vulnerability for millions of families. The good news? Closing that gap is easier and more affordable than you probably think.

Term vs. Whole Life: The Two Main Paths

Getting started means understanding your two basic options. Don't get overwhelmed by the jargon; it really boils down to two different approaches to protecting your family.

Term Life Insurance: This is the go-to choice for most new parents, and for good reason. It covers you for a specific period—say, 20 or 30 years—which perfectly aligns with the time your kids will be growing up and depending on you financially. It's straightforward, budget-friendly, and gives you the most coverage for your money.

Whole Life Insurance: This is a lifelong policy that never expires. It also has a savings component called "cash value" that grows over time. Because of these features, it's significantly more expensive and often used for complex estate planning rather than pure income replacement for a young family.

For most new parents, the mission is clear: get the biggest, most affordable safety net possible for the years your kids need you most. That's why term life insurance is almost always the right call.

To give you a clearer picture, here's a quick side-by-side comparison.

Quick Guide: Term Life vs. Whole Life Insurance

Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

Coverage Duration | For a specific period (e.g., 20 or 30 years) | Lifelong, as long as premiums are paid |

Primary Purpose | Income replacement for dependents | Estate planning, inheritance, lifelong needs |

Cost | Low. Very affordable, especially when young. | High. Can be 5-15x more expensive than term. |

Cash Value | No. It's pure insurance protection. | Yes. A portion of the premium builds savings. |

Best For... | Young families needing maximum coverage on a budget. | High-net-worth individuals with complex estate needs. |

This table helps illustrate why term life is such a practical tool for new parents. It directly addresses your most pressing need—protecting your children during their dependent years—without breaking the bank.

Of course, life insurance is just one piece of the financial puzzle. As you build your family's security, you might also look into long-term investment vehicles like a Roth IRA for minors to give your child a powerful head start. But it all begins with this foundational step: ensuring your family is protected today.

Figuring Out How Much Coverage Your Family Actually Needs

Trying to pin down the right amount of life insurance can feel a bit like throwing a dart in the dark. You've probably seen those generic online calculators, but they often spit out a number without really understanding your family's story. Let's toss those aside and build a number that truly fits your life, giving you real peace of mind.

This isn't just about making sure your family can "get by." It's about ensuring they can thrive and maintain their lifestyle without financial worry. Think of it as building a financial safety net that covers all the major future expenses your income was meant to handle.

A Practical Approach: The DIME Method

One of the most straightforward and effective tools I recommend to clients is the DIME method. It’s a simple acronym that stands for Debt, Income, Mortgage, and Education—the four cornerstones of your family’s financial foundation. Instead of just pulling a number out of thin air, this approach helps you calculate a meaningful total based on concrete needs.

Let's walk through it with a common scenario: a young couple who just welcomed their first baby. They have a mortgage, some leftover student loans, and big dreams for their child's future education.

Debt: First, add up all your debts except for the mortgage. We're talking student loans, car payments, credit card balances—all of it. Let's say our example family has $40,000 in combined car and student loans.

Income: How many years of your salary would your family need to stay afloat? With a new baby, a good rule of thumb is 10 years. If you earn $80,000 a year, that’s $800,000 for income replacement.

Mortgage: Next, what’s the outstanding balance on your home? The goal here is to give your family the option to pay it off completely and not worry about losing their home. Let's assume they have $300,000 left to pay.

Education: College isn't getting any cheaper. A realistic estimate for a future four-year degree is anywhere from $100,000 to $150,000 per child. We’ll budget $125,000 for their newborn.

Let's Do the Math: $40,000 (Debt) + $800,000 (Income) + $300,000 (Mortgage) + $125,000 (Education) = $1,265,000

Based on this, our example family really needs about $1.27 million in life insurance coverage. That number isn't random; it’s a tangible figure tied directly to their financial life and future aspirations.

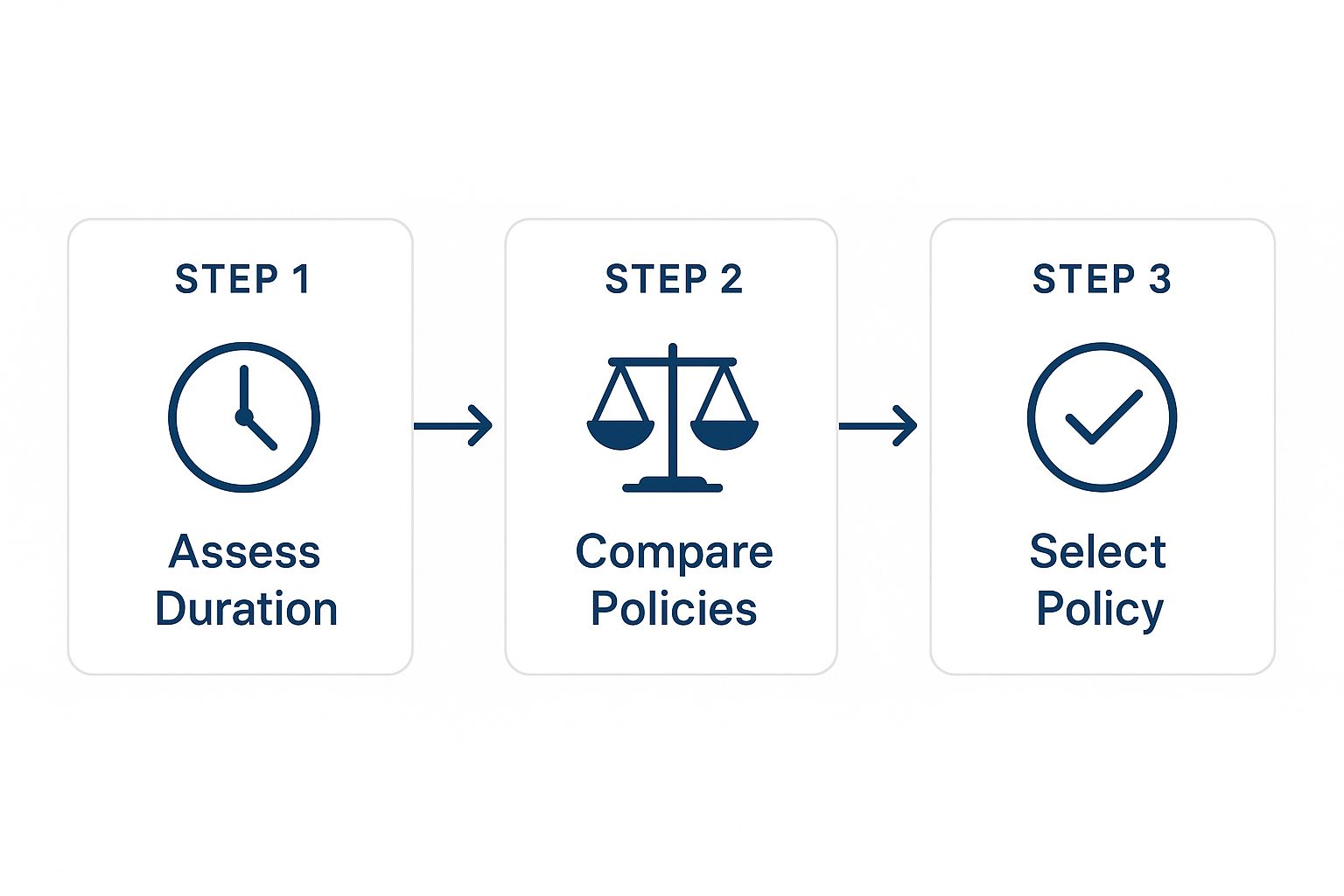

Once you have your number, the next step is choosing the right policy. The infographic below maps out that decision-making process perfectly.

This visual breaks down the journey into three manageable steps, guiding you from how long you need coverage to what kind of policy makes the most sense. Your coverage amount is a huge part of this—a larger need like the one we calculated often points young families toward affordable term life insurance, which offers the most bang for your buck.

Choosing the Right Policy for Your New Family

Alright, you've got your magic number—the amount of coverage that will protect your family. Now comes the next big question: what kind of policy should you actually buy?

For new parents, this conversation almost always boils down to two main players: term life and permanent life insurance. The best choice for you really depends on your family's immediate needs, your long-term financial picture, and, let's be honest, your current budget.

Your core mission right now is simple. You need the biggest, most effective financial safety net possible for the years your kids will rely on you completely. We're usually talking about the next 20 to 30 years. This is precisely why term life insurance is the go-to choice for the vast majority of young families. It’s built for this exact job.

A term policy is pure insurance. You get a massive amount of coverage for a set number of years, and because it doesn't have extra bells and whistles like a cash-value investment account, it's incredibly affordable. That affordability is a lifesaver when you're suddenly juggling the costs of diapers, daycare, and trying to save for the future.

Term Life: The Practical, Powerful Choice

Let's put some real numbers to this. A healthy 30-year-old can often get a $1 million, 30-year term policy for somewhere between $50 and $70 a month. Think about that. For the cost of a few weekly coffees, you can guarantee your family could pay off the mortgage, handle daily expenses, and fund college tuition if you weren't there. That’s some serious peace of mind.

Now, compare that to a permanent policy like whole or universal life. For that same $1 million death benefit, you'd be looking at a premium that's many times higher. While those policies do offer lifelong coverage and a cash value component that grows, the steep cost can be a real burden for a young family. It might even force you to buy far less coverage than you actually need.

The biggest mistake I see new parents make is choosing a pricier policy type and ending up underinsured. Your goal is to get enough protection to cover your most vulnerable years, and term life insurance delivers that better and more efficiently than anything else.

When Permanent Life Insurance Might Enter the Picture

So, is term life the only answer? Not always. While it’s the right call for most, there are a few specific situations where a permanent policy might be a smart move, usually for more complex, long-range financial planning.

Significant Estate Planning: If you have a high net worth and want to use life insurance as a tool to pass on wealth to your children in a tax-efficient way.

Funding a Special Needs Trust: This is crucial for parents of a child who will need financial support for their entire life.

Supercharging Your Savings: If you've already completely maxed out every other tax-advantaged retirement account (we're talking 401(k)s, IRAs, the works) and are looking for another place to grow money.

Families are definitely thinking more about this. In the U.S., new life insurance premiums recently jumped by 8% to $3.9 billion, which shows that financial protection is a growing priority. You can dive deeper into these life insurance trends and statistics on Bankrate.com.

But for the vast majority of new parents, the logic is crystal clear. Start by locking in a solid term life insurance policy. It solves your most urgent problem—protecting your kids' future—in the most affordable way possible.

How to Find Coverage That Fits a New Parent's Budget

Let's bust a huge myth right now: life insurance has to be expensive. I see this misconception stop so many new parents from getting the protection they need. Your budget is already stretched thin with diapers, formula, and a million other new expenses, so the thought of another big bill can feel overwhelming.

But here’s the reality I’ve seen play out for countless families: quality life insurance for new parents is often surprisingly affordable. We're talking less than what you might spend on a few lattes or your favorite streaming service each month.

The trick is to act while you’re young and healthy. Insurers set their prices based mostly on your age and health right now. A healthy 30-year-old can lock in a fantastic rate for a 30-year term policy, and that price won't budge for three decades while the kids are growing up. If you wait until you're 40, you could easily pay a lot more for the exact same coverage.

Actionable Ways to Lower Your Premiums

Getting a great deal isn't just about timing; it's also about being smart before and during your application. Insurers love low-risk applicants, and even small, proactive changes can lead to significant savings over the life of your policy.

You actually have more control over your rates than you might realize. Here are a few practical things you can do to find the most affordable coverage:

Boost Your Health Profile: If you have the time, spend a few months before you apply working on key health metrics. This could be as simple as focusing on a healthier diet, getting more exercise, or working with your doctor to lower your blood pressure or cholesterol.

Ditch Tobacco and Nicotine: This is the single most impactful thing you can do to slash your premium. Non-smokers often pay up to three times less than smokers for identical coverage. To get the best non-smoker rates, most companies will want to see that you've been completely nicotine-free for at least one year.

Stick with a Term Policy: As we've covered, term life insurance gives you the most protection for the lowest price. It’s the perfect fit for new parents who need to cover the years their children are financially dependent.

My best piece of advice? Don't just get one quote and call it a day. I've seen rates for the same person vary wildly between insurance companies. Using a tool to compare offers is an absolute must if you want to be sure you aren't overpaying.

Shop Around and Compare Multiple Quotes

Every life insurance company plays by its own set of rules—what they call underwriting guidelines. One insurer might be more forgiving of a spotty family medical history, while another might offer better rates to someone with a well-managed health condition like high cholesterol. This is precisely why shopping around is so critical.

At America First Financial, we've made this part easy. Our online tool lets you get a quote in less than three minutes, giving you an instant, clear picture of what great coverage actually costs. By comparing your options, you put the power back in your hands to find a policy that delivers real protection without wrecking your new family budget.

We Get It—Applying for Anything Right Now Feels Impossible

As a new parent, you’re running on fumes and operating on a sliver of your former free time. The thought of starting a long, complicated application for anything, let alone life insurance, is enough to make you want to crawl back into bed.

Fortunately, the days of stacks of paperwork and endless phone calls are mostly behind us. Modern life insurance applications have moved online, meaning you can get the ball rolling from your couch while the baby naps.

The journey from getting a quote to having an approved policy is designed to be efficient. It usually starts with a simple online form, followed by a health questionnaire, and sometimes a quick medical check. The goal is to get you covered without adding more stress to your plate.

This push for easier access to financial protection isn't just a local trend. As more families recognize the need for a safety net, the global life insurance market is seeing major growth. One report projects that life insurance will account for over EUR 2,055 billion in global premium growth over the next decade. You can dive deeper into these global insurance market insights from Allianz if you're curious.

Your Quick Application Checklist

To keep things moving smoothly, a little bit of prep goes a long way. Before you sit down to apply, try to have these details handy.

Your Basics: Full name, address, date of birth, and Social Security number.

Your Health Snapshot: A general idea of your medical history, any current medications, and your doctor's contact info.

Family Health History: Insurers will ask about the health of your parents and siblings, so be ready for those questions.

Beneficiary Info: The full name and date of birth of the person (or people) you want to receive the payout.

My Two Cents: Be upfront and honest. It can be tempting to fudge details about your health or that occasional cigar, but it's not worth it. If an insurer discovers you've misrepresented something, they could deny a claim or even cancel your policy down the road, leaving your family unprotected.

The Medical Exam: Not as Scary as It Sounds

For many policies, a brief medical exam is part of the process. But don't let that intimidate you. A technician comes to your home or office—at a time that works for you—to check the basics: height, weight, blood pressure, and to take blood and urine samples. It's usually over in about 30 minutes.

Even better? You might not need one at all.

Many insurers now offer no-exam life insurance policies, which are a game-changer for busy parents. If you're relatively young, in good health, and applying for coverage under $1 million, you have a great shot at qualifying. These policies use data and algorithms to make a decision in days, not weeks, letting you lock in protection and get back to what matters most.

Got Questions? We've Got Answers for New Parents

Stepping into the world of life insurance for the first time? It's completely normal to have a long list of questions. In fact, it's a good thing—it means you're taking this seriously. Let's walk through some of the most common questions I hear from new parents and get you some clear, straightforward answers.

Do We Both Really Need a Policy?

Yes, without a doubt. It’s a common misconception to only insure the parent with the higher income, but that’s a huge mistake. The financial value of a stay-at-home parent is massive.

Just imagine for a second what would happen if that parent were no longer there. The surviving partner would suddenly be on the hook for childcare, after-school programs, meal prep, and managing the entire household. Hiring help for those tasks can easily cost tens of thousands of dollars a year. A policy for the stay-at-home parent is what bridges that financial gap, preventing a family crisis from turning into a financial catastrophe.

When Should We Actually Buy It?

The best time was yesterday. The next best time is right now. I’m not just saying that to create urgency—it’s a financial reality.

Life insurance rates are based almost entirely on your age and health. The younger and healthier you are, the cheaper your premiums will be. By getting a policy now, you can lock in a low rate for the next 20 or 30 years. Waiting even a year or two will mean higher costs, and it also opens the door to developing a health issue that could make coverage even more expensive or harder to qualify for.

My advice to every new parent is to lock in your coverage as early as possible. It’s the single most effective way to secure the most affordable protection for the entire time your children will depend on you.

What About Getting a Policy for Our Baby?

I get this question a lot. While you can buy life insurance for a child, it should be at the absolute bottom of your financial to-do list. Your priority is protecting your income and your ability to care for them.

The whole point of life insurance is to replace lost income and support dependents when a provider is gone. Your child has no income to replace. The small amounts you’d pay for a child’s policy are far better invested in getting a robust policy for yourself and your partner. That’s the coverage that will actually protect your child's future.

Isn't the Life Insurance I Get From Work Good Enough?

Think of your employer-sponsored life insurance as a nice little bonus, not the foundation of your family's financial security. It’s a great perk, but it’s almost never enough and has one critical flaw: it isn't portable. The moment you leave your job, that coverage disappears.

Work policies typically offer a small payout, often just one or two times your annual salary. That might cover funeral costs, but it won’t pay off a 30-year mortgage or fund college tuition down the road. Having your own private policy gives you control and guarantees your family has a real safety net, no matter where your career takes you.

At America First Financial, we simplify the process so you can get the right protection for your family without the hassle. Get a clear, no-obligation quote in less than three minutes and see how affordable true peace of mind can be. Secure your family’s future today.

_edited.png)

Comments