Long Term Care Insurance Planning That Actually Works

- dustinjohnson5

- Jun 11

- 15 min read

Why Most Families Get Long Term Care Insurance Planning Wrong

Let's be honest, long-term care isn't exactly a fun conversation starter. Most families avoid it like the plague until a crisis forces their hand. Suddenly, they're scrambling for solutions under pressure, which often leads to costly mistakes. I've seen it happen within my own circle, and I've talked with financial planners who say it’s a common scenario.

One big mistake? Assuming family will step up to provide all the care. While family support is crucial, it’s not always realistic. Jobs, distance, and the sheer intensity of long-term care can make it impossible. Another pitfall is putting off planning until retirement. Waiting until health issues pop up makes finding affordable coverage incredibly difficult. Pre-existing conditions have a huge impact on your eligibility and premiums.

This is where planning ahead really pays off. I know, nobody wants to think about this stuff, but trust me, it’s better to explore options from a position of strength. You can truly evaluate your family’s needs, research different policies, and build a budget that works. For example, if Alzheimer’s runs in your family, you might focus on policies with strong cognitive impairment coverage. If your family is spread across the country, you might prioritize options that cover in-home care.

Thinking ahead is even more important with the rising demand for these services. With healthcare costs going up and people living longer, the market for long-term care insurance is predicted to explode—reaching USD 45.89 billion by 2032, with a growth rate of 4.5% from 2025 to 2032. This really highlights why getting a handle on this early is so important. Check out this report for more info: long-term care insurance market.

Finally, don't just think about the money. The emotional and logistical side of long-term care is just as big a deal. Who will manage everything? How will decisions be made if someone can’t make them for themselves? Talking about these things ahead of time makes it so much easier on everyone and ensures decisions are made thoughtfully, not in the midst of a crisis. A good financial advisor can be a lifesaver here. They can help you navigate the ins and outs of long-term care insurance and create a plan that truly fits your family’s values and goals.

Assessing Your Family's Real Long Term Care Insurance Needs

Forget those generic online calculators. Your family is unique, and your long-term care insurance planning should be too. Let's ditch the industry averages and walk through a practical way to assess your specific needs.

Beyond the Numbers: Considering Your Family's Story

Effective long-term care insurance planning starts with honest conversations. I've spoken to families who've been through this, and the ones who navigated it best started by looking at their actual family history. What's your family's health trajectory? Is there a history of heart disease, Alzheimer's, or other conditions that might require extensive care down the road?

Also, think about longevity. Do people in your family tend to live into their 90s? This could mean you need coverage for a longer period than most. These conversations can be difficult, but they're essential for understanding what your family actually needs, not what some algorithm thinks you need.

Lifestyle Preferences and Financial Realities

Next, consider the kind of care you would actually want. Do you envision aging in place at home, or would you prefer a community setting like assisted living? This significantly impacts the types of policies you should consider. For example, a friend's parents really wanted to stay in their home, so they looked for a policy that specifically covered in-home care expenses.

Your financial picture plays a key role too. Be realistic about what premiums you can comfortably afford now, and how that might change in the future.

To help you get a better grasp on the costs involved, take a look at the table below. It shows how much long-term care can vary based on where you live and the type of care you need.

Long Term Care Cost Comparison by Region and Care Type

Care Type | National Average | High-Cost Areas | Low-Cost Areas | Cost Trend |

|---|---|---|---|---|

Home Care | $55,000 | $70,000 | $40,000 | Increasing |

Assisted Living | $60,000 | $80,000 | $45,000 | Increasing |

Nursing Home Care | $100,000 | $130,000 | $75,000 | Increasing |

This table represents estimated average annual costs and may not reflect your specific situation. Consult with a financial advisor for personalized advice.

As you can see, the costs can be pretty substantial, and they’re on the rise. Talking to a financial advisor can be incredibly helpful for navigating these regional differences and planning for future increases due to inflation.

The Unspoken Truth: Family Dynamics and Caregiving

Now for the often-uncomfortable part: family dynamics. Who in your family could realistically provide care if needed? What are your children’s lives actually like? Do they live nearby? Do they have demanding careers or young children of their own? It’s easy to assume family will handle everything, but life is unpredictable.

Having honest discussions about caregiving expectations is essential. These aren't easy conversations, but they're crucial. One family I spoke with realized that their children, while willing, simply wouldn't be able to provide the necessary level of care due to distance and their own busy lives. This realization led them to prioritize long-term care insurance that would cover professional care options.

These potentially difficult conversations are the key to creating a realistic and sustainable plan. Remember, long-term care insurance is about securing your future and providing peace of mind, not just checking a box on a to-do list.

Decoding Long Term Care Insurance Options Without The Sales Pitch

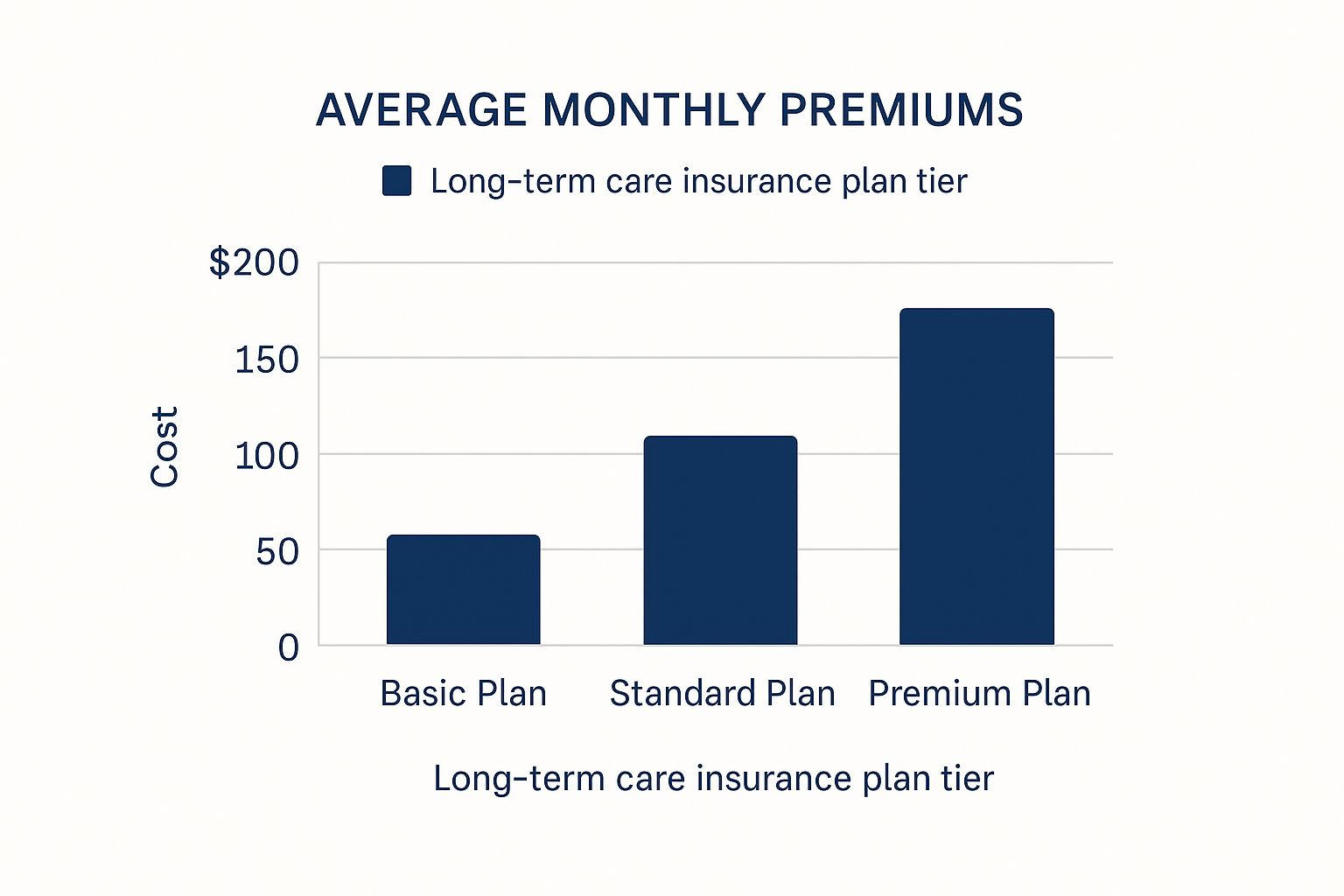

This infographic gives you a visual snapshot of average monthly premiums for long term care insurance, broken down into Basic, Standard, and Premium levels. Notice how the costs climb as the coverage gets more comprehensive? This really underscores why planning is so important. And a big part of that planning means getting a good handle on the different types of policies available. Insurance can feel like a maze, so let’s untangle the options together.

Traditional Long-Term Care Insurance: The Classic Approach

Traditional long term care insurance is like that dependable old car in the garage. It’s built for one purpose: covering long-term care expenses. You pay a regular premium, and when you need care, the policy steps in. This type of coverage is usually easier on the wallet upfront, especially if you get it while you’re younger. But here’s the rub: those premiums can go up over time. I’ve seen this firsthand with friends whose parents had a traditional policy. Those increasing premiums became a real strain on their finances. This is something conservative families, particularly those focused on budgeting and long-term financial health, need to think about seriously.

Hybrid Life Insurance and Long-Term Care: Two-in-One

Hybrid policies blend life insurance and long-term care coverage. The upside? If you don't need long-term care, there's a death benefit for your loved ones. This can be attractive, and it’s the right fit for some families. Another plus? The premiums are often locked in, giving you predictable costs. But… (there’s always a but, right?) these policies typically require a bigger upfront investment. This can be a significant chunk of change, especially if you're balancing other priorities like saving for college or retirement.

Newer Options on the Block: Short-Term and Linked Benefit Policies

Think of short-term care insurance like a temporary safety net. It’s meant to cover expenses for a shorter period, typically a year or less. This could be helpful for recovering from an injury or illness. Linked benefit policies are another newer option, tying long-term care benefits to an annuity or life insurance policy. These can offer flexibility, but they need to be examined carefully. For instance, short-term care might be all someone needs if they have strong family support and expect to need assistance for only a limited time.

Choosing Wisely: What Matters Most in a Policy

When you're looking at policies, don’t get lost in the fine print. Concentrate on the features that truly benefit your family. An inflation rider, for example, is a must-have. It adjusts your benefits to keep pace with rising healthcare costs (which, let's be honest, never seem to go down). A waiver of premium feature is another important consideration. This can be a lifesaver if you can no longer pay premiums due to illness or disability.

Timing is Key: Age, Health, and the Cost Equation

The old adage "buy young" isn’t always the golden rule. While younger applicants usually snag lower premiums, they pay them for a much longer period. Older applicants face higher premiums but pay for a shorter timeframe. It's a balancing act. Someone who's 55 might find that waiting until 60 actually saves them money in the long run. But there’s another wrinkle: your health. Waiting could make it tougher to qualify for coverage, especially if health issues crop up.

To help you compare the options we've discussed, take a look at this table:

Long Term Care Insurance Policy Comparison

Policy Type | Key Benefits | Typical Premium Range | Best For | Drawbacks |

|---|---|---|---|---|

Traditional Long-Term Care Insurance | Specifically designed for long-term care expenses; potentially lower initial premiums | Varies widely based on age, health, and coverage level | Those seeking dedicated long-term care coverage at a potentially lower initial cost | Premiums can increase over time; no death benefit |

Hybrid Life Insurance and Long-Term Care | Combines life insurance with long-term care benefits; locked-in premiums | Generally higher than traditional long-term care insurance | Those who want both life insurance and long-term care coverage with predictable premiums | Higher initial cost; may not offer the same level of long-term care benefits as a dedicated policy |

Short-Term Care Insurance | Covers expenses for a limited time (typically one year or less) | Lower than traditional or hybrid policies | Those needing coverage for a shorter duration, such as recovery from an injury or illness | Limited coverage period; may not be suitable for extended care needs |

This table highlights the key differences between policy types, helping you see which aligns best with your needs.

Choosing the right long term care insurance is a big decision. It's about protecting your family's future and ensuring they have the resources they need when they need them most. Don’t just grab the cheapest policy; choose the one that provides the right level of protection for your family's unique circumstances. A financial advisor can be a tremendous help in navigating these choices. They can help you build a plan that truly aligns with your family’s goals and financial situation. And remember, long term care planning isn’t a one-and-done deal. It’s an ongoing process. Be prepared to review and adjust your plan as your family's needs change over time.

Building A Long Term Care Insurance Budget That Actually Works

Let's talk frankly about the money side of long-term care insurance. Premiums that strain your budget today won't do you any good down the road. I've helped families navigate this, and finding a good balance is essential. They've found ways to fit these costs into their finances without sacrificing other important goals like retirement or their kids' college funds.

Balancing Act: Integrating Premiums With Your Financial Life

Imagine your budget as a pie. Each slice is a financial priority: your house payment, food, retirement savings, and now, long-term care insurance. The trick isn't to let one slice take over the whole pie. It's about making sure each piece is a reasonable size.

For example, one couple I worked with decided to slightly decrease the amount they were putting into their retirement accounts each year to make room for long-term care insurance premiums. Their thinking was that protecting their future also meant protecting their retirement savings from being wiped out by potential long-term care expenses.

Creative Strategies: Shared Benefits and Flexible Premiums

For married couples, a shared benefit policy can be a really good option. This type of policy combines the benefits, so if one spouse needs more care, they can use the other spouse's unused benefits. It's often much less expensive than having two individual policies. Think of it as a joint bank account for long-term care.

Another strategy is to consider policies that have flexible premiums. Some policies let you change the premium amount based on your income. So, if you expect to earn more later in your career, you might opt for a smaller premium now and increase it down the line. It's all about making your premiums work for your financial situation.

Timing Is Everything: Smart Strategies for Premium Savings

When you start paying premiums has a big impact on the total cost. Starting younger usually means lower premiums, but you'll pay them for a longer time. Starting later means higher premiums for a shorter period. There’s no perfect answer, and it’s different for everyone. I knew someone who waited until he was 60 to get a policy, even though he could have started in his 50s. He figured the higher premiums for fewer years would actually be cheaper for him overall than smaller payments spread over a longer time.

The Elephant in the Room: What if You Can’t Afford Premiums Later?

This is a real worry, and it's smart to think about it from the beginning. Some policies allow you to reduce your coverage or benefits if premiums become too much to handle. It's not the best-case scenario, but it’s there as a safety net. This is especially important for conservative families who are focused on financial security. Remember, the costs and the benefits of long-term care insurance are substantial. As of January 2025, leading providers are paying over $18 million in benefits daily. This shows the growing need for financial protection against the high cost of long-term care. Discover more insights into long term care insurance statistics.

Planning for the Unexpected: Building Flexibility Into Your Strategy

Life has a way of changing unexpectedly, so your long-term care insurance plan should be able to change with it. Regularly reviewing your policy, particularly during big life events like retirement or a new health diagnosis, is key. Think of it like a financial checkup for your insurance. It’s about actively managing your plan, not just setting it up and forgetting about it. A good financial advisor can be a huge help in guiding you through these changes and making sure your plan still works for you. They can help you understand your choices and adjust your plan so that your long-term care insurance stays a valuable part of your overall financial picture. Having a solid plan provides real peace of mind, knowing that you've taken steps to protect your future, no matter what comes your way.

Why Traditional Family Care Plans Are Failing

The picture above shows what many families imagine: aging parents lovingly cared for by their children. The reality, though, is usually much more complex. Traditional long-term care insurance often relies on this ideal, but it's increasingly out of touch with today's world. Let’s talk about why.

The Shifting Sands of Family Dynamics

Things are different now. Families are smaller, spread out geographically, and adult children often juggle demanding jobs with raising their own families. My friend, Sarah, always figured she'd take care of her mom. But when her mom needed serious help, Sarah was in over her head. Two young kids, a full-time job, and living hundreds of miles away – it just wasn't workable. This is a common story. Many families face similar struggles.

The Geographic Divide: Distance Matters

Where we live makes a big difference. Families are scattered across the country, even the globe. Love and good intentions are one thing, but providing day-to-day care from afar is practically impossible. I know another family, the Johnsons, who ran into this. Their parents were in Florida; they were in California. Constant flights weren't realistic, and the emotional strain of being so far away during a tough time was huge.

Changing Family Structures: A New Reality

The very structure of families has changed. More blended families, single-parent households, and smaller families overall mean fewer people are around to share the load of caregiving. This puts enormous pressure on those who are available, often leading to burnout and financial hardship. It also highlights why families are rethinking their long-term care insurance strategies.

Additionally, demographics are playing a significant role. The Baby Boomers are retiring, birth rates are down, and it all adds up to a higher old-age dependency ratio. Simply put, fewer workers support a growing elderly population. By 2074, the UK's elder care dependency ratio is projected to more than double, placing a huge burden on the working-age population. Discover more about demographic shifts and long term care.

Honest Conversations: The Foundation of a Solid Plan

Families who are succeeding in this area are having frank, sometimes tough conversations. They’re discussing expectations, geographic limitations, and the financial and emotional costs of caregiving. They’re also adapting their long-term care insurance plans to reflect those realities. These talks aren’t always easy, but they're crucial. They help families build plans rooted in the real world, not on what they hope will happen. Recognizing these shifts and having these open conversations allows families to make informed decisions about their long-term care needs. It’s about building a safety net that works for modern life, not some idealized version.

Executing Your Long Term Care Insurance Strategy

Alright, so you've done the hard work of planning, and now it's time to actually get that long-term care insurance coverage locked in. This is where the rubber meets the road, and I know from experience it can feel a little overwhelming. But don't worry, I've helped lots of families through this process, and I'm here to share some practical tips to make it go as smoothly as possible.

Preparing For the Application Process: What to Expect

Think of applying for long-term care insurance as a financial physical. The insurance company, through a process called medical underwriting, wants to understand your health status to assess their risk. They'll look at your medical history, ask about current conditions, and maybe even require a medical exam. The key here is preparation. Gather your medical records, make a list of your medications, and be ready to discuss your family's health history openly. The more organized you are upfront, the quicker and easier this process will be.

Having helped families navigate this, I know firsthand how important accurate information is. Being upfront can save a lot of headaches down the line.

Decoding the Health Questions: What They Really Mean

Those health questions on the application? They can feel a bit like a foreign language sometimes. Remember, they're designed to understand your future care needs. Don't try to guess or minimize anything. Be precise and detailed. For example, if they ask about "heart conditions," don't just say "no" if you've had high blood pressure or a heart murmur. Provide the details. I've seen how important complete answers are in preventing delays later on.

Working With Agents: Finding the Right Fit

A good insurance agent can be a lifesaver during this process, but finding the right one is essential. Look for an agent who specializes in long-term care insurance. They should really take the time to understand your family's unique circumstances and explain your policy options clearly. Think of them as your sherpa guiding you through the sometimes confusing world of insurance. Don't hesitate to ask friends, family, or your financial advisor for referrals.

Comparing Quotes: Beyond the Price Tag

When you start getting quotes, remember, there's more to it than just the monthly premium. Look at the whole package: What are the benefit amounts? How long is the elimination period (that's the time you pay for care before the policy starts paying)? Does it include an inflation rider? (Trust me, you want that.) It’s like buying a car – you wouldn't just look at the sticker price, would you? You’d consider gas mileage, safety features, and reliability. Same applies here.

Integrating Your Policy: The Bigger Financial Picture

Think of your long-term care insurance as one piece of your overall financial puzzle. It needs to fit in with your other plans, like your will, power of attorney, and beneficiary designations. This is where having a financial advisor can be incredibly valuable. They can help make sure everything works together harmoniously.

Talking to Family: Addressing Concerns and Questions

Finally, get ready to talk to your family. They might not understand why you're investing in long-term care insurance. Some might see it as an unnecessary expense. Have an open conversation, explain your reasoning, and show them how it protects not just you but the entire family's financial well-being. This is especially important for conservative American families who value financial security and open communication.

The screenshot below from Medicare.gov shows what Medicare doesn't cover regarding long term care. This highlights the importance of having a plan in place to address these potential costs.

Medicare, as you can see, only provides limited coverage for long-term care, mainly focusing on skilled nursing care after a hospital stay. This reinforces why long-term care insurance is so vital for filling those gaps and protecting your savings from potentially enormous expenses.

Your Long Term Care Insurance Planning Action Plan

Now that we’ve gotten a handle on the ins and outs of long term care insurance planning, let’s map out a practical action plan. This isn’t about getting lost in the weeds; it’s about making smart decisions you can actually put into action this week.

Prioritizing Your First Steps

Your starting point really depends on where you are in life. If you’re in your 50s or early 60s, now's the time to get serious about long term care insurance. Start by thinking about your family’s health history and what kind of care you’d realistically prefer down the road. For example, if Alzheimer's runs in your family, you’ll want to zero in on policies with solid coverage for cognitive impairment. From there, start exploring policy options and do some preliminary budget planning.

If you’re already in your 70s, your options might be fewer, but planning is still essential. Focus on exploring what coverage is available and think about how to work your existing assets into your long term care plan.

Creating a Realistic Timeline: Milestones and Decision Points

It helps to think of long term care insurance planning as a project with distinct phases. Phase one: figure out your needs and research policies (aim to wrap this up within two months). Phase two: develop a budget and compare quotes (give yourself another two to three months). Phase three: apply and finalize your policy (allow one to two months). These are just ballpark figures, of course – your timeline might be different – but having goals will keep you on track.

Reviewing and Adjusting Your Plan: Life Happens

Life throws curveballs. Marriage, divorce, job changes, new health diagnoses – these can all affect your long term care insurance needs. Get in the habit of reviewing your coverage at least annually, and definitely after any major life event. It's like a financial check-up!

Involving Adult Children: A Collaborative Approach

Talk to your adult children early on, not after a crisis. Share your planning process and explain your decisions. This open communication prevents surprises later and makes sure everyone’s on the same page. For example, if your plan involves them helping out in some way, discuss it now, not when you suddenly need the help.

Maintaining Your Coverage: Long-Term Strategies

Getting a policy is just the beginning. Keep an eye on premium increases and understand what your options are if they become too expensive. Stay informed about changes in the insurance world. Long term care insurance planning isn’t a one-time thing – it's an ongoing process.

By breaking this big topic down into smaller, manageable pieces, you can build a long term care plan that really works for your family. The key is moving forward with confidence, not fear.

Ready to secure your family's future with affordable, values-aligned protection? Explore long term care insurance options designed for conservative American families at America First Financial. They offer a straightforward, no-pressure approach, so you can find the right coverage without the sales pitch.

_edited.png)

Comments