Navigating Retirement Health Insurance Costs

- dustinjohnson5

- Jul 25, 2025

- 19 min read

Let's get straight to the point: the cost of healthcare in retirement is one of the biggest financial hurdles you'll face. For a healthy 65-year-old couple, the total bill is estimated to run into the hundreds of thousands of dollars over their lifetime—and that’s before even thinking about long-term care.

This staggering number doesn't even cover everything. It often leaves out the day-to-day costs like deductibles, copayments, and specialized treatments that can quickly drain your savings. Simply put, planning for this expense isn't optional; it's a cornerstone of a secure retirement.

The Real Cost of Healthcare in Retirement

If we're being honest, the true cost of healthcare in retirement shocks just about everyone. It's so much more than a simple monthly insurance premium. A good way to think about it is like a financial iceberg—that monthly premium is just the tip you see above the water.

What you don't see is the massive, hidden block of expenses lurking beneath the surface. These are the costs that can easily sink an unprepared retirement budget. Getting a handle on these "hidden" costs is the only way to stay afloat.

Beyond the Monthly Premium

Your total annual healthcare bill is a combination of several different moving parts. The first step to managing it all is understanding what those parts are.

Premiums: This is the fixed, predictable amount you pay every month to keep your insurance policy active. It could be for Medicare Part B, a private Medicare Advantage plan, or a supplemental Medigap policy.

Deductibles: This is the initial amount you have to pay out-of-pocket for your care before your insurance starts chipping in. For example, if your plan has a $500 deductible, you're on the hook for the first $500 of your medical bills.

Copayments and Coinsurance: After you’ve met your deductible, these are your share of the costs. A copayment is typically a flat fee (like $30 for a specialist visit), while coinsurance is a percentage of the total bill (like 20% for a hospital stay).

These out-of-pocket expenses can add up fast, especially if you need ongoing care or get hit with an unexpected health issue.

The big takeaway is that having insurance doesn't make healthcare free. The specific design of your plan—its deductibles, copays, and coverage limits—is what ultimately determines how much you'll actually spend.

To put these numbers into a clearer perspective, here's a table outlining what a retiree might realistically expect to spend each year.

Estimated Annual Health Insurance Costs for Retirees

Expense Category | Estimated Annual Cost Range | Key Considerations |

|---|---|---|

Premiums | $2,000 - $7,000 | Includes Medicare Part B, and may include Advantage or Medigap plans. Varies by plan and income level. |

Deductibles | $250 - $2,500+ | Higher for some private plans. Depends entirely on the plan you choose. |

Copays & Coinsurance | $1,000 - $6,000+ | Highly variable based on your health needs and frequency of care. Can rise significantly with a major health event. |

Prescription Drugs | $500 - $5,000+ | Depends on your Part D plan's formulary, tiering, and whether you hit the "donut hole." |

Dental, Vision, Hearing | $500 - $2,000 | Often not covered by Original Medicare. Requires a separate policy or an Advantage plan that includes it. |

This breakdown shows how quickly the costs can stack up, pushing the total annual spend well beyond just the basic premium.

The Rising Tide of Healthcare Costs

It’s not just your personal health that dictates the final bill. Broader economic trends are a huge factor, and the reality is that healthcare costs have consistently grown faster than both inflation and wages for decades. This trend puts immense pressure on a fixed retirement income.

Consider this: in the United States, the cost of family health coverage has nearly tripled since 2005. It's projected to climb from $12,214 to an estimated $35,119 annually by 2025, which averages out to a 6.1% increase every single year. During that same period, healthcare costs ballooned by 188%, while wages only grew by 84%. You can explore this trend in more detail in TechTarget's analysis.

This gap is precisely why you can't just assume what you paid in the past will be enough for the future. You need a proactive strategy. Now that you have a realistic financial snapshot, you’re ready for the next step: learning the actionable strategies to control these expenses and protect your nest egg.

Your Guide to Retiree Health Insurance Options

Once you leave the workforce, figuring out health insurance can feel like trying to read a map in a foreign language. For years, you probably had a straightforward employer plan. Now, you’re faced with a whole new world of choices, and it's easy to feel overwhelmed. Let's clear up the confusion and walk through the main paths you can take to protect both your health and your nest egg.

Think of it this way: you're building a toolkit for your healthcare needs in retirement. You won't need every tool, but knowing what each one is for is the key to creating a plan that works for you—one that gives you great coverage without breaking the bank.

The Foundation: Medicare Part A and Part B

For most folks hitting 65, Medicare becomes the bedrock of their health coverage. This is what people often call "Original Medicare," and it’s split into different parts that cover specific services.

Medicare Part A (Hospital Insurance): The good news is that Part A is typically premium-free for anyone who paid Medicare taxes for at least 10 years. It's designed to help with costs for inpatient hospital care, short stays in a skilled nursing facility, hospice, and certain types of home health care.

Medicare Part B (Medical Insurance): This part covers your everyday medical needs, like doctor’s appointments, outpatient procedures, lab tests, and preventive care. Unlike Part A, this comes with a standard monthly premium. That premium can actually be higher if you have a larger retirement income, something we'll get into a bit later.

Original Medicare is a great start, but it was never meant to cover 100% of your costs. You'll still face deductibles and coinsurance, which can leave you with some significant out-of-pocket expenses. That’s where the next set of options comes in.

Filling the Gaps: Medicare Advantage vs. Medigap

To handle the costs that Original Medicare doesn't cover, you’ll typically head down one of two main roads.

Medicare Advantage (Part C): Think of these as an "all-in-one" package. Private, Medicare-approved insurance companies offer these plans, bundling Parts A, B, and usually Part D (for prescriptions) together. They often throw in extras like dental, vision, or hearing benefits. The retirement health insurance cost can be very appealing—some plans even have $0 premiums. The trade-off is that you’ll have to use doctors and hospitals within a specific network (like an HMO or PPO) and manage copays and deductibles.

Medigap (Medicare Supplement Insurance): Just like the name says, these policies help fill the "gaps" in Original Medicare by paying for things like your deductibles and coinsurance. Sold by private insurers, Medigap gives you the freedom to see any doctor in the country who accepts Medicare. The catch? You'll pay a separate monthly premium for the Medigap policy, and you’ll also need to buy a standalone Part D plan for your prescription drugs.

Your choice between a Medicare Advantage plan and a Medigap policy is one of the most significant decisions you'll make. It directly impacts both your access to care and your total retirement health insurance cost.

Other Paths to Coverage

While Medicare is the most well-traveled road, it's not the only one. Depending on your specific situation, a few other options might be on the table.

Employer-Sponsored Retiree Plans: This is becoming a rare perk, but some companies still offer health coverage to their retirees. If you're lucky enough to have this as an option, it's vital to compare its costs and coverage directly against what you could get with Medicare.

COBRA: Retiring before you turn 65? COBRA lets you stay on your former employer's health plan, usually for up to 18 months. It’s a solid bridge, but be prepared for the cost. You have to pay the entire premium yourself, plus an administrative fee, which makes it a very expensive short-term solution.

ACA Marketplace: For early retirees, the Affordable Care Act (ACA) marketplace is another place to find coverage before you’re eligible for Medicare. Depending on your income, you might even qualify for subsidies that lower your monthly premiums.

Veterans Affairs (VA) Healthcare: If you’re an eligible military veteran, you can access VA health benefits. This can work alongside your Medicare coverage or even replace it. Recent laws like the PACT Act are constantly expanding these benefits, so understanding the available PACT Act benefits and healthcare solutions is a smart move for managing your overall healthcare strategy.

What Drives Your Personal Healthcare Spending

The amount you'll spend on health insurance in retirement can look wildly different from what your neighbor pays, even if you’re the same age. There's no magic, one-size-fits-all number. A better way to think about it is as a set of personal dials you can adjust.

When you understand what those dials are, you're back in the driver's seat. Knowing which factors to focus on allows you to make smart, proactive choices that can directly lower your premiums and out-of-pocket costs. It gives you a real say in your financial health.

The Big Three Personal Factors

Three core elements really set the stage for your personal cost profile. Insurance carriers look at these to figure out their risk and, ultimately, the price you'll pay for coverage.

Your Age: Most people know Medicare eligibility starts at 65, but your age still matters, especially with Medigap plans. The younger you are when you first sign up, the better your chances are of locking in a lower initial premium.

Your Health Status: It’s no surprise that your current health and medical history play a big part. While you can't be denied coverage for pre-existing conditions, your health will absolutely influence which type of plan makes the most financial sense. Someone managing a chronic condition will weigh a low-deductible plan differently than a healthy individual.

Your Location: Where you decide to retire matters—a lot. Healthcare costs and the types of plans available can change dramatically from one state, county, or even zip code to the next. A Medicare Advantage plan in Miami will have entirely different costs, doctor networks, and benefits than one in rural Montana.

How Your Income Influences Medicare Costs

One of the most common surprises for new retirees is finding out their income can actually make their Medicare premiums more expensive. This is all because of something called the Income-Related Monthly Adjustment Amount, or IRMAA.

Think of IRMAA as an extra surcharge added to your Medicare Part B (medical) and Part D (prescription drug) premiums. It kicks in if your modified adjusted gross income from two years ago goes over a certain limit. For instance, what you earned in 2023 will determine your IRMAA in 2025.

This is a huge planning point. A single large withdrawal from a traditional IRA or 401(k) to buy a car or renovate your home could easily bump you into a higher income bracket. The result? You could trigger IRMAA for a future year and get hit with an unexpected jump in your health insurance costs.

The Power of Your Plan Choice

The single most powerful dial you can turn is the type of plan you choose. This decision is a direct trade-off between what you pay every month (your premium) and what you might have to pay when you actually see a doctor (your out-of-pocket costs).

A Medicare Advantage plan, for example, might lure you in with a $0 monthly premium. But the trade-off could be higher copayments for specialist visits and a much more limited network of doctors you're allowed to see. On the other hand, a Medigap plan has a much higher monthly premium, but it might cover nearly all of your out-of-pocket expenses, giving you far more predictable spending year-round.

To get a clearer picture of how different plans might handle your specific needs, you can use online tools to estimate healthcare procedure costs. This can be incredibly helpful when comparing your options.

Ultimately, your lifestyle and financial strategy have a direct impact. Staying active, carefully managing chronic conditions, and being smart about your plan selection and retirement account withdrawals are all concrete steps toward lowering what you'll spend on healthcare for the long haul.

How Global Trends Affect Your Bottom Line

It’s easy to think of your retirement health insurance costs as a purely personal number, but that’s not the whole story. Your monthly premium is actually connected to massive, global forces that create ripples felt in every corner of the healthcare world. Getting a handle on these big-picture trends is key to understanding why your costs always seem to be climbing.

Imagine the global healthcare economy is a powerful ocean current. Your personal planning and choices are like your own small boat. While you can certainly steer your boat to navigate the waves, you can't change the direction of the tide itself. But if you understand how that current works, you become a much smarter sailor.

The Unstoppable Force of Medical Inflation

One of the biggest factors at play is that medical inflation almost always outpaces general inflation. You might see the price of milk or gas go up a few percent, but healthcare costs often leap by a much bigger margin. This means that even if your retirement income gets a cost-of-living adjustment, healthcare will take a larger bite out of your budget every single year.

This isn't a new problem; it's a stubborn pattern that has been going on for decades. This growing gap is a huge reason why just saving what you think you'll need often isn't enough. You have to plan for a specific cost that's growing at a supercharged rate compared to everything else.

Breakthroughs Come with a Big Price Tag

Medical innovation is one of the most incredible stories of our time. We have access to drugs, diagnostic tools, and surgical techniques that can extend and improve our lives in ways we once only dreamed of. The catch? These amazing advancements are also a primary driver of rising costs.

Expensive Specialty Drugs: Medications that can manage complex conditions like cancer, rheumatoid arthritis, or multiple sclerosis can be life-changing, but they often come with price tags of tens or even hundreds of thousands of dollars a year.

Advanced Medical Technology: The invention and operation of sophisticated equipment, from robotic surgery systems to high-resolution MRI machines, is incredibly expensive. Those costs eventually get passed down to patients and their insurance providers.

Pioneering Therapies: Newer treatments like cell and gene therapies hold astounding promise but can have staggering upfront costs, adding to the financial weight carried by the entire healthcare system.

It's wonderful that these innovations exist, but they directly contribute to the rising tide of healthcare spending that inflates your insurance premiums.

The dilemma is clear: we all want access to the best care possible, but that very same care is a key reason the retirement health insurance cost continues to climb for everyone.

This isn't just a personal challenge; it's a global one. The 2025 Global Medical Trends Survey from Willis Towers Watson really puts this into perspective. It projects that global medical costs will jump by 10.4% in 2025. Here in North America, the forecast is an 8.7% increase, up from 8.1% in 2024, proving this trend isn't hitting the brakes anytime soon.

Knowing this isn't meant to be discouraging. Far from it. It's meant to show you why the proactive strategies we're about to cover are so essential for your financial health. Your plan isn't just about managing your personal habits; it's about building a strong financial defense against these powerful, systemic trends.

Alright, let's get into the nitty-gritty. Knowing the numbers is one thing, but now it's time to take control. This is your playbook for actively cutting down what you spend on health insurance in retirement. We're moving past the theory and into real, actionable strategies you can use to keep more of your hard-earned money.

It’s easy to think of healthcare costs as a fixed, unavoidable bill. That’s a mistake. Think of them instead as a set of variables you can absolutely influence. A little proactivity and strategic thinking can go a long way, freeing up cash for the parts of retirement you actually want to spend money on.

Master the Health Savings Account

If you have a high-deductible health plan (HDHP), the Health Savings Account (HSA) is probably the single most powerful financial tool you can use. Honestly, it’s like a super-charged retirement account, but built specifically for your medical expenses.

The magic of an HSA comes from its triple tax advantage—something you won't find anywhere else:

Tax-Deductible Contributions: The money you put in lowers your taxable income right now.

Tax-Free Growth: Your funds can be invested and grow completely tax-free.

Tax-Free Withdrawals: As long as you use the money for qualified medical expenses, you can pull it out without paying a dime in taxes.

Here’s the kicker: once you turn 65, the rules relax. You can withdraw funds for any reason at all. If it’s not for a medical expense, you’ll just pay ordinary income tax on it, exactly like a traditional 401(k). This flexibility makes it an incredible way to build a dedicated nest egg just for your health.

Become an Annual Plan Shopper

Getting comfortable with your plan is the enemy of saving money. Your health changes from year to year, and so do the insurance plans available in your area. That’s why you have to treat the annual Medicare Open Enrollment period as a non-negotiable financial check-up.

Every year from October 15 to December 7, you get a window of opportunity. You can switch between Original Medicare and a Medicare Advantage plan, or even just hop from one Advantage plan to another. This is your prime time to compare everything—premiums, doctor networks, and especially prescription drug coverage—to make sure you’re not overpaying.

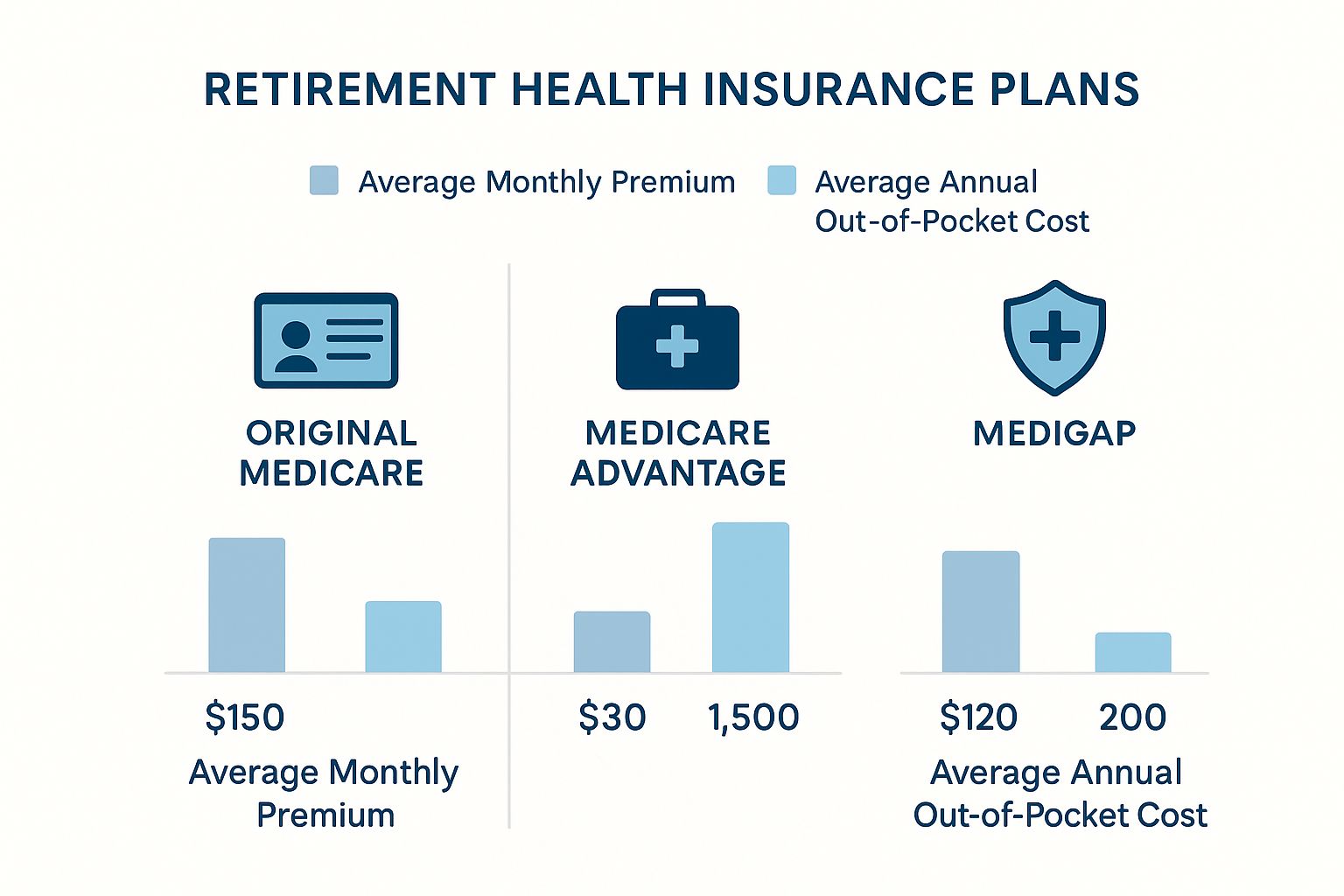

This chart drives the point home, showing just how much costs can vary between different plan types.

As you can see, the balance between what you pay each month and what you could face in out-of-pocket costs shifts dramatically. This makes it absolutely critical to find the right fit for your specific budget and health needs each year.

Actively Manage Your Prescription Costs

For many retirees, prescription drugs are the real budget-busters. The reason costs are ballooning is a perfect storm of expensive specialty drugs, new therapies hitting the market, and the ongoing need to manage chronic conditions. If you want to discover more insights about these healthcare cost trends, you'll see just how much pharmacy spending is driving the overall increase.

But you can fight back. Always take these steps:

Ask for Generics: When your doctor writes a prescription, make it a habit to ask if a generic version is available. They are chemically the same as their brand-name cousins but can cost up to 85% less.

Review Your Part D Plan Annually: During open enrollment, use Medicare's Plan Finder tool. Plug in your list of medications and see which plan will cover them most cost-effectively. A different plan could easily save you hundreds, if not thousands, of dollars.

Look for Assistance Programs: Many states have State Pharmaceutical Assistance Programs (SPAPs) designed to help eligible seniors pay for their prescriptions. It’s worth a quick search to see what your state offers.

Don’t be afraid to speak up and advocate for yourself. A simple question like, "Is there a less expensive alternative?" can lead to significant savings on your pharmacy bills.

Don't Be Afraid to Negotiate

Finally, always remember that a medical bill isn't set in stone. If you get hit with a large, unexpected bill, your first reaction shouldn't be to just pay it.

First, always request an itemized statement and go through it with a fine-toothed comb. Billing errors are surprisingly common. If you spot a charge that looks wrong or inflated, call the provider’s billing department and question it. If you’re paying out-of-pocket, you can often negotiate a lower price or ask for a discount for paying in cash. At the end of the day, hospitals and clinics would rather get a smaller, guaranteed payment than chase a full bill they might never receive.

To help you decide which actions to prioritize, here's a quick comparison of the strategies we've discussed.

Cost-Saving Strategy Comparison

Strategy | Potential Savings | Who It's Best For |

|---|---|---|

Using an HSA | High. Triple tax advantage creates long-term wealth. | Anyone with a high-deductible health plan (HDHP), especially those who can contribute consistently over many years. |

Annual Plan Shopping | Moderate to High. Can save hundreds or thousands annually on premiums and co-pays. | Everyone on Medicare. It's a must-do yearly financial check-up to align your plan with your current needs. |

Managing Prescriptions | Moderate to High. Switching to generics or a better Part D plan can drastically cut costs. | Anyone taking regular medications, especially brand-name or specialty drugs. |

Negotiating Bills | Variable. Most effective for large, unexpected out-of-pocket expenses. | People facing significant medical bills not fully covered by insurance. Best for those comfortable being assertive. |

Each of these strategies requires a different level of effort, but all of them empower you to take an active role in managing your retirement healthcare costs. Even small adjustments, when made consistently, can lead to substantial savings over time.

Planning Your Long-Term Care Strategy

Many retirement plans have a glaring hole—one that people often don't see until they're falling through it. We spend decades planning for medical costs, but most health plans, including Original Medicare, are built for doctor visits and hospital stays. They aren't designed to handle the day-to-day assistance many of us will need as we get older.

This is the reality of long-term care (LTC), and it’s one of the biggest financial risks to your nest egg. LTC isn't about medical treatment; it's about getting help with daily activities. Without a plan for it, you’re leaving your financial future wide open to devastating costs.

Health Insurance vs. Long-Term Care

Let’s use an analogy. Think of your health insurance as a top-notch auto mechanic. When your car breaks down or gets in an accident, the mechanic fixes the specific problem. Health insurance does the same for your body—it covers surgery, diagnoses illnesses, and pays for prescriptions.

Long-term care, however, is completely different. It's like hiring a personal assistant and chauffeur because you can no longer handle daily errands and driving on your own. It’s not about curing a disease; it’s about providing the support you need to live your life. This care can happen in a few different settings:

In-Home Care: A professional aide comes to your house to help with things like bathing, getting dressed, making meals, or managing medications.

Assisted Living Facilities: These are residential communities offering apartment-style homes with support services close at hand, blending independence with peace of mind.

Nursing Homes: This option provides the highest level of care for those who need skilled nursing and supervision around the clock.

The price tag for this kind of support is steep, easily ranging from $5,000 to over $9,000 per month. It all depends on where you live and the level of care you need. Since Medicare won't step in to pay for this custodial care, that massive bill falls squarely on your shoulders.

Your Options for Covering LTC Costs

Facing those numbers without a strategy is a huge gamble. You really have three main avenues to explore, and each comes with its own set of pros and cons.

1. Traditional Long-Term Care Insurance (LTCI) This is a dedicated insurance policy you purchase specifically for LTC expenses. You pay regular premiums, and if you eventually need care, the policy pays a set daily or monthly amount. The catch? You have to buy it when you’re young and healthy. Premiums skyrocket with age, and coverage can be impossible to get if you already have serious health conditions.

2. Hybrid Life/LTC Policies These plans have become incredibly popular because they solve the "use it or lose it" dilemma of traditional LTCI. A hybrid policy combines life insurance with a long-term care benefit. If you need care, you can access the death benefit while you're still alive. If you pass away without ever needing LTC, your heirs get the full payout.

This dual-purpose design gives people tremendous peace of mind. Your premium dollars are guaranteed to be used, whether for your own care or as a legacy for your loved ones.

3. Self-Funding This is exactly what it sounds like: you set aside a large chunk of your own assets to pay for any future care needs. It requires a very substantial nest egg and a disciplined investment plan. While self-funding gives you the most flexibility, it also carries the highest risk. A long stay in a care facility could completely wipe out your savings, leaving little for a surviving spouse or your estate.

As you build out a solid long-term care plan, it's also smart to think about final expenses. Knowing the difference between cremation vs burial costs, for example, helps create a truly complete financial picture. The ultimate goal is a strategy that protects both your health and the assets you worked so hard to build.

Answering Your Top Retirement Healthcare Questions

Even with the best-laid plans, a few lingering questions about healthcare costs in retirement can cause real anxiety. These are the "what-ifs" that can make you second-guess your entire strategy. Let's walk through some of the most common concerns people have, answering them directly so you can move forward with confidence.

Think of it like double-checking your packing list before a long trip. You've got the big items handled, but now it's time to make sure you haven't forgotten the small, essential things that make the journey smooth.

How Much Should I Actually Budget?

This is the big one, isn't it? While there's no universal number that fits everyone, a good rule of thumb is to plan for $5,000 to $7,000 per person, per year for your total healthcare spending. That figure covers not just premiums but also things like deductibles, copays, and basic vision or dental needs.

Of course, that’s just a starting point. Your own budget needs to reflect your life. If you're managing a chronic condition or you've chosen a premium-heavy Medigap plan, you might be looking at something closer to $10,000 a year. On the flip side, a healthy person with a low-cost Medicare Advantage plan could come in under that initial estimate.

What Happens If I Retire Before I Turn 65?

Retiring before Medicare kicks in at 65 means you have an insurance gap to fill, and going without coverage simply isn't an option. The good news is, you have a few solid choices to bridge that period:

COBRA: This federal law lets you stay on your former employer's health plan for up to 18 months. The coverage is familiar and seamless, but be prepared for the cost. You'll be paying the full premium yourself, plus a small administrative fee.

ACA Marketplace: For many early retirees, the Affordable Care Act (ACA) Health Insurance Marketplace is the go-to solution. You can find a plan that covers you until you turn 65, and if your retirement income is modest, you might qualify for subsidies that make your monthly premiums much more manageable.

Spouse's Plan: If your spouse is still working and has health insurance through their job, getting added to their plan is often the most straightforward and affordable route.

The crucial thing for early retirees is to plan for this "bridge" period intentionally. The cost of health insurance before you're eligible for Medicare can be a major expense, so it needs to be a specific line item in your retirement budget.

Is Medicare Advantage or Medigap Better for Cost Control?

This is a classic dilemma, and it really comes down to a trade-off between predictable monthly payments and potentially lower out-of-pocket costs when you need care. There’s no right or wrong answer—it all depends on your personal finances and how much risk you're comfortable with.

You might lean toward Medicare Advantage if:

You want a low—or even $0—monthly premium.

You're okay with using a specific network of doctors and hospitals.

Your budget can absorb variable costs, like copayments and deductibles, as they come up.

You might be better off with Medigap if:

You value predictable monthly bills and want to avoid financial surprises.

You want the freedom to see any doctor or use any hospital in the country that accepts Medicare.

You're willing to pay a higher monthly premium for that extra peace of mind.

It’s a simple trade-off: Medigap provides cost certainty for a higher upfront monthly payment. Medicare Advantage keeps your fixed monthly costs down but means you'll share more of the cost when you actually receive medical care.

Are Vision and Dental Covered in My Retirement Plan?

This is a huge blind spot for many retirees, and it can be a costly one. Here's the short answer: Original Medicare (Parts A and B) does not cover routine dental, vision, or hearing services. That's a major gap, considering how essential—and expensive—this kind of care can be.

To get coverage for these services, you generally have two paths:

A Medicare Advantage (Part C) Plan: Many Advantage plans are all-in-one packages that include dental, vision, and hearing benefits. The quality and extent of this coverage can vary dramatically from plan to plan, so you have to read the fine print.

A Standalone Private Plan: You can buy separate insurance policies for just dental and vision. This gives you more flexibility and choice in your coverage level, but it also means another monthly premium to add to your budget.

Don't make the mistake of ignoring these costs. Realistically planning for a few hundred to a couple of thousand dollars a year for dental cleanings, a new pair of glasses, or hearing aids is a critical part of managing your total health expenses in retirement.

Navigating these decisions is crucial for a secure retirement. At America First Financial, we provide healthcare plans that align with your values and your budget, ensuring your family is protected without compromise. Get a clear, no-hassle quote in under three minutes and see how we can help you build a financially sound future. Find the right protection for your family by visiting https://www.americafirstfinancial.org today.

_edited.png)

Comments