Life Insurance for Veterans A Complete Guide

- dustinjohnson5

- Sep 12, 2025

- 13 min read

After a career spent looking out for others, making sure your own family is financially secure becomes the next mission. Life insurance for veterans acts as a crucial safety net, guaranteeing your loved ones have support long after your time in service is over. Think of this guide as your personal briefing on the options out there, from VA-backed programs to plans you can find on the civilian market.

Why Life Insurance is a Critical Mission for Veterans

Your time in the military taught you the importance of planning and protecting your unit. Life insurance is really just applying that same mindset to your family. It's a strategic move to ensure your beneficiaries receive a tax-free, lump-sum payment when you pass away, giving them a solid financial foundation to stand on.

Consider it the ultimate contingency plan for the people who matter most. That money can be used for almost anything, making sure life can go on without the added weight of financial hardship during an incredibly tough time.

The Purpose of a Policy

For veterans, a life insurance policy isn't just about covering a funeral. It’s about preserving the life and legacy you worked so hard to build for your family. A good policy can help:

Replace lost income: If your paychecks are what keep the household running, a policy ensures your family can maintain their lifestyle.

Wipe out major debts: It can be used to pay off the mortgage, clear car loans, or settle other big financial commitments.

Secure future dreams: This could mean funding your kids' college education or making sure your spouse has a comfortable retirement.

This guide is your map for navigating the terrain. We’ll break down government programs like Veterans' Group Life Insurance (VGLI) and the newer VALife plan, which offers guaranteed acceptance for veterans who have service-connected disabilities.

Life insurance is one of the most powerful ways to continue serving your family. It builds a legacy of security, ensuring they’re taken care of, no matter what.

By the time you're done reading, the jargon will be gone, and you’ll know exactly how to find a policy that lets you rest easy. You'll have a clear path forward to protect what you’ve built and provide lasting security for your family.

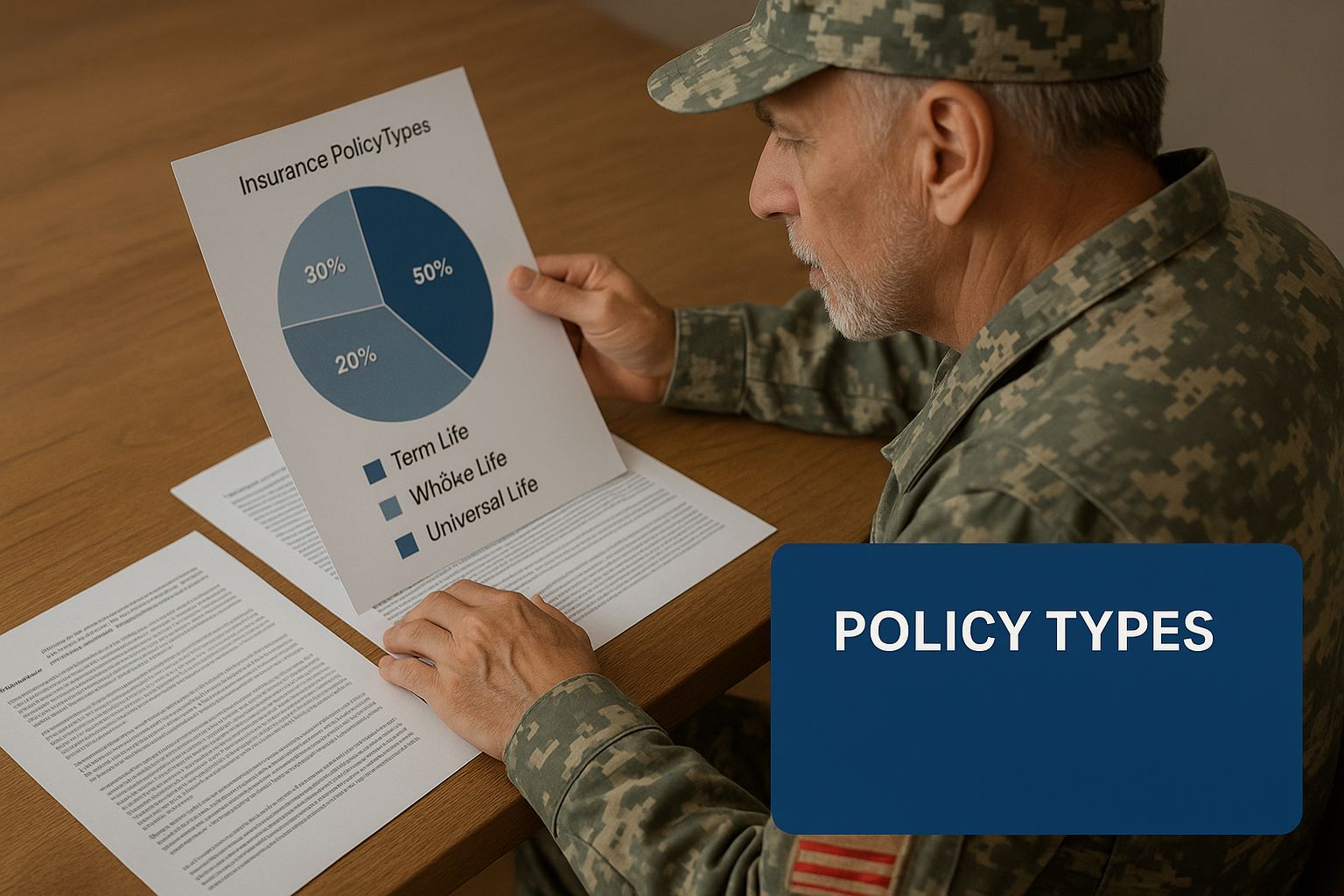

Choosing Your Path: VA vs. Private Life Insurance

When you're looking at life insurance, one of the first big decisions you'll face is whether to stick with a VA-sponsored plan or go out into the civilian market. It's a common crossroads for veterans.

Think of it this way: VA insurance is like your standard-issue service rifle—it's reliable, gets the job done, and is designed to work for a large group of people. Private insurance is more like a custom-built rifle; you get to choose the caliber, the optics, and the stock to fit your specific mission.

There’s no single "right" answer here. The best choice is a personal one, and it really comes down to your health, your family's needs, and what you want to accomplish financially.

Understanding the Core Differences

VA options, particularly Veterans' Group Life Insurance (VGLI), are incredibly accessible. One of their biggest selling points is guaranteed acceptance, as long as you apply within a specific window after leaving the service. This is a huge relief for anyone with service-connected health issues that might make getting private coverage tricky. The trade-off? These plans often have a ceiling on how much coverage you can get.

Civilian policies, on the other hand, can offer much larger death benefits, sometimes stretching into the millions. They also come with a whole menu of optional add-ons, called riders, that can do things like pay out early if you're diagnosed with a critical illness or become disabled. The catch is that you'll almost always need to go through a medical review or exam, and pre-existing conditions can definitely affect your rates—or even your ability to get a policy at all.

The real question isn't which type of insurance is "better," but which one is the better fit for the specific mission of protecting your family's future.

This visual helps break down how the two paths compare.

As you can see, it’s a balancing act between the ease of guaranteed acceptance and the need for higher coverage limits or more customized features.

To make things even clearer, let's look at a side-by-side comparison.

VA vs. Private Life Insurance at a Glance

This table breaks down the essential differences to help you see which column aligns more closely with your personal situation.

Feature | VA Life Insurance (VGLI, VALife) | Civilian Life Insurance |

|---|---|---|

Medical Exam | Often no exam required (guaranteed acceptance within a time limit). | Usually requires a medical exam and health questionnaire. |

Eligibility | Based on military service and separation date. | Based on health, age, lifestyle, and financial underwriting. |

Coverage Limits | Capped at specific amounts (e.g., VGLI max is $500,000). | Much higher limits available, often $1 million+. |

Premiums | Based on age bands; rates increase every five years for VGLI. | Can be level for the entire term (e.g., 20 or 30 years). |

Customization | Limited; plans are standardized with few add-ons. | Highly customizable with a wide variety of riders (disability, critical illness, etc.). |

Best For | Veterans with pre-existing conditions or those who prefer simplicity and guaranteed coverage. | Healthy individuals needing high coverage amounts or specific policy features. |

Ultimately, many veterans find that a combination of both provides the most comprehensive protection for their families.

Key Factors to Consider

As you weigh these two paths, a few key things should be at the forefront of your mind. It’s about more than just the monthly payment; you need to look at the long-term value and how a policy will perform when your family needs it most.

Your Health Profile: This is a big one. If you're dealing with significant service-connected disabilities, VA plans like VALife offer guaranteed acceptance, which takes the stress of a medical exam completely off the table. Private insurers, however, will dig into your health records, and that could mean higher premiums or even a denial.

Coverage Needs: How big of a financial safety net does your family actually need? If you’ve got a hefty mortgage, young kids who need college funded, and want to replace your income for years to come, a private policy with a high death benefit is probably the way to go. VA plans are a fantastic foundation but might not be enough on their own.

Flexibility and Customization: Do you want a policy that can do more than just pay out when you pass away? Private insurance often includes riders for "living benefits," which can give you access to a portion of the death benefit if you're diagnosed with a terminal illness. These kinds of features are not typically part of standard VA plans.

Life insurance is a cornerstone of financial planning for the veteran community—around 5.6 million Americans are insured through VA programs alone. The broader market reflects this priority, with an 8% increase in new life insurance premiums recently, totaling $3.9 billion. It shows a clear trend toward locking in financial security. For a deeper dive into these numbers, you can explore the full life insurance statistics on Bankrate.

Understanding the Core VA Life Insurance Programs

When you're navigating the world of veterans' benefits, life insurance can feel like its own universe. The Department of Veterans Affairs has a handful of core programs, but each one is built for a specific time in your life—from active duty to your post-military years. Think of it less like a one-size-fits-all policy and more like a set of specialized tools. You just need to know which one to grab for the job at hand.

Let's start with the one you probably already know from your time in uniform.

The All-Important Hand-Off: From SGLI to VGLI

Just about everyone who serves gets automatically signed up for Servicemembers’ Group Life Insurance (SGLI). It’s a fantastic benefit, offering up to $500,000 in term coverage at a really low cost. SGLI is your safety net while you're in, but the moment you hang up your uniform, that net is gone.

This is where Veterans’ Group Life Insurance (VGLI) steps in. VGLI is designed to be a direct continuation of your SGLI. It lets you convert that military policy into a civilian one without a break in coverage. The most critical part of this deal? You have one year and 120 days from your separation date to enroll without having to prove you're in good health. No medical exam, no health questions. That guaranteed acceptance is a lifeline for veterans dealing with service-connected injuries or illnesses.

Think of that deadline to convert SGLI to VGLI like the final muster of your military career. It's a date you absolutely cannot miss. If you do, getting affordable life insurance later can become a much bigger battle.

If you let that window close, you can still apply for VGLI, but you’ll likely need to submit evidence of good health. That can be a tough hurdle to clear. So, making the VGLI decision should be right at the top of your transition checklist.

VALife: A Modern Solution for Veterans with Disabilities

The VA knew that some veterans, especially those with service-connected disabilities, were falling through the cracks. It could be tough, or even impossible, to get private insurance. That’s why they rolled out Veterans Affairs Life Insurance (VALife). Honestly, it's been a game-changer.

VALife is a guaranteed acceptance whole life insurance policy. It's available to veterans 80 or younger who have a VA disability rating—any rating at all, from 0% to 100%.

Here’s what makes it stand out:

No Health Hurdles: You're in. There are no medical exams or questionnaires.

Solid Coverage: You can select a policy worth up to $40,000, with options in $10,000 chunks.

Stable Costs: Your premiums are locked in for good. Unlike VGLI, they will never go up as you get older.

It Builds Value: Because it's a whole life policy, it gradually builds cash value. Down the road, you can even borrow against it if you need to.

This policy is a perfect fit if you're looking to cover final expenses or just leave a little something behind for your family, particularly if other insurance options are off the table.

The creation of VALife really plugged a major gap in veteran benefits. It provides a solid, dependable option for those whose service left a lasting mark on their health. There's a two-year waiting period before the full death benefit is payable, but after that, you're fully covered. To see how these programs continue to evolve, it's always a good idea to check for the latest updates on VA life insurance.

What Determines the Cost of Veteran Life Insurance

Trying to pin down the exact cost of life insurance can feel a bit like chasing a moving target. The good news is, it's not random. Whether you're looking at a VA-sponsored plan or a policy from a private company, the price you pay comes down to a clear set of factors.

For VA programs like Veterans' Group Life Insurance (VGLI), the math is pretty simple. Your premium is based almost entirely on two things: your age and the amount of coverage you want. Because it's a group plan, the risk is spread out among everyone insured, which keeps the pricing stable and predictable. Just keep in mind that VGLI rates are set in five-year age bands, so your premium will go up each time you enter a new bracket.

Key Factors for Private Insurance

Once you start exploring options on the civilian market, the picture gets a lot more personal. Private insurance companies use a process called underwriting to figure out your specific risk level. It's less like joining a group and more like getting a custom-tailored assessment.

They'll look closely at a few key things:

Your Age: This one’s a constant across the board. The younger and healthier you are when you lock in a policy, the less you'll typically pay over the long haul.

Your Health: This is a big one. Insurers review your entire health history, including any service-connected conditions you might have. Being in good health usually translates to better rates.

Lifestyle Choices: Your daily habits matter, especially tobacco use. If you smoke or use other tobacco products, you can expect to pay significantly more than someone who doesn't.

Coverage Type and Amount: The policy itself plays a huge role. The type of insurance (like term vs. whole life) and the death benefit amount directly affect your premium. A $1 million term policy will naturally cost more than a $250,000 one.

Recent VA Premium Reductions

Here’s some great news: the cost for VA-backed life insurance is actually going down. The U.S. Department of Veterans Affairs recently announced some major premium cuts across its programs, a move that benefits over 3 million veterans, service members, and their families.

This change makes government-backed life insurance for veterans more competitive than ever, providing automatic savings with no action needed from policyholders.

To give you an idea, around 450,000 veterans enrolled in the VGLI program saw their premiums automatically drop by anywhere from 2% to 17%, depending on their age. These reductions make VA life insurance an even more affordable and solid foundation for your family’s financial security. You can find more information about these VA premium decreases for veterans on the DAV website.

A Step-by-Step Guide to the Application Process

Applying for life insurance shouldn't feel like another military operation. Whether you're looking at a VA program or a plan from a private company, the path forward is pretty clear once you know the steps. Let's break it down so it feels less like a mission and more like a simple to-do list.

For the government-backed options, the process is well-defined. You can apply for both Veterans' Group Life Insurance (VGLI) and the newer Veterans Affairs Life Insurance (VALife) right on the VA's website. The most important thing to remember here is timing, especially for VGLI.

Applying for VA Life Insurance

As soon as you separate from service, a timer starts. You have exactly one year and 120 days to roll your SGLI into a VGLI policy without having to prove you’re in good health. If you miss that window, you'll need to submit medical evidence, which can sometimes make things more difficult.

Getting it done is straightforward:

Head to the VA website: You'll want to find the life insurance section, which has the portals for both VGLI and VALife.

Get your info ready: You’ll need your service information and some personal details on hand.

Fill out the online form: The digital application guides you through everything. With VALife, you can often get an instant decision right then and there.

Honesty is always the best policy when applying for life insurance. Being completely upfront on your application—whether it's for a VA plan or a private one—is the surest way to prevent any headaches or denied claims for your family later on.

Navigating the Private Insurance Process

Going with a civilian policy involves a few more steps because private insurers need to do their own risk assessment for every applicant. Here’s what that typically looks like.

Shop Around for Quotes: The first move is always to compare quotes. See what different companies are offering to get a real sense of the market and find a rate that fits your budget.

Submit Your Application: After you've picked a provider, you'll fill out a detailed application. This will cover your health, lifestyle, and some financial basics. Having your medical history handy will definitely make this part go faster.

Go Through Medical Underwriting: This is the part where the insurer assesses your health. It might mean a quick medical exam, but a lot of companies now offer "no-exam" policies that rely on your health records and the answers you provide. This information is what they use to set your final premium.

Accept and Activate Your Policy: Once you get the green light, you'll receive the final policy paperwork. Read it over carefully, sign on the dotted line, and make that first premium payment. Just like that, your coverage is active.

By getting your documents in order and knowing what to expect, you can confidently lock in the right life insurance and make sure your family is protected.

Making the Right Choice for Your Family

Choosing the right life insurance plan feels like the final, critical step in your post-service mission. You've gathered all the intel, and now it's time to make the call that secures your family's future and protects your legacy. This is more than just a numbers game; it's about matching a policy to the real, everyday needs of the people you care about most.

So, how do you make that call? It helps to boil it down to the core differences. VA plans like VGLI are built on a foundation of simplicity and guaranteed acceptance. This is a massive advantage if you have service-connected health issues that might make other policies hard to get.

On the other hand, private insurance often offers much higher coverage limits and lets you add custom features. If you're looking to cover a large mortgage or ensure your kids' college education is fully funded, a private plan might give you the flexibility and financial muscle you need.

Your Personal Readiness Checklist

Before you sign any paperwork, run through a quick personal assessment. Getting clear on these points will make your decision a whole lot easier.

What are your major financial responsibilities? Think about the mortgage, car payments, and any other significant debts that would fall on your family.

Who is counting on your income? Try to calculate what your spouse, kids, or other dependents would need to maintain their quality of life.

What big goals are on the horizon for your family? Are you planning for college tuition, helping with a wedding, or just ensuring your spouse has a comfortable retirement?

How does your current health affect your options? A candid answer here will point you toward either a guaranteed VA plan or a medically underwritten private policy.

Securing a life insurance policy is one of the most powerful ways you can continue to serve your family. It's a promise—a guarantee that they will be taken care of, no matter what tomorrow brings.

At the end of the day, your life insurance isn't a "set it and forget it" decision. It's a living part of your financial plan that should grow and change as your life does. By taking this step, you're not just buying a policy; you're giving your family a legacy of security and the priceless gift of peace of mind.

Common Questions About Veteran Life Insurance

It's completely normal to have questions when you're sorting through life insurance options. Getting the right answers is the key to choosing a plan that truly protects your family. Let's tackle some of the most common things veterans ask.

Can I Have Both a VA Policy and a Private One?

Yes, you absolutely can. In fact, for many veterans, this is the smartest way to go.

Think of it this way: your VA policy is like a sturdy foundation for your financial security, especially if you have a service-connected disability. A private policy then builds on that foundation, adding the extra coverage you might need for big-ticket items like paying off the mortgage or covering college tuition.

Layering policies like this is a common strategy. You get the guaranteed acceptance of a VA plan and the higher coverage amounts and flexibility of a private plan, creating a comprehensive safety net for your family.

Are My Life Insurance Benefits Taxable for My Family?

This is a big one, and the answer is a huge relief for most families. The death benefit from a life insurance policy, whether it's from the VA or a private company, is paid out to your beneficiaries income-tax-free in almost every case.

This means the full amount you intended for your family gets to them without the government taking a cut. They can use the money right away to cover expenses during a difficult time.

This tax-free feature is one of the most powerful aspects of life insurance, ensuring your legacy remains intact.

What If I Miss the VGLI Enrollment Deadline?

It's easy to miss that initial one-year and 120-day window to switch from SGLI to VGLI without a health check. If that happens, don't stress—you still have good options.

You can still apply for VGLI later, but you'll have to prove you're in good health, which can be a challenge for some.

But that's not your only option. You could look into VALife, which offers guaranteed acceptance to veterans with a service-connected disability rating. Or, you can explore the private market. Many companies offer no-exam policies or plans that are a great alternative for securing the coverage you need.

At America First Financial, we help you find life insurance that aligns with your values and protects your legacy. Our straightforward process makes it easy to get the coverage you need without the hassle. Get your free, no-obligation quote in under three minutes and take the next step in securing your family's future. Learn more at https://www.americafirstfinancial.org.

_edited.png)

Comments