Minimizing Taxes in Retirement: Real Strategies That Work

- dustinjohnson5

- Jun 13

- 14 min read

Understanding Your Real Retirement Tax Reality

Let's be real, retirement planning often skips over the nitty-gritty of taxes. Most advisors focus on the fun stuff, but the truth is, minimizing your tax burden in retirement is a whole other ball game. It's not about magically shrinking your income; it's about smart account management and strategic withdrawals. I've seen this firsthand, both in my own planning and in talking to others navigating retirement.

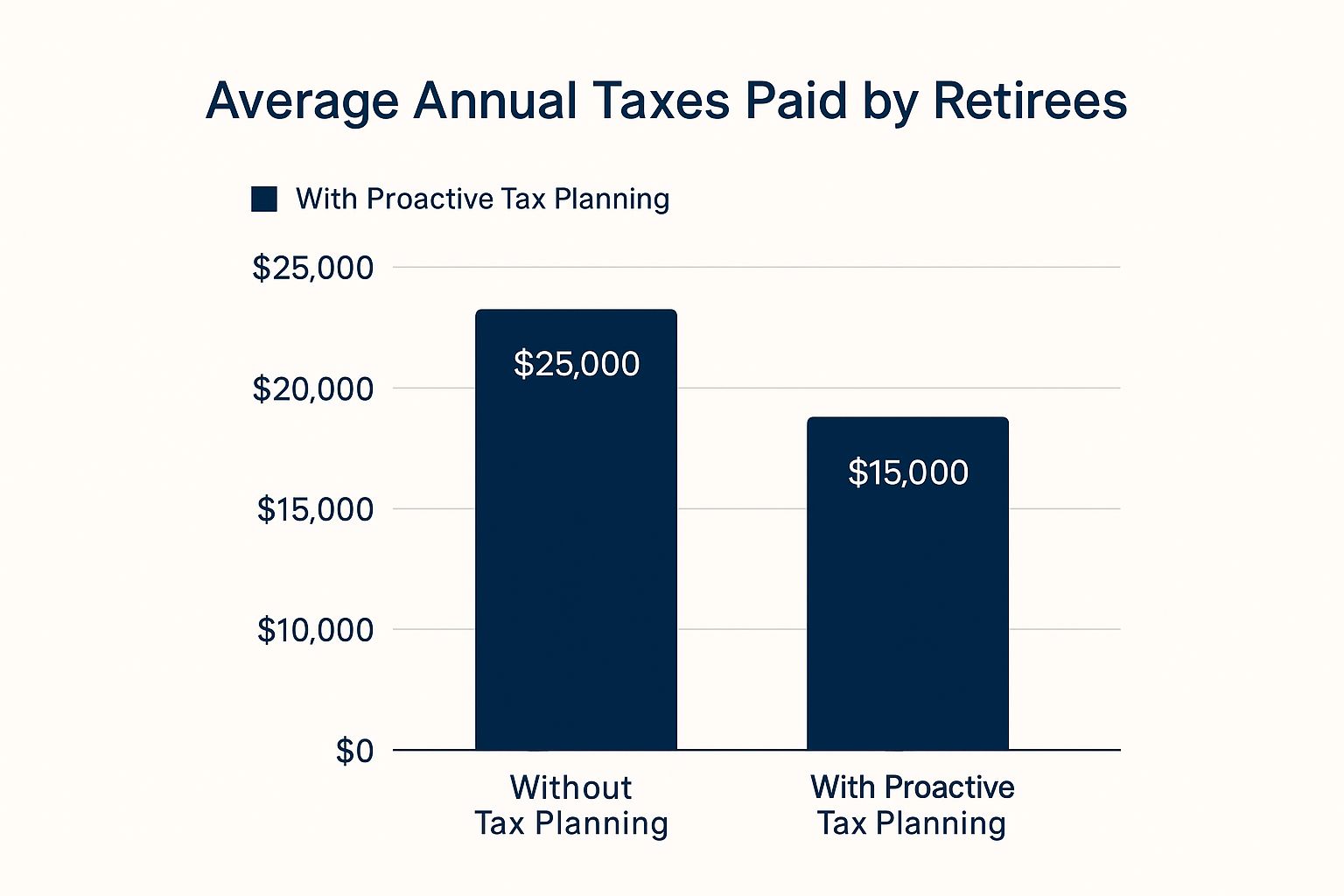

Many people assume retirement means an automatic drop in income and taxes. Not necessarily! Things like Social Security, Required Minimum Distributions (RMDs), and even Medicare premiums can bump you into a higher bracket than expected. This is where being proactive really pays off. The infographic below shows the potential impact of tax planning:

See the difference? Proactive planning can significantly lower your yearly taxes, potentially saving you thousands. Think of it this way: would you rather pay $25,000 a year or $15,000? That extra $10,000 could go towards travel, hobbies, or just give you more peace of mind.

Tax-Advantaged Accounts

One key piece of the puzzle is understanding how different retirement accounts are taxed. For example, contributions to a 401(k) or 403(b) are often tax-deductible. As of 2025, you can contribute up to $23,500, with a catch-up contribution of $7,500 for those 50 and over, and a special catch-up of $11,250 for those between 60 and 63. This not only lowers your current taxable income, but also sets you up for tax-efficient withdrawals down the road. While withdrawals are taxed as ordinary income, smart strategies can soften the blow. You can find some great insights on tax planning trends here.

To illustrate the different tax treatments of various retirement accounts, let's look at this comparison:

Retirement Account Tax Treatment Comparison

A comprehensive comparison showing how different retirement accounts are taxed during contribution, growth, and withdrawal phases.

Account Type | Tax on Contributions | Tax on Growth | Tax on Withdrawals | RMD Required |

|---|---|---|---|---|

Traditional 401(k)/403(b) | Tax-deductible | Tax-deferred | Taxed as ordinary income | Yes |

Roth 401(k)/403(b) | After-tax | Tax-free | Tax-free | Yes |

Traditional IRA | Tax-deductible (sometimes) | Tax-deferred | Taxed as ordinary income | Yes |

Roth IRA | After-tax | Tax-free | Tax-free | No |

This table highlights the key differences in how these accounts are taxed, allowing you to choose the best fit for your circumstances. Remember, the best approach depends on your individual situation.

Social Security & Medicare Considerations

Another important factor is the interplay between Social Security and Medicare. Many folks are surprised to learn that part of their Social Security benefits can be taxable, and that hitting certain income levels can trigger higher Medicare premiums. This is where understanding your Modified Adjusted Gross Income (MAGI) is critical. I've seen retirees accidentally land themselves in higher tax brackets and premium surcharges simply because they weren't aware of these thresholds.

Ongoing Adjustments

Finally, remember that tax planning isn't a one-and-done deal. It's an ongoing process that needs tweaking as your life changes. Tax laws are updated, your income might fluctuate, and your needs will evolve. By staying informed and adapting your strategy, you can maintain better control of your retirement finances and really enjoy the rewards of your hard work. This isn't about chasing every single deduction; it's about making informed decisions that support your overall retirement goals.

Strategic Withdrawal Sequencing That Actually Works

Let's be honest, most people approaching retirement treat their withdrawals like a buffet – grabbing a bit of everything without much thought. They often don't consider the differences between their accounts, missing a big chance to save on taxes. It's like playing chess with the IRS, and you need a smart strategy.

The Bucket Strategy: A Smarter Approach

Savvy retirees use what’s called the bucket strategy. Picture three buckets: one for short-term expenses, one for mid-term, and one for long-term needs. This helps you match your withdrawals with how each account is taxed.

Bucket 1 (Short-Term): This holds cash and easily accessible funds for daily expenses. Think of it as your everyday spending money.

Bucket 2 (Mid-Term): This typically has things like bonds or dividend-paying stocks, creating a reliable income stream for the next 5-10 years.

Bucket 3 (Long-Term): This is where growth investments like stocks live, designed to build wealth over the long run.

The real power comes from strategically filling these buckets from your different accounts. For example, you might use your taxable accounts first for Bucket 1, lessening the tax hit on those withdrawals.

Delaying Social Security: A Powerful Lever

Knowing when to start Social Security is another key part of the plan. Waiting past your full retirement age can significantly increase your monthly payments. I’ve personally seen people add thousands of dollars to their annual income just by waiting a few extra years. They can draw from other accounts to cover expenses during that time.

Minimizing taxes in retirement also means understanding tax-deferred accounts and tax-efficient withdrawals. The SECURE 2.0 Act of 2022, for instance, raised the Required Minimum Distribution (RMD) age to 73, giving retirees more flexibility. The standard deduction also went up, offering additional tax breaks. These changes can really affect your retirement plan. For more on this, check out T. Rowe Price.

Using Your Early Retirement Years Wisely

Those years between retirement and starting Social Security are prime time for tax planning. You might be in a lower tax bracket then, making it a good time for Roth conversions or other strategic moves. Consider it a pre-RMD sweet spot.

Real-World Examples: From Theory to Practice

Let me give you a real-life example. A retired couple I know successfully used this bucket approach. They used their taxable accounts first, then carefully pulled from their traditional IRA to fill their mid-term bucket. By delaying Social Security until 70, they maximized their monthly checks and minimized the taxable portion.

Another retiree I talked to used his early retirement years to do a series of Roth conversions. Since he was in a lower tax bracket, the tax he paid on the conversion was less than what he would have paid on withdrawals later. This saved him a bundle in the long run.

These are just a couple of ways strategic withdrawal sequencing can have a real impact. It's all about managing your income across different tax brackets and avoiding common pitfalls that bump you into a higher bracket unnecessarily. It's like optimizing your income stream for the lowest possible tax impact, a move that can save you significant money throughout your retirement.

Roth Conversion Strategies That Make Financial Sense

Roth conversions are a popular topic these days. But they're not a one-size-fits-all solution. The real benefit comes from a strategic approach, not just blindly converting assets. It's all about minimizing your tax burden in retirement based on your specific financial situation.

Finding the Sweet Spot for Conversions

There's a prime window for Roth conversions: the years between retirement and when Required Minimum Distributions (RMDs) begin. Why? Your tax bracket might be lower during this period. This is the sweet spot. Imagine converting funds while you’re in the 12% bracket, instead of the 22% you might face later with RMDs. That's a significant difference.

Let me give you a real-world example.

A friend of mine retired early and was wrestling with this very decision. He had a substantial traditional IRA and was considering converting it all at once. We sat down, analyzed his situation, and crunched the numbers. By spreading the conversions over several years, taking advantage of his lower tax bracket, he saved a considerable amount compared to a lump-sum conversion.

Calculating the Conversion Benefit

This brings me to a crucial point: calculating your potential tax savings. You'll need to estimate your current and future tax brackets, the amount you'd like to convert, and the potential tax implications. Don't worry, you don't have to do this alone. There are online calculators and tax professionals who can help you navigate this process.

Market Downturns: A Conversion Opportunity

Here's something many people overlook: using market downturns to your advantage. When the market dips, the value of your IRA also decreases. This presents a golden opportunity to convert at a lower value, meaning you pay less in taxes on the converted amount. Then, when the market recovers, you benefit from tax-free growth within the Roth. It's like buying low and watching your investment grow without the tax burden.

Medicare Premiums and Social Security: The Hidden Costs

Now, it's important to remember that Roth conversions aren't without their complexities. The converted amount counts as income in the year of conversion, which can affect your Medicare premiums and the taxable portion of your Social Security benefits. It's a ripple effect.

I know a financial planner who shared a story about a client who made a large conversion without considering the impact on their Medicare premiums. They ended up paying significantly more in increased premiums than they saved in taxes, effectively negating the conversion’s benefits.

So, before you make any decisions, be sure to look at the big picture. Understand how a conversion will affect not only your income taxes, but also your Medicare premiums and Social Security taxation. This way, you can avoid any unpleasant surprises and make informed decisions that truly benefit your long-term financial well-being. Considering every angle of minimizing taxes in retirement is key to achieving your financial goals.

Navigating Social Security and Medicare Tax Landmines

This screenshot, straight from the Social Security Administration website, shows the income limits that determine how much of your Social Security benefits Uncle Sam might want a piece of. The important thing to remember is these limits are based on your combined income. That means your Social Security, plus everything else coming in – pensions, retirement account withdrawals, even some investment income.

For example, let's say you're single and your combined income lands between $25,000 and $34,000. You could see up to 50% of your Social Security benefits taxed. Anything over $34,000? That number jumps to 85%. This is why managing your income in retirement is so important if you want to keep more of your money.

Understanding the MAGI Maze

You'll hear the term Modified Adjusted Gross Income (MAGI) a lot when it comes to Social Security and Medicare taxes. Think of it as your adjusted gross income with a few extras tacked on. It's what the IRS uses to figure out your tax bill and Medicare premiums.

If you're single and your MAGI goes above $91,000, brace yourself for higher Medicare Part B premiums. These are called Income Related Monthly Adjustment Amounts (IRMAA). These surcharges can add up to serious money each month – sometimes hundreds of dollars – making tax minimization in retirement even more crucial.

Strategic Withdrawals and Conversions: Playing the Timing Game

This is where smart withdrawal strategies and Roth conversions come into play. By carefully timing when you take money from different accounts – taxable, tax-deferred, and tax-free – you can manage your MAGI and potentially stay below those important tax and IRMAA limits. For example, withdrawing from a taxable account before tapping your IRA could help keep your MAGI lower in certain years.

Roth conversions are another tool, but they’re a bit tricky. Yes, they create future tax-free income, but they also bump up your MAGI in the year you do the conversion. I had a friend who learned this the hard way. He converted a big chunk of his IRA without considering the impact on his Medicare premiums. The IRMAA increase ate up a good portion of his tax savings. This just shows how important it is to look at the whole picture.

Real-World Wisdom: Lessons from Experienced Retirees

I recently talked to a retired couple who avoided this problem altogether. They spread their Roth conversions over several years, carefully managing their MAGI to stay below the IRMAA thresholds. They also waited to claim Social Security until 70, which reduced the taxable portion of their benefits. These are just a couple examples of how good timing can make a big difference.

It's all about making the right decisions for your situation. And don't be afraid to talk to a qualified financial advisor. They can help you build a personalized plan to navigate these rules and keep more of what you've worked so hard for.

Geographic Tax Planning: Your Location Strategy

Retirement isn't just about the size of your nest egg, it's also about where that nest egg can hatch most effectively. Minimizing taxes in retirement often means thinking strategically about location. Where you live can dramatically affect how much of your hard-earned money you actually get to keep, and I've personally witnessed how a well-planned move can translate to significant savings. While many retirees flock to the popular no-income-tax states, a truly savvy strategy involves looking beyond the headlines and considering property taxes, sales taxes, and specific retirement income exemptions. These often-overlooked details can make all the difference.

Beyond the No-Income-Tax Headlines

Sure, states like Florida and Texas don't tax your income, but they often generate revenue in other ways. Higher property taxes or sales taxes can quickly eat into any income tax savings. Take New Hampshire, for example. While they don't tax earned income, they do tax dividends and interest, which often form a significant chunk of a retiree's income. This means you need to look at the big picture—your total tax burden, not just one piece of the puzzle. It's easy to get tunnel vision, but a broader perspective is essential.

Hidden Gems: State Retirement Exemptions

You might be surprised to find that some states offer generous exemptions for retirement income. Georgia, for instance, has some appealing exemptions for various retirement income sources, potentially making it a better option than a no-income-tax state for some retirees. Pennsylvania also excludes certain retirement income from its state taxes. Uncovering these hidden gems requires some digging and a willingness to look beyond the usual suspects. This is where a good tax advisor specializing in multi-state planning can be worth their weight in gold. They can help you navigate the complexities and find opportunities you might otherwise miss.

Retirement planning is a balancing act between optimism and practical preparation. Studies show that while many Americans feel optimistic about retirement, they often haven't fully grasped the financial realities. Discover more insights. This underscores the importance not only of saving diligently but also of planning for tax-efficient income in retirement. Strategies like tax-loss harvesting and Roth conversions are essential tools in your retirement tax-minimization toolkit.

Timing Your Move and Establishing Residency

Timing is crucial, especially when it comes to taxes. Moving mid-year can create a tangled web of complications, and simply renting an apartment doesn't automatically establish residency in a new state. I’ve heard horror stories of retirees facing residency audits because they didn't properly document their change of domicile. This can quickly turn a smart tax move into a major headache. Be meticulous with your paperwork and understand the specific requirements of your chosen state.

Part-Time Paradise: Splitting Your Time

The dream of splitting time between different locations is a common one for retirees. However, this adds another layer of complexity to the geographic tax puzzle. Understanding domicile rules is absolutely critical for minimizing taxes when you're a part-time resident of multiple states. Some states have aggressive tax laws targeting part-time residents, making careful planning essential. A tax professional experienced in multi-state residency can help you avoid unpleasant surprises.

Comparing State Tax Treatments

To get a better sense of just how much state tax policies can vary, let's take a look at a hypothetical comparison:

State | Social Security Tax | Pension Tax | 401k/IRA Tax | Property Tax Level | Overall Ranking |

|---|---|---|---|---|---|

State A | Partial | Partial | Partial | Low | Moderate |

State B | None | None | None | High | Moderate |

State C | Partial | Exempt | Partial | Moderate | Moderate |

State D | None | Partial | Exempt | Low | Favorable |

This simple example demonstrates that comparing states isn't always straightforward. A state with no income tax could still hit you with high property taxes, impacting your overall tax burden. The key takeaway? Choosing the right location for minimizing your retirement taxes is about finding the best fit for your specific financial situation. There's no magic bullet or one-size-fits-all solution.

Advanced Tax Strategies: Beyond the Basics

So you’ve mastered the basics of minimizing taxes in retirement. Great! But let’s face it, there's always more to learn. Think of it like leveling up your retirement game. Now we'll dive into some advanced strategies that can truly supercharge your savings. These tactics are especially useful if you're juggling income from several different accounts, which is pretty common for retirees.

Tax-Loss Harvesting in Retirement

You might think tax-loss harvesting is just for your working years, but think again. It works a little differently in retirement, but it's still a powerful tool. Imagine you have some investments in your taxable account that have taken a dip. Selling those investments at a loss can actually offset gains you’ve made elsewhere, lowering your overall tax bill for the year. For example, let's say you sold some stock and made a $5,000 profit. If you have other investments that are down $3,000, you can use that loss to offset the gain, reducing your taxable gain to $2,000. It's like strategically taking a small hit to win the larger tax battle.

Strategic Asset Location: Optimizing Your Accounts

Think of your various retirement accounts – taxable, tax-deferred, and tax-free – as separate buckets. Each one is best suited for a specific type of investment. This is called strategic asset location. Generally, it’s smart to keep tax-inefficient investments, like high-dividend stocks or bonds, in your tax-deferred or tax-free accounts (like a 401(k) or Roth IRA). This shields that income from being taxed now. On the flip side, keeping tax-efficient investments, like growth stocks, in your taxable account can be beneficial. This way, any gains are taxed at the (usually) lower capital gains rates.

For example, holding a high-dividend stock in your Roth IRA lets those dividends grow tax-free. Imagine those dividends being taxed every year in a taxable account – it would really chip away at your returns over time. Conversely, holding growth stocks in your taxable account can be a savvy move since you’ll only pay taxes when you sell, ideally at the lower long-term capital gains rate. This strategy lets your investments grow more efficiently, maximizing your after-tax returns.

Municipal Bonds: Tax-Free Income

Municipal bonds offer tax-free income, which makes them tempting for retirees looking to minimize taxes. But remember, "tax-free" often just means free from federal taxes. Some states still tax municipal bond interest, so check your state's rules before diving in. Also, municipal bonds usually offer lower yields than taxable bonds. You’ll want to compare the tax-equivalent yield of a municipal bond to a taxable bond to see if the tax benefits truly outweigh the lower yield. It's a balancing act.

Weighing Complexity Against Savings

These advanced strategies can definitely improve your tax situation, but it’s important to be realistic about the extra effort involved. If managing these strategies feels like too much to handle, it might be better to stick with the basics or talk to a financial advisor. Remember, minimizing taxes in retirement isn't about being perfect; it's about making smart choices that fit your overall financial goals and give you peace of mind. Sometimes, keeping things simple is the best approach.

Your Personal Tax Minimization Action Plan

So, we've talked about a lot, from understanding your tax situation to fancy strategies like tax-loss harvesting. How do you actually build a usable plan from all this? Think of it like having all the ingredients for a great meal, but now you need the recipe. This isn't about some perfect, zero-tax dream. It's about making smart choices, consistently, to keep more of your money where it belongs—in your pocket.

Prioritizing Strategies: Your Personal Roadmap

Not all tax strategies are the same. Some, like maxing out your 401(k) contributions, are good for pretty much everyone. Others, like Roth conversions, really depend on your personal situation. It’s like building a house – you start with the foundation, not the roof.

Foundation: Nail the basics first. Max out those tax-advantaged accounts like 401(k)s and IRAs. This is your financial bedrock.

Framing: Think about how you'll take money out – your withdrawal sequencing. Remember the bucket strategy? This is where you decide which accounts you'll use first, second, and third.

Finishing Touches: Things like tax-loss harvesting and figuring out the best states for taxes are the final tweaks. They can really help, but they're not must-dos for everyone.

Annual Tax Planning Checkup: Staying on Track

Just like your health, your tax plan needs a yearly checkup. I look over mine every year, looking for things I need to adjust.

Income Changes: Did you make more or less money than you expected? This can change your tax bracket and even your Medicare premiums.

Tax Law Changes: Let’s be honest, Congress loves changing tax laws. Stay updated on anything that could impact your retirement plan. I've seen small changes make a huge difference.

Life Changes: Did you move? Get married? Receive an inheritance? Big life changes can really shift your tax situation.

Realistic Expectations: How Much Can You Save?

While it’s tempting to hunt down every single tax break, keep your expectations realistic. The goal isn't to pay zero taxes; it's to pay less. I’ve seen people save thousands of dollars a year with these strategies, but it’s different for everyone.

DIY or Pro? Knowing When to Get Help

Some tax planning is easy to do yourself, like contributing to your 401(k). But things like Roth conversions or planning around state taxes can get complicated. A good tax professional can be incredibly valuable here. They can help you understand the tricky parts and make good choices. Seriously, don’t hesitate to ask for help! I've learned from experience that a good tax advisor is worth their weight in gold. They can see the whole picture and create a plan just for you.

This isn’t about stressing over every penny, it’s about being smart and having a solid plan. This way, you can enjoy retirement knowing you’re making the most of your money.

Ready to feel secure about your future and enjoy the retirement you deserve? America First Financial can help. We offer a range of insurance and financial planning services designed to protect your assets and provide peace of mind. Get a free quote in under three minutes.

_edited.png)

Comments