Mastering RMD Rules for Smart Retirement

- dustinjohnson5

- Aug 3, 2025

- 15 min read

For decades, you've diligently saved in your tax-deferred retirement accounts, watching your nest egg grow without Uncle Sam taking a cut each year. But this tax-friendly arrangement doesn't last forever. The government eventually wants its share, and that's where Required Minimum Distributions, or RMDs, come into play.

Think of RMDs as a mandatory call from the IRS. Once you hit a certain age, you must start withdrawing a specific amount from accounts like your Traditional IRA or 401(k). If you don't, the penalties are steep. It’s the government's way of ensuring that tax-deferred money finally enters the taxable world.

What Are Required Minimum Distributions?

Let’s try an analogy. Your retirement account is like a tax-sheltered savings dam you've spent your career building up. The water level—your investment balance—rises year after year, and the government agrees not to tax the growth along the way.

But that dam isn't meant to hold water forever. RMDs are essentially the government opening the floodgates. Once you reach the RMD age, the rules require you to start releasing some of that water. This ensures those funds don't stay locked away from the tax man indefinitely and become part of your taxable income for the year.

Which Accounts Do RMD Rules Apply To?

Knowing which of your accounts are on the hook for RMDs is ground zero for smart retirement planning. Not every account type is treated the same.

As a general rule, RMDs apply to retirement plans where you got a tax break on your contributions. These include:

Traditional IRAs

SEP IRAs

SIMPLE IRAs

401(k) plans

403(b) plans

457(b) plans

Profit-sharing plans

The guiding principle is simple: If you didn't pay tax on the money going in, you'll have to pay tax on it coming out. RMDs are the system that makes sure that happens.

The big exception here? The Roth IRA. Since you contribute to a Roth with money you've already paid taxes on, the original owner is never required to take RMDs. This is a huge advantage, giving you total control over those assets in your later years. It's always smart to understand the specific rules for any account you hold, even specialized ones like those covered in Precious Metals SIRA Regulations.

The Ever-Changing RMD Landscape

One thing to remember is that these rules aren't set in stone. The Required Minimum Distribution rules have shifted quite a bit recently, thanks to major legislation like the SECURE Act of 2019 and SECURE 2.0 Act of 2022.

Not long ago, the RMD starting age was 70½. Then, Congress pushed it to 72, and now, it's 73 as of 2023. These frequent updates show just how important it is for retirees to stay on top of the latest changes in retirement law to ensure their financial plan remains on track.

When Do I Actually Have to Start Taking RMDs?

Figuring out exactly when you need to start taking money out of your retirement accounts can feel confusing, especially since the rules have changed a few times recently. For years, everyone knew the quirky magic number: age 70½. It was a strange deadline that tripped a lot of people up.

Thankfully, things have gotten a bit more straightforward. First, the SECURE Act of 2019 got rid of the 70½ rule and pushed the starting line to age 72. Then, the SECURE 2.0 Act of 2022 moved it again for younger folks. The goal of these changes is simple: to give your retirement nest egg more time to grow, tax-deferred, before Uncle Sam requires you to start withdrawing.

The key to it all? Your birth year. That's what determines which set of rules applies to you.

Understanding Your "Required Beginning Date"

The IRS has a specific term for your first RMD deadline: the Required Beginning Date (RBD). This is the absolute last day you can take that initial distribution before you get hit with a penalty.

For your very first RMD, the deadline is April 1 of the year after you reach your specific RMD age. Simple enough. But for every single year after that, the deadline shifts to December 31.

Here’s a crucial planning point: if you wait until that April 1 deadline to take your first RMD, you're setting yourself up to take two distributions in one year.

Your first RMD (for the year you turned the required age) is due by April 1.

Your second RMD (for the current year) is due by December 31.

This "doubling up" can easily bump you into a higher tax bracket, which means a bigger tax bill. It's often smarter to just take your first RMD in the same year you hit your RMD age, even though you have until April 1 of the next year.

Find Your Start Age by Birth Year

So, how do you find your magic number? Just look at when you were born. The law creates clear-cut groups, so there’s no guesswork involved.

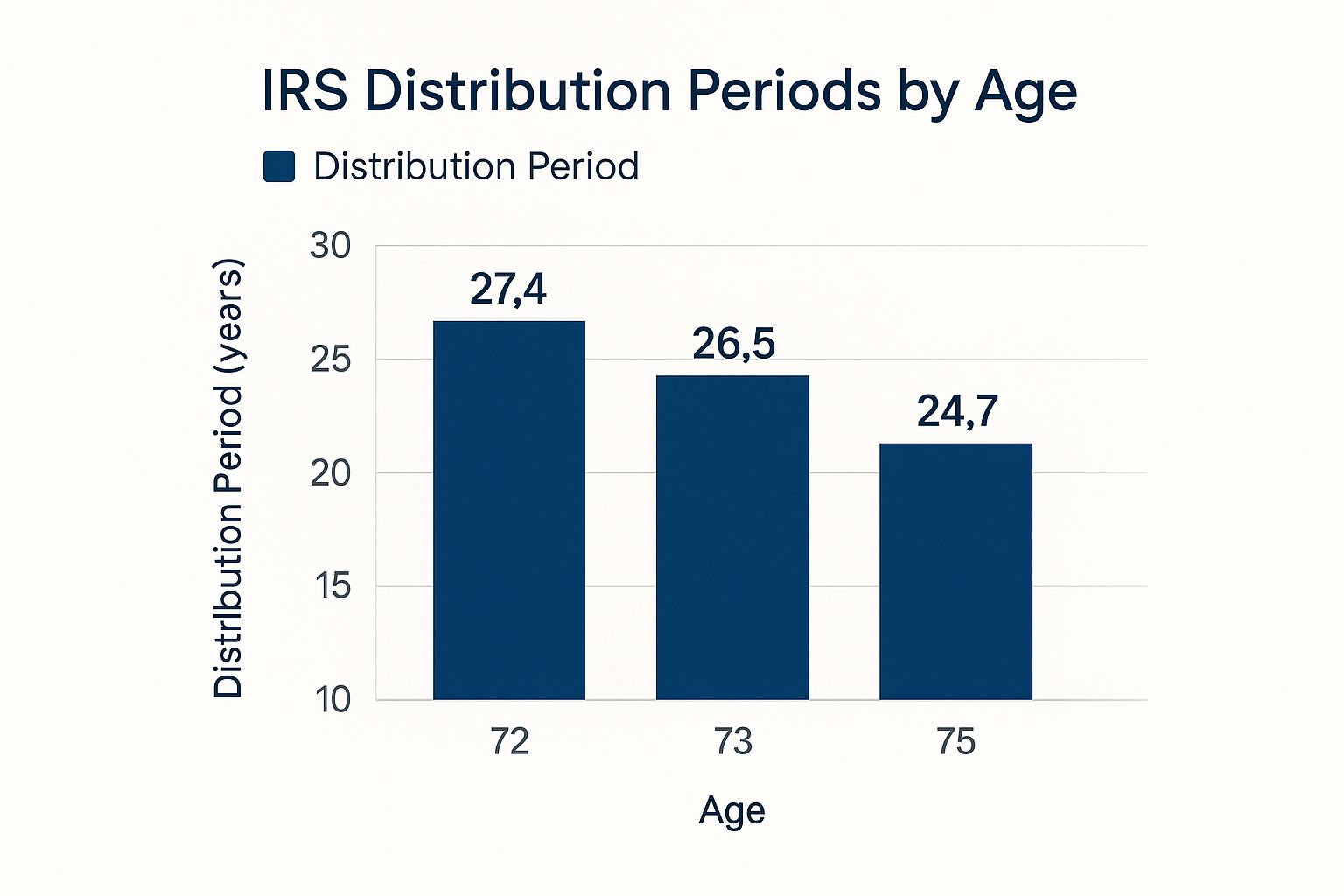

This image shows how your age relates to the IRS "distribution period," a factor that gets shorter as you age and dictates how much you need to withdraw.

As you can see, the older you get, the larger the percentage of your account you'll need to take out each year.

The following table lays out the current RMD age rules based on your birth year.

Your RMD Start Age by Birth Year

Use this table to find your required minimum distribution starting age based on your date of birth, reflecting changes from the SECURE Act and SECURE 2.0.

If You Were Born... | Your RMD Start Age Is... |

|---|---|

On or before June 30, 1949 | 70½ (You should already be taking RMDs) |

July 1, 1949 – 1950 | 72 |

1951 – 1959 | 73 |

1960 or later | 75 |

Think of this table as your go-to reference. For instance, if you were born in 1955, your RMDs must begin at age 73. If your younger cousin was born in 1961, they can wait until age 75. Knowing your correct starting age is the first and most important step in managing your retirement withdrawals with confidence.

Calculating Your Annual RMD Amount

Figuring out your Required Minimum Distribution might seem daunting, but it’s not as complex as you’d think. Honestly, it’s just a simple division problem. Once you know which two numbers you need, the rest is easy.

The entire process boils down to taking your retirement account balance from the end of last year and dividing it by a specific number provided by the IRS, called a "life expectancy factor." That's all there is to it.

Let's walk through exactly how this works, step by step.

Step 1: Find Your Prior Year-End Account Balance

First things first, you need a starting point. That number is the total value of your retirement account as of December 31 of the previous year.

So, to figure out your RMD for 2024, you'll need to look at your account statement from December 31, 2023. Your financial institution usually makes this crystal clear on your year-end statement or in your online account portal.

This is a critical detail because your RMD is always based on past value. What the market does this year has zero impact on the amount you’re required to take out for this year.

Step 2: Locate Your Life Expectancy Factor

Next up is the "magic number"—your life expectancy factor. Don't worry, you don't have to guess. The IRS publishes official life expectancy tables for this exact purpose. For most people, the right one is the Uniform Lifetime Table.

The Uniform Lifetime Table is the standard for most retirees calculating their RMDs. It’s what you’ll use if you're an unmarried account owner, or if you're married and your spouse isn't more than 10 years younger than you.

All you do is find your age for the current year on the table. The number right next to it is your life expectancy factor (sometimes called a "distribution period"). For someone who is 73, that factor is 26.5. In the eyes of the IRS, this means your retirement savings are expected to last another 26.5 years.

Here’s a quick look at a piece of the IRS Uniform Lifetime Table:

Age | Distribution Period |

|---|---|

73 | 26.5 |

74 | 25.5 |

75 | 24.6 |

76 | 23.7 |

77 | 22.9 |

You can see the full, official version in IRS Publication 590-B.

Step 3: Divide Your Balance by the Factor

Now that you have your two key numbers, the final step is a breeze. Just divide your account balance from December 31 by your life expectancy factor.

The Formula:

Let's put this into practice with an example. Meet Susan, who turns 73 in 2024.

Find Balance: She checks her statement and sees her Traditional IRA was worth $500,000 on December 31, 2023.

Find Factor: She looks at the Uniform Lifetime Table for age 73 and finds her factor is 26.5.

Calculate RMD: She does the simple math: .

Susan's RMD for 2024 is $18,867.92. She needs to withdraw at least this much from her IRA before the end of the year to meet the RMD rules.

Handling RMDs from Multiple Accounts

So, what happens if you’re juggling more than one retirement account? This is where it’s essential to understand the rules on "aggregation." In short, you need to know if you can lump your RMDs together or if you have to take them out separately.

IRAs (Traditional, SEP, SIMPLE): You have some great flexibility here. You must calculate the RMD for each IRA you own individually. But after you've done that, you can add up all the RMD amounts and take the total withdrawal from just one of your IRAs, or any combination you like.

401(k) and 403(b) Plans: These are much stricter. You have to calculate the RMD for each 401(k) or 403(b) plan you have, and you must withdraw that specific amount from that specific plan. You cannot mix and match or take one plan's RMD from another.

This is a really important distinction. Getting the IRA and 401(k) rules mixed up is an easy way to accidentally miss an RMD and face a stiff penalty.

The Steep Price of a Missed RMD

Forgetting or ignoring your Required Minimum Distribution is one of the costliest mistakes you can make in retirement. The IRS doesn't take missed RMDs lightly, and the penalty for failing to take your required withdrawal can be a painful financial hit.

For a long time, the penalty was a jaw-dropping 50% of the amount you were supposed to withdraw. Imagine you were required to take a $10,000 RMD and missed it. You would have owed the IRS a $5,000 penalty, plus the regular income tax on that distribution. It was a brutal mistake to make.

Understanding the Excise Tax

Thankfully, some recent legislative changes have softened that blow. The penalty, which is officially called an excise tax, is now lower, but it’s still something you absolutely want to avoid.

Here’s how the penalty structure works today:

Standard Penalty: The tax is now 25% of the RMD amount you failed to take. While it’s half of what it used to be, losing a quarter of your required withdrawal is still a substantial setback.

Reduced Penalty for Correction: If you catch the mistake and fix it promptly—which the IRS generally defines as within two years—the penalty drops to just 10%.

This tiered system creates a powerful incentive to be vigilant. Realizing you've missed a deadline is stressful, but acting fast to correct the error can save you a significant amount of money.

How to Fix a Missed RMD

So, what do you do if you look at the calendar and realize you've blown past the December 31 deadline? First, don't panic. The IRS has a straightforward process for getting back on track. Your very first move should be to withdraw the full required amount as soon as you discover the oversight.

Once you’ve taken that late distribution, you’ll need to file IRS Form 5329, "Additional Taxes on Qualified Plans (including IRAs) and Other Tax-Favored Accounts." This is the form where you report the shortfall and calculate the penalty you owe. But it also serves another vital purpose: it's your chance to ask for forgiveness.

You can request that the IRS waive the penalty if you can demonstrate that the error was due to "reasonable cause" and not simply because you chose to ignore the rule.

A "reasonable cause" waiver isn't a sure thing, but the IRS is often understanding of legitimate reasons. This could be anything from a serious personal illness or a death in the family to a mistake made by the financial institution managing your account.

To make your case, you'll attach a letter to Form 5329 explaining exactly why you missed the RMD. Be clear, honest, and to the point. The evolution of these penalties shows just how seriously the government takes RMD compliance. As detailed in this in-depth analysis of RMD rule changes, these regulations significantly impact how retirees manage their wealth and lifetime tax burden. The reduction from 50% to 25% (or 10%) is a major shift, but the goal remains the same: ensuring retirees take their distributions.

Of course, the best strategy is always prevention. Setting up automatic withdrawals with your brokerage or simply putting a recurring alert on your calendar can help you avoid this entire headache.

Navigating RMD Rules for Inherited Accounts

Stepping into the world of inherited retirement accounts is like entering a whole new territory with its own map and rules. The old guidelines were completely upended by the SECURE Act, so what you thought you knew might no longer apply.

When you inherit an IRA or 401(k), you're not just getting the money—you're also getting a new set of deadlines. Getting these rules right is absolutely critical for protecting the value of your inheritance and sidestepping some nasty tax surprises. For most people, the days of stretching out distributions over a lifetime are a thing of the past.

The 10-Year Rule for Most Beneficiaries

For most non-spouse beneficiaries inheriting an account in 2020 or later, the game is now governed by one big rule: the 10-Year Rule. It’s straightforward but unforgiving. The rule mandates that the entire balance of the inherited account must be completely withdrawn by the end of the 10th year after the original owner's death.

Think of it like a countdown timer. The moment the original account holder passes away, a 10-year clock starts ticking, and you have until the end of that decade to empty the account. This can have huge tax consequences, since every dollar you pull from a traditional IRA or 401(k) is taxed as regular income.

A major point of confusion for years was whether you had to take money out each year during that 10-year window. The IRS finally brought some clarity. If the person you inherited from was already taking their RMDs, then you must also take annual RMDs. If they hadn't started RMDs yet, you have the option to wait and withdraw the entire sum in year 10, though be warned—that could trigger a massive tax bill all at once.

Favorable Rules for a Surviving Spouse

Things look much different—and much better—for a surviving spouse. This is one of the most important distinctions in the RMD rules, as spouses get options no one else does.

A surviving spouse typically has two powerful choices:

Treat the account as inherited: They can leave the account in their deceased spouse's name. This lets them put off taking RMDs until the year their late spouse would have reached RMD age.

Execute a spousal rollover: They can move the funds into their own IRA. This effectively makes the money their own, letting them delay RMDs until they hit their own RMD age and use the more favorable Uniform Lifetime Table for calculations.

The SECURE 2.0 Act sweetened the deal even more. Now, a spouse who chooses to keep the account as inherited can still elect to use the Uniform Lifetime Table, which often results in smaller required withdrawals.

Key Takeaway for Spouses: The ability to roll over an inherited IRA is a unique and powerful advantage. It allows the surviving spouse to seamlessly integrate the assets into their own retirement plan, delaying distributions and extending the life of the tax-deferred growth.

This flexibility gives a surviving spouse the chance to pick the path that makes the most sense for their age, financial situation, and long-term estate planning.

Exceptions for Eligible Designated Beneficiaries

While the 10-Year Rule is the new norm, it doesn't apply to a select few. The SECURE Act carved out a special group known as Eligible Designated Beneficiaries (EDBs). These individuals get a pass on the 10-Year Rule and can often still "stretch" distributions over their own life expectancy.

So who gets this special treatment? The list is very specific:

The surviving spouse (who already has great options)

A minor child of the original account owner (but only until they turn 21, at which point the 10-Year Rule kicks in)

A disabled or chronically ill individual (as defined by strict IRS guidelines)

Someone who is not more than 10 years younger than the deceased account owner (like a sibling or partner close in age)

For these beneficiaries, being able to stretch withdrawals is a huge financial win. It keeps the funds growing tax-deferred for much longer, leading to smaller annual tax hits and preserving the account's value for decades to come.

Strategies to Lower Your Future RMD Tax Bill

Knowing the RMD rules is just the first step. The real magic happens when you start planning ahead to shrink the tax bill that comes with them. With a bit of foresight, you can take control and significantly reduce how much of your nest egg gets taxed in your later years.

The trick is to not wait until your RMDs are knocking at your door. By taking action years in advance, you can strategically manage your account balances. Let's walk through two of the most powerful ways to do this: Roth conversions and Qualified Charitable Distributions (QCDs).

Embrace the Power of Roth Conversions

A Roth conversion is a fantastic tool for long-term tax planning. It’s the process of moving money from a pre-tax account, like a Traditional IRA or 401(k), over to a post-tax Roth IRA. Now, there's a catch: you have to pay income tax on the amount you convert in the year you make the move. That can sting in the short term, but the long-term payoff is often worth it.

Once your money is in a Roth IRA, it grows completely tax-free. And here's the best part: Roth IRAs have no RMDs for the original owner. That means every dollar you convert is a dollar you won't be forced to withdraw—or pay taxes on—when you're older.

Strategic Insight: Many people find the best time for Roth conversions is during their "gap years." This is the window after you've retired but before you start taking Social Security and RMDs. Your income is often at its lowest point then, which means you can convert the money at a much lower tax rate.

This is just one piece of the puzzle. For a bigger picture on managing your tax liabilities after you stop working, take a look at these strategies for minimizing taxes in retirement.

Make a Difference with Qualified Charitable Distributions

If you're charitably inclined, the Qualified Charitable Distribution (QCD) is an incredibly smart way to handle your RMDs. This option opens up once you turn 70½—and yes, that age is different from the RMD starting age. A QCD lets you send up to $105,000 (the limit for 2024, which adjusts with inflation) directly from your IRA to a charity you support.

This is where it gets really good.

The amount you donate can satisfy all or part of your RMD for the year.

Even better, the money given through a QCD is completely excluded from your adjusted gross income (AGI).

This one-two punch is a massive tax advantage. Lowering your AGI can help reduce your Medicare premiums and lessen the taxes you owe on your Social Security benefits. It's a win-win: you support a cause you're passionate about while satisfying your RMD in the most tax-friendly way imaginable.

Just as a side note, it’s interesting how acronyms can have multiple meanings. While "RMD" in our world means Required Minimum Distribution, the European Centre for Disease Prevention and Control uses RMD for its Response Measures Database, which tracks public health data from the COVID-19 pandemic. You can see this very different use of the acronym in their database and its findings.

Your Top RMD Questions, Answered

Once you get the basics of RMDs down, the specific, real-world questions start popping up. Let's tackle some of the most common ones that retirees and their families run into.

Can I Take My RMD In-Kind?

Absolutely. An "in-kind" RMD simply means you move investments, like shares of a stock or mutual fund, directly from your IRA into a regular, taxable brokerage account. You don't have to sell them and withdraw cash.

The fair market value of those shares on the day you transfer them is what counts toward your RMD. You'll report that amount as taxable income for the year. This is a great strategy if you’re bullish on a particular stock and don't want to part with it. It lets you meet the IRS requirement while keeping your investment, though you'll eventually owe capital gains tax when you sell the shares from your brokerage account.

What About My Roth 401(k)?

This is a classic "gotcha" in the retirement world. We all know Roth IRAs are exempt from RMDs for the original owner, but many people are surprised to learn that Roth 401(k)s *do* have RMDs. If you have a Roth 401(k), you must start taking distributions at your RMD age, just like with a traditional 401(k).

Important Tip: There's a straightforward fix for this. You can roll your Roth 401(k) funds directly into a Roth IRA. As soon as that money is in a Roth IRA, it's free from the RMD rules for the rest of your life.

This simple move gives you the best of both worlds—your money continues to grow tax-free, and you decide when (or if) to take it out.

How Do Market Ups and Downs Affect My RMD?

This is a crucial point to understand. Your RMD for any given year is always calculated based on your account's value on December 31 of the *previous* year. What the market does this year doesn't change the dollar amount you're required to take out.

Think about it this way: if your account had a high balance last December but the market has since dropped, you're stuck with that higher RMD amount. It can feel painful because you're forced to sell more shares at a lower price to generate the required cash.

On the flip side, if the market has a fantastic year, your RMD will be based on the lower value from the year before. This leaves more of your recent gains in the account to keep growing tax-deferred. The amount is set in stone, but you do have some flexibility on when during the year you take it.

At America First Financial, we believe in protecting your financial future with plans that honor your values. Secure your family's well-being without worrying about political agendas. Get a clear, no-hassle insurance quote in under three minutes by visiting us at https://www.americafirstfinancial.org.

_edited.png)

Comments