Long Term Care Insurance Quotes Online: Expert Guide

- dustinjohnson5

- Jun 21, 2025

- 14 min read

Understanding What You're Really Shopping For

Before you start hunting for long-term care insurance quotes online, it’s a good idea to take a step back and figure out what you’re actually buying. A lot of people jump straight into comparing monthly premiums, but that's like shopping for a car by only looking at the price tag. You wouldn't do that without knowing if you're looking at a sedan, an SUV, or a sports car, right? Each one serves a different purpose, and the same goes for long-term care (LTC) insurance.

The world of LTC insurance is a lot bigger than just one type of policy. Generally, your choices boil down to two main categories: traditional policies and hybrid policies.

Traditional LTC Insurance: Think of this as a "use it or lose it" plan. You pay regular premiums for coverage that only kicks in if you need long-term care. If you pass away without ever needing that care, the money you paid in premiums is gone. It's pure insurance, designed to protect against a specific risk.

Hybrid LTC Insurance: These plans are a two-in-one deal, combining long-term care benefits with either a life insurance policy or an annuity. If you need care, you can draw from the benefits. If you don't, your family or beneficiaries receive a death benefit. This gets rid of the "use it or lose it" anxiety but usually means a higher cost upfront.

Which Type Is Right for Your Situation?

Deciding between a traditional and a hybrid plan really comes down to your personal finances and what you're comfortable with. For example, a healthy 55-year-old couple might find a traditional policy more affordable. It lets them lock in solid coverage without a huge initial payment.

On the other hand, someone in their 60s who has their house paid off and a good amount in savings might lean toward a hybrid policy. They could move an existing asset, like money from a CD, into a single-premium hybrid plan. This gives them LTC protection while making sure the money goes to their kids if they never use the care benefits.

Your family’s health history is another big piece of the puzzle. If you have relatives who needed extended care for chronic conditions, your own chances of needing it are higher. This could make a strong traditional policy a very smart move. This growing awareness is reflected in the market; the global LTC insurance market was valued at USD 32.25 billion in 2024 and is projected to hit nearly USD 45.89 billion by 2032. It’s not a niche product anymore—it's a key financial tool for many families.

Beyond Insurance: Proactive Health and Planning

At the end of the day, getting ready for long-term care is about more than just buying an insurance policy. It's about having peace of mind and staying in control of your life down the road. While you’re looking into long-term care insurance, it’s also a great time to explore strategies for healthy aging, which can directly affect your future health. Taking smart steps today can change your future care needs and even improve your chances of getting approved for insurance. By getting a handle on these basics, you can look for online quotes not just as a consumer, but as an informed planner making the best choice for your family's future.

Getting Ready For Accurate Online Quotes

Gather Your Essential Information

First things first, let's get your medical history organized. To give you a realistic quote, insurers need a clear picture of your health. Don't try to wing it from memory. A much better approach is to create a dedicated folder—either on your computer or a physical one—and pull together these key details:

A list of your current doctors, including their contact information.

The specifics of any prescriptions you take, like the dosage and what it's for.

A rundown of past surgeries, hospital stays, and any chronic conditions you manage, such as high blood pressure or diabetes.

Your current height and weight.

This isn't just about filling out a form correctly. When you provide a detailed and honest health summary right from the start, you present yourself as a lower-risk applicant, which can have a real impact on your rates. For instance, if you're actively managing high cholesterol with diet and exercise, documenting that shows you're proactive, and that can work in your favor.

Calculate Realistic Coverage Needs

With your health information ready, it’s time to think about what you’re actually insuring. The cost of long-term care can change a lot depending on where you live. For example, recent surveys show the median annual cost for a home health aide can top $75,000, while a private room in a nursing facility can soar past $116,000. It's a smart move to do a quick search for a "cost of care survey" in your state to see what the local numbers look like.

Once you have a ballpark figure, consider your ideal benefit period, which is the length of time you want the policy to pay out. It's worth noting that women, on average, require care for longer than men (3.7 years compared to 2.2 years). Knowing this target helps you avoid the pitfall of buying too little coverage or overpaying for too much. Taking the time to prepare these details ensures the quotes you receive aren’t just random numbers, but a genuine reflection of your future needs and potential expenses.

Mastering Online Insurance Platforms

Starting the hunt for long term care insurance quotes online can feel a bit like wading into a digital bazaar. Everyone is vying for your attention, but not all vendors are offering the same experience. It's important to know who you're dealing with—is it a direct insurance company, a broker comparing multiple options, or something else entirely?

Some websites are little more than lead-generation tools. You punch in your info hoping for an instant quote, but what you get is a phone that won't stop ringing with calls from various agents. While this isn't necessarily a bad thing, it’s not helpful if you're just trying to get a feel for the costs. The best platforms offer genuine value upfront. For example, the screenshot above shows a resource focused on education, giving you tools and guides before asking for your personal info. This lets you figure out what you need before talking to an agent, making that future conversation much more productive.

Direct Carriers vs. Independent Brokers

As you search for quotes, you'll mainly encounter two types of websites: those run by insurance companies themselves and those run by independent brokers.

Direct-to-Carrier Websites: When you go straight to an insurer like New York Life or Nationwide, you get an in-depth look at their specific policies. This is a solid approach if you've already done some homework and have a company in mind. The downside? You're only seeing their prices. It's like visiting a single car dealership—you might find a great vehicle, but you have no idea if a better deal is waiting down the street.

Independent Broker Platforms: These sites are your one-stop-shop. They partner with multiple insurance carriers and can display several quotes for you at once. A good broker platform will let you compare key features side-by-side, such as the elimination period (the waiting time before your benefits kick in) and different inflation protection riders. The biggest plus is getting a wide view of the market without having to visit a dozen different websites.

No matter which route you choose, look for sites with built-in educational resources. Many of the better platforms feature cost-of-care calculators or online questionnaires to help you nail down your needs. Using these tools is a great way to figure out the right daily benefit amount and policy length for your budget. You’ll go from being a casual browser to a confident buyer, ready to find a policy that works for you without breaking the bank.

Comparing Quotes That Tell The Real Story

When you start getting long-term care insurance quotes online, your eyes might naturally gravitate to the monthly premium. It’s easy to do, but that single number is just the cover of the book, not the whole story. To make a smart choice, you have to look past the price tag and understand what’s actually under the hood of the policy.

Let's imagine you're holding two quotes. Quote A is $150 per month, and Quote B is $200 per month. On the surface, Quote A seems like the obvious winner. But what if it comes with a 90-day elimination period, while Quote B's is only 30 days? This "elimination period" is your deductible, but instead of a dollar amount, it's measured in time. With Quote A, you'd be paying for care out of your own pocket for three full months before the insurance benefits start.

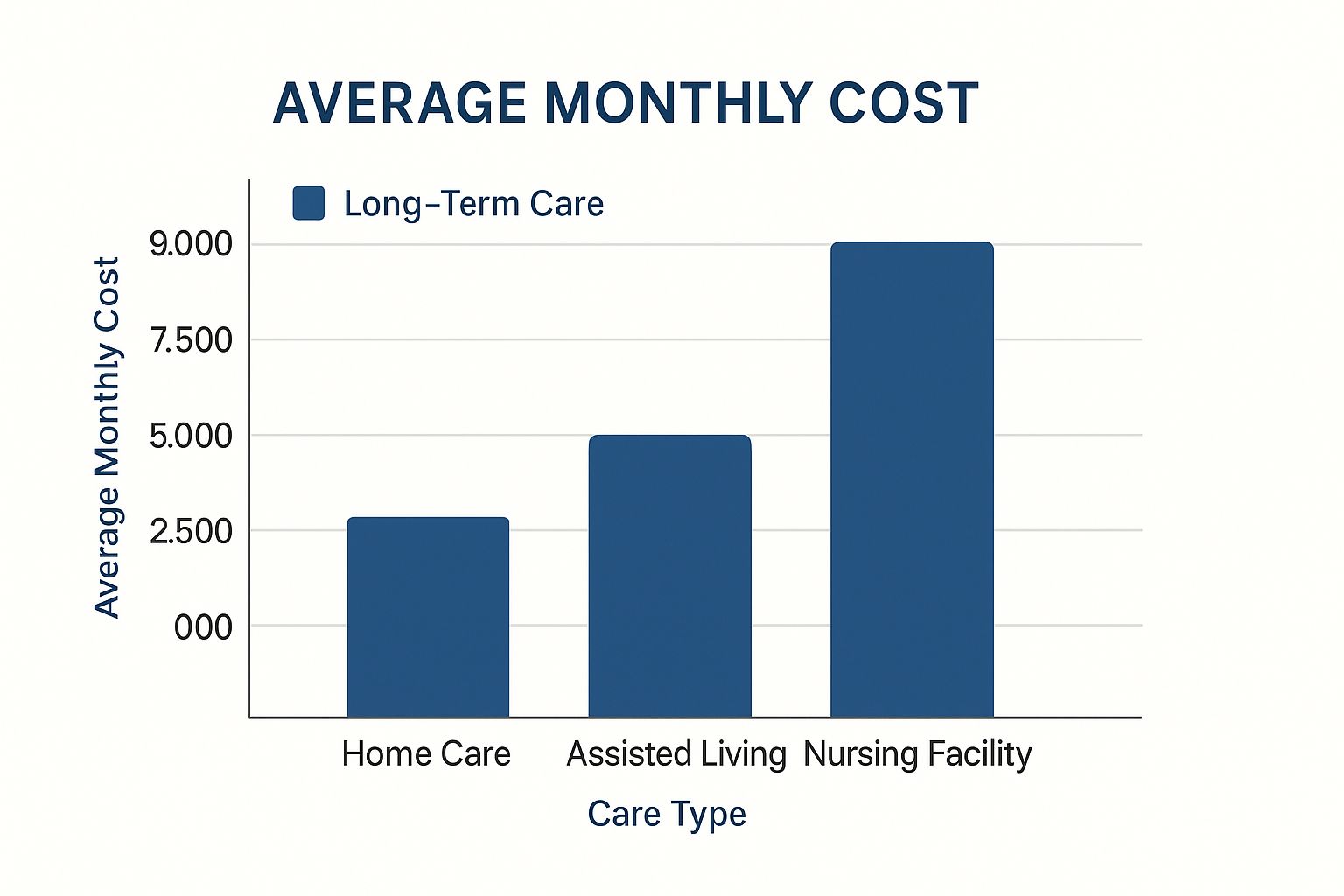

The infographic below shows just how fast those costs can pile up, depending on the type of care you need.

As you can see, even the most affordable option, home care, could set you back $7,500 or more during that 90-day waiting period. Suddenly, that "cheaper" policy doesn't seem like such a bargain.

Key Policy Features Comparison Guide

When you're sifting through quotes, the details truly matter. A higher premium might be attached to a policy that offers significantly more value in the long run. This table breaks down the essential features you'll need to compare side-by-side.

Feature | What It Means | Typical Options | Impact on Premium | Recommendation |

|---|---|---|---|---|

Daily/Monthly Benefit | The maximum amount the policy will pay for care each day or month. | $100 - $500 per day or $3,000 - $15,000 per month. | Higher benefit = higher premium. | Base this on the average cost of care in your area. Aim for an amount that covers at least 70-80% of projected costs. |

Benefit Period | The total length of time the policy will pay out benefits. | 2 years, 3 years, 5 years, or lifetime/unlimited. | Longer period = higher premium. | A 3 to 5-year period is often a good balance. The average long-term care claim is just under 3 years. |

Elimination Period | The waiting period before the policy starts paying; your out-of-pocket time. | 30, 60, 90, or 180 days. | Shorter period = higher premium. | A 90-day period is a common choice that helps keep premiums manageable. Just be sure you have savings to cover this gap. |

Inflation Protection | An option that increases your benefit amount over time to keep pace with rising care costs. | 3% or 5% simple; 3% or 5% compound. | Higher protection = higher premium. | Compound inflation protection is critical, especially if you are younger than 65. Care costs rise steadily. |

Company Financial Strength | The insurer's ability to pay future claims, rated by independent agencies. | Ratings from A++, A+, A (Superior/Excellent) to B (Fair). | Not a direct impact, but lower-rated companies may offer cheaper rates. | Insist on a company with an "A" rating or higher from an agency like A.M. Best. This is non-negotiable. |

Ultimately, comparing these features will give you a much clearer picture of what each policy truly offers. A slightly more expensive plan might provide double the real-world value when you factor in a shorter waiting period or stronger inflation protection.

Beyond the Basics: Benefit Periods and Company Reputation

Your analysis shouldn't stop at the main numbers. The benefit period—how long the policy pays out—is another crucial factor. One policy might cover you for three years, while another offers five. A longer period provides more security, especially against chronic conditions that require extended care.

Also, dig into the inflation protection. A policy with 3% compound inflation protection will grow your benefit pool much more effectively than one with simple inflation. This is vital, as the cost of care you might need in 20 years will be much higher than it is today.

Finally, do a background check on the insurance company itself. A low premium from an insurer with a shaky financial foundation or a history of denying claims is a risk not worth taking. A quick search for the company’s financial strength rating can tell you a lot. A high rating (look for 'A' or better) indicates that the company is financially stable and likely to be there when you need them, potentially decades from now. This thorough approach ensures you’re not just buying a piece of paper, but securing a reliable safety net for your future.

Understanding The Real Cost Beyond Premiums

That first number you see when you get long-term care insurance quotes online? Think of it as the opening chapter, not the whole book. Your monthly premium is a huge piece of the puzzle, but the true cost of your policy plays out over years, sometimes even decades. It’s essential to look past that initial sticker price to grasp what your financial commitment might really look like down the road.

One of the biggest lessons to learn about traditional long-term care insurance is that your premiums aren't always set in stone. Insurers can, and frequently do, file for rate increases over time. This isn't a bait-and-switch; it's a reaction to reality. If more people need care for longer than the company originally projected, or if the cost of that care skyrockets, the insurer has to adjust premiums for a whole group of policyholders to stay afloat. The industry is paying out more than ever before. In fact, by early 2025, major LTC providers were paying out over $18 million in benefits every single business day. This shows just how many people are now leaning on these policies. You can find more details on this and other insurance stats on comparelongtermcare.org.

Evaluating Your Long-Term Financial Commitment

So, how do you plan for a cost that isn't fixed? First, have a frank conversation with your agent about the insurer’s rate increase history. Some companies are much better at keeping prices stable than others. Second, explore different payment options that might give you more predictability.

Traditional Monthly/Annual Premiums: This is the standard way to pay. It’s the most budget-friendly way to get started, but it comes with the risk of future rate hikes. When you're budgeting, it's smart to build in a little extra room for potential increases later on.

Single-Premium Policies: These are often tied to hybrid life/LTC plans. You make one large, lump-sum payment at the beginning. The upside is huge: your premium is done, and you’ll never see a rate increase. This can be a fantastic move if you have funds from a non-qualified annuity or the sale of an asset that you can put to work.

Considering Tax and Family Planning

Don't forget to look at the other financial pieces of the puzzle. A portion of your premiums might be tax-deductible, which can help soften the blow to your budget. If your employer offers a group plan, that could be another avenue for a more stable rate, but you should always compare it with individual policies to be sure. Ultimately, the right choice is one that fits into your family’s bigger financial picture, giving you peace of mind you can actually afford for the rest of your life.

Smart Ways To Reduce Your Premium Costs

Finding affordable long-term care insurance quotes online isn't just about grabbing the cheapest policy you see. The real goal is to find the smartest one for your financial situation. With a few strategic adjustments, you can lower your premiums quite a bit without sacrificing the core coverage you'll rely on later.

For couples, one of the most practical strategies is the shared care rider. Instead of maintaining two completely separate policies, this rider connects them, creating a combined pool of benefits. If one partner uses up all their benefits, they can start using their spouse's. This setup is often more efficient and can lead to lower combined premiums compared to two individual plans.

Another key factor you can adjust is the elimination period. You can think of this as a deductible, but measured in days instead of dollars. It's the number of days you'll pay for care out-of-pocket before your insurance kicks in. A short 30-day waiting period might sound appealing, but it comes with a higher price tag. Stretching this to 90 days is a popular choice that can significantly reduce your premium. You're taking on more initial risk, but the long-term savings can be well worth it. Just make sure you have enough in savings to cover about three months of care costs yourself.

Considering Hybrid Policies And Benefit Periods

Adjusting your benefit period is another way to manage costs. A lifetime benefit offers the ultimate peace of mind, but it’s also the most expensive option by far. Since research shows the average long-term care need is less than four years, a policy with a three to five-year benefit period often hits the sweet spot between solid protection and affordability.

It’s also a good idea to explore hybrid long-term care policies. These plans blend life insurance with LTC benefits, neatly solving the "use it or lose it" dilemma of traditional policies. If you end up never needing long-term care, your heirs receive a death benefit. The initial cost is typically higher, but you're guaranteed a payout one way or another, which ensures your premiums provide value no matter what happens.

To help you visualize how these different strategies can affect your bottom line, here’s a breakdown of the most common ways to lower your premiums and what you can expect in return.

Strategy | Potential Savings | Coverage Impact | Best For | Considerations |

|---|---|---|---|---|

Extend Elimination Period | 10-30% | Delays when benefits start. Requires more out-of-pocket spending upfront. | Individuals with enough savings to self-fund for 90+ days. | Assess your emergency fund. Can it comfortably cover 3-6 months of potential care costs? |

Choose a Shorter Benefit Period | 20-40% | Limits the total duration of coverage. Average need is 3 years. | Those seeking a balance between affordability and substantial protection. | A shorter period might not cover extended needs, like for dementia or Alzheimer's. |

Opt for a Shared Care Rider | 15-25% (for couples) | Pools benefits, offering flexibility if one spouse needs more care. | Married or partnered couples looking for combined savings and security. | Both partners must qualify medically. The total benefit pool is still finite. |

Select a Hybrid Policy | Varies (Higher Upfront) | Guarantees a payout (death benefit or LTC). Less risk of "wasted" premiums. | People who want both life insurance and LTC coverage and dislike the "use it or lose it" model. | Premiums are higher than traditional LTC policies. The death benefit may be reduced by LTC claims. |

Ultimately, choosing the right premium-reduction strategy is a personal decision based on your financial health and risk tolerance. By carefully considering these options, you can design a policy that effectively safeguards your future without straining your current budget.

This approach is becoming more important as the long-term care sector grows. The global market for these services, including nursing and home health care, hit an incredible USD 1,138.5 billion in 2024. To learn more about this expanding industry, you can read the full long-term care market research from IMARC Group. Understanding these trends helps you see why having a smart, affordable plan in place is so crucial.

Making Your Decision And Moving Forward

After weighing your options and comparing long term care insurance quotes online, you’ve likely found a policy that feels right for your family's future and your budget. This is a huge accomplishment, but now it’s time to take the final steps. The application and underwriting process is the last piece of the puzzle, and getting through it smoothly is what stands between you and secured coverage.

This part of the journey is more than just paperwork. The insurance company will now do its own due diligence to verify the health information you've shared. This usually means they'll take a close look at your medical records and may require a short phone interview or a visit from a paramedical professional. Think of it as a final check-up to confirm all the details before the policy goes into effect.

Successfully Navigating the Application

The two most important things at this stage are honesty and consistency. Every piece of information you provide now must line up perfectly with what you submitted for your initial quotes. Any contradictions, even accidental ones, could cause delays, lead to higher premiums, or even result in a denial. For example, if you forgot to mention a minor surgery from a few years back, it's far better to disclose it now. It shows you’re being upfront and helps the underwriter get a complete and accurate health profile.

To keep the process moving forward, try to avoid these common slip-ups:

Downplaying Health Issues: It's tempting to minimize a chronic condition, but it’s better to be transparent. Instead, explain how you are actively managing your health with your doctor's guidance.

Rushing Through Interviews: When you have your health interview, take your time. Have your list of medications, doctor's contact information, and medical history ready so you can give clear and accurate answers.

Submitting Incomplete Forms: Before you send anything in, give it a final look. A missed signature or an unanswered question can send your application right back to the beginning, causing unnecessary delays.

After Approval: Managing Your Policy

Congratulations—you’ve been approved! Your work isn’t quite finished, though. Your new policy is a valuable asset that needs a little bit of ongoing management to remain effective. First, store your policy documents somewhere safe and accessible. Critically, make sure your spouse or adult children know where these documents are and have a basic understanding of your coverage. A quick family chat to go over the policy holder, the insurance company, and how to file a claim can save a lot of stress down the road.

Finally, get into the habit of reviewing your coverage every couple of years, or whenever you have a major life change. This simple check-in ensures that your long-term care plan continues to be a strong and relevant part of your family's financial security for many years to come.

Ready to secure your family’s future with a plan that aligns with your values? At America First Financial, we offer clear, affordable long-term care options without the political noise. Get your personalized quote in under three minutes and take the first step toward lasting peace of mind. Find your plan with America First Financial today!

_edited.png)

Comments