Life Insurance with No Waiting Period Explained

- dustinjohnson5

- Sep 13, 2025

- 16 min read

When people talk about life insurance with no waiting period, they’re describing a policy that protects your family from the very first day. Unlike many other plans that can make you wait, this type of insurance makes the entire death benefit available the second your first payment goes through. It's about getting real, immediate financial security without that typical two-year delay.

Understanding Immediate Coverage Life Insurance

So, what does “life insurance with no waiting period” really mean in practice? It’s refreshingly simple: your family is eligible to receive the full policy amount right away, whether the death is from natural causes or an accident.

Think of it like this: it’s the difference between buying a car with a full warranty that starts the moment you drive off the lot versus one where major components aren't covered for the first two years. This kind of policy closes that coverage gap, offering genuine peace of mind from day one.

What Does "Day One" Coverage Really Mean?

"Day one" coverage is as straightforward as it gets. If you're approved for a policy and you make your first premium payment on a Monday, your coverage is officially active. If something unexpected were to happen on Tuesday, your beneficiaries are entitled to the full death benefit. It's that fast.

There are no confusing tiers or partial payouts during those initial years. You just get the full protection you signed up for, right from the start.

The core promise of a no waiting period policy is the elimination of uncertainty. Families can have confidence that if the unthinkable happens, the financial support they were promised is available immediately, not after a lengthy delay.

Before we go further, it's helpful to see a side-by-side comparison of how these policies stack up against those with a waiting period.

Immediate Coverage vs. Waiting Period Policies

This table breaks down the key differences at a glance, helping you see why "day one" coverage is such a significant feature.

Feature | No Waiting Period Policy | Standard Policy with Waiting Period |

|---|---|---|

Coverage Start | Immediately after the first premium payment. | Full death benefit is delayed, typically for 2 years. |

Payout for Natural Death (in first 2 years) | 100% of the death benefit is paid out. | Usually, only a refund of premiums plus interest (~10%). |

Ideal Candidate | Individuals in relatively good health. | Those with significant, pre-existing health conditions. |

Peace of Mind | High, knowing your family is covered from day one. | Lower, due to the initial coverage gap for natural death. |

This comparison makes it clear: if you qualify, a no-waiting-period policy offers a much more robust and immediate safety net.

The Contestability Period Still Applies

Now, here’s a crucial point to understand: even with immediate coverage, almost every life insurance policy includes a two-year contestability period. This isn't a waiting period for your payout; it’s a standard clause that allows the insurance company to review a claim if a death occurs within the first two years. It’s their way of protecting against fraud.

So, if a death occurs during that timeframe, the insurer will simply pull up the original application and double-check that the health questions were answered truthfully.

Honest Application: If everything you stated about your medical history was accurate, the full death benefit gets paid out. No problem.

Misrepresentation: If the investigation finds that major health issues were intentionally hidden, the claim could be denied. In that case, the company would typically just refund the premiums paid.

This clause is all about fairness—for you and the insurer. As long as you’re upfront and honest on your application, your "no waiting period" coverage will work exactly as it’s supposed to. At America First Financial, we walk you through every question to make sure your application is crystal clear from the get-go.

How Does Life Insurance With No Waiting Period Actually Work?

It might sound a little too good to be true—getting full life insurance coverage from day one. But it's very real, and the "secret sauce" is a modern evaluation method called accelerated underwriting.

This isn't about cutting corners. It's about being smarter. Instead of the old-school approach of sending you to a doctor for blood tests and a physical exam, insurers now use technology to quickly get a reliable picture of your health. It’s a faster, data-driven way to make a decision, making life insurance with no waiting period a far less intimidating and much more accessible option for many people.

The Magic Behind Accelerated Underwriting

Think of it like an express checkout lane for your life insurance application. The traditional lane is slow, involving a full medical exam and a mountain of paperwork that can take weeks. The accelerated lane uses technology to verify your information in near real-time. The goal is the same—accurately understand your risk profile—but the method is worlds apart in terms of speed.

This process pulls from a few key sources to make a solid decision without that in-person medical exam.

Your Application: It all starts with the health questions you answer. Your honest responses create the foundation for the entire evaluation.

Prescription History: With your permission, the insurer can check your prescription records. This helps them confirm the medical conditions you’ve disclosed and get a clearer view of your health history.

Public and Industry Records: Insurers also look at data from places like the MIB (Medical Information Bureau) and your motor vehicle report. This information helps build a more complete picture of your lifestyle and overall risk.

By piecing together these digital records, insurers can confidently approve many applicants in a fraction of the time it once took. This is how day-one coverage has become a reality.

Your Step-by-Step Path to Immediate Coverage

So, what does this actually look like for you? The whole point is to make it simple and transparent. When you apply for a policy through a provider like America First Financial, here's what you can generally expect.

Fill Out the Application: You’ll start by completing a straightforward online application that includes a series of health and lifestyle questions.

Let the Tech Do Its Thing: Once you hit "submit," the insurer's automated systems immediately get to work, cross-referencing your answers with the digital records we just talked about.

Get a Quick Decision: For many applicants, a decision comes back almost instantly. If your information checks out and you meet the health criteria, you can be approved right then and there.

Activate Your Policy: Once approved, you just need to make your first premium payment. The moment that payment goes through, your full death benefit is officially active. No waiting.

The entire process, from start to finish, can often be wrapped up in a single day. That’s a huge difference from the weeks or even months you might wait for a traditionally underwritten policy. Innovations like automated underwriting are at the heart of this change, allowing insurers to handle applications more efficiently while still making sound decisions. If you're curious about the data behind the industry, you can discover key life insurance statistics on feather-insurance.com to learn more.

The core of accelerated underwriting isn’t just speed; it’s accuracy. By using verified data points, insurers can make reliable decisions that benefit everyone, leading to faster approvals for applicants and well-managed risk for the company.

Ultimately, this modern approach tears down the biggest barriers that used to stop people from getting coverage. It respects your time, simplifies what’s required of you, and delivers the peace of mind you’re looking for without that frustrating, unnecessary delay.

Who Needs No Waiting Period Life Insurance?

Sure, having immediate financial protection sounds good to just about anyone, but life insurance with no waiting period is truly essential for certain people. It's not some niche, complicated product; it’s a practical solution built for specific life stages where getting coverage locked in now is what matters most.

Think of it like this: when you're at the grocery store, the regular checkout lanes work fine. But if you’re in a hurry with just a few items, the express lane is a lifesaver. This kind of insurance is the express lane for your financial security.

New Parents and Growing Families

The moment you bring a child into the world, your financial responsibilities skyrocket. You now have a tiny person who depends on you for absolutely everything, and the thought of leaving them unprotected—even for the two or three months of a typical waiting period—can be terrifying.

Immediate coverage gives you a safety net from day one. It means that if the unthinkable were to happen, the funds for childcare, education, and all the day-to-day costs would be there instantly. That peace of mind lets you focus on the joys of raising your family without that "what if" worry hanging over your head.

Seniors Planning for Final Expenses

Many seniors want to make sure their final wishes are carried out without placing a huge financial weight on their kids. With the average funeral costing more than $9,000, that’s a massive, unexpected bill for any family to handle.

This is where a no-waiting-period policy fits perfectly.

Immediate Peace of Mind: It guarantees that money for funeral costs, final medical bills, and other end-of-life expenses is available right when it's needed.

Protecting Your Legacy: Your loved ones won't have to drain their own savings or sell assets to cover these costs, preserving the inheritance you wanted to leave for them.

Maintaining Control: It puts you in charge of your own arrangements, so you can ensure your send-off happens just the way you envision it.

This approach ensures you leave behind a legacy of love, not a mountain of debt.

Immediate coverage acts as a dedicated financial tool, specifically designed to handle final expenses without delay. This prevents the emotional burden of loss from being compounded by a sudden and stressful financial crisis.

Busy Professionals and Business Owners

If you’re a busy professional or an entrepreneur, you know that time is your most valuable asset. You simply don't have weeks to block off for medical exams and a long, drawn-out underwriting process. You need solutions that are fast, efficient, and fit your demanding lifestyle.

Life insurance with no waiting period delivers exactly that. Thanks to a streamlined, data-driven application, you can often secure coverage in less than a day. It provides the protection you need without derailing your schedule. For business owners with loans or key person dependencies, this isn't just a convenience—it’s a vital tool for business continuity.

When you're setting up a policy, it’s also a good time to get a clear picture of your entire estate, including understanding how beneficiary designations interact with a will.

Individuals with Some Health Conditions

Finally, this type of policy can be a real game-changer for people who are in pretty good health but might have a pre-existing condition or two. While very serious health issues often lead you to a guaranteed issue policy (which always has a waiting period), many common conditions won't stop you from getting day-one coverage.

Insurers have gotten much better at assessing risk for a wide range of health profiles. Things like well-managed diabetes, high blood pressure, or even past health events that have stabilized often won't disqualify you from getting immediate protection. It's always worth exploring your options with a provider like America First Financial—you might be surprised to find you’re eligible for the full, immediate coverage you're looking for.

To really appreciate why life insurance with no waiting period is such a big deal, it helps to look at the alternatives. Not all policies protect you from day one, and those delays aren't just fine print—they can leave your family financially exposed right when they need support the most.

Think of it like this: a no-waiting-period policy is like having a brand-new home security system that's fully armed the second the installer leaves. On the other hand, policies with waiting periods are like a system that won't go off for the first two years. It's a critical gap in protection.

The Standard Two-Year Contestability Period

First, let's clear up something that often causes confusion: the two-year contestability period. This is a standard clause in almost all life insurance policies, even those that offer immediate coverage. It’s not a waiting period for the payout.

It simply gives the insurance company the right to review your application if a death occurs within the first two years. They do this to protect against fraud—for example, if someone wasn't truthful about a major health issue. As long as you were honest on your application, the full death benefit gets paid. This clause ensures your "day one" coverage is based on good faith.

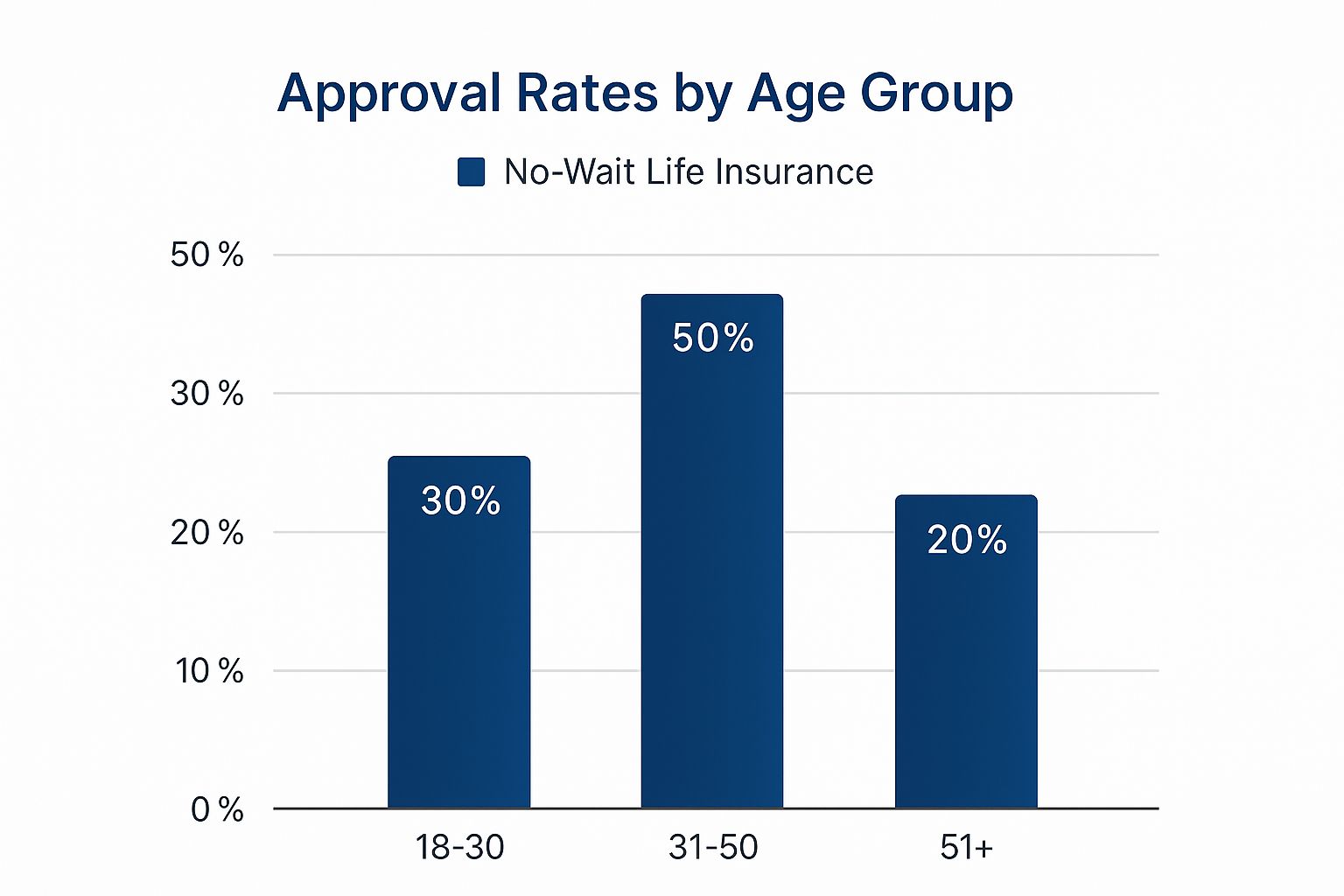

This is a great visual breakdown of who typically gets approved for these no-wait policies.

As you can see, approval rates are highest for people in their prime working years, but it's an option that's available across all adult age groups.

Graded Death Benefits: The Partial Payout Plan

One of the most common types of waiting periods is known as a graded death benefit. You'll often find this with policies for people who have some health issues but are still in better shape than someone who needs a guaranteed issue plan.

With a graded plan, the payout is limited if a death from natural causes happens in the first two years. It’s a tiered system that usually looks something like this:

Year 1: Beneficiaries might receive 30-40% of the full death benefit.

Year 2: The payout increases, maybe to 50-75% of the full amount.

After Year 2: The full 100% death benefit is finally available.

This structure is a compromise. It offers some immediate protection, but it falls short of the complete financial security you get with a no-waiting-period policy.

A graded benefit is a middle ground. It provides some level of immediate protection but reserves the full financial safety net until the policy has been in place for a couple of years.

The Full Waiting Period: Just a Refund of Premiums

Finally, you have policies with a full two-year waiting period. These are almost always tied to guaranteed issue life insurance. Since these plans skip the health questions, approval is a near certainty. But that convenience comes with a major catch.

If the insured person passes away from a natural cause (like a heart attack or cancer) during those first two years, the beneficiaries get no death benefit. Instead, the insurance company simply returns the premiums that were paid in, sometimes with a little bit of interest (often around 10%). The full coverage only kicks in after that two-year clock has run out.

To make these differences crystal clear, here’s a table breaking down how a payout would look in those critical first two years depending on the policy type.

How Life Insurance Payout Timelines Differ

Policy Type | Payout If Death Occurs in First 2 Years | Typical Underwriting Process |

|---|---|---|

No Waiting Period | Full 100% death benefit from day one. | Health questions, and sometimes a medical exam. |

Graded Death Benefit | A partial percentage (e.g., 30-75%) of the death benefit. | Health questions, but designed for those with some health issues. |

Full Waiting Period (Guaranteed Issue) | Return of premiums paid, plus a small amount of interest. | No health questions asked; approval is guaranteed. |

This table really highlights the gap. While some policies delay full protection, no-waiting-period plans activate coverage the moment your first premium is paid. Some of the best carriers in the business offer this kind of immediate coverage based only on your answers to health questions, with no medical exam needed. It's a key distinction, and it's what provides families with genuine peace of mind from the very beginning.

The Pros and Cons of Immediate Coverage

When you choose life insurance with no waiting period, you’re putting immediate security first. But it's crucial to have an honest look at the trade-offs. This isn't about finding some mythical "perfect" policy; it's about finding the one that truly fits your life right now.

Think of it like buying a car. A zippy sports car is a thrill to drive, but a minivan makes more sense for a big family. They're both great vehicles, just built for different jobs.

Policies with immediate coverage are designed for speed and simplicity. The biggest win, hands down, is the instant peace of mind. The moment you make that first payment, your loved ones have a financial safety net. It completely erases the anxiety of that two-year waiting period, where a non-accidental death could leave your family with nothing but a refund of the premiums you paid.

The Clear Advantages of Day-One Protection

The benefits here are straightforward and powerful. They all center on getting you security and convenience when it matters most.

Instant Peace of Mind: Your family is covered from day one. No more "what ifs" or worrying about the gaps found in graded or waiting-period policies.

A Painless Application: These policies often use what's called accelerated underwriting. That means no medical exams, no needles, and no long, drawn-out appointments. The whole process is quick and you can usually get it done online.

More Accessible to More People: If you have some health conditions that are under control, you can often qualify for immediate coverage without the stress of a full medical exam.

This streamlined process is a huge reason for the industry's shift. The growth of no-exam policies, often bundled with immediate benefits, is a major trend. Today, digital underwriting has made no-exam term life one of the fastest-growing products on the market. Some top-tier insurers are now offering coverage up to $2 million without a physical exam, using a detailed phone interview and digital health records instead. You can explore the details of no-exam life insurance on policygenius.com to get a feel for the options out there.

Understanding the Trade-Offs

Now, let's look at the other side of the coin. That convenience and speed come with a couple of key considerations. This isn't a hidden catch—it’s just the reality of an insurer taking on more risk without the deep dive of a full medical exam.

The main trade-off is usually the cost. Since the insurance company has less medical data to go on, the premiums for these policies can be higher than a fully underwritten plan that requires a complete medical check-up. The insurer is essentially pricing in the unknown.

The higher premium isn't a penalty. It's the price you pay for speed, convenience, and the insurer's willingness to cover a wider range of health profiles without a full screening.

On top of that, the available coverage amounts might be lower than what you could secure with a traditional policy. While some plans offer very generous coverage, many are geared toward specific goals, like wiping out a mortgage or covering final expenses, rather than replacing your income for decades to come.

Here’s a simple breakdown of what to weigh:

Aspect | The Upside (Pros) | The Downside (Cons) |

|---|---|---|

Premiums | Accessible for many health profiles. | Can be more expensive than fully underwritten plans. |

Coverage | Great for specific goals like debt or final costs. | May offer lower maximum benefit amounts. |

Process | Fast, simple, and no medical exam required. | Your approval relies heavily on an accurate application. |

At the end of the day, a life insurance with no waiting period policy is a specialized tool. It’s built for people who value immediate security and a hassle-free process above all else. By understanding both its powerful benefits and its practical trade-offs, you can decide with confidence if it’s the right way to protect your family's future.

How to Choose Your No Waiting Period Plan

Picking the right life insurance with no waiting period isn't as complicated as it sounds. It really comes down to matching a simple, effective policy to your personal situation. Think of it like making a checklist before a big trip—a few key steps can ensure you get to your destination safely and without any unnecessary stress.

The goal here is simple: find a plan with the right amount of coverage, at the right price, with an application process that doesn't feel like a chore.

First, Assess Your Financial Needs

Before you even start looking at quotes, take a moment to figure out exactly what financial gaps you need to fill. This isn't a gloomy task; it's a practical step to make sure your family isn't left scrambling during a difficult time. Getting a clear financial picture now empowers you to choose a coverage amount that actually makes sense.

Start by jotting down your financial obligations. What needs to be covered?

Final Expenses: The average funeral can easily top $9,000. This is often the main reason people look for this kind of immediate coverage in the first place.

Outstanding Debts: Think about any mortgage balances, car loans, or credit card debt that would otherwise be passed on to your loved ones.

Income Replacement: If your family relies on your income, how much would they need to get by for a certain period while they adjust?

Add those numbers up. That's your target for the death benefit. This simple calculation prevents you from buying too little coverage (leaving your family short) or paying for a policy that’s much larger than you really need.

Choosing your coverage amount is about replacing financial burdens with peace of mind. Your policy should be large enough to handle immediate costs and small enough to fit comfortably within your budget.

Next, Prepare for the Health Questions

The application for a no waiting period policy is your fast pass to skipping the medical exam. Since the insurance company is relying on your answers, being honest and prepared is crucial. They will cross-reference your information with digital records, like your prescription history, so accuracy is your best friend for a quick approval.

Most applications will ask about major health events or ongoing conditions. It helps to have dates and details ready for things like a past heart attack, stroke, or cancer treatment—it just makes the process that much smoother. And remember, many common health issues won't automatically disqualify you from getting immediate coverage.

At America First Financial, we’ve made our process straightforward and transparent. We'll help you find a plan that fits your budget and values, so you can lock in your family's financial security with total confidence. Comparing a few quotes and understanding the details is the final step to putting that protection in place.

Got Questions? We’ve Got Answers.

As you get closer to making a decision, a few questions always seem to pop up. Let's walk through some of the most common ones so you can feel completely confident about finding the right life insurance plan.

Do I Really Have to Go Through a Medical Exam for Instant Coverage?

Nope. In fact, one of the biggest perks of these plans is that you get to skip the medical exam entirely. Instead of needles and nurses, you’ll just answer some questions about your health.

The insurance company then double-checks your answers against digital records, like your prescription history, to make sure everything lines up. It's a much faster and more convenient way to get things done.

What if I Have Some Health Issues?

This is a big one. Many people worry that a pre-existing condition will automatically disqualify them from day-one coverage, but that's rarely the case. If your health issues are under control and well-managed, you can still absolutely find a policy with no waiting period.

Insurers are mostly concerned with very high-risk or terminal illnesses. The only time a waiting period is truly unavoidable is with a guaranteed issue policy. These are designed for people with serious health problems and skip the health questions altogether, but that trade-off means a mandatory waiting period.

The bottom line is this: don't count yourself out. Most common health conditions are insurable. It's always worth checking to see what's available for you.

Can I Get a Policy With Zero Health Questions and No Waiting Period?

This is a crucial point to understand: no, you can't. It’s one or the other. Any policy that guarantees your approval without asking health questions will always come with a two-year waiting period.

Think of it from the insurance company's point of view. If they didn't have a waiting period, anyone with a terminal diagnosis could sign up one day and have their family receive a payout the next. The company would go broke. That waiting period is what makes it possible for them to offer coverage to high-risk applicants in the first place. So, if you see an ad promising both, be skeptical.

How Do I Find the Right Plan for Me?

Finding the perfect fit doesn't have to be complicated. First, take a moment to figure out how much coverage you actually need to protect your family. From there, just be ready to answer the health questions honestly.

Your best move is to work with an independent agency. They can shop your profile around to a bunch of different insurance companies at once. This gives you the best odds of finding an insurer that’s a great match for your specific health situation, locking in immediate coverage at the best possible price.

At America First Financial, we do the heavy lifting for you. Our goal is to connect you with affordable and trustworthy life insurance that fits your needs and secures your family’s future right away. Get your free, no-obligation quote from America First Financial today and take the first step toward lasting peace of mind.

_edited.png)

Comments